Related Headlines

| 09/09/2019 | Canada dragging its heels on open banking |

| 06/27/2019 | Join the Open Banking Summit in Toronto |

Related Videos

deBanked and Crypto |

Stories

Canadian Fintech Continues to Soar as Open Banking Comes to Fruition

April 5, 2022

After seemingly endless deliberation, Canadian open banking is finally being implemented; a huge win for the already high-performing fintechs that call Canada home.

After overcoming laws that prevented access to the data that fintechs need to innovate, the Department of Finance in Canada named Abraham Tachjian as the open banking lead as of last week, in another legitimate step towards incorporating open banking within their legacy financial institutions.

This comes on top of Canadian fintech’s major impact both in Canada and abroad. Canadian companies in the space of lending, payments, banking, and crypto have been some of the best performing and most innovative companies around the world, despite not being able to leverage open banking in their innovation strategies within Canada until now.

In a release from the Canadian government, Randy Boissonnault, the Minister of Tourism and Associate Minister of Finance, commented broadly on open banking’s implementation of the new system.

“Canadians deserve a secure open banking system that is regulated, efficient, and protects their personal information,” said Boissonnault. “This is an important next step in the process of implementing the Advisory Committee’s recommendations, in order to convene stakeholders to design and implement the foundational elements of an open banking system that benefits both Canadians and businesses.”

As the laws are being put in place, Canadian fintech continues to soar. According to a recent LinkedIn post from Tal Schwartz, Senior Project Manager at Noomis Solutions and formerly of the Canadian Lenders Association, Canadian banking and fintech continues to lead the way globally.

In all the niches in finance, Canadian companies seem to have their name on the top of list. Corporate card companies like Jeeves is now with over $2B, Canadian Venture Capitalist firm Portage Ventures is one of the world’s largest with $4B in assets.

Online stock trading platform Questrade Financial Group has begun to offer mortgages. Their competitor Wealthsimple, another Canadian stock trading platform, has also said that mortgages are on the way alongside a big push into lending.

In the US, Canadian-giant TD Bank became the 6th largest bank in the states with recent acquisitions of First Horizon Bank in late February.

Apart from the success of companies themselves, a sign that the Canadian fintech space is doing well is a desire to reconnect in person. The CLA’s Leaders in Lending Summit was recently announced for mid-November, a gathering of a sector of Canadian finance whose future was doubted after pandemic-induced restrictions on their industry. deBanked reporters will be attendees of the event.

Canada is Looking Forward to Open Banking

October 4, 2021 “It’s a fairly big deal,” said Tal Schwartz, Senior Advisor to the Canadian Lenders Association, when discussing the Canadian government’s renewed interest in alternative lenders after the recent Canadian election. As potential government officials from both parties discussed ideas about open banking in their election campaigns, such a conversation had been quelled by the “Big Five” Canadian banks— until now.

“It’s a fairly big deal,” said Tal Schwartz, Senior Advisor to the Canadian Lenders Association, when discussing the Canadian government’s renewed interest in alternative lenders after the recent Canadian election. As potential government officials from both parties discussed ideas about open banking in their election campaigns, such a conversation had been quelled by the “Big Five” Canadian banks— until now.

“The closer we get to some kind of entrenched regulatory framework, the better positions fintechs will be in to actually compete, get access to financial data, and raise money in an environment where there is regulatory certainty,” said Schwartz.

In August, the Canadian department of Finance welcomed a Final Report from the Advisory Committee on Open Banking that showcased a plan to modernize the Canadian financial regulatory system, with open banking and fintech in mind.

“Consumer-driven finance, or open banking, is already part of Canadians’ lives,” said Chrystia Freeland, Canada’s Deputy Prime Minister and Minister of Finance, in the report.

“Many use digital services every day to manage their money, to budget for expenses, and to make investments. Working towards a regulated, made-in-Canada system will make sure that we continue to enjoy a strong, stable, and innovative financial sector that is globally competitive, promotes consumer choice, prioritizes data privacy, and contributes to economic growth,” Freeland continued.

Schwartz said that the traditional oligopolistic structure of Canadian banking can offer advantages in times of financial crisis, but not when the government is shelling out money to help businesses during pandemic-related shutdowns.

“The reality was, if you’re a small business, you don’t have a credit relationship with a big bank, the only credit relationship you have is with an alternate lender,” said Schwartz. “By distributing money through big banks, in one sense, you’re not servicing customers the way they want to be served, and you’re cutting oxygen to a flourishing part of the innovation economy in Canada.”

