Archive for 2017

Upstart’s Average Borrower

June 12, 2017Online lender Upstart considers more than 10,000 variables such as an applicant’s education, academic performance, and employment background, according to their website, a proprietary system they say is used to detect “future prime” borrowers. But according to a recent Kroll Rating Agency report, their borrower base looks prime even by traditional standards in that their average borrower is 28 years old, earns $95,000 a year and has a FICO score of 690. Upstart lends money (through Cross River Bank) to individuals for a variety of purposes including student loan refinancing and debt consolidation.

In the Kroll report, Upstart asserts its belief that its use of additional data points will outperform traditional credit models, but concedes that their system has not been tested through economic cycles.

Upstart has raised $88.35 million in equity to-date. The Kroll Report was prepared in anticipation of a $163 million securitization transaction that is expected to close this month. They expect to be making $100 million of loans per month by the end of the year.

Another NY Supreme Court Judge Casts Doubt On The MFS – Volunteer Pharmacy Case

June 10, 2017Just as an Orange County, NY judge found in Merchant Funding Services, LLC v. Micromanos Corporation d/b/a Micromanos and Astsumassa Tochisako that a uniquely structured merchant cash advance was not a criminally usurious loan, so too did the Honorable Maria S. Vazquez-Doles on June 8th, court records reveal. Vazquez-Doles, who also presides in Orange County, concurred that the attorney representing defendants in Yellowstone Capital LLC v M N B Waterford LLC d/b/a MAC N’ Brewz! Mac N.Cheez! LLC d/b/a Mac N’Cheez! Somerset and Gary E Sussman, misquoted the contract’s language in their motion papers to suit their argument that the agreement was in fact a loan. In her decision, she referred to defendants’ attempt to twist the words as “incomplete and palpably misleading.”

“The Agreement is not on its face and as a matter of law a criminally usurious loan,” she held.

This is the second judge to opine that the decision in Merchant Funding Services, LLC v. Volunteer Pharmacy Inc. was premised on the opposition palpably misquoting an addendum to the contract in their motion papers. The first was the Honorable Catherine M. Bartlett last month.

The weight of the Volunteer Pharmacy case to a cottage industry of attorneys hoping to argue that merchant cash advances are disguised loans, is rapidly declining. The actual language of the these particular contracts has now twice exonerated the merchant cash advance companies.

The Yellowstone case decided on June 8th is filed under Index Number: EF001264-2017.

Sound Bites From Underwriting – Gambling With a New Broker

June 9, 2017At the Factoring Conference during a portfolio warning signs panel, Emma Hart, the COO of Sallyport Commercial Finance, was asked if she recalled any red flag situations that hinted at collusion. Whether in factoring or not, you can probably relate to this situation with a new broker:

We had one fairly recently that we should not have funded that the CEO of our business puts on. It was a slow one. We needed the deals. The client was a flour mill supplying flour to Indian restaurants. It was a special type of flour. I can’t remember what it was. He had 4 debtors. The invoices were for $14,500 each. Each of the 4 debtors verified by invoice perfectly and we never heard from him again. And every single one of the debtors claim to have paid him directly. He came to pick up the checks. We don’t even know whether they were valid invoices, whether they even parted with the money, but we never saw him again. And the warning flags were all over the place. They were bright red, weren’t they? It didn’t pass any of the underwriting criteria. The individual was not an individual of good character. He had some history, but the deal had been given to Nick [the company’s president] by a broker. We were establishing a relationship. We always say in our business and every other business, you know, the new sales people get a freebie. Nick doesn’t get any freebies ever anymore, but that was a first funding loss. So, that was a classic first funding loss. It didn’t pass any underwriting criteria. We did it because we were slow. We needed some business. It was a new broker relationship. […] So, that was classic case of collusion, but we should have known better. Absolutely. And he absconded.

This is one of several excerpts from this panel that we plan to post under the Sound Bites From Underwriting tagline.

Humans vs. Bank Statements – An Underwriting Journey

June 8, 2017 Automation hasn’t replaced humans yet when it comes to reading bank statements in the alternative small-business finance industry. ISOs, brokers, funders and underwriters still fend off drowsiness and ignore the risk of eye strain as they pore over months of paper or electronic documents.

