Confessions of a Bitcoin Miner

If you’re even vaguely familiar with Bitcoin, you’ve probably heard that you can mine them. It’s one of Bitcoin’s most unfortunate pieces of jargon because it sounds like a scam. We can’t mine U.S. Dollars so there’s no frame of reference for what enthusiasts are talking about. We can mine gold and silver of course, but how the heck can one mine a digital currency? It’s clear there’s more to Bitcoin than just being a form of money and that frightens people. It certainly frightened me.

The first time I imagined bitcoin mining, I pictured sentinels from The Matrix drilling down with unrelenting intensity towards the last human city of Zion. Perhaps the humans were hoarding a vast trove of valuable bitcoins and a war was being waged to achieve digital hegemony. Like Ray in Ghostbusters, I couldn’t help it. The thought just popped in there.

The first time I imagined bitcoin mining, I pictured sentinels from The Matrix drilling down with unrelenting intensity towards the last human city of Zion. Perhaps the humans were hoarding a vast trove of valuable bitcoins and a war was being waged to achieve digital hegemony. Like Ray in Ghostbusters, I couldn’t help it. The thought just popped in there.

The next thought was that I better stay away from Bitcoin. It was easier to take the blue pill where “the [Bitcoin] story ends, you wake up in your bed and believe whatever you want to believe.” That’s what many consumers have done in the past. And who could blame them? I liked my life without Bitcoin in it, so why mess it up?

But the maniac I am, I took the red pill and explored just how the deep the rabbit hole goes.

I mined some bitcoins and the machines didn’t kill me, at least so far. I’m mining them right now as I type this. If you’re getting excited that I’m about to tell you that I’m getting rich while you fools sit on the sidelines, you’re going to be disappointed. There is no actual mining. It’s just slang for facilitating bitcoin transactions over the Internet. Womp womp. If people weren’t sending bitcoins back and forth, then there would be nothing to facilitate and therefore nothing to mine.

To illustrate simply, I’ll start off by reminding you that Bitcoin has no central authority. There is no Visa, no banks, and no Federal Reserve to sign off on a transaction. Instead Bitcoin transactions are validated by computers connected to the Internet running free Bitcoin software.

To illustrate simply, I’ll start off by reminding you that Bitcoin has no central authority. There is no Visa, no banks, and no Federal Reserve to sign off on a transaction. Instead Bitcoin transactions are validated by computers connected to the Internet running free Bitcoin software.

If I have 5 bitcoins and I send 3 to you, computers all over the world running this software are processing algorithms to validate this and make them permanent in a global ledger. The computers make sure you really have those bitcoins to send and then transfers them. You can’t create a fake bitcoin or spend one you’ve already spent because the Bitcoin system will know about it.

On just a single day there are nearly one hundred thousand bitcoin transactions. That’s too much for just a few computers to handle, not to mention that the processing power required to validate them is intense. Validating transactions requires lots of processing power and utilizing processing power has a cost in electricity.

So it pays

The Bitcoin system has a built in reward system to incentivize people around the world to keep the system in order. If your computer achieves a specific milestone while facilitating transactions, you are rewarded with bitcoins. Again, don’t get excited. These milestones are extremely rare to reach and totally random (for the record it’s called solving a block). You could facilitate transactions for 200 years and never get any bitcoins back as a reward.

But while random, it’s a probability game. The faster your processing power, the better your odds of being the lucky computer to receive the reward. That’s a necessary but unfortunate component to Bitcoin because there’s a built-in arbitrage opportunity. Why be a passive facilitator when you could arm your computer with a faster processor and rig the odds in your favor? If your computer was significantly faster than the other ones on the network, you could potentially get rewarded bitcoins often enough and with enough consistency to cover both the cost of your upgraded computer and the electricity to keep it cranked up.

And with that understanding, an international arms race began for increased processing power. Up until early 2013 you could quite easily profit from being a facilitator. Those folks didn’t see themselves as facilitators anymore but as miners. It wasn’t a passive activity. It was a business, like hauling ore out of a silver mine.

Today, so many people have tricked out their processors that it’s nearly impossible to get an edge. In fact, mining often results in losses. I have experienced a net loss in actual U.S. dollars through mining even though I’ve acquired fractions of bitcoins. Net loss? whuh?!

