Industry News

Visa Acquires Plaid in $5.3 Billion Deal

January 14, 2020 Yesterday it was announced that Visa and Plaid, the financial services company that helps business connect with customers’ bank accounts, have penned a deal that would see Visa purchase the San Francisco-based startup for $5.3 billion. The purchase price is roughly double Plaid’s previous valuation of $2.7 billion after its 2018 Series C investment of $250 million. Pending regulatory confirmation, the acquisition is expected to be completed in 3-6 months.

Yesterday it was announced that Visa and Plaid, the financial services company that helps business connect with customers’ bank accounts, have penned a deal that would see Visa purchase the San Francisco-based startup for $5.3 billion. The purchase price is roughly double Plaid’s previous valuation of $2.7 billion after its 2018 Series C investment of $250 million. Pending regulatory confirmation, the acquisition is expected to be completed in 3-6 months.

Founded in 2013 by Zach Perret and William Hockey, Plaid’s API enables companies to easily link with customers bank accounts and connects to a host of apps, such as Venmo, Robinhood, Coinbase, TransferWise, and Acorns. The company claims to have connected to one quarter of Americans with bank accounts and has expanded to both the UK and Canada.

Not being Visa’s first interaction with Plaid, the startup had previously received investment from its new owner, along with other recognizable names like Mastercard, Goldman Sachs, Citi, and American Express.

“This fits well, strategically,” commented Al Kelly, Visa’s CEO, in a call with investors on Monday. “We’re excited about new business and the ability for this to accelerate our revenue growth over time.”

Speaking to CNBC, Perret told CNBC that “We feel fortunate to have been there for the early days of fintech, and to have helped develop that ecosystem … This represents an important milestone, and the ability to work with Visa to make our products much bigger and better – both domestically and internationally.”

Whether such developments mean added features, further expansion to new territories, or something else entirely remains unclear. However, much like Google’s acquisition of Fitbit late last year, this merger witnesses the passing on of a treasure trove of data, with the curtain being pulled on the financial details of millions of transactions between startups and consumers; leaving Visa better positioned to understand and pre-empt what exactly is happening in industries where unpredictable disruption is valued above all else.

Pacific Equity And Loan Acquires Emerald Capital Funding

January 12, 2020 This week Pacific Equity & Loan, a hard money lender based in Washington state, acquired Emerald Capital Funding. Done to “provide more resources and investment opportunity to real estate investors in the Washington market,” according to a statement from PEL, the merger will see all of ECF’s staff move over to PEL.

This week Pacific Equity & Loan, a hard money lender based in Washington state, acquired Emerald Capital Funding. Done to “provide more resources and investment opportunity to real estate investors in the Washington market,” according to a statement from PEL, the merger will see all of ECF’s staff move over to PEL.

“The move comes amid a rapidly evolving mortgage industry in specifically the private money and hard money lending sector,” ECF’s President and Founder Christopher Robinson commented. “We need to stay ahead of the curve and assure that our customer receive the best value, the best technology, and continue to work with a trusted local lender.”

Speaking to deBanked, Sang Yoon, PEL’s Director of Business Development and Co-founder said that he was excited to move forward, noting that it’s a “two heads are better than one situation. By merging or acquiring a company, we are better able to service our customers.”

The Scoop Behind The Primary Capital / Infinity Capital Funding Acquisition

January 6, 2020 This morning, Primary Capital announced that it had acquired the merchant cash advance division of Infinity Capital Funding. Infinity, which has been operating from California since 2006, began as an MCA company before expanding to offer small business loans as well. The acquisition will see Infinity’s thirteen years of data, technology, and merchant portfolios pass onto Primary.

This morning, Primary Capital announced that it had acquired the merchant cash advance division of Infinity Capital Funding. Infinity, which has been operating from California since 2006, began as an MCA company before expanding to offer small business loans as well. The acquisition will see Infinity’s thirteen years of data, technology, and merchant portfolios pass onto Primary.

Speaking on the acquisition, Primary Capital Managing Member David Korchak said that “anything that you can acquire with that much time behind it and that much experience behind it is excellent, and for us with what we’re trying to do it’s tremendous. It’s a big, massive help for us.”

As well as the intangible assets that will be conferred to Primary, Isaiah Kenigsberg will be joining their team. Having served as Infinity’s Financial Controller, Kenigsberg is now CFO at Primary.