Automation hasn’t replaced humans yet when it comes to reading bank statements in the alternative small-business finance industry. ISOs, brokers, funders and underwriters still fend off drowsiness and ignore the risk of eye strain as they pore over months of paper or electronic documents.

Many consider the drudgery a necessary part of the business. A merchant’s bank statements can reveal negative balances and commitments to previous loans or previous cash advances – any of which can indicate a bad risk, observers say. Moreover, detecting altered statements can expose fraudulent attempts to obtain credit, they add.

So why not dispense with the tedium and possible tampering of reading paper statements and pdfs? Instead, interested parties could simply obtain the login credentials for a credit or advance applicant’s bank accounts and explore their banking records firsthand. But a mixture of fear, fraud and expense often prevents that direct and relatively simple approach, multiple sources contend.

“Merchants simply don’t want to give up their username and password to enable someone to log into their bank account,” says Sam Bobley, CEO of Ocrolus, a company that specializes in automating the reading of paper statements and statements that have been converted to PDFs. Fear of somehow falling victim to an electronic robbery may be at the root of that reluctance, many in the industry agree.

Whatever the source of the hesitancy to share login information, the wariness usually seems more pronounced at the beginning of the underwriting process than toward the end, notes Arun Narayan, senior vice president of risk and analytics at Strategic Funding Source Inc., a New York City-based direct funder. “I don’t think that’s a problem after the commitment to fund,” he says, “but it is a problem before the commitment to fund.” Funders can try to leverage their market power to urge brokers to obtain a username and password from a merchant, Narayan suggests. But he admits that approach works only some of the time.

Whatever the source of the hesitancy to share login information, the wariness usually seems more pronounced at the beginning of the underwriting process than toward the end, notes Arun Narayan, senior vice president of risk and analytics at Strategic Funding Source Inc., a New York City-based direct funder. “I don’t think that’s a problem after the commitment to fund,” he says, “but it is a problem before the commitment to fund.” Funders can try to leverage their market power to urge brokers to obtain a username and password from a merchant, Narayan suggests. But he admits that approach works only some of the time.

Merchants who have had a bad experience applying for loans or advances or are submitting their first application exhibit the most fear of surrendering login credentials, according to John Tucker, managing member at 1st Capital Loans, a broker with headquarters in Troy, Mich. “If they’ve been through the process before, they pretty much know what’s expected of them,” he says.

All too often, applicants balk at presenting their login information because they have something to hide, notes Cheryl Tibbs, owner of One Stop Commercial Capital, an Atlanta-based brokerage that handles deals for multiple ISOs. She says her detective work with bank statements uncovers an average of two fraudulent applications per week.

Attempts at fraud average more than five a day at Elevate Funding, a Gainesville, Fla.-based director funder, says CEO Heather Francis. Her company’s underwriters learn what to look for in bank statements that can indicate a merchant is trying to defraud a funder, she says.

First, an underwriter who’s manually checking bank statements knows that documents bearing the names of certain banks have a higher likelihood of being bogus, Francis says. Apparently, fraudsters find the statements from those banks easier to alter, or perhaps they have the templates for those banks and can plug in false information, sources speculate.

WHETHER PAPER OR PDF BANK STATEMENTS PROVIDE TO BE ON-THE-LEVEL OR NOT, READING THEM MANUALLY TAKES TIME

Besides, anyone hoping to bilk a funder can buy a customized “vanity statement” for $25 or $30 on craigslist, complete with whatever deposits, opening balances and closing balances they choose, Francis notes. That can tempt troubled merchants as well as outright criminals, observers agree.

And some of the more bizarre errors that appear in falsified statements can seem almost comical. Tibbs cites the example of a statement she saw that was supposedly for January but was populated with transactions dated in February. On altered statements the ending balance for one month might not match the beginning balance for the next month, several sources note.

