Fintech

C-level Credit Exec Leaves Lending Club for Affirm

September 21, 2017Lending Club’s Chief Credit Officer and Interim General Manager, Sandeep Bhandari, has joined fintech lender Affirm, according to Affirm CEO Max Levchin. Levchin posted the following on LinkedIn:

I am excited to announce and welcome Sandeep Bhandari to Affirm, Inc. as Chief Strategy and Risk Officer (CSRO).

Sandeep joins us from Lending Club where he was the Chief Credit Officer (CCO). Prior to Lending Club, he was at Capital One for many years, where he was Assistant Chief Credit Officer at Capital One Bank (Credit Risk Management) and Venture Partner (Capital One Ventures). Prior to that Sandeep held a variety of roles requiring expertise in strategy, credit risk management, marketing, product development, and underwriting across several lines of business including consumer and small business credit card, auto lending, and mortgage and home equity lending.

We are excited for Sandeep to join us for our next phase of rapid growth and to help us fulfill our mission of delivering honest financial products that improve lives.

The move comes on the heels of Lending Club announcing their “most advanced and predictive credit model ever.” Bhandari was responsible for credit strategy and overall credit risk management at Lending Club and presumably would’ve overseen that.

Talkative investors on the LendAcademy forum were not immediately sold on Lending Club’s new system, however. Some users bemoaned that Lending Club is ignoring common sense in favor of data. In one instance, the CEO of PeerCube referenced an interest rate anomaly alleged to be discovered in Lending Club’s pricing as “Data-driven but knowledge-unaware.”

Affirm and Lending Club differ. Whereas Lending Club targets the credit card refinancing market, Affirm helps consumers finance purchases. Last month, Affirm and Walmart were reportedly in talks to offer financing to consumers.

Where Alternative Finance Ranks on the Inc 5000 List

September 14, 2017Here’s where your peers rank on the Inc 5000 list for 2017:

