Fintech

Hey Cool Cats and Kittens, Let’s Reform Banking

May 12, 2021 “Hey, all you cool cats and kittens in the banking industry, it’s Carole Baskin from Big Cat Rescue, you might remember from Tiger King i’m married to a former banker,” Carole Baskin, TV star of Tiger King, said. “Yeah, love that Howie Baskin. Anyway, I just wanted to tell you guys about a new report….”

“Hey, all you cool cats and kittens in the banking industry, it’s Carole Baskin from Big Cat Rescue, you might remember from Tiger King i’m married to a former banker,” Carole Baskin, TV star of Tiger King, said. “Yeah, love that Howie Baskin. Anyway, I just wanted to tell you guys about a new report….”

Baskin, known for her competing tiger tourism venture in Florida, and the myth that she had something to do with the disappearance of her late husband Don Lewis sometime in 1997, appeared in a Cameo video for banking-as-a-service company called 11:FS. It’s an advertisement for a special report available on their website.

11:FS offers a “financial service operating system,” information and reports, and digital services.

This week Baskin also launched a $CAT cryptocurrency to let users buy her t-shirts without the US dollar.

AFC Trade Group Surpasses 100 Members

May 12, 2021 Two months ago, the Marketplace Lending Association and Online Lending Policy Institute merged, forming the American Fintech Council (AFC).

Two months ago, the Marketplace Lending Association and Online Lending Policy Institute merged, forming the American Fintech Council (AFC).

American Fintech Council has grown to 107 members. The trade group is a cross-section of payments, lending, legal, and data sectors of the fintech industry, set to lobby Washington lawmakers and set standards. The member list includes names like LendingClub, Varo, SoFi, Cross River, and Rocket Mortgage. The group also launched a Community Advisory Board, with Boston University and Cambridge departments of alternative finance working on “responsible practices in the industry.”

“The American Fintech Council is poised to play a critical role in the US regulatory landscape,” Colin Walsh, founder-CEO of Varo, said in a press release.

According to the website, the group’s core principles include:

1. Supporting the use of technology to develop financial services to enrich people’s lives.

2. Offering affordable, transparent, and responsible products.

3. Advancing financial inclusion and racial equity.

4. Embracing and supporting regulation that furthers and promotes responsible innovation.

Members must support a 36% APR cap on the cost of loans, adhere to the Small Business Borrower’s Bill of Rights, and offer “transparent products and fees.”

“We are thrilled to welcome these new members and leadership groups to the AFC team and look forward to working with them to promote policies that create an open and efficient marketplace that benefits everyone,” said Garry Reeder, CEO of the AFC. “Our members are constantly working to better serve consumers and communities around the country.”

The Death of A Thousand Financial Companies

April 28, 2021Unfortunately, Deleting Your Business May Not Be An Option One Can Risk.

In March 2021, deBanked revealed that 7.5% of DailyFunder’s user base that had existed in March 2020, was lost during the pandemic. DailyFunder, of course, is the most widely used forum for small business finance brokers and the statistic offered one of the most compelling insights into the damage inflicted on the industry.

In March 2021, deBanked revealed that 7.5% of DailyFunder’s user base that had existed in March 2020, was lost during the pandemic. DailyFunder, of course, is the most widely used forum for small business finance brokers and the statistic offered one of the most compelling insights into the damage inflicted on the industry.

A loss was defined as a user whose email address ceased to exist. It was either deleted or the domain name was not renewed. It was a startling revelation. And yet, in a sign of optimism, DailyFunder added more new users in that 12 month time frame than were lost.

And yet, is anything ever truly deleted in the digital age? And how did it come to pass that the owners of these companies believed deletion to be a preferable outcome to transference? Surely as a thousand brokerages closed, there would have been an eager buyer to scoop them up, even if the sales price was for pennies?

And so I arrived at a theory, that companies that simply wound up and disappeared rather than sold themselves off, probably left behind a digital footprint that still drew in prospective customers, a path that ultimately led nowhere. A competitor might rejoice at that outcome but it’s not exactly a net gain because that customer may have decided to go somewhere else or nowhere else instead. Someone else’s loss wasn’t their win. Even the customer was a net loser. That could be resolved, of course, if the competition simply acquired the expired domain names of their fallen competitors, something that could be reasonably achieved for the price of ten bucks through any domain name registrar.

