Industry News

Recent M&A Activity in the Space

April 17, 2025There’s been quite a bit of M&A activity in the small business finance industry over the last 6 months. Here’s a list of some of the more notable deals:

10/25/24 – Kapitus Acquires Ten Oaks Commercial Capital and Launches Equipment Financing Arm

1/7/25 – eCapital Acquires LSQ to Expand Technology Solutions and Strengthen Market Leadership

4/1/25 – NMEF Acquires Pawnee, Marking a Significant Milestone of Growth and Industry Leadership

4/8/25 – Onset Financial Acquires Channel Forming One of the Largest Independent Equipment Finance Lenders

4/15/25 – Pipe Acquires Glean.ai

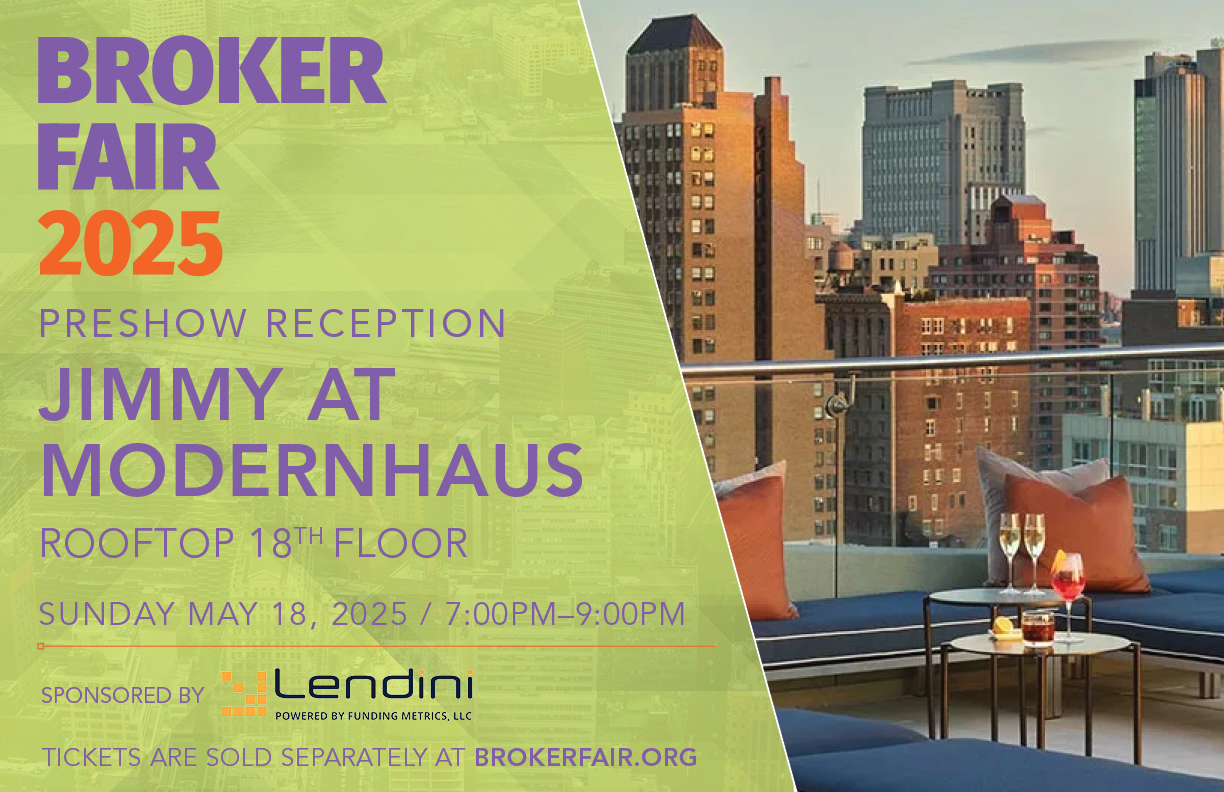

Broker Fair Preshow Party Info – NYC

March 25, 2025Broker Fair 2025’s preshow party is at JIMMY, located on the rooftop of ModernHaus in SoHo. Sponsored by Lendini, it’s being held on the evening of May 18th. To attend, make sure you add the preshow ticket during online checkout for Broker Fair. Broker Fair’s special pricing room block is also at ModernHaus and you should use this link to book your hotel stay.

Broker Fair is on May 19th in NYC at Tribeca 360 in Tribeca, walking distance from ModernHaus.

OppFi: Bitty to Disrupt the SMB Financing Space

March 5, 2025 OppFi continues to like what they see with its investment in Bitty. During the Q4 earnings call this morning, CEO Todd Schwartz gave the latest update on that relationship.

OppFi continues to like what they see with its investment in Bitty. During the Q4 earnings call this morning, CEO Todd Schwartz gave the latest update on that relationship.

“As you may recall, Bitty was our first outside investment in the small business financing space,” Schwartz said. “Similar to our consumer business, we continue to see a large supply demand imbalance in the working capital space for small business. Bitty has experienced significant growth and we believe it will continue to provide profitability and cash flow to OppFi in 2025. We are excited to continue working with Bitty as they seek to disrupt the space with best-in-class products, modeling, and servicing.”

