|

Phone: 212-220-9872 Learn More |

Since: September 2017 Since: September 2017 |

Stories

Total Merchant Resources Launches Wholesale Funding Division, Secures $20 Million in Private Equity

December 1, 2016Dec 2, 2016 / Piscataway, NJ – An old name in the industry is now a new kid on the block with wholesale. Total Merchant Resources in Piscataway, NJ announced today that it is finished with a first round of funding and has secured $20 million in private equity. This new designation allows TMR to quickly and easily service ISO’s from coast to coast via its wholesale funding division, TMRNOW.

“We are thrilled to open our very successful funding platform to the entire industry. In addition, TMR is now perfectly positioned to do business in California since we are one of the few in this space to obtain a California lending license.” said TMR Co-Founder and CEO Jason Reddish.

Reddish and co-founder Val Pinkhasov, who were featured on CNBC’s ‘Shark Tank’, were among the very first business lenders to enter this space. They are a respected name in the industry and, thanks to their major prime time TV appearance, have brought attention to this underutilized model for businesses to obtain working capital.

“Funding on the retail side all these years, we understand where funders have failed in the past and being that our money is completely private, we have no one to answer to in regards to underwriting. We create our own programs and common sense pricing. We look forward to being a name that ISO’s can trust on every level and making common sense, in house decisions” says Val Pinkhasov President of TMR.

Both Reddish and Pinkhasov have several decades of finance experience and have helped thousands of businesses achieve their goals. They are now excited, in a properly regulated fashion, to do so in on the wholesale side. Please visit TMRNOW.COM for more information.

For more information call Gary Lane (212) 220 9872.

Total Merchant Resources Obtains California Lending License

October 17, 2016Piscataway, N.J. – October 17th 2016 – Total Merchant Resources, a Piscataway based business funder and a veteran in the merchant cash advance space, has obtained their California Lending License to capitalize on providing businesses with working capital in the Nation’s most populous state. This new designation allows TMR to quickly and easily extend money to small and medium sized business throughout the Golden State.

“We are thrilled to have access to this very important market. In addition, TMR is now perfectly positioned to do business in California as we await the imminent and necessary regulation of the industry,” said TMR Co-Founder and CEO Jason Reddish.

Reddish and co-founder and CFO Val Pinkhasov, who were recently featured on CNBC’s ‘Shark Tank’, were among the very first business lenders to enter this space. They are a respected name in the industry and thanks to their major prime time TV appearance, have brought attention to this underutilized model for businesses to obtain working capital.

For more information contact Gary Lane, Director of Business Development at (212) 220-9872.

CFG Merchant Solutions Closes Credit Facility of up to $145 Million to Support Small Business Growth

May 29, 2024NEW YORK, NY. May 29, 2024 – CFG Merchant Solutions, LLC (“CFGMS” or the “Company”), a technology-enabled specialty finance and alternative funding provider, announced the successful completion of a $100.0 million senior credit facility. The credit facility is expandable up to an additional $45.0 million, representing a total capital raise of up to $145.0 million. Proceeds from the funding, secured from a prominent, U.S.-based institutional investor focused on private structured credit, will serve to further fuel the Company’s mission to empower and support the growth of small and medium-sized businesses (SMBs).

Since its founding in 2015, CFGMS has a proven track record of asset performance and profitability, and has funded more than $1.4 billion to over 33,000 SMBs across diverse industries throughout the U.S. With the infusion of additional capital, CFGMS will continue to focus on delivering flexible and accessible financing solutions that empower small businesses to seize growth opportunities, create jobs, and contribute to the overall economic prosperity of the communities they serve.

“We are thrilled to have secured this substantial capital raise, as it reaffirms our commitment to empowering small businesses,” said Andrew Coon, Chief Executive Officer of CFGMS. “We extend our heartfelt gratitude to our investors for their continued trust and support. With this new credit facility, we will be able to reach a wider range of small businesses and provide them with the financial resources they need to thrive.”

