OppFi Encouraged By Early Results With Bitty

November 10, 2024OppFi achieved a new record in Q3.

“The record quarterly net income was a result of credit initiatives that continue to drive strong loss payment and recovery performance, marketing cost efficiency and prudent expense discipline across the organization,” said OppFi CEO Todd Schwartz during the quarterly earnings call. One part of that organization is Bitty Advance, which it acquired a 35% stake in this past summer. “We are encouraged by the early results and potential opportunity of this platform and the strength of our relationship with Bitty,” Schwartz said of the progress so far. “We continue to explore similar opportunities that would be accretive and align with OppFi’s strategic vision.”

One analyst on the call inquired further about what similar opportunities Schwartz might be referring to on the M&A front. Schwartz responded with the following:

I mean I think whatever it is, it’s got to be something that’s highly accretive. I mean, OppFi’s vision is to be a platform for digital alternative financial service products where we see large supply-demand imbalances in large addressable markets. There’s definitely different profiles of business out there, different situations are pretty — it’s pretty bespoke, but we’re prepared to handle either-or. So it has to make sense for us, though. And obviously, we’re going to protect and mitigate risk with anything we do to make sure that it’s successful and make sure that we’re going to be getting a return on our capital and it’s highly accretive to shareholders.

eBay: ‘We’ve Already Done $40M in MCAs’

November 3, 2024 eBay is coming in hot to the small business financing game. The company reported that it had connected merchants with $100M in funding YTD, over $40M of it being “business cash advances” through Liberis alone.

eBay is coming in hot to the small business financing game. The company reported that it had connected merchants with $100M in funding YTD, over $40M of it being “business cash advances” through Liberis alone.

Liberis is a UK-based company that expanded into North America 4 years ago. It secured $112M in debt funding last year. The partnership between Liberis and eBay only started this past July. eBay’s other big funding partner is Funding Circle.

eBay’s role as a facilitator for funding follows what every other major e-commerce platform is doing. For example, Amazon, Shopify, Walmart, Lightspeed, and DoorDash all offer funding to sellers on their platforms. Technically, eBay was the first considering it had originally partnered up with Kabbage back in 2010. That relationship did not last, however.

PayPal is Back to Growing its Merchant Lending Program

October 29, 2024 After taking drastic action over the last year to rein in surging SMB lending charge-offs, PayPal believes it has corrected the issue.

After taking drastic action over the last year to rein in surging SMB lending charge-offs, PayPal believes it has corrected the issue.

“We have now fully lapped the actions taken last year to tighten credit underwriting and reduce on balance sheet risk,” said PayPal CFO Jamie Miller on the Q3 earnings call. “We’re seeing better performance across the portfolio, and have now started to modestly grow merchant originations. We’ll continue to prudently manage the portfolio’s exposure with the goal of sustaining our balance sheet-business model, while providing our customers with more ways to manage their cash flow, spending and borrowing needs.”

The reduction in originations since the pullback had been severe, down by as much as 50% by deBanked’s prior estimates.

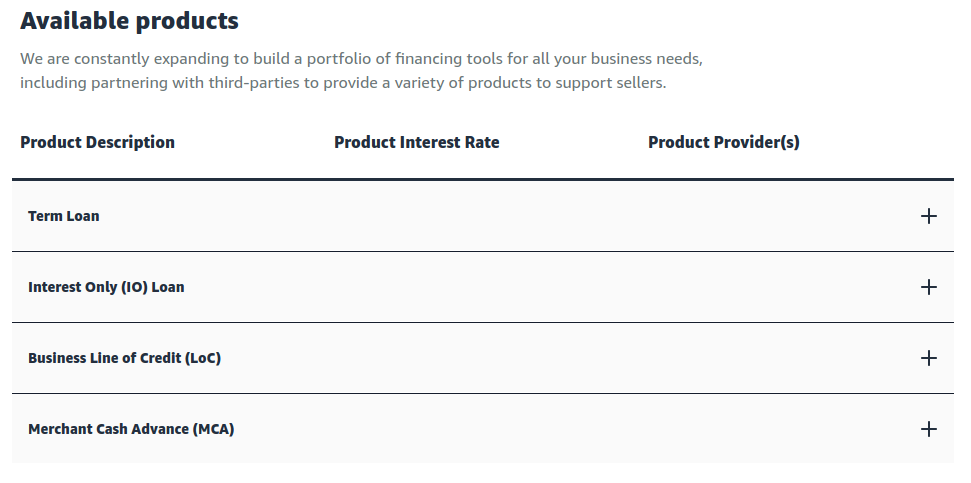

TikTok is Now Offering Business Financing

October 7, 2024 Add TikTok to the list of tech platforms offering business loans. TikTok Shop Capital is now “offering sellers access to fast and flexible business financing,” the company states on its website. Unsurprisingly, one of TikTok Shop’s partners is Parafin but the company also lists Storfund and Kanmon as funding partners. Storfund announced its deal with TikTok earlier today and said that its program would be called Daily Advance.

Add TikTok to the list of tech platforms offering business loans. TikTok Shop Capital is now “offering sellers access to fast and flexible business financing,” the company states on its website. Unsurprisingly, one of TikTok Shop’s partners is Parafin but the company also lists Storfund and Kanmon as funding partners. Storfund announced its deal with TikTok earlier today and said that its program would be called Daily Advance.

“TikTok is not a lender or loan broker,” the company website states. “TikTok partners with third-party lenders and financing providers to offer TikTok Shop sellers business financing options.”

The process works different depending on which solution a customer uses. For example, Storfund repayments are automatically debited from TikTok Shop payouts, Parafin repayments are automatically debited from the business bank account associated with TikTok Shop payouts, and Kanmon requires repayment via auto-pay deductions from the business bank account provided during the application process.

The Parafin option does not appear to be a standard merchant cash advance. TikTok says it would actually be a Parafin commercial flex loan issued by Celtic Bank. There is no credit check required for it.

TikTok’s foray into business financing is invite-only. “If a seller has an available pre-qualified and/or pre-approved offer, it will appear within Seller Center under the Finances tab,” the website says.

How the Amazon / Parafin Merchant Cash Advance Deal Came to Be

November 2, 2022Back in December, Parafin, then a fintech startup with 20 employees, submitted a proposal to Amazon to roll out a potential Amazon merchant cash advance product. At the time, Parafin was little known to the general public and its surprise deal with DoorDash wouldn’t even become public until a month later.

The prospect of an MCA would not have been foreign to Amazon given that the company already offers direct business loans, lines of credit through Marcus by Goldman Sachs, and other loans thanks to a successful pilot with Lendistry. But the team behind Parafin were virtual unknowns in the merchant cash advance industry itself. The company’s 3 co-founders, including CEO Sahill Poddar, all hail from Robinhood, the investment app that became wildly popular especially with younger adults over the last several years.

The prospect of an MCA would not have been foreign to Amazon given that the company already offers direct business loans, lines of credit through Marcus by Goldman Sachs, and other loans thanks to a successful pilot with Lendistry. But the team behind Parafin were virtual unknowns in the merchant cash advance industry itself. The company’s 3 co-founders, including CEO Sahill Poddar, all hail from Robinhood, the investment app that became wildly popular especially with younger adults over the last several years.

Coincidentally, more than a dozen people employed by Parafin, including the co-founders, are former Robinhood employees, according to profiles reviewed on LinkedIn. It’s part of a trend, it appears, as other members of their team hail from well known Silicon Valley firms like Lending Club, Stripe, Funding Circle, Google, Amazon, Facebook, StreetShares, and more.

Ultimately, Parafin’s big bet paid off. On Tuesday, November 1st, Amazon announced that the Parafin team was the one it had chosen to debut its official merchant cash advance product.

“Amazon is committed to providing convenient and flexible access to capital for our sellers, regardless of their size,” said Tai Koottatep, director and general manager, Amazon WW B2B Payments & Lending, in the announcement. “Today’s launch is another milestone in strengthening Amazon’s commitment to sellers, and builds on the strong portfolio of financial solutions we already provide. This latest offering significantly expands sellers’ reach and capabilities, and broadens their access to capital in a flexible way—one that helps them control their cashflow, and by extension, their entire business.”

“We founded Parafin with the mission to grow small businesses, and we’re thrilled that we have the opportunity to do that by providing Amazon sellers with this merchant cash advance option,” said Vineet Goel, co-founder of Parafin. “It’s a privilege to count ourselves among Amazon’s suite of financial solutions, and we look forward to making a difference for Amazon.com sellers looking to expand their business.”

The product is already listed on Amazon’s website and was rolled out to some US businesses immediately. It will be available to hundreds of thousands of additional sellers by early 2023, the company claims.

Unique to an Amazon MCA is that funding amounts can start as low as $500 and go up to $10 million.

Amazon’s entrance into the merchant cash advance market coincides wih a unique moment in the product’s history as several states are in the midst of imposing strict regulations on their sale.

Broker Fair 2022 Photos

October 25, 2022The Broker Fair 2022 Photos can be FOUND HERE. Thank you so much to all the sponsors and attendees!

Ready for what’s next? deBanked returns to Miami Beach on January 19th! Registration is now open. For questions, email events@debanked.com.

Lavu Adds MCA Product Through Partnership With Parafin

October 7, 2022 It’s not just DoorDash that Parafin has partnered up with to provide MCA funding. Last week, the restaurant software company Lavu launched Lavu Capital to help restaurants owners access capital.

It’s not just DoorDash that Parafin has partnered up with to provide MCA funding. Last week, the restaurant software company Lavu launched Lavu Capital to help restaurants owners access capital.

