Online Lending

Amazon Now Among The Top Online Small Business Lenders in The United States

May 8, 2019

Amazon has joined PayPal, OnDeck, Kabbage, and Square as being among the largest online small business lenders. On Tuesday, Amazon revealed that it had made more than $1 billion in small business loans to US-based merchants in 2018. Amazon says the capital is used to build inventory and support their Amazon stores.

By selling on Amazon, “SMBs do not need to invest in a physical store or the costs of customer discovery, acquisition, and driving customer traffic to their branded websites,” the company says. Small and medium-sized businesses selling in Amazon’s stores now account for 58 percent of Amazon’s sales. More than 200,000 SMBs exceeded $100,000 in sales on Amazon in 2018 and more than 25,000 surpassed $1 million.

You can view the full report they published here.

| Company Name | 2018 Originations | 2017 | 2016 | 2015 | 2014 | |

| PayPal | $4,000,000,000* | $750,000,000* | ||||

| OnDeck | $2,484,000,000 | $2,114,663,000 | $2,400,000,000 | $1,900,000,000 | $1,200,000,000 | |

| Kabbage | $2,000,000,000 | $1,500,000,000 | $1,220,000,000 | $900,000,000 | $350,000,000 | |

| Square Capital | $1,600,000,000 | $1,177,000,000 | $798,000,000 | $400,000,000 | $100,000,000 | |

| Amazon | $1,000,000,000 | |||||

| Funding Circle (USA only) | $792,000,000 | $514,000,000 | $281,000,000 | |||

| BlueVine | $500,000,000* | $200,000,000* | ||||

| National Funding | $494,000,000 | $427,000,000 | $350,000,000 | $293,000,000 | ||

| Kapitus | $393,000,000 | $375,000,000 | $375,000,000 | $280,000,000 | ||

| BFS Capital | $300,000,000 | $300,000,000 | $300,000,000 | |||

| RapidFinance | $260,000,000 | $280,000,000 | $195,000,000 | |||

| Credibly | $290,000,000 | $180,000,000 | $150,000,000 | $95,000,000 | $55,000,000 | |

| Shopify | $277,100,000 | $140,000,000 | ||||

| Forward Financing | $210,000,000 | $125,000,000 | ||||

| IOU Financial | $125,000,000 | $91,300,000 | $107,600,000 | $146,400,000 | $100,000,000 | |

| Yalber | $65,000,000 |

Small Businesses Rank Online Lenders More Transparent Than Big Banks

April 16, 2019When it comes to business loans, small businesses say online lenders are more transparent than big banks.

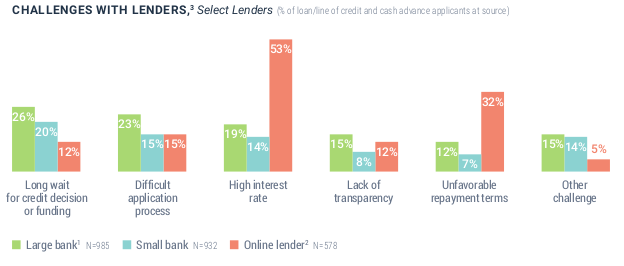

Specifically, 15% of respondents to a Federal Reserve survey reported challenges with transparency experienced at big banks versus only 12% with online lenders. Small businesses also ranked big banks worse on credit decision wait times, application process difficulty, and other unspecified challenges.

The Federal Reserve survey examined small businesses with less than 500 employees.

Small banks fared the best on transparency, payment terms, and interest rates.

Direct Lending Fund CEO Resigns, Investigation

March 20, 2019

Direct Lending Fund CEO Brendan Ross, has resigned, according to Bloomberg News and numerous individuals identifying themselves as investors on an industry blog. The fund not only lost nearly 25% of its portfolio in a single sour investment, but it’s reported that they may have overvalued its investments in QuarterSpot’s small business loan platform.