Forget about using your desktop or laptop to mine bitcoins. That’s so 2011. Engineers went on to build special hardware chips much better than household computers that do nothing other than process calculations for bitcoin transactions. Then came small boxes of chips, then large ones…

And when everyone started buying large bitcoin processing boxes, they began to buy two or three of them…

Then a stack of them…

Then a room full…

Then a warehouse full…

And of course a lot of additional money had to be spent on cooling, ventilation, and protecting against fires.

This is where a little problem started. Once everybody was using a million dollars worth of specialized hardware for speed and was spending tens of thousands of dollars per month on electricity, the edge was constantly being neutralized. Worse, the frequency that bitcoins are awarded per day does not increase. There will only be 21 million bitcoins ever placed in circulation. They’re awarded through mining at a fixed frequency. You can try to be the recipient of each reward but the frequency of which they’re awarded doesn’t increase.

Bummer for those that have amassed nuclear arsenal sized mining operations.

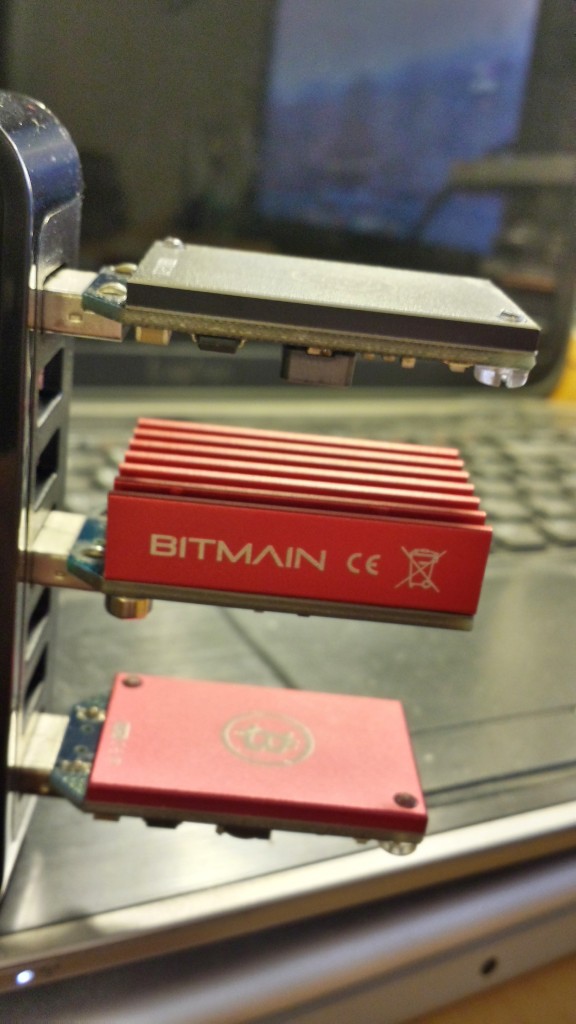

But also bummer for me. This is the extent of my mining equipment.

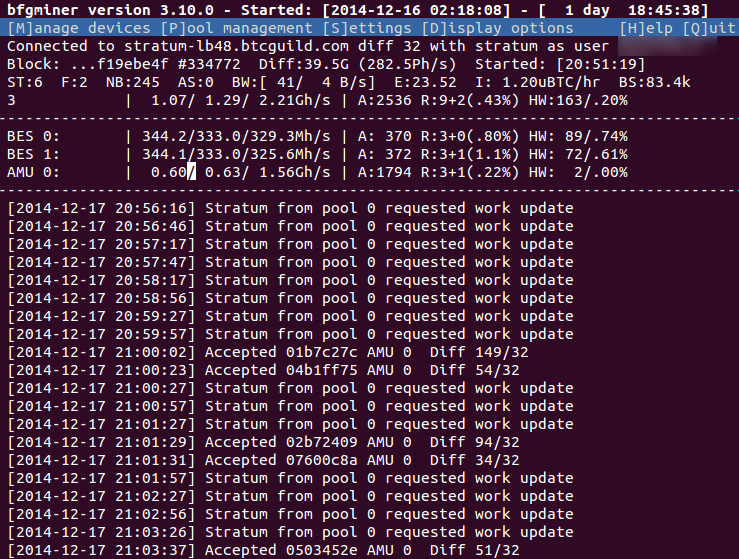

I have three small mining chips all connected via a USB strip. The outer pieces are ASICMiner Block Erupters and between them is a Bitmain Antminer U2. They run 24/7 connected to my home laptop. I can monitor their activity through this little window on my screen:

Combined they are crunching out an average of 2.2 Giga hashes (GH/s) per second, a speed so insignificant compared to the network’s competition that I will probably die without ever receiving a reward of bitcoins.

