Archive for 2020

Impact Of COVID-19 on The Merchant Cash Advance Market

June 8, 2020deBanked recently caught up with Gunes Kulaligil, author of Merchant Cash Advance Valuation Dynamics.

Gunes Kulaligil (gkulaligil@methodicalmgmt.com) is a co-founder of Methodical Management, a New York based firm providing valuations, transaction advisory and due diligence services to lenders and investors active in the specialty finance sector. www.methodicalmgmt.com

Gunes Kulaligil (gkulaligil@methodicalmgmt.com) is a co-founder of Methodical Management, a New York based firm providing valuations, transaction advisory and due diligence services to lenders and investors active in the specialty finance sector. www.methodicalmgmt.com

deBanked: The economic effects of the coronavirus are myriad and widespread. What are some of the specific challenges that the merchant cash advance market is currently experiencing? And what new obstacles can the industry expect further down the line as a result of the pandemic?

Gunes Kulaligil: The pandemic has redefined what “off the charts” means for unemployment claims and other leading economic indicators, but the full impact of job losses and halted economic activity has yet to be observed in the credit performance of many specialty finance assets. MCAs are unique in the sense that payments are daily or weekly and tied directly to revenues. As such, we were able to observe the preliminary impact of the lockdown on MCA cashflows earlier than for most other types of non-bank specialty finance loans.

When incomes and revenues are disrupted, consumers and businesses alike will often prioritize which debt to service first. They may be unwilling to pay certain accounts, even if able to do so, in order to preserve cash for prolonged uncertainty. However, this is not the case for MCAs as payments are remitted automatically; therefore, the cashflows are aligned with and reflect true business performance free of the impact of payment prioritization. As early as the second half of March, we observed payments from merchants drop approximately 20% to 30% depending on the type of industry. In addition, payment pace continued to decline into April and May, albeit at a slower pace, as modifications and servicing efforts picked up. Funders have a vested interest in merchants being able to stay in business and to build their revenues back up. Thus, any modification effort — whether that is a deferral, reduced percentage of sales remitted, or lower payback amounts — that incentivizes the merchant and provides some flexibility goes a long way.

At the same time, funders’ portfolios look worse as performing MCAs pay down and a lack of new origination results mechanically in the remainder of their portfolios having more tail risk – a lack of new origination would be a drag on performance even without the pandemic. For these portfolios, it is crucial to monitor portfolio performance at a granular level to identify businesses that will successfully navigate reopening and increase their revenues; so that servicing resources can be directed where they are most needed and will be most effective. Funders that have invested in technology and maintain connectivity with merchants via CRM tools and with established servicing / resolution teams and processes will have a competitive edge in doing so.

Poor performance caused by the pandemic has also led warehouse facilities to breach covenants or take-out partners to pause purchases unless platforms pledge additional skin in the game or pay higher interest rates to go forward with covenant modifications or resume purchases. They may also increase monitoring requirements and the level of oversight they apply.

deBanked: Conversely, is the pandemic creating any opportunities for funders and brokers as the situation develops?

Gunes Kulaligil: Indeed. While the near-term outlook is grim, a lot of relief and stimulus is working its way through the economy. The U.S. Government is intent on providing support as states are starting to re-open as quickly and as safely as possible. In retrospect, nobody had a pandemic playbook and programs like PPP were designed, deployed and funded on the fly with collaboration from both banks and non-bank lenders during volatile markets.

Non-bank lenders’ success in being able to reach truly small businesses, as well as the speed and efficiency in deploying the funds, has not gone unnoticed. The PPP experience also highlighted stark differences between the types of clients that large commercial banks serve versus those served by non-bank lenders. As deBanked reported, banks focused on larger clients whereas non-bank and fintech lenders assisted much smaller businesses in comparison. Origination fees on PPP loans were not insignificant either. SBA pays PPP lenders a 1% to 5% origination fee depending on the funded amount. For example, Ready Capital reported a gross revenue of $100 million on $2.1 billion funded. Notably, Ready Capital’s average PPP loan size was approximately $70,000 compared to an average of more than $500,000 for JP Morgan Chase for approximately $15 billion the bank funded in round one of PPP.