“We are a restaurant software company that focuses on small and medium restaurants,” said Saleem S. Khatri, CEO of Lavu. “Think of your favorite restaurants that have one or two locations that are really really popular, that are ingrained in the community. We do everything from point of sale to online ordering, payment processing, and anything a restaurant would need to start and grow their business.”

Khatri said that one thing they noticed is that these restaurants have a fundamentally hard time getting loans and that led them to connect with Parafin. Parafin’s product is an advance on future sales, not a loan, and their offerings have been simply integrated into Lavu’s technology. Parafin automatically generates an offer for restaurant owners that they can see in their Lavu dashboard.

“…it’s just really beautifully designed,” said Khatri. “It basically says, ‘Hey, you have an offer to borrow up to $5,000. Do you want it yes or no?’ And you just click ‘yes’ and you’re good to go, the money deposits straight into your bank account, and then you have a repayment schedule. And it just pulls it directly from your bank account according to that repayment schedule.”

Khatri says they haven’t really begun to market the product yet and they’ve just started off with a limited base of customers but that the plan is to roll it out to all their customers around the US. They’d even do it with their customers outside of the US if they could, but the tech is not set up to do that just yet.

“This is going to be a feature and an offering that really really benefits our customers because it gets to the heart of what they need, which is they’re in constant need of liquidity, they’re in constant need of kind of tools to run their business better,” Khatri said. “And it just really fits our portfolio of products that we offer to these customers. So the reception has been awesome.”

Think The New California Disclosure Law is Just About a Disclosure Form? Think Again

September 13, 2022 “We’re one of the good guys so of course we’ll comply and include the form with our contracts.”

“We’re one of the good guys so of course we’ll comply and include the form with our contracts.”

Variations of the above phrase have been oft-repeated in the last few months by participants in the commercial finance industry when queried by deBanked about California’s new disclosure law. Several companies have shared that they are prepared for what’s to come, but are they? The regulations go into effect on December 9th and begin a new chapter of compliance for the industry.

Though one might be aware that California will require specific disclosures on commercial finance contracts (including purchases of future sales), Katherine C. Fisher, Partner at Hudson Cook, LLP, explained that the breadth of the state’s law will likely require changes to a funding company’s operational processes as well. Fisher told deBanked that there’s not just the matter of disclosing but also the matter of what triggers a disclosure having to be made. What might otherwise be considered the normal discourse between a funding provider and a customer prior to a deal being consummated is now an area requiring close examination.

“If a broker sends a text to a merchant with the offers, could it trigger this?” is one scenario she posed about the threshold for disclosure.

The funding provider needs to know the answer because once the disclosure requirement is triggered, the broker needs to relay back the details of the offers made, the specific disclosures provided, and the timestamp of when this took place. All of this data then needs be stored by the funding provider to maintain compliance.

And funding providers will need to be vigilant.

“The funder is responsible for broker compliance,” Fisher said.

The entire process of who-said-what, when, and how will suddenly become a realm requiring tight control it seems. And that all comes back to the form itself, which is not all that simple either.

California will require funding providers to estimate an APR on a purchase transaction using one of two methods: the Historical Method or the Underwriting Method. While the methodology selected is probably best left to qualified counsel to assist with, the likely deviation of a future estimated APR from a backwards-looking APR was a reality considered by state regulators. To bridge this gap, California requires that funding providers disclose reasonably anticipated true-up scenarios. A true-up in this instance refers to the already well-established option for a merchant to perform a monthly reconciliation of payments if the amount collected is above or below the purchased percentage specified in the contract.

California will require funding providers to estimate an APR on a purchase transaction using one of two methods: the Historical Method or the Underwriting Method. While the methodology selected is probably best left to qualified counsel to assist with, the likely deviation of a future estimated APR from a backwards-looking APR was a reality considered by state regulators. To bridge this gap, California requires that funding providers disclose reasonably anticipated true-up scenarios. A true-up in this instance refers to the already well-established option for a merchant to perform a monthly reconciliation of payments if the amount collected is above or below the purchased percentage specified in the contract.

Though the very nature of the reconciliation is a consequence of not being able to predict the future exactly, California’s law requires that funding providers disclose the dates and amounts of the true-ups that they reasonably anticipate. Such concepts and mathematics, once perhaps the subjective domain of a funding provider’s in-house underwriters will soon be subject to regulatory scrutiny for total accuracy. And this just scratches the surface.

The scope of this law is so unique and technical that the Hudson Cook law firm spent a considerable amount of time preparing a guide on this very subject. deBanked saw some of the pages of this guide during a call.

Fisher, meanwhile, insisted that compliance in California is different than compliance with the law recently enacted in Virginia and that if funding providers wait until December to begin preparing, it will probably be too late to be ready in time.

“This is more than just a form,” Fisher said. “You need to spread the word about it.”