Outside of the small business finance industry, such tactics are commonplace. One can simply go on Godaddy’s domain auctions to see the never-ending revolving door of expiring domains which are often ranked and priced on the basis of how much traffic they stand to generate, mainly because of the past owners’ efforts.

According to WhoIsHostingThis, 70% of all web domains fail to be renewed 1 year after they’re purchased. “[41% of these expired domains] go on to be snapped up and registered by other users to potentially benefit and profit from,” they say. And there is nothing controversial about this. This is simply a standard of the world wide web. Your fallen online business is recycled as someone else’s marketing tool.

Applying that math to the small business finance industry at hand, that would mean that of 1,000 brokerage failures, 41% of the expired domain names are going to be acquired by someone else or they already have been. And if the expired domain only costs $10 (and they’re not all this cheap), then theoretically one could acquire the web traffic of 410 failed brokers for roughly $4,000.

WHOA.

The realization led me to conduct a controlled experiment, one in which I would try to prove this theory for a deBanked story.

I bought roughly twenty expired domains, intentionally leaning toward older ones, domains that had been expired for 2-10 years rather than recent casualties of the pandemic. Once completed, I jotted down my hypothesis, that these domain names probably produced some level of prospective customer traffic.

When my experiment concluded, I became alarmed, even sick, over what the results taught me. Deletion, I learned, is an outcome that no business, let alone a financial services company, can afford to surrender themselves to.

When my experiment concluded, I became alarmed, even sick, over what the results taught me. Deletion, I learned, is an outcome that no business, let alone a financial services company, can afford to surrender themselves to.

Here’s why:

Among the first steps taken was to create a “catch-all” email account on each domain so that if a former owner of a domain came along and tried to contact me, I would get it no matter which address they tried and that I would be able to tell them that I had acquired it accordingly and even tell them my theory!

No marketing or anything was done for any of the domains. I simply acquired them and let them sit stagnant. I did not resurrect whatever their old websites were. And yet, I received thousands and thousands of emails, none from what I could tell were from former owners.

It’s important to state that I did not use these accounts to actually do anything, but that these vulnerabilities came to light by virtue of monitoring the inbound emails these domains accrued.

Some domain names still had control of social media accounts like business facebook pages and twitter accounts. Someone could not only acquire your old domain, but use it to resurrect and use dormant social media accounts, including being able to view all past private correspondence on them. Yikes.

Some domain names were still attached to active bank accounts, credit card accounts, or financial services. Correspondence regarding these accounts was still being transmitted to them. When you delete a domain, you need to make sure its access is revoked from every account you have, especially bank accounts. Some received NSF notices or were being subject to debt collection efforts.

Every domain name was subscribed to newsletters or communities or some service in which one could use to learn personal information or business information about the previous owner.

Unknown but likely is that some of these domains may have been the “lost password” email address of record for other accounts online, a particularly troubling thought.

Unknown but likely is that some of these domains may have been the “lost password” email address of record for other accounts online, a particularly troubling thought.

As the litany of stroke-inducing vulnerabilities piled up, then came live correspondence. Lenders wanted to know where to send a still-owed commission, a borrower was reaching out for customer service, old business partners were trying to rekindle past relationships.

Presumably such domains could give someone access to portals or databases where previous customer data was held. This implies that not only is the old domain owner at risk but that business vendors that had not disabled access to their systems for the defunct users could also be at risk from nefarious actors now in control of email addresses belonging to former customers.

A nefarious actor could surely dream up still more ways to carry out compromising acts. I disabled incoming email altogether for the domains pretty soon into my aforementioned discoveries so that emails to those domains would simply bounce back and indicate to the sender that there’s nobody there anymore.

And my original hypothesis had been blown to smithereens. These domains generated no material web traffic of note, except for probing “bots” instead of human users. What I thought might be a hidden source of web traffic, a clever insight on internet marketing 101, instead turned out to be a glimpse into a business’s worst nightmare.

No matter how much one’s business has failed, control over the domain name should be preserved at all cost, that is unless, all of the above vulnerabilities are addressed first and completely.

Originally, the costs of this journalistic experiment were to be recouped by simply reselling the domains onto the public market for fair market value. Instead, they were simply cancelled, cast back in the sea anonymously, where anyone else could buy them and do whatever they want with them. I, however, made no effort to alert anyone’s attention to them.