Small business activity is not only a leading indicator of distress but also at the center of any significant economic recovery. Small businesses account for 45% of GDP with 88% of these businesses employing fewer than 20 people. There is no meaningful recovery without small businesses getting back on their feet. As businesses re-emerge, their financing needs will vary widely in timing, amount, frequency, term, etc. depending on industry and many other factors. Continued involvement from the federal government whether in the form of deploying more low-interest rate loans, forgivable loans or loans with some sort of guarantee is likely. Lenders who can continue to serve their clients either by extending a suite of bespoke private credit or by facilitating the deployment and servicing of government funds will succeed.

Broker Fair 2020 Virtual Video Q&A

June 6, 2020Broker Fair 2020 Virtual is this week! Still have questions? I answered some of Johny Fernandez’s questions in this video interview below:

How Stimulus Packages are Accidentally Ending Up in The Trash Bin

June 3, 2020 Since March, over 150 million Americans have woken up to find their banks accounts newly graced with checks from the government. Allowed by the CARES Act, this stimulus package, titled the Economic Impact Payment, was dispatched to help ease the short-term financial troubles that arose from covid-19’s disruption of the economy. And while many Americans have received their money from the Treasury, a selection of recipients are dropping their stimuli into the garbage.

Since March, over 150 million Americans have woken up to find their banks accounts newly graced with checks from the government. Allowed by the CARES Act, this stimulus package, titled the Economic Impact Payment, was dispatched to help ease the short-term financial troubles that arose from covid-19’s disruption of the economy. And while many Americans have received their money from the Treasury, a selection of recipients are dropping their stimuli into the garbage.

The reason for this being that the mode of delivery was switched up mid-May. Instead of having the money directly wired to their bank accounts, roughly four million Americans will instead receive their packages via prepaid VISA debit cards. This group is made up of those taxpayers who do not have bank information on file with the Treasury and who had their tax returns processed by the Andover or Austin Service Centers.

Treasury-sponsored and issued by MetaBank, these cards are shipped in a plain envelope that bares the words “Money Network Cardholder Services, and which contains instructions alongside the card: making the stimulus package look more like marketing spam than anything else. As such, numerous complaints have been made about the delivery method, with many of those who received the cards saying they threw out the entire envelope without thought, believing it to be junk mail.

“It really read to me like a scam,” said one woman interviewed by Yahoo! Finance. “So into the shredder it went.”

As well as this, Yahoo! also found that other recipients received cards that had mixed up their names with those of their spouse. A situation that proved confusing given that the cards must be activated via your phone using your social security number and other personal details.

Funds on the cards can be used to directly pay expenses as well as be transferred to personal accounts; they can also be used at ATMs, although the withdrawal amount per day is limited to $1,000, meaning multiple trips to a bank during a pandemic will be required.

Done in an effort to reduce instances of fraud as well as speed up the process of getting money to Americans, communication about the EIPCard setup seems to have gotten lost in the fray.

Going forward, the Treasury will be waiving the fees associated with reissuing an EIPCard to anyone who claims they shredded or threw it out, and initial reissuance fees from earlier dates will be reversed.

CFG Merchant Solutions Enhances Partnership with Arena Investors and its Affiliates to Serve SMEs

May 29, 2020NEW YORK, New York., May 29, 2020 — CFG Merchant Solutions (“CFGMS”), a leading financier of small and medium-sized enterprises (“SMEs”), announced today that the company is building upon its partnership with Arena Investors, LP (“Arena”), in conjunction with Ceteris Portfolio Services (“Ceteris), an Arena servicing affiliate, in servicing and providing liquidity to Platinum Rapid Funding’s (“PRF”) merchant portfolio. CFGMS has been a leading capital provider to SMEs and an originator of advances to growing merchants, providing in excess of $400 million merchant cash advances since 2015. Arena has been CFGMS’s primary capital partner since 2016.

CFGMS and Arena are determined to prioritize the needs of PRF’s existing customers in the wake of the COVID-19 crises and its resulting impact on small businesses across the country.

