Block CEO Jack Dorsey Favors RFK Jr. For President

June 4, 2023Jack Dorsey, the former CEO of Twitter and current CEO of Block (aka Square), tweeted that Democratic candidate RFK Jr. could beat both Donald Trump and Ron DeSantis in the 2024 presidential election. When pressed what this meant, he replied that this was both a prediction and an endorsement.

Robert F. Kennedy Jr. is the son of Robert Kennedy who was assassinated in 1968.

He can and will https://t.co/zrKLc2BKhz

— jack (@jack) June 4, 2023

RFK Jr. is a strongly pro-bitcoin, pro-cryptocurrency candidate. A potential motive behind Dorsey’s support is that Block has not only cumulatively invested $220M in bitcoin itself but also that the company depends on selling bitcoin for nearly half of its overall revenue. Block recorded $7.1B in bitcoin revenue in 2022 and $10B in bitcoin revenue in 2021. That only amounted to 3% and 5% of the total gross profit for each year respectively, however.

RFK Jr. is a strongly pro-bitcoin, pro-cryptocurrency candidate. A potential motive behind Dorsey’s support is that Block has not only cumulatively invested $220M in bitcoin itself but also that the company depends on selling bitcoin for nearly half of its overall revenue. Block recorded $7.1B in bitcoin revenue in 2022 and $10B in bitcoin revenue in 2021. That only amounted to 3% and 5% of the total gross profit for each year respectively, however.

RFK Jr. recently spoke at a bitcoin conference in Miami, he accepts campaign donations in bitcoin, and he was recently quoted as referring to bitcoin as “freedom money.”

Big Short Seller’s Allegations About Block Don’t Make Block Look Too Good

March 23, 2023 Block, the parent company of Square Loans, suffered a rough day in the market (down 15%) on Thursday after an activist short seller made bombshell allegations about the way Block conducts its business. Hindenburg Research, the short seller, posted a report of alleged findings it had uncovered over a period of two years. In Block: How Inflated User Metrics and “Frictionless” Fraud Facilitation Enabled Insiders To Cash Out Over $1 Billion, the report focuses almost entirely on alleged shenanigans with Cash App. Block has often been referenced in the pages of deBanked because of its massive small business lending subsidiary, Square Loans, which last year originated $4 billion in funding to merchants. That subsidiary was not the subject of the report.

Block, the parent company of Square Loans, suffered a rough day in the market (down 15%) on Thursday after an activist short seller made bombshell allegations about the way Block conducts its business. Hindenburg Research, the short seller, posted a report of alleged findings it had uncovered over a period of two years. In Block: How Inflated User Metrics and “Frictionless” Fraud Facilitation Enabled Insiders To Cash Out Over $1 Billion, the report focuses almost entirely on alleged shenanigans with Cash App. Block has often been referenced in the pages of deBanked because of its massive small business lending subsidiary, Square Loans, which last year originated $4 billion in funding to merchants. That subsidiary was not the subject of the report.

While one can read the report on their own and form their own opinion, which the authors hope to profit from by Block’s stock going down, it should be noted that the timing of its release is a little suspicious. Block, for all the bells and whistles it has in payments and lending, is at its core these days, a crypto company. Block generated $7.1B in revenue just off of Bitcoin alone in 2022, perhaps making it an easier target given the string of recent events.

3/12/23

- Regulators shutter Signature Bank. Rumors abound that it was less about solvency and more about governmental dislike of its crypto clientele.

3/22/23

- Coinbase reveals that it received a Wells Notice from the SEC

- Tron founder Justin Sun sued by the SEC

- Several celebrities including Lindsay Lohan charged by the SEC for failing to disclose compensation they received for crypto promotions

- The President published his annual Economic Report which referenced crypto with astounding frequency

3/23/23

- Hindenburg Research releases its report about Block, causing the company stock to plummet 15% in a day. Although the focus is not on crypto, Block’s big revenue generator is Bitcoin, which generated $7.1B in revenue for the company in 2022.

El Salvador Partners with DeFi Lending Platform for Bitcoin-Backed SMB Loans

January 21, 2022

El Salvador continues to be an unprecedented experiment of mainstream crypto use. The small Latin American country that shifted its national currency to Bitcoin alongside the US dollar in June is now partnering with Acumen, a DeFi lending platform, to power Bitcoin-backed loans.

