Archive for 2019

Canadian Lenders Association to Host Open Banking Summit on July 10th

June 27, 2019The Canadian Lenders Association will be hosting its Open Banking Summit on July 10th at Dentons Toronto. It begins at 8am and ends at 11am. This is the third in their event series, and will tackle topics in Open Banking and Big Data in Canada. They will discuss how the industry can best work toward an open data economy in Canada. Join the amazing panel of industry leaders.

The total cost to attend is CA$79.08. You can register here.

“Do It Better Than How You Learned It”: How Paul Pitcher Came To Be In Canada

June 27, 2019 Few kids who dream of running their own international business actually grow up to live that fantasy. Even fewer end up working alongside their childhood heroes. Paul Pitcher is doing both, and he’s loving every minute of it.

Few kids who dream of running their own international business actually grow up to live that fantasy. Even fewer end up working alongside their childhood heroes. Paul Pitcher is doing both, and he’s loving every minute of it.

Growing up in Annapolis, Maryland, the Managing Partner at First Down Funding and SharpShooter Funding studied at Severn School and immersed himself in sport. Under the eye of his father, Pitcher began playing basketball and baseball at the age of 4. Golf came later, and it followed him into his young adult life as he played at a collegiate level while enrolled at the University of Tampa, where he studied International Marketing and Finance. And upon graduation, Pitcher landed a job in Washington D.C., working in sales for the Washington Wizards and Capitals.

Sports accompanied him in each phase of his life, so it comes as no surprise that it is entwined with his current business ventures.

After leaving the Regional Sales Manager position he held with the Wizards and Capitals, Pitcher became a broker, eventually establishing First Down in 2012 – seeing it as a solution to a problem many business owners across the country face: acquiring capital. Offering funds via merchant cash advances, First Down provides financial aid to small and medium-sized businesses.

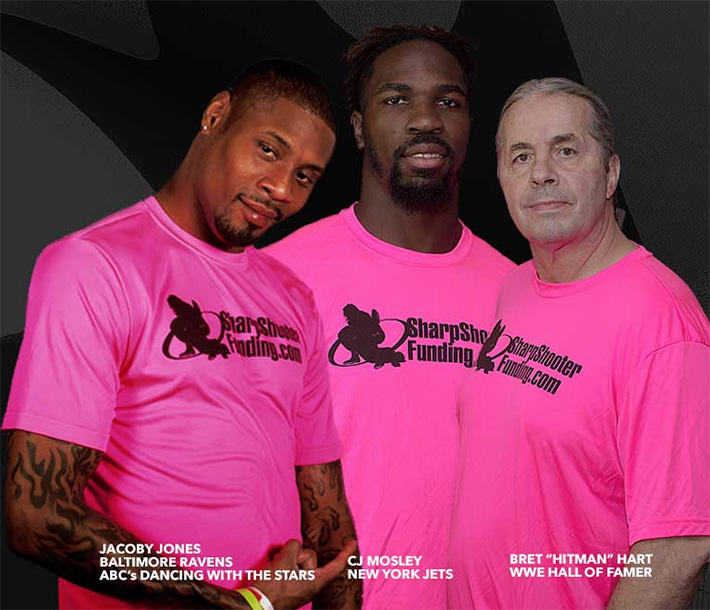

And after enjoying success in the United States, lightning struck on June 6th, 2015. Out of the blue, over 25 Canadian business owners applied for funding from First Down. Chalking it up to ads First Down had placed across social media, Pitcher decided to dive into the new, northern market, but only after consulting with the only Canadian he knew, WWE Hall of Famer Bret ‘Hitman’ Hart.

Having met the wrestler in 1993, Pitcher gambled on Hart remembering the 10-years-old kid in the Looney Toons t-shirt that he took a photo with two decades ago. And it paid off. Following discussions of what First Down did and how it met the needs of the Canadian market, Hart partnered with the company and now serves as commissioner to SharpShooter, the Canadian arm of First Down.

