Legal Briefs

Gregory J. Nowak, Partner at Troutman Pepper, Has Passed Away

April 13, 2021 Gregory J. Nowak, a partner at Troutman Pepper, passed away suddenly on April 11th at the age of 61.

Gregory J. Nowak, a partner at Troutman Pepper, passed away suddenly on April 11th at the age of 61.

The firm’s website introduced Nowak as a veteran attorney that was “sought after for advice on complex securities law matters, particularly on issues arising out of the Investment Company Act of 1940; the Investment Advisers Act of 1940; federal and state securities laws and regulations; broker dealer, FINRA, CFTC and NFA regulatory matters; and corporate and M&A transactions.”

That perfectly sums up the context in which I first encountered Nowak in 2017 when he spoke at a small event put on by the Alternative Finance Bar Association where I was the only non-lawyer in the entire audience. One might expect a presentation on the finer minutiae of securities law of which he gave, to be a mundane, easily forgotten experience for a financial journalist such as myself, but his energetic delivery and fluid command of the subject matter translated complex securities questions into a folksy debate wherein one could feel confident in resolving the Howey Test over the dinner table just as easily as they could in the courtroom.

In fact, I approached him afterwards to thank him on his presentation and even followed up later over email, asking if I might have the honor to list him as a recommended securities attorney on the deBanked website. That was four years ago and as fate would have it, he remained the only recommended attorney that deBanked formally listed under the securities category, despite my coming to know very many accomplished and competent attorneys in the same field of law.

Nowak was one of the earliest public voices in the world of merchant cash advance participations and syndication where the securities question was a consideration some weren’t even sure applied as the industry created new products and investing structures at a furious pace.

He spoke at deBanked’s first major conference in 2018 on the subject of “Syndication and Raising Capital,” and he continued to generate recognition of the need for securities legal support in the burgeoning industry.

He was a co-author of an article published with a colleague at Pepper Hamilton LLP (now Troutman Pepper) that he had given permission to be reprinted on deBanked in December 2018, titled MCA Participations and Securities Law: Recognizing and Managing a Looming Threat. It was read by more than 1,500 people on the deBanked website that first day alone.

Nowak was highly sought out on merchant cash advance issues. “Most judges want to see consistency of treatment and that includes your vocabulary,” Nowak said in an interview with deBanked in April 2019. “The word ‘loan’ should be banned from their email and Word files.”

Although our relationship was one of professional acquaintances, I often told those seeking advice about MCA syndication that they should “probably call Greg Nowak about that.”

In “Does Your Merchant Cash Advance Company Pass The Scrutiny Test?“, Nowak explained that funders that decide for business purposes to solicit money from investors, have to be careful not to run afoul of SEC rules. He said that he recommended funders treat these fundraising efforts as if they are issuing securities and follow the rules accordingly. Otherwise they risk being the subject of an enforcement action where the SEC alleges they are raising money using unregulated securities.

“You need to be very careful here because these rules are unforgiving. You can’t ignore them,” Nowak said.

No, Corporations Can’t Sue For Usury in New York, Appellate Division Rules

March 25, 2021 Businesses hoping to use the New York State court system to invalidate an MCA or financing agreement, suffered a major defeat on Wednesday. The Appellate Division, Second Judicial Department, ruled that corporations cannot assert usury as a cause of action, even if the allegations meet the criminal usury basis. In deciding this, the Appellate Court was simply affirming what New York’s statute on the matter plainly says.

Businesses hoping to use the New York State court system to invalidate an MCA or financing agreement, suffered a major defeat on Wednesday. The Appellate Division, Second Judicial Department, ruled that corporations cannot assert usury as a cause of action, even if the allegations meet the criminal usury basis. In deciding this, the Appellate Court was simply affirming what New York’s statute on the matter plainly says.

This has not stopped plaintiffs from asserting criminal usury as a cause of action in New York, however, but now such attempts will probably be fruitless.

In May 2016, Global Merchant Cash, Inc. (GMC) entered into a merchant agreement to buy the future receivables of Paycation Travel, Inc. Paycation breached the contract and GMC ultimately filed a confession of judgment. Paycation then tried to vacate the judgment by suing GMC on several grounds including its theory that the judgment was void and unenforceable because the underlying agreement was for a criminally usurious rate of interest.

GMC moved for summary judgment to dismiss the complaint and its motion was denied. GMC appealed the decision insofar as it believed Paycation could not assert criminal usury as a basis for a cause of action.