“The reality was, if you’re a small business, you don’t have a credit relationship with a big bank, the only credit relationship you have is with an alternate lender,” said Schwartz. “By distributing money through big banks, in one sense, you’re not servicing customers the way they want to be served, and you’re cutting oxygen to a flourishing part of the innovation economy in Canada.”

Unlike in the United States, the Canadian government gave exclusive access of allocation to pandemic-induced federal assistance loans to the Big Five banks, leaving small business lenders relatively out to dry during that time. When asked about what issues he would like to see the new administration tackle first when it comes to alternative lenders, Schwartz mentioned the allocation of this type of money moving forward.

Other institutions outside of big banking in Canada are making strides in their effort to compete. Fintech giant Stripe announced hiring sprees for their new Toronto office last Thursday. Then there’s Nuula, a startup that aims to build a user-centric financial super app, announcing $120M in funding in early September.

To reach its full potential, Canadian fintech companies need the access to more data. The report recognizes the acknowledgement of the necessity this data is to fintech companies. “The scope of Canada’s open banking system in its initial phase should include data that is currently available to consumers and small business through their online banking applications,” it says. “Financial institutions should be allowed to exclude derived data – described as data enhanced by financial institutions to provide additional value to their consumers, such as internal credit risk assessments” the report reads.

“Historically, there hasn’t been very tech friendly or [Big Bank] challenger friendly regulations,” Schwartz said. “This is really the first time we’ve seen the political parties even mention issues of open banking and saying this will be a priority for our next government.”

“This has given the industry a lot of hope,” said Schwartz.

Open Banking: Canada Might Not Be Able to Make Up for Lost Time

January 22, 2020

Over the last two years, open banking has become a matter of public conversation in Canada. Most would agree there is overwhelming support for the implementation of an open banking regime. So why has nothing concrete happened yet?

2019 turned out to be an exciting, yet painfully underwhelming year for open banking in Canada. The news media finally caught on to the movement and started publishing stories on the rise of robo-advisor apps, or how small and medium-sized businesses would be impacted, and so forth. Experts and industry leaders pitched in with a massive volume of op-eds, most of which were in support of open banking, and with many deploring Canada’s slowness. Some came to our podcast to discuss their perspective (spoiler: customer-centricity is a very big theme.)

Another telling sign of the importance of open banking is the fact that at the federal level, both the legislative and executive arms of the government have become actively engaged in the public conversation. The Senate of Canada’s committee on Banking, Trade and Commerce produced a well-researched report — perhaps the most valuable contribution to the conversation. This report calls for swift action on the part of the federal government to advance a regulatory framework for open banking. In parallel, the Department of Finance’s appointed advisory committee on open banking held a consultation with key stakeholders and should publish its own report in the near future.

Even to a casual observer, there was an obvious sense that Canada is ready to embrace open banking.

But here’s the thing: despite all this work and evidence of widespread support, Canada didn’t move the needle on open banking in any concrete way.

Who’s leading?

The UK has already implemented a comprehensive open banking regime, and continental Europe is close behind. Dozens more countries are working toward their own versions. Among the various geographies moving in this direction, some are opting for a government-led approach, the UK probably being the best example. Others, like the US, tend to be more market-driven. In Canada, the main stakeholders are still largely hesitant about where to strike the balance between the two approaches — and the result is that so far, both have failed to provide the leadership that would allow open banking to move forward.

The Department of Finance’s advisory committee was tasked to study the “merits of open banking”. This line of inquiry feels very old, and for good reason: to question whether we should have open banking or not is a false debate, and a time-wasting rabbit hole. The real question Canada should be asking itself when it comes to open banking is, “what is the objective we want to achieve here?”

Let’s take a few steps back to realize just how important this question is.

The UK had a very clear vision for their open banking regime. The Competition and Markets Authority had assessed that the oligopolistic dynamics of the banking sector were putting consumers at a disadvantage. Thus, the UK set on their open banking journey with a very precise objective in mind: make it easier for consumers to switch providers. While some take great pride in criticizing the UK’s implementation — stating that its objective was either wrong, too narrow, or poorly executed — the fact remains that they are ahead of the pack. And the UK’s leadership in this area still persists, with the Financial Conduct Authority now studying the question of extending the current open banking regime into a holistic open finance regime.

