Archive for 2020

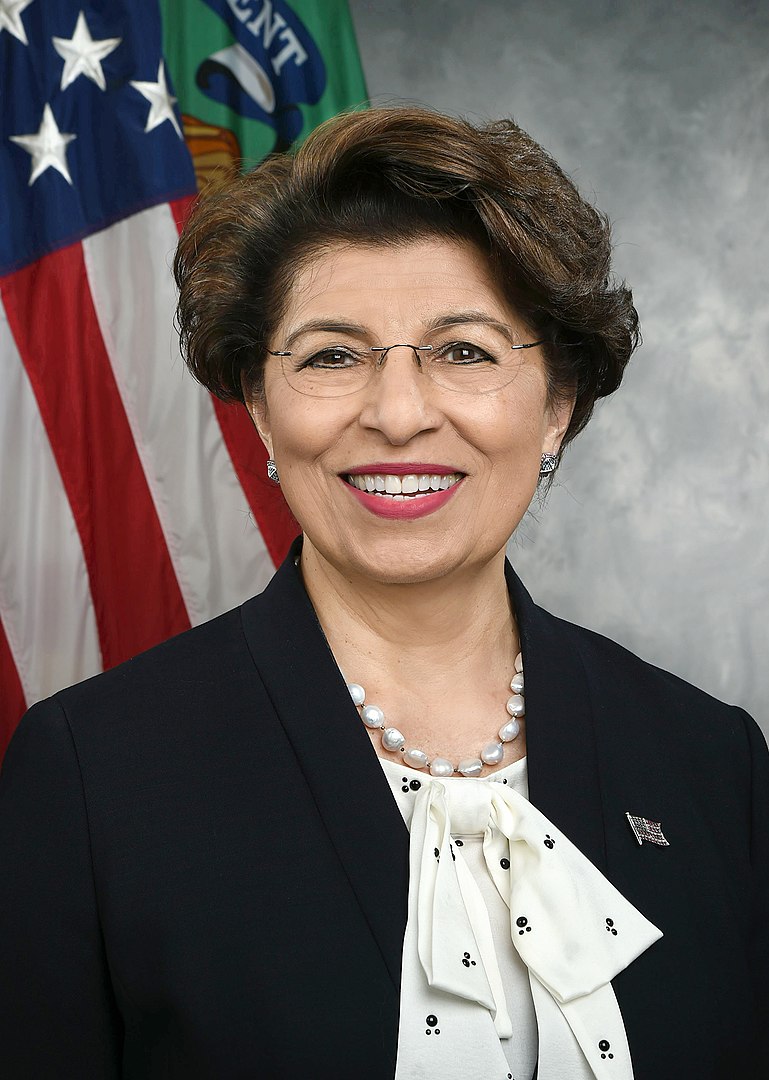

New Small Business Administration Chief Confirmed

January 9, 2020The newest Administrator of the SBA was announced on Tuesday. Jovita Carranza was appointed after President Trump had tweeted the previous Thursday about her nomination.

I am pleased to announce that Jovita Carranza will be nominated as the new @SBAgov Administrator. She will be replacing Linda McMahon, who has done an outstanding job. Jovita was a great Treasurer of the United States – and I look forward to her joining my Cabinet!

— Donald J. Trump (@realDonaldTrump) April 5, 2019

Replacing Linda McMahon, of WWE corporate fame who left the position in early 2019 to work at pro-Trump super PAC America First Action, Carranza will be the SBA’s first permanent leader in just under a year. The Administration had been led by Chris Pilkerton as the Acting Administrator in the interim.

Nominated by bipartisan vote of 88-5 in the Senate, Carranza appears to draw support from both sides of the political spectrum. Among those who voted against Carranza were former Democratic presidential nominee hopefuls Kamala Harris and Kirsten Gillibrand. Speaking on the appointment, Democrat and Ranking Member of the Senate Committee on Small Business and Entrepreneurship Ben Cardin said that he was “optimistic that Treasurer Carranza can be the leader and advocate that the Small Business Administration and American small businesses need right now.”