“Basically what we are doing is an alliance with the government,” said Andrea Maria Gomez, a Project Manager for Acumen. “[The government] is not backing anything. They are just giving us the channels for which we will reach the small and medium enterprises.”

CONAMYPE, an acronym in Spanish that represents the national commission for medium and small enterprises, already offers business financing. Rates for this are generally high, and just like in the US, the qualifications to get financing are extensive. With Bitcoin-backed loans, it seems that the funding process will be the thing that affects El Salvadoran merchants the most.

“We work through a stable doc so investors put their crypto in there, we convert it into a stable coin, and what we eventually loan out to the end user is dollars,” said Gomez. “So we don’t give Bitcoin or Solana or anything like that, we give them dollars.”

“For [merchants], it’s easier,” Gomez continued. “You are not depending on the volatility of a coin, you just have dollars.”

Just like in the US, funders borrow money at high rates from banks, resulting in the cost of financing being pushed down to the final borrower. In a government that has Bitcoin as an official currency, Acumen can lend Bitcoin backed dollars at a lower rate than what’s already being offered in the marketplace.

“What we are doing, this is like an initial run, is we are going to contribute one fund to CONAMYPE for them to be able to [lend] at a lower rate,” said Gomez. “We can provide at a lower rate because in crypto, the capital is loaned at a lower rate.”

When asked about the lack of digitally-native people in El Salvador, Gomez stressed that the application process doesn’t require a crypto-enthused business owner. “Business owners don’t need to understand the tech or go to a wallet to ask for the loan. It’s a regular loan to them. The difference is, the source of the funds is coming from this protocol.”

The El Salvadoran government is confident that these loans will open up access to capital to small businesses who would have no alternative source for funding. Mónica Taher, Technological & Economic International Affairs Director at Government of El Salvador, shared her thoughts with deBanked about the vision for this plan down the line.

“The Bitcoin small loans for Salvadoran businesses will re-energize the economy by allowing the unbanked to have the opportunity to have access to digital money and create a credit history,” said Taher.

This Just In: Crypto Transactions Aren’t Tax Free

January 20, 2022 Patrick White, CEO, Bitwave

Patrick White, CEO, Bitwave“I don’t always believe people that say they are surprised about having to pay taxes on crypto. There’s a field on your tax form to say where you’ve made money doing illegal things. If you sell drugs, there’s a place to report how much money you’ve spent selling drugs. The IRS doesn’t care. Everything is taxed in this country.”

There is no such thing as too many crypto transactions when it comes to accounting purposes according to Patrick White, CEO of Bitwave. Bitwave operates the software that does the accounting for major blockchain companies and retailers who have taken crypto as payment.

White says that the high volume of crypto transactions aren’t coming from individuals sending digital assets back and forth, but rather from the companies that host the infrastructure of these transactions.

“It’s not just trading, trading is fun and we all love the rat race that is trading, but where it’s a lot more interesting is how some of our customers who are in the NFT space are seeing millions of revenue transactions a month.”

These sites like OpenSea, a client of Bitwave, are seeing sky high amounts of these types of transactions. When asked about the cost of accounting for an individual doing ten-thousand trades a month, White laughed.

“Ten-thousand trades a month is nothing,” he said.

White spoke of an instance which is seemingly a common occurrence in the crypto world. “We had a customer who when we were running their [transactions], I couldn’t figure out [an issue] with one of their months. I went to go look at the data, and they had turned on a Binance bot and without even realizing it, they didn’t know this, they accidentally had 200,000 trades in a month. The volume is incredible.”

White spoke of an instance which is seemingly a common occurrence in the crypto world. “We had a customer who when we were running their [transactions], I couldn’t figure out [an issue] with one of their months. I went to go look at the data, and they had turned on a Binance bot and without even realizing it, they didn’t know this, they accidentally had 200,000 trades in a month. The volume is incredible.”

When asked about how digital assets have impacted the accounting world, White stressed that the amount of transactions have resulted in companies appearing larger than they are from a transactional-perspective. According to him, some of his clients are doing as many transactions as some of the largest companies in the world.

“[One client] is a one-year old company that is doing the volume of a sixty year-old retail business, it’s unheard of.”

When asked further about the difference of cost in accounting digital assets versus dollars, White explained that it isn’t much different than how larger companies have maintained their books for some time.

