Regulation

1,334 Page CFPB Loan Rule Proposal Warns Business Lenders

June 2, 2016 Congress isn’t responsible for lending lawmaking anymore it seems, the CFPB is. That’s a bit chilling considering the federal agency is also tasked with enforcing the laws it creates. A new 1,334 page law proposal published by Richard Cordray at the CFPB to assert control over payday loans, vehicle title loans, and certain high-cost installment loans also mentions business loans in it.

Congress isn’t responsible for lending lawmaking anymore it seems, the CFPB is. That’s a bit chilling considering the federal agency is also tasked with enforcing the laws it creates. A new 1,334 page law proposal published by Richard Cordray at the CFPB to assert control over payday loans, vehicle title loans, and certain high-cost installment loans also mentions business loans in it.

“The Bureau intends to exclude loans that are made primarily for a business, commercial, or agricultural purpose,” the proposal states. However, since the proposal is not a bill that would be brought before Congress for a vote, the weakly and seemingly intentionally phrased statement of “intends to exclude” is not the most reassuring language. Cordray concedes in an earlier paragraph though that Dodd-Frank only empowered the Bureau to prescribe rules over consumer finance, which was defined primarily as personal, family, or household purposes.

Already the proposal explains how a business lender might violate that threshold:

“A lender would violate this part if it extended a loan ostensibly for a business purpose and failed to comply with the requirements of this part if the loan in fact is primarily for personal, family, or household purposes. See the section-by-section analysis of proposed § 1041.19 for further discussion of evasion issues.”

That referenced further analysis basically says that if the lender is really just pretending a personal loan is a business loan, then they’re just trying to evade the rules and that won’t work.

If a consumer claims they’re going to use the money for a personal purpose but then decides to use it to finance a small business, well then it’s still a consumer loan, Cordray argues:

“Proposed § 1041.3(b) specifies that the proposed rule would apply only to loans that are extended to consumers primarily for personal, family, or household purposes. Loans that are made primarily for a business, commercial, or agricultural purpose would not be subject to this part. The Bureau recognizes that some covered loans may be used in part or in whole to finance small businesses, both with and without the knowledge of the lender. The Bureau also recognizes that the proposed rules will impact the ability of some small entities to access business credit themselves. In developing the proposed rule, the Bureau has considered alternatives and believes that none of those alternatives considered would achieve the statutory objectives while minimizing the cost of credit for small entities.”

Business lenders and even merchant cash advance companies should make sure they ask every applicant what the intended use of the funds are. If it’s for a personal purpose, the CFPB could try to exercise jurisdiction in the future.

Here’s Why The DOJ Wants to Keep an Eye on Online Lenders

May 26, 2016

Online lending has been getting a lot of attention, but not necessarily all good.

The U.S. Justice Department is among the latest authorities to be concerned about online lending, while it’s going through a rather choppy ride.

Assistant Attorney General at the DOJ, Leslie Caldwell voiced the regulator’s concern that the loans made online were backed by investors and are without “traditional” safeguards of deposits that banks rely on. Although alternative lending is still a small part of the lending industry, DOJ wants to keep an watchful eye to avoid another mortgage crisis-like situation.

“I’m not saying … that we’ve uncovered a massive fraud, but just that there’s a potential for things to go awry, like when underperforming loans were being sold in residential mortgage-backed securities,” Caldwell told Reuters.

And while the DOJ questions Lending Club, New York’s financial regulator is said to have sent letters to 28 online lenders seeking information on loans made in the state.

The New York Department of Financial Services first subpoenaed Lending Club on May 17th, seeking information about fees and interest on loans made to New Yorkers. Bloomberg reported that the regulator has sent letters to 28 firms including Funding Circle and Avant asking for similar disclosures. The full contents of those letters have not been made public yet, but Reuters seemed to characterize them as being perhaps more aggressive than the inquiry in California six months ago.

Most lenders, the NYDFS will likely learn, are relying on preemption granted under the National Bank Act or Federal Deposit Insurance Act. Chartered banks covered under these laws are typically the entities in question making the actual loans. The “online lenders” buy the loans from the banks and service them. But absent that structure, it is possible that New York could model future regulation on California’s system, where lenders must go through a vetting process and be licensed.