Nominated by bipartisan vote of 88-5 in the Senate, Carranza appears to draw support from both sides of the political spectrum. Among those who voted against Carranza were former Democratic presidential nominee hopefuls Kamala Harris and Kirsten Gillibrand. Speaking on the appointment, Democrat and Ranking Member of the Senate Committee on Small Business and Entrepreneurship Ben Cardin said that he was “optimistic that Treasurer Carranza can be the leader and advocate that the Small Business Administration and American small businesses need right now.”

Discussing her confirmation, a moment of political unity in an increasingly divided period for Washington, Heidi Chung of Yahoo! Finance noted the duality that Carranza brings to the office: “Long been known as someone for the people, she want to definitely help women as well as people of color, so I think, broadly speaking, even though she is a Trump favorite, I think a lot of people are looking forward to what she’s going to bring to the table when she really takes this job on.”

Having served as United States Treasurer from 2017 to 2019, Carranza was responsible for the operations of the US Mint, had dealings with the Federal Reserve, acted as an advisor to Secretary of the Treasury Stephen Mnuchin, and is likely to appear inside your wallet as a signature on dollar bills. Carranza also served as Deputy Administrator in the SBA during George W. Bush’s presidency.

Prior to her time in Washington however, Carranza worked at UPS for over twenty years. Starting off as a part-time truck loader, Carranza worked her way up through the package delivery service to become President of the company’s Latin American and Caribbean operations and subsequently Vice President of Air Operations from their Louisville, Kentucky facility.

Having worked at UPS while being a young mother and attending college, Carranza said on those years that “I thought if I could make it out of this situation – having an opportunity to acquire leadership and managerial skills; receiving on-the-job training – I would be able to finance higher education for myself; secure better caretakers and schools for my daughter – this is the American dream – what I strived to achieve not looking back!”

Carranza was born in Chicago to Mexican immigrant parents. Her father working as a factory foreman and her mother as a housewife. According to Carranza, her mother read a newspaper every day in order to teach herself English.

Seen as a long-time ally to Mnuchin, Carranza is credited by the Secretary as being instrumental in Republicans’ 2017 tax bill, and has said in a statement that she will “continue to promote pro-growth economic policies, eliminate job-killing regulations, and fight for the small businesses that are the lifeblood of the American economy.”

When asked at her Senate confirmation hearing in December what she would do in office, Carranza said that she would “put particular emphasis on opening more doors for women and for entrepreneurs in underserved communities, including military families and veterans,” and that she “will be a tireless advocate in the Cabinet for small businesses.”

Created in 1953, Carranza will be the SBA’s 44th Administrator, working with a budget of $820 million for 2020.

For ISOs Only — How To Develop Your Factoring Brokerage Business (Part 3)

January 9, 2020 CONGRATULATIONS!!! You have finally made the decision to quit “stepping over” those hundred-dollar bills and establish a factoring brokerage business!

CONGRATULATIONS!!! You have finally made the decision to quit “stepping over” those hundred-dollar bills and establish a factoring brokerage business!

But here’s the problem. With literally THOUSANDS of hundred-dollar bills spread all over, WHERE and HOW do you start picking them up?

To be sure, you need a GAME PLAN for doing so, right? Well, today’s your lucky day because that’s exactly what Part 3 of our series is about; “HOW TO establish a GAME PLAN for establishing your factoring brokerage business”.

But first, a couple things to keep in mind. The first is that the closing and funding cycle for factoring is much longer than an MCA, and typically takes from a few days to a couple weeks. However, once your merchant is set up, they will typically fund invoices EVERY MONTH.

What that means to YOU it’s like getting an automatic renewal every month, because you’re GETTING PAID for the life of the factoring relationship. And that automatic monthly paycheck will keep getting bigger and bigger with every new factoring merchant! True “residual income”.

The second thing to consider is that you will need to identify the “mix” of factoring funders to do business with and get set up with as a broker.

While we touched on the topic of finding factoring funders in Part 2, we could actually do a series on this subject alone. Keep in mind that funders specialize by industry, i.e. construction, medical, trucking, etc., while others are generalists, and fund a broad range of industries both domestically and internationally.

OK. So, let’s get started. It’s basically a 2 step process. (Don’t worry. We’ll teach you how to dance.)