Bill Gallagher, President of CFGMS, expressed enthusiasm for the future impact of the capital raise, stating, “This new facility will strengthen our position to ensure our small business clients have access to fast and efficient financing solutions tailored to their unique needs. We are excited to leverage this capital to expand our operations and deepen our commitment to empower U.S. small businesses to succeed.”

Brean Capital, LLC served as the Company’s exclusive financial advisor and sole placement agent in connection with the transaction.

About CFG Merchant Solutions

CFG Merchant Solutions (“CFGMS”) is an independent, technology-enabled alternative funding platform focused on providing capital access to small and mid-sized businesses that have historically been undeserved by traditional financial institutions and may have experienced challenges obtaining timely financing. The Company uses its historical transactional data, proprietary underwriting, predictive analytics, and electronic payment technologies and platforms to assess risk, and provide access to flexible and timely capital.

For additional information about the Company, visit: https://cfgmerchantsolutions.com/.

Contact:

Name: Richard Polgar

Title: Chief Financial Officer

rpolgar@cfgms.com

A Q4 To Remember – A Timeline

December 18, 2016In case you haven’t noticed, it’s been an interesting few months for alternative finance. The below timeline is an expanded version of what appears in the print version of our Nov/Dec magazine issue.

9/27 Able Lending secured $100 million in debt financing

9/30 The FTC won a judgement of $1.3 billion against payday loan kingpin Scott Tucker, its largest ever award through litigation

10/11 The United States Court of Appeals for The District of Columbia ruled the CFPB’s organizational structure unconstitutional. To remedy, the agency will either have to convert its one-person directorship to a multi-member commission or the director will have to report to the President of the United States. The CFPB is appealing the decision.

10/13 Affirm secured $100 million in debt financing

10/14

- CircleBack Lending was reported to have ceased lending operations

- Goldman Sachs unveiled its new online consumer lending division, Marcus

10/20 CommonBond secured a $168 million securitization deal

10/24 Bizfi announced that John Donovan had joined the company as CEO. Donovan was the COO of Lending Club from 2007 to 2012.

10/25

- Expansion Capital Group announced new management team. Vincent Ney, the company’s majority shareholder became the CEO

- Lendio raised $20 million through a new equity round led by Comcast Ventures and Stereo Capital

- Lending Club announced its foray into the $1 trillion auto refinancing market

11/1

- Cross River Bank raised $28 million in equity led by Boston-based investment firm Battery Ventures along with Silicon Valley venture capital firms Andreessen Horowitz and Ribbit Capital

- Square beat earnings estimates and extended $208 million through 35,000 loans in Q3

11/3

- OnDeck announced earnings, continued use of balance sheet to fund loans and extended $613 million in Q3

- Independent merchant cash advance training course goes live, allowing brokers and underwriters to earn a certificate

11/4 SEC concluded its investigation into Lending Club

11/7 Lending Club announced earnings and a deal to sell $1.3 billion worth of loans to a National Bank of Canada subsidiary

11/8 CFG Merchant Solutions secured a $4 million revolving line of credit

11/9 Donald Trump became the President-Elect

11/11

- Fintech leader Peter Thiel joins the executive committee of Trump’s transition team

- Kabbage appointed Amala Duggirala as Chief Technology Officer and Rama Rao as Chief Data Officer

11/14 Prosper’s CEO Aaron Vermut, stepped down

11/16

- UK-based p2p lender Zopa applied for a banking license

- Small business lender Dealstruck reportedly ceases lending operations

- Former Lending Club CEO revealed to be launching a new rival, Credify

11/17

- LiftForward secured a $100 million credit facility

- Prosper filed their Q3 10-Q, revealing that they only originated $311.8 million in loans for the quarter compared to $445 million in Q2

- The IRS sent a broad request to Coinbase, the nation’s largest bitcoin exchange, as part of a hunt for tax evaders

- PeerStreet raised a $15 million Series A funding round led by Andreessen Horowitz