Meanwhile, in Canada, the government is trying to wrap its head around the big questions, such as the liability framework that should be put in place for an open banking regime to be viable. (In other words, in a system where financial services are decentralized, how do we go about making the consumer whole when something goes wrong?) However, without a decision on what end state we are looking to achieve with open banking, these conversations are doomed to keep looking exactly like they’re looking now: a bunch of market actors with conflicting interests pretending they know what’s best for consumers. Conversations happening in industry groups aren’t much more productive, with the “trench war” dynamics being the trend there as well.

Meanwhile, in Canada, the government is trying to wrap its head around the big questions, such as the liability framework that should be put in place for an open banking regime to be viable. (In other words, in a system where financial services are decentralized, how do we go about making the consumer whole when something goes wrong?) However, without a decision on what end state we are looking to achieve with open banking, these conversations are doomed to keep looking exactly like they’re looking now: a bunch of market actors with conflicting interests pretending they know what’s best for consumers. Conversations happening in industry groups aren’t much more productive, with the “trench war” dynamics being the trend there as well.

The irony is that the technical aspects of open banking can be dealt with easily. From a technical standpoint, financial data-sharing APIs have proven their effectiveness, and coming up with a shared technical standard should not be too difficult. The real challenge is coming up with a framework everyone — incumbents and new entrants alike — can rally behind, something industry groups have largely been ineffective at.

Canada’s highly concentrated financial services sector is a stable one, but incumbents are not likely to open themselves up to disruption. This is the part where bold political leadership is required.

The clock is ticking

Data sharing is nevertheless picking up, as 4 million Canadians (and counting) have made fintech apps a part of their financial lives. Consumers and businesses who want the benefits of on-demand data sharing must rely on the current generation of financial aggregators, like Flinks. This system may work as a de facto connectivity layer, but the lack of standards results in a clumsy patchwork of bilateral deals between aggregators and banks. It just isn’t a viable way to achieve an open banking regime that levels the playing field when it comes to data portability.

In its report, the Senate’s Committee on Banking, Trade and Commerce states that Canada “risks falling behind” if it fails to implement open banking, and that “without swift action, Canada may become an importer of financial technology rather than an exporter.” It is true that if we keep delaying open banking, our slowness will prove to be a very stingy and lasting price to pay for the Canadian society; this is why we need bold action now. We can’t afford the comfort of waiting until we’ve figured out the 100% perfect solution.

There’s nothing like a real-world example: 2020 opened with a seismic shift when financial giant Visa acquired Plaid, one of the largest US financial aggregators, for over five billion USD. This is hinting at a new phase where markets will consolidate around a few large players; Canada can either ride the tide or get towed under.

It’s time to be bold

In the end, what needs to happen for Canada to move forward with open banking?

Our financial services sector can be compared to those of the UK and Australia, where a few powerful banks control a very large portion of the market. In those two countries, open banking was designed to stimulate competition, and government action was necessary to get things moving.

Right now, the question politicians ought to ask shouldn’t be if — or even how — but why. A why will pave the way and provide a natural direction to sort out the how. In 2019, discussions around open banking lacked this fundamental feature: political leadership centered on a bold, ambitious, consumer-centric mission statement. A why.

So here’s one for 2020: open banking will increase consumers’ choice when it comes to financial services. That would be a good start — and while good is not perfect, it still beats nothing by a landslide.

Canadian Lenders Association to Host Open Banking Summit on July 10th

June 27, 2019The Canadian Lenders Association will be hosting its Open Banking Summit on July 10th at Dentons Toronto. It begins at 8am and ends at 11am. This is the third in their event series, and will tackle topics in Open Banking and Big Data in Canada. They will discuss how the industry can best work toward an open data economy in Canada. Join the amazing panel of industry leaders.

The total cost to attend is CA$79.08. You can register here.

Open Banking — A U.S. Pipe Dream or Near-Term Reality?

December 18, 2018 Some alternative funders are anxious for “open banking” to become the gold standard in the U.S., but achieving widespread implementation is a weighty proposition.

Some alternative funders are anxious for “open banking” to become the gold standard in the U.S., but achieving widespread implementation is a weighty proposition.

Open banking refers to the use of open APIs (application program interfaces) that enable third-party developers to build applications and services around a financial institution. It’s a movement that’s been gaining ground globally in recent years. Regulations in the U.K., a forerunner in open banking, went into effect in January, while several other countries including Australia and Canada are at varying stages of implementation or exploration.