The decision to acquire Infinity’s book came after Primary noticed that it was winding down its MCA operations, Korchak told deBanked. Seeing the value in obtaining such a trove of data proved too enticing to pass the Managing Member said, and Primary has been digging into the information obtained for the last three months.

For Korchak, something that has stood out from this analysis is the patterns that have emerged in the portfolio. “The thing that’s remarkable for these companies that have been around as long as them, is everyone seems to have clients that have taken 30 advances from them. They have clients that started back in ’07, ’08, that are still active merchants which is remarkable.

“The only difficulty is trying to analyze and say, ‘Why is this merchant after 30 different cash advances over a 12-year period still taking cash?’ And that’s really our model. And our goal for this year is to try and help subprime borrowers get out from having to take toxic debt like cash advances for their business. Ultimately, the data that we’re acquiring from ICF and this acquisition is going to help us study a lot of the transitions that MCA merchants have made since the beginning and see which ones have actually been able to get out of it.”

Asked whether there are any more acquisitions in the pipeline, Korchak responded, “Absolutely, we’re heavily data and service-driven for this year specifically, and we have a lot more to come.”

Jonathan Braun Has Checked In To Prison

January 2, 2020 Jon Braun, who Bloomberg Businessweek profiled in a 2018 story series, checked into FCI Otisville on Thursday. He was sentenced to 10 years in prison on May 28th for drug related offenses he committed a decade ago. He was originally scheduled to surrender on August 25th but he successfully delayed the date until today, January 2nd.

Jon Braun, who Bloomberg Businessweek profiled in a 2018 story series, checked into FCI Otisville on Thursday. He was sentenced to 10 years in prison on May 28th for drug related offenses he committed a decade ago. He was originally scheduled to surrender on August 25th but he successfully delayed the date until today, January 2nd.

I have not attempted to contact Mr. Braun since the day of his sentencing. But purely by chance I shared an elevator with him in the Brooklyn Federal Courthouse on May 28th just mere minutes after he had been handed ten years. Given the opportunity, I asked him how he felt about what just happened.

“I hope it goes by quick,” he replied stoically.

The End Of An Era – deBanked Through The Decade

December 30, 2019

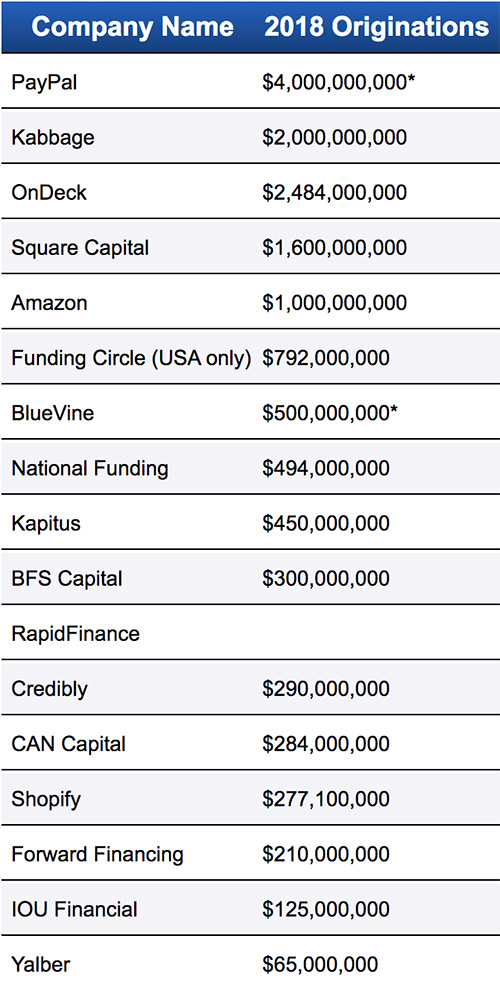

deBanked estimated that approximately $524 million worth of merchant cash advances had been funded in 2010.

In 2019, merchant cash advances and daily payment small business loan products exceed more than $20 billion a year in originations.

First Funds

Merchant Cash and Capital

Business Financial Services

AmeriMerchant

Greystone Business Resources

Strategic Funding Source

Fast Capital

Sterling Funding

iFunds

Kabbage

OnDeck

Square Capital

Amazon Lending

Funding Circle USA

Yellowstone Capital

Entrust Cash Advance

Merchants Capital Access

Merchant Resources International

American Finance Solutions

Nations Advance

Bankcard Funding

Rapid Capital Funding

Paramount Merchant Funding

deBanked’s Top Ten Things of 2019

December 20, 2019In this video, I break down deBanked’s Top Ten Things of 2019. Happy holidays and have a Happy New Year from all of us at deBanked!

