Kevin Travers was a Reporter at deBanked.

Articles by Kevin Travers

LoanMe, Liberty Tax Merger to Take on Intuit, Enova

February 22, 2021NextPoint Financial will combine LoanMe’s business, consumer, and mortgage lending with Liberty Tax’s tax preparation business, according to merger announced on Monday. Liberty’s “2,700+ locations in the US and Canada” will become consumer and SMB loan shops.

The new firm will also offer Merchant Cash Advances; LoanMe launched MCA funding in January and expects to fund $15 million in MCAs in 2021. Based on the acquisition prospectus, NextPoint will be a tax readiness firm, with the added suite of financial products as a value and growth builder.

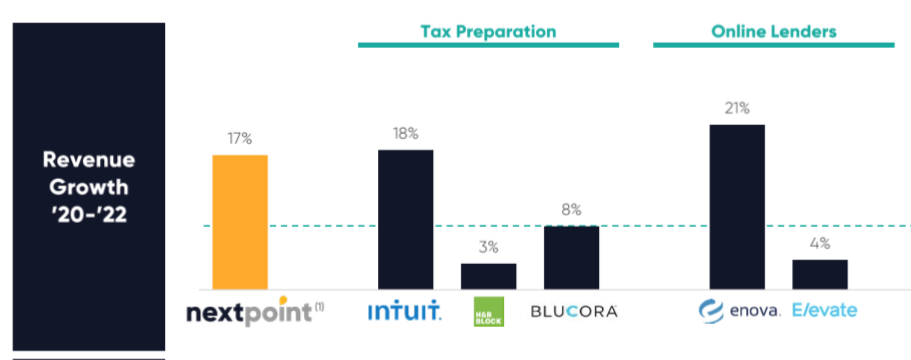

Ramping up consumer, installment, and MCA lending, paired with the third-largest tax-prep business in the U.S, NextPoint expects to compete directly with Intuit, H&R Block, Enova, and Elevate.

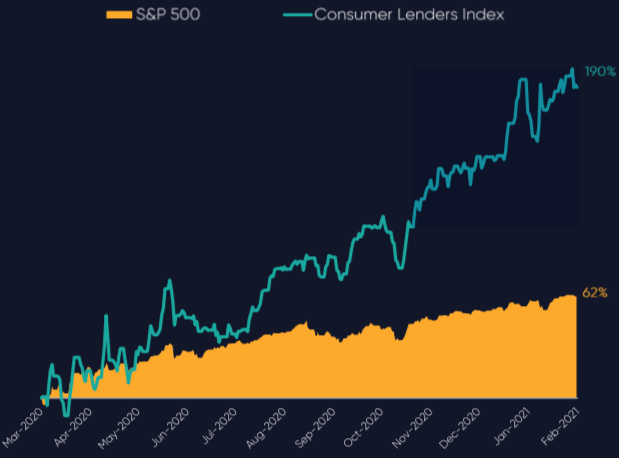

Fintech firms are setting themselves apart from the competition as one-stop shops for everything a business needs, including MCA products. Why branch into financial services now? NextPoint found that this year alt lenders have outperformed the S&P500 three times over.

“We are a one-stop financial services destination empowering hardworking and credit-challenged consumers and small businesses,” the investor presentation reads. “To get to the next point in their financial futures.”

Intuit offers a variety of financial products, like business loans through Quickbooks Capital, alongside their popular, 60%+ market share of tax prep software. H&R began offering small $1,000 lines of credit this year, but not much more.

The team leading the new company, NextPoint Financial, will feature execs like Brent Turner as CEO, Mike Piper CFO, both keeping their previous Liberty Tax positions. Jonathan Williams, former president and founding shareholder of LoanMe, will become president of lending.