Sometimes the fake numbers that wayward applicants choose to include in their fraudulent statements can send up red flags, Tibbs maintains. If a merchant is seeking $40,000 and presents account documents indicating $80,000 or $90,000 balances at the end of each month, something’s amiss “10 times out of 10,” she says.

Tibbs tells the story or a referral partner from a one-or two-person ISO calling her in a state of near-euphoria in the middle of the night, breathlessly describing a potential customer with monthly sales of $800,000 and a need for $500,000 in capital. Experience told her immediately that something wasn’t right. In the morning, she saw the statement’s ending balances of $300,000 to $400,000, which confirmed her suspicions.

Yet grafting such unlikely numbers to a forged bank statement isn’t as unsophisticated as some of the telltale signs that the industry sees when viewing bank statements manually, notes Francis. Some aspiring crooks doctor genuine statements with white-out correction fluid and then type in new numbers in a mismatched font, she says.

Anyone reading bank statements should also beware of applicants who “shotgun” applications to multiple ISOs, often on the same day, Tibbs warns. She often comes across that scam because numerous partners refer deals to her, she says.

Whether paper or pdf bank statements prove to be on-the-level or not, reading them manually takes time. An experienced underwriter who knows where to look for what he or she needs to find to verify a statement requires 15 to 20 minutes to approve one from a familiar financial institution, Francis says.

It seems that nearly every bank or credit union has its own way of designing statements, so the manual reading process slows down when an underwriter manually reads a document with an unfamiliar layout, Francis notes. Unfamiliar types of statements sometimes come from small, obscure credit unions or remote community banks, observers say.

Familiar or unfamiliar, statements represent a key part of the underwriting process, and some funders accept the time and expense of reading them manually as simply a cost of doing business, according to Francis. But that expense can become a significant portion of the cost of a credit evaluation, according to Narayan.

That’s why Narayan and his colleagues at Strategic Funding Source have been working with Ocrolus, a startup company that automates the reading of paper statements and pdf’s of statements. Ocrolus uses optical character recognition, or OCR, to automate the reading of those statements.

Simply stated, OCR enables a machine to make sense of the characters it perceives in an image, says Bobley, the Ocrolus executive quoted earlier. When the platform can’t make out certain data points, they’re snipped and verified by humans in crowdsourced mini CAPTCHA tests, which stands for Completely Automated Public Turing.

Simply stated, OCR enables a machine to make sense of the characters it perceives in an image, says Bobley, the Ocrolus executive quoted earlier. When the platform can’t make out certain data points, they’re snipped and verified by humans in crowdsourced mini CAPTCHA tests, which stands for Completely Automated Public Turing.

They’re those tests that ask computer users to type what they see to prove they’re not robots, Bobley notes. When two of three crowd workers agree on what an image says in the CAPTCHA test, the Ocrolus platform accepts their verdict as correct, he says.

Ocrolus envisions a large market for its new platform among the many funders still reading bank statements manually in the early stages of underwriting, Bobley says. However, in the later stages of underwriting many of those funders already use bank sync companies to verify statements.

Bank sync companies include DecisionLogic, MicroBilt, Yodlee, Plaid and Finicity. They connect directly with some financial institutions to verify statements. Funders often mention the expense when they talk about bank sync companies, and they also note that bank sync companies have not yet established connections with some lesser-known financial institutions.

But late in the funding process, Elevate Funding requires merchants to cooperate with the bank sync company it uses unless extenuating circumstance dictate otherwise, says Francis. The bank sync company can gain direct access to statements using encrypted login information that does not reveal the true username or password to Elevate Funding or the bank sync company, she maintains.

Some of Elevate Funding’s brokers maintain portals that merchants can use to provide their login credentials to get the bank sync process underway, Francis notes. The portal takes merchants to a page with Elevate Funding branding through a white-label program the bank sync company provides.

“IT HAS SAVED US FROM MERCHANTS THAT WOULD HAVE DEFAULTED…IT IS A NECESSARY TOOL – ONE THAT WE HAVE TO USE”

In about 85 percent of Elevate deals, the bank sync company is connected with the merchant’s financial institution and therefore theoretically capable of gaining access to the accounts in question, Francis notes.

