It’s Time to Check That ISO Agreement and Balance the Broker/Funder Relationship

November 8, 2021 The fine print of ISO Agreements, long a thorn in the side of brokers when it’s worked against them, is an area that is ripe for change. All too often the price of a referral relationship is a take-it-or-leave-it contract that is not up for negotiation. So says Jared Weitz, CEO of United Capital Source and Co-Chairman of the Broker Division at the SBFA. He told deBanked that he’s gotten major pushback from some funders for redlining deals prior to inking them.

The fine print of ISO Agreements, long a thorn in the side of brokers when it’s worked against them, is an area that is ripe for change. All too often the price of a referral relationship is a take-it-or-leave-it contract that is not up for negotiation. So says Jared Weitz, CEO of United Capital Source and Co-Chairman of the Broker Division at the SBFA. He told deBanked that he’s gotten major pushback from some funders for redlining deals prior to inking them.

Aware that he is not alone in dealing with this, Weitz is looking to push out uniform agreements to the industry that would align both sides, creating a fair arrangement and providing for mutual indemnifications.

“I want to explain the importance of it on a broker’s side because I think that what is happening is that there are funders who solicit business [by saying] that they are broker and customer-centric, us being the customer, and [then] we get handed an agreement that literally signs [our] business away,” said Weitz.

“If you don’t know any better, you’re totally screwed.”

Weitz spoke in detail about how the concept of redlining an agreement is a part of doing business with large financial institutions, but when it comes to funders, it’s an entirely different situation.

“In most industries, it’s such a normal thing to redline an agreement. We were [working] with AMEX, a huge company, and it was understood like ‘hey, shoot this over to your lawyer, let us know,’ it was already understood that we were going to redline it. In [small business lending] if you want to redline something, it’s almost like the funder gets offended.”

When it comes to mutual indemnification, Weitz talked about how this is the biggest issue in these types of deals, especially as new laws are creeping into certain states that are going to change the way many funders do business. In response to some of these new laws, funders are not only trying to put all of the legal responsibility on the brokers, but forcing them to give up their book of business in order to get deals done.

“Now that there are new laws popping up in different states and being enforced differently, funders have come out with new agreements, and look, that’s okay to do right, any broker worth their salt is going to say ‘hey, we agree to not lie and mislead, we agree to follow the TCPA laws, to follow the CAN-SPAM email laws,’ that stuff is easy. What is with these agreements is that you have funders that say to a broker in the [contract], we want the right to come and fully audit your books.”

After the implementation of his own mutual agreement, Weitz claims that a quarter of the funders he worked with prior to his agreement no longer want to do business with him.

“There is a large 25 percent, and were talking about big name funders that I have stopped working with over the last twelve to eighteen months because they have literally tried to hit me with the most onerous agreement you could ever see, and when I spoke to them about it, they said ‘you know what Jared, most people just sign this and send it back.’ And that made me afraid for the broker industry.”

“There is a large 25 percent, and were talking about big name funders that I have stopped working with over the last twelve to eighteen months because they have literally tried to hit me with the most onerous agreement you could ever see, and when I spoke to them about it, they said ‘you know what Jared, most people just sign this and send it back.’ And that made me afraid for the broker industry.”

Although a positive relationship with a funder is imperative to being a successful broker, Weitz believes that some type of mutual agreement will protect people like him from being taken advantage of when things don’t go as planned for the funder.

“The guy that doesn’t let you redline his agreement, you should run away from that guy, because I have been in that scenario, where I’ve hugged, I’ve eaten at a man’s house with his family, and I’ve had that same man when things are down do what he has to do.”

Weitz talked about how the relationship with a funder can start a business relationship, but stressed that a fair agreement keeps it going. “Everyone’s friends when they’re making an agreement. Everyone’s [all] smiles, everyone is handshakes and hugs, but when things are bad in the world, and those smiles turn into straight faces, people look to that agreement, and say ‘okay what can I do?’”

When asked about losing deals to brokers who are willing to sign their lives away to get a deal done, Weitz said that those types of brokers are the ones that even if they do make a quick deal, they will never survive long enough to make a legitimate impact on the industry.

“I think funders will say ‘listen, you sign this agreement we will give you XYZ,’ and let me tell you, that’s the funder that is going to take your lunch from you, and that’s real,” said Weitz.

“The guy that offers you everything to just sign without a redline, is the guy that will crush your business, mark my words.”

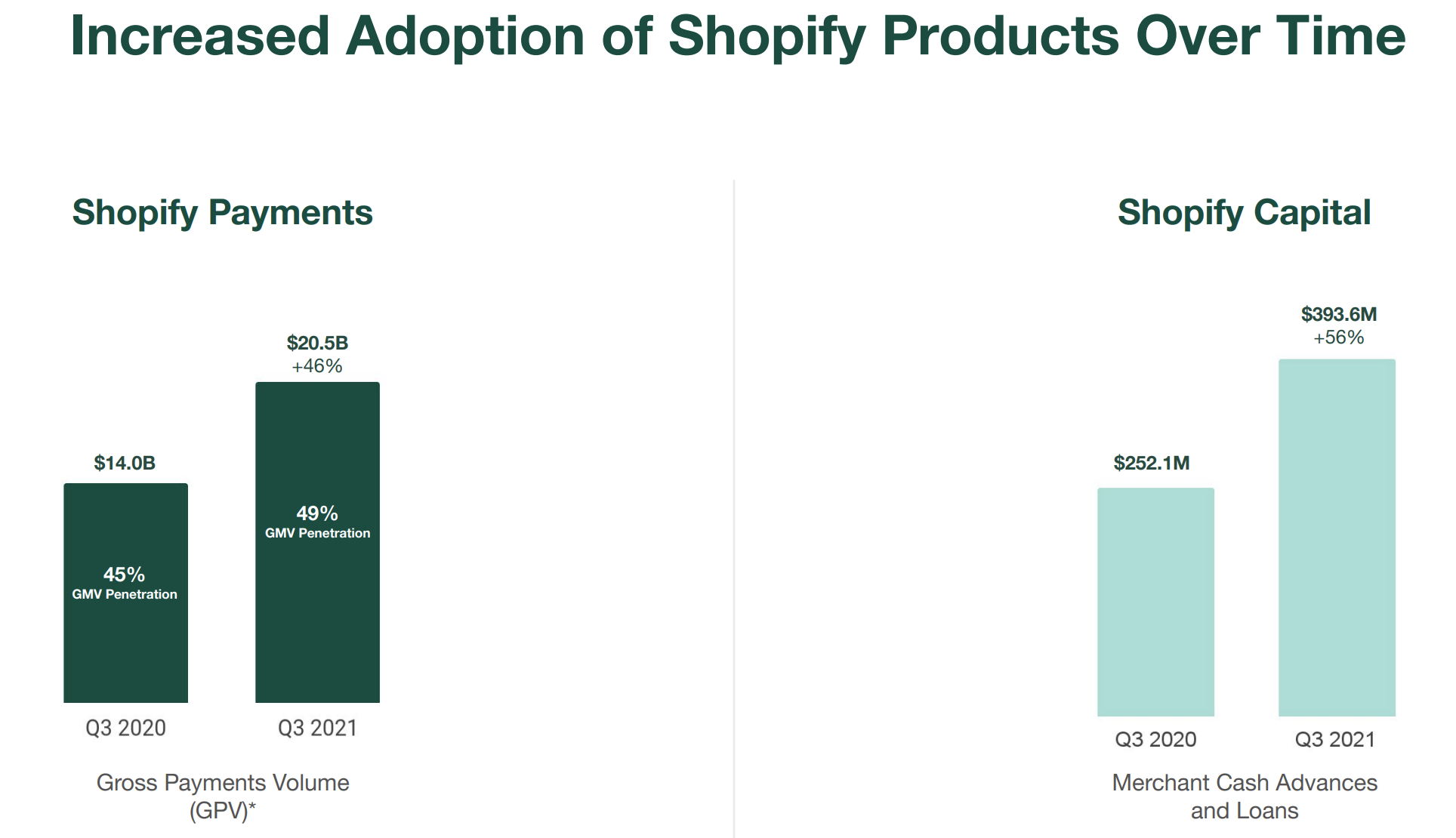

Shopify Capital Originated $393.6M in MCAs and Business Loans in Q3

October 28, 2021Shopify Capital, the funding arm of e-commerce giant Shopify, originated $393.6M in merchant cash advances and business loans in Q3, the company reported. That’s up from the $363M in the previous quarter.

Covid was a boon to Shopify Capital given its dependence on e-commerce businesses. Its 2020 funding volume was almost double that of 2019.

“Shopify Capital has grown to approximately $2.7 billion in cumulative capital funded since its launch in April 2016,” the company announced. The large volume and continued success has landed the Shopify Capital division in the company’s “core” bucket of “near-term initiatives” that will build the company for the long term, according to a presentation accompanying Q3 earnings.

Q&A with Isaac Wagschal on One Percent Ventures’ Intentions to Transform MCA

October 21, 2021One Percent Ventures, a loaded name with implications depending on who reads it, is the latest small business funding company to enter the fray. No, it’s not funding for the one percent, but rather the numerical percentage the company would make off first-time clients with near-perfect performance. They’d make just one percent…

The concept, which caught the attention of deBanked, had to be explained in detail, especially when a merchant paying only $500 on a $50,000 advance was communicated as an example. Say what? The catch is in a rebate and the cost independent of the broker’s commission. Nevertheless, One Percent Ventures CEO Isaac Wagschal seems to be bringing in a new concept, one that was originally supposed to be 0%, he says, but he was already stuck with his company name. deBanked did a Q&A to find out exactly how it all works.

– The Editor

Q&A

Q (Adam Zaki): Why did you choose the name One Percent Ventures?

A (Isaac Wagschal): The original idea for One Percent Ventures wasn’t to be a funding company that gives one percent deals. Originally, we were going to provide branding and marketing services to small businesses who do not have any marketing, but can benefit from it. Our compensation was to be a one percent partnership in the company. Then a situation came my way where I was able to form a team of people with extensive knowledge and experience in the MCA space. I grabbed the opportunity and switched from marketing to funding small business.

We designed the product with a rebate that refunds basically the entire cost of the first advance. I realized that if we changed the rebate where instead of refunding 100% of the 1st advance factor cost, we keep 1%, I wouldn’t have to change the name and logo of the company. This is the reason our merchants are now paying one percent. If I had not already determined the name, the merchants would have been paying zero instead of one percent.

Q: What was the most difficult part of the shift from marketing to funding?

A: Shifting from marketing to funding was very difficult because of the nature of the market which existed at that time. That difficult transition forced the creation of our unique product, which includes rebates and payment-pauses. I looked into the mainstream MCA product in-depth, and realized that from a marketing point of view the product is flawed, and cannot be marketed properly. The more I scrutinized the MCA industry, I realized that the problems are not just from a marketing perspective. There are existential problems that need to be addressed, or they will eventually cause the demise of the industry altogether. Default rates are so high that mathematically the industry is forced to charge extremely high prices. This makes the product unmarketable to merchants who are not in the absolutely highest risk bracket.

I knew that unless we remade the product to be more attractive and marketable to a larger market share, the funding industry had no tangible room for expansion. Why would we want to get into this market space in the first place? As a team, we agreed that instead of hiring ISO-reps and underwriters, we would first hire accountants, actuaries, and data analysts.

We applied the same psychological principles used in marketing, where you try to predict and manipulate people’s reactions. By doing that, we were able to redesign the old MCA product. We introduced a rebate system that gives the merchant an opportunity to potentially only pay a $500.00 factor cost on a $50k advance. In this way, we expanded the current market share, and turned it into a hot product. I hear from ISOs on a daily basis who recontacted old unsuccessful leads, and turned them into deals after they presented the OPV-rebate and payment-pause-award system. This proved that the OPV product is expanding the market share.

Q: What are your thoughts about the market share in MCA?

A: The current market share consists of the absolute highest risk merchants who are willing to pay such high prices. It is becoming harder and harder to maintain deal flow. This has forced the industry to slowly keep raising the standard with respect to how many positions we are willing to accept. If nothing happens, we will soon find ourselves talking about 10th and 15th positions. This is certainly not sustainable, and puts an amazing amount of stress on the ISOs who are working tirelessly to maintain deal flow. They see it all happening, but feel helpless because at the end of the day, they can only present a product that a funder puts on the table. The tiny market of willing and able merchants is also a source of stress, and a key factor to the mistrust that is largely present between ISOs and funders.

Q: What are your thoughts on a relationship with the ISOs and funders?

A: Let’s face it, the way the current ISO-Funder relationship is set up scientifically creates a conflict of interest. It is simple math – when a funder loses a renewal that carried a potential profit of 50k and thinks that the deal could have happened if not for the 14 points that is reserved for the ISO, there is a natural conflict of interest. You can be honest with your ISOs and even give Rolexes and call them your partners on paper, but the spreadsheet still calculates a conflict of interest at the end. The lavish gifts are nice, but they do not eliminate the scientific conflict of interest.

We have corrected this fundamental problem by designing our business model so that our ISOs are genuine partners. This too is simple math – when a funder’s product is designed to issue an unheard-of large rebate, and 3rd party costs are deducted from the final rebate amount, the merchant will obviously be super happy because of the astronomic refund. More importantly, by using this model, the conflict of interests between ISO and funder is erased because mathematically the merchant paid the commission, not the funder!

Q: How does OPV make money? How do merchants qualify for all of your incentives? What are these incentives?

A: Let me first answer the latter part and explain how our product works and then I’ll come back to answer how we make money.

Our typical product is a ninety-day term at 1.49 sell rate. At mid-term, if the merchant didn’t miss any payments, they are eligible for an add-on, largely known as a renewal. At this phase, we begin to issue an OPV-Pause award after each cycle of four consecutive successfully completed payments. The pause awards can be submitted smoothly on our automated online system either one at a time, or they can be saved and initiate a pause for an entire week. After the final payment, if the merchant didn’t miss more than three payments, excluding the pauses, we refund the entire factor cost of the first advance except for 3rd party fees, processing fees, and 1% of the advance, which gives us only $500 profit on a 50k advance.

Every merchant that qualifies for funding, automatically qualifies for all the incentives. The OPV funding model is actually designed to perform better when more merchants actually receive the rebate. Why? Because that also means there has been a drop in the default rates. If every merchant was to qualify for the rebate, it would mean we had a zero percent default rate, which would allow us to make a healthy return, even if we made profit only on the 2nd advance.

This is precisely the reason we added the OPV-Pause awards. It is in our best interest to keep the merchant motivated to stay current on their payments, in order to qualify for the rebate. We even added a condition that in the event a merchant doesn’t have an unused pause award, they can purchase an OPV-Pause for 20% the daily payment. The goal must be to lower default rates so that we can lower the end cost. In this way we can expand the market share and keep the MCA industry alive. The OPV product is designed to do just that.

Q: What are your immediate goals for OPV? How about long term?

A: Phase I was designing the product and building the platform. Now in phase II, we plan to fund deals for at least a year before making any significant changes. We want to build relationships and earn trust by being transparent and honest, even when it hurts. At phase III we will analyze the data and make tweaks we deem necessary. At phase IV, given that the canary returned from the coal mine, we will share our intelligence, and license the OPV platform to reputable funders throughout the MCA industry.

Q: What is your outlook on the future of the non-bank small business funding/lending sphere?

A: In an effort to truly make a constructive change towards preserving the MCA industry, I will speak openly about the elephant in the room. We are all aware of the unfavorable new laws and regulations that constantly threaten our existence. As long as there are politicians who need to win elections, they will be on the hunt for “do-good projects.” There will always be a lobbyist that is looking for deal-flow, who is willing to provide the perfect “do-good” project. One of those will be – “Let’s save the poor merchant from the greedy funder.” The politician can only succeed because the nature of the MCA industry is such that our funders share only the good news. The bad news is confidential, so there is a stigma of excess profit in the MCA sphere. If we can successfully change that stigma, then we will be a thriving industry for many years to come.

What Makes a Great ISO?

October 13, 2021 Working and developing relationships with ISO’s can be some of the best and most difficult parts of working in the small business finance industry. The relationships between the merchants and these individuals can make or break the success of a funder, and a great ISO can take a funder and the merchant to the next level.

Working and developing relationships with ISO’s can be some of the best and most difficult parts of working in the small business finance industry. The relationships between the merchants and these individuals can make or break the success of a funder, and a great ISO can take a funder and the merchant to the next level.

Kristin Parisi, ISO Relations Manager for Park East Capital, shared with deBanked what traits, characteristics, and commonalities separate the best reps from the rest of the pack.

“I think the top thing is someone that is super attentive,” said Parisi, when asked what is the biggest factor that makes a successful ISO. “Someone [who] is available to speak at all times, after sending something in an email or they send me something, I’ll call them and they’ll pick up, someone easy to reach out to, and someone who cares about the deal.”

Kindness also plays a big factor in making a great ISO according to Parisi, who said that sometimes the attitude of certain reps can impede business and make funding deals much more difficult. “I have come across some people who can be super rude,” she said. According to her, kindness and honesty can make or break not only an individual deal between a funder and a rep, but can be the foundation for the entire relationship between the two.