Game Stopped? Short Selling, Social Media, and Retail Investors Collided in House Hearing

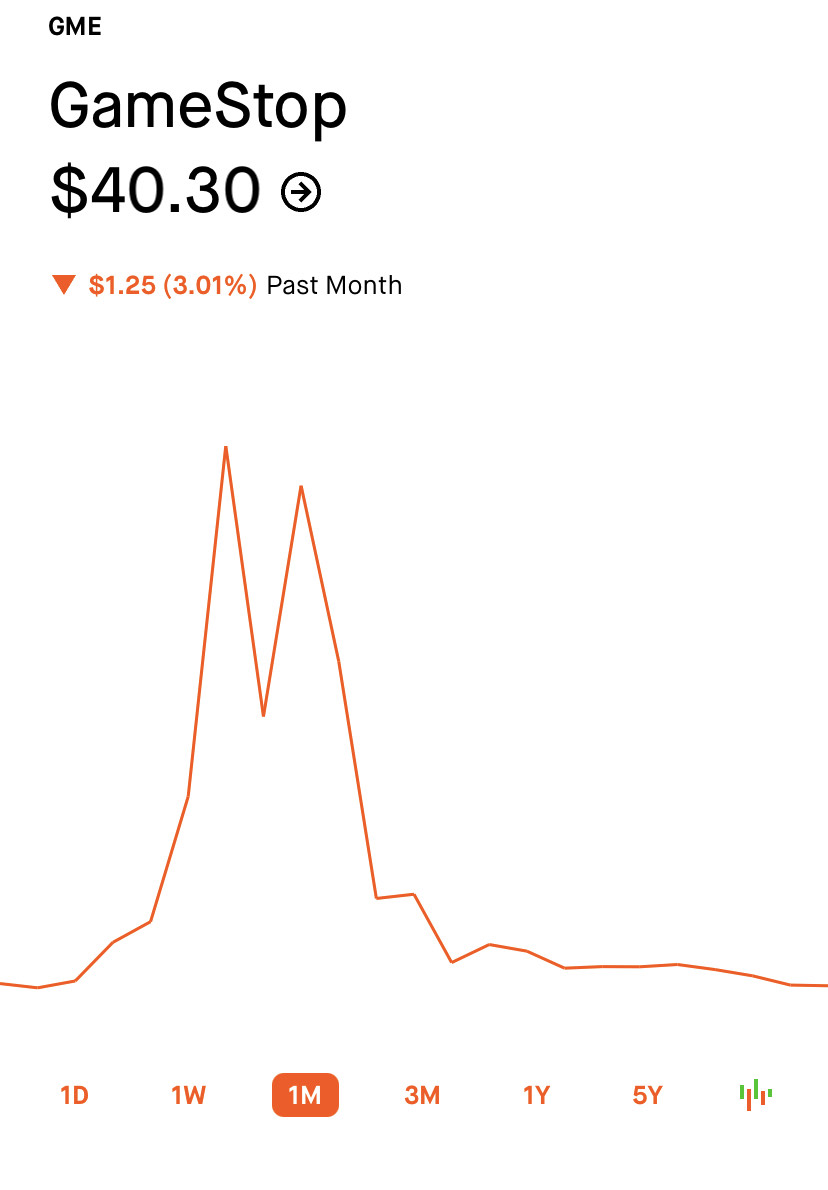

February 21, 2021 Nearly a month after the GameStop (GME) stock price shot halfway to the moon, the House Committee on Financial Services gathered representatives from the trading conflict in a hearing to examine what happened.

Nearly a month after the GameStop (GME) stock price shot halfway to the moon, the House Committee on Financial Services gathered representatives from the trading conflict in a hearing to examine what happened.

The focus was on a struggle between big institutional money and retail, everyday investors. Armed with nothing but zero-commission investment apps, government stimulus, and with nothing to do but sit at home waiting for a pandemic to end, retail traders exploded onto the securities markets. One of the results was a dramatic rise and fall of GME at the end of January.

Vlad Tenev, the Robinhood app’s co-founder, faced the highest number of questions after the firm blocked trading of GME on January 28th. Across the videocall-octagon was Keith Gill, a r/WallStreetBets retail investor long on GME since the summer, known by some as u/DeepFuckingValue.