STEP 1: Take A Look in The Mirror

3 things you want to look at:

- The first is the size and structure of your existing ISO organization. What size is it? Are you a one-man shop? How many ISOs do you have in-house? How many in the field? Do ISOs in the field work under your umbrella or do they work under their own? Who makes the decision on which MCA funder to use?

This is important because the size and structure of your ISO organization will help you in determining which GAME PLAN OPTION is the BEST FIT. More on that later…

- The second thing you want to look at is how your existing merchant database is organized. This could range from a box of index cards to a computerized database where you can pull up contact info for every prospect, merchants funded, funding date, funded amount, commission, renewal date, and maybe even blood type. (Don’t laugh. Some guys are anal like that).

This is important because, regardless of how or where you keep this info, your existing files are where you’re going to find “low hanging fruit”.

More specifically, these are YOUR merchants who sell B2B with receivables RIGHT NOW! Plus, most are generating new invoices every month, and are PERPETUALLY WAITING to get paid. But let’s face it, you can’t sell the guy a new position every month (even though you might like to) because they obviously can’t sustain it. But now you have a solution that will.

- The last thing you want to look at is how you do your marketing; i.e., telemarketing, lead purchase, direct mail, email marketing, door to door, media advertising, etc. This is important because to be successful with integrating factoring into your existing business, you will need to integrate it into your existing marketing medium and message as well.

There are several ways to do this, but it essentially boils down to 3 simple questions:

- Do you sell B2B? Even restaurants who offer commercial catering could do more business if they didn’t have to wait 30 days or more to get paid.

- Roughly how much do you have outstanding in receivables?

- Would you be interested in looking at how to convert your invoices into cash with no payments?

Why Do We Need to Look in The Mirror?

REGARDLESS of how you operate your business, the purpose of this exercise is NOT for you to be judgmental (it is what it is), but simply to help you determine which GAME PLAN OPTION you feel is the BEST FIT for you. But to do so you have to be honest with what you see. That’s what “LOOKING IN THE MIRROR” is all about.

In starting a new year, we ALL would like to do better. And as much as we might consider making radical changes to our business model and even our personal lives, (i.e. losing 200 lbs. in 3 weeks), the changes that have a better chance of sticking are those we gradually integrate into our lives and business over time.

In other words, establish realistic goals for your new factoring brokerage business, establish a GAME PLAN for doing so, and over time you will gradually, and consistently generate positive results. Now, where’s that pie?

2. Select Your GAME PLAN Option

Once you’ve taken stock of where you are, the next step is to look at options for integrating factoring into your day-to-day operations.

Below are 3 GAME PLAN OPTIONS to consider;

OPTION 1: “Limited Service” Broker/Referral Agent

This option which might appeal to small ISO organizations or one-man shops. Once you have identified a factoring prospect and they have expressed interest in moving forward, make the introduction to your selected factoring funder, and for the most part, step back from the process.

HOW you do the introduction is totally up to you and can range from a three-way call, email, or even text in some cases. Regardless of how you do it, you want to make sure your Factoring Funder knows the referral came from you in order to get paid.

The funder will typically keep you posted as your merchant moves through the process. However, don’t forget. It’s YOUR merchant and YOUR money. So, don’t hesitate to follow-up with both.

This is essentially what I refer to as a “low touch” approach, designed for ISOs who want to start picking up one hundred-dollar bills, but have limited time or resources for doing so. At a minimum, it gets them in the game and launches a “new profit center”.

OPTION 2: “Full Service” Broker/Referral Agent

The full-service referral broker operates much like a traditional ISO does for MCAs. You work with the merchant to compile their factoring app package and submit it to the funder. In addition, as questions arise during underwriting, the funder may reach out and in some instances seek your help in addressing them.

Depending on the size and structure of your ISO organization, you might want to consider establishing an in-house Factoring Desk. This would be an individual designated as the point of contact between the referring ISO, the merchant, and the factoring funder.

There are multiple benefits for taking this approach. For one, you centralize the decision-making on the factoring funder best suited for the merchant. In so doing, your Factoring Desk should be familiar with each funder, their doc requirements, approval criteria, rates, terms, timing, etc.