Over the past 30 days the Elevate Funding bank sync results included 3 percent bank error and 17 percent merchant error, while 73 percent of the statements were verified, Francis says. Bank error occurs when the bank sync company is connected to the bank but still can’t obtain the account information. Merchant error sometimes happens when the potential client provides an incorrect user name or password, probably after forgetting the right one. Merchant error can also mean that the applicant was plotting fraud and abandoned the bank sync process upon realizing he or she was about to get caught.

The upshot? Some 73 percent of the bank statements submitted are verified, meaning that the information the merchants submitted matches the numbers at the bank, Francis reports. That also means that for whatever reason 7 percent don’t even start the process they’ve requested, she says.

Meanwhile, the bank sync connection also provides real time data that would indicate to the funder whether the merchant has had a decline in sales, an increase in negative activity or the recent addition of a credit provider, Francis says.

The service can pay off. In an average month, the bank sync service detects about 10 or 15 bad deals that Elevate Funding underwriters had accepted, Francis says. “It has saved us from merchants that would have defaulted,” she says. “It is a necessary tool – one that we have to use.”

But what about those cases where the bank sync company can’t connect with the financial institution and the merchant still won’t give up the login for the account? At 1st Capital Loans, Tucker can sometimes handle the situation by getting a bank activity sheet that lists transactions. If that type of sheet’s not available, he arranges a phone call to with a representative of the bank to verify that nothing’s amiss with the applicant’s bank account.

It’s another example of how – even with today’s rampant automation – the human touch sometimes remains indispensable in assuring that merchants deserve the loans or advances they seek.

Marketplace Lending: The Next 10 Years

June 7, 2017 The marketplace for consumer and small-business loans has come a long way over the last 10 years. Since the early days of peer-to-peer lending, there has been a great proliferation of new types of intermediaries creating new layers of distribution for the risk involved with the lending process. Now marketplace lending has reached an inflection point that will create a much different scenario with fewer players and more partnerships.

The marketplace for consumer and small-business loans has come a long way over the last 10 years. Since the early days of peer-to-peer lending, there has been a great proliferation of new types of intermediaries creating new layers of distribution for the risk involved with the lending process. Now marketplace lending has reached an inflection point that will create a much different scenario with fewer players and more partnerships.

“Marketplace lending has created a much richer ecosystem for risk distribution,” said Shane Hadden, a marketplace lending consultant at BlackLine Advisory Group. “There are many more participants on the investor side, new origination strategies and more intermediaries. We are seeing new types of risk being distributed to the best holders of that risk. This is a very good development for consumers and small business borrowers.”

Now that investors agree that marketplace lending risk is attractive, this segment is poised to mature. Hadden has turned his attention toward the next stage of marketplace lending.

“Marketplace lending has been about intermediation with new types of technology-driven companies being placed between the risk and the ultimate loan holder. That’s going to collapse back over time,” said Hadden.

Indeed marketplace lending to date has been the practice of lenders going around the banks to reach bank customers. This has created a market where lenders are competing against banks for originating credit risk that they then distribute, which in turn has created an appetite from investors for this type of risk.

Now that investors agree this is the type of risk they desire, they’re examining the process to determine the most cost efficient way to take on this risk. As they look down the marketplace lending supply chain, they’re faced with multiple layers that ultimately lead to the consumer.

“The next phase is that investment firms will partner directly with credit originators, the ones that have the data. They will partner with banks, for example, directly. Or with data driven online aggregators like Credit Karma Whoever is the ultimate holder of the loan partners with the company that has the best primary relationships with the borrower, cutting out the middle man,” said Hadden.

The linchpin holding this model all together is technology including machine learning, which is driving more efficient distribution. “Technology is what has made marketplace lending so rich and competitive. But technology firms must now compete within the market they’ve created. And typically technology – once it exists can be commoditized,” said Hadden, adding that technology will eliminate intermediaries, not create new ones.