With his signature headband hanging in the background, sitting in a gaming chair, Gill donned an uncharacteristic suit and tie while representing himself as a stand-in for the millions of retail investors who were along for the ride.

His message: he is no expert, is not responsible for the volatility of a multi-billion dollar securities market, and after everything, he still likes the stock.

“I support retail investors right to invest in what they want when they want to,” Gill said. “I do not have clients, and I do not provide personalized investment advice for fees or commissions. I am an individual investor.”

Gill went on in his testimony to state that his posts and video appearances about GME to other investors were not trading advice and no different than talking in a bar about a stock he liked.

Before the run-up of GME, Gill had a small audience of around 500 viewers. After GME started gaining ground, Gills’s online popularity exploded alongside the Reddit stock betting forum r/WallStreetBets.

Gill gained hundreds of thousands of followers, while WSB saw a rise of 8 million members in just one week. In the end, his positions in the stock earned him $22 million, as he shared with his extended family over the holidays, “we’re millionaires.” Many were not as lucky, and some have looked toward social influencers like Gill as speculators and market manipulators.

The Congressional Committee were light on their interrogation of Gill, acknowledging the importance of protecting retail investor rights. In challenging Tenev of Robinhood, Committee Chairwoman Maxine Waters set the tone, stating: “The market volatility around GameStop has highlighted how many people believe the cards are stacked against them.”

Waters asked numerous yes or no questions to Robinhood’s Tenev, who could only respond with drawn-out statements. Overall, the fintech founder was apologetic but still insisted Robinhood did nothing wrong and does not answer to hedge funds.

“Look, I’m sorry for what happened, and I apologize. I’m not going to say Robinhood hasn’t made mistakes in the past,” Tenev said. “We’re going to learn from this and make sure it doesn’t make the same mistake in the future.”

At the height of the trading frenzy Thursday, January 28th, Robinhood suddenly restricted the purchase of GME and other “meme” stocks and only allowed selling. Demand plummeted because, despite problems in the past, Robinhood is still a favorite in the r/WallStreetBets community. Prices roller coasted downward. From a high of $468/share, the GME price dropped down to trading in the $40 range in the month that followed.

Tenev was explaining his financial responsibilities to clearinghouses as a brokerage firm.

On the morning of January 28th, Robinhood suddenly received an email from a subsidiary of the DTCC, holder of all U.S. traded securities. It asked for an increase of $3 billion to ensure Robinhood could back the explosion of GME trading, an astronomical price. Robinhood complied by shutting down buying, offering sell-only, bringing the insurance price down to more than $700 million. The firm also reached out to existing investors to raise billions in capital, yet Tenev still insists there was never a liquidity problem.

Representing traditional, “smart money” investors was Ken Griffin of Chicago hedge-fund Citadel LLC and market-maker Citadel Securities, known for its short-selling positions. Alongside was Gabe Plotkin, the founder of Melvin Capital, a hedge fund with many short positions in GME, lost $6 billion in just 20 trading days. During the crazy trading week, Melvin was offered $2.7 billion in new investment from Citidel funds after losing 30% of its value.

Citadel is also a prime market maker for Robinhood, completing many of the app’s trades. Some, including those house members lobbing questions, saw a firm that self describes its mission as “to democratize investing,” cut out the poor and give to the rich. It looked like a collaboration between a major investor making up for losses due to app trading while retail investors were left out.

Chair member Blaine Luetkemeyer, a Republican from Missouri, expressed his concern that GME had been an over shorted stock and that “naked shorting” drove the price down.

“You have stated in your testimony that you had no intention of manipulating the stock,” he said. “If you’re short selling your stock 140%, for me from the outside, that looks like what you’re doing.”

Both Citidel and Melvin Capital representatives said there was no collusion to drive the price down, no over shorting, and no buy-out when the short positions failed.

