p2p lending

Are We in a $300 Billion Market?

August 7, 2014 Earlier today on a large group conference call with Tom Green and Mozelle Romero of LendingClub, I learned a few more details about their business loan program. In the Q&A segment, one attendee came right out and asked if they believed their competition was merchant cash advance companies and online business lenders.

Earlier today on a large group conference call with Tom Green and Mozelle Romero of LendingClub, I learned a few more details about their business loan program. In the Q&A segment, one attendee came right out and asked if they believed their competition was merchant cash advance companies and online business lenders.

According to Green, it’s not so much other companies that they feel they are up against but more of the broad challenge of market awareness. Their struggle is about getting people to know that there are non-bank options available and to make people aware of their existence.

It’s the same challenge merchant cash advance (MCA) companies have been dealing with for more than a decade. Notably though, there are many in the MCA industry that feel the market is saturated and thus a lot of the industry’s growth has been fostered through a turf war for the same merchants. Stacking (the practice of funding merchants multiple advances or loans simultaneously) is partially spurred by a belief that there are no more untapped businesses left to fund. The acquisition costs of a brand new untouched business that is both interested and qualified is so high, that it is not a pursuit some funders and brokers can afford to take on.

Market Size

Market Size

At present, daily funders, which are a combination of both MCA companies and lenders that require daily payments, are funding somewhere between $3-$5 billion a year. On the call Green said he believed the potential market was far larger than that, though he discredited the $200 billion figure that some independent research had predicted. That was only because LendingClub believes the potential market is substantially higher, more like $300 billion.

$300 billion?! That’s about 100x larger than the current daily funder market combined and starkly contradicts any belief that there’s no merchants out there who haven’t already gotten funded.

LendingClub’s minimum gross sales requirement is $6,250 a month and they have an upper monthly gross threshold on applicants at $830,000 a month, though they’ve had businesses apply who do even more than that. Their sweet spot as Green put it, is the segment doing $16,000 to $416,000 gross per month.

I can’t help but notice that’s the same sweet spot that daily funders have. And we mustn’t forget, LendingClub’s target business owner has at least 660 FICO. If it’s a $300 billion market for good credit applicants, then it’s got to be even bigger for the ultra FICO-lenient companies in MCA.

What’s a business?

LendingClub only needs someone with at least 20% ownership to both apply for and guarantee the loan, an unheard of stipulation in the rest of alternative business lending. One cardinal rule in MCA has been that there needs to be at least 51% or 80% ownership signing the contract. That’s had a lot to do with the fact that most MCA agreements are not personally guaranteed and the signatory is required to have absolute authority to sell the business’s future proceeds.

Summer of Fraud

In 2013 the MCA industry experienced what many insiders dubbed the summer of fraud. Spurred by advances in technology, small businesses were applying for financing en masse while armed with pristinely produced fraudulent bank statements. Fake documents overwhelmed the industry so hard that today it is commonplace for underwriters to verify their legitimacy with the banks. This is done manually or with the help of tools such as Decision Logic or Yodlee.

In 2013 the MCA industry experienced what many insiders dubbed the summer of fraud. Spurred by advances in technology, small businesses were applying for financing en masse while armed with pristinely produced fraudulent bank statements. Fake documents overwhelmed the industry so hard that today it is commonplace for underwriters to verify their legitimacy with the banks. This is done manually or with the help of tools such as Decision Logic or Yodlee.

Knowing this firsthand, I asked LendingClub if they also take the care to verify bank statements. In the majority of cases they do not. They rely greatly on an algorithm that detects fraudulent answers on the application but the statements themselves are not scrutinized except in very high risk situations. Considering they’re wildly less expensive than MCAs, I find it odd that they are exposed to this type of risk. Fraudulent documents are the norm and in these underwriting conditions, I would expect them to charge as much or more than MCA companies, not less.

At the same time it’s important to mention that at present, business loans on their platform are only funded by institutional investors. Retail investors can only invest in consumer loans. LendingClub has been very transparent about excluding retail investors here for the very purpose of shielding them from unevaluated and unforeseen risk. My guess is that as time goes on, they will do more to validate the bank statements which is the bread and butter of assessing the risk and health of a business.

$300 billion

In a FICO flexible environment, it’s possible the potential for daily funders is at least $300 billion. If true, that would mean that for the 16 years that MCA players have been around, they barely reached even 1% of their target audience. I’ve been saying it since I’ve started this blog 4 years ago, every business owner I’ve spoken to has never heard of a merchant cash advance… which means saturation is a myth.

