Fintech

Empathy in Design, Data in Development; How Specialized Fintechs are Bringing Humanity and Finance Together

March 15, 2022 Ahon Sarkar, GM of Helix

Ahon Sarkar, GM of Helix“I think the idea of being human has to exist at the core of your business. When you’re building a product, you have to start by asking ‘what’s the problem I am trying to solve and who is the person and what are they actually dealing with, and then how do I build it.’ You don’t build something and then bring it out to people. Empathy has to be the core of your product development.”

Ahon Sarkar is the GM of Helix, Q2’s BaaS arm, and a brand new homeowner. According to him, innovation happens when you define products based around problem solving, not creating products and then trying to force them on industries that desire innovation.

“I just finished buying a house, and it’s been a crazy process,” said Sarkar. “When I sent the wire to go buy my house, I went and asked my bank, ‘how will I know it’s been sent?’ Obviously I’m anxious about it,” he continued, “it’s the largest amount of money I have ever sent in my entire life.”

Sarkar said that his bank told him their system doesn’t give notifications that wire funds are indeed sent. The bank was like “‘oh, you won’t know.’ I was like what?”

“That day, I walked out and called our Product Owner for Wires and I said, ‘Kady, we have to build wire notifications.’ That’s empathy. That’s putting yourself in the shoes of the person and figuring out what is wrong with the system and making it better for a human being, as opposed to focusing on just the top line revenue.”

Helix’s whole mantra is about making finance human. By creating specifically tailored products for their clients, the company has developed both a brand and mindset internally and externally about their goals, values, and outlooks on what their work means to the greater good of both levels of consumer and B2B economics.

On top of offering employees complete flexibility on where and how they work, Helix also looks for people who are outside of the ‘cookie cutter’ software guru fintech employees are labeled as. Instead, Sarkar and Helix are looking for genuine human beings with life experiences that they can bring value to both the product and company’s culture.

“It’s hiring people that are empathetic, that are curious and are driven, because that propagates this idea into customer support, into operations and how we work with our bank partners,” said Sarkar. “It goes into marketing and how we’re talking about the overall message, so if it’s not at the core of what you do, at some point it will be pushed to the side so you can do the innovation and revenue you really want to do.”

“We have realized that you can innovate and drive revenue by being empathetic, by being human, and actually entrenching those values within the genetic fabric of the company,” Sarkar said.

When asked about the state of small business lending, Sarkar spoke about the data pools some companies are sitting on that would allow them to approve individuals for financial products. However it’s regulations according to him that are holding companies like Uber back from offering financial products to their employees.

Sarkar pitched the scenario of Uber lending a driver money at a cheaper rate because the information they have on their own employee may be able to prove their creditworthiness more than the information that is accessible to a bank.

“Let’s say you have an Uber driver, who has been on the job for four years. Five star driver, five thousand rides, Uber trusts this person. When that person walks into a bank, what does the bank see? Someone they never met before who makes $35K-$45K a year and comes with a bucket of risk. So that bank is going to run it through traditional underwriting, and that person may be challenged to get a loan because they have non-traditional income.”

According to Sarkar’s analogy, it’s Uber who should be funding this driver. “Uber trusts this person, Uber has been paying them for years. They know who this person is and they’re willing to extend more credit because they don’t think they are taking as much risk,” Sarkar said.

“So if you could take that idea and give Uber the ways to conform to a [financial] product that is based on what they already know about their drivers, those people might actually qualify for funds.”

Sarkar stressed that underwriters cannot even attempt to develop these products without the government giving these companies clearance to go out and provide these types of products for employees. “Whether it be gig economy workers or solopreneurs, or medium-sized business owners, it doesn’t matter,” he continued. “At the end of the day, if regulation doesn’t allow the underwriting for these products, no company is going to put them into practice.”

Whether it’s culture, product design or staffing a team, it seems that this idea of humanity is sticking to the fundamentals of Helix’s brand. “If you take the financial products and loans being written and just make them more practical and more human, I think we would be able to solve a lot of problems.” said Sarkar.