“It’s like a friendship type of thing,” she said, when describing the ideal relationship between both parties. “Someone who is trustworthy, loyal, someone who won’t screw you over behind your back, who won’t send your deals somewhere, someone who won’t screw you over for money. Honesty is the main thing.”

Parisi credits her success to these developed relationships. “The ISO’s I do work with are all my friends now, and I think we have a great thing going,” she said.

She noted the challenge of dealing with ISO’s from a female perspective, setting boundaries and being assertive while also trying to be kind and develop positive relationships. “Being a woman in this industry is a little different than being a male. I’m kind of approached differently, the girls on my team are approached differently. I’m one for being really kind and honest, but [only] to a certain extent because [ISO’s] will walk all over you.”

Apart from the personality that is projected on the funders themselves, another key trait is the professionalism of the ISO themselves, according to Parisi. She spoke about the younger, money-hungry mentality that can lead to ISO’s becoming disingenuous or difficult to work with. Rather than a hustle and bustle mentality, she credits understanding the terminology and how the industry functions as a desirable trait in a potential ISO.

“You don’t need ten plus years in the industry,” said Parisi. “You need a few months in the industry, you get it, and you’re good.”

Sonia Alvelo, CEO of Latin Financial Will Appear on deBanked TV

October 6, 2021 Sonia Alvelo, CEO of Latin Financial, will join Sean Murray live on deBanked TV on Thursday at approximately 12:15pm EST. Latin Financial is based in Newington, CT and Alvelo has contributed valuable insight to deBanked over the years, particularly on the Puerto Rican small business finance market.

Sonia Alvelo, CEO of Latin Financial, will join Sean Murray live on deBanked TV on Thursday at approximately 12:15pm EST. Latin Financial is based in Newington, CT and Alvelo has contributed valuable insight to deBanked over the years, particularly on the Puerto Rican small business finance market.

Anyone can tune in to debanked.com/tv/ for free without any registration to watch.

Who is Latin Financial?

A family owned and operated brokerage firm with a variety of backgrounds and expertise. We’re here to help all of our clients with their business’ unique financial needs. No loan is too big or too small for us; our goal is to simply help create a positive future for all of our clients. Here at Latin Financial, we understand that working capital can be difficult to obtain. With banks approving fewer and fewer loans, borrowing for your business’ future can be frightening and uncertain, especially in today’s economy. With Latin Financial you’re in good hands.

Latin Financial has over 10 years of business financial experience between its advisors.

We are at the forefront of this quickly changing economy and we work closely with our clients and investors because we are fully committed to meeting and exceeding expectations. We also believe in keeping our services affordable, working around your budget while never charging fees.

We are proud that so many of our clients have repeatedly turned to us for guidance and assistance with their business capital needs. We work hard to earn their loyalty every day.

MCA Skeptic Rohit Chopra Confirmed by Senate to Head CFPB

October 1, 2021 More than eight months after deBanked announced that FTC Commissioner Rohit Chopra would be the next head of the Consumer Financial Protection Bureau, his appointment has finally been confirmed by the Senate.

More than eight months after deBanked announced that FTC Commissioner Rohit Chopra would be the next head of the Consumer Financial Protection Bureau, his appointment has finally been confirmed by the Senate.

The confirmation of Chopra is notable given the agency’s objectives to collect data from small business finance companies and the fact that Chopra himself has been very vocal about merchant cash advances in particular.

One year ago, in his capacity as an FTC commissioner, he referred to the industry as “opaque” with “pay-day style” products whose structure “may be a sham.”

In an interview with NBC around the same time, he used stronger language, saying that he was “looking for a systemic solution that makes sure they can all be wiped out before they do more damage.”

Chopra knows his way around the CFPB. He worked for the agency when it first started in 2010 and was there for five years as the Assistant Director & Student Loan Ombudsman. He later moved to the FTC as a commissioner and now returns back at the CFPB in the director’s seat.

Would You Invest Your IRA Funds into MCAs?

September 22, 2021 A partnership between Supervest and Alto Solutions will bring in an unprecedented opportunity for investors, as the two groups will come together to allow IRA investors a chance to put their money in MCA funding. Account holders with Alto will be able to divide their money on a fractional basis to a diverse set of investments on the Supervest interface.

A partnership between Supervest and Alto Solutions will bring in an unprecedented opportunity for investors, as the two groups will come together to allow IRA investors a chance to put their money in MCA funding. Account holders with Alto will be able to divide their money on a fractional basis to a diverse set of investments on the Supervest interface.

