business cash advance

The Merchant Cash Advance Abridged Bible

July 10, 2013Whether you’re an investment fund researching the merchant cash advance industry or an account rep that’s just been handed a phone book on his first day of work, these 5 slides will teach you almost everything you need to know:

Questions? E-mail sean@merchantprocessingresource.com

– Merchant Processing Resource

https://debanked.com

MPR.mobi on iPhone, iPad, and Android

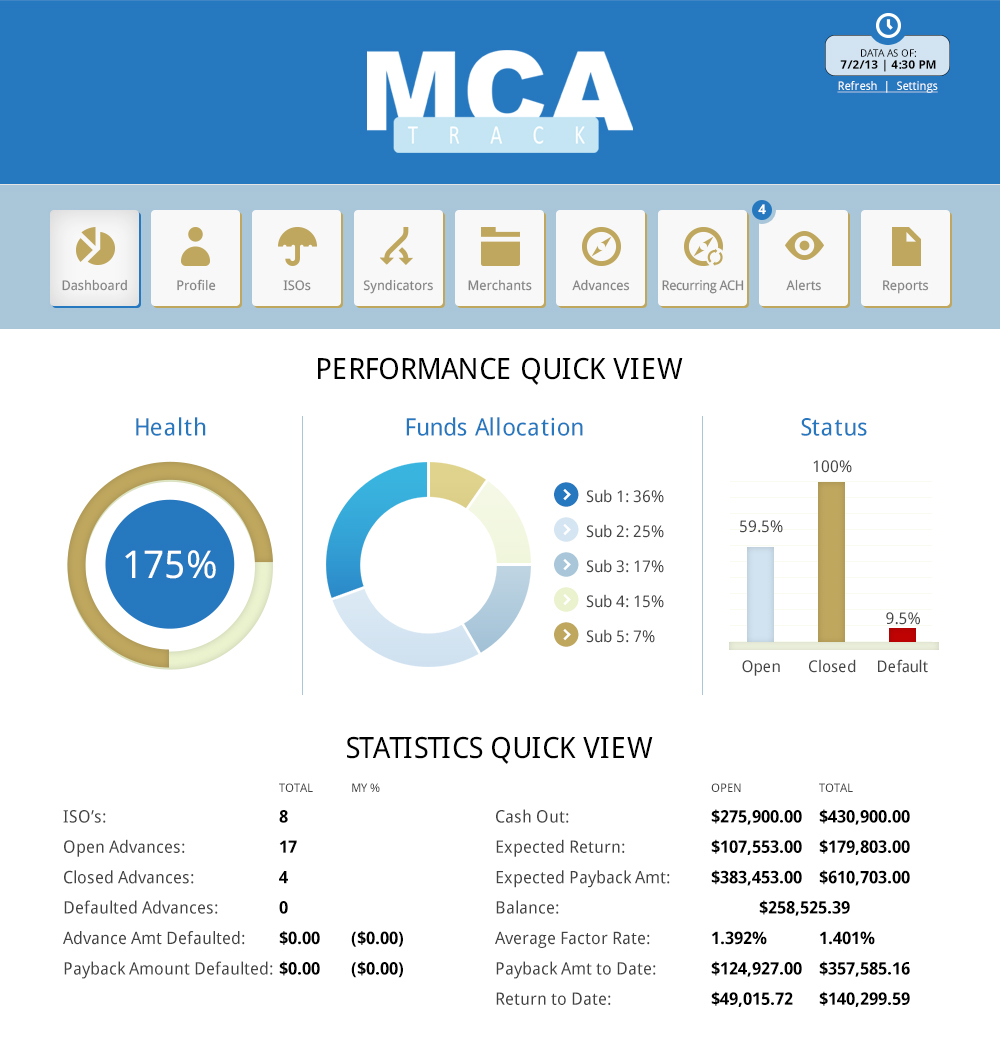

MCA Track – A Merchant Cash Advance Back End

July 6, 2013Running your funding business off of excel spreadsheets or clunky old software that wasn’t meant for the Merchant Cash Advance (MCA) market? You might want to consider using something that was both made and used by MCA people. A couple weeks ago, Benchmark Merchant Solutions gave me a private demo of their all-in-one back end system to manage incoming and outgoing payments for both split-funding and ACH deals.