Second, establishing an in-house Factoring Desk will limit the number of ISOs reaching out directly to your factoring funder. This is important because you don’t want an ISO to suggest, demand, or work outside the scope of your broker relationship and agreement with the funder.

Finally, establishing a Factoring Desk will facilitate a rapid response to getting your factoring deals done. The last thing you need is for a deal to be “stuck on someone’s desk,” simply because they shifted attention to work on something else.

OPTION 3: Broker/ Referral Partner Relationship

This option involves establishing a broker/referral relationship with an established entity which specializes in factoring and other forms of asset-based lending. This relationship can also be blended with Option 1 or 2.

For this arrangement to make sense, the broker/ referral partner should be well established and bring several things to the table including;

- Extensive and detail knowledge of the underwriting, due diligence, documentation, closing and funding process.

- Established relationships and history with a diverse mix of funders.

- Experience in addressing one of the fastest growing issues factoring funders are facing, which is resolving UCC filing issues, particularly within the MCA industry.

- Relationships with factoring funders who fund in “second position” behind other secured parties, including traditional bank financing.

- Knowledge and experience of other forms of financing including purchase order financing, material supply financing, etc.

To be sure, the right relationship will enable you to accelerate the funding process for your merchants while learning from their experience as well.

By the way, in Part 2 of the series, I mentioned a client who needed funding for 63 purchase orders to 63 different locations, of which half were expired. Well, I am pleased to announce they were funded!

Report Finds Canadian Alternative Lending Market Making Gains

January 8, 2020 A study released by Smarter Loans this week indicates that the Canadian alternative finance industry has grown since last year’s iteration of the report. Titled ‘The State of Alternative Lending in Canada 2019,’ the report highlights how the market has developed in regard to the age and gender of its customers, the level of trust in online lenders compared to financial institutions, as well as the levels of satisfaction felt by Canadians dealing with alternative funders.

A study released by Smarter Loans this week indicates that the Canadian alternative finance industry has grown since last year’s iteration of the report. Titled ‘The State of Alternative Lending in Canada 2019,’ the report highlights how the market has developed in regard to the age and gender of its customers, the level of trust in online lenders compared to financial institutions, as well as the levels of satisfaction felt by Canadians dealing with alternative funders.

The first of these, regarding aspects of the customers’ identities, demonstrates that generational gaps are as wide as they’ve ever been amongst customers. Each age bracket questioned by the study showed differing priorities when seeking a loan. Generation Z, fitting in between those aged 18-24, paid attention to funders’ track records and reputation when looking for funding; whereas millennials (25-34) sought speedier applications and approvals. Generation X (45-54) however appeared more money-minded, with the priority being placed on terms and interest rates; and Baby Boomers (55-64) demonstrated a desire for having someone to talk to, putting customer service at the top of their list.

Vlad Sherbatov, Smarter Loans’ President and Co-founder, told deBanked that these differences can be summed up as the values each generation has developed through experience. Explaining that Gen Z is “all about the personal brand,” Sherbatov said, “People that are younger now really associate with the company they work for, they ask, ‘Am I aligned with or would I be embarrassed supporting this brand?’” While the Millennials’ response indicates a greater desire for results, “as the age progress the intent increases.” Gen X is “more educated and experienced people,” who appear to place the greatest importance on money; and Baby Boomers, the least digitally fluent group, just want the online applications to go smoothly and to have ready access to assistance.

As well as age, gender appeared to divide customers, with women more likely to spend more time researching loan providers than men; and more men saying that they were interested in approaching a traditional financial institution for a loan in the future, with half of them being of this opinion compared to just 39% of women. As well as this, it was found that women are more likely to find the application easier, but are less likely to be approved than men.

Regarding trust and transparency, roughly 70% of Canadians believe alternative finance to be a safe way of getting a loan. With 80% of customers feeling that they are informed enough of the industry’s practices and 69% saying that they believe online loan providers are transparent about their fees, interest rates, terms, and conditions.

According to Sherbatov, “this is a trend that’s been moving in a positive direction” over the years. With the 2018 version of this study emphasizing the need to build trust with Canadians to reduce that 30% which is holding out on, Sherbatov maintains the need to do more. “The more transparency from lenders, the more trustworthy it’ll be, the further the industry will advance.”