Meanwhile, growth for the software providers will be through partnerships. “In the short run technology companies will participate as new financial intermediaries, but that will eventually correct itself and we will be in a situation where there are fewer intermediaries. When the smoke clears, all of the technology will be in the hands of two parties — the primary originators and the ultimate lenders,” said Hadden.

So the big question is ‘who will survive?’ According to Hadden, it will be the players that transition into a natural competitive position as either the lender or the risk originator. “These are the two big specialties. Either you have capital and algorithms and are good at investing or you have relationships and data and you are good at originating loans. These firms need to go in one direction or the other,” said Hadden.

While the patchwork of the new marketplace lending space has yet to be completed, one thing seems abundantly clear. “It will look different from what it looks like today,” said Hadden.

Industry CEOs Were Less Confident in Q1

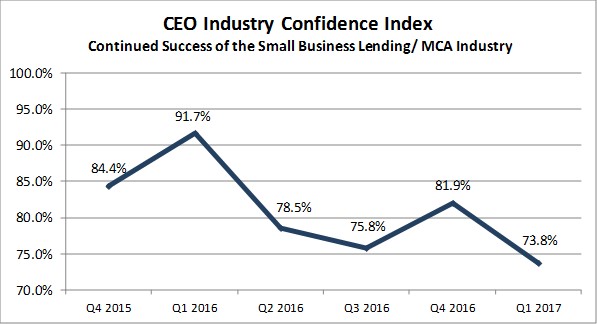

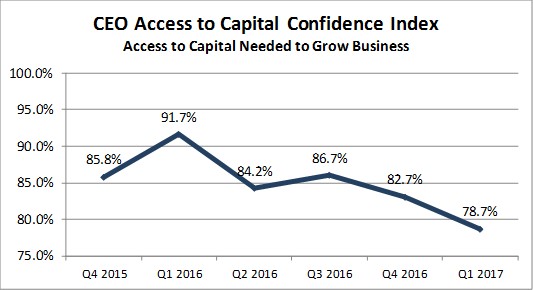

June 6, 2017According to the latest quarterly Bryant Park Capital/deBanked survey of industry CEOs, confidence dropped to the lowest levels since the survey first began in Q4 2015. Specifically, confidence in being able to access capital needed to grow dipped down to 78.7% from 82.7% in the prior quarter. Confidence in the continued success of the Small Business Lending & MCA Industry shrank from 81.9% in Q4 to 73.8% in Q1.

See the trends below:

The survey does not ask participants to offer a reason for their confidence but the drop could probably be partially attributed to the events that occurred at CAN Capital, OnDeck’s struggles, and a general correction that took place at several other competing firms.

District Court Offers Guidance on Merchant Cash Advances in Precedent-Setting Decision

June 6, 2017On May 9, in Colonial Funding Network, Inc. v. Epazz, Inc., the U.S. District Court for the Southern District of New York dismissed counterclaims alleging the overcharging of interest and the affirmative of usury. The decision is the first federal case to recognize that a contractual relationship establishing a bona fide merchant cash advance (MCA) does not create a loan. Beyond that, the decision offers helpful guidance on how to structure a legally enforceable MCA agreement.

In Colonial Funding, the parties’ MCA agreement required the subject cash advance to be repaid in daily payments equal to 15 percent of defendant Epazz’s daily collected receivables. To this end, the agreement authorized plaintiff TVT Capital to make daily withdrawals in agreed-upon, set amounts from a designated bank account into which Epazz was required to deposit sums it collected. In addition, TVT was required to reconcile its withdrawals on a monthly basis against the bank statement for the designated deposit account. If TVT’s withdrawal on a given day was higher or lower than 15 percent of the receivables Epazz had collected on that day, TVT was required to debit or credit the deposit account for the difference. If, however, Epazz failed to provide TVT with the bank statement needed to make reconciliations, “TVT [was] not required to reconcile future payments.” The parties’ dispute arose when Epazz stopped making deposits into the account. Colonial, as servicing provider for TVT, responded by filing a lawsuit in New York Supreme Court, which was removed to federal court.

Epazz counterclaimed, alleging that the parties’ MCA agreement actually created a usurious loan. In considering this argument, the district court noted that, under New York law, “there can be no usury unless the principal sum advanced is repayable absolutely.”