It had a lot of nice features and certainly would make it possible to manage your books with ease. The reports are very easy to produce, read, and make sense of. Alerts can be set up for merchants that have not processed for any gap of time you set. ACH rejects are automatically recorded and flagged.

At the current moment, the only direct split-funding integration it has is with Benchmark Merchant Solutions. They will be directly integrating with other processors in the coming month. The system uses a proprietary ACH provider.

Contact: Zalman Notik

Phone: 212-444-9567

zalman.notik@mcatrack.com

Benchmark Merchant Solutions is a registered ISO and MSP of Deutsche Bank AG, New York. This is not a paid ad or review. The Benchmark team is run by solid folks.

Having issues with your books? Make it easy with MCA Track.

– Merchant Processing Resource

https://debanked.com

MPR.mobi on iPad, iPhone, and Android

The Alternative Business Lending Worker Shortage

July 1, 2013“You open 40 accounts, you start working for yourself. Sky’s the limit.“

Is the dream getting harder to sell? The alternative business lending industry is booming and so much so that many job openings are going unfilled. I am asked on almost a daily basis if I know any experienced sales people that are looking for work. There really aren’t that many people out there with a strong merchant cash advance background and I think it’s impacting how fast this industry can grow. On the one hand, the industry is a lot less sophisticated than it used to be. Hold on for a second and allow me to explain myself. There was a good chunk of time in this business where saying the word, loan could get you fired. Loan?! Are you kidding? We buy future receivables at a discount!

Anyone could sell a prospect on working capital but only a select group of people could explain the purchase of future sales properly all while justifying the relatively high cost. And an even smaller group of people could take the deal to the next step and discuss the merchant’s current 3 tiered or interchange based rates, pick out the junk costs, and sell them on a better deal with a new payment processor. And an even smaller group of people could sell the merchant on the idea of using a new terminal due to PCI compliance issues or acquirer compatibility. And an even smaller group of people could sell or lease the merchant a new terminal instead of swapping out their current one or lending one for free with a multi-year contract. And still an even smaller group of people could convince the underwriter to approve their file in order for the 5 closed sales to even go through. Merchant cash advance in the traditional manner was and is a highly complicated multi-layered sale. The men and women that churn(ed) these deals out month after month on a consistent basis are nothing short of pros. Let’s not forget that payment processors have underwriters too so even after 6 closes, the payment processor could decline the approval of a merchant account, nuking the entire deal from start to finish.

Do you have any idea how comical it was when the mortgage brokers invaded the industry as the housing market neared collapse? They had no idea what they were doing and some of them barely lasted for 90 days before saying “I give up, this makes no sense.”

In today’s market, there’s a faster learning curve. I’d estimate that 55-60% of all new deals being funded with daily repayment in this country are using direct debit ACH to collect. Some funders and brokers lean towards this model so much so that they report funding more than 90% of their deals on ACH. That’s good news for new account reps because there isn’t much to learn about the product. There’s the amount being funded, the cost, and a daily debit to pay it back. Pretty simple stuff. This isn’t to say it’s not a tough sell or that it’s not competitive, because it is both of those things. Companies that swear by the ACH product have a hiring advantage because they don’t necessarily need salespeople with MCA specific experience. Almost any financial sales background will work or even no experience at all.

The smaller part of the industry is a mishmash of the old school sophisticated reps and the newbies that rely on the old schoolers to help them out with anything technical. When companies post ads saying they are looking for MCA sales reps with experience, they’re implying that they want people that can handle the multi-layer sale. A good craigslist ad should say:

Are you hungry?!