“No matter what, if you are a high frequency trader and you’re making hundreds of millions of trades a year, you will need software to deal with that,” said White. “I wouldn’t say that [the amount of transactions] are increasing costs across the board, it is a cost that you would already be expected to [have].”

When asked about the apparent vacuum of crypto-native accountants, White seemed to cast blame on the approach of the information. When hiring, he says he finds more value in people with engineering experience over accounting experience, and blockchain experience over anything else.

“[Other accountants] are trying to apply finance 1.0 things to this crypto world,” said White. “We look for good engineers. A good engineer can figure anything out, a bad engineer with accounting experience can’t. We’re looking for blockchain experience, as blockchain [technology] is more difficult than accounting in many ways.”

While most businesses will file extensions this time around and finish their taxes in October, White believes that blockchain accounting will become more widespread as new firms leverage the infancy of the space and settle into their niches.

“Cottage industries will come up in order to enable the IRS,” said White. “I don’t expect the IRS to build this technology or this understanding in-house. There will be people and businesses that will do it for them.”

With the IRS’ decisions about taxing crypto having the potential to change at any notice, White stressed the necessity for malleability when developing this kind of accounting technology in such an unpredictable space.

“We’ve designed Bitwave from the very beginning to be able to rapidly adjust to the new laws that are coming out,” he said. “Even back then, it was very obvious that we couldn’t build this tech in such a way that it is inflexible.”

Dorsey Focuses Tweets on Bitcoin and Anti-Web3 Since Leaving Twitter

January 18, 2022 Jack Dorsey’s departure from Twitter didn’t leave him without a job. He’s still the CEO of Square (now Block), a payments company that is one of the largest small business lenders in the country. Still, all that extra time on his hands must mean he has plans in the works, especially since he believes hyperinflation is right around the corner.

Jack Dorsey’s departure from Twitter didn’t leave him without a job. He’s still the CEO of Square (now Block), a payments company that is one of the largest small business lenders in the country. Still, all that extra time on his hands must mean he has plans in the works, especially since he believes hyperinflation is right around the corner.

If his tweets are any indication, Dorsey is focused mainly on Bitcoin as both an answer to inflation and as a counter to the burgeoning “web3” concept attributed mainly to projects on the ethereum blockchain.

“You don’t own ‘web3.’ The VCs and their LPs do,” Dorsey tweeted on December 20. “It will never escape their incentives. It’s ultimately a centralized entity with a different label. Know what you’re getting into…”

“The VCs are the problem, not the people,” he later added.

His comments rubbed some in Silicon Valley the wrong way.

I’m officially banned from web3 pic.twitter.com/RrEIAuqE6f

— jack⚡️ (@jack) December 22, 2021

Since being “banned by web3,” Dorsey announced that Block is building an Open Bitcoin Mining System to help make mining more distributed and efficient. A tweet thread he shared by Block Hardware Manager Thomas Templeton explained exactly what that means:

“We want to make mining more distributed and efficient in every way, from buying, to set up, to maintenance, to mining. We’re interested because mining goes far beyond creating new bitcoin. We see it as a long-term need for a future that is fully decentralized and permissionless.

We started by digging into two big questions. 1) What are customer pain points today? 2) What are the specific technical challenges? We spoke with members of the mining community to learn more about their experiences. Here’s what we’ve found so far:

1/ Availability. For most people, mining rigs are hard to find. Once you’ve managed to track them down, they’re expensive and delivery can be unpredictable. How can we make it so that anyone, anywhere, can easily purchase a mining rig?

2/ Reliability. Common issues we’ve heard with current systems are around heat dissipation and dust. They also become non-functional almost every day, which requires a time-consuming reboot. We want to build something that just works. What can we simplify to make this a reality?

3/ Performance. Some mining rigs generate unwanted harmonics in the power grid. They’re also very noisy, which makes them too loud for home use. Unsurprisingly, all miners want lower power consumption and higher hashrates. What’s the right balance of performance vs other factors?

Developing products is never a solo journey, and evaluating existing tech is always part of our practice. For this project, we started with evaluating various IP blocks (since we’re open to making a new ASIC), open-source miner firmware, and other system software offerings.

We are interested in performance *and* open-source *and* our own elegant system integration ideas. Which tech and which partners should be on our list to consider? We’ve learned so much just from these preliminary conversations and we want to keep this going.

Team. We’re incubating this investigation within Block’s hardware team and are starting to build out a core engineering team of system, asic, and software designers led by @afshinrezayee. A few of the open roles are Electrical Engineers, Analog Designers, and Layout Engineers.

Thanks for engaging with our work. If you have questions, want to share more feedback about the pain points or missing features of the existing mining solutions, or know someone we should be talking to about our open roles, you can reach us at miningsystem (at) block (dot) xyz”

As for inflation, well Dorsey’s not so shocked that the number continues to tick upwards.

damn Santa didn't take the transitory inflation away https://t.co/P1CFEIQyNV

— jack⚡️ (@jack) January 12, 2022

Buying the Constitution at $20 Mil? More Like $25 Mil

November 16, 2021 While crypto fans rally to hit a $20 million fundraising target in order to make a competitive bid for a copy of the United States Constitution on Thursday, lurking in the background is another cost, the auction house fees.

While crypto fans rally to hit a $20 million fundraising target in order to make a competitive bid for a copy of the United States Constitution on Thursday, lurking in the background is another cost, the auction house fees.

Known as the “Buyer’s Premium,” Sotheby’s charges 25% on the first $400k, 20% on the next $3.6M and $13.9% on the amount over $4 million, according to the auction terms.

That would mean that a $20 million winning bid would generate $3,044,000 in Buyer’s Premium Fees. And that’s before an additional 1% overhead premium equivalent to $200,000, bringing the house fees to $3,244,000.

Oh, and that’s not inclusive of the upfront sales tax of $1,775,000 (8.875% of the sales price).

All combined, the fees and taxes to take the $20 million haul off the premises, before transport, preservation, and security is: $4,819,000.

That means that the ConstitutionDAO would really need at least $25 million in its coffers in order to place a legitimate $20 million bid.

On Tuesday at 5pm EST, approximately 48 hours before auction time, the DAO had only raised 1,382 ETH, equal to about $5.87M. Sotheby’s starts the bidding at 6:30pm on Thursday at its location in NYC.

Time will tell if it is able to muster up the rest in time.

El Salvador Becomes First Bitcoin Nation as 70% of Country Remains Unbanked

September 7, 2021 With over $20 million in Bitcoin, the El Salvadorian government is set to put the basis of their already crumbling economy on the back of the world’s most sought-after cryptocurrency. President Naykib Bukele took to Twitter over the weekend to boast about his country’s unprecedented economic shift in a time when 70% of residents lack access to traditional financial services.

With over $20 million in Bitcoin, the El Salvadorian government is set to put the basis of their already crumbling economy on the back of the world’s most sought-after cryptocurrency. President Naykib Bukele took to Twitter over the weekend to boast about his country’s unprecedented economic shift in a time when 70% of residents lack access to traditional financial services.

In a country where roughly half of its population has no internet access, the government has released a state-sponsored app (called Chivo Wallet) that will allow its citizens to buy goods using Bitcoin the government owns. Mostly dominated by the US Dollar, the local economies of El Salvador will now be forced to accept Bitcoin as legal currency.

Each citizen who uses Chivo will be given $30 worth of Bitcoin to jumpstart the spending.

Buying the dip 😉

150 new coins added.#BitcoinDay #BTC🇸🇻

— Nayib Bukele 🇸🇻 (@nayibbukele) September 7, 2021

The move has faced backlash from all different types of groups including economists, politicians, and investors. The world is watching to see if this shift in currency will help pull the country out of its troubles, or if it is more public relations posturing — at the expense of the El Salvadorian economy.

The United States top official in El Salvador, Jean Manes, referred to the nation at a press conference Saturday as “a democracy in decline” as the move is just one of a handful of that technically increase the power of the federal government in the small country. Manes compared Bukele to the likes of Hugo Chávez, using his notoriety with the population to cover up a strategic economic collapse and dismantling of democracy.

The El Salvadorian embassy did not immediately respond to a request for comment.

The value of Bitcoin dropped by 15% against the US dollar on the day of its debut.

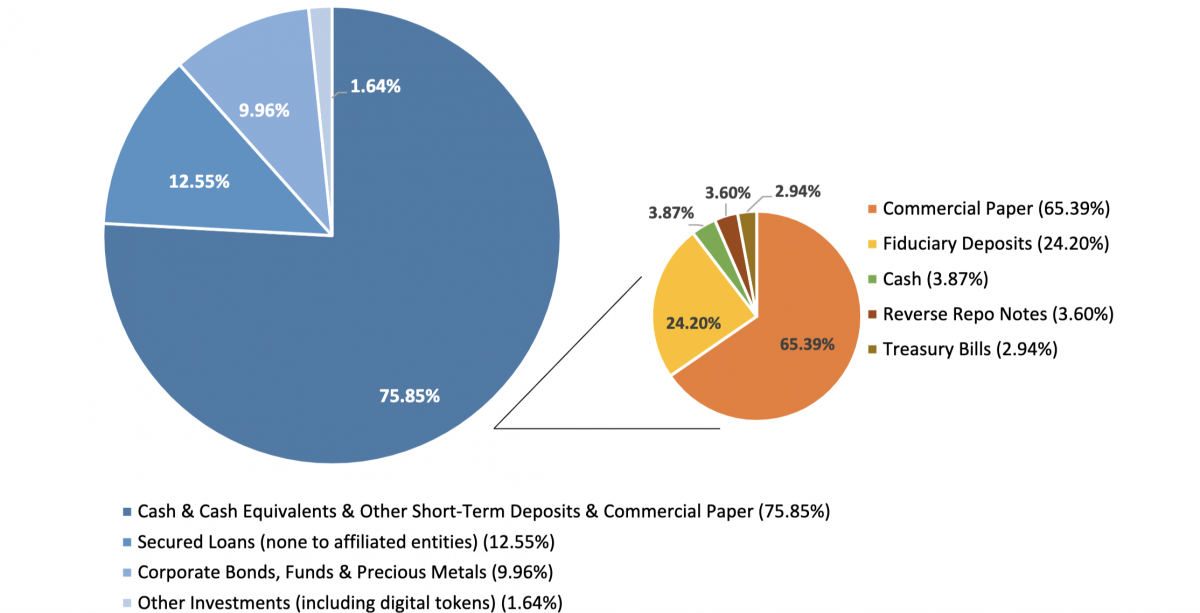

Tether is Now So Big, Its Collapse Could Disrupt the Short-Term Credit Markets

June 26, 2021 More than $62.5 billion worth of Tethers have been printed in the last few years to facilitate liquidity in the crypto markets. The system has worked because the company behind Tether had long claimed that each unit of the digital currency was backed somewhere by a real dollar in a bank account.

More than $62.5 billion worth of Tethers have been printed in the last few years to facilitate liquidity in the crypto markets. The system has worked because the company behind Tether had long claimed that each unit of the digital currency was backed somewhere by a real dollar in a bank account.

That was determined false. “Tether’s claims that its virtual currency was fully backed by U.S. dollars at all times was a lie,” wrote the New York State Attorney General in February after the regulator announced a settlement with the company. “These companies obscured the true risk investors faced and were operated by unlicensed and unregulated individuals and entities dealing in the darkest corners of the financial system.”

Despite the characterization, Tether has continued to be the glue that makes the global crypto market hum. And their size is now so big, that it’s no longer just a crypto problem.

According to the Federal Reserve Bank of Boston, Tether now poses a risk to all short-term credit markets. The central bank listed it as an example of “new disruptors” that pose financial stability challenges.

Eric S. Rosengren, the CEO of the Boston Fed, said “There are many reasons to think that stable coins, at least many of the stable coins are not actually particularly stable and actually have some of the same features as money market funds. The difference is prime money market funds have been losing market share but these stable coins have been growing very rapidly in part because of their use along with the cryptocurrency market.”

On Tether in particular, he said, “While [Tether talks] about being stable, if you look at the set of assets that are there, it includes corporate bonds, secured loans, commercial paper, in effect this is a very risky prime fund. Prime funds would not be able to hold all these assets.”

Tether has drawn enhanced public scrutiny in recent months after releasing the following breakdown of its assets. The digital asset company that once claimed all Tethers were backed by dollars, revealed that less than 3% of them were actually backed by dollars.

Tether’s riskiness was also the subject of a recent segment on Jim Cramer’s Mad Money show on CNBC:

deBanked first shed light on the Tether mystery more than two years ago in a story that questioned what drove the cryptocurrency bull market of 2017.