For the U.S., however, the time frame for comprehensive adoption of open banking is murkier. Industry participants say the prospects are good, but the sheer number of banks and the fragmented regulatory regime makes wholesale implementation immensely more complicated. Nonetheless, industry watchers see promise in the budding grass-roots initiative among banks and technology companies to develop data-sharing solutions. Regulators, too, have started to weigh in on the topic, showing a willingness to further explore how open banking could be applied in U.S. markets.

Open banking “is a global phenomenon that has great traction,” says Richard Prior, who leads open banking policy at Kabbage, an alternative lender that has been active in encouraging the industry to develop open banking standards in the U.S. “It’s incumbent upon the U.S. to be a driver of this trend,” he says.

The stakes are particularly high for alternative lenders since they rely so heavily on data to make informed underwriting decisions. Open banking has the potential to open up scores of customer data and significantly improve the underwriting process, according to industry participants.

“Open banking massively enables alternative lending,” says Mark Atherton, group vice president for Oracle’s financial services global business unit. What’s missing at the moment is the regulatory stick to ensure uniformity. Certainly, data sharing is gradually becoming more commonplace in the U.S. as banks and fintech companies increasingly explore ways to collaborate. But even so, banks in the U.S. are currently all over the map when it comes to their approach to open banking, posing a challenge for many alternative lenders. Many alternative lenders would like to see regulators step in with prescriptive requirements so that open banking becomes an obligation for all banks, as opposed to these decisions being made on a bank-by-bank basis. Especially since many consumers want to be able to more readily share their financial information, they say.

“It will create huge value to everyone if that data is more accessible,” says Eden Amirav, co-founder and chief executive of Lending Express, an AI-powered marketplace for business loans.

Some global-minded banks like Citibank have been on the forefront of open banking initiatives. Spanish banking giant BBVA is also taking a proactive approach. In October, the bank went live in the U.S. with its Banking-as-a-Service platform, after a multi-month beta period. Also in October, JPMorgan Chase announced a data sharing agreement with financial technology company Plaid that will allow customers to more easily push banking data to outside financial apps like Robinhood, Venmo and Acorns.

There are several other examples of open banking in action. Kabbage customers, for instance, authorize read-only access to their banking information to expedite the lending process through the company’s aggregator partners, says Sam Taussig, head of global policy at Kabbage.

Also, companies such as Xero and Mint routinely interface with banks to put customers in control of their financial planning. And companies like Plaid and Yodlee connect lenders and banks to help with processes such as asset and income verification.

Some banks, however, are more reticent than others when it comes to data sharing. And with no regulatory requirements in place, it’s up to individual banks how to proceed. This can be nettlesome for alternative lenders trying to get access to data, since there’s no guarantee they will be able to access the breadth of customer data that’s available. “As an underwriter, you want the whole financial picture, and if data points are missing, it’s hard to make appropriate lending decisions,” Taussig says.

The problem can be particularly acute among smaller banks, industry participants say. While the quality of data you can get from one of the money-center banks is quite good, “as you go down the line, it becomes a little less consistent,” says James Mendelsohn, chief operating officer of Breakout Capital Finance. For these smaller banks, the issue is sometimes one of control. There’s a feeling among some community banks, that “if I make it easier for my small business customers to get loans elsewhere, I’m done,” says Atherton of Oracle.

Absent regulatory requirements, alternative lenders are hoping that this initial hesitation among some banks changes over time as they continue to gain a better understanding of the market opportunity and as more of their counterparts become open to data sharing through APIs.

Open banking could be a boon for banks in that it would enable them to service customers they probably couldn’t before, says Jeffrey Bumbales, marketing director at Credibly, which helps small and mid-size businesses obtain financing. Open banking makes for a “better customer experience,” he says.

One challenge for the U.S. market is the hodgepodge of federal and state regulators that makes reaching a consensus a more arduous task. It’s not as simple here as it may be in other markets that are less fragmented, observers say.

Major rule-making would be involved, and there are many issues that would need attention. One pressing area of regulatory uncertainty today is who bears the liability in the event of a breach—the bank or the fintech, says Steve Boms, executive director of the Northern American chapter of the Financial Data and Technology Association. Existing regulations simply don’t speak to data connectivity issues, he says.