Must be able to do the following in a single phone call while driving at least 65 MPH on the Brooklyn Queens Expressway regardless of whether or not traffic is backed up:

- Convert a Micros POS system

- Lease an additional wireless terminal for off-premise sales

- Shave 12 basis points off the non-qualified tier (but make it back up by adding a $15 monthly statement fee)

- Close a 150k deal on a 1.40 (but know that the reduced factor rate is coming out of YOUR end)

- Write in a 6% closing fee

- Cut off 47 cars in traffic without hitting them

- Eat a slice of greasy pizza with your left hand without getting a single drop on your lap

Oh and below it will be a note that says “THIS POSITION IS COMMISSION BASED ONLY, NO DRAW, SELF-STARTERS WANTED, HOURS ARE 7-7 Mon-Sat“. Don’t laugh. This was the MCA industry for a time and a lot of people did very well in it. If you wanted to make money, you had to be able to do it all. For some of you, it’s still this way.

Oh and below it will be a note that says “THIS POSITION IS COMMISSION BASED ONLY, NO DRAW, SELF-STARTERS WANTED, HOURS ARE 7-7 Mon-Sat“. Don’t laugh. This was the MCA industry for a time and a lot of people did very well in it. If you wanted to make money, you had to be able to do it all. For some of you, it’s still this way.

And let’s face it, the split-funding market may shrink but it will never die. Split-funding’s advantage is the ability to finance businesses that have poor cash flow. The risk of a bounced check is removed when payments are diverted to the funder by the payment processor. You hear that kids? You should be brushing up on your payment processing-ology.

Even as the ACH market boom continues, there are whispers of woe as funders deal with ACH rejects and closed bank accounts. It’s no surprise then that some companies are looking for pros, not just bodies to put on the telephone. It seems as the product has become less sophisticated, merchants have become more sophisticated. In 2007, I’d be willing to bet that more than 90% of small businesses had never even heard of a merchant cash advance and that was basically the only alternative available. In 2012 I actually did a presentation to a large room of business owners about merchant cash advance and none of them had ever heard of it until I taught them about it. That’s astounding!

Now I don’t think that many more people know about the purchase of future credit card sales in 2013 specifically, but I am inclined to believe that 90% of merchants are at least aware that alternatives to bank loans exist. And when they encounter somebody offering an alternative, they do their homework and check these companies out online. They get 2nd opinions and question why they have to switch processing when four other account reps said they don’t have to. They ask for better deals, longer programs, and they look you up on facebook to see who you really are. This is a different sales environment than what there used to be. The lowest price, the fastest process, or the most charming personality won’t guarantee you’ll win anything. Seeing that you’re backed by Wells Fargo or learning that Peter Thiel is on your company’s board of directors might be the hook, line and sinker for a business with a full plate of options at their disposal. Yes, it’s a different world, a different sale, and even a different product.

Now I don’t think that many more people know about the purchase of future credit card sales in 2013 specifically, but I am inclined to believe that 90% of merchants are at least aware that alternatives to bank loans exist. And when they encounter somebody offering an alternative, they do their homework and check these companies out online. They get 2nd opinions and question why they have to switch processing when four other account reps said they don’t have to. They ask for better deals, longer programs, and they look you up on facebook to see who you really are. This is a different sales environment than what there used to be. The lowest price, the fastest process, or the most charming personality won’t guarantee you’ll win anything. Seeing that you’re backed by Wells Fargo or learning that Peter Thiel is on your company’s board of directors might be the hook, line and sinker for a business with a full plate of options at their disposal. Yes, it’s a different world, a different sale, and even a different product.

Funders and brokers need human resources to keep up with the fast pace of growth and there’s not too many of the old school guys looking for work. Not to mention that fewer people are willing to work on a 100% commission only basis these days. During and after the financial crisis, the herd of out-of-work financial service people flocked to whatever opportunity the could find. It was like you could throw a fishing net in front of the Lehman Brothers entrance and use it to scoop up 50 brokers as they all ran out the door for the last time. Newly minted graduates wanted to build their resumés instead of remaining unemployed. Some people were willing to work all 31 days of a month just for the opportunity even if they walked away with zero dollars at the end of it. Although the economy hasn’t recovered much, that hunger has relaxed and job seekers are being a bit more selective of the opportunities they choose. They want a base salary (even if small), benefits, and vacation time. Somewhere out there in another universe, Ben Affleck’s younger self is crying at the thought of this. “Vacation time?”