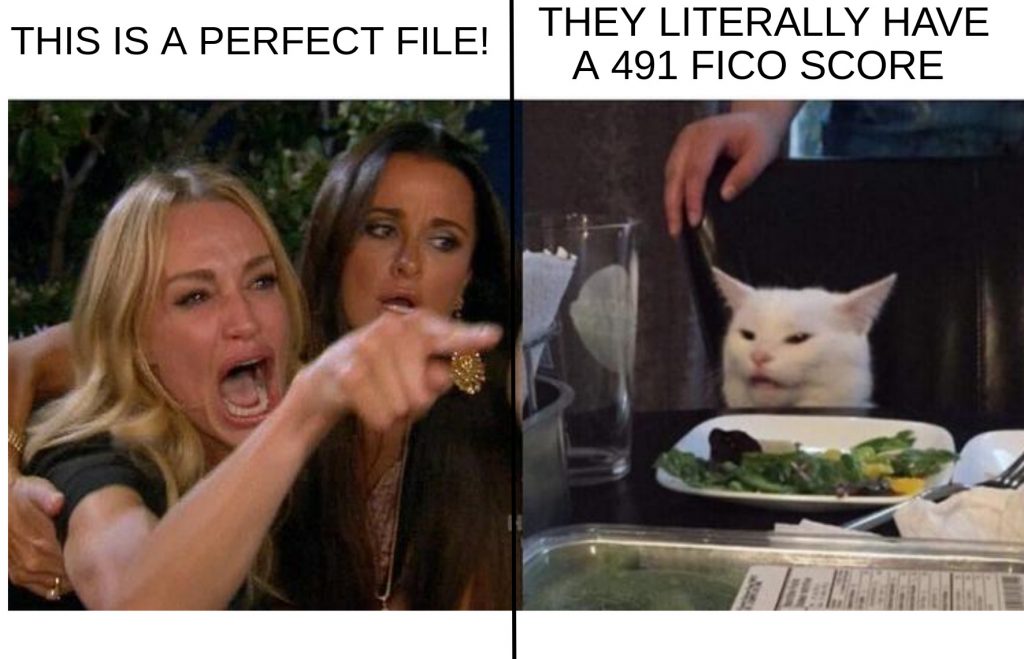

Happy Thanksgiving. It’s Meme Time!

November 27, 2019Happy Thanksgiving. You know what that means! deBanked original memes! Here’s the latest:

SEE ALL THE MEMES FROM PREVIOUS YEARS!

2017 1: The State of The Industry (In Memes)

2017 2: Take a Break From Funding This Thanksgiving

2016: The History of Alternative Finance (As Told Through Memes)

2013: 10 Clues You’re Hardcore About Merchant Cash Advance

SEE ALL OF OUR PREVIOUS THANKSGIVING POSTS!

2018

2017

2016

2012

Merchant Infamous For Safari-Themed Home, Has Died

November 18, 2019 The saga of Michael Willhoit has come to an end. deBanked wrote about Willhoit in December 2018 when we learned he defaulted on nearly half a million dollars in merchant cash advance transactions and was sued by banks over $4.5 million in bad loan deals. This past June he was also indicted on 36 counts of bank fraud.

The saga of Michael Willhoit has come to an end. deBanked wrote about Willhoit in December 2018 when we learned he defaulted on nearly half a million dollars in merchant cash advance transactions and was sued by banks over $4.5 million in bad loan deals. This past June he was also indicted on 36 counts of bank fraud.

But on Sunday, Willhoit passed away of natural causes, the Springfield News-Leader reported. He was 66.

Willhoit’s local notoriety gained somewhat national interest thanks to his fully-customized multimillion dollar safari-themed home, dubbed “The African Queen.” Willhoit told a News-Leader reporter in 2016 that he spent $3 million renovating the Sprinfield, MO property including $400,000 for a 900-square-foot wood floor and $300,000 for landscaping. Other notable items on the property included:

- Two roaring lion masks

- Two 7-foot tall hand-carved wooden tusks

- An eight-legged genuine impala horn zebra-hide chair

- A 15-foot African warrior statue

- A 3,000-pound (approximately) bronze rhino

- Four gazelle taxidermy mounts

- A baboon, full-body mount

Willhoit’s criminal trial was scheduled for July 2020.

You can still view a virtual video tour of his home below: