Archive for 2021

deBanked to Livestream from the SEAA Show in Bonita Springs

May 21, 2021May 24th LIVE schedule: 4:45pm – 6:30pm

May 25th LIVE schedule: 9:00 – 10:45am, 3:00 – 4:00pm, 5:00 – 6:30pm

deBanked will be streaming live from the Southeast Acquirers Association conference on May 24th and 25th in Bonita Springs, FL. The payments show celebrating its 20th anniversary is expected to have nearly 800 people IN PERSON.

deBanked will be streaming live from the Southeast Acquirers Association conference on May 24th and 25th in Bonita Springs, FL. The payments show celebrating its 20th anniversary is expected to have nearly 800 people IN PERSON.

The livestream will be available at scheduled times at deBanked.com/tv/. We will be speaking with executives across the payments and small business finance industries.

Lawsuit Alleging Google Ad Abuse is Latest Iteration of the Search War

May 20, 2021 Google parent company Alphabet reported a record profit in Q1 2021 of $18 billion, up 162% from 2020. The firm attributes the success to a 32% surge in Covid related advertising sales.

Google parent company Alphabet reported a record profit in Q1 2021 of $18 billion, up 162% from 2020. The firm attributes the success to a 32% surge in Covid related advertising sales.

A recent lawsuit from ten US States filed in a district court in Texas would argue that it’s not just a covid based bump in ad sales. According to the WSJ, in response to the lawsuit, Google accidentally confirmed what prosecutors suspected: they run a secret program called “Project Bernanke” that uses proprietary data to win bids on the firm’s ad exchange, netting hundreds of millions of dollars over the years. It amounts to a digital ad monopoly, which has already pushed Google’s parent company, Alphabet, to new highs.

Google’s ad exchange works like a stock exchange for marketing, as enterprises buy and sell placements and seconds of attention within the Google advertising universe. Firms bid on purchasing slots for ads in browsers and videos, and the auctions happen lightning fast in real-time. The lawsuit from ten states through the Taxes district court alleges Google used insider information on what they knew firms were willing to pay, to drive the prices as high as they would go.

Google is both on the buy and sell-side of its transactions and admitted in the papers WSJ saw that the data they mined to inform bids in Project Bernanke was not disclosed to publishers. The papers were quickly redacted and sealed by a judge days after WSJ found the details. The documents also mention “Jedi Blue,” a sweetheart deal between Google and Facebook. Instead of competing with Google ads, Facebook agreed to bid on and automatically win a fixed percentage of Google ad auctions. The deal originated back in 2018 when Facebook announced it was joining a competitor advertising program called “open bidding.” The states’ lawsuit alleges the firms must have made a side deal then, and the leaders of the internet ad market colluded; it’s why a bipartisan coalition of ten states is pushing back.

deBanked has tracked Google’s relationship with funders who use the search engine for marketing their products. After reducing the effetiveness of SEO and forcing most businesses into buying ad space out of necessity, the new lawsuit alleges Google rigged the game for themselves. The House always wins.

Back in 2012, deBanked’s Sean Murray first evaluated the SEO landscape. Google punished blogs that were printing out backlinks by the hundreds, nose-diving the competitive market for SEO rankings.

In 2014, Google’s “penguin algorithm” inflicted further pain.

In 2017, Google outright blocked merchant cash advance as an advertising keyword.

Good Funding Announces Closing of up to $30 Million Credit Facility

May 19, 2021 Transaction Represents Company’s Inaugural Institutional Financing

Transaction Represents Company’s Inaugural Institutional Financing

TUSTIN, Calif., May 19, 2021 – Good Funding, LLC (“Good Funding”), a recently-launched small business finance company, has closed on a $20.0 million senior revolving credit facility with a U.S.-based, credit focused asset manager. The agreement includes an accordion feature with the option to increase the credit facility to $30.0 million. The transaction represents Good Funding’s inaugural institutional financing. Proceeds will be used to increase the Company’s funding capabilities and execute its strategic growth plan.