Fintech is Bringing Data to Banking, and It’s Going to Change Everything

March 9, 2022As the rush to innovate legacy finance and its surrounding institutions continues, companies across the fintech space are rushing to build tech-infused brands while designing and marketing innovative financial products. Paul Walker, Senior Vice President of Revenue and Partnerships at Helix, spoke with deBanked about how tech’s impact in finance will not only impact how money moves in a B2B space, but how it will impact the lives of everyone who works to earn and spend money.

Walker spoke about how many banks are sitting on stockpiles of potential revenue, but just don’t have the infrastructure to leverage it. “[Fintechs] are data driven companies, and banks have not been data driven,” said Walker. “They’re sitting on some of the most valuable data you can ever imagine, but it’s the fintechs that are able to apply and anticipate areas of a consumer’s need [with this data] that not even the consumer knew they needed.”

According to Walker, fintech’s incoming impact on banking will hit both consumer and commercial banking pretty quickly. He spoke about how things like payroll information can be leveraged by banks as a harnessing tool for data on particular individuals who might be ripe for certain financial products.

“Imagine something like [banks] tracking the fact that your payroll or direct deposit changed by 20%, that might indicate that you got promoted,” said Walker.

“If you got promoted, is that a good time to go and engage you in a [financial] service that might be appropriate?”

Walker continued to speak on how smaller fintechs are bringing new ideas to traditional financial products and services on a widespread basis through approach via a problem solving lens.

“Using context is where these fintechs have done a change in things, some of the things are fundamentals like paychecks two days early,” Walker said. “I think fintechs have really tried to think about these points and new services.”

Walker spoke about how fintech has impacted every facet of the financial system and how the industry’s vast array of companies makes up a pretty large basis of his company’s clientele. With a history of banks and credit unions being their primary customers, Q2’s branch into Helix appears to be an effort to meet a rising demand of tech’s desire to incorporate themselves into legacy banking.

“From a tech perspective, more-so than anything, one of the interesting things we’ve done which what appeals to a lot of folks is our long history of working with a long line of banks and credit unions,” said Walker. “Over the last few years, we have been on the forefront of working with fintechs, and I think we’ve brought some really unique partnership models to market.”

“We’ve combined the things that fintechs do really well, and the things that banks and credit unions do really well, especially in regards to oversight and understanding the regulatory environment that will keep someone out of hot water in a highly regulated space.”

When asked whether innovation is truly exponential, Walker was hesitant to identify a point in which innovation reaches limits. According to him, innovation has no limits. In Walker’s world, finance seems to be just a subset of societies’ immersion with technology.

“I don’t think innovation ever stops, and I think that’s the basis of technology,” he said. “I don’t think its specific to just finance, but when tech and finance converge, there’s an opportunity to say ‘how do we do this better’”.

Walker expanded on how innovation has changed legacy products over and over again in a short period of time, and how examples of this are just the starting point for what is to come. “Now we’re going from same-day to real-time payments. At some point, you’re not going to have a physical card, you will have a digital card.”

“I think data will continue to create innovation,” said Walker. “Ultimately, I’m confident that innovation is not a destination—it’s a journey.”

Five Takeaways from Q2’s Helix Launch Event

March 8, 2022Q2, a fintech that works to digitize large banks, hosted a launch event at the New York Stock Exchange last week for Helix, the company’s new [Banking as a Service] BaaS platform that intends to humanize fintech by tailoring products to specific user needs. Attended by Q2 clients and employees from across the fintech and crypto space, the event celebrated a legacy financial company making a push into the next dimension of finance.

Below are five initial takeaways from the event-

Finance Needs a Face- Humanizing finance is the focus of Helix’s brand. By creating a human approach in their practices both internally and externally, the company is attempting to tailor financial services and products on an individual basis. The Helix employees deBanked spoke to seemed genuinely invested in defining the line between the human touch and innovating redundancy. Even the innovators themselves believe that a personal touch needs to a part of the marketing, selling and maintaining a service-based financial product.