The end of Gills’ testimony, read in front of a “hang in there” cat poster summed up the hearing well.

“It’s alarming how little we know about the inner-workings of the market, and I am thankful that this Committee is examining what happened,” He wrote. “I’m as bullish as I’ve ever been on a potential turnaround. In short, I like the stock.”

Fintech Lenders Did Better Job Meeting Intentions of the CARES Act, Study Finds

February 18, 2021 Fintech lenders doling out PPP not only reached smaller businesses on average but played an essential role in extending PPP loans to Black-and Hispanic-owned businesses, according to a study conducted by professors at the NYU Stern School of Business.

Fintech lenders doling out PPP not only reached smaller businesses on average but played an essential role in extending PPP loans to Black-and Hispanic-owned businesses, according to a study conducted by professors at the NYU Stern School of Business.

“Fintech lenders originated much smaller loans than other lenders, suggesting they served smaller firms on average,” researchers found. “Overall, we find that, relative to other lenders, [Minority Development Institutions] nonprofits, and fintech lenders make a substantially larger share of their loans to minority borrowers, particularly Black- and Hispanic-owned businesses.”

The team of economists looked over 3.4 million PPP transactions to determine what category of lenders had the highest minority share among their loans. Ryan Metcalf, Head of Public Policy for Funding Circle, member of the Innovative Lending Platform Association (ILPA), shared the full study on LinkedIn, pointing out that six ILPA members had contributed to saving jobs.

“(Funding Circle US, BlueVine, Kabbage, Inc, OnDeck, Fundbox, Lendio) provided more than 476,000 #PPP loans totaling $16.5 billion with an average loan size of ~$30,000, median loan size of $15,000, and helped save more than 2 million jobs,” Metcalf wrote. “And that was just in 2020.”

The study found that fintech lenders did a better job meeting the intention of the CARES act. While most lenders were giving out larger loans to large firms, fintech better reached actual small businesses with smaller loans on average.

“Section 1102 of the CARES Act explicitly specified that the program should prioritize ‘small business concerns owned and controlled by socially and economically disadvantaged individuals,'” they wrote. “However, the SBA did not issue specific guidance for distributing the loans, leaving private financial institutions administering the loans to independently determine which businesses to serve first or at all.”

Instead, as has become clear, many funds went to larger firms and seemed to miss minority communities. The team compared the mean and median loan amounts for different Lenders, finding the smallest in both types were fintech loans.

Researchers put first and last names through a mathematical model to predict race because that data was not available from the majority. Then predictions were compared to the sample borrowers that self-reported race. The algorithm was 78% accurate in guessing black names, 84% in guessing Hispanic, 95% for Asian, and 99% accurate for white names.

Shopify Originated $226.9M in MCAs and Business Loans in Q4, Close to $800M For the Year

February 17, 2021 Shopify released its 2020 fourth-quarter earnings on Wednesday, revealing its financial arm’s latest stats. Shopify Capital originated $226.9 million in merchant cash advances and loans to businesses in the U.S., Canada, and the U.K.

Shopify released its 2020 fourth-quarter earnings on Wednesday, revealing its financial arm’s latest stats. Shopify Capital originated $226.9 million in merchant cash advances and loans to businesses in the U.S., Canada, and the U.K.

That is a posted increase of 96% over the same quarter in 2019 but was down 10% from q3. The full year 2020 originations of $794M were nearly double the $430M in 2019.

“Products like Shopify Capital are increasingly sought out by entrepreneurs and small businesses that face unnecessary barriers to access from traditional banks,” Shopify President Harley Finkelstein said in the quarterly earnings call. “Merchant empathy runs deep at Shopify. When traditional businesses were turned away, for the perceived high risk, we financed a record number of merchants when they needed it most.”

“We also introduced Shopify Capital to Canada and to the U.K. in 2020,” Finkelstein said. “To expand where we could help merchants.”

Shopify Capital still lagged behind rival OnDeck in origination volume, who reported a little over $1B in originations for the year.