With the backing of a hero from his youth behind him, Pitcher expanded beyond the borders of the US, and with this came further support from sports stars. Recent years have seen CJ Mosley of the New York Jets, Jacoby Jones of the Baltimore Ravens, and the Shogun Welterweight Champion Micah Terill partnering with Pitcher.

With the backing of a hero from his youth behind him, Pitcher expanded beyond the borders of the US, and with this came further support from sports stars. Recent years have seen CJ Mosley of the New York Jets, Jacoby Jones of the Baltimore Ravens, and the Shogun Welterweight Champion Micah Terill partnering with Pitcher.

Noting that the spirit and culture of sport has definitely bled into First Down and SharpShooter from both his own personal life as well as the lives of those athletes that are partnered to it, Pitcher affirms that healthy competition is integral to both sport and business.

Believing that it’s just as important to win as it is to develop the environment you are in, Pitcher is in the funding market for the long-run. And it is exactly this that attracts him to Canada. Comparing it to Baltimore in his home state, he sees the Great White North as a region that is less saturated with funding firms like you would find in New York or Chicago, in other words, he sees it as a place of opportunity, where there is room to grow.

Of course, with such opportunity there are growing pains, like the populace’s level of product knowledge as well as the building of trust between business owners and SharpShooter, but Pitcher welcomes it. Emphasizing his love for competition, he calls for more firms like his to enter the market, be they big or small, as according to him, it could only help build upon the culture of non-bank funding that has taken root in Canada.

“Whatever you do, do it better than how you learned it,” are among the final words Pitcher leaves me with, and with the other closing remarks hinting at further expansion beyond Canada, the Managing Partner seems to be living by this maxim. Be it the education he picked up in Tampa, the lessons learnt in sales, or even a chance encounter with a childhood hero, Pitcher appears to be aiming to continually build and expand upon what he has experienced.

Paul Pitcher is also speaking on a sales and marketing strategies panel at deBanked CONNECT Toronto on July 25th alongside Smarter Loans President Vlad Sherbatov and SEO Consultant Paul Teitelman.

Are The Bankers Taking Over Fintech?

June 27, 2019

For Rochelle Gorey, the chief executive and co-founder of SpringFour, a “social impact” fintech company, mingling with industry movers and shakers at this year’s LendIt Fintech Conference was just what the doctor ordered. “I went mainly for the networking opportunities,” Gorey told deBanked.

SpringFour, which is headquartered in Chicago, works with banks and financial institutions in the 50 states to get distressed borrowers back on track with their debt payments. It does this by digitally linking debtors with governmental and nonprofit agencies that promote “financial wellness.

The indebted parties—more than a million of whom had referrals that were arranged by Gorey’s tech-savvy company last year—constitute not only household consumers but also commercial borrowers. “Small businesses face the same issues of cash flow as consumers, and their business and personal income are often combined,” she says. “If their financial situation is precarious, it’s super-hard to get credit, a line of credit, or a business loan.”

Although Gorey felt “overwhelmed” at first by the throng of 4,000 conference-goers at Moscone Center West in San Francisco—roughly the same number as attended last year, conference organizers assert— her trepidation was short-lived. It wasn’t too long before she was in circulation and having chance encounters and serendipitous interactions, she says, with “all the right people at the workshops and at the tables in the Expo Hall.”

Although Gorey felt “overwhelmed” at first by the throng of 4,000 conference-goers at Moscone Center West in San Francisco—roughly the same number as attended last year, conference organizers assert— her trepidation was short-lived. It wasn’t too long before she was in circulation and having chance encounters and serendipitous interactions, she says, with “all the right people at the workshops and at the tables in the Expo Hall.”