Unless…

Join forces

There’s a trick to mining to ensure you don’t die rewardless. You can combine your processing power with other miners and leverage your chances. Then if the group’s effort yields a reward, it’ll be distributed on a prorated basis. Someone got this idea a long time ago and in today’s ultra competitive environment, it’s practically a must.

They’re called mining pools. Pools aren’t just a couple of friends, they’re nearly small cities of miners working together collaboratively. The pool I mine in (BTC Guild) has 14,000 to 16,000 users mining together at any one moment and a single user could have an entire warehouse full of mining equipment. In the last hour, the fastest user provided 1,047,666.38 GH/s worth of power to our pool. That’s 476,211x more than what I contributed and he is just 1 of 15,000 users in our pool. woah!

What’s even more wild is that BTC Guild only makes up 5% of the world’s Bitcoin mining power. And yet because I am part of that pool I am paid a prorated amount for every reward the team earns. Surprisingly, that number is not zero. Running 24/7, I am earning an average of 60,000 satoshis a month.

The exchange rate of Bitcoin is extremely volatile but at this moment 60,000 satoshis is equivalent to 19 cents. Yes, 19 cents per month!

And don’t forget that the mining chips cost money to buy and running them 24/7 runs up more than 19 cents worth of electricity used. This means Bitcoin mining isn’t about getting rich. I’m losing money mining. It’s a hobby or benefit conferred upon the digital currency system to keep it running smoothly and accurately. Well at least for me…

Remember that miner that’s out-processing me on a scale of 476,211 to 1? He’s earning about $90,000 per month. I don’t know what his expenses are to run an operation like that but I’m sure it’s not cheap. His biggest enemy is that the value of Bitcoin to the dollar has fallen pretty heavily this year. $90,000 a month in revenue could become $45,000 a month just through exchange rate risk. Those are pretty high stakes to gamble with. But it could also become $180,000!

And whether the big players like that mine or don’t is irrelevant. Whether he makes money or not doesn’t matter. Arbitrage opportunities in the facilitation of transactions is for ultra geeks with big bucks. Mining as a hobby is for regular geeks. It’ll cost some money to do but you get to contribute to a system you believe in.

As for you, the potential average currency user, mining is not really of any consequence. The facilitation of digital transactions already happens with dollars, euros, and pounds. In My Journey to Bitcoin, I explained that buying a cup of coffee with a credit card requires 8 people to get paid for the transaction. Sure the process is completely different for Bitcoin but so what? Bitcoin is unique.

The problem is the mining terminology. It should be called facilitation but that doesn’t sound sexy especially if you are trying to convince an investor to give you $1 million to take advantage of potential arbitrage opportunities on the network.

And that’s about it. The real story behind mining isn’t so scary and you won’t necessarily be at any disadvantage if you still have no idea what the hell mining is. Bitcoin is full of technical nonsense best left to geeks, but you as an actual currency user do not have to worry about a lot of it.

If you’re at all like me though, obsessively curious about how things work and excited to try them out, I’m happy to clue you into the mechanics of mining and even get into the finer details behind it.

An ASIC Block Erupter costs about $10 on Amazon or eBay. I run Ubuntu Linux as my native desktop OS at home (geeky I know) but you should be able to do it with Mac or Windows. The mining software I use is BFG Miner 3.10 and I use BTC Guild as my pool. Admittedly, I am waiting for a delivery of two more Antminer U2s (5x faster than the Erupters but just as cheap) and a delivery of two Antminer U3s (210x faster than the Erupters). I will in all likelihood not achieve a profit even with the additional equipment. And that’s okay, it’s enjoyable just messing with the gizmos.

The best way to learn about Bitcoin is to try it yourself. Hey maybe you’ll hate it, but at least it’ll be based off experience. You can buy fractions of a Bitcoin, even just a few dollars worth from Coinbase. From there you can shop online, convert them back to cash, or send them all to me. 😉

I’m not afraid to say that I mine bitcoins, even if it’s infinitesimally small amounts. What else did you expect from a guy running the deBanked website?

I put my bitcoins where my mouth is. If you’re into alternative finance too, it’s finally time you gave in and tried it.

Last modified: May 5, 2021Sean Murray is the President and Chief Editor of deBanked and the founder of the Broker Fair Conference. Connect with me on LinkedIn or follow me on twitter. You can view all future deBanked events here.