“We are thrilled to have closed on this first round of institutional financing,” said Jason Osiecki, Co-Founder and President of Good Funding. “This credit facility will allow us to accelerate the growth of our funding platform, expand our team, and ultimately empower even more small businesses to move forward.”

“With less than a year in business, in the midst of a pandemic that is still negatively impacting America’s small businesses, we view this investment as a strong endorsement of what Good Funding can accomplish,” said Co-Founder and CEO of Good Funding Ben Gold. “Closing on this credit facility validates our mission to transform the way small businesses access the capital they need to grow and thrive. We cannot wait to put this investment into action.”

Brean Capital, LLC served as the Company’s exclusive Advisor and Placement Agent in connection with this transaction.

About Good Funding, LLC

Founded in 2020, Good Funding is a privately-held financial services firm that provides alternative funding resources to America’s small businesses. Our products are designed for business owners who cannot access working capital through traditional methods, or simply need funding with a rapid-fire turnaround. Good Funding allows entrepreneurs, start-ups and established businesses to build self-reliance and a brighter financial future.

Media contact:

Jenny Alonzo

VP, Marketing

714.384.7189

jalonzo@goodfunding.com

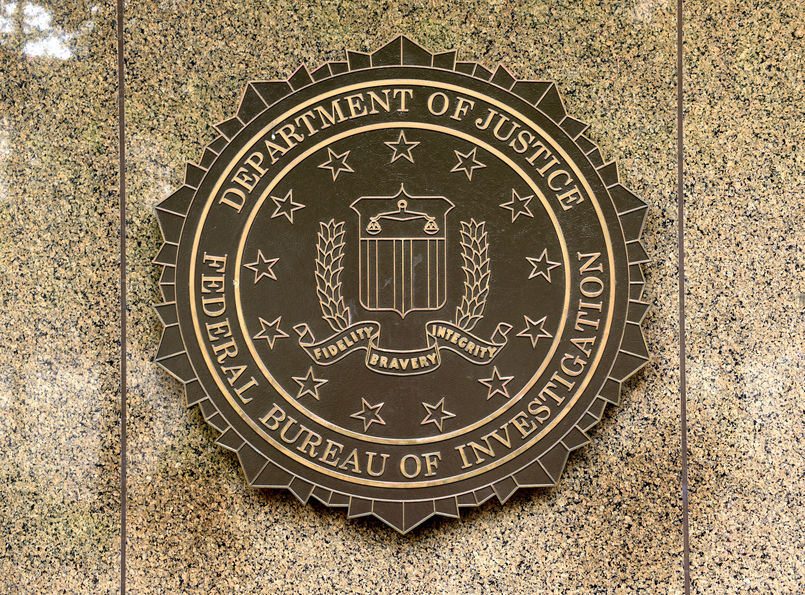

DOJ Probes Fintech PPP Lenders

May 19, 2021 The DOJ has launched a probe into fintech firms like Kabbage for their handling of PPP loan distribution, expressing concern that firms may have miscalculated eligible loan amounts or misrepresented payroll taxes, Reuters reported.

The DOJ has launched a probe into fintech firms like Kabbage for their handling of PPP loan distribution, expressing concern that firms may have miscalculated eligible loan amounts or misrepresented payroll taxes, Reuters reported.

The probe is the beginning of an investigation and does not indicate any wrongdoing. The DOJ is reacting to the concerns from multiple sources since PPP launched that the $780 billion program ran the risk of fraud and misuse of funds.

The PPP lending portion of Kabbage, since spun off and rebranded to K Servicing, made less than 300,000 PPP loans worth $7 billion from April to August alone, according to the website. Based on the original PPP lender guidelines, that could net the firm as much as $350 million in commission for sourcing the loans.

As recently as December, the SBA’s own oversight officer Hannibal Ware found that possibly “over 2 million approved PPP loan guarantees” or about $189 billion in loans were “potentially” not in compliance with the law. Those applications are a piece of the puzzle and may turn out to be not fraudulent at all, but the DOJ is taking steps to make sure.

The SBA compliance rules changed constantly, creating a challenge for many PPP lenders to adapt their automated loan processing while updates came out.

In related news, the SBA began accepting applications for the Restaurant Revitalization Fund on Monday, May 3rd. In the first two days, the organization recorded 186,200 applications from restaurants and eligible businesses from across the country.

“61,700 of the applications came from businesses with under $500,000 in annual pre-pandemic revenue,” the SBA reported. “Representing some of the smallest restaurants and bars in America.

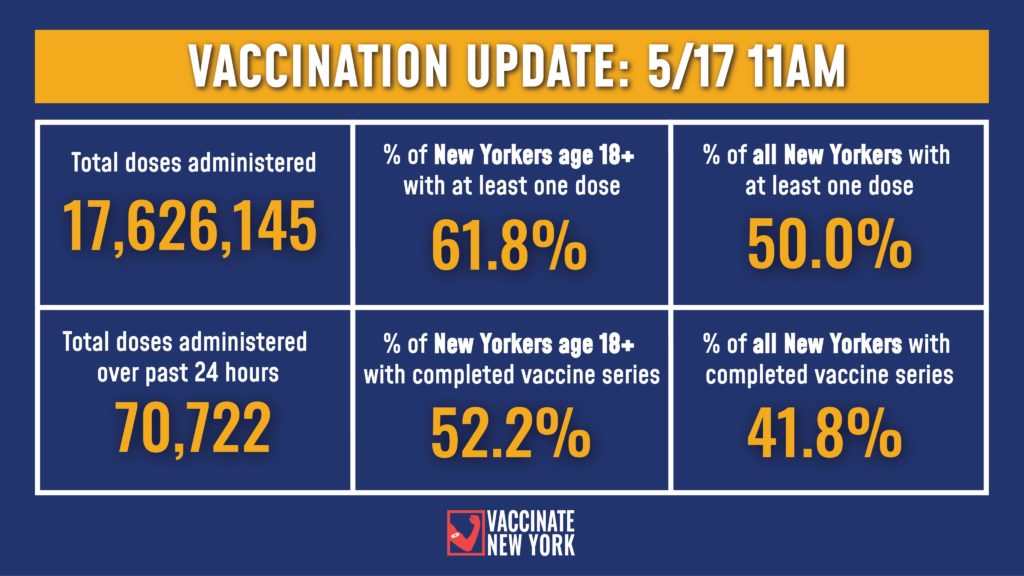

Vaccinated New Yorkers No Longer Have to Wear Masks

May 19, 2021Vaccinated New Yorkers are back, maskless, at 100% capacity. Governor Cuomo went live from Radio City Music hall for a press conference and Twitter announcement to outline the specifics.

“Effective this Wednesday, we’re going to adopt the CDC guidelines and regulations on masks and social distance,” Cuomo said. “If you are vaccinated, you are safe. No masks, no social distancing.”

Effective Wednesday, NYS will adopt the CDC's new mask & social distancing guidance for vaccinated people.

Unvaccinated people should continue to wear a mask.

Masks will still be required on public transit, in schools & some communal settings. Private venues may require masks.

— Andrew Cuomo (@NYGovCuomo) May 17, 2021

The new guidelines said you still need to wear a mask on public transportation, on the subways, buses, healthcare facilities, and schools, in nursing homes, homeless shelters, and correctional facilities. Private businesses will still be able to set their own restrictions like no mask, no entry.

“Individual private venues have the ability to add additional guidelines to the state and CDC,” Cuomo said. “For our part, we’re adopting the CDC and saying ‘lets open.'”

“Individual private venues have the ability to add additional guidelines to the state and CDC,” Cuomo said. “For our part, we’re adopting the CDC and saying ‘lets open.'”

Many chains, from Starbucks to CVS, are already welcoming the maskless vaccinated with open arms. The outdoor food and beverage curfew is gone, while the indoor will remain until May 31st.

“Over half the population is fully vaccinated now, but we have more work to do on vaccinations,” Cuomo said. “We have to get back to life, and living, and do it the way New Yorkers do it. We have to do it quickly and robustly.”

17.6 million doses of vaccine have been doled out to New Yorkers. 52.2% of the population over 18 are fully vaccinated, and 61.8% of the over 18 crowds have at least one shot in the arm. The average number of deaths a day from covid is below 20, dropping to just 11 on Monday. With numbers like that, anyone with a vaccine will be free from wearing a mask from now on. Social distancing, inside or outside, is ending. The 50% caps on dining, gyms, and other indoor activities, are also going away.

To prove vaccination at the door, the state created Excelsior Pass- a free mobile app that lets users connect their vaccine to a scannable QR code. Users have to first register their vaccine on the Excelsior website and can use the app to show negative PCR test results.

Broker Fair 2021 is BACK – December 6 in NYC

May 17, 2021 Broker Fair returns to New York City in person on December 6, 2021 at Convene at Brookfield Place!

Broker Fair returns to New York City in person on December 6, 2021 at Convene at Brookfield Place!

As previously announced, tickets that were purchased for Broker Fair 2020 have simply carried over to Broker Fair 2021. That means you might already be registered! You can confirm by emailing events@debanked.com.

Broker Fair is the largest annual conference for brokers in the commercial finance industry. Business loans, merchant cash advance, factoring, leasing, SBA, real estate, and more will be incorporated into the full-day lineup. Sponsorships are almost entirely sold out.

If you’ve been following along, New York City is already roaring back. Most capacity restrictions are scheduled to be lifted this week on May 19th.

We’ll see you there!

Ebay to Launch Sales-Based SMB Loans in UK

May 13, 2021 Ebay is launching a small business working capital product in the UK, offering sales-based loans to 300k SMBS through YouLend.

Ebay is launching a small business working capital product in the UK, offering sales-based loans to 300k SMBS through YouLend.

The product, called “Capital for eBay Business Sellers,” offers loans repaid through a percentage of daily sales and a lump sum. A year after eBay first ventured into offering merchant payments services, the firm is joining the likes of PayPal, Shopify, and Amazon by offering a business loan product. Loans will vary in size based on sales volumes, from £500 to £1 million, or about $640- $1.3M.

“Capital for eBay Business Sellers is intended to help plug this gap, giving small businesses quick access to a range of financing options,” Murray Lambell, GM of eBay UK, said. “With 300,000 UK small businesses trading on eBay, this proposition will help them reinvest, protect jobs, and succeed, even as the government’s support schemes dry up.”

The application process will take five to ten minutes, the firm attests, landing funds that same day.

“Our focus is on giving leading e-commerce platforms, tech companies, and payment service providers the ability to offer their customers rapid funding through our technology platform,” CCO of YouLend Jakob Pethick said. “We’re delighted to partner with eBay UK to support their business sellers thrive and grow.”

Hey Cool Cats and Kittens, Let’s Reform Banking

May 12, 2021 “Hey, all you cool cats and kittens in the banking industry, it’s Carole Baskin from Big Cat Rescue, you might remember from Tiger King i’m married to a former banker,” Carole Baskin, TV star of Tiger King, said. “Yeah, love that Howie Baskin. Anyway, I just wanted to tell you guys about a new report….”

“Hey, all you cool cats and kittens in the banking industry, it’s Carole Baskin from Big Cat Rescue, you might remember from Tiger King i’m married to a former banker,” Carole Baskin, TV star of Tiger King, said. “Yeah, love that Howie Baskin. Anyway, I just wanted to tell you guys about a new report….”

Baskin, known for her competing tiger tourism venture in Florida, and the myth that she had something to do with the disappearance of her late husband Don Lewis sometime in 1997, appeared in a Cameo video for banking-as-a-service company called 11:FS. It’s an advertisement for a special report available on their website.

11:FS offers a “financial service operating system,” information and reports, and digital services.

This week Baskin also launched a $CAT cryptocurrency to let users buy her t-shirts without the US dollar.