So when you put up an ad on LinkedIn or Craigslist and say you’re looking for 10 guys with MCA experience, just know that breed is in short supply and high demand. If you’re heavy on ACH, you can train new guys quick but they’re not going be equipped to take on the multi-layered sale if the tide turns back towards split-funding. There are tons of job openings out there for sales reps but those spots aren’t as easy to fill as they used to be.

“You become an employee of this firm, you will make your first million within three years. I’m gonna repeat that – you will make a million dollars.”

Happy hiring.

– Merchant Processing Resource.com

https://debanked.com

MPR.mobi on iPhone, iPad, and Android

Merchant Cash Advance Competition

June 3, 2013 If I had a dollar for every time someone told me that Kabbage wasn’t a competitor in the Merchant Cash Advance space, I’d have my own funding company. It’s been argued that they only care about Ebay or Paypal and that their business model revolved around strengthening Ebay’s PowerSellers for the good of Ebay. I never really believed that was the case.

If I had a dollar for every time someone told me that Kabbage wasn’t a competitor in the Merchant Cash Advance space, I’d have my own funding company. It’s been argued that they only care about Ebay or Paypal and that their business model revolved around strengthening Ebay’s PowerSellers for the good of Ebay. I never really believed that was the case.

On September 11, 2012 I wrote this about Kabbage:

Some people feel that they are not a serious challenger to the status quo and that their tactics, methods, and headlines are merely shock value fodder for the rest of us to laugh at while we all rant and rave about ACH deals being the hottest thing since Square. We believe Kabbage is a company everyone should keep an eye on.

Kabbage analyzes many pieces of data in their underwriting including how many facebook fans a business has or added. And as of 2 weeks ago, what do you think happened?

Kabbage expanded their cash advance programs to brick and mortar businesses… (BusinessWeek)

And so here we are with yet another fierce well-capitalized competitor, a company that isn’t struggling to add technology but is rooted in it. Not only that, but last I heard they don’t work with brokers or agents. They cut out the middleman, much like Square did with ISOs.

Which brings me to the next few companies to keep an eye on:

Amazon: People say that their goal is to finance Amazon retailers for the good of Amazon. Sound familiar? I admit that Kabbage wasn’t owned by Paypal but there was a solid relationship there. Is it that ludicrous to think that Amazon will enter the brick and mortar cash advance business?

Groupon: They’ve been sniffing around this industry for quite a while. Keep an eye on them.

American Express: They already have their own cash advance program for premium merchants that accept a high volume of amex transactions. Every six months or so, their standards loosen. It’s only a matter of time until they have enough data to loosen their standards even more and compete head to head with the rest of the alternative business lending industry and cash advance industry.

———-

Scott Griest, the CEO of American Finance Solutions wrote in Disruption in the Alternative Business Lending Space that when all the dust settles in a couple years down the road, there will be only 4-5 large alternative business lenders. Consolidation and competitive pressure will thin out the herd and the strongest will prevail. The question is, will those 4-5 funding companies be the grass roots companies that propelled the industry to where it is today or will it be the big mega-corporations who are looking at our the industry like a delicious snack?

In one of the most read ever articles of MPR, I made this prediction in The End of an Era:

2014 will eliminate the weaker firms that remain and by 2015, Merchant Cash Advance will no longer be a term that anyone uses. Big banks and billion dollar technology companies will go on to rebrand all that which the funding warriors of the last decade have worked so hard to establish. MCA will simply assimilate into other financial products. The metaphorical Sally, Joe, and Tom will probably still be in the business, but be working for companies like Capital One, Wells Fargo, and American Express.