To be sure, policymakers have started to give these matters more serious attention, with various regulators weighing in, though no regulator has issued definitive requirements. Still, some industry participants are encouraged to see regulators and policymakers taking more of an interest in open banking.

A recent Treasury Report, for example, notes that as open banking matures in the United Kingdom, “U.S. financial regulators should observe developments and learn from the British experience.” And, The Senate Banking Committee recently touched on the issue at a Sept. 18 hearing. Industry watchers say these developments are a step in the right direction, though there’s significant work needed, they say, in order to make open banking a pervasive reality.

“We’re seeing the pace and interest around these things picking up pretty significantly,” Boms says. Even so, it can take several years to implement a formal process. “The hope is obviously as soon as possible, but the financial services sector is a very fragmented market in terms of regulation. There’s going to have to be a lot of coordination,” Boms says.

Another challenge to overcome is customers’ willingness to use open banking. Many small business owners are more comfortable sending a PDF bank statement versus granting complete access to their online banking credentials, says Mendelsohn of Breakout Capital Finance. “There’s a lot more comfort on the consumer side than there is on the small business side. Some of that is just time,” he adds.

Certainly sharing financial data is a concern—even in the U.K. where open banking efforts are well underway. More than three quarters of U.K. respondents expressed concern about sharing financial data with organizations other than their bank, according to a recent poll by market research body, YouGov. This suggests that more needs to be done to ease consumers into an open banking ecosystem.

The topic of data security came up repeatedly at this year’s Money20/20 USA conference in Las Vegas. How to make people feel comfortable that their data is safe is a pressing concern, says Tim Donovan, a spokesman for Fundbox, which provides revolving lines of credit for small businesses. Clearly, it’s something the industry will have to address before open banking can really become a reality in the U.S., he says.

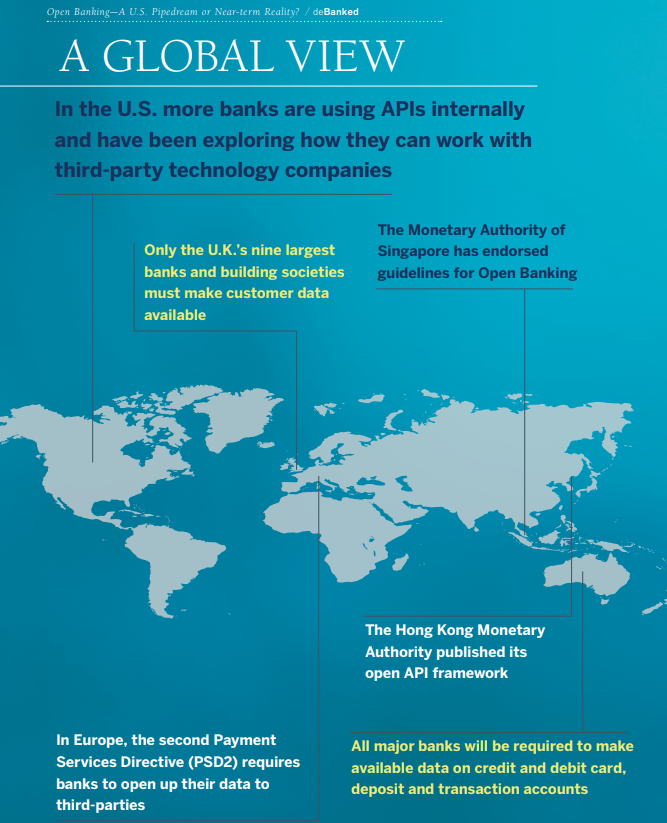

Despite these challenges, many market watchers feel open banking in the U.S. is inevitable, given the momentum that’s driving adoption worldwide. Several countries have taken on open banking initiatives and are at varying states of implementation—some driven by industry, others by regulation. Here is a sampling of what’s happening in other regions of the world:

In the U.K., for example, the implementation process is ongoing and is expected to continually enhance and add functionality through September 2019, according to The Open Banking Implementation Entity, the designated entity for creating standards and overseeing the U.K’s open banking initiative.

At the moment, only the U.K.’s nine largest banks and building societies must make customer data available through open banking though other institutions have and continue to opt in to take part in open banking. As of September, there were 77 regulated providers, consisting of third parties and account providers and six of those providers were live with customers, according to the U.K. open banking entity.