OppFi says that with the amount of cash it has on hand, it may decide to make an investment in another company similar to Bitty but that it was currently looking at a menu of options, including the possibility of share buybacks.

Bitty recently updated its logo and website.

Recent Developments at Mulligan Funding

January 9, 2025 Last month, Mulligan Funding announced the closing of a second asset-backed securitization (ABS) totaling $120M and expandable up to $500 million. Business has been great since.

Last month, Mulligan Funding announced the closing of a second asset-backed securitization (ABS) totaling $120M and expandable up to $500 million. Business has been great since.

According to a representative of Mulligan, “December was the best month we’ve ever had as a company, capping off our best year since inception. And a large measure of that success is owed to the extraordinary community of ISO partners that we work with – and the incredible relationships we’ve been able to develop with them.”

As part of that, Mulligan Funding has made some changes to continue its success, an explanation of which is quoted here:

“We are continually looking for ways in which to improve our relationships and the level of service we’re able to offer them. And so, in order to continue to improve our level of service and improve the depth of our relationships with our partners, we decided to implement a restructure of our ISO Team and the way in which we manage our partner relationships.

We have established for the first time a regional segmentation of our ISO partners. This has allowed us to rationalize our ISO groupings, and to create smaller, more focused multi-person teams purely dedicated to the relationships in their particular region.

Each team will consist of people with different levels of seniority and very specific roles. Some will be dedicated purely to looking after the relationship at a strategic level; and others will be tasked with handling the transactional details of day-to-day operations.

This regional focus will allow these teams to develop much deeper relationships at all levels of the partner’s business, and to spend more time in front of these partners, developing a better understanding of their needs and wants – something we have historically found challenging, being on the West Coast.”

– Mulligan Funding

Top Stories of 2024 vs 2014

December 30, 2024A lot happened in 2024, but rather than just rehash it all out, let’s revisit the world of 10 years ago. In 2014, both OnDeck and LendingClub went public, Bitcoin landed in the mainstream, Square started funding, securitizations in the industry commenced, and the world was still not totally sold on the concept of MCA. Oh how things changed!

Are You The Top Broker?!

November 21, 2024

Broker Battle returns on February 20, 2025 at deBanked CONNECT MIAMI. The competition, now the 2nd ever after last year’s very successful launch, is back with an improved format that allows for almost any qualified broker the opportunity to be tested LIVE in person. Broker Battle TWO will also have 3 separate broker categories versus last year’s catch-all. Those categories are Revenue Based Finance, SBA Lending, and Equipment Financing.

All competing brokers will be vetted, tested, and scored through very short judging rounds on the showcase floor. The two top scores from each category will actually compete on stage for the championship.

That means that as opposed to last year’s 6 total contestants and 7 separate battles on stage, this year’s competition could feasibly manage up to 100 contestants for which there will only be 3 total battles on stage (each being a championship). The format allows for more brokers to prove themselves in person while reducing total stage time for the final grand performance.

Each broker will win a cash prize and the distinction of being Top Broker (in their category). To be eligible for entry, you must be an active broker with good ethics and a positive reputation. You must also be registered to attend deBanked CONNECT MIAMI where it will take place and enter yourself in the battle itself here.

Broker Battle intends to foster best practices.

Shopify Funds $507.6M in Q3, Expands MCAs and Loans to Australia

October 27, 2022Shopify Capital originated $507.6M in merchant cash advances and loans in Q3, up from $416.4M in Q2. The increase was assisted in part by the company’s expansion into Australia, bringing the total countries that Shopify funds in to four (US, UK, Canada, AUS).

Shopify is the largest e-commerce platform after Amazon but the two companies are in the same ballpark when it comes to lending originations, and Shopify is potentially doing more.

Shopify generated total revenue of $1.4B in Q3.

“In Q3, we delivered another solid quarter of GMV, revenue, and gross profit dollar growth against the high inflationary environment,” said Amy Shapero, Shopify’s CFO. “From an operational perspective, we recalibrated our organizational structure, successfully rolled out a new compensation framework, and began integrating Deliverr into Shopify. Looking ahead, the flexibility of our platform, breadth of solutions, pace of innovation, and disciplined investment approach position Shopify well to realize the enormous opportunity ahead.”

Arrangements for Nick Gregory of CDG: Rest in Peace

August 29, 2022Nick Gregory, a co-founder and partner of both Central Diligence Group and Capital Dude, passed away suddenly last Thursday. Gregory was a well-known and beloved 16-year veteran of the small business finance industry. If you’d like to pay your respects, please take note of the following arrangements:

Wake Location:

Roslyn Heights Funeral Home

75 Mineola Ave

Roslyn Heights, NY 11577

Tues August 30th: 3-5PM, 7-9PM

Wed August 31st: 3-5PM, 7-9PM

Mass:

Thurs September 1st, 10AM:

St. Mary’s Roman Catholic Church

110 Bryant Ave, Roslyn, NY 11576

-Funeral Procession to Cemetery-

Burial:

11:30-11:45AM:

Cemetery of the Holy Rood

111 Old Country Rd, Westbury, NY 11590