“Arena is pleased to continue its partnership with CFGMS and its senior management team consisting of CEO, Andrew Coon, Chief Legal Officer and General Counsel, Robert Martini, and President, William Gallagher. Together, we remain deeply committed to serving the needs of PRF’s existing customers, particularly for ongoing financing and liquidity needs in an environment when even much larger businesses struggle to attract capital,” said Victor Dupont, who leads Arena’s investments in the financing of the SME sector. “We welcome further involvement with PRF’s customers and their affiliated ISOs and are committed to working collaboratively with all throughout the COVID-19 crises and beyond”.

“Arena and its affiliates have built a reputation as a group that combines uniquely flexible capital with broad-based expertise in servicing, resolutions, and SME finance,” said Coon. “So, while we excel at sourcing, originations, and underwriting, we felt that they brought a critical level of IP and know-how that is uniquely suited to benefit all parties in today’s environment. Combining forces to offer a broader set of servicing solutions to the MCA market segment made complete sense.”

Jonathan Pike, CEO of Ceteris, added: “Ceteris is excited to work with CFGMS and Arena by offering best-in-class servicing strategies and assisting merchants in a difficult economic environment.”

The Small Business Association (“SBA”) estimates that traditional banks still reject approximately 90 percent of SME loan applications. Since 2015, CFGMS has emerged as a proven platform that leverages sales partner relationships, analytics, and proprietary underwriting to provide SMEs with a straightforward and streamlined access to critical funding. The company addresses the fundamental capital needs of SME owners across a broad credit spectrum and through every stage of a business’s life cycle.

SMEs across a wide variety of industries that include restaurants, retail stores, salons, spas, dry cleaners, auto body shops, and professional offices. All of these businesses, and more, rely on CFGMS to secure the necessary capital they need to grow.

For questions or funding solutions, please contact:

– William Gallagher

– (646) 880-3817

– WGallagher@CFGMS.com

– Ryan Banda

– (856) 545-8322

– rbanda@ceterisassetsolutions.com

About CFGMS

Headquartered in New York, NY, CFGMS specializes in providing financing to support the growth and development of underserved small-to-medium sized businesses that lack access to traditional bank funding. Founded in 2010, CFGMS’s affiliated company, CapFlow Funding Group, provides factoring, purchase order finance, and asset-based lending solutions. CFGMS and CapFlow have together provided over $1 billion in liquidity solutions to their SME clients. For more information please visit www.cfgmerchantsolutions.com

About Arena Investors, LP

Arena Investors is a privately held, SEC-registered, global alternative investment firm which combines mandate flexibility, proprietary sourcing and systems-plus-servicing to enable solutions for those seeking capital. The firm was founded in 2015 and is headquartered in NewYork with additional offices in Jacksonville, London, and San Francisco. For more information, please visit www.arenaco.com.

About Ceteris Portfolio Services

Ceteris is a nationally licensed servicing company providing debt recovery solutions and other related services for consumers and commercial businesses across a broad range of financial assets. Ceteris provides first- and third-party revenue cycle management, business process outsourcing and portfolio backup servicing to heavily regulated, high volume industries including banking, automotive finance, credit card, equipment leasing, medical, telecommunications, utilities, retail and other industries. For more information please visit www.ceterisholdco.com.

OnDeck Status Update

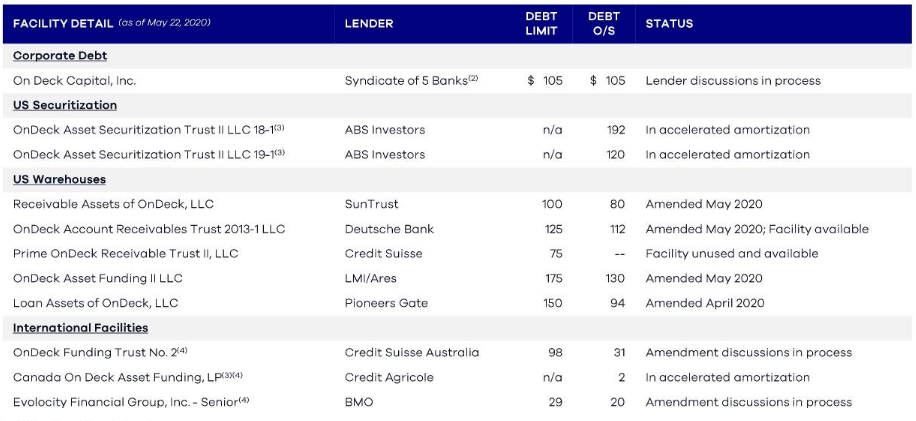

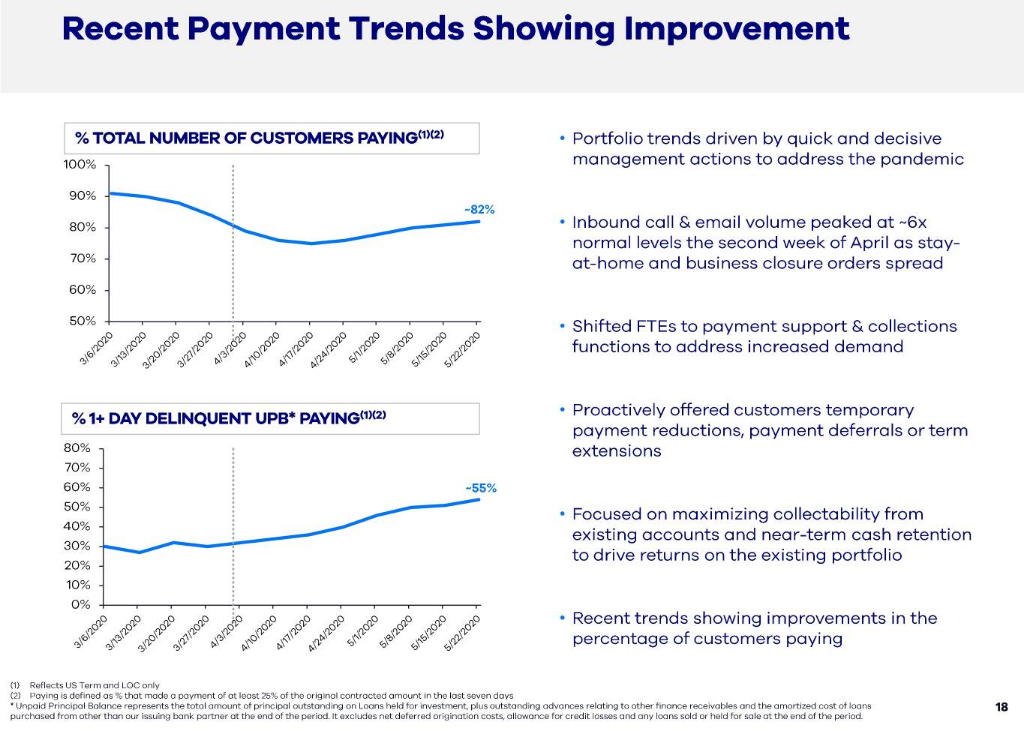

May 28, 2020OnDeck submitted an unprompted mid-quarter update with the SEC early this morning on its status. Unlike previous submissions, the company prepared a visual of its debt situation. The bad news is that there is a good amount of negotiating with creditors left to be done. The good news was that there was an uptick in borrower payments. The attached graphics were pulled straight from their filing.

The company also said that it believes it is “well-positioned to benefit from economic recovery & market dislocation.” It based that belief on the below stated bulletpoints:

- Small business lending is a large market and will be critical in leading the economic recovery.

- OnDeck has deep experience from a 14-year operating history to increase originations with a targeted approach and reshape the portfolio.

- OnDeck is a scaled platform with demonstrated historical profitability and an established brand, unlike many competitors.

- Consistent with the last crisis, banks are likely to retrench further and only selectively serve SMBs.

- Expected consolidation of SMB lending industry will ultimately lead to improved unit economics and growth opportunities.

