Kevin Travers was a Reporter at deBanked.

Articles by Kevin Travers

Hey Cool Cats and Kittens, Let’s Reform Banking

May 12, 2021 “Hey, all you cool cats and kittens in the banking industry, it’s Carole Baskin from Big Cat Rescue, you might remember from Tiger King i’m married to a former banker,” Carole Baskin, TV star of Tiger King, said. “Yeah, love that Howie Baskin. Anyway, I just wanted to tell you guys about a new report….”

“Hey, all you cool cats and kittens in the banking industry, it’s Carole Baskin from Big Cat Rescue, you might remember from Tiger King i’m married to a former banker,” Carole Baskin, TV star of Tiger King, said. “Yeah, love that Howie Baskin. Anyway, I just wanted to tell you guys about a new report….”

Baskin, known for her competing tiger tourism venture in Florida, and the myth that she had something to do with the disappearance of her late husband Don Lewis sometime in 1997, appeared in a Cameo video for banking-as-a-service company called 11:FS. It’s an advertisement for a special report available on their website.

11:FS offers a “financial service operating system,” information and reports, and digital services.

This week Baskin also launched a $CAT cryptocurrency to let users buy her t-shirts without the US dollar.

AFC Trade Group Surpasses 100 Members

May 12, 2021 Two months ago, the Marketplace Lending Association and Online Lending Policy Institute merged, forming the American Fintech Council (AFC).

Two months ago, the Marketplace Lending Association and Online Lending Policy Institute merged, forming the American Fintech Council (AFC).

American Fintech Council has grown to 107 members. The trade group is a cross-section of payments, lending, legal, and data sectors of the fintech industry, set to lobby Washington lawmakers and set standards. The member list includes names like LendingClub, Varo, SoFi, Cross River, and Rocket Mortgage. The group also launched a Community Advisory Board, with Boston University and Cambridge departments of alternative finance working on “responsible practices in the industry.”

“The American Fintech Council is poised to play a critical role in the US regulatory landscape,” Colin Walsh, founder-CEO of Varo, said in a press release.

According to the website, the group’s core principles include:

1. Supporting the use of technology to develop financial services to enrich people’s lives.

2. Offering affordable, transparent, and responsible products.

3. Advancing financial inclusion and racial equity.

4. Embracing and supporting regulation that furthers and promotes responsible innovation.

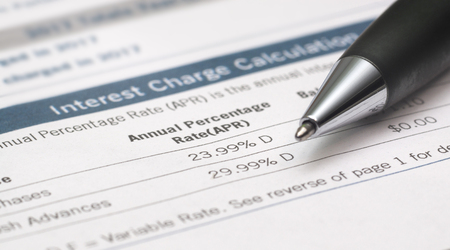

Members must support a 36% APR cap on the cost of loans, adhere to the Small Business Borrower’s Bill of Rights, and offer “transparent products and fees.”

“We are thrilled to welcome these new members and leadership groups to the AFC team and look forward to working with them to promote policies that create an open and efficient marketplace that benefits everyone,” said Garry Reeder, CEO of the AFC. “Our members are constantly working to better serve consumers and communities around the country.”

Forward Financing Wins Customer Service Award, Originates $165M in 2020

May 10, 2021 Forward Financing won a Silver Stevie Award for the Best Customer Service Department of the Annual American Business Awards, for their work helping clients during the pandemic year. The firm originated a total of $165,826,203 across 6,142 advances in 2020, a representative said.

Forward Financing won a Silver Stevie Award for the Best Customer Service Department of the Annual American Business Awards, for their work helping clients during the pandemic year. The firm originated a total of $165,826,203 across 6,142 advances in 2020, a representative said.

“We are truly honored to receive recognition for the fantastic job our Account Servicing team does every day to help our small business customers,” Justin Bakes, co-founder and CEO, said. “Particularly in 2020, that help was needed more than ever before to help small business owners get through the most difficult months of the pandemic.”

The firm said that in 2020, thousands of customers reached out to the Account Servicing Department (ASD) to request payment relief from the pandemic shutdown. The company trained 18 team members from different departments to join ASD, nearly tripling the size of the team, the firm said.

Forward competed with more than 3,800 nominations submitted this year for organizations across the US. Since 2012, Forward Financing has provided more than $1 billion in funding to more than 26,000 small businesses.