The fund was reputed as one of the largest funds in the online lending industry and one that “historically earned investors unlevered double digit returns” by investing in online loan marketplaces.

Were there signs of problems?

In a tell-all book published by DealStruck founder Ethan Senturia in late 2017, Senturia describes how Ross’s fund had been overly dependent on his company’s success. “I am like, literally staring over the edge. My life is over,” Senturia quotes Ross as saying in Unwound when he became aware of DealStruck’s downward spiral*. Despite this characterization, Ross’s fund continued to grow relatively unscathed.

Meanwhile, James R. (“Jim”) Hedges, IV wrote an op-ed in Mid-2017 on Lend Academy of a mystery fund he refused to identify that had a Bernie Madoff-feel to it. In the comments, users point out that the monthly returns matched the ones on Direct Lending’s investor letters.

“When I first saw these returns, I instinctively thought of Madoff,” Hedges wrote. “The narrow band of returns is, in my experience, highly unusual and inconsistent with the returns of investments being marked-to-market. To be clear, I am not saying that this fund is a fraud. I am stating that the performance they’ve reported is, in my experience, unlikely indicative of a valuation methodology that accurately reflects the month-to-month performance of the underlying assets.”

*DealStruck announced a restructuring in December 2018

Elevate Reflects on Success of Fintech in Personal Loans

February 21, 2019The unsecured personal loan market hit an all-time high in 2018, jumping 17 percent year-over-year to $138 billion, according to data from TransUnion released today and featured in a CNBC story.

“The rapid growth in consumer loans sits squarely on the shoulders of fintechs,” said Jason Laky, senior vice president and leader of TransUnion’s consumer lending line of business. “They continue to be the main driver.”

According to the data, fintech companies, like LendingClub, Prosper and Elevate, issued 38 percent of all U.S. personal loans last year, which is up from 35 percent in 2017 and just five percent in 2013. Conversely, banks’ market share for unsecured personal loans is shrinking. Traditional banks’ share of these loans is down to 28 percent from 40 percent five years ago.

Will this trend continue? The non-bank consumer lenders think so.

Credit unions are down to 21 percent from 31 percent in the time period. While their market share shrank, they still saw overall growth in total loan balances, according to Laky.

“Although regulations are starting to loosen, banks still cannot provide the kind of emergency funds that so many Americans need,” Chief Operating Officer of Elevate Credit Jason Harvison told deBanked via email.

He said that the rise of the gig economy has created near-constant income volatility for a large number of Americans and cited a recent JP Morgan Chase study that found that 41% of U.S. households experience income fluctuations of 30% or more month-to-month.

“Many consumers who need access to funds quickly in order to weather financial emergencies can’t access personal loans from banks,” Harvison said. “Online lenders can help fill this void.”

By lending to non-prime borrowers, do these lenders worry a lot about what might happen in an economic downturn?

“We’ve found in past downturns that non-prime consumers actually fare better than prime,” Harvison said. “Essentially, non-prime consumers are always living their lives in a state of “recession.” They experience income volatility, job insecurity, and a lack of access to necessary financial products. They live like this every day, and therefore know how to weather these challenges.”

‘Peers’ Are Almost Gone From Lending Club’s Funding Mix

February 20, 2019 Long gone are the days of peer-to-peer lending.

Long gone are the days of peer-to-peer lending.

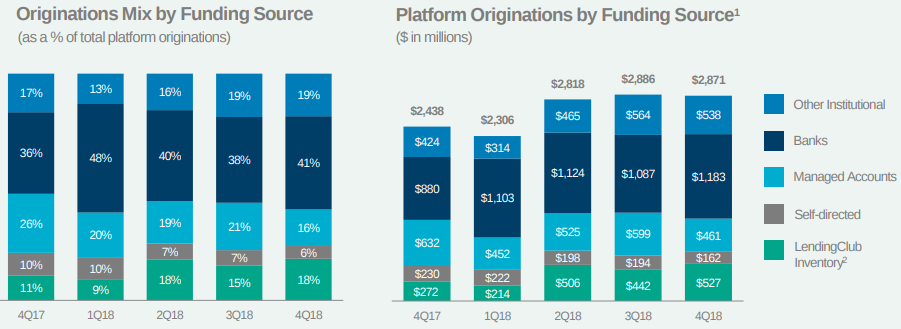

On Tuesday, Lending Club, a pioneer in the peer-to-peer lending space, reported that only 6% of its Q4 originations came from individual self-managed accounts. Accounts professionally managed for individuals made up 16%, with the rest of the loans being funded by a combination of banks, institutions, and Lending Club itself.

Nearly 4 years ago, the ratio was flipped. Self-managed accounts made up 24% of originations in early 2015 and accounts professionally managed for individuals made up 51%.

Despite the changes, Lending Club still identified itself as a “marketplace connecting borrowers and investors” in its Q4 2018 earnings report. A review of the site revealed that it is still possible for individual investors to manually review unfunded loans on the platform and invest in them, though it prods investors to rely on Lending Club’s automated investing strategy instead. The implication for manual investors is obvious, that banks, institutions, automated investment algorithms, and Lending Club itself are more likely to fully fund the best borrowers before the individual has a chance to even see them on the platform.

According to the blog of LendItFintech co-founder Peter Renton, Lending Club is producing among the lowest returns of any platform in the field, with his own accounts generating from 1.57% a year to 4.35% a year.

LendingPoint Gets Even More Financing

February 4, 2019LendingPoint announced today that it has closed an increase of its mezzanine funding, a hybrid of debt and equity financing. The company’s mezzanine financing now totals more than $67.5 million. Paragon Outcomes Management LLC is the primary investor and was joined for this round by an unnamed co-investor.

“Paragon Outcomes continues to provide outstanding support for the growth of the LendingPoint platform and balance sheet,” said Tom Burnside, LendingPoint co-founder and CEO. “Their support enables us to continue to build our high performing balance sheet and fuels our march towards profitability quarter. To have companies like Paragon Outcomes want to be part of our future is a strong wind at our back.”

This is a continued expansion of an initial credit facility from Paragon Outcomes for $20 million in 2017, followed by an increase to $52.5 million in June 2018.

LendingPoint provides consumer loans of up to $25,000 and has a platform, called LendingPoint Merchant Solutions, that allows merchants to offer loans to their customs for point-of-sale purchases.

In addition to today’s announcement, LendingPoint also secured an up to $500 million senior credit facility in August 2017 and an up to $600 million senior credit facility in May 2018. Both deals were arranged by Guggenheim Securities.

Founded in 2014, LendingPoint is a privately held company headquartered in Kennesaw, GA with offices in San Diego, CA.

Multimillionaire CEO Claims Predatory Lenders are Causing Him to Sell His Furniture for Food

November 22, 2018 Two months ago, a billionaire hedge-fund manager named Philip Falcone, the 377th richest person in the United States who once “put the squeeze on Goldman Sachs,” led a Virginia-based investment group to make a strategic purchase of a local Telemundo TV station in Columbus, Ohio. The seller, a company led by local businessman Richard Schilg, pocketed a lavish sum of $850,000, according to the Columbus Dispatch.

Two months ago, a billionaire hedge-fund manager named Philip Falcone, the 377th richest person in the United States who once “put the squeeze on Goldman Sachs,” led a Virginia-based investment group to make a strategic purchase of a local Telemundo TV station in Columbus, Ohio. The seller, a company led by local businessman Richard Schilg, pocketed a lavish sum of $850,000, according to the Columbus Dispatch.