NYC Taxi Workers Block Brooklyn Bridge, Demand Debt Forgiveness

February 11, 2021 Taxi drivers demanding Medallion debt forgiveness briefly blocked the Brooklyn Bridge Wednesday. The protest, organized by the 21,000-member strong New York Taxi Workers Alliance union (NYTWA), was a release of fury over the astronomical debt they have faced during a global pandemic that has cut ridership by 80%.

Taxi drivers demanding Medallion debt forgiveness briefly blocked the Brooklyn Bridge Wednesday. The protest, organized by the 21,000-member strong New York Taxi Workers Alliance union (NYTWA), was a release of fury over the astronomical debt they have faced during a global pandemic that has cut ridership by 80%.

“Debt forgiveness now,” chanted Union Founder Bhairavi Desai through a megaphone, leading the drivers in a chant. That’s a lot of debt: To get a city-licensed taxi medallion, drivers had to pay inflated prices, up to $1.3M in 2014, before the advent of rideshare apps crashed prices to a fraction of what they were worth.

We shut down the Brooklyn Bridge because only direct action will get us what we need: medallion debt forgiveness now! pic.twitter.com/kmbQlBrOO3

— NY Taxi Workers (@NYTWA) February 10, 2021

In 2021, thousands of taxi drivers are paying up to $600,000 in debt on medallions that are only worth $120-$150k. Last year, Desai testified before the State House Financial Services Committee that Confessions of Judgment were used extensively to take hundreds of thousands in debt from the pockets of taxi drivers.

The day of action started with a gathering of union members at the mayor’s office at 9 am before senior members (62 yo+) testified that the medallion crash stole retirement savings at a City Council Committee on Immigration.

Dozens of taxis then formed a motorcade, blocking the bridge before gathering at the Park Slope home of Senator Chuck Schumer, Democratic Majority leader of the Senate, who NYTWA said is leading negotiations over the stimulus bill.

Protestors could be seen across from the north entrance to Prospect Park to encourage Schumer’s support to push bill H.R. 5617 through Congress. The Taxi Medallion Loan Forgiveness Debt Relief Act will eliminate the need to pay taxes on outstanding medallion debt, the NYTWA website states.

The union also calls for the leveling of taxi medallion debt to $250k per medallion. NYTWA holds that the city helped inflate medallion prices and should assume the leftover debt. The New York Times and Post reported a bailout of that size could top $500M.

Broker in Early Twenties Builds MCA Business in Less Than Three Years

February 10, 2021 Davron Karimov, a 22-year-old MCA broker, went from $10k in debt to collecting $200k a year in commissions. It took less than three years, and Karimov shared his journey on his personal, sometimes chaotic, yet always informative YouTube channel.

Davron Karimov, a 22-year-old MCA broker, went from $10k in debt to collecting $200k a year in commissions. It took less than three years, and Karimov shared his journey on his personal, sometimes chaotic, yet always informative YouTube channel.

The Staten Island native said he first started at a Long Island City shop and quickly made some early deals, eventually leaving to start his own firm, FunderHunt, and recently opened an office in Miami.

But do the YouTube videos help him make deals? Of course they do, Karimov says, and he not only gets deals through his video platform but he also get questions from other MCA brokers who reach out for help.

“Of course, we get people all the time calling in, people that have questions, people in the industry need help with their merchants,” Karimov says. “I started around 2018, and there was no info on YouTube about business funding, a huge void online. I stepped up and thought I could be the one to supply info.”

Nearly three years later, Karimov has built an expanding business while helping others through the struggles of being a broker and CEO in the MCA world. In the last year alone, the pandemic caused applications to explode, Karimov says.

“It’s been better than ever; I’ve never seen so many applications in March and April; they were just soaring,” Karimov says. “And then I’ve never seen so many applications get denied because of the industry at the time everything was shutting down.”