In Europe, the second Payment Services Directive (PSD2) requires banks to open up their data to third parties. But implementation is taking longer than expected—given the large number of banks involved. By some opinions, open banking won’t really be in force in Europe until September 2019, when the Regulatory Technical Standards for open and secure electronic payments under the PSD2 are supposed to be in place.

In Australia, meanwhile, the country has adopted a phase-in process to take place over a period of several years through 2021. Starting in July 2019, all major banks will be required to make available data on credit and debit card, deposit and transaction accounts. Data requirements for mortgage accounts at major banks will follow by February 1, 2020. Then, by July 1 of 2020, all major banks will need to make available data on all applicable products; the remaining banks will have another 12 months to make all the applicable data available.

For its part, Hong Kong is also pushing ahead with plans for open banking. In July, the Hong Kong Monetary Authority published its open API framework for the local banking sector. There’s a multi-prong implementation strategy with the final phase expected to be complete by mid-2019.

Singapore, by contrast, is taking a different approach than some other countries by not enforcing rules for banks to open access to data. The Monetary Authority of Singapore has endorsed guidelines for Open Banking, but has expressed its preference to pursue an industry-driven approach as opposed to regulatory mandates.

Other countries, meanwhile, are more in the exploratory phases. In Canada, the government announced in September a new advisory committee for Open Banking, a first step in a review of its potential merits. And in Mexico, the county’s new Fintech Law requires providers to provide fair access to data, and regulators there are reportedly gung-ho to get appropriate regulations into place. Still other countries are also exploring how to bring open banking to their markets.

The U.S. meanwhile, is on a slower course—at least for now. More banks are using APIs internally and have been exploring how they can work with third-party technology companies. Meanwhile, companies like IBM have been coming to market with solutions to help banks open up their legacy systems and tap into APIs. Other industry players are also actively pursuing ways to bring open banking to the market.

As for when and if open banking will become pervasive in the U.S., it’s anyone’s guess, but industry participants have high hopes that it’s an achievable target in the not-too-distant future.

Thus far, there has been little pressure for banks to adopt open banking policies, says Taussig of Kabbage. But this is changing, and things will continue to evolve as other countries adopt open banking and as pressure builds from small businesses and consumers in an effort to ensure the U.S. market stays competitive, he says. Open banking “is going to happen in the near future,” Taussig predicts.

ROK Financial Announces Cannabis Banking Partnership with BNB Bank

January 14, 2021Great River, NY: ROK Financial, a leader in the alternative and commercial lending space is excited to announce their newest partnership with BNB Bank’s Cannabis division. This new partnership allows for ROK Financial to offer direct checking and savings to Cannabis businesses through BNB Bank.

“This new partnership is truly filling a void within the Cannabis industry” says James Webster, CEO of ROK Financial “Federal regulations make it near to impossible for Cannabis related businesses to utilize traditional banking methods. We’re proud to partner with a financial institution that sees the value and need within the industry.”

BNB Bank, headquartered in Bridgehampton, NY has 39 locations from Manhattan to Montauk. BNB Bank provides the resources of a strong financial institution, exceptional customer service, and access to a suite of leading-edge money management tools. They are publicly traded on Nasdaq (BDGE) and have a 5-star rating (Bauer Financial). Peter Su, Vice President – Private Banking BNB says: “This new relationship with ROK Financial allows us to service a wider variety of clientele. We’re excited to work with ROK Financials existing Cannabis clients as well as attracting new relationships through this partnership.”

A large majority of traditional institutions tend to shy away to offering traditional banking to the industry as a whole due to the lack of regulations and financial risk they may face. Banks also risk losing their master account with the Federal Reserve due to the ‘risk’ of the industry. “BNB Bank has a board approved Cannabis Banking Policy that we strictly abide to, and have established a compliance monitoring program providing seed to sale regulatory support to ensure we all are in compliance” says Su “We are happy to help provide needed resources to these thriving businesses.”

About ROK Financial

ROK Financial’s team committed to establishing ROK solid relationships with our clients, lenders, and partners. By providing the best financing solutions available to business owners while creating a positive association with business financing. Through our streamlined process, revolutionary technology and educated team of experts, we support business owner’s ability to create new opportunities. ROK Financial is proud to empower the heartbeat of our country, our small businesses.