Two months later, Schilg, who is 61-years old, had become so poor and destitute that he would have to sell his furniture just to buy food. That’s what Bloomberg Businessweek says of Schilg in its purported tell-all piece about predatory lending. Though Schilg successfully negotiated a deal with a Wall Street billionaire, he apparently was outmatched and “unable to defend himself” when it came to much less sophisticated transactions at his other business, Pathmark HR, a human resources company located 15 miles outside of Columbus.

Pathmark HR is anything but small. At the end of 2017, Schilg’s company was on track to gross $20 million a year in sales. Along the way, he engaged in commercial finance transactions that required the sale of future receivables, non-loan arrangements that businesses use to fuel their growth.

They did not go as planned. Multiple financial companies obtained judgments to enforce the contracts that Pathmark HR had entered into, NY State court records confirm. Schilg told Bloomberg Businessweek that “your life is ruined by their contract.”

But if that’s the case, it stands to reason he wouldn’t enter into one again.

Pathmark HR kept applying for more of these things, industry insiders told deBanked, though the stream of judgments filed against his business from competitors offering similar products have served as a veritable red flag for underwriting departments. That would’ve created a problem for Pathmark HR if it intended to rely on that type of capital going forward.

That’s when a straw man appeared.

According to a purported (and admittedly unauthenticated) corporate resolution reviewed by deBanked, Schilg appears to have transferred his majority interest in Pathmark HR to an 82-year old minority shareholder named Robert Renzetti, who lists a small mobile home more than 1,000 miles away in Sarasota, FL as his residence.

There’s a catch. The corporate resolution (dated in 2017) says that Schilg can just buy the shares back from Renzetti in the future. Either way, several finance companies said they received applications for capital from Pathmark HR up through and including this year, with only Renzetti’s name and information included. Schilg’s is nowhere to be found.

Schilg, who Bloomberg Businessweek portrays as so poor that he’s more-or-less eating his household furniture to stay alive, is the former founder, chairman and CEO of Team America Corp, a staffing organization that grew to more than $350 million in annual sales by 1999. That’s more than $500 million at today’s value, larger than almost every single alternative funder that deBanked ranked in 2018.

Meanwhile, the only thing that separates Schilg from the sale of his TV station to a billionaire is FCC approval. Hopefully the man has enough furniture to see it through.

This is the second in a series of articles relating to a fanciful tale in Bloomberg Businessweek

LendingClub Funds $1 Billion in CLUB Certificates

November 20, 2018LendingClub announced today that it has funded $1 billion in CLUB Certificates, in just under a year since the company introduced the offering. According to its website, CLUB Certificates are “pass-through securities with CUSIP numbers backed by LendingClub prime or near prime personal loans.”

What does this mean? LendingClub was unreachable at the time, but LendAcademy researched it in December 2017 when the product was announced and indicated that the initiative was prompted by a potential investor who did not want to invest in whole loans, which can have a duration of several years. Instead, the investor wanted a security that acted like a whole loan, but had liquidity.

The result, according to LendIt, was the LendingClub CLUB Certificate, a security with an identification code that is cleared by the Depository Trust & Clearing Corporation (DTCC) and could be traded in over-the-counter markets. Furthermore, LendIt wrote in the December 2017 story that the deal that precipitated the LendingClub CLUB Certificate was “a $25 million deal that was sold to one investor and in keeping with Dodd-Frank rules LendingClub retained 5% of the deal total on their balance sheet.”

“We continue to innovate for investors and diversify our investor base,” said Valerie Kay, Chief Capital Officer of LendingClub. “By continually innovating on products, LendingClub expects to further deepen and broaden investor access in 2019 and beyond through a variety of new products and structures.”

CLUB Certificates can be seen on Bloomberg and Intex with the “CLUBC” ticker.

In the third quarter of 2018, LendingClub posted record originations of $2.9 billion, up 18% year-over-year. Founded in 2006 and headquartered in San Francisco, LendingClub offers fixed rate business loans from $5,000 to $300,000 and personal loans of up to $40,000.