The publication of this story was delayed as I, the journalist, had to weigh the merits of disclosing my findings. But as the data says, 41% of expired domains are going to get snapped up anyway. And true to form, I was actually outbid by other unknown buyers by some of the original domain names I had hoped to acquire for my experiment. A financial service company’s domain and all the vulnerabilities with it, were sold to bidders willing to pay $30, $40, or $50+ versus my $10-$20 or so budget. That seems a terrifyingly small cost. And I highly doubt they were journalists.

Perhaps those domains are generating web traffic, but if they’re not, one has to ponder why someone would want to acquire the lapsed domains of so many dead financial service companies. And post-pandemic, there are too many to count.

If the death of a thousand companies has taught me anything, it’s that even business failure needs a well thought-out security plan. Otherwise one risks death by a thousand cuts.

Governor Phil Murphy on Fintech in New Jersey

April 14, 2021 In a joint webinar between Choose New Jersey, FinTech Ireland, the New Jersey City University School of Business, and others, NJ Governor Phil Murphy kicked off the event by saying that his state’s object is nothing short of being the state of innovation, where new ventures can take shape, companies can expand, and people can raise a family.

In a joint webinar between Choose New Jersey, FinTech Ireland, the New Jersey City University School of Business, and others, NJ Governor Phil Murphy kicked off the event by saying that his state’s object is nothing short of being the state of innovation, where new ventures can take shape, companies can expand, and people can raise a family.

Murphy’s participation in Irish fintech collaboration was steeped in his commitment to international relations and business.

“The fintech business in particular is a big part of our economy,” Murphy said. “We’ve got proximity to New York City’s financial markets and as a result we’ve become sort of the perfect home for fintech companies. We have 145 fintech companies headquartered in New Jersey.”

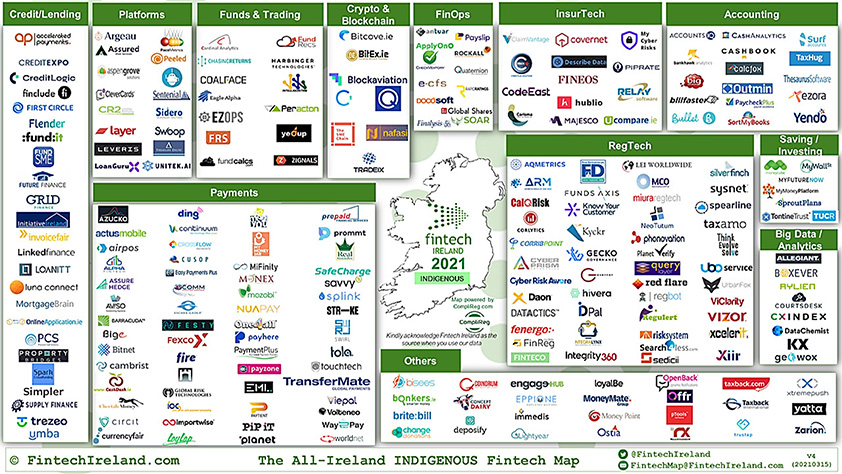

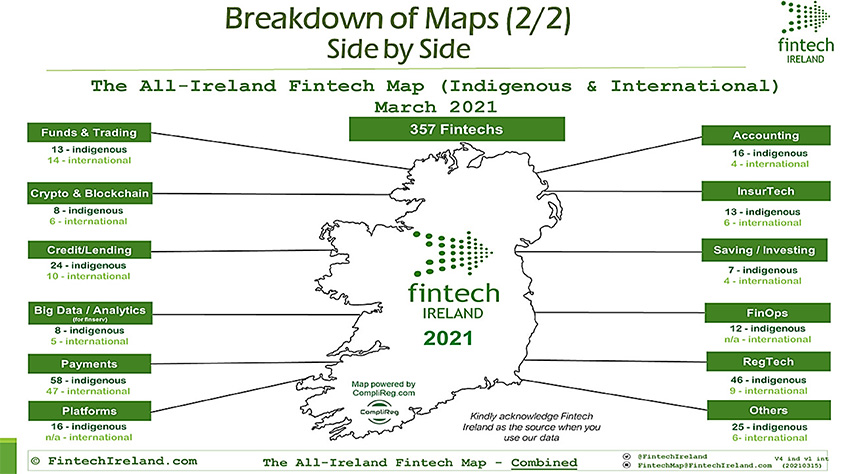

The island of Ireland, by comparison, is home to nearly 250 indigenous fintech companies, according to the latest Fintech Ireland map. Recently, Irish fintech companies ranked the United States and Canada as their #1 priority region for expansion.