The full presentation, which is mostly a recap of the company’s Q1 earnings data, can be accessed here.

Most Brokers Plan to Minimize Use of a Central Office Post-COVID, Survey Suggests

May 26, 2020 A survey conducted by Overland Park, KS-based Strategic Capital revealed that only 36.8% of respondents plan to completely return to the office full-time after cities fully open back up. The vast majority of respondents were small business finance brokers.

A survey conducted by Overland Park, KS-based Strategic Capital revealed that only 36.8% of respondents plan to completely return to the office full-time after cities fully open back up. The vast majority of respondents were small business finance brokers.

44.7% selected that they would minimize office space or only use office space to house core team members while 18.4% planned to terminate their office lease altogether and adopt a work from home model permanently.

How NYC Fintech Women is Keeping its Community Going in a Pandemic

May 23, 2020 How does a community of people continue to support each other and network in a pandemic? What is lost when in-person meet ups are replaced by stop-start Zoom conversations? Do geographical limits even exist anymore when everyone is bound to their homes? These are the questions that NYC Fintech Women are dealing with now.

How does a community of people continue to support each other and network in a pandemic? What is lost when in-person meet ups are replaced by stop-start Zoom conversations? Do geographical limits even exist anymore when everyone is bound to their homes? These are the questions that NYC Fintech Women are dealing with now.

Founded in 2017, NYC Fintech Women is an organization of roughly 5,000 members that aims to provide its members with the opportunity to build a web of connections that might otherwise be out of reach. Open to both men and women, the group revolved around regular gatherings that afforded the chance to rub shoulders with both those entrenched in fintech as well as figures from institutional finance. Ranging from mid-tier employees all the way up to executives, the organization encompasses a broad section of those working in the intersection of finance and technology.

Born out of the frustration that Founder Michelle Tran felt when trying to locate fintech people at New York events which largely catered to institutional and traditional finance, the plan for the organization was two-pronged: get all these fintech types together for easier communication while also creating an environment that will allow women to “build their own board.”

Described by Tran as part of Fintech Women’s ethos, the idea is that you’ll have to build your own team if you’re going to get anywhere. “You really need to build your own personal board in order for any type of career advancement,” Tran explained over a call. “So making sure you’re pulling in the right leaders, the right support systems that are also diverse, and the best way to do that is to have a strong network of people at your fingertips.”

And it’s this ethos as well as the social aspects of community that have been challenged by the pandemic. But determined not to let covid-19 get the best of what the organization has become in the past three years, the group has been forced to adapt.

Like the rest of us, telecommunication is being brought in to replace what once came naturally. Slack will offer the chance to chat as a large group, smaller coffee chats will replace the opportunities to talk amongst peers, and a mentoring program launched in January is in the process of being turned fully virtual. And as well as these developments, the decision to expand beyond New York, a move that’s been on Tran’s mind for a while, is now looking more likely as events go online, removing the barriers that come with location.

“It’s a bit harder to just meet somebody, but we’re going to facilitate a number of different platforms in order to do that,” Tran said. “That’s one of the things that we continue to say is really important, and I think that’s what a lot of people miss too, as we’re all sitting alone in our home or with our families. We missed that engagement that we have with others, so we’re finding ways to do that.”

OnDeck Hits Payout Event Trigger on $105M Credit Facility

May 22, 2020Earlier today, OnDeck filed a status update to shareholders with the SEC. The company’s portfolio performance triggered an Asset Performance Payout Event (Level 1 they say) with a credit agreement that at present has an outstanding balance of $105 million.

The event triggers monthly principal repayments which, if not cured or amended, would commence with a $13 million payment on June 17, 2020. Subsequent principal payments are based on a percentage of the currently outstanding balance of $105 million until the Corporate Facility matures in January 2021. The Company is in active discussions with the Corporate Facility lender group to evaluate potential options with regard to this facility.

OnDeck was able to further modify agreements on two credit facilities (ODAF II and ODART) to which they had previously secured only interim relief of a few days.

Shares of OnDeck have hovered between 60 cents and 70 cents in the past week.