11/18 P2Bi raised $7.7 million in venture financing

11/22 LendIt announced the first ever industry awards event

11/29 Three C-level executives at CAN Capital are placed on a leave of absence after the company identified assets that were not performing as expected

12/2

- Total Merchant Resources secures $20 million in private equity, launches wholesale funding division

- Bitcoin-based P2P lending platform BitLendingClub shuts down

- OCC announces they are moving forward with a special purpose national charter for fintech companies

12/8 Former CEO and co-founder of World Wrestling Entertainment tapped to run Small Business Administration

12/9 OnDeck announced new $200 million revolving credit facility with Credit Suisse

12/12 Knight Capital Funding announced new Chief Data Scientist

12/13 Fifth Third Bank is reported to buy a stake in franchise marketplace lender ApplePie Capital

12/14 BlueVine raised $49 million in Series D funding

12/15

- Swift Capital named Tim Naughton as Chief Legal Officer

- John MacIlwaine, Lending Club’s Chief Technology officer, submitted his resignation to the company to pursue another opportunity

12/16 CAN Capital is reported to have laid off more than 100 employees

Funders Prep for the Holiday Rush

November 1, 2016

As the year draws to a close sending everyone into a dizzying holiday frenzy, funders are prepared to fire on all cylinders to fuel their retail customers with cash.

The last quarter is crunch time for funders alike, who start preparing months in advance — designing new products, marketing and selling them. deBanked spoke to a few to find out what business looks like at this time of the year and what’s in store for 2017.

For some, Christmas comes in August

At South Dakota-based Expansion Capital Group, the holiday prep started as early as August. “We think demand is going to be very strong and to accommodate for it, we started 60 days early,” said Marc Helman, director of strategic partnerships. The company launched four new products in August for a wide spectrum of borrowers — longer term products for existing customers and starter offers for new companies and those with challenged credit.

Since the demand peak is cyclical, most funders who have been around a while have the drill down to a science. For NYC-based funder Hunter Caroline, demand spikes up close to the tax extension period, in September and October. “We sit down with our marketing team, see which clients ramp up this time of the year and focus our sales efforts in that direction,” said Cody Roth, managing partner at Hunter Caroline. During the holiday season the company turns its attention to customers in mom and pop retail, restaurants, liquor stores and gift stores in small towns.

“We weigh a lot into seasonal businesses and have certain hybrid programs,” Roth said. “We collect a little bit more during the busy season and keep it down during the slow time.” For this year specifically, the two-year-old firm is pushing invoice factoring, purchase order financing and unsecured loan products apart from its usual business loan offering of up to $4 million for 24 months.

Plan, pilot, pivot

Q4 is also the time when companies plan and strategize for the year ahead. And for loan marketplace Bizfi, a lot of changes are in the offing. The company appointed John Donovan, a 30-year veteran in the payments and alternative finance industry as its new CEO. And while on track to approach nearly $600 million of fundings this year, Bizfi also decided to cut ties with some non-performing ISOs to increase efficiency. “We just told around a hundred sales offices we could not do business with them anymore to use resources for our own funding channels that have better conversion rates,” said Stephen Sheinbaum, founder and president of Bizfi.

Holiday Hangover

The holiday season is arguably one of the busiest times of the year for merchants, but it doesn’t have to be so for funders. Jason Reddish, CEO of New Jersey-based Total Merchant Resources advises all his clients to take the money when they don’t need it, asking clients to borrow early, put away the money and by November, have the capital pay for itself through the peak season. “The oldest problem with credit is that you get as much as you want when you don’t need it,” Reddish remarked. “You have access to cheap and the most flexible money when you don’t need it.”

The company tries to structure deals that way for some of its retail clients who see high holiday demand.“We see a pretty big spike going into the holidays and then there is a holiday hangover where they are absorbing all the money they borrowed,” Reddish remarked. “Until the hangover wears off in February and we get busy again.”

All things considered, funders are on their marks for the holiday. Will it be bright for them?

