Archive for 2021

deBanked’s Most Watched Videos of 2021

December 20, 2021deBanked TV made a splash in 2021, generating more than 50,000 views. For the first time ever, we’ve ranked the most watched videos for the year.

1. Moving to Miami

deBanked kicked off a Miami tour in March 2021 that included an interview with Mayor Francis Suarez. The three-part series was the most watched on deBanked TV for all of 2021. (Vid 1 | Vid 2 | Vid 3)

2. One-on-Ones With Industry Professionals

Two in-person interviews streamed live from the deBanked TV studio were virtually neck and neck for 2nd place. Oz Konar of Business Lending Blueprint, who recently spoke at Broker Fair 2021, talked about working as a loan broker from home.

Meanwhile, Jennie Villano’s state of the industry was a more introspective look at doing business during the era of covid, useful marketing tips, and business development.

3. ROK

An inside look at ROK Financial, a Long Island-headquartered broker shop came in at a strong #3.

4. Terminology Lesson

What’s the difference between a lender and a funder? Numerous people have tuned in to find out.

5. Brokers, Brokers, Brokers

It’s tough to pinpoint a firm #5. Multiple videos achieved just about the same level of views. Our viewers love brokers.

Check out some of our top video categories:

deBanked’s Docuseries

MCA/Small Business Lending help

deBanked Event Footage

deBanked News

deBanked’s Top Five Stories of 2021

December 20, 2021 deBanked’s most read stories of 2021 were similar but different to those read in 2020. We broke them down into categories by popularity.

deBanked’s most read stories of 2021 were similar but different to those read in 2020. We broke them down into categories by popularity.

1. Scandal

A South Florida business apparently masquerading as a small business finance company, was by far and away the most read story of 2021. Authorities now believe that it was a $200M+ ponzi scheme with more than 5,500 investors. Unlike other alleged schemes that have rocked the finance world, thousands of people believe the allegations are not true and have rallied around the CEO.

2. Domain Life after Death

The Death of a Thousand Financial Companies, the leading story of deBanked’s March/April 2021 magazine issue, was the 2nd most popular across 2021. In it, deBanked went undercover to find out what happened to the domain names of financial companies that went out of business. The findings were terrifying. (See: Video discussion about the story)

3. Real Estate Investing

Think what you want about crypto as the future because when it came down to it, deBanked readers were vastly more interested in real estate investing. Why Funders Are Investing in Real Estate As Their Side Hustle of Choice was the 3rd most read story of 2021. “[Real estate is] just a way that people who have been successful and spin off a lot of cash for their businesses see as a safe way to diversify their income,” said a lawyer that was interviewed for the story.

4. Regulation

It was a close call between several stories pertaining to regulation. While interest in CFPB-related activity ranked high, so too did a court decision in Florida that ruled on the legality of merchant cash advances. The New York commercial financing disclosure law was also top of mind for many readers as was interest in proposed legislation in Maryland.

5. An Exit

The fall of LendUp, an online consumer lending company, was apparently of great interest in 2021. After some difficult encounters with regulators, the company ceased lending operations. “Although we are no longer lending, we also offer a series of free online education courses designed to boost your financial savvy fast,” the company’s website now says.

Velocity Group USA Names Keith Nason President, Launching KapSource in Q1 2022

December 16, 2021 Melville, NY – December 16th, 2021 – Velocity Group USA is pleased to announce Keith Nason as the newly appointed President. In conjunction with stepping into the role as President, Nason will continue to hold his position as Chief Operating Officer, building on business development strategies and appointing new members of Velocity Group’s executive team.

Melville, NY – December 16th, 2021 – Velocity Group USA is pleased to announce Keith Nason as the newly appointed President. In conjunction with stepping into the role as President, Nason will continue to hold his position as Chief Operating Officer, building on business development strategies and appointing new members of Velocity Group’s executive team.

“We have undergone many necessary changes over the past year, but the change we are most excited about is appointing Keith Nason as the President of Velocity Group. He has extensive industry experience, as well as the knowledge, innovation and vision to drive growth in 2022. I have no doubt these qualities will help set us apart from our competitors as we continue to expand our business,” said Lisa Gioia, Chief Executive Officer

Nason is an industry veteran with over eight years of experience within the Merchant Cash Advance market, specializing in both top and bottom-line growth, building infrastructure and security, data integrity, risk models, technology, and securing capital through multiple channels.