Tom Green was right, the real competition is public awareness. 99% of the potential market is untapped. If you’re fighting with 5 other companies over the same merchant, you gotta:

You gotta keep on looking now

Keep on looking now

You’re looking for love

In all the wrong places

Suspicious Listing on LendingClub

August 4, 2014While perusing LendingClub’s loan platform today, I came across a highly suspicious borrower. It’s member loan #23954784 who is currently a lab assistant in Albuquerque, NM. The reason for the loan request? “Other”.

This is what I suspect behind the scenes:

Six Signs Alternative Lending is Rigged

August 3, 2014There’s a lot of players at the alternative lending table but there are two that have won a string of lucky hands to put them on top. Neither were the first to draw cards, nor do either of them offer something that everybody else does not. These two lenders have something in common of course, special favor with the Internet gods. Is the game rigged?

OnDeck Capital is the most celebrated alternative business lender of our time. Their daily repayment loans and fast approval times are a hit with customers. In fact, as told in their recent securitization prospectus, OnDeck has been eroding its reliance on brokers and third parties to accommodate growth through their direct channel. Direct has been good for OnDeck, very good.

LendingClub on the other hand is the big dog in consumer lending, having funded more than $5 billion since inception. Every month they shatter the previous record for volume of loans funded and they’re expected to go public within the next year. LendingClub continues to pound their distant rival Prosper in monthly loan production. Are they just better at marketing?

Curiously I can’t help but notice they have something in common, they’re both owned by Google. Google Ventures led OnDeck Capital’s series D round and Google Ventures’ Karim Faris sits on OnDeck’s board of directors. Similarly, Google owns a minority stake in LendingClub.

While neither is outright owned or controlled, It’d be surprising if Google didn’t do something to foster the success of their investments. What could a billion dollar Internet giant possibly do to give them a little push?

Stop backlinking and SEO. The game is rigged

If you reproduce a search for the same keywords, you should know that results vary depending on what kind of device you’re using (mobile vs. desktop), what zip code you’re in, what time of the day it is, whether or not you’re logged into Gmail/Google+/Youtube, and whether you’ve searched for related topics before. I performed my searches with a fresh desktop browser on a Sunday evening in NYC with all cookies, cache, and Google account sessions wiped clean.

You might not get exactly what I get and I realize that obfuscates the conspiracy I’m trying to establish here. If you do witness peculiar keyword domination though, keep an open mind that there might be more going on than good SEO and strong natural backlinking brought on by mainstream media publicity. Plenty of big businesses that dominate offline fail to rank well in the top ten results online.

You might not get exactly what I get and I realize that obfuscates the conspiracy I’m trying to establish here. If you do witness peculiar keyword domination though, keep an open mind that there might be more going on than good SEO and strong natural backlinking brought on by mainstream media publicity. Plenty of big businesses that dominate offline fail to rank well in the top ten results online.

Search engines say that if you’re popular, you’ll rank well. But there are plenty of cases where ranking well has made businesses popular.

Maybe, just maybe the game is rigged…

Yield Baby Yield

July 30, 2014 Somebody once called business loans the Cadillac of Credit products and that person is Brendan Ross, the President of Direct Lending Investments (DLI). In a newsletter he put out in September 2013, he began by saying:

Somebody once called business loans the Cadillac of Credit products and that person is Brendan Ross, the President of Direct Lending Investments (DLI). In a newsletter he put out in September 2013, he began by saying:

Business loans are the Cadillac of credit products, with the highest yields and lowest default rates. Portfolio returns of 13-17% are the norm for successful underwriters – generally private, non-bank institutions.

He goes on to share his firm’s own investment success in these asset classes, claiming to be earning approximately 1% a month. DLI currently manages $48 million, all of which is deployed in alternative lending.

In today’s newsletter Ross admitted the goal is to “maintain unlevered, double-digit, investment returns.” With savings accounts today paying only fractions of a percent, double digits sounds too good to be true. But do you need $48 million to partake in the action?

The truth is you don’t. If you’re an ISO in the merchant cash advance industry you likely have the option to syndicate on your deals and if you’re friends with the right people you can syndicate on deals you don’t even originate.

But even then for folks who don’t have tens of thousands or hundreds of thousands at their disposal to recycle into deals, you can still strive for double digit returns through peer-to-peer lenders like LendingClub or Prosper. Through investments as small as $25 a pop you can participate in 3-5 year consumer loans that pay out monthly.