Finance Needs a Face- Humanizing finance is the focus of Helix’s brand. By creating a human approach in their practices both internally and externally, the company is attempting to tailor financial services and products on an individual basis. The Helix employees deBanked spoke to seemed genuinely invested in defining the line between the human touch and innovating redundancy. Even the innovators themselves believe that a personal touch needs to a part of the marketing, selling and maintaining a service-based financial product.

Big Changes to Banking are Coming- There is an underlying narrative that fintech is building the infrastructure to support different types of value propositions from large financial institutions. As banks can no longer promise interest rates to provide a benefit from holding money in their accounts, many are beginning to get into financial education, guidance, and leveraging data to create personalized budgets, analyze spending habits, and offer money-saving tips. Rather than just be a place where consumers keep their money, look for banks to leverage fintech and data to create different types of services for their customers.

Above: deBanked Reporter Adam Zaki speaks with Jonathan Price, Executive Vice President of Emerging Businesses, Corporate & Business Development at Q2

Above: deBanked Reporter Adam Zaki speaks with Jonathan Price, Executive Vice President of Emerging Businesses, Corporate & Business Development at Q2If You’re not Hybrid, You’re Doomed- Fintech companies as a whole, especially those attended by this event, always speak on the idea of creating a work environment that is as innovative as their products. By allowing employees to work fully remote, hybrid or in office at their own accord, all of the companies there have drastically improved company culture and employee retention. Not only does this open up the hiring pool outside of geographic restrictions, but these fintechs are able to hire experienced employees from around the industry who are leaving jobs they enjoy solely because they work for companies that demand work in the office to be full-time. According to executives of both Helix and Q2, they have seen production, communication, engagement and revenue increase as a result of giving employees a choice on where to work.

One executive actually laughed at the idea of employers demanding employees be in person for any type of job in fintech. “CEOs and executives that make employees show face for the sake of it will never survive in this industry,” said one executive from Helix.

New York Hasn’t Lost its Reputation- As many of the people who attended the event flew in from out of state, it appears that an out-of-towners’ look on New York City hasn’t changed much despite contrary belief since the pandemic. When asked about why the event was being held in Manhattan, those there believed that it was a no-brainer to have it in what they still believed to be the ‘main hub’ of finance. Even when discussing their individual excursion plans with whatever free-time they had left in the area after the event, attendees of the event seemed pumped to be able to checkout whatever spots they could around New York City.

Crypto Needs Regulation before Implementation- The biggest pushback attendees of the event expressed when it came to the crypto space was a lack direction when it comes to regulation. Banks and large financial institutions are aware, educated, and eager to begin widespread implementation of digital assets and financial products that use them, but are waiting for the government to show signs of life when it comes to regulation of the space. Until the government says how crypto will operate, no large scale financial institution will invest both time and money into creating new products around it.

With Latest Merger, Walmart is Set for its Launch into Financial Services

February 2, 2022 Walmart-backed fintech startup Hazel announced that it plans to acquire the fintechs Even and ONE, setting the stage for Walmart to open up financial services and products to its 1.6 million U.S. associates and 100 million plus customers. The company plans to bring on Omer Ismali as CEO of the merger under the ONE brand.

Walmart-backed fintech startup Hazel announced that it plans to acquire the fintechs Even and ONE, setting the stage for Walmart to open up financial services and products to its 1.6 million U.S. associates and 100 million plus customers. The company plans to bring on Omer Ismali as CEO of the merger under the ONE brand.

Ismali climbed the ladder at Goldman Sachs in both investment and consumer banking prior to becoming the CEO of a NewCo backed by Ribbit Capital, the leading investor in Hazel.

“Consumers everywhere are being left behind by the world of financial services,” said Ismail. “Our vision is clear, build on Even and ONE’s success to offer a product that offers consumers the best way to spend, the best way to access their wages, and helps millions save and grow their money. I’m looking forward to partnering with two stellar leaders in Brian and David to improve the financial lives of tens of millions of consumers.”