Armed, moreover, with a “networking app” on her mobile phone, Gorey was able to arrange targeted meetings, scoring roughly a dozen, 15-minute tete-a-tetes during the two-day breakout sessions. These included audiences with community bankers, financial technology companies, and “small-dollar” lenders. “And it went both ways,” she says. “I had people reaching out to me”—just about everyone, it seemed, appeared receptive to “finding ways to boost their customers’ financial health.”

Gorey’s success at networking was precisely the experience that the event’s planners had envisioned, says Peter Renton, chairman and co-founder of the LendIt Fintech Conference. Organizers took pains to make schmoozing one of the key features of this year’s gathering. Not only did LendIt provide attendees with a bespoke networking app, but planners scheduled extra time for meet-ups. “We had around 10,000 meetings set up by the app,” Renton says, “about double the number of last year.”

deBanked did not attend the LendIt USA conference on the West Coast this year. But the publication sought out more than a half-dozen attendees—including several financial technology executives, a leading venture capitalist, a regulatory law expert, and the conference’s top administrators—to gather their impressions. While informal and manifestly unscientific, their responses nonetheless yielded up several salient themes.

The popularity—and effectiveness—of networking was a key takeaway. Most seized the opportunity to rub elbows with influential industry players, learn about the hottest startups, compare notes, and catch up on the state of the industry. Most importantly, the event presented a golden opportunity to make the introductions and connections that could generate dealmaking.

“My goal this year was to strike more partnerships with lenders and fintech companies,” says Levi King, chief executive and co-founder at Utah-based Nav, an online, credit-data aggregator and financial matchmaker for small businesses. “We had great meetings with Fiserv, Amazon, Clover Network (a division of First Data), and MasterCard,” he reports, rattling off the names of prominent financial services companies and fintech platforms.

James Garvey, co-founder and chief executive at Self Lender, an Austin-based fintech that builds creditworthiness for “thin file” consumers who have little or no credit history, said his goal at the conference was both to serve on a panel and “meet as many people as I could.”

Self Lender is in its growth stage following a $10 million, series B round of financing in late 2018 from Altos Ventures and Silverton Partners. Garvey reports having meetings with Bank of America and venture capitalist FTV Capital “over coffee” as well as F-Prime Capital, another venture capitalist. “It’s just about building a relationship,” he said of making connections, “so that at some point, if I’m raising money or want to partner, I can make a deal.”

There was a concerted effort to recognize women, as evidenced by a packed “Women in Fintech” (WIF) luncheon that drew roughly 250 persons, 95% of whom were women. (“Many men are big supporters of women in fintech and we didn’t want to exclude them,” Renton says). The luncheon was preceded by a novel event—a 30-minute, ladies-only “speed-networking” session—which attracted 160 participants, reports Joy Schwartz, president of LendIt Fintech and manager of the women’s programs.

At the luncheon, SpringFour’s Gorey says, “it was empowering just to see lot of women who are senior leaders working in financial services, banks and fintechs.” The keynote speech by Valerie Kay, chief capital officer at Lending Club, was another highlight. “She (Kay) talked about taking risks and going to a fintech startup after 23 years at Morgan Stanley,” Gorey reports, adding: “It was inspiring.”

The women’s luncheon also marked the launch of LendIt’s Women In Fintech mentor program, and presentation of a “Fintech Woman of the Year” award. The recipient was Luvleen Sidhu, president, co-founder and chief strategy officer at BankMobile, a digital division of Customers Bank, based near Philadelphia, which employs 250 persons and boasts two million checking account customers.

I am honored to be the 2019 Fintech Women of the Year and thrilled that @BankMobile won Most Innovative Bank. It’s very exciting to be recognized by @LendIt Fintech with this prestigious award and I congratulate the finalists in all the categories. https://t.co/qjADuKEMrB pic.twitter.com/hFJVFw1fLS

— Luvleen Sidhu (@LuvleenSidhu) April 11, 2019

BankMobile, which also won LendIt’s “Most Innovative Bank” award, has an alliance with Upstart to do consumer lending and a partnership with telecommunications company T-Mobile. Known as T-Mobile Money, the latter service provides T-Mobile customers with access to checking accounts with no minimum balance, no monthly or overdraft fees, and access to 55,000 automated teller machines, also with no fees. (At its website, T-Mobile Money describes itself as a bank and uses the slogan: “Not another bank, a better one.”)