| Ranking | Company Name | Growth | Revenue | Type |

| 15 | Forward Financing | 12,893.16% | $28.3M | MCA |

| 47 | Avant | 6,332.56% | $437.9M | Online Consumer Lender |

| 219 | OppLoans | 1,970.22% | $27.9M | Online Consumer Lender |

| 260 | US Business Funding | 1,657.42% | $5.8M | Business Lender |

| 361 | nCino | 1,217.53% | $2.4M | Software |

| 449 | Kabbage | 979.31% | $171.8M | Online Consumer Lender |

| 634 | Lighter Capital | 712.03% | $6.4M | Online Business Lender |

| 694 | Swift Capital | 652.08% | $88.6M | Business Lender |

| 789 | CloudMyBiz | 575.46% | $2.1M | IT Services |

| 1418 | loanDepot | 286.11% | $1.3B | Online Consumer Lender |

| 1439 | Nav | 281.98% | $2.7M | Online Lending Services |

| 1731 | United Capital Source | 224.85% | $8.5M | MCA |

| 1101 | ZestFinance | 165.99% | $77.4M | Online Lending Services |

| 2050 | National Funding | 184.74% | $75.7M | Online Business Lender |

| 2572 | Blue Bridge Financial | 136.73% | $6.6M | Online Business Lender |

| 2708 | Bankers Healthcare Group | 127.51% | $149.3M | Financial Services |

| 2714 | Tax Guard | 127.02% | $9.9M | Financial Services |

| 2728 | Fora Financial | 125.81% | $41.6M | Online Business Lender |

| 2890 | Reliant Funding | 121.61% | $51.9M | Online Business Lender |

| 4005 | Cashbloom | 70.47% | $5.4M | MCA |

| 4945 | Gibraltar Business Capital | 42.08% | $16M | MCA |

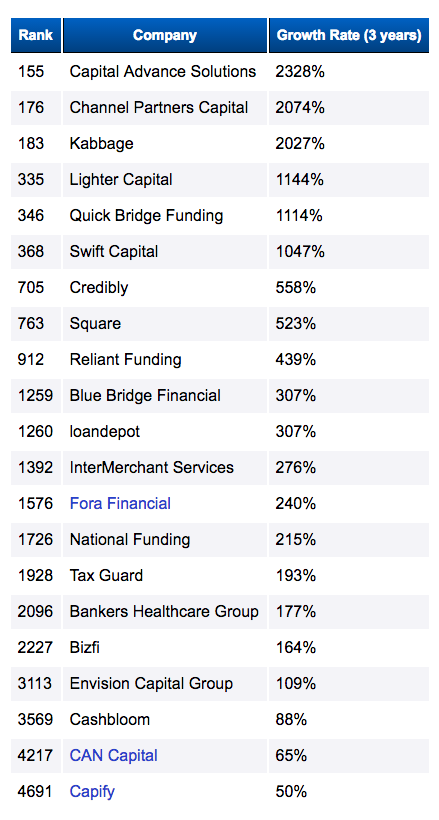

Compare that to last year’s list below:

Of the companies on the 2016 list, Capify and Bizfi were wound down while CAN Capital ceased operations but then later resumed them more than half a year later.

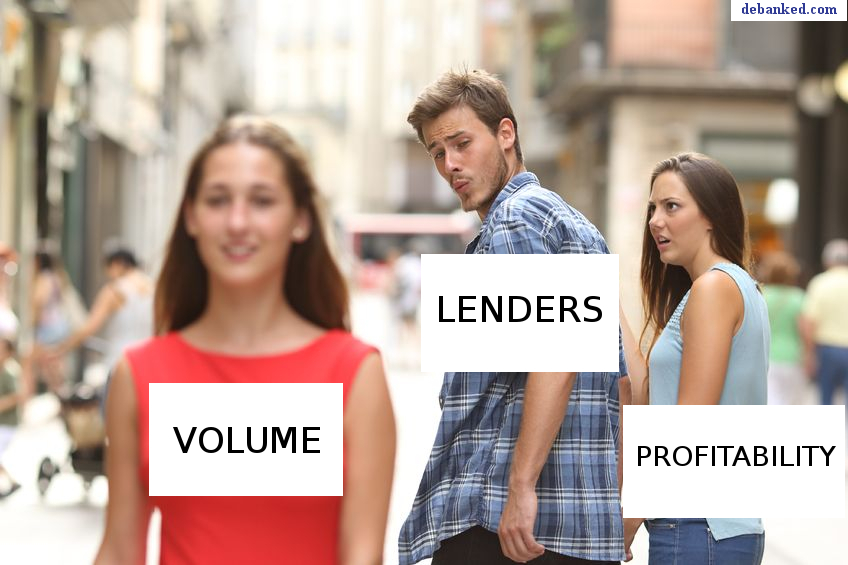

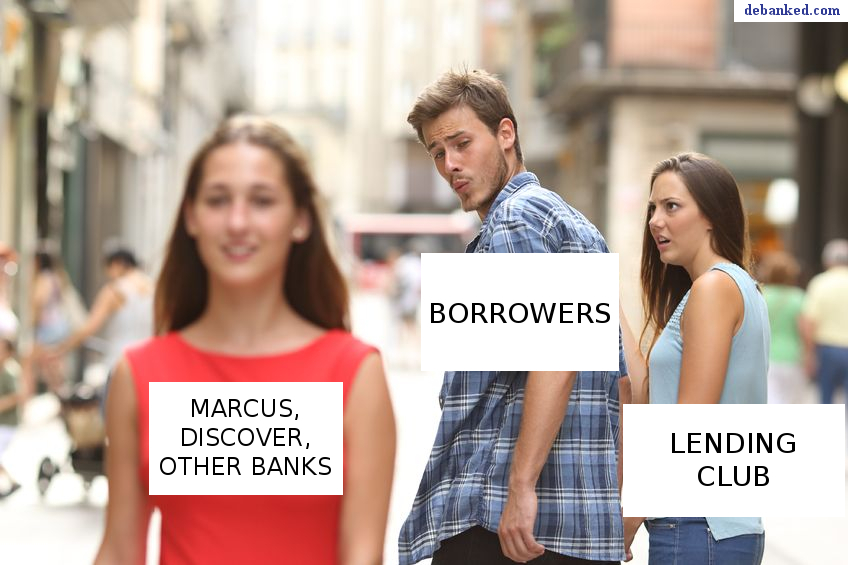

The State of The Industry (In Memes)

September 2, 2017The state of things in MCA, online lending, and fintech through the disloyal boyfriend meme:

SEE MANY MORE DEBANKED MEMES

The History of Alternative Finance (As Told Through Memes)

Ready to Trade ONDK and LC? Scroll to the bottom of the page

10 Clues You’re Hardcore About Merchant Cash Advance

As Summer Winds Down, Square, Bitcoin, Yirendai Big Winners of the Year So Far

August 30, 2017Yirendai, an online lender in China listed on the NYSE, is up 92% this year, according to the deBanked Tracker. China is reported to be the largest marketplace lending market in the world. Yirendai went public in December 2015 at the peak of the online lending bubble and the stock price has tripled since then.

Square, a payment processor and tech-based small business lender is up 90% year-to-date. The company lent $317 million in Q2, or about 30% less than what OnDeck lent over the same time period. Unlike OnDeck whose stock is down 76% from the IPO price, Square is up 186% since inception. While Square is lending less, the company has virtually no borrower acquisition costs and is a payments company first.

While the value of a Bitcoin fluctuates all the time, it was up 78% for the year as of Wednesday afternoon. One Bitcoin was equal to $4,554.07. Yesterday, Bitcoin reached a record high of $4,703 after North Korea fired rockets over Japan. While the increase in value can be partially attributed to speculators, there is a growing chorus of Bitcoin owners who are using it as a hedge against governmental currency manipulation or collapse.

Fintech Carries the Torch in Northern Delaware

June 14, 2017

Delaware’s history in financial services is rich. The Financial Center Development Act of 1981, for instance, which rolled back the limits on how much lenders could charge as interest on consumer credit, attracted some of the biggest names in banking to the state over the past several decades. Now fintech companies are carrying the torch, evidenced by alternative lender SoFi’s recent expansion into the region.

Glen Trudel, a partner at Ballard Spahr who specializes in fintech, described the view from the rooftop of his downtown Wilmington, DE office as evidence of Northern Delaware’s banking influence. “Many of the large buildings bear the name of a bank. Bank of America. Capital One. Citi. Chase. Barclays. They are all here. And it isn’t just the Financial Center Development Act that makes Delaware a financial services haven. In consumer lending and in certain other financial industry areas, Delaware law provides flexibility that the laws of other states do not. That has drawn a lot of companies from those industries here,” he said, adding that this includes fintech startups in some cases.

SoFi is among them, evidenced by its expansion plans in Claymont, Delaware, which is the home of its recent acquisition, Zenbanx. The alternative lender joins a fintech community that is already flourishing there. J.P.Morgan and Capital One, both of which are partners of Wilmington, Delaware-based non-profit school for coding, Zip Code Wilmington, similarly have an expanding presence in the region.

“That’s why we were created, as a result of that increasing demand for software developers. That increase is the genesis of Zip Code,” said Melanie Augustin, head of school at Zip Code Wilmington.

Rob Meck, SoFi’s senior vice president of operations, told deBanked that Delaware is key to the company’s growth.

“[Delaware is] a great talent bed for financial services, and with the acquisition of Zenbanx we have a team in the state and executives with ties here,” said Meck. Among those executives is Arkadi Kuhlmann, SoFi’s head of banking products, Zenbanx president and former chief executive of ING Direct USA, which brings Kulhmann full circle and plays into SoFi’s recent hand of applying for a bank charter in Utah, another business friendly state.

“One bank that used to be here [in Delaware] that was bought by Capital One was ING Direct. Their European parent ran into some issues and needed to restructure, so they sold their U.S. online banking arm to Capital One. Guess who ran ING Direct here before?” said Ballard Spahr’s Trudel, pointing to SoFi’s Kulhmann.

In fact it is the presence of banking veterans like Kulhmann in addition to the placement of former Citi chief Vikram Pandit on Wilmington, Delaware-based fintech startup Fair Square Financial’s board that tie the fintech theme all together for Trudel, who spent more than a decade of his career as an in-house counsel at MBNA America, one of the banks that established themselves in Delaware as a result of the Financial Center Development Act.

“I don’t think it’s surprising that startups are getting into the fintech space or that SoFi is expanding here given the Kulhmann connection and given the management and people who are trained in various functions as a result of the history of banking here in Wilmington and other parts of Delaware,” said Trudel. “He has worked here. And there is a large labor pool of very experienced business and consumer lending people in all aspects – from marketing, to collections, to operations. This has been going on for many years,” he adds.

Fintech & The First State

SoFi is hiring across many different departments including engineering, business development and finance, with the bulk of the new jobs being in customer service and operations roles. “We’re hiring aggressively to be able to have 100 people in the office by the end of July and to scale from there over the next few quarters to several hundred,” Meck said.

Fortunately for SoFi and other fintech companies in the region, the talent pool from which they have to select is widening thanks to Zip Code. The coding school, which James Spadola, Zip Code’s director of business development describes as a nonprofit software development boot camp, trains people who might not have had the opportunity to learn to code before sending them out to the local workforce.

“We have 200-300 applications in each cohort and three cohorts per year. And our process is selective. We only accept 12 percent of applicants,” Spadola said.

The process seems to be working, evidenced by applicants from as far away as Wisconsin and Zip Code’s 93 percent job placement rate for students within three months of graduating.

Head of School, Zip Code Wilmington

Incorporate vs. Operate

Delaware is the leading state for registering corporations, LLCs and other structures, evidenced by more than 1 million businesses domiciled there. Nonetheless most entities that incorporate in Delaware don’t actually operate there. Still there are benefits, such as generous tax savings including no state income tax for Delaware companies not operating in the state, as Zip Code Wilmington’s Augustin points out.

Another feature is the non-jury Delaware Court of Chancery that focuses on corporate legal issues using judges who are well versed in corporate legal issues and the generally favorable laws for corporations.

“The state of Delaware’s corporate law is cutting edge. There is a sort of partnership between the Delaware State Bar Association and the legislature. The Delaware corporate attorney bar keeps an eye on what is going on nationally and every year a panel of them recommend amendments to the corporate code and other entity codes to the legislatures. And the legislatures will typically pass those,” said Trudel.

Of course there are also a host of reasons for businesses to not only incorporate but also operate in the state.

“We’re in close proximity to I-95, which runs from Maine to Florida, there’s no sales tax and the residents are a microcosm of America. We have beaches, deep country and cities as well, so you get a little bit of everything. There is a general appeal to any employer,” said Spadola, who is also a University of Delaware alum.

Zip Code’s Augustin points to Delaware’s lower cost of living versus New York or the West Coast as another reason why companies don’t only want to incorporate but also operate in the state.

Spadola came to Zip Code Wilmington following a stint in politics including a recent run for State Senator. “Zip Code from the launch has been neat to watch. I’ve always attended civic events, including the launch of Zip Code. They did a boot camp in 2015, and I’ve been following the success of it. Through relationships and community outreach, this opportunity arose at the right time,” he said.

Prior to her role at the nonprofit, Augustin was working as an employment attorney in Washington, D.C. “I was looking for work I was passionate about. Zip Code filled that need,” she said

Meanwhile, although SoFi is not currently a Zip Code partner, their paths have crossed albeit indirectly.

“Speakers from Zenbanx have talked with our students before. We’re connected with them and are impressed with what they’re doing. We’re excited that they’re growing here,” said Augustin.