Online lenders dependent on chartered banks to enjoy preemption have slightly less reason to be worried after the US Solicitor General recently filed a response to the US Supreme Court’s request, that argued the Second Circuit’s ruling in Madden v Midland, a case that challenged preemption, was simply incorrect.

Google’s Payday Loan Ad Ban Smells Like Government Intimidation

May 12, 2016 CFPB Director Richard Cordray

CFPB Director Richard CordrayGoogle loved payday lending and products like it, until something happened.

Google Ventures is one of the most notable investors in LendUp, a personal lender that charges up to 333% APR over the period of 14 days. The famous creator of Gmail, Paul Buchheit, is also listed as one of LendUp’s investors. Four months ago, Google Ventures even went so far as to double down on their love for the concept by participating in LendUp’s $150 Million Series B round.

This week, Google Inc. has apparently found Jesus after “reviewing their policies” and determined that personal loans over 36% APR or under 60 days will be forever BANNED from advertising on their systems. “This change is designed to protect our users from deceptive or harmful financial products,” they wrote in a public message. Ironically of course, Google is tacitly admitting that it must protect users from its own products that it has invested tens of millions of dollars in because they are deceptive or harmful.

LendUp is not the only company that Google Ventures has invested in that charges more than 36% APR. A business lender they previously invested in charged up to 99% APR. That investment was for $17 million as part of a Series D round. At the time, they called the management team’s vision “game changing.”

The only thing game-changing now is their about-face after their supposed policy and research review. It’s hard to imagine that in 2016, Google is just finally reading research about payday lending, especially considering that payday loan spam has for so long been a part of their organic search results. It cannot be understated that they’ve even created entire algorithms over the years dedicated to payday search queries and results. And “loans” as a general category is their 2nd most profitable. Yes, surely they know about payday.

Predatory middleman

Google has good reason lately to be afraid of sending a user to a website to get a payday loan however, even if they’re just an innocent middleman in all of this.

Last month, the Consumer Financial Protection Bureau filed a lawsuit against Davit (David) Gasparyan for violating the Consumer Financial Protection Act of 2010 through his previous payday loan lead company T3Leads. In the complaint, the CFPB acknowledges that T3Leads was the middleman but argues that its failure to properly vet the final lender customer experience is unfair and abusive. At its core, T3Leads is being held responsible for the supposed damage caused to individuals because they may not have ended up getting the best possible loan terms.

One has to wonder if Google could be subject to the same fate. Could they too be accused of not auditing every single lender they send prospective borrowers off to?

Four months before being sued by the CFPB personally, the CFPB sued T3Leads as a company.

Gasparyan however, is already running a new company with a similar concept, Zero Parallel. That company is indeed advertising on Google’s system.

Chokepoint

For the CFPB, coming fresh off of having made the allegations that even a middleman sending a prospective borrower off to an unaudited lender is culpable for damages, the most bold way to achieve their goals of total payday lending destruction going forward would be to threaten the Internet itself, or in more certain terms, Google.

It’s quite possible that Google has been strong-armed into this new policy of banning short term expensive loans by a federal agency like the CFPB. Not giving in to such a threat would likely put them at risk of dangerous lawsuits, especially now that there are some chilling precedents. By forcing Google to carry out its agenda under intimidation, the CFPB wouldn’t have to do any of its day-to-day work of penalizing lenders individually that break the rules. Google essentially becomes a “chokepoint” and that’s quite literally something right out of the federal regulator playbook.

In 2013, the Department of Justice and the FDIC hatched a scheme to kill payday lenders by intimidating banks to stop working with them even though there was nothing illegal about the businesses or their relationships. That plan, which caused a massive public outcry, had been secretly codenamed “Operation Chokepoint” by the DOJ. A Wall Street Journal article uncovered this and a Congressional investigation finally put an end to the scheme after two years, but not before some companies went out of business from the pressure.

Given this history, it’s highly plausible that Google has been pressured in such a way that it’s too afraid to reveal it.

Google has long known all about payday lending. Their recent decision smells like government and they just might very well be the chokepoint.

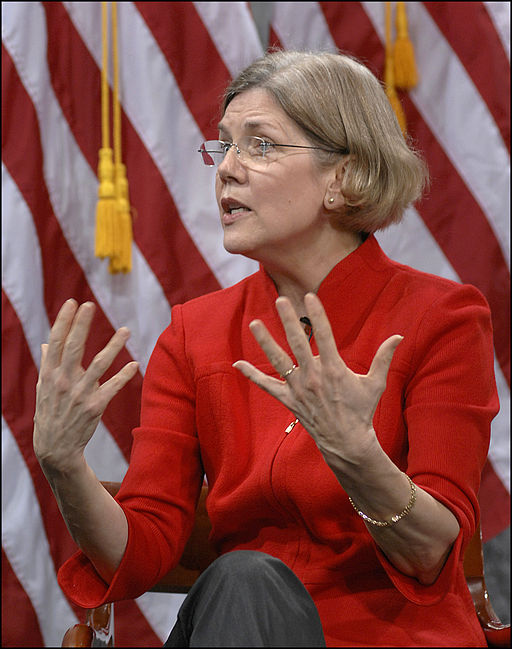

Senator Elizabeth Warren Rips Former Protégé in CFPB Debate

April 6, 2016 Massachusetts Senator Elizabeth Warren was forced to confront an unexpected witness yesterday in a Senate hearing over consumer finance regulations, former protégé Leonard Chanin. Chanin, who was there to testify about why he believed the Consumer Financial Protection Bureau (CFPB) was acting outside its intended scope, was accused by Warren of being the person responsible for not catching the entire 2008 financial crisis.

Massachusetts Senator Elizabeth Warren was forced to confront an unexpected witness yesterday in a Senate hearing over consumer finance regulations, former protégé Leonard Chanin. Chanin, who was there to testify about why he believed the Consumer Financial Protection Bureau (CFPB) was acting outside its intended scope, was accused by Warren of being the person responsible for not catching the entire 2008 financial crisis.

“Of all the people who might be called on to advise Congress about how to weigh the costs and benefits of consumer regulations, I am surprised that my Republican colleagues would choose a witness who might have one of the worst track records in history on this issue,” Warren said.

Of note however, is that after the financial crisis, she herself hired Chanin to be the CFPB’s rule-writer after he came highly recommended for his service as the deputy director of the Federal Reserve’s Division of Consumer and Community Affairs. “I’m also pleased to have Leonard Chanin playing a key role in building an effective and efficient rule writing team,” she said back in December 2010.

Chanin spent nearly 20 years at the Fed and received a Federal Reserve Board Special Achievement Award for his work on the Truth in Savings Act.

“So my question is, given your track record at the Fed, why should anyone take you seriously now?” she asked Chanin, even while acknowledging that she had hired him previously based upon that same track record.

Chanin is now an attorney at Morrison & Foerster LLP.

The CFPB is often attributed as being Warren’s brainchild and she is believed to be a contender for Vice President on the Democratic ticket.

Watch the exchange between Warren and Chanin below:

SoFi Funds $1B in Student Loans, is Lobbying Working?

March 29, 2016 Student lender SoFi crossed $1 billion in student loan refinancing through its corporate partnerships which lets employers like Microsoft pay for student loans.

Student lender SoFi crossed $1 billion in student loan refinancing through its corporate partnerships which lets employers like Microsoft pay for student loans.

The announcement is rightly timed as lawmakers push for bills that give tax benefits on employer-paid student loan repayment programs.

Companies can contribute as little as $100 a month to refinance employee student loans or offer to refer them to SoFi as part of the bonus package. All roads thus leading to SoFi.

What SoFi likes to boast as the “hottest employee benefit,” over a 401k plan, is being advocated for by Congressman Rodney Davis, who is pushing the Employer Participation in Student Loan Assistance Act, which gives employees a tax-exempt benefit of up to $5,250 per year to pay on their already incurred student loan debt and allows employers to deduct the subsidy provided to employees.

“The Employer Participation in Student Loan Assistance Act encourages employers to be part of the solution by allowing them to offer an employee benefit that will help graduates pay down their student debt. With outstanding student loan debt totaling more than $1 trillion, we must find ways to engage the private sector and help graduates manage their debt,” according to Davis’ website.

And he did find ways to engage with the private sector. Records show that SoFi spent close to $130,000 in the last two years, lobbying to get the bills enacted into law. The act which ostensibly helps employers attract and retain young talent creates a bigger market for SoFi loans.

And with $1 billion in originations, it seems to have gotten itself a great deal. And in its own words, “with programs like these, everybody wins.”

CFPB Mends Mortgage Rules to Serve Small Creditors

March 22, 2016The Consumer Financial Protection Bureau (CFPB) broadened the Qualified Mortgage rule to certain special provisions for small creditors that operate in rural or underserved areas under the Helping Expand Lending Practices in Rural Communities (HELP) Act.

The Bureau’s mortgage rules which was brought into effect in January 2014 had a rule called ‘Ability-to-Repay’ which laid the onus of determining creditworthiness strictly on lenders.

As a result, the category of ‘Qualified Mortgages’ that emerged out of it kept certain risky features of the loan from borrowers who could not comply with the ability-to-repay rule. For instance, small creditors operating in rural areas were not allowed to originate balloon payments. Additionally, escrow accounts for higher-priced mortgage loans were not permitted.

The Bureau received flak for this from the House Financial Committee which alleged that the rule harmed consumer access and choice when it comes to home loans and mortgages by forcing many community banks and credit unions to downsize or shut down their mortgage operations.

The CFPB in its statement acknowledged that the “rule is being adopted to fit within the background of the CFPB’s prior regulations in the mortgage market.”

Financial Services Committee Chairman Jeb Hensarling in his critique against the rule said, “We are already hearing numerous feedback concerning the harmful impact on consumers of the Bureau’s Qualified Mortgage rule, which went into effect just days ago.”

Is this a way of making amends?

OnDeck, UK Trade Group Work on Fintech Policy

March 17, 2016 Don’t look now but OnDeck is getting knee-deep in fintech policy.

Don’t look now but OnDeck is getting knee-deep in fintech policy.

The online lender said that it will partner with UK’s Innovate Finance, a fintech trade group to launch a Transatlantic Policy Working Group to exchange intelligence and information on regulatory and policy issues governing fintech.

The group will work on universal fintech issues like the use of data, building a payments infrastructure for financial inclusion, open source APIs in banking and automated investment advice through robo advisors, when kicking off its first meeting at Google’s Washington DC office.

“The transatlantic policy working group represents a great opportunity to share key insights, best practices and knowledge between US and UK fintech stakeholders,” said Daniel Morgan, head of policy and regulation at Innovate Finance “It will help drive real change in the public policy arena when it comes to the development and growth of a vibrant fintech sector.”

Venture capital investment in fintech companies more than doubled last year compared to 2014, hitting an all time high of $14 billion, up 106 percent from $7 billion in 2014. The UK attracted a total of $623 million in fintech investment in 2014 and Innovate Finance committed to increasing that number to $8 billion by 2020 in venture and institutional investment.

Fed’s Steady Interest Rates: What Does This Mean for You?

March 16, 2016The Federal Reserve kept interest rates unchanged citing a global economic slowdown and market volatility in the US.

The central bank kept the benchmark federal funds rate at 0.25-0.5 percent and scaled back forecasts of higher interest rates noting that the economy is exposed to the “uncertain global economy.”

What does this mean for online lenders? Not much directly as marketplace lenders don’t use the prime rate as a benchmark. But by association, it could affect demand for loans, credit performance and capital supply as the Fed rates play with investors’ expectations of yield.

But a small increase in rates wouldn’t have affected the industry too adversely. “Given the cushion we’ve already built into our loan pricing, we don’t plan to increase rates if there’s a small shift in the base rate,” Sam Hodges, co-founder and managing director of Funding Circle told WSJ last year, ahead of the rate hike in December.

But policymakers expect the central bank to raise rates by 0.5 percent by the end of this year. Will that affect be of any consequence? Hard to tell.