We weren’t kidding…

10 Clues You’re Hardcore About Merchant Cash Advance

May 30, 2013You might eat and breathe funding small business, but unless you’ve got a set of pajamas like mine, you probably don’t sleep it too.

Yeah, Funding Just Got Serious…

1. You miss your train back to Westchester, Long Island, Brooklyn, or North Jersey because of something someone said on DailyFunder:

2. You yawn whenever you reference millions of dollars…

3. This is what you have for lunch every day…

4. You know at least three people that talk about starting their own ISO on a daily basis but never do it…

5. You’ve realized that the only reason the MCA industry has grown so much in recent years is because of account reps like this…

6. You’ve accidentally referred to your friends, relatives, or other non-business owners as merchants. “I mean hey, we’re all merchants here, right?“

7. You’ve gotten at least one trophy. Top Salesman, Hardest Working or…

8. You’ve worked for this guy before or you probably still do..

9. You’ve been on a totally great sales call and had a colleague walk in the room and do one of these to ruin it…

10. But most of all, if you help your clients in a timely manner and they look like this…

Then you’ll always be hardcore in their eyes!

View More Merchant Cash Advance Memes on DailyFunder

– Merchant Processing Resource

https://debanked.com

MPR.mobi on iPhone, iPad, or Android

Alternative Business Lending With Steve Sheinbaum on #BusinessFuel

May 27, 2013This past friday, I joined in on Lendio’s #BusinessFuel on twitter, a twitter chat that is held weekly. There were many alternative business lending experts in attendance including Steve Sheinbaum, the CEO of Merchant Cash and Capital. He was the featured guest and the questions were directed at him for the last half hour. I’ve created a storify summary below with all of the important pieces:

Alternative Business Financing

A small group of experts got together on Lendio’s #BusinessFuel twitter chat to discuss alternatives to banking with Merchant Cash & Capital’s CEO, Steve Sheinbaum

Storified by Sean M· Mon, May 27 2013 10:13:11

QUESTION 1 ———–>

QUESTION 1 ———–>

QUESTION 2 ———–>

QUESTION 2 ———–>

QUESTION 3 ———–>

QUESTION 3 ———–>

QUESTION 4 ———–>

QUESTION 4 ———–>

The CEO of Merchant Cash and Capital, Steve Sheinbaum Joined the Chat

MCC’S ANSWERS BELOW

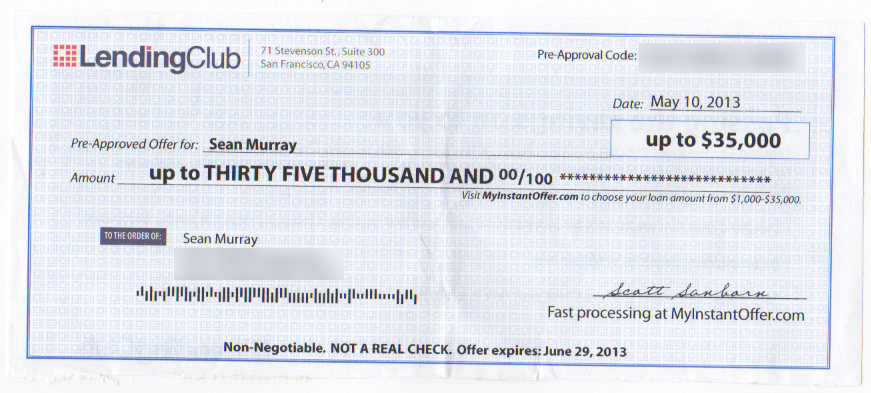

Lending Club in Action

May 26, 2013Soon after Google Inc. bought a stake in the personal loan company Lending Club, I apparently got added to their mailing list. I wonder if Google is providing Lending Club with better targeted data to close more loans. They probably are, although I probably shouldn’t be on this list.

