Do Opportunities Abound?

Just recently I found myself in an office surrounded by some folks who had each worked in the merchant cash advance business for more than 10 years. The first generation of MCA pioneers are still out there of course but it’s rare to be in the presence of so many at one time. It was weird. Weirder still was the realization that no matter how much things have changed, some things continue to be exactly the same.

Just recently I found myself in an office surrounded by some folks who had each worked in the merchant cash advance business for more than 10 years. The first generation of MCA pioneers are still out there of course but it’s rare to be in the presence of so many at one time. It was weird. Weirder still was the realization that no matter how much things have changed, some things continue to be exactly the same.

Me: You guys looking to recruit ISOs?

Them: Damn right

As far as the industry is concerned, these guys might as well have fought in ‘Nam. They’re from another generation where life was hard and men were still men. When businesses couldn’t get bank loans, these guys were splitting payments with their bare hands and reprogramming credit card machines with nothing more than a paper clip and a ball of twine. Funding a deal wasn’t a product of technology, it was one of sweat, tears, and blood. Have you ever bled for your deals?

This August I celebrate my 8th year in the industry. Next month marks the 4 year anniversary of this blog. I enjoy reading some of my posts from back then, particularly since most of them discuss the ordeals of credit card processing. A lot of what I’ve written no longer applies and some of what I’m writing these days will be outdated years from now. As I approach 600 articles and blog posts on this subject matter, I’ve had to stop and ask myself if everything has already been written. What more can possibly be said about this business? Perhaps the tale of the industry has already been told and I am on my way to retelling exaggerated stories to anyone who will listen. I don’t want to be that wrinkled up old man swaying back and forth in a rocking chair talking about how ISOs got it so easy these days.

Sadly, even the name of the website is reflective of a previous era. This is the Merchant Processing Resource, not exactly what you’d expect a top destination to be called on the subject of alternative business lending.

Sadly, even the name of the website is reflective of a previous era. This is the Merchant Processing Resource, not exactly what you’d expect a top destination to be called on the subject of alternative business lending.

But the story’s not finished. Every passing month is filled with events that inspire a dozen new chapters, which is more than one man can keep up with. Last month at the LendIt conference, I got a glimpse of just how many opportunities still lie ahead.

Some alternative business financing companies such as Funding Circle and DealStruck are diverging away from merchant cash advance and going back to the traditional roots of term lending. Funding Circle is doing it with a 21st century twist, by making their system peer-to-peer based.

Still other firms have sprung up around LendingClub’s and Prosper’s APIs and offer their users ways to make better loan investment decisions.

And even among the players we’re all familiar with, there is innovation, growth, and new ideas. Just recently CAN Capital launched CAN Connect, a software application that can be integrated with any other company’s software. According to CAN’s release,

Through CAN Connect™, merchants will be able to receive a CAN Instant Quote™ based solely on data provided by the partner. Once the merchant elects to proceed, they are taken through a simple online application process and can obtain access to working capital without ever leaving the partner’s platform.

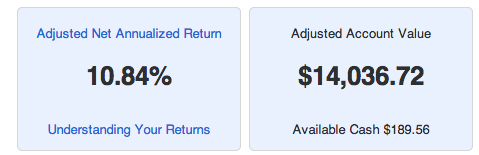

Indeed technology has even allowed me to become a lender myself,

My LendingClub portfolio, which is still very young and made up by hundreds of $25 consumer loan contributions has a current Net Annualized Return of more than 10%. Contrast that against the average U.S. savings account that pays out less than 1%.

While it’s certainly not the 54% yield that OnDeck Capital enjoys, there are levels of risk and markets set up for just about anyone interested in alternative lending.

And what might come next may not all be broker/funder related. As the industry flies in a thousand different directions, entire new industries and services are going to grow up around them. That brings me back full circle. Has everything already been written? 4 years of blogging here and this might as well be my first day.

Some things haven’t changed a bit, but the rest of it, well… we must soldier on in this strange new world.

Do you see opportunities ahead? Discuss with industry insiders on DailyFunder.

Last modified: April 20, 2019Sean Murray is the President and Chief Editor of deBanked and the founder of the Broker Fair Conference. Connect with me on LinkedIn or follow me on twitter. You can view all future deBanked events here.