It was a time to capitalize if your shop was strong enough to survive what Karimov called the “dark ages” for MCA. If you survived, you get to reap the reward of a capital-deprived market, he says.

“The whole crisis took out so many funders that were just not good, they probably were supposed to go out of business a long time ago, but this accelerated it,” Karimov says. “It took out all the bad funders and replaced them with people that are solid, fast, and have everyone’s best interest at heart, from the merchant to whoever the ISO is.”

According to Karimov, 2020 solidified who is a real player in the game. Launching a new office himself, Davron says he enjoys sunny days in Miami while it is twenty degrees in-between blizzards in New York. Though snow wasn’t the reason he moved, but instead the funding environment.

“Everyone has been warm and welcoming [in Miami], the government knows what this is, and that’s what we do. We try to educate them: not a lot of people know here about this; it’s like it’s a secret,” Karimov says. “If you go to New York, it’s like everybody knows, there are so many shops there. But here, it’s kind of rare to see someone that knows what a cash advance is.”

Compared to New York’s increasingly restrictive funding ecosystem, the Florida space is open to growth. That’s exactly the environment Karimov hopes to profit from, expanding his business in any way that will be geared toward helping businesses.

“I’m not a huge fan of diversification,” Karimov says. “I like doing one thing. But we opened up an office in Miami; we’re bringing experienced people in and trying to fund deals as fast as possible. We’re maybe looking to develop into offering a debit card, whatever is in the business’s best interest.”

Over Half of Small Businesses Had Unmet Funding Needs

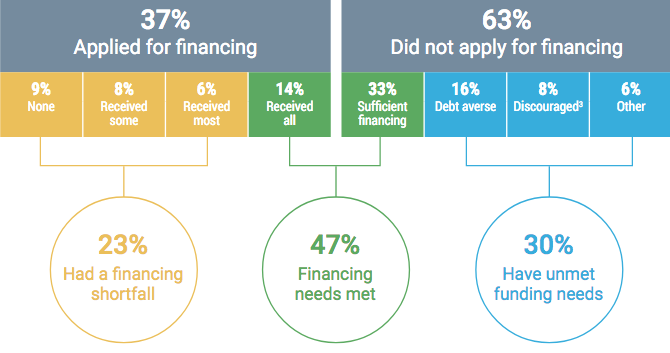

February 8, 2021The Federal Reserve’s analysis of overall funding efforts for all small businesses demonstrates a market of unmet financial needs. In 2020, a total of 47% of firms met their funding needs, while the other half (53%) still needed capital.

23% of firms saw a “financing shortfall.” They were partially approved but still needed more funds. The other 30% have unmet funding needs because they never applied according to the survey- they’re scared of debt, risk-averse, or don’t meet requirements.

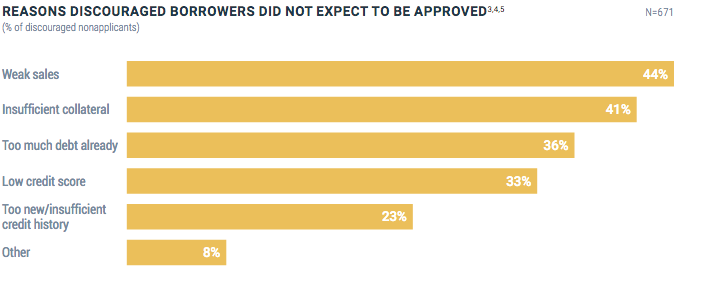

Those that did not apply for funds would have if they were not discouraged by weak sales (44%), insufficient collateral (41%), low credit (33%), and too much debt already (36%).

83% of companies used a bank or small bank as their primary financial service provider, while only 11% said an online lender or fintech was their primary.

Meanwhile, in the funding world, MCAs were only sought by 8% of all funding applicants last year, compared to 89% of firms applying for a loan or line of credit.

Most firms that went for an MCA went with a bank. 85% percent of firms that applied for a loan, credit, or cash advance used a large or small bank. In contrast, only 20% of firms applied to an online lender, falling from 33% since last year.

42% of firms that worked with online lenders or fintech companies were dissatisfied with support during the pandemic. Comparatively, firms that did receive some funding from an online lender were far happier: only 18% were dissatisfied.

Forty-Four Percent of Small Businesses Were More Than $100,000 in Debt in 2020

February 5, 2021 Fifty-three percent of firms expected total sales revenues for 2020 to be down by more than twenty-five percent because of the pandemic, according to the latest small business survey published by the Federal Reserve. Eighty-eight percent of firms indicated that sales had still not returned to normal.

Fifty-three percent of firms expected total sales revenues for 2020 to be down by more than twenty-five percent because of the pandemic, according to the latest small business survey published by the Federal Reserve. Eighty-eight percent of firms indicated that sales had still not returned to normal.

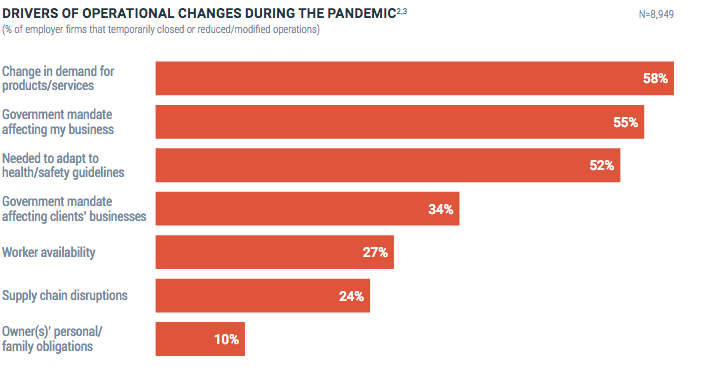

Of those hurt by shutdowns, supply chain troubles, and government shutdowns, 26% percent closed temporarily, fifty-six percent reduced their operations, and 48% percent modified their operations.

Fifty-seven percent of firms characterized their financial condition as “fair” or “poor.”

The struggle to remain open sent firms further into debt. Seventy-nine percent of firms had debt outstanding, an 8% increase from 2019. Debt also increased; the share of firms with more than $100,000 in debt rose from 31% to 44%.

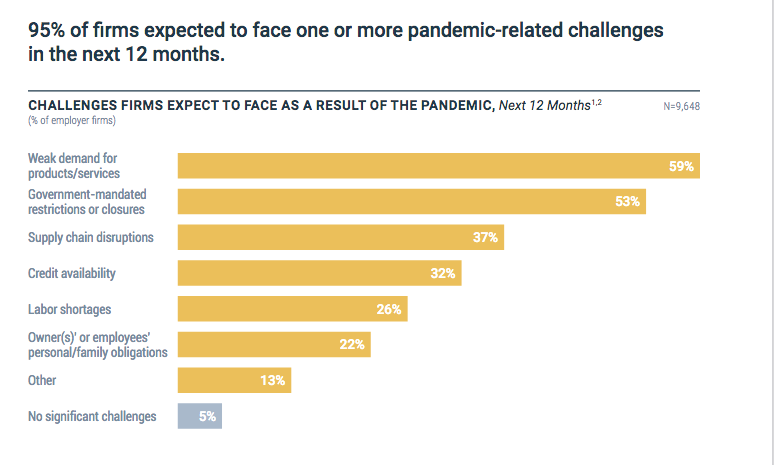

The majority of U.S. businesses believe the next year will be rife with the same struggles as the last. Many believe weak demand, government shutdowns, and supply chain breaks will continue disrupting the world economy.

Overall, firms applied for financing less, from 43% in 2019 to 37% in 2020.

Firms got their funds this year through Government aid programs, and they did so through their pre-existing bank relationships, forgoing alternative funders. Forty-eight percent went through large banks for PPP, 43% to smaller banks. 95% and 83%, respectively, already had a relationship with their large or small bank.