I myself opened a LendingClub account early this year to understand the experience and grew comfortable enough to begin amassing a real portfolio there. You can craft a portfolio based on your yield goals but the higher paying loans have much higher levels of default.

Investing in G-rated loans with an average annual interest rate of 25% doesn’t mean you’ll get that number or that you can even comfortably expect double digit returns. But you can try… And most do.

Investing in G-rated loans with an average annual interest rate of 25% doesn’t mean you’ll get that number or that you can even comfortably expect double digit returns. But you can try… And most do.

In fact the higher yielding loans are bought up fast and furiously every time LendingClub uploads a fresh batch to the platform. They’re added at four precise times a day: 9am, 1pm, 5pm, and 9pm EST. Savvy investors call each interval feeding time and the early bird truly gets the worm. By 9:03 a.m., hundreds of newly added loans are already fully funded and off limits to late investors looking to get the good stuff.

That doesn’t mean there is nothing to invest in if you log on an hour later, but the loans with the most desirable characteristics are nowhere to be found.

The average interest rate of my own portfolio is currently 15.72% a year before taking into account defaults. Using LendingClub’s sophisticated tools, I can compare how my portfolio is likely to play out against very similar ones on their platform (Same yield range with a minimum of 500 loans). Over the course of 30 months, it suggests that defaults will probably drop my actual yield below 10%.

I have a say in how it will actually play out. For instance if loans in Nevada and Florida are likely to default substantially more than loans in other states, then perhaps I can expect different results between a D-rated loan in Florida and one in Vermont. Using both experience as a merchant cash advance underwriter and the controversial article, The Joys of Redlining as a basis, I never make loans to consumers in Florida, Nevada, or California.

Logging into the platform between feeding times, I often notice an abundance of seemingly attractive but very available loans in those specific states.

Whether that and other aspects of my strategy allow me to prevail with consistent double digit returns is to be determined but I can’t help but contrast even a substantially worse outcome against my savings account which legitimately only pays .01% a year. Not 1% and not .1%. It actually pays .01%.

My S&P mutual funds meanwhile are up more than 6.5% this year already but stocks are far more volatile. I’d also like to add that rather than compare the performances of both and decide to choose 1 over the other, consumer lending is a great way to diversify your overall investment capital. An index fund diversifies your stock holdings but there were very few options for everyday people to invest in outside of the stock market until alternative lending came along.

I still keep some cash in the savings account, but much like Brendan Ross announced in his newsletter today, I’m going full speed ahead with buying loans. In 2014, you don’t have to have $48 million in assets to make the returns that institutional investors can. There’s yield to chase out there and anyone can grab it.

The Missing Puzzle Pieces

July 24, 2014 About 1% of my LendingClub consumer loan portfolio bounces their very first payment. It’s discouraging stuff, especially considering these loans range between 3 and 5 years. Granted, most manage to get caught back up at least for a little while.

About 1% of my LendingClub consumer loan portfolio bounces their very first payment. It’s discouraging stuff, especially considering these loans range between 3 and 5 years. Granted, most manage to get caught back up at least for a little while.

LendingClub, like the rest of the alternative lending industry relies on ACH debits to retrieve those monthly payments. I’ve published my feelings before on single monthly debit payment systems (they’re like roulette). Out of 30 days of the month, you’re betting on the balance being available on just 1 particular day. When I noticed that 1% of my borrowers were failing right out of the gate, it validated two practices that originated in the merchant cash advance industry, daily payments and the analysis of historical cash flow.

For all the underwriting data points that LendingClub offers its investors, I don’t get to see average daily bank balance, overdraft activity, NSF data, or anything at all related to the borrower’s bank account. Ironically, many merchant cash advance companies consider that data to be the single most important piece of assessing a deal.

The problem my 1%-ers have is not a credit problem or a stable income problem, it’s a cash flow problem. You can have 750 credit and be broke. You can have a good job with a hefty salary and be broke. You and I knew this already, which is why it’s odd that LendingClub and other p2p lenders like them still rely mainly on employment data and FICO score.

What I want to know is if the borrower is broke…

That’s something that LendingClub can’t tell me and doesn’t know. Hence a good looking borrower like the one mentioned below, missed the first payment. That led to a negotiation for a reduced monthly payment. They then failed to pay even the reduced amount.

This was a very low risk B1 note. The borrower is a nurse that has worked at their current job for 5 years. They had over 700 credit and very little revolving debt, only $5,500 (compared to some on the platform that have more than 50k!). It was a 3 year loan and it has blown up in my face.

The borrower is broke and nobody knew it.

The Missing Puzzle Pieces

The Missing Puzzle Pieces

This borrower may very well have done better with a change in how the deal was both underwritten and structured. With daily payments:

- The borrower will know exactly how much cash they can really spend on any given day. They don’t have to worry about trying to set aside for that one big day.

And

By examining their last 3 months bank transactions:

- Their payment plan will be based on more relevant data. There are 3rd party tools like yodlee that consumers could connect their bank accounts to, so at the very least LendingClub could see what’s really going on. Why business lenders consider this essential while consumer lenders completely ignore this, I don’t understand. Business lender Kabbage for example requires applicants to connect their bank accounts in the application process before they even type in their business address. It is the single most important part of their underwriting.

Picking loans on LendingClub is like trying to complete a puzzle without half the pieces. If you guessed the puzzle on the right was an ocean scene with dolphins playing because of the pretty blue border pieces, you were wrong. It’s actually a picture of a guy on a boat holding a bank statement that shows a negative $3,000 balance and 10 NSFs.

Oops…

LendingClub Anti-Money Laundering: Too far?

July 16, 2014 Perhaps as part of wider governmental banking pressure, p2p platform LendingClub has instituted a new controversial Anti-Money Laundering policy. The new rule is that you can only connect your investment account to 1 bank account for deposits. This isn’t a technical limitation since as of recent, you could update your bank information at any time. I regularly made deposits to LendingClub from 2 checking accounts but no longer can I do this.

Perhaps as part of wider governmental banking pressure, p2p platform LendingClub has instituted a new controversial Anti-Money Laundering policy. The new rule is that you can only connect your investment account to 1 bank account for deposits. This isn’t a technical limitation since as of recent, you could update your bank information at any time. I regularly made deposits to LendingClub from 2 checking accounts but no longer can I do this.

What’s even weirder is that if you moved from 1 bank to another, you can’t even update the new correct information. You’re cut off. In such a situation, LendingClub offers a high tech alternative, mailing in a paper check from the new account. Why this is more acceptable I do not know.

In my call to LendingClub to complain, they were adamant that all such restrictions were necessary to prevent money laundering. Recalling the discussion now, I think the investment services rep used the term money laundering more than 20 times. Realizing that they wouldn’t budge, I asked if I could update my account information just one last time so that it reflected my main checking account. The answer was ‘no’, due to possible money laundering of course.

So what do you do if you changed banks?

LendingClub said fear not, at regular specified intervals which they cannot reveal, they will allow you to update your banking information. So if you need to update your account info, all you can do is check every day to see if the ban message has gone away. Only then can you update. Better make it a bank account you plan to use for the long haul.

—-

Could the move be due to governmental pressure in the banking and lending markets? I suspect it is.

Making Cents of Short Term Business Lending

June 22, 2014Where do you see yourself in 5 years? Perhaps you’ve seriously planned what you’ll be doing in mid-2019 or maybe you at least have an idea of how things will play out. It’s only a half a decade after all so how hard could it be to foresee the future?

Surely all of us saw the DOW surging 5 years ago and got rich right?

Did New Yorkers factor Hurricane Sandy into their 5 year plan back in 2009?

It’s only 5 years, what could possibly happen to a small business in that time?

As I recently logged onto LendingClub to invest in consumers loans, I began to wonder just how safe the 60 month terms were. Not that I have a lot of options since LendingClub only offers 3 or 5 year terms, but the latter is unquestionably risky. The borrower might look good now, but where in the heck will they be in 5 years? I can’t even begin to guess.

Mortgages, student loans, and car leases aside, I can think of very few reasons to use a 5 year loan from a personal perspective, mainly because that’s an extremely long commitment. For a small business, such a term far exceeds the rationale behind “working capital”, the reason oft-cited by businesses seeking less than $200,000.

The Small Business Administration’s website speaks of this:

Businesses that are seasonal or cyclical often require more working capital to stay afloat during the off season. Although your company may make more than enough to pay all its obligations yearly, you must ensure you have enough working capital at any one time to meet your short term obligations. For example, a company may do significantly more business over the holidays, resulting in large payoffs at the end of the year. However, the company must have enough working capital to buy inventory and cover payroll during the off season as well, when revenues are lower.

Working capital may come in handy for something like inventory for which the business probably expects to sell it all off in less than a year. Can you imagine still making monthly payments in 2019 for inventory you bought with a loan in 2014?

I bet this guy can’t:

And if the financial picture looks great and they have a long term need, why not go out 5 years?