“Over the last 12 months, we’ve invested a tremendous amount of time, energy, and capital in our team, product, infrastructure and data security, as well as our process. Doing so has positioned us for significant growth in 2022 and beyond,” commented Nason.

He also credited his institutional investors as being a key to success by having faith in the long-term goals of the company, and confidence in the new team to prioritize long-term success over strictly short-term returns. Nason also stated, “It’s a true testament to the team that we were able to completely rebuild our business foundation while still funding over $100MM and producing record returns to our investors.”

With the revamp of the company infrastructure and data security, Velocity Group USA will be launching KapSource within the first quarter of 2022, a “business in a box” model that will allow other members of the industry to use its proprietary technology to increase conversions, alongside a marketplace in which brokers can fund their owns deals and create additional revenue streams through Velocity’s capital sources.

EIDL Applicants Still Waiting for Funds as Deadline Approaches

December 16, 2021 There is a major pileup of applicants waiting to hear back from the SBA regarding EIDL applications, according to Iron Capital Equities, a fintech firm who owns websites that help businesses through the EIDL application process. According to a press release by the company, many applicants who have not yet received funding seem to believe they’ve been ghosted by the SBA.

There is a major pileup of applicants waiting to hear back from the SBA regarding EIDL applications, according to Iron Capital Equities, a fintech firm who owns websites that help businesses through the EIDL application process. According to a press release by the company, many applicants who have not yet received funding seem to believe they’ve been ghosted by the SBA.

The EIDL deadline to file an application is December 31.

“90% (9 out of 10) of our 400 client applicants are still in limbo, with no update regarding the status of the funds,” states co-founder Matthew Elling. “The short-term economic outlook from small businesses is dim, so these funds are highly sought after.”

Elling insisted that he is in constant contact with his customers, and says his company is doing everything they can to service these clients who are playing the waiting game.

“Even though we are a financial technology company, we still ‘talk’ with our customers,” Elling continued. “We understand their struggles in a post COVID economic environment, we have provided them with advice on the SBA assistance like EIDL and the two PPP rounds for payroll and business expense assistance during and after the government-imposed lockdowns.”

EIDL loans were a beacon of hope for many businesses struggling to survive in the pandemic. This type of government funding isn’t a grant, and needs to be paid back by the merchant at a term of 30 years at 3.75% annual interest.

How a Former Banker is Servicing Clients that Turned Down Alternative Funding Offers

December 15, 2021 What do brokers do with the clients that don’t want to pay the costs of an alternative product, but are still too underqualified for traditional financing?

What do brokers do with the clients that don’t want to pay the costs of an alternative product, but are still too underqualified for traditional financing?

Juan Caban, CEO and Co-Founder of Financial Lynx, has leveraged his interpersonal relationships as a former banker with his passion for networking and his discovery of a niche type of client into a business that is now spread across 44 states. Lenders aren’t the only ones turning down deals, the applicants do too, he says.

Caban built a referral business by talking to people, being an active member of the industry, and taking advantage of pandemic-induced halts in business to research the best ways to serve a section of business owners that prior to Financial Lynx, were either using less attractive products or never taking on financing at all.

“I’m a big networker,” said Caban. “I always go out, I meet a lot of people, I always get referrals from a lot of different areas.” He spoke about how as a decade-long banker with major banks, he knew right off the bat in his career that traditional financing was excluding financially-sound merchants who weren’t meeting overzealous bank qualifications.

“I would meet people who want to do business with me and I would present it to my bank, but it was always a challenge,” Caban said. “You want to help out a client, but you’re limited to the credit appetite of the bank that you are working for. After getting frustrated and declining a lot of clients, I wanted to seek out how I can help these clients out.”

After leaving the traditional finance world in 2019, Caban began work at an alternative lender, where the doors to a variety of new options opened up for him.

Caban still felt limited in his abilities to get deals done because of the confines funders mandate through their qualifications, and left to start his own company within seven months. After seeing a market in financing for merchants who fall between the high risk and traditional financing qualification threshold, he began talking to people across the financial community about what products exist for these types of clients.

“I used my banker network, I probably know about 200 bankers here in New York, and I started asking them, ‘hey, do you have a program in your bank that can help this type of client?’” Seeing that merchants with good credit and no desire to pay a 40% cost of capital were being pushed aside throughout the industry, Caban decided to pursue a business out of servicing this type of merchant.

“What I found was that there are some banks out there that as long as [the merchant] has a 700 FICO score, has been in business at least two years, and are considered to be in a preferred industry, some banks are willing to lend in some cases 20% of annual sales, up to $250,000, with just an application and one year of tax returns.”