Applying this standard to the MCA agreement in question, one could argue that the nature of the parties’ relationship would convert to a loan if Epazz ceased delivering bank statements to TVT; i.e., from that point forward, TVT would be entitled to collect daily payments in specified uniform amounts, with no obligation to reconcile, until the advance was repaid in full. In the district court’s view, however, if this contingency were to occur, Epazz’s obligation to repay would remain tethered to 15 percent of its daily collected receivables, and, in the absence of reconciliation, TVT’s daily withdrawals would be presumed to have been made in appropriate amounts. In this regard, the district court’s opinion stressed that “Epazz, rather than [Colonial] controls whether daily payments will be reconciled.” Moreover, “[n]o allegation is made that TVT ever denied Epazz’s request to reconcile the daily payments.”

After reviewing the structure of the parties’ MCA relationship, the district court noted that Epazz’s argument that the relationship constituted a loan rested on three specific cases. With respect to the first of those cases, Merchant Cash & Capital LLC v. Edgewood Group, LLC, 2015 U.S. Dist. LEXIS 94018, 2015 WL 4451057 (S.D.N.Y. July 20, 2015), the district court stated that “[w]hether the arrangement was a loan was not briefed and was not determinative to the outcome [of the case.]” The Colonial Funding court then noted that the judge in Merchant Cash reviewed a supplemental filing made by the plaintiff MCA provider and concluded that the parties’ relationship “appear[ed] to be structured not as a loan but as the sale of accounts receivable” because the MCA agreement required weekly reconciliations of payments made against collected receivables.

In regard to the second case cited by Epazz (Clever Ideas, Inc. v. Rest. Corp., 2007 N.Y. Misc. LEXIS 9248 (N.Y. Sup. Ct. Oct. 12, 2007)), the district court noted that the contract at issue had “included neither a reconciliation provision, nor payment contingent on the amount of receipts generated.” Hence, the court opined that “the clear facts [of Clever Ideas] differ from those in this case.”

The district court next determined that Platinum Rapid Funding Group Ltd. v. VIP Limousine Services, Inc., 2016 N.Y. Misc. LEXIS 4131 (N.Y. Sup. Ct. Oct. 27 2016), the third case cited by Epazz, presented facts that more closely resembled the dispute at hand. In Platinum, the New York Supreme Court held that the respective repayment obligations of the merchant and its co-defendant principal owner were not unconditional and the “deposited receipts from future transactions” constituted the sole source of repayment of the subject MCA. In this regard, the court concluded that the personal guaranty of the merchant’s principal owner did not give rise to a loan because the “personal guaranty [was] no broader than the [merchant’s] obligations under the Agreement, and the requirement of payment by the Guarantor [was] no greater than that of the Merchant.”

Finally, in addition to the above cases, the Colonial Funding court considered the parties’ dispute in light of Merchant Cash & Capital, LLC v. Transfer International Inc., 2016 N.Y. Misc. LEXIS 4515 (N.Y. Sup. Ct. Nov. 2, 2016). In that case, the amount of the merchant’s daily payment “could be adjusted downward in the event that the average daily receipts were less than anticipated, and adjusted upward in the event that the average daily receipts were greater than anticipated.” According to the defendant, these adjustments made the subject MCA arrangement a usurious loan. The New York Supreme Court disagreed on the basis that the “plaintiff assumed the risk that, if the receipts were less than anticipated, the period of repayment would be correspondingly longer, and the investment would yield a correspondingly lower annual return.”

Based on its review of the parties’ relationship in Colonial Funding, the district court concluded that Epazz’s obligation to repay was not absolute and did not constitute a loan under applicable law. Rather, the court found that “[p]ayment depends upon a crucial contingency; the continued collection of receipts by Epazz from its customers.” That condition, the court noted, was stated explicitly in the parties’ agreement: “Payments made to FUNDER in respect to the full amount of the Receipts shall be conditioned upon Merchant’s sale of products and services and the payment therefore by Merchant’s customers in the manner provided in Section 1.1.”