The impressive salute to women notwithstanding, their ranks remained fairly thin: just 733 attendees identified themselves as “female” on their registration forms, LendIt’s Schwartz says, a little more than 18% of total participants. Seventy-five of the 350 total speakers and panelists—or 21%—were female. (Schwartz also reports that another 157 registrants selected “prefer not to say” as their sexual orientation, while 22 checked the box describing themselves as “non-conforming.”)

In LendIt’s defense, deBanked, who caters to a similar audience, regularly reviews its readership demographics using several tools. They have consistently indicated that women make up 18% – 23% of the total, in line with what LendIt experienced at its most recent event.

By all accounts, many panels were informative, jampacked and attendees were engaged. King, who moderated a panel on regulatory changes in small business lending, which dealt with such topics as California’s commercial “truth-in-lending” law and controversial “confessions of judgment” laws, says: “They didn’t have to lock the door but the room was pretty full and people seemed to be paying attention. I didn’t see people studying their cellphones.”

The Expo Hall was teeming with budding fintech entrepreneurs, financial services companies and multiple vendors hawking their wares. But as numerous fintechs were angling to forge lucrative symbiotic relationships with banks, some participants—even those who were hailing the conference for its networking and deal-making opportunities—lamented the heavy presence of the establishment.

The banks’ ubiquitousness especially vexed Matthew Burton, a partner at QED Investors, an Arlington, (Va.)-based, venture capital firm and a veteran fintech entrepreneur. Before signing on with QED last year, Burton had been the co-founder of Orchard Platform, an online technology and analytics vendor for fintech and financial services companies which was purchased by fintech lender Kabbage.

Not only did bankers seem to playing a more prominent role at the LendIt conference, Burton notes, but “big four” accounting firm Deloitte had signed on as a major sponsor. “The energy level seemed a bit lower than in past years,” Burton told deBanked. “It’s not like people were depressed but it wasn’t bubbling with excitement. A couple of years ago we thought all these new fintechs would replace the banks,” he explains. “Now the discussion is over how to partner and collaborate with banks. It’s not as exciting as when everyone thought banks were dinosaurs.

“I couldn’t really tell if there were more bankers attending this year,” Burton adds, “but it sure felt like it.”

King, the Nav executive, told deBanked: “It was a little bit subdued. I don’t know if it was nervousness about the economy or politics, but the subject of risk came up more often in side conversations with venture-backed businesses and banks and alternative fintech lenders. One large bank we deal with,” he adds, “told me it’s spending most of its time working on risk.”

Cornelius Hurley, a Boston University law professor and executive director of the Online Lending Policy Institute who participated in a standing-room-only session on state and federal fintech regulation, declares: “I’ve been to three of their conferences, including one in New York, and I would say that this one did not have as much pizzazz. It may be that the industry is maturing.”

For his part—when asked whether there was a palpable absence of passion this year—LendIt’s Renton told deBanked: “I would say that it felt more businesslike. Fintech has had a lot of hype and we have had conferences that were ridiculously over-hyped in 2015 and 2016. And in 2017 (the mood) was much more somber. This one felt optimistic and businesslike.”

There were 750 bankers in attendance, almost one in five participants. “The number of bankers was not up significantly” over last year, Renton says, “but the seniority of the bankers was higher. We worked very hard to get senior bankers to attend this year.”

Renton was bullish on the closer ties developing between nonbank online lenders and banks. That was reflected as well in the several panels exploring ways to develop partnerships between the two sides. He noted that a session called “How Banks are Matching Fintechs on Speed of Funding and User Experience” drew a heavy crowd. “It brought more bankers than we’ve ever had before,” Renton says.