Verizon replaced Washington Mutual. But a Verizon store, that will last forever…

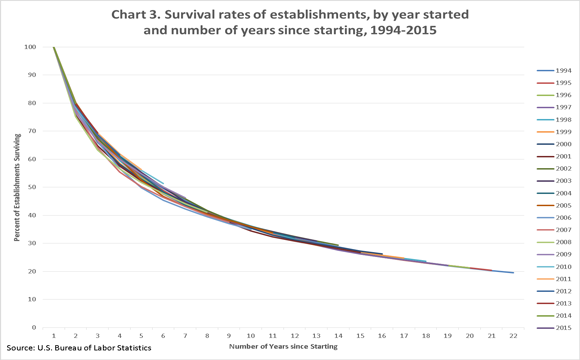

Only 41.1% of retail businesses live to experience their 5th birthday.

And even then when business types are aggregated, making it past year 5 doesn’t ensure lifelong success. Don’t confuse established with safe:

In fact, even borrowers are opting for shorter term loans with higher interest rates than long term loans with lower interest rates. Part of that is due to the lower net dollar cost paid for the loan said OnDeck Capital CEO Noah Breslow in an interview with Peter Renton:

5 years ago I used to spend way too much time on Instagram. Oh wait, no I didn’t… there was no such thing as Instagram.

What do you think is the best bet for this CD store? A 3-6 month working capital loan or a 5 year term loan?

Giving a borrower a lengthy repayment term ensures they will be able to pay you back right?

Above is the result of my $25 contribution towards a 5-year LendingClub loan issued on May 16th. They missed the very first payment. I’m really looking forward to the next 59 months…

In 2019, everything will be business as usual, won’t it Madam President…

As short term business lending critics herald the emergence of 3-5 year term business loans, I think it’s important to remember that they are catering to a market that likely has different goals. Long terms are often not appropriate for borrowers with working capital needs. The CEO of RapidAdvance, Jeremy Brown discussed this in an article he wrote for DailyFunder more than a year ago.

Our industry is based on providing working capital to merchants. By its very definition, working capital is less than 12 months. Longer term deals are permanent capital, even when they are repaid over 15-24 months.

As a borrower, the very idea of committing yourself to monthly payments 5 years from now should be considered very seriously. The average length of a marriage prior to a divorce is 8 years. For past or future divorcees, a 5 year loan is more than half as long as a marriage!

Alternative lenders should be asking themselves if they really have the data and underwriting skills necessary to make accurate predictions that far out in the future. Working capital underwriting models are not applicable as long term assessments.

If you’re going to make 5 year business loans, make sure to take advantage of Google maps. Take a look back at the business location and the ones surrounding it over the last few years. You may not feel so safe about your investment…

Exponential Finance

June 15, 2014 Last week, DailyFunder was a media sponsor of Exponential Finance presented by Singularity University & CNBC. It was a totally different atmosphere from some of the other events I’ve been to this year already (Transact 14, LendIt, etc.). In the upcoming July/August issue of DailyFunder magazine, I’ve got a column that summarizes the event that I think you’ll like.

Last week, DailyFunder was a media sponsor of Exponential Finance presented by Singularity University & CNBC. It was a totally different atmosphere from some of the other events I’ve been to this year already (Transact 14, LendIt, etc.). In the upcoming July/August issue of DailyFunder magazine, I’ve got a column that summarizes the event that I think you’ll like.

Exponential Finance brought together leading experts to inform financial services leaders how technologies such as artificial intelligence, quantum computing, crowdfunding, digital currencies, and robotics are impacting business. And my mind = blown.

Some tweets to hold you over:

Robots may be coming to a bank near you: http://t.co/r0PlWUrYqU #xfinance pic.twitter.com/WYWUhZIUaD

— CNBC Social Team (@CNBCSocial) June 10, 2014

"The more data you produce, the more organized crime will consume." Goodman’s Law. #xfinance Be prepared!

— Exponential Finance (@xfinance) June 11, 2014

"Banks charge 32B in overdraft every year…that's almost as much as the gov. spends on food stamps." – Customers Bancorp CEO at #xfinance

— CNBC Social Team (@CNBCSocial) June 11, 2014

"It is no coincidence that Satoshi Nakamoto published this paper [on Bitcoin] during the financial crisis." #xfinance pic.twitter.com/a9eCWO7OXi

— CNBC Social Team (@CNBCSocial) June 11, 2014

Robots are going to steal your finance job:

I also had the chance to do a Q&A with a longtime prominent U.S. Congressman. The next issue should be available in about 3 weeks.