On March 24, 2021, the Court rendered its decision on the narrow debate in GMC’s favor.

“A transaction . . . is usurious under criminal law when it imposes an annual interest rate exceeding 25%” (Abir v Malky, Inc., 59 AD3d 646, 649; see Penal Law § 190.40). General Obligations Law § 5-521 bars a corporation such as the plaintiff from asserting usury in any action, except in the case of criminal usury as defined in Penal Law § 190.40, and then only as a defense to an action to recover repayment of a loan, and not as the basis for a cause of action asserted by the corporation for affirmative relief (see LG Funding, LLC v United Senior Props. of Olathe, LLC, 181 AD3d 664, 666; Intima Eighteen, Inc. v Schreiber Co., 172 AD2d 456, 457). Accordingly, the Supreme Court should have granted that branch of the defendant’s motion which was for summary judgment dismissing so much of the first cause of action as alleged criminal usury in violation of Penal Law § 190.40.

This decision did not decide the entirety of the case and litigation between the parties is still pending. It does, however, bring conclusive clarity to whether or not corporations can assert usury as a cause of action, even if it’s alleged to be criminal.

The case number is 52579/2017 in Westchester County in New York Supreme Court. The Appellate decision can be viewed here.

Lawsuit Against Former MCC Executives Dismissed

February 12, 2021A lawsuit brought by various investment vehicles of Atalaya Capital Managment LP against former officers and/or senior management of Merchant Cash and Capital (later known as Bizfi), was dismissed on Tuesday.

In the judge’s decision, the Hon. Jennifer Schecter said that “plaintiffs seek to hold defendants, former officers and managers of Merchant Cash & Capital, LLC, liable for money plaintiffs lost by investing in the Company. […] Plaintiffs do not sue the Company for breach of contract; instead, they seek to hold the individual defendants liable for the Company’s deficient underwriting through causes of action for negligent mispresentation and fraud. Those claims fail.”

Bizfi failed in 2017 after a long run of being among the largest and earliest merchant cash advance funders in the US.

The case was in the NY Supreme Court under Index No: 655593/2019

Outgoing President Trump Extends Clemency to Jonathan Braun

January 20, 2021 President Trump issued an executive grant of clemency to Jonathan Braun on Tuesday, commuting his sentence to time served. Braun checked into FCI Otisville last year to continue serving a sentence for a marijuana-related conviction in 2011.

President Trump issued an executive grant of clemency to Jonathan Braun on Tuesday, commuting his sentence to time served. Braun checked into FCI Otisville last year to continue serving a sentence for a marijuana-related conviction in 2011.

The executive order requests that he be released as fast as possible.

A statement from the White House said that “upon his release, Mr. Braun will seek employment to support his wife and children.”

Greenbox Capital Comments on Landmark Florida Legal Victory

January 7, 2021 Greenbox Capital was the victor of a major lawsuit argued before Florida’s Third District Court of Appeal that conclusively established the legality of merchant cash advances in the state.

Greenbox Capital was the victor of a major lawsuit argued before Florida’s Third District Court of Appeal that conclusively established the legality of merchant cash advances in the state.

When asked for comment, Greenbox Capital® CEO Jordan Fein said:

“It’s been a long, arduous, and expensive battle over the last few years proving in a court of law that a Merchant Cash Advance is not a loan. Today, we celebrate a win for all Merchant Cash Advance companies in Florida and the entire United States who are dedicated to funding small businesses through ethical practices. Our hard work and commitment to helping small businesses grow was validated and we are thrilled with the final decision of the District Court of Appeal.”

The decision in Florida echoes a similiar opinion reached in New York in 2018.

It’s Official, Merchant Cash Advances Not Usurious in Florida

January 6, 2021 Big news in the State of Florida. The Third District Court of Appeal entered its order on January 6th to decide the fate of Craton Entertainment, LLC, et al., v Merchant Capital Group, LLC, et al..

Big news in the State of Florida. The Third District Court of Appeal entered its order on January 6th to decide the fate of Craton Entertainment, LLC, et al., v Merchant Capital Group, LLC, et al..

Merchant Capital Group, LLC dba Greenbox Capital sued Craton in December 2016 over a default in a Purchase and Sale of Future Receivables transaction. In turn, Craton responded with various defenses and counterclaims that asserted the underlying transaction was really an unenforceable usurious loan.

The Circuit Court for Miami-Dade County sided with Greenbox in August 2019. The defendants appealed.