I have seen the fake check method used many times by companies to excite mail recipients. The envelope also looked pretty fancy and it had a warning notice on it indicating that the contents of the letter were time sensitive. Do mailers still work these days? This leads me to believe they do. After all, I opened the letter and read through everything instead of throwing it away in the trash like I did with the other junk mail I got…

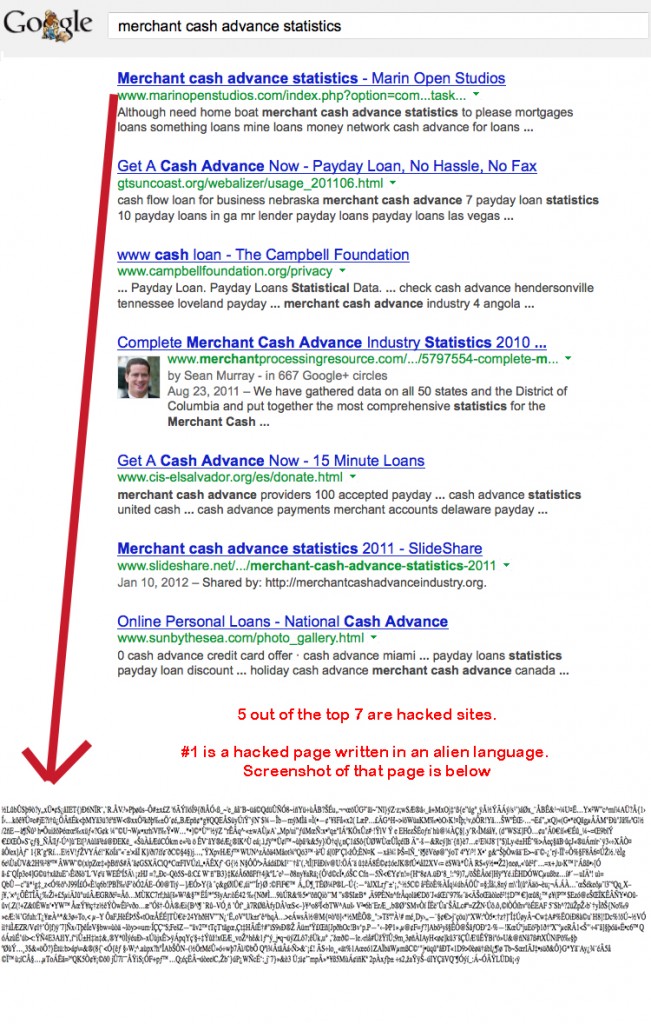

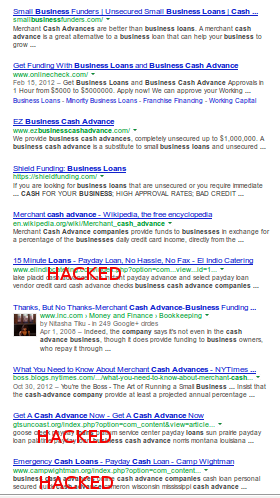

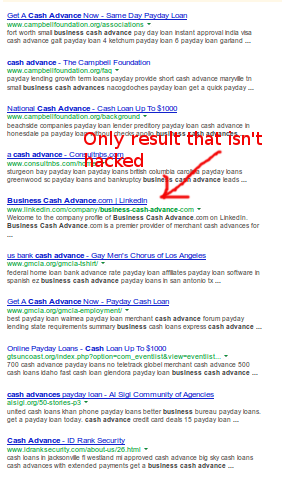

Penguin 2.0 Epic Fails

May 23, 2013Just as the Merchant Cash Advance industry is beginning to enjoy positive publicity, Google has the potential to set the momentum backwards by pushing terrible results. I’m going to post some Penguin 2.0 epic fails over the next couple days. So check in every now and then to see what’s new. You can also send screenshots of any epic fails you find to webmaster@merchantprocessingresource.com

Epic Fail #3: Page 1 for the search of Business Cash Advance Companies

Epic Fail #2: Page 3 for the search of Business Cash Advance

Epic Fail #1: