Banking

JPMorgan Plans to Charge Fees to Fintechs to Get Customer Bank Account Data

July 16, 2025After Bloomberg News revealed that JPMorgan was planning to charge fintechs to access their customer bank account data, CEO Jamie Dimon was questioned about this during the bank’s latest quarterly earnings call. Dimon said that this was a customer-driven decision designed to protect them.

“So we think the customer has the right to if they want to share their information. What we ask people to do is do they do they actually know what’s being shared? What is actually being shared? It should be everything. It should be what their customer wants. It should have a time limit because some of these things went on for years. It should not be remarketed or resold to third parties. And so we’re kind of in favor of all that done properly.

And then the payment, it just costs a lot of money to set up the APIs and stuff like that to run the system protection. So we just think it should be done and done right. And that’s the main part. It’s not like you can’t do it. The last thing is a liability shift. I don’t think JPMorgan should be responsible if you’ve given your bank passcodes to third parties who market and do a whole bunch of stuff with it, and then you get scammed or fraud through them, they should be responsible. And we want real clarity about that. And if you see today, lot of these scams and frauds run through third party social media and stuff like that, there should be a little more responsibility on their part so we could all do a better job for the customer. That’s why.

There’s a debate brewing as to whether or not this move is actually designed to serve the customer. The American Fintech Council (AFC), for example, said that it’s actually designed to accomplish the opposite and that it would hurt consumers and borrowers alike.

“Consumers have a right to their own financial data, full stop,” said AFC CEO Phil Goldfeder. “Any effort to restrict or monetize access to consumer-permissioned financial information is a direct threat to responsible innovation, healthy competition, and the progress we’ve made toward a more inclusive financial system.”

Just a few months earlier, Dimon hinted in a bank shareholder letter that such a move would be defensive and that a fight with the fintechs monetizing their data was on the horizon.

“Banks provide fantastic services, and it’s time to defend ourselves – in the public realm or in court if need be,” he said. “Now a new battle is brewing: Third parties want full access to banks’ customer data so they can exploit it for their own purposes and profits.”

Need a Bank to Fund MCAs? You Can’t Operate Without One

May 12, 2025 “I learned back in the early 2000s when merchant processors started to offer merchant cash advances, that was the first time I ever heard of MCA,” said Christian Sanchez, Relationship Manager for the National Deposits Group of Dime Private & Commercial Bank. Sanchez, who’s been in banking for 25 years, understands MCAs in their current iteration from a unique vantage point in the ecosystem. Dime, for example, is a full‑service commercial bank based in New York that today provides a variety of customers, including MCA funding companies, with services like checking accounts, wire access, and ACHs.

“I learned back in the early 2000s when merchant processors started to offer merchant cash advances, that was the first time I ever heard of MCA,” said Christian Sanchez, Relationship Manager for the National Deposits Group of Dime Private & Commercial Bank. Sanchez, who’s been in banking for 25 years, understands MCAs in their current iteration from a unique vantage point in the ecosystem. Dime, for example, is a full‑service commercial bank based in New York that today provides a variety of customers, including MCA funding companies, with services like checking accounts, wire access, and ACHs.

Sanchez worked with his first MCA client in 2021 and immersed himself in their business and the industry. When he got them onboarded and saw how well it worked out, he knew there was something there. By early 2024, he set out to find a place where he could meet many MCA funders at once and attended the deBanked CONNECT MIAMI conference that January. It was almost right afterward that he started a new role at Dime, and he has been actively looking to serve MCA companies ever since.

“Through the connections I made—I attended Broker Fair in New York last May and from there my access to the industry has been great and I continue to meet contacts, and one contact leads me to another,” Sanchez said.

It’s more than just a basic account that Dime is offering to MCA funders.

“Our platform is designed to give you the tools that you need to run your MCA funding company,” he said, “coming in from the standard online banking access, being able to view your accounts, run reports, extract information to your accounting system… We give you access to our ACH platform, which allows you to set up your payment collections, and based on how your deal is structured with the merchant, you can set those up with the different recurring schedules.”

Dime customers can also continue to use their own third‑party ACH processor if they choose.

Banking, believe it or not, can be one of the most overlooked considerations in running a funding company. A bank’s underwriting team has to understand the business, be comfortable with it, approve it, and be prepared to handle the flurry of activity—yet, even when they do, things may not always run smoothly. To that end, Sanchez said that even if someone already has an MCA banking relationship elsewhere and doesn’t want to switch to Dime, being fully onboarded with another bank as a backup is a smart plan. The time‑sensitivity surrounding things like wire deadlines and daily ACHs is critically important in the industry. It’s crucial not to wait until it’s too late for that Plan B, since onboarding and risk underwriting are neither instantaneous nor guaranteed.

“Obviously I would love to be the primary and having the biggest share,” Sanchez said. “But at the end of the day, it’s business. If I can be part of your business and work together, then I fulfill my need.”

Credit facilities, investors, and syndicates may also require an MCA funder to have a backup bank ready to go as a condition of working together. They might even require a Deposit Account Control Agreement (DACA), which Dime is equipped to put in place.

“[A DACA] is a tri‑party agreement between the MCA funder, the lender, and the bank,” Sanchez explained. “And what happens is this is a way for a lender to ensure that the MCA is doing what they say they were going to do…”

Dime customers need not be located in New York, but those who want to drop in on their banker can do so at the Midtown Manhattan branch or set up a meeting with Sanchez himself.

Dime customers need not be located in New York, but those who want to drop in on their banker can do so at the Midtown Manhattan branch or set up a meeting with Sanchez himself.

“A lot of times what I can assure you is, if you look for me, you can find me, whether it’s by phone or we might be meeting somewhere but I’m constantly available.”

True to that promise, Sanchez said he will once again attend Broker Fair in person on May 19 in New York City.

It’s important to note that, as a bank, there is still a rigorous underwriting process and not every company may be approved.

“It’s absolutely amazing to see how Dime is willing to work with MCAs,” he said. “We have a clear understanding of the industry, the risk that’s involved with it, but the bank has embraced it instead of running away.”

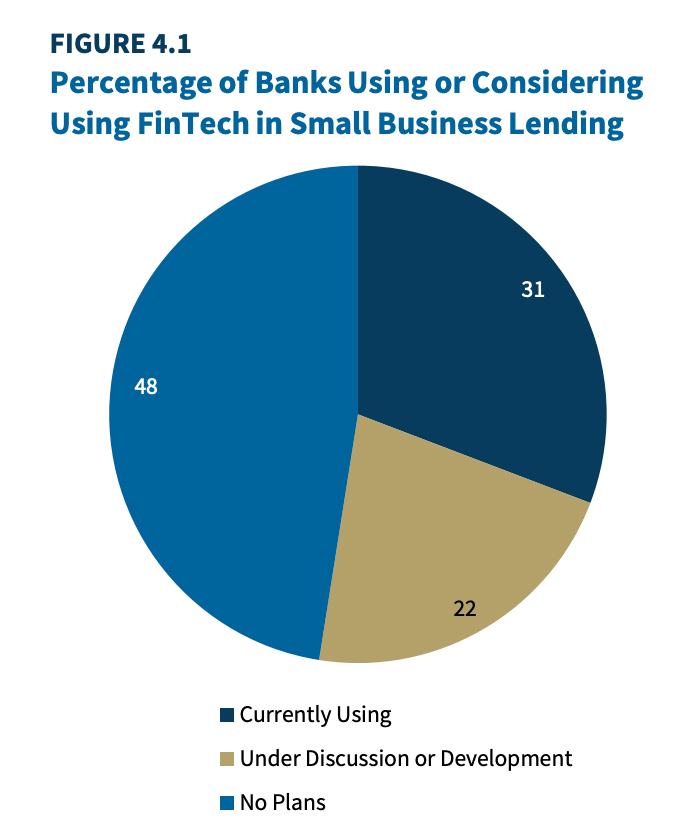

Only 10% of Banks Have a Credit-Scoring System That Can partially or Fully Automate Small Business Lending

October 3, 2024If you thought that fintech had already largely come in and revolutionized the lending process at banks, you’d be wrong. According to the FDIC’s latest annual small business lending report, only 10% of banks have a credit-scoring system that can partially or fully automate the underwriting of some non-credit-card lending. Further, only 3% of banks use a credit-scoring system to auto-approve loans and less than 1% will auto-approve a loan of $250,000.

When it comes to fintech, “banks most commonly use fintech to help with regulatory compliance and for steps taken after loan approval,” the report says, “such as closing, performance and servicing, and portfolio analytics.”

Still, that doesn’t mean they’re terribly slow. In fact, thirty percent of banks can approve a small and simple business loan within one business day and 75% of of banks can approve one within five business days, though approvals usually happen within ten days on average.

And just because a bank’s business loan operation isn’t fully automated doesn’t necessarily mean they’re at a disadvantage competitively because banks actually tend to view the personal relationship with their small business loan customers as one of their core advantages.

“Banks use and high value branch locations and on-site visits as ways to generate and maintain small business lending relationships,” the report says. “About four in five banks define their geographic market for small business lending based on their branch footprint and, on average, their market extends 40 miles from their branch locations.”

“Very few banks allow borrowers to complete a loan application entirely through an online portal,” it adds. And that’s by design apparently. Of the banks surveyed for the report, almost half of them said they had NO PLANS to use or CONSIDER fintech in small business lending.

There’s a lot more insight in the full report that you can view here.

NorthOne is Building Finance Departments For Small Businesses

October 20, 2022 NorthOne recently received $67 million in Series B funding from investors including former NFL star Drew Brees, Battery Ventures, Don Griffith, Ferst Capital Partners, FinTLV, Operator Stack, Redpoint Ventures, Tencent, Tom Williams, and Next Play Capital.

NorthOne recently received $67 million in Series B funding from investors including former NFL star Drew Brees, Battery Ventures, Don Griffith, Ferst Capital Partners, FinTLV, Operator Stack, Redpoint Ventures, Tencent, Tom Williams, and Next Play Capital.

Founded in 2016 by CEO Eytan Bensoussan and COO Justin Adler, NorthOne was designed for small business owners to build a finance department without the complexity of a bank. Coming from an entrepreneurial background, Bensoussan noticed that being a great owner does not make one a great financial manager. With the idea of building good banking and accounting for businesses and combined with Adler’s professional career in the tech space, NorthOne was born.

“We want to build finance departments out of every small business in America, bring the sophistication of what so many of the biggest companies around us enjoy but bring it to the small businesses that could never dream of being able to build a finance department for their small business,” said Bensoussan. “I think that’s the gap that we’re closing.”

Through NorthOne, customers not only get access to a bank account but also technology that organizes and manages other business functions. Business owners can pay invoices, do payroll, and send ACHs or wires in seconds, for example, all while integrating with their existing accounting, e-commerce, and POS software.

Conducting all this from a desk or mobile device without having to go to a bank is a service directed at small businesses with fewer than 10 employees, that are family owned, and are managed locally in the community.

“…here we are talking to a lot of these business owners explaining that there’s so much more that a bank account could offer if it was designed to be more than just a store of money,” said Bensoussan. “I think that’s this eye-opening moment when we talk to them, and we get a lot of folks saying I never even thought that it could go that far. And it’s an exciting moment for us as well.”

Pay Day Just Switched Its Day

October 20, 2022 Direct deposit could soon be hitting some JPMorgan Chase customers’ accounts two days earlier than their regular pay day. A new feature they’re rolling out aims to reduce over drafted checking accounts. In addition to paycheck deposits, it can also be applied to tax refunds, pensions, and government benefits. Such a move is a nod to perks already being offered by fintechs such as Chime and banks as well.

Direct deposit could soon be hitting some JPMorgan Chase customers’ accounts two days earlier than their regular pay day. A new feature they’re rolling out aims to reduce over drafted checking accounts. In addition to paycheck deposits, it can also be applied to tax refunds, pensions, and government benefits. Such a move is a nod to perks already being offered by fintechs such as Chime and banks as well.

The feature will be available for Chase Secure Banking customers starting this week. There is no minimum deposit to get started and there is a monthly service fee of $4.95.

The transition away from overdraft fees is becoming more common. Last year, Capital One announced it was completely removing overdraft fees and non-sufficient fund fees, for example. Following that trend banks such as Discover, Ally, Axos, Betterment, Wealthfront and Alliant have also introduced no-overdraft account options.

Some “pro-overdraft bankers” believe that fees encourage responsible behavior while opponents have criticized a service that charges money to people for not having enough money.

Rapid Finance Has Evolved Into a Three-Piece Business

October 12, 2022 Historically, Rapid Finance has been a lender, but over the last few years the company has expanded into other areas including portfolio servicing and technology. It’s a three-piece business, one that now includes a new wholly owned subsidiary, Thrive.

Historically, Rapid Finance has been a lender, but over the last few years the company has expanded into other areas including portfolio servicing and technology. It’s a three-piece business, one that now includes a new wholly owned subsidiary, Thrive.

Thrive is described as an end-to-end digital lending platform that can be used by banks, credit unions, or other organizations to offer small business loans faster and easier to their customers.

Kunal Sehgal, co-founder and CEO at Thrive, said that Thrive’s technology can handle everything “from the application intake, to actual data collation and aggregation, to underwriting to decisioning, to origination to closing, and then servicing as well.”

The product gives Rapid a unique tool in its arsenal, given the company’s background. Will Tumulty, CEO at Rapid Finance, explained that Thrive’s technology will be greatly enhanced by Rapid’s own experience in the lending business.

“If you want to do a partnership with Rapid [through Thrive], you’re not just signing up for software,” Tumulty told deBanked. “You can get software, you can get potentially balance sheet access, you get expertise in servicing and credit management that Rapid has developed over more than 15 years in small business lending. And we think that’s a big difference for companies that are looking for a partner to help them get into the small business lending space.”

The acquisition was announced on October 3rd at American Banker’s Small Business Banking conference and is part of Rapid’s recent corporate rebrand and restructuring, which includes a new logo and website.

Has That Doc Been Tampered With? Ocrolus Will Detect it

September 20, 2022 Building off its original technology, Ocrolus has added a new fraud detection solution called Detect.

Building off its original technology, Ocrolus has added a new fraud detection solution called Detect.

“Detect uncovers document fraud and provides high-quality, decision-ready data that helps lenders minimize risk and prevent unnecessary losses,” said David Snitkof, Head of Analytics at Ocrolus. “With Detect, we’re able to show lenders when editing software was used, and if things like account number, account holder, dollar amounts, and more have been edited on a document.”

This analysis can be performed through the Ocrolus dashboard or API so that can lenders can review it and make a qualified decision. Tampered areas of a document are highlighted in red.

“In some cases, we’re able to uncover the original document and show it side-by-side with the tampered document,” said Snitkof. “This paints a vivid picture of how fraud is taking place.”

Snitkof believes Detect will be an asset to the company as they have already seen tremendous impact with their customers.

“For a leading small business lender, we were able to identify file tampering on 21% of confirmed fraud losses. Detect would have saved the lender over $1.2 million. That’s a significant return on investment,” said Snitkof.

To be clear, the company had previously provided customers with a fraud detection solution and this is merely a significant update.

“Fraudsters are constantly innovating and developing new techniques to misrepresent the truth and steal lenders’ capital. Even when they manipulate a document, it is often a high-quality forgery, where there would be no way for a human reviewer to identify any inconsistency,” said Snitkof.

Recent occurrences and the increase in fraud have ignited Ocrolus to improve their tools.

“People often take others’ financial documents, modify the information, and pass it off as their own. Sometimes, a fraudster will create cash out of thin air – for instance adding digits to a transaction amount – and then also change all the other numbers on the statement so that all the numbers reconcile perfectly,” said Snitkof.

Is Your Big Brand a Bank? You Can Turn it into One

August 16, 2022

“Any entity that has employees, customers, and fans can create a banking infrastructure that looks just like a bank,” said Yuval Brisker, Co-founder and CEO of Alviere. Founded in 2020 as a spinoff of Brisker’s previous firm, Mezu, Alviere is ringing in the next generation of fintech through its embedded finance solutions.

Brisker wasn’t talking about turning the corner diner into a bank, but rather about providing the infrastructure to enable the largest companies and brands in the US to be one-stop shops for financial services, including banking.

“[It could look] like a bank in every sense,” he said, “FDIC insured, providing a savings account with yield, being able to ultimately give them a credit card, that is not a co-branded credit card, but it’s a single brand…”

Alviere has already spent loads of time dealing with the hard parts, building the tech, but also navigating the regulatory framework to make this concept a reality.

“We are a 100% regulated entity, meaning we’re not piggybacking on a banking license,” Brisker said. “We are actually licensed across the United States in every state that takes a license (except Montana). We are licensed with the federal government in Canada and Quebec and in the English speaking provinces, we’re in the process of completing our licensing in Mexico, and in Europe and in the UK.”

Brisker says this proactive approach is a “big differentiator” against the competition because they really want to provide the full services end-to-end. And that’s a big range given that it spans from bank accounts to payments to cards to cryptocurrency.

In making this possible, partnerships are key. Alviere has multiple bank partners across the globe, the company claims, one among them being Community Federal Savings Bank in the US. Alviere even solidified a deal with Coinbase back in March that enables brands to provide crypto services to their customers all through their own branded technology.

In making this possible, partnerships are key. Alviere has multiple bank partners across the globe, the company claims, one among them being Community Federal Savings Bank in the US. Alviere even solidified a deal with Coinbase back in March that enables brands to provide crypto services to their customers all through their own branded technology.

Retail customers might not ever know the name Alviere because they remain in the background, Brisker explained. The brands would, but the customers would only see themselves interfacing with the brand, which is basically the whole point.

“We tell [brands] those customers will never be our customers,” Brisker said. “We’re never going to take over the customer relationship.”

Larger companies have probably entertained this whole idea at some point already, according to Brisker. The potential to capitalize on a loyal customer base by trying to offer them financial services is increasingly being looked at.

“If you’re one of those companies and you also look at the same time how difficult it is to get into this business, both from a regulation, an ecosystem, and a technological point of view, then you’re probably putting that on your back burner and saving this for another day,” he said. Alviere, however, can make this a reality right now.

“We have all the contracts, we have all the relationships, you just need to have one point of contact, one API, one relationship, one contract, and that’s us,” Brisker said. “And we take care of everything else.”

But perhaps it’s all a big bet, because would customers actually use financial services offered through non-bank brands that they’re fans of otherwise? Technically, they already are.

When Alviere launched two years ago, more than 1 out of every 2 Americans had already used a Buy-Now-Pay-Later (BNPL) service, an embedded financial concept that’s taken off around the world. BNPL sales amounted to $100 billion in 2021 in the US alone.

“We believe that there’s a huge opportunity for more traditional beloved and essential brands to become the financial service providers for [people] coming of age,” Brisker said. “And then of course there’s a huge unbanked population that for whatever reason has not entered the financial system here and abroad, which we think that through the affinity with sort of less foreboding, less anxiety, stress-ridden relationships like some people have toward banks that they will be more inclined to come into the financial system through the back door of the system, the front door of the brands they already know and patronize.”