David Baga and Brian Hamilton are the former CEO and Co-founder of Even and ONE respectively. The two will remain in leadership roles at ONE according to a press release from Walmart.

The merger will form a company of over 200 employees whose CEOs and upper management will also remain in lateral positions. The release also says that ONE will get their balance sheet stuffed with $250M to “fund future growth.”

“Walmart is constantly looking for new ways to deliver on our core mission of helping our customers save money and live better,” said John Furner, President and CEO of Walmart U.S. and board member of the reemerged ONE. “Customers have made it clear that they want more from us in the financial services arena.”

“Creating a simple, personalized app that allows users to manage their money in ONE place is the natural next step toward fulfilling that,” Furner continued.

Judging by the release, it looks as if Walmart is planning to market this both internally and externally. As America’s largest employer, they could easily become a player in financial services if they hosted the technology to manage the accounts of their employees alone.

Furner spoke further on the intentions of Walmart to offer up financial services to the seemingly underbanked. “We couldn’t be more excited about what this will mean for Walmart customers, associates and consumers everywhere as we try to help empower millions to improve their financial lives.”

Codat’s Partnership with Moody’s Brings Real-Time Merchant Accounting Data to Lenders

January 10, 2022 Codat and Moody’s Analytics are partnering to bring the fintech’s API software into Moody’s CreditLens solution. The move will enable Moody users looking to fund small businesses the ability to access and manage all of the accounting data for the respective merchant looked to be funded.

Codat and Moody’s Analytics are partnering to bring the fintech’s API software into Moody’s CreditLens solution. The move will enable Moody users looking to fund small businesses the ability to access and manage all of the accounting data for the respective merchant looked to be funded.

Along with an effort to increase efficiency in the approval and funding processes, both companies seem to hope that the partnership will also improve access to capital for small businesses across the US.

“We find ourselves in a time of rapid change, where new approaches to financing and technology are becoming increasingly important to small businesses,” said Peter Lord, CEO & Co-Founder of Codat . “Moody’s Analytics has impressive global scale and reach, so this partnership holds the potential to meaningfully reverse the credit crunch facing SMEs while opening up new profitable lines of business for financial institutions.”

“Together we will be able to extend the benefits of Codat’s two-way flow of financial data to more lenders and financial institutions, allowing them easier access to a wider data set to make high-quality, data-driven credit decisions,” said Lord.

CreditLens is a “credit lifecycle management solution” with access to large amounts of data from across the lending space. Codat’s software will enhance data transferring in the CreditLens platform by offering real-time accounting data on merchants that is instantly accessible by Moody users.

“We are excited to welcome Codat as a new accounting data aggregation technology partner to boost the value of Moody’s Analytics lending solutions,” said Eric Grandeo, Product Head for Moody’s Analytics Lending Solutions.”Codat provides a seamless interchange of real-time data to enable valuable credit insights and predictive capabilities.”

“We are both dedicated to helping financial service businesses gain [a] deep understanding of their client’s risk and behavior, and make better decisions based on real-time accounting, banking, and commerce data,” Grandeo continued. “Ultimately, the partnership will afford small businesses across the U.K and U.S. access to more credit options, opportunity and growth.”

Cashback-Crazed Enzo Launches Deposit Accounts

January 4, 2022 Enzo Wealth, the fintech launching a neobank-esque software through Blue Ridge Bank finally came out with their initial account offerings to a select group among the 35,000 people on the account holder’s waitlist. Since the announcement, the company has marketed themselves by offering attractive cashback and equity-based incentives to account holders. According to an email sent out to the selected invitees by CEO Jeremy Shoykhet, the company is still working out the kinks to their offerings.

Enzo Wealth, the fintech launching a neobank-esque software through Blue Ridge Bank finally came out with their initial account offerings to a select group among the 35,000 people on the account holder’s waitlist. Since the announcement, the company has marketed themselves by offering attractive cashback and equity-based incentives to account holders. According to an email sent out to the selected invitees by CEO Jeremy Shoykhet, the company is still working out the kinks to their offerings.