The District Court of Appeal decided the matter conclusively on January 6, holding that the original ruling was affirmed on the basis that:

- The transaction is not indicative of a loan where repayment obligation is not absolute but rather contingent or dependent upon the success of the underlying venture

- that the transactions in which a portion of the investment is at speculative risk are excluded from the usury statutes

- when the principal sum lent or any part of it is placed in hazard, the lender may lawfully require, in return for the risk, as large a sum as may be reasonable, provided it is done in good faith.

The decision can be viewed here.

The lawyers representing Appellee Greenbox Capital were Henderson, Franklin, Starnes & Holt, P.A., William Boltrek III, Shannon M. Puopolo and Douglas B. Szabo.

You should contact an attorney to discuss the implications of this ruling. Merchant Cash Advance contracts are not all the same.

This ruling is similar to a ruling in New York that was made in 2018.

States and DC Sue OCC Over True Lender Rule

January 5, 2021 A coalition of eight Attorneys General sued the Office of Comptroller of the Currency (OCC) over its recently finalized “True Lender Rule.” The group, including representatives from New York, California, and New Jersey, filed a complaint that alleges that the OCC’s rule is an attempt to unlawfully circumvent state lending laws.

A coalition of eight Attorneys General sued the Office of Comptroller of the Currency (OCC) over its recently finalized “True Lender Rule.” The group, including representatives from New York, California, and New Jersey, filed a complaint that alleges that the OCC’s rule is an attempt to unlawfully circumvent state lending laws.

“Rent-a-bank schemes undermine the civil and criminal usury laws New Jersey has put in place to protect our residents,” said New Jersey Division of Consumer Affairs Director Paul R. Rodríguez. “Our laws have kept unscrupulous lenders from gaining a foothold in our state, but this new rule undermines those protections and will make it easier for predatory payday and vehicle title lenders to profit at the expense of New Jersey consumers.”

Under the National Bank Act, banks licensed by the OCC function under extensive oversight but can charge interest rates at the maximum allowed in their “home” state anywhere in the country. The complaint alleges alternative lenders partner with national banks, “renting” their name.

This has been happening for years, but NJ Attorney General Grewal argues that these “Trump-era” policies must be reversed because “many families are struggling economically.”

The final rule from the OCC went into effect on Dec 29. Similar court battles have occurred at the state level, as in Colorado vs. alternative lenders Avant and Marlette and their banking partners. The case was settled.

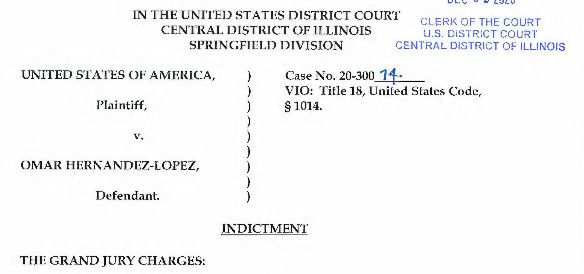

Merchant Indicted For Sending Fake Bank Statements to Online Lenders

December 7, 2020 On December 17, 2018, the owner of a mexican restaurant in Springfield, Illinois, is alleged to have submitted altered bank statements to National Funding, Inc as part of a loan application to obtain $35,000. What he got in return was an indictment by a federal grand jury.

On December 17, 2018, the owner of a mexican restaurant in Springfield, Illinois, is alleged to have submitted altered bank statements to National Funding, Inc as part of a loan application to obtain $35,000. What he got in return was an indictment by a federal grand jury.

On Dec 2, 2020, the US District Court for the Central District of Illinois unveiled a seven-count indictment against Omar Hernandez-Lopez. Hernandez-Lopez is the owner of El Tapatio De Jalisco Inc DBA La Fiesta Grande.

Prosecutors say Hernandez-Lopez sent doctored PNC bank statements to two lenders, National Funding and Loan Depot in multiple instances. The actual charge is that the defendant knowingly made a false statement for the purpose of influencing the action of a lender in connection with a loan application.

Apparently, no falsehood is too small. For example, in one count the defendant is alleged to have changed a monthly ending bank statement balance of negative $72.91 to positive $131.90, a difference of $204.81. He is also said to have obscured the amount incurred in overdraft fees.

The penalty if found guilty on any one count? Up to 30 years in prison.

Prosecutors cite Title 18, United States Code,§ 1014.

Defendant is innocent until proven guilty. A copy of the indictment can be viewed here.