“We expect these alternative investments to be very popular given the meaningful diversification they can provide to individual retirement portfolios in addition to being yield-generating and short-duration products,” Alto’s Chief Revenue Officer Tara Fung told deBanked on Tuesday. “We will continue adding to our platform so that clients have more options to invest in alternative assets that further diversify and grow their retirement portfolios.”

Alto has made a business model out of using IRA funds for unique alternative investments. Crypto investments are another option listed on their website.

Supervest is no stranger to incorporating new business ideas, either. Their business model is based on connecting investors to inaccessible classes of assets, like MCAs for example.

John Donahue, the Chief Investment Officer with Supervest, spoke with deBanked on Wednesday about the opportunity it gives IRA account holders. “It’s the opportunity for any accredited investor to now be able to access the Supervest platform of fractionalized participation in MCA deals through their self-directed IRA,” Donahue said.

MCAs can be inherently riskier than a typical lukewarm investment portfolio, but the IRA concept is basically detached from the selected risk profile therein.

“The IRA is strictly a structure,” said Donahue, when asked about the inherent risks of MCA investments with IRA money. “It really doesn’t have a connotation of conservative or aggressive nature. You can have aggressive mutual funds [in an IRA], you can have your entire investment of your IRA in the ARK New Technology fund, and while that has gone up considerably in the past few years, there’s a massive amount of volatility, it’s extremely risky, and arguably much riskier than an MCA investment.”

Donahue reiterated that only “accredited investors” would have access to these types of investments through the Supervest platform.

As the partnership between the two companies kicks off, it’ll be interesting to see if individuals are willing to put their retirement money on the line to invest in small businesses.

Miami May Become the New Small Business Funding Hub

September 22, 2021 At least two funding companies have told deBanked off the record that they plan on opening offices in the Miami area in the new year.

At least two funding companies have told deBanked off the record that they plan on opening offices in the Miami area in the new year.

It seems that South Florida, particularly Miami, is where the small business finance industry may be moving for a fresh start, and with that potentially ditching the suit and tie for flip flops and shades in the process. The social, political, and economical elements of South Florida make it a well-suited landing spot for an industry that is looking to evolve with the shifting environment.

One catalyst to the potential industry-wide migration could be the S5470B regulations that go into effect in New York on January 1. The new law will require funding companies to navigate a complex system of disclosure to any interested small business finance prospect.

There are other benefits to Florida, of course.

Jordan Fein, CEO of Greenbox Capital, whose operated his business out of Miami since 2012, prides his choice of locale on all the factors that are seemingly pushing those in New York down south. “We do not have state and city tax, we are near water and have a better lifestyle than most companies in New York, or in other areas where it gets very cold in the winter,” he said.

Fein stressed the relaxing Miami lifestyle as the reason why he has only called South Florida home to his company. “The lifestyle here is second to none. Being near the ocean, it makes it much more enjoyable to be able to go to the beach or on a boat to relax and take a load off from the busy work week. New York and other large cities seem to add more stress from [New York’s] super-fast-paced style.”

Despite his love for Miami, Fein respects New York’s ability to churn out top tier employees in the industry. “The talent pool is still among the best,” Fein said, when asked if there were any reasons he or others would ever consider maintaining a connection with the area should an exodus occur.

Fein isn’t worried about the incoming competition should offices relocate to his area. “Location of a funding company has no bearing on competition,” he said. “We all do business over the internet and the competition of funding is dependent on new companies entering the space, not on their location.”

If it is true that the industry is moving to a fully digital competitive space, the idea of a warm weather city with great tax benefits, comparatively low costs of living, and a low-stress atmosphere may be a no-brainer when it comes to finding the funding industry a much needed new home. Not to mention, the mayor of Miami also really wants small business finance companies to relocate there.

In a taped episode of deBanked TV, Miami Mayor Francis Suarez told reporter Johny Fernandez that he really wants small business lenders and MCA companies to set up shop in his city.

Watch: Miami Mayor Francis Suarez talks with deBanked in March 2021“We definitely want to make sure that small business, merchants, and lenders are able to capitalize small businesses in our community,” he said. “Miami’s a very thriving small business community. One of the things that people have criticized us for is we don’t have those big massive companies. We’re actually really built on small businesses. So for us, having fluidity of capital, liquidity of capital, access to capital are enormous things in terms of scaling. And I think that’s one of the things that we’re seeing change now is because of technologies. We’re getting a tremendous amount of access to capital that we weren’t getting before.”