The lending services being provided through Financial Lynx based on these qualifications are bank lines of credit that revolve and renew annually.

Caban described the qualifications for this type of financing as a look into the business owner themselves, and not as much into the business. “[These banks] focus on you as an individual and if you have personal credit.”

The concept took off.

“I started working exclusively with one MCA broker shop, they were calling hundreds of businesses a day,” said Caban. “They were trying to sell [merchants] cash advances obviously because it is a very lucrative commission business, but anything that was non-cash advance, or didn’t fit the cash advance space, or merchants who wouldn’t accept the expensive cash advances, they would refer that client to me.”

The twist is that the banks don’t pay him a commission so he has to charge a fee to the merchant once the financing is completed.

“At the end of the day I feel good because I am providing the client with something that they couldn’t find on their own,” Caban said. “So I am helping the client, and almost 100% of my clients are satisfied with what they have, because they’re getting cheap financing, 5% instead of 30% money, so even with my 10% consulting fee to connect the client, it’s still 50% cheaper than what they would’ve gotten in any type of cash advance.”

The biggest hesitancy Caban sees from alternative finance companies in terms of working with his niche product and client is the patience required in dealing with bigger banks. “Everything is quick in MCA, [brokers] get approved today, get funded today, and get paid tomorrow. I say look, I can provide the client what you’re looking for, but it is a three week process.”

“The ones that say, ‘hey we want to do what’s best for the client,’ they buy into it, they send us referrals on a constant basis,” Caban continued. “The ones that say ‘it’s taking too long, they’re not into it’ and I tell them ‘you’re going to lose that client eventually.’ As opposed to losing them, make some money out of it before you leave them.”

Trying to convince the legitimacy of his product seems to be part of the daily ritual for Caban. “Having a bank line of credit is considered a unicorn in the industry. Everyone says that they have it, but it’s not really a line of credit. We’re actually providing true lines of credit. It’s truly a revolving line of credit.”

“It’s always a thing where it’s like, are you for real?”

MCA-Centric Fintech Looks to Continue Expanding into US Market

December 14, 2021

“I had an ISO once ask me if our software was for real. He was like, ‘Can it really do all that?’”

SysArc, an Indian fintech company that has branched into the US market via Texas, attended Broker Fair last week in order to pitch their product to the industry’s head honchos. The company offers software specifically catered to each component of the MCA process. With software program names like FUNDperfect and ISOperfect, deBanked was all ears.

“FUNDperfect, is a highly configurable solution with an exceptional capacity to adapt and is function-based on diverse organizational needs,” said Pria Chandrakumar, Vice President of Customer Engagement at SysArc, and winner of 2021 Fintech Woman of the Year in India. “We have a merchant portal where merchants can submit an application online, upload documents and even authorize bank verification so bank statements can be automatically pulled.”

When asked about the company’s thought process on creating an MCA-focused software, it appears as if SysArc came upon a niche after casting a net into the greater finance world. “[We’ve] always had a strong presence in the US servicing banks, credit unions, FHLBs, and MCAs,” said Chandrakumar. “We are experts in lending and cater to all forms of lending right from real estate, mortgages, personal loans, [and] small business loans.“

The biggest difficulty it seems for fintechs across the space, including SysArc, is trying to explain how tech can be useful to an industry that has been dominated by sales tactics and practices that go back generations. Chandrakumar spoke on some of reasons that make brokers and funders who operate in old-school sales mentalities hesitant to adopt fintech.

“Common misconceptions [among MCA] are affordability, complexity of software, loss of commission and mostly ignorance of what technology is capable of,” said Chandrakumar. “Brokers and funders must understand that the fintech industry has come a long way and has solved most of their operational problems.”

“The software also plays a huge role in reducing the risk since first level scoring and underwriting is done by the system, avoiding any human errors,” Chandrakumar continued.

FUNDperfect seems to be flexible in nature, so much so that it is broken down into smaller modules if needed, allowing ISOs and funders to pick the modules they need.

“ISOs can get just the brokering piece of the software called ISOperfect,” said Chandrakumar. “This takes the application through the point of selecting an offer and passing it on to the funder.”

After talking about plans of further expansion into the American market, Chandrakumar reiterated SysArc’s value in their gameplan of how to sell it here in the states. “We will use technology to make MCA financing quicker, while at the same time reducing the risks associated with funding by sharing data on merchant, ISO, and funder performances; so companies can make informed business decisions.”