PayPal Originated ~$2.6B in Funding During 2020

May 10, 2021 PayPal reported originating a total of about $2.6B in capital for U.S. SMBs in 2020, which doesn’t include the more than $2B in PPP loans it arranged.

PayPal reported originating a total of about $2.6B in capital for U.S. SMBs in 2020, which doesn’t include the more than $2B in PPP loans it arranged.

“PayPal delivered record performance in 2020 as businesses of all sizes have digitized in the wake of the pandemic,” Dan Schulman, President and CEO, said.

Exact origination figures are hard to track through the firm’s quarterly reports. The Working Capital product is only mentioned in passing. At the outset of the pandemic, PayPal reported that they helped merchants by “Granting deferral of repayments on business loans and cash advances at no additional cost.”

Throughout the remainder of the year, PayPal was echoing the problems of the industry and slowed down funding as a whole. In the 2021 first quarter call, John Rainey the CFO Global Customer Operations, said that the firm “Tightened underwriting and strong repayment activity contributed to lower balances in our merchant loan portfolio.”

PayPal’s origination volume fell relative to their 2019 estimate.

Zoom CEO and Big Banks Rolling Back Remote Work

May 5, 2021 It’s not just you: Zoom CEO Eric Yuan admitted to suffering from video meeting fatigue at the Wall Street Journal’s CEO Council Summit. During a video conference panel called “The Future of Work,” Yuan said he is done with it after sitting through 19 video calls in one day last month.

It’s not just you: Zoom CEO Eric Yuan admitted to suffering from video meeting fatigue at the Wall Street Journal’s CEO Council Summit. During a video conference panel called “The Future of Work,” Yuan said he is done with it after sitting through 19 video calls in one day last month.

“I’m so tired of that,” Mr. Yuan said, “I do have meeting fatigue.”

Yuan said he would begin requiring employees to return to the office at least two days a week. Many WSJ guests at the May 4th conference shared the same sentiment, like JPMorgan CEO Jamie Dimon, who said the firm would begin to bring people back by July.

For creating new ideas, and “for those who want to hustle,” Mr. Dimon said, remote work doesn’t match in person. “I’m about to cancel all my Zoom meetings,” Dimon said. “I’m done with it.”

Along with the announcement from Gov. Cuomo that New Jersey, New York, and Connecticut would begin relaxing all restrictions on May 19th, FIDI hot dog vendors must be excited this week. Goldman Sachs also announced this week through a memo to employees that they should “make plans to be in a position to return to the office” in June.

How Funders Survived PPP and a Year of Covid

May 4, 2021 A year into the pandemic and from the deBanked office in Brooklyn, it looks like the world is opening up again.

A year into the pandemic and from the deBanked office in Brooklyn, it looks like the world is opening up again.

After a year of Zoom and LinkedIn networking, those in the industry lucky or talented enough to have survived can still complain without restraint about big government lockdowns and misguided legislation. Competing with Uncle Sam’s deep PPP pockets have slowed deals down, and with a new fund opening this week for restaurants, it might be more of the same.

But two funders said that though there is an initial slowdown when a new stimulus is rolled out, the programs have still been vital for business– and if firms kept up with contacts, the business could be booming even after the pandemic.

CEO David Leibowitz of San Diego-based Mulligan Funding said that his firm survived the worst of the shutdown. That was due in no small part to government programs that kept merchants in business.

“People forget where we were sitting in April, May last year, 20 million people filed for unemployment. The segments of the market that we serve in general don’t have more than 30 days of cash on hand at any time,” Leibowitz said. “There’s no chance that our market survives that without the level of government support that they’ve been given.”

Sure, there’s a dampening effect at first, but there wouldn’t be B2B without businesses to fund. Leibowitz said he thinks the macroeconomic effects of printing money will have consequences in the long term, but it’s the lesser of two evils.

Matthew Washington, the well-known CRO of PIRS Capital, has also been vocal about PPP. Like Liebowitz, he said it has its pros and cons, creating a slowdown and demand for capital in one stroke. In his experience, because the stimulus was limited to payroll and rent, merchants were hungry for other products.

“They’re only able to allocate it for certain things, payroll, and hiring people, right,” Washington said. “Our funding allows them to be able to use capital for other opportunities, like buying supplies, buying inventory. Although it’s kind of been somewhat slow, they need to have other working capital needs to be provided for.”

Washington also said some merchants used their PPP funds as low-interest loans, paying off and refinancing advances. PIRS has succeeded through the pandemic due to its relationship-based model.

“It’s all about keeping in touch with your merchants during this time, having a big pulse with the people you do business with,” Washington said. “We’re really a lean and mean company, we kind of have the community bank approach to this space; we’re more relationship-based.”

PIRS had only paused for 60 days and was lucky enough to be set up with recurring merchant partners that turned out to be essential businesses.

“We were very blessed; a lot of our portfolio was operating during the shutdown,” Washington said. “Our portfolio did very well for the circumstance.”

That was how they survived, a lot of good faith and hard work, but pinches of luck as well. Leibowitz said that contrary to popular belief, many good people lost their business during the pandemic. It wasn’t just bad actors and funders with terrible underwriting.

“In March, we had customers who, for reasons totally beyond their control, couldn’t pay. And we weren’t sure in March, how long that would go on for, we weren’t sure how bad it would get,” Leibowitz said. “If you’d asked me in March, April, were we going to survive this thing. There’s no way I would have been able to give you a confident answer.”

Some with public securitizations, well-run businesses, dropped out and disappeared. Leibowitz said Mulligan was able to keep every employee on staff and got through the “sh*t show.” In part, it was with help from competitors who specialized in PPP funding that Leibowitz said his firm was still going strong.

“So I think for all of its shortcomings, I have a world of respect for the SBA and the program. I think of Brock and guys at Lendio, I think of the guys at BlueVine and Kabbage, who really have done a truly extraordinary job of distributing that product to our target market,” Leibowitz said. “And I’m sitting here today, unquestionably, enjoying the benefit.”

So PPP helped, despite the slowdowns, in the short term, and Liebowitz said in the long term, the government overspending might get hairy. But with talk about the world opening back up, with bars open down the block for the first time in a year, what does Washington think about the near future?

The world just isn’t going to stop; it’s just evolving with the new temp of what’s going on; I think there’s a lot of positive things on the horizon for our business,” Washington said. “Once the vaccine rates, and everyone’s ‘cured’ how are they not going to open up.”

IOU Financial Posts 2020 Results

April 29, 2021 IOU Financial filed their full-year 2020 financial results, boasting a total of $84.9 million in originations. Though at a $3.2 million net loss and decrease of 45% in originations from 2019, IOU representatives attest the firm weathered the worst of the pandemic and has left the other side prepared to take part in fueling “the recovery ahead.”

IOU Financial filed their full-year 2020 financial results, boasting a total of $84.9 million in originations. Though at a $3.2 million net loss and decrease of 45% in originations from 2019, IOU representatives attest the firm weathered the worst of the pandemic and has left the other side prepared to take part in fueling “the recovery ahead.”

Shares of IOU are trading at about 8 cents, creating a market cap of just under $10 million. In 2020, Neuberger Berman acquired a significant stake in the company and agreed to purchase up to $150M in loans a year over two years. Founder and CEO Phil Marleau will transition into an advisory role on June 10th, replaced by Robert Gloer, COO.

“Robert and I have worked side-by-side since the Company was founded,” said Marleau. “Together, we underwrote our first small business loan in December 2009 and have since originated nearly US$1 billion in loans. IOU’s resilience and success are a direct result of the team’s considerable efforts over the past decade – a team that Robert and I have built and led. I look forward to continuing our partnership in an advisory capacity and as Director.”

At Least One Firm is Leaving New York before Disclosure Law Lands

April 29, 2021 New York MCA firms are in the dark. In January, the governor delayed implementation of the APR disclosure bill until 2022. But the bill leaves it to the Department of Financial Services (DFS) to finalize how it will all work and not everyone is confident the outcome will be positive for business in New York State.

New York MCA firms are in the dark. In January, the governor delayed implementation of the APR disclosure bill until 2022. But the bill leaves it to the Department of Financial Services (DFS) to finalize how it will all work and not everyone is confident the outcome will be positive for business in New York State.

For example, Greenwich Capital, a small business funding company, has decided to move from Manhattan to Hoboken, NJ in preparation for the law. They anticipate that the cost of compliance will be high enough to warrant a trip on the PATH starting now rather than when it may be too late to contemplate later.

“There’s a lot of ambiguity, and our five-year lease was up,” Rich Gipstein, General Counsel at Greenwich Capital, said. “We’ll be moving to Hoboken for the time being and see what’s going on with this law. But in the meantime, it’s a lot cheaper for us.”

Based on vague wording language like double-dipping, Gipstein said there is no clear way to tell who or what the law aims to regulate. At least for his firm, it’s better to sit this one out.

“I think there’s quite a lot left open, and it’s intended to be broad,” Gipstein said. “There won’t necessarily be much time to know what the law means until it’s effective. I think there will probably be some lead time, but likely not quite enough for most businesses in the industry to adapt.”

For example: when does a deal become a “specific offer” and come under the purview of the law? In an industry where deals are won through cold calling, social media blitzes, and emails, when would it become necessary to disclose an APR? In a DM on LinkedIn? Rich said it is unclear what a “provider” is, whether it be funders, brokers, or ISOs. In the bill, a provider is required to make commercial financing disclosure clear and let a recipient know at the time of the “specific offer” the all-inclusive rates of a product. Without clarity, it’s hard to predict what the cost of compliance will be.

For example: when does a deal become a “specific offer” and come under the purview of the law? In an industry where deals are won through cold calling, social media blitzes, and emails, when would it become necessary to disclose an APR? In a DM on LinkedIn? Rich said it is unclear what a “provider” is, whether it be funders, brokers, or ISOs. In the bill, a provider is required to make commercial financing disclosure clear and let a recipient know at the time of the “specific offer” the all-inclusive rates of a product. Without clarity, it’s hard to predict what the cost of compliance will be.

“I think, from my reading of it and from my understanding of New York’s position, it would seem that they are trying to regulate both funders and brokers under the same regulation,” Gipstein said. “I think it’s possible that the legislature intentionally left some things vague for DFS to fill in. The law basically says, ‘there’ll be regulations that will make this make sense.'”

Gipstein said it’s common for politicians to leave it to the regulators to finish the job, after all, the DFS has its nose to the grindstone in the day-to-day. But when a law affects an entire industry like this, Gipstein said it is uncommon for changes to be left until the last moment.

“It’s more than just disclosure requirements; this is not similar to what California did,” Gipstein said. “The law also dictates how to calculate the projected sales volume. You’re required to either use the historical method, in which you must always use the same number of months leading up to the deal, or you can opt-out and use your own projection. But if you use your own projection, that opens you up to disclose the results of all your deals to the government… It’s almost like an annual audit.”

The historic method doesn’t really work, Rich said when the industry comprises atypical merchants who wouldn’t be looking for funding if traditional methods could predict their sales volume. When it comes to self-declaring and letting the government poke around: Gipstein said the way a funder evaluates deals is proprietary. It’s what sets them apart; it’s the value proposition.

Greenwich Capital isn’t alone in their assessment. The Small Business Finance Association (SBFA), a trade group comprised of similar financial companies, has also been vocal about the law’s perceived shortcomings.

Greenwich Capital isn’t alone in their assessment. The Small Business Finance Association (SBFA), a trade group comprised of similar financial companies, has also been vocal about the law’s perceived shortcomings.

“You have a group of companies that are pushing these types of disclosures, for no reason other than their own self-interest,” said Steve Denis, executive director of the SBFA, back in October. “We’re fine with disclosure, we are all for transparency, but it needs to be done in a way that we believe is meaningful to small business owners.”

Denis had further said that those firms taking credit for writing the laws are the same companies that will end up suffering under the strict tolerance of an APR rule.

“The companies pushing this, the trade associations pushing it, they like to take credit for writing the bill in California and writing the bill in New York: I don’t even think they’ve read it,” Denis said at the time. “It’s going to subject their own members to potentially millions if not hundreds of millions of dollars in potential liability [fines.]”

When the DFS finalizes the terms, it will likely make dealing with disclosure too costly to remain in New York State, Gipstein said.

Gipstein said we’ll have to wait and see if NY-based brokers will have to go through extra compliance even if their funders or merchants are out of state. The worst-fear scenario is a possibility that after New Years’ 2022, out-of-state funders will stop working with NY brokers entirely, just because they live in NY. Merchants in the state, subject to the law, may find commercial finance a barren marketplace.

“We’ve got a lot of different things to manage as we grow, and one of the things we don’t want to do is create is a large compliance department,” Gipstein said. “It’s just cheaper for us, after doing a cost-benefit analysis, to move to a different state. We’re probably not going to be a New York funder by 2022.”