Megan Capobianco

3500 Sunrise Highway

Building 100, Suite 201

Great River, NY 11739

833-337-6534

press@rok.biz

www.rok.biz

Capify Announces $10 Million Equity Round As Well As Continued Support From Goldman Sachs Merchant Banking Division

September 30, 2020

Access To Business Loans Especially During COVID-19 Pandemic

(Manchester, England and Sydney, Australia) – Capify (http://www.capify.co.uk, http://www.capify.com.au ), a leading fintech small business lending platform, today announced it has closed a $10 million equity round as well as continued support from Goldman Sachs Merchant Banking Division through its existing credit facilities.

“The fact that we were able to raise $10 million for an online small business lender in the midst of a global pandemic from sophisticated investors with industry experience speaks to Capify’s business model, the unprecedented opportunity ahead of us and its management team,” said David Goldin, Founder and CEO of Capify.

Continued, Mr. Goldin, “We believe demand by small businesses seeking access to unsecured capital will be at unprecedented levels because most businesses have already accessed the government backed business loan programs in the UK and Australia market but will still need additional capital – as do the many businesses that didn’t qualify for the Government guaranteed programs and are seeking much needed working capital to grow.”

In addition, Capify is actively seeking partnerships with companies with large small business customer bases to provide much needed financing to their small business customers, thus allowing them access to capital to purchase goods / services which have proven financially difficult during this challenging time. Furthermore, we are looking for opportunities where we can assist our industry peers who don’t have access to capital during this time by providing capital to their customer base.

Capify’s 12 year presence in the UK and Australia market is more relevant than ever as small businesses demand for access to capital to navigate through COVID-19 is at an all time high. According to John Rozenbroek, COO / CFO of Capify, “It is crucial at this time that small businesses are aware of alternative funding solutions to support cash flow or invest in their future. Capify is one of the few online small business lending platforms in the marketplace that can actively provide non-government backed business loans at scale to small businesses seeking working capital to grow their business. ”

About Capify

Capify is an online lender that provides flexible financing solutions to small businesses in the UK and Australia seeking working capital to sustain or grow their business. The fintech company has been operating in the UK and Australia market for over 12 years.

For more details about Capify, visit

Capify UK: http://www.capify.co.uk

Capify Australia: http://www.capify.com.au

Capify UK Media Contact:

Ian Wood, Marketing Director

iwood@capify.co.uk

+44 0161 393 9536

Capify Australia Media Contact:

Nandita Graham, Senior Marketing Manager

ngraham@capify.com.au

+61 433 511 653

Smarter Loans Expands into Banking, Insurance, Investing, Money Transfers and Debt Relief Solutions

September 22, 2020 Smarter Loans – Canada’s largest loan comparison website – is excited to announce their expansion into new financial categories that include: Everyday Banking, Insurance, Investing, Money Transfers, and Debt Relief.

Smarter Loans – Canada’s largest loan comparison website – is excited to announce their expansion into new financial categories that include: Everyday Banking, Insurance, Investing, Money Transfers, and Debt Relief.

Canadians nationwide use Smarter Loans to find the most innovative financial products and services in the country, compare their options, and make smarter financial decisions. Launched in 2016, Smarter Loans today works with over 80 of the top financial brands in Canada, including banks, credit unions, alternative lenders, financial services and innovative FinTech companies that are leading the digital transformation in the Canadian financial sector.

The expansion is another step by Smarter Loans in helping Canadians access more financial products online.

We believe that Smarter Loans is at the forefront in the evolution of how people want and expect to shop for financial products. There is a big shift towards buying online and companies that are setup to transact and sell their services on the Internet are winning. We work hard to seek out top financial brands and are really excited that Smarter Loans visitors can now find even financial solutions on our site. (Rafael)

It’s a great experience when a person can send money overseas, get life insurance, and open a savings account all from the comfort of their home or on their mobile device. Our mission is to highlight all of the great and reputable companies that offer Canadians that experience. (Vlad)

Smarter Loans has responded to the growing demand for digital financial products and services in Canada by securing working relationships with leading brands that offer financial services online, including chequing and savings accounts, investing solutions, insurance for personal and commercial coverage, international money transfers, debt relief and credit solutions.

The new categories are available to all new and existing Smarter Loans members, everywhere in Canada.

The new categories will help even more Canadians save time and money, and discover great companies that can help them with various financial needs, entirely online.

If you are a financial brand and are interested in discussing partnership opportunities please get in touch with Smarter Loans at: info@smarter.loans.