NFT Owner’s Typo Costs $297K

December 13, 2021It seems the only thing blockchain technology can’t promise is a solution to human error.

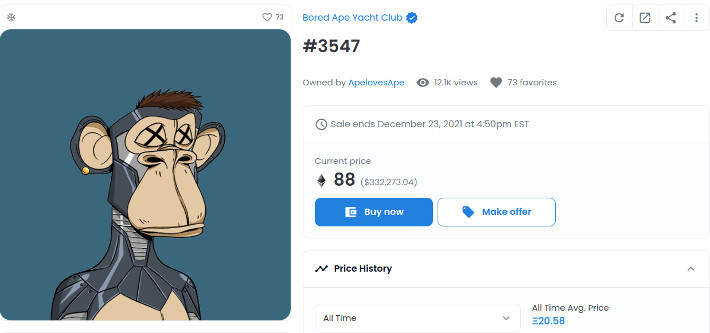

The owner of an NFT Bored Ape Yacht Club #3547 got their decimals mixed up on Saturday when they sold the token for 0.75 eth, or 1% of its market value, by mistake. In an attempt to sell the token for 75 eth, or $300,000, the NFT was sold in error to an automated buyer in a call option-like purchase for $3,066, according to CNET.

After the purchase, the buyer dumped ten times the amount paid for the NFT into gas fees to process the transaction instantaneously, a move that prevented any chance of the error being remedied.

“How’d it happen? A lapse of concentration I guess,” the seller of Bored Ape #3547 told CNET. “I list a lot of items every day and just wasn’t paying attention properly. I instantly saw the error as my finger clicked the mouse but a bot sent a transaction with over 8 eth [$34,000] of gas fees so it was instantly sniped before I could click cancel, and just like that, $250k was gone.”

Members of the NFT legal community spoke to deBanked about how this type of stuff is all too common and unfortunate, but just comes with the territory of an unregulated financial space.

“It’s a pretty typical problem here in the Wild West,” said Jacob Martin, an attorney specializing in NFTs and author of the NFT Tax Guide. “It’s user error, not platform error. It sucks, but it is what it is.”

The Bored Ape NFT collection is one of the most sought after collections on the blockchain, with entry level tokens being worth about $200,000. While this error may have been able to be fixed in the world of traditional finance, the unforgiving nature of the blockchain world allows errors like this to be cashed in on by opportunistic purchasers.

Back in August, another Bored Ape was accidentally sold for $26,000. When the seller offered the purchaser almost double that to return the NFT, the new purchaser flipped the token to another user for $150,000.

In November, Cryptopunk #7557 which at the time was worth $19 million, was accidentally listed for $19,000. It immediately sold without remedy for the error.

When asked if regulation would help remedy errors like this in the future, some NFT legal gurus were weary about turning to government for solutions to user-committed blockchain errors.

“I don’t think it’s about regulation, it’s about education,” Shekinah Apedo, an attorney who serves as a Compliance SARs Analyst for Bittrex and NFT legal consultant to numerous companies, told deBanked. “The point of decentralization is that there’s no middleman or institution to run to when an error occurs, like one may do with a typo during a bank transaction. Education is necessary and warnings involving risk should be made known.”

“Cigarettes are legal but they are required to have warning labels,” Apedo continued. “Perhaps, regulation involving warning labels or advertising the risks of being your own bank as an NFT and crypto trader or investor would be good for the mainstream public.”

QuickBooks Capital’s Small Business Lending Originations Surge

December 13, 2021 QuickBooks Capital, part of Intuit, originated $125M worth of small business loans in the fiscal quarter ending October 31, 2021.

QuickBooks Capital, part of Intuit, originated $125M worth of small business loans in the fiscal quarter ending October 31, 2021.

For context, the company originated $232M across the entire fiscal year of 2021 ending on July 31st and $243M for the entire fiscal year of 2020. The company’s best fiscal year so far was 2019 when it originated $316M.

The company is now on track to surpass all previous years.

During the earnings call, CEO Sasan Goodarzi said that one of the company’s big bets is “to become the center of small business growth by helping our customers get customers, get paid fast, manage capital, pay employees with confidence and grow in an omnichannel world.”

“60% of small businesses struggle with cash flow and we are continuing to innovate to create solutions for customers to overcome this challenge,” Goodarzi said.

Intuit recently acquired Mailchimp and acquired Credit Karma last year.