“We launched the Enzo Early Access Beta a few weeks ago, and are thrilled with the progress so far,” said Shoykhet. “We’ve seen over one-thousand customers join the early access beta. We’ve also been excited to see the uptake in our Rent Payment Cashback Program, with a current run-rate of $1mm of rent payments we will be processing annually.”

Invited waitlist members who sign up for the trial will not only receive a $50 bonus, but any money they spend that may qualify for cashback in the future will be retroactively funded to accounts, should money spent now be qualified for cashback at a later date.

The trial period includes the originally offered 1.5% cashback on rent payments, but with a stipulation during the trial period. Enzo customers seeking cashback on rent must pay rent via ACH from the landlord’s payment portal. According to an email sent by Shoyket to invitees, Enzo account holders will be able to receive the cashback on rent regardless of their payment method as launch progresses.

Enzo caught eyes when it offered wild cashback offerings like 10% on Ubers, 5% on DoorDash, and 1.25% on pretty much everything else. Enzo accounts also pay out a 0.50% APY, which the company claims will be increased as their capabilities allow.

Shoykhet hinted at Enzo continuing to grow as the trial period takes stride. “We are excited to continue growing the platform, adding more features, and inviting more folks to use the product.”

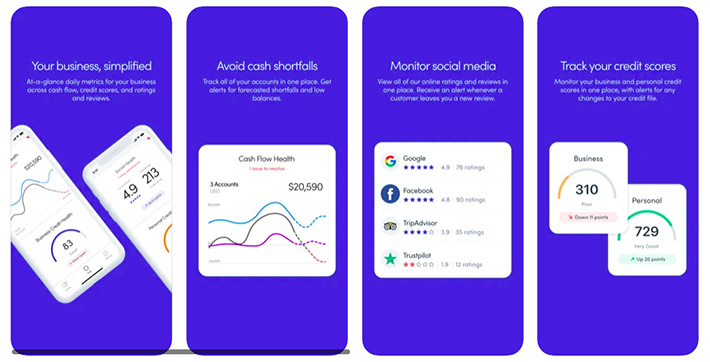

Nuula, Still in the Business Lending Game, Lays Groundwork for Larger Ecosystem

December 29, 2021 Nuula, formerly known as BFS Capital, has 5,000 merchants on a waitlist to access a line of credit after just four months of its application process being made available.

Nuula, formerly known as BFS Capital, has 5,000 merchants on a waitlist to access a line of credit after just four months of its application process being made available.

But there’s more.

“Nuula is built to not only deliver our own financial products, but it’s developed to help us provision and deploy third party financial products that come from our ecosystem,” said Mark Ruddock, Nuula’s CEO. “So what we’re trying to do here is not really be a broker, but we will carefully curate products.”

“That could be larger, longer loans from one partner, it could be insurance from another partner, it could be entrepreneur wealth management from a third partner,” he continued.

“So we bring those partners onto the platform, and then we expose their functionality within the app, in a way that’s consistent with all the other tools in the app. So yes, there is room for third party lenders.”

Ruddock spoke about how as of now, Nuula’s infrastructure only offers opportunities to those interested in directly funding businesses. The company profits via revenue sharing when businesses are provided with capital from a third party funder on the platform.

Despite not being available yet, he hinted at possibly incorporating broker-esque products as the app’s financial product suite grows.

“Today, we don’t see a near term role for brokers on the app, because we’re not really trying to create a marketplace of a multitude of products, we’re really trying to curate things very, very carefully,” said Ruddock. “However that’s not to say say that we will not over time provide the ability for the more digital brokers or intermediaries to play a role as we seek to broaden the portfolio of tools that we offer.”

“I would say no to brokers in the sense that we really don’t have a compelling offer for them at the moment, but yes to other financial services providers.”

