Articles by deBanked Staff

A Glimpse At How Big Fintechs Are Approaching The Small Business Loan Market

March 1, 2023| Company Name | Status | Notes |

| Square Loans | Just recorded its biggest originations year ever. $4.07B funded in 2022 | |

| Enova/OnDeck | Seeing tremendous demand. Focusing on diversification. $2.97B funded in 2022 | |

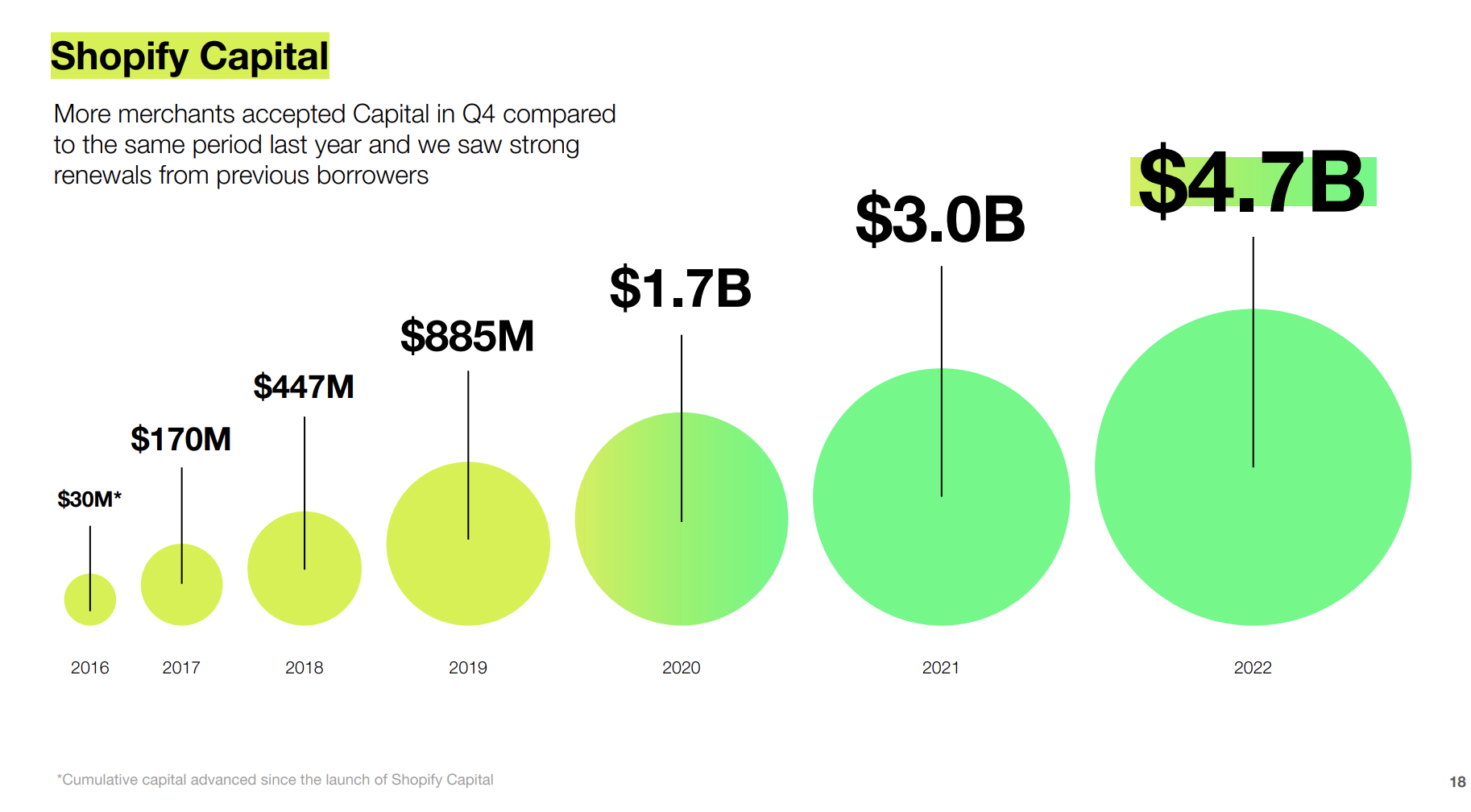

| Shopify Capital | Reporting strong renewals. Just had its biggest originations year ever with $1.66B funded in 2022. | |

| Upstart | Suspended business loan originations only 6 months after it started them. | |

| LendingClub | Has suspended its equipment financing and commercial real estate lending divisions. | |

| SoFi | Not interested in joining the small business loan market at this time. |

Square Loans Completes Monster Funding Year

February 26, 2023 Square Loans rose to the top of deBanked’s small business loan originations leaderboard last year after announcing $1.16B in originations in Q4. That brought the company, which is a subsidiary of Block (formerly Square), to over $4B funded for the year total, spread out across 461,000 loans.

Square Loans rose to the top of deBanked’s small business loan originations leaderboard last year after announcing $1.16B in originations in Q4. That brought the company, which is a subsidiary of Block (formerly Square), to over $4B funded for the year total, spread out across 461,000 loans.

In its annual shareholder letter, Block said that “Square Loans achieved strong revenue and gross profit growth during the fourth quarter of 2022.” Demand for loans has been steady and loss rates have stayed consistently within historical ranges.

Square Loans typically approves merchants for less than 20% of a merchant’s expected annual Square gross payment volume, is repaid by withholding a percentage of credit card sales, and enjoys a borrower base that pays off its loans in less than 9 months on average.

Block’s business is so large and now has so many components that Square Loans did not even come up in Block’s Q4 earnings call. Overall, the company generated $5.7B in revenue in 2022.

The small business loans originations leaderboard contains a lot of blanks. That’s because several public companies have attempted to obscure their business lending figures or non-public ones have opted to not disclose their figures. If you want your company’s figures to be added, email info@debanked.com.

New Commercial Financing Disclosure Bills Emerge in Several States

February 24, 2023Several states have resumed efforts to pass a commercial financing disclosure bill this year, following successes that have already taken place in other states. Below are three on the table so far:

- Illinois – Small Business Truth in Lending Bill

- Maryland – Consumer Credit Commercial Financing Transactions

- Connecticut – An Act Requiring Certain Financing Disclosures

Illinois Introduces Small Business Truth in Lending Bill

February 23, 2023 Illinois introduced a Small Business Truth in Lending bill last week, which one would correctly infer is about… disclosures. The language is similar to the law recently enacted in California and includes an APR requirement.

Illinois introduced a Small Business Truth in Lending bill last week, which one would correctly infer is about… disclosures. The language is similar to the law recently enacted in California and includes an APR requirement.

LendingClub Ceases Equipment Financing Biz

February 22, 2023 Similar to Upstart, LendingClub is hitting the pause button on a segment of its lending business. In particular the company announced that it has ceased originations in equipment finance and commercial real estate.

Similar to Upstart, LendingClub is hitting the pause button on a segment of its lending business. In particular the company announced that it has ceased originations in equipment finance and commercial real estate.

“…commercial real estate and equipment finance, in this environment just not as attractive returns for the bank or for shareholders,” said LendingClub CEO Scott Sanborn in the Q4 earnings call. “So, we aren’t originating new loans there.”

What will remain on the commercial side, however, is its SBA Government Guaranteed Lending business.

“Lender” Sued for $10 Million

February 21, 2023 King Family Lending says that it offers loans from $10,000 to $2M with 1-4 month terms that can be funded within 24 hours. There’s a collateral requirement, however, which could be anything from inventory, to real estate, to equipment, to sports contracts, to POs, to crypto. Founded in 2020, the lender was a borrower itself, allegedly borrowing more than $10 million from a law firm in order for it to make 97 loans to third parties.

King Family Lending says that it offers loans from $10,000 to $2M with 1-4 month terms that can be funded within 24 hours. There’s a collateral requirement, however, which could be anything from inventory, to real estate, to equipment, to sports contracts, to POs, to crypto. Founded in 2020, the lender was a borrower itself, allegedly borrowing more than $10 million from a law firm in order for it to make 97 loans to third parties.

According to a lawsuit filed on February 11, however, its alleged that King Family Lending and its owner never made any such loans and that the owner simply committed fraud and swindled the money.

The story behind King Family Lending, which includes all types of twists and turns, is best told by the Daily Mail. Enjoy.

Shopify Capital Seeing “Incredibly Strong Renewals From Previous Borrowers”

February 16, 2023Shopify Capital originated $393.2M in MCAs and business loans in Q4, an increase of 21% YoY, the company revealed. The company also began funding small businesses in Australia last year, bringing the total countries it does business in to four.

“[Shopify] Capital has acted as a lifeline for merchants, especially through the pandemic and this tough macro environment, allowing them to conveniently access capital when they need it most,” said Shopify President Harley Finkelstein. “Capital is now available in four countries, and our machine-learning algorithms to underwrite merchants keeps getting better.”

Finkelstein also noted that the company is “seeing incredibly strong renewals from previous borrowers.”

The graphic below, illustrating the cumulative growth of Shopify Capital’s originations, was shown in the company’s Q4 earnings presentation:

Upstart Halts Small Business Lending Division

February 14, 2023 Upstart, the embattled online lender that recently announced a 20% reduction in headcount, revealed on Tuesday that it had also suspended its small business lending operations. The sudden about-face is notable given that the company just entered that market in mid-2022.

Upstart, the embattled online lender that recently announced a 20% reduction in headcount, revealed on Tuesday that it had also suspended its small business lending operations. The sudden about-face is notable given that the company just entered that market in mid-2022.

“With th[at] reduction in staffing, we also decided to pause development of our small business lending product,” said Upstart CEO David Girouard during the quarterly earnings call. “This was a necessary step to ensure we can adequately resource the rest of the roadmap. We look forward to the day when we can resume our pursuit of the world’s best AI-powered business loan.”

In the previous quarter, talk of small business lending had sounded more celebratory, which had just crossed $10 million originated since inception at the time.

“In many ways, last year was the perfect storm for our business model,” Girouard said. “The withdrawal of federal stimulus disproportionately harmed our borrowers, akin to a simulated recession for millions of mainstream Americans suddenly lost what had become their primary source of income. The Fed’s interest rate hikes, the fastest in several decades, left both lenders and capital markets cautious and concerned about what might come next in our economy.”