Jason Reddish Talks Business Lending On Cleveland Radio

June 14, 2016Total Merchant Resources CEO Jason Reddish talked all things lending on AM 1490 in Cleveland, Ohio recently, including much about the alternative business financing industry. Have a listen below:

Reddish was also kind enough to give a shout out to deBanked at about 9 and a half minutes in.

Reddish and his business partner Val Pinkhasov made a splash in the industry after their appearance on ABC’s Shark Tank in 2013.

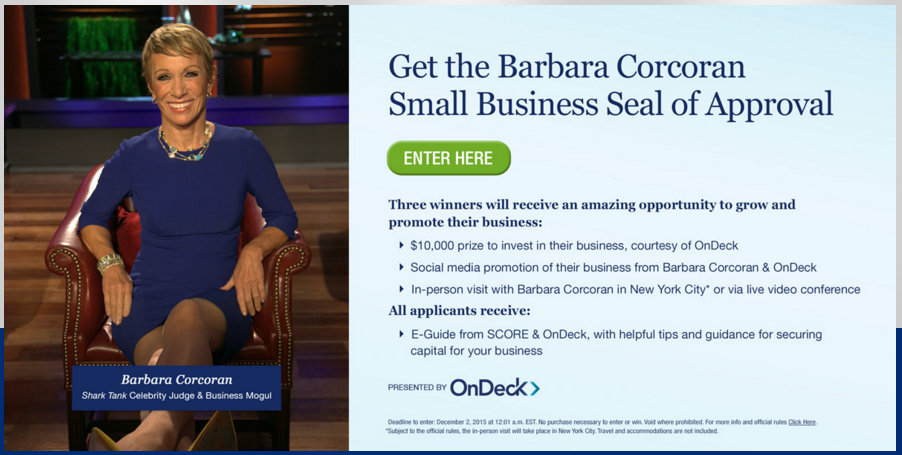

Shark Tank’s Barbara Corcoran Teams Up With OnDeck for Small Business Contest

November 29, 2015 Barbara Corcoran, co-founder of The Corcoran Group and famous Shark Tank investor, has teamed up with small business lender OnDeck to support entrepreneurs through a contest. Three winners will be chosen for a $10,000 prize and they’ll also get to meet Barbara Corcoran.

Barbara Corcoran, co-founder of The Corcoran Group and famous Shark Tank investor, has teamed up with small business lender OnDeck to support entrepreneurs through a contest. Three winners will be chosen for a $10,000 prize and they’ll also get to meet Barbara Corcoran.

Contest applicants are asked to enter what they would spend the $10,000 on to grow their business. The deadline to enter is December 2nd, 2015.

The partnership is significant because it marks yet another time that a Shark has crossed paths with online business lenders. Just one year ago, Kevin O’Leary became a spokesperson for IOU Financial.

I'm thrilled to announce a new partnership between O'Leary Financial & @IOUCentralInc this morning! http://t.co/ECJl1K5ZUC #smallbusiness

— Kevin O'Leary (@kevinolearytv) October 2, 2014

Also around that time, Kevin Harrington, an original Shark Tank investor before Mark Cuban or Lori Greiner, co-founded his own small business lending marketplace, Ventury Capital. Straight out of the OnDeck or merchant cash advance playbook, Ventury’s FAQ says their system “deducts a fixed, daily payment directly from your business bank account each business day.”

Watch Kevin Harrington explain his company here:

Of course there was the time that a merchant cash advance company (Total Merchant Resources) actually went on Shark Tank and pitched the sharks…

It seems that the show and the real world have a lot in common.

See Post... total merchant resources. they did a deal on shark tank. no experience with them., , i know who they are, i know they did a deal on shark tank. i just want... |

See Post... total merchant resources. they did a deal on shark tank. no experience with them.... |

See Post... total merchant resources... |

If you missed Friday night’s episode of Shark Tank, you absolutely must catch a rerun of it.

If you missed Friday night’s episode of Shark Tank, you absolutely must catch a rerun of it.