Ruddock described how Nuula is serving a niche customer base, a tech-centric merchant who is looking for an easy-to-use mobile software that can manage their businesses’ X’s and O’s. Not only is this type of merchant underserved and beginning to substantiate in numbers according to Ruddock, but they are extremely eager for access to capital.

“It’s a fundamental change in the way underwriting has been done, away from kind of a rearward looking model, towards a real-time forward looking model, and that’s what we believe is going to be required to unlock capital to this new generation of businesses.”

“[Nuula] reimagines underwriting in a way that says ‘don’t just look at the last six months of bank statements’,” Ruddock said. “[We] look on not only of the day of lending, but the lifetime of your relationship, and how those businesses are recovering, growing, and thriving.”

He spoke about how with real-time data being accessible through Nuula, businesses that are building their creditworthiness can have a mobile reference point for the data that they need to see their real-time financial state, while simultaneously giving lenders a live picture of the businesses’ books.

“So even if a business is not strong enough for credit today, it might be in three months, and we can go watch your progression through this period and unlock the capital when the time is right, and then if that business grows out of the pandemic and recovers and is stronger, we’re going to be able to a broader and richer portfolio of credit.”

Although their target customer seems to be a digitally native merchant, Ruddock says that Nuula’s onboarding process is designed to be simple enough for a merchant who may not be as familiar with fintech.

“I’m a fifty-plus year-old CEO of a fintech company, and I would say I’m as digitally savvy as a twenty year-old, so it isn’t really about age anymore,” said Ruddock. “It’s by the way which [merchants] have embraced technology.”

“What we’ve done with Nuula is we’ve tried to make this product intuitive and simple for a first time app user and we’ve tried to help these folks get access to the data that now is sitting in a multitude of systems. While we believe people who have grown up in an app-centric world are going to be amongst the first adopters, we’re trying to make this product accessible for the fifty year-old restaurant owner too.”

Nuula plans on expanding their data harnessing tools with other fintechs early next year. “Over the next two weeks, we will actually unlock the ability for [merchant] sales data from Shopify or Square,” said Ruddock.

Buy Now Pay… Now?

December 22, 2021 During this year’s online Christmas shopping you may have noticed a new button at checkout from your favourite BNPL providers – “Pay Now”.

During this year’s online Christmas shopping you may have noticed a new button at checkout from your favourite BNPL providers – “Pay Now”.

The pay in full option allows shoppers to initiate a direct bank transfer without pulling out a credit card. Both Klarna (through their acquisition of Sofort) and Affirm have launched theirs.

This begs the question… umm why?

Customer preference. “I thought the whole point of BNPL was to spread your payments out over time?” Merchants attract more shoppers, shoppers receive interest free loans. It’s a win-win.

Correct. But not all shoppers are looking to defer payments in installments or to the end of the month on their credit cards. By offering a one-click pay in full option, BNPLs widen their net to shoppers not interested in financing.

Regulation. As with all financial products, regulators are sensitive to marketing; particularly ensuring that consumers are not being encouraged to take on more than they can afford. A pay in full option sends a strong sign to both regulators and consumers that BNPLs are completely aligned with any payment preference.

Banking > Lending. BNPLs are expanding beyond POS finance to a full banking suite of products:

- Klarna recently launched virtual cards in the UK.

- Affirm launched a cash-back savings account.

- Afterpay is now part of the artist-formerly-known-as Square (Block), and will be integrated into their suite of small business banking solutions.

- PayPal has gone the opposite way, starting with checkout and expanding into BNPL themselves and through their acquisition of Paidy in Japan.

All four of these companies are converging around an online banking model that goes well beyond payments and lending.

Payment processing. Payments are a zero-sum game. At checkout, there can only be one winner per transaction. A shopper either pays with cash, cards, or more recently installments (over simplification). Visa and Mastercard have expressed concern that BNPL eats into the demand for revolving credit, and in turn their payment rails. A pay now option will take even more traffic away from these rails, allowing BNPLs to compete head to head with the payment titans.