Furthermore, Epazz’s contention that the agreement amounted to a loan because it required specified daily payments was “contradicted by the reconciliation provisions which provide that if daily payments are greater than 15% of Epazz’s daily receipts, TVT must credit the difference to Epazz, thus limiting Epazz’s obligation to 15% of daily receipts.” Accordingly, the court dismissed Epazz’s counterclaim for the overcharge of interest and affirmative defense of usury.

Takeaways

- Colonial Funding reinforces that, in order to avoid an MCA being deemed a usurious loan, (i) the provider’s acquired interest in the merchant’s accounts receivable must constitute the sole source of repayment and (ii) the contract must include a mechanism for reconciling required contract payments against the financial performance of the purchased receivables.

- Colonial Funding also illustrates that the line between an MCA and a loan may be a fine one. Without effective contract drafting, a court could consider a default provision requiring fixed payments with no reconciliation requirement as giving rise to a loan. In Colonial Funding, the court noted that the right to require reconciliations rested solely with the defendant merchant, and, if the merchant chose to forgo that right by failing to provide a bank statement to the MCA provider, the provider could presume that its daily withdrawals corresponded to 15 percent of the merchant’s daily collected receivables.

- Requiring the merchant’s principal owner(s) to give a personal guaranty will not render an otherwise bona fide MCA a usurious loan so long as the terms of the guaranty mirror the obligations of the merchant. For example, in Colonial Funding, the guarantor was obligated, along with the merchant, to deposit each day’s collected receivables into a designated account. The guarantor was not, however, obligated to make up any deficiencies in the amounts deposited out of his pocket, which would have constituted a loan.

New York State Assembly Proposes Online Lending Task Force

June 5, 2017On June 2nd, the New York Assembly drafted its answer to the recent joint-committee hearing on online lending. It’s called Bill A8260, an ACT to establish a task force on online lending institutions. As it’s proposed now, the task force would include individuals from the online lending community, the small business community, the financial services industry, and the consumer protection community that would be appointed by the Assembly, Senate and Governor.

The task force would be required to present a report on the following by April 15, 2018:

(a) an analysis of data received by the department of financial services on the prevalence of these institutions in the state, specifically, how many online lenders are lending to consumers and small businesses in this state;

(b) an analysis of data received by the attorney general and division of consumer affairs regarding the number of complaints, actions and investigations related to online lending institutions;

(c) an examination of the online lending industry and the key participants therein, and an investigation and understanding of the differences in small business and consumer borrowers, lenders and markets, such as the history, business models and practices of online lending institutions including identification of interest rates charged by online lenders;

(d) an examination of how consumers are utilizing online consumer credit to manage existing debt, potentially reduce borrowing costs or access needed funds;

(e) an examination of the existing small business credit gap and small business’ use of credit and credit needs;

(f) identification of alternatives for consumers and small businesses who are unable to access traditional financing and whether new technologies can enhance access to credit;

(g) an examination of whether existing federal and state laws already provide appropriate police powers and regulation of small business and consumer lending by online lending institutions;

(h) an evaluation of the impact of any contemplated or proposed law or regulation on the small business credit gap, including a quantitative analysis of the amount of increased or decreased credit available to small businesses as a result of such law or regulation, including the extent to which access to credit would be affected under the state’s current usury laws;

(i) an analysis of the potential interaction of federal law with any contemplated or proposed state regulation;

(j) an exploration of options for multi-state collaboration to harmonize the laws and regulations of various states related to small business and consumer lending across state borders;

(k) an assessment of best practices for small business and consumer loan disclosures, including current online lending industry efforts to advanced standardized and clear information for borrowers;

(l) an assessment of whether consumer loans and small business loans are treated differently by online lending institutions and if any level of oversight should take such differences into consideration;

(m) an identification of what consumer protections exist to protect consumers in this state from predatory practices of online lending institutions; and

(n) a determination of what new measures, if any, are needed to ensure consumers are protected from deceptive or predatory lending without unduly restricting access to credit.

Once the report is delivered, the task force would be disbanded. The bill is currently in committee.