Customers appear to be mostly satisfied with the service they received from alternative lenders in 2019, with the average rating taken from the 2,415 respondents being 3.4 out of 5. This being a 0.2 bump up from last year’s score. Interestingly, one of the sectors reporting the highest levels of satisfaction were those customers who received payday loans, noting that they appreciated the speed with which they were approved.

Altogether, the report paints a picture of the Canadian scene as a market still in flux, where growth is happening, albeit slight, and both the customers and the lenders still have much to learn from each other.

SEC, US Attorney Charge Steven A. Schwartz in 1 Global Capital Case

January 6, 2020 New criminal and civil charges have been filed against an individual in the 1 Global Capital case. This time it’s Steven A. Schwartz, who served as 1 Global’s Director and Chief Operating Officer.

New criminal and civil charges have been filed against an individual in the 1 Global Capital case. This time it’s Steven A. Schwartz, who served as 1 Global’s Director and Chief Operating Officer.

The SEC alleges that Schwartz aided and abetted former CEO Carl Ruderman in carrying out a securities fraud.

The US Attorney for the Southern District of Florida separately alleged that Schwartz engaged in a conspiracy to commit wire fraud and securities fraud.

Schwartz is the third person to be charged criminally in connection with 1 Global Capital’s scheme. Alan Heide and Jan Atlas already pled guilty to their roles in the fraud.

The SEC said of its case against Schwartz:

The complaint further alleges that Schwartz became trustee of a Ruderman family trust in June 2014, and that shortly afterwards, Ruderman had Schwartz execute an agreement conveying ownership of 1 Global to the trust. As alleged, until 1 Global declared bankruptcy in July 2018, Schwartz allowed Ruderman to use the trust to misappropriate several million dollars in investor funds to pay for Ruderman’s luxury lifestyle.

The Scoop Behind The Primary Capital / Infinity Capital Funding Acquisition

January 6, 2020 This morning, Primary Capital announced that it had acquired the merchant cash advance division of Infinity Capital Funding. Infinity, which has been operating from California since 2006, began as an MCA company before expanding to offer small business loans as well. The acquisition will see Infinity’s thirteen years of data, technology, and merchant portfolios pass onto Primary.

This morning, Primary Capital announced that it had acquired the merchant cash advance division of Infinity Capital Funding. Infinity, which has been operating from California since 2006, began as an MCA company before expanding to offer small business loans as well. The acquisition will see Infinity’s thirteen years of data, technology, and merchant portfolios pass onto Primary.

Speaking on the acquisition, Primary Capital Managing Member David Korchak said that “anything that you can acquire with that much time behind it and that much experience behind it is excellent, and for us with what we’re trying to do it’s tremendous. It’s a big, massive help for us.”

As well as the intangible assets that will be conferred to Primary, Isaiah Kenigsberg will be joining their team. Having served as Infinity’s Financial Controller, Kenigsberg is now CFO at Primary.

The decision to acquire Infinity’s book came after Primary noticed that it was winding down its MCA operations, Korchak told deBanked. Seeing the value in obtaining such a trove of data proved too enticing to pass the Managing Member said, and Primary has been digging into the information obtained for the last three months.

For Korchak, something that has stood out from this analysis is the patterns that have emerged in the portfolio. “The thing that’s remarkable for these companies that have been around as long as them, is everyone seems to have clients that have taken 30 advances from them. They have clients that started back in ’07, ’08, that are still active merchants which is remarkable.

“The only difficulty is trying to analyze and say, ‘Why is this merchant after 30 different cash advances over a 12-year period still taking cash?’ And that’s really our model. And our goal for this year is to try and help subprime borrowers get out from having to take toxic debt like cash advances for their business. Ultimately, the data that we’re acquiring from ICF and this acquisition is going to help us study a lot of the transitions that MCA merchants have made since the beginning and see which ones have actually been able to get out of it.”

Asked whether there are any more acquisitions in the pipeline, Korchak responded, “Absolutely, we’re heavily data and service-driven for this year specifically, and we have a lot more to come.”