Moderated by Brock Blake, founder and chief executive at the fintech Lendio, the panel was composed of three bankers: Ben Oltman, the Philadelphia-area head of digital lending and partnerships at Citizens Bank; Gina Taylor Cotter, a senior vice-president at American Express (the highest-ranking woman at the company); and Thomas Ferro, a senior marketing manager at Bank of America. “The banks came to LendIt not just to learn but to decide whom they’re going to partner with,” Renton says. “Fintechs need banks and banks need fintechs. That is the narrative you hear on both sides.”

(Asked whether any banks sponsored this year’s conference, Renton replied: “They are not sponsoring yet in any number but we are working on that.”)

OnDeck, a top-tier fintech lender to small-businesses in the U.S., which has been making forays abroad to Australian and Canadian markets, is an enthusiastic champion of the fintech-bank union. So much so that it claimed LendIt’s “Most Promising Partnership” award for the cooperative relationship it struck with Pittsburgh-based PNC Bank, which uses OnDeck’s platform to make small business loans. (Among the partnerships that OnDeck-PNC beat out: Gorey’s SpringFour, which was named a finalist in the competition for its association with BMO Harris Bank.)

“We were the first fintech lender to strike a true platform relationship with a bank,” Jim Larkin, head of corporate communications at OnDeck says, noting that the PNC deal follows on the New York-based fintech’s similar, innovative arrangement with J.P. Morgan Chase. “Others may do referrals,” he explains. “What we do is actually provide the underlying platform to accelerate a bank’s online lending capabilities. We deliver the software and expertise to construct the right type of online lending engine.”

Meanwhile, there was avid interest about the stock performance of publicly traded fintechs—for example, Square and GreenSky—both of which had seen their share prices tumble and then recover.

Burton noted that, among venture-backed firms, the most excitement seemed to be coming from Latin America. “Everyone was very bullish on a Mexican company, Credijusto, an alternative small business lender that was written up the in the Wall Street Journal,” he says. “It’s not going public yet but it had a large debt-and-equity raise of $100 million from Goldman Sachs. And SoftBank Group announced a $5 billion Latin American tech fund.

“There was a lot of talk,” he adds, “about how money was flowing into Mexico and Brazil.”

Ocrolus Secures $24M in Series B

June 26, 2019 A fresh logo and new company jumpers aren’t the only recent additions to the Ocrolus offices this month, as the business has secured $24 million in Series B funding.

A fresh logo and new company jumpers aren’t the only recent additions to the Ocrolus offices this month, as the business has secured $24 million in Series B funding.

This development marks the $33 million point in investments for the automation platform. Led by Oak HC/FT, and backed by FinTech Collective,

Bullpen Capital, QED Investors, among other investors, the funds will be put to use expanding upon Ocrolus’s software and staffing.

With 40 employees currently working at Ocrolus, Co-founder and CEO Sam Bobley said that the company hoped to double this number over the next 12 months, aiming to have “a little over north of 80 this time next year.” As well as this, plans are underway to expand the capabilities of their product. Built to analyze financial documents, such as bank statements, pay stubs, and IDs, with 99% accuracy, Bobley explained that he plans for Ocrolus to be able to extract data from invoices and mortgage documents as well.

And while work on their software continues, the company is also looking to develop their customer base. With intentions to both deepen their core clientele, which is small business lenders, while also opening up their product to new markets, Ocrolus is set to put this $24 million towards building upon what they have established since opening their doors in 2014.

WATCH CAPITOL HILL HEARING LIVE: Crushed by Confessions of Judgement: The Small Business Story

June 26, 2019 The House Committee on Small Business will meet for a hearing titled, “Crushed by Confessions of Judgement: The Small Business Story” today at 11:30am. This hearing is intended to bolster support for The Small Business Lending Fairness Act, a bill to outlaw COJs in small business loans and merchant cash advances nationwide. (Read more about this initiative here)

The House Committee on Small Business will meet for a hearing titled, “Crushed by Confessions of Judgement: The Small Business Story” today at 11:30am. This hearing is intended to bolster support for The Small Business Lending Fairness Act, a bill to outlaw COJs in small business loans and merchant cash advances nationwide. (Read more about this initiative here)

The hearing will be live streamed here when it commences.

The witnesses scheduled to testify include:

Mr. Hosea Harvey

Law Professor and Consumer Finance Law Expert

Philadelphia, PA

Mr. Jerry Bush

Former Owner of JB Plumbing & Heating of Virginia, Inc.

Roanoke, VA

Mr. Shane Heskin

Partner, White and Williams, LLP.

Philadelphia, PA

Mr. Benjamin R. Picker

Shareholder, McCausland Keen + Buckman

Devon, PA

As New Regulations Sweep The Industry, Find Out Where The Next Big Opportunities Are

June 25, 2019

Connect with peers, learn from the pros, and find out what the future holds!

Federal Lawmakers Not Convinced NY Confession of Judgment Ban is Enough

June 25, 2019

The recent New York State law that effectively ended the era of Confessions of Judgment in the small business finance industry is apparently not enough to satiate the outrage of some federal lawmakers. This morning, Rep. Nydia M. Velázquez (D-NY) and Rep. Roger Marshall (R-KS) introduced the “Small Business Lending Fairness Act” that would outlaw confessions of judgment in small business financing transactions nationwide.

Given the impact the New York law is expected to have, the effort may appear to be duplicative. But not quite. The New York law prohibits COJs from being filed in New York against out-of-state debtors. As New York had the friendliest commercial COJ process, financial companies were using New York courts to file COJs against debtors in all 50 states whether there was a nexus to New York or not. By requiring the debtor be in New York, as the new law requires, the utility of COJs in the New York courts for the other 49 states has been eliminated.

However…

That doesn’t mean that courts in other states don’t allow commercial COJs to be filed in their home states. Some do, such as California and Pennsylvania, for example, but the process isn’t as friendly or as easy as New York’s. (See an analysis of California’s and Pennsylvania’s COJ process here)

That is where the proposed federal law would have the most reach and why a federal bill is not merely an academic exercise at this stage.

The federal bill’s language is not new. It mirrors a bill introduced by Senators Sherrod Brown and Marco Rubio in December. No movement has been made on it since but they reportedly intend to move forward with it.

Velázquez intends to keep the momentum going.

“I was appalled to find out that New York State has become an epicenter for dishonest lenders seeking to swindle small businesses around the country,” Velázquez said. “That’s why I’m proud to introduce this legislation and will be leading a hearing this week to further expose these abusive practices.”

The hearing she refers to is titled, “Crushed by Confessions of Judgement: The Small Business Story” and it’s being held tomorrow at 11:30am on Capitol Hill. It will be livestreamed here.

An alleged victim of predatory lending is among the guest speakers. Mr. Jerry Bush, who was featured in Bloomberg’s controversial series on merchant cash advances, is on the witness list. Bush reportedly lost his business after a series of unfortunate business dealings. Nobody from the small business finance industry is currently appearing to offer any opposing testimony on the matter of COJs. If that changes, deBanked will provide an update.

The hearing will be livestreamed on the deBanked homepage.

Last Chance for VIP Rate on deBanked CONNECT Toronto Room Block

June 24, 2019deBanked CONNECT’s discounted room rate at the Omni King Edward Hotel in Toronto ends today. Don’t wait until the rate goes up! Book your room now for deBanked’s first ever event in Canada!

Omni Hotels Reservations

Business Hours: 8am to 1am EST

Telephone: 1-800-THE-OMNI (1- 800-843-6664)

Group Name: deBanked CONNECT Toronto