United Capital Source Placed $199M In Deals In 2019

January 5, 2020 United Capital Source, a commercial finance brokerage based in New York, placed 3,883 deals in 2019 for a grand funding total of $199.3 million. Company CEO Jared Weitz said on LinkedIn of the milestone, “Our employees all saw growth (again) this year both professionally and personally. As we come into 2020 we are going into our 10th year of business!!!!! I cannot wait to see what these next year(s) hold for us. I’m so thankful for our Funding Partners and most of all our wonderful staff.”

United Capital Source, a commercial finance brokerage based in New York, placed 3,883 deals in 2019 for a grand funding total of $199.3 million. Company CEO Jared Weitz said on LinkedIn of the milestone, “Our employees all saw growth (again) this year both professionally and personally. As we come into 2020 we are going into our 10th year of business!!!!! I cannot wait to see what these next year(s) hold for us. I’m so thankful for our Funding Partners and most of all our wonderful staff.”

Weitz is scheduled to speak at deBanked CONNECT MIAMI on January 16th at the Loews Hotel on a panel discussion about how to make money in 2020.

Jonathan Braun Has Checked In To Prison

January 2, 2020 Jon Braun, who Bloomberg Businessweek profiled in a 2018 story series, checked into FCI Otisville on Thursday. He was sentenced to 10 years in prison on May 28th for drug related offenses he committed a decade ago. He was originally scheduled to surrender on August 25th but he successfully delayed the date until today, January 2nd.

Jon Braun, who Bloomberg Businessweek profiled in a 2018 story series, checked into FCI Otisville on Thursday. He was sentenced to 10 years in prison on May 28th for drug related offenses he committed a decade ago. He was originally scheduled to surrender on August 25th but he successfully delayed the date until today, January 2nd.

I have not attempted to contact Mr. Braun since the day of his sentencing. But purely by chance I shared an elevator with him in the Brooklyn Federal Courthouse on May 28th just mere minutes after he had been handed ten years. Given the opportunity, I asked him how he felt about what just happened.

“I hope it goes by quick,” he replied stoically.

Robocalls Targeted by Trump, Cuomo, Michigan Attorney General

January 2, 2020 In what turned out to be a tough week for illegal robocalls, both the President and New York’s Governor have been behind bills set to combat the invasive form of marketing.

In what turned out to be a tough week for illegal robocalls, both the President and New York’s Governor have been behind bills set to combat the invasive form of marketing.

On Tuesday, President Trump signed the TRACED (Telephone Robocall Abuse Criminal Enforcement & Deterrence) Act, bringing into effect legislation first introduced to in November 2018. Aiming to crack down on the number of robocalls received by Americans, TRACED increases the fine faced by robocallers, setting it now in the range of $1,500 to $10,000 if caught. As well as this, the bill pushes for the rollout of call-authentication technology by telecommunication companies to identify ‘spoofed’ numbers and block them accordingly.

Such technology was authorized for use by an FCC vote last June. However while it has since been employed by the likes of T-Mobile and AT&T, the authorization did not guarantee all Americans access to the service, as in some cases it has been offered as a premium feature of more expensive phone plans.

Another detail of TRACED is that it extends the FCC’s period of time to collect fines from illegal robocallers from one year to four, a development that is seen optimistically as a path to increasing the number of charges made. According to the FCC, between 2015 and March of 2018, $208.4 million in fines was collected from illegal robocallers.

Historically, the onus has been on the individual to shield themselves from robocalls, with companies such as Hiya and YouMail offering apps to block them. But with this legislation, moves are being made to compel service providers to better protect their customers, and Governor Cuomo’s bill seeks to take this one step further.

Announced on January 1st, one day after Trump’s signing, Cuomo’s robocall bill is part of his 2020 agenda, titled State of the State. Sharing similarities with TRACED, one of the primary differences between the two bills is that Cuomo’s would require telecommunications companies to block robocalls, pinning them with a fine upon failing to do this.

And making it a hat-trick for anti-robocall legal action this week is Michigan’s Attorney General, Dana Nessel, who set up a Robocall Crackdown Team dedicated to charging those partaking in the criminal activity. “The message we want to send loud and clear is if you are engaged in this kind of illegal activity, we are going to come after you,” said Nessel at a press conference. “And we are going to prosecute you to the fullest extent of the law.”