New Jersey is hoping to benefit from transatlantic opportunities this might present.

“There’s no better place in America than to plant your flag here in New Jersey,” Murphy said. “To those who are considering [it], it’ll be the best decision you ever make.”

The Governor also revealed that his family is descended from Donoughmore, County Cork and that he hopes to make a state trip to the republic soon.

Ireland’s Fintech Industry May Be Coming to North America

March 16, 2021 Americans asked to name an Irish fintech company often say Stripe, the company founded by two Ireland-born brothers that is dual headquartered in San Francisco and Dublin. Recently valued at $95 billion, its financial backers include Sequoia Capital and the Irish government via the National Treasury Management Agency.

Americans asked to name an Irish fintech company often say Stripe, the company founded by two Ireland-born brothers that is dual headquartered in San Francisco and Dublin. Recently valued at $95 billion, its financial backers include Sequoia Capital and the Irish government via the National Treasury Management Agency.

Stripe’s Irish roots may not be a one-off. Though the Republic’s entire population (4.9M) is less than that of New York City (8.7M), it is home to nearly 250 indigenous fintech companies, dozens of which offer lending and payment products, according to the latest Fintech Ireland map. And many have expansion plans in the works.

Despite the close proximity to the UK, the United States and Canada tied for the #1 priority region that homegrown Irish fintech companies said they want to expand to, according to Fintech Ireland’s industry survey. The UK came in 2nd. The majority of Irish fintech companies actually said they prioritized expansion plans for the US and Canada even over expansion in their home country.

A flight from New York to Dublin can be shorter than a flight from New York to San Francisco and Ireland’s primary language is English. 7,000 people work in fintech in Ireland, the bulk of which are based in Dublin.

deBanked evaluated the market in-person during the Fall of 2019 and determined that there are many cultural and operational similarities to the US. A follow-up piece in May 2020 captured how the industry there was faring through the Covid pandemic.

Escape From Manhattan? Not So Fast Miami

March 16, 2021 As the pandemic raged, word on the street was that fintechs were mulling a Manhattan exodus. Expensive midtown offices didn’t look great compared to Miami beaches.

As the pandemic raged, word on the street was that fintechs were mulling a Manhattan exodus. Expensive midtown offices didn’t look great compared to Miami beaches.

But according to research by Bloomberg, there were no crowds of fleeing New Yorkers like it may have seemed. Only 2,246 people filed a permanent address change from Manhattan to Miami-Dade County, and 1,741 went to Palm Beach County.

3,987 NYC-area residents packed up shop and flew south for the Covid winter, never to return- But that’s only ~5.6% of the total 70,000 people that moved from NY state last year, according to Unicast, a real estate location analytics firm.

“The main problem with moving to Florida is that you have to live in Florida,” Jason Mudrick, a hedge fund manager, told Bloomberg.

In 2019, the US Census Bureau estimated a net 38,512 Greater New York State residents moved to the Sunshine State, suggesting that what was experienced in 2020 may have been nothing more than the routine annual migration. 2020’s Census data is not yet available so it’s difficult to say.

“We’re going to keep going with New York City if that’s all right with you,” Jerry Seinfeld wrote in an August 2020 NY Times Op-ed, “and it will sure as hell be back.”

Prosper Marketplace Posts $18.5M Profit for 2020

March 15, 2021 Prosper Marketplace reported a $18.5M profit for 2020, up from a net loss of $13.7M in 2019, marking yet another online lender that successfully weathered Covid.

Prosper Marketplace reported a $18.5M profit for 2020, up from a net loss of $13.7M in 2019, marking yet another online lender that successfully weathered Covid.

In 2020, Prosper originated $1.5B in loans, $1.4B of which were originated through their Whole Loan Channel.

Like Lending Club, the company has long retreated from its peer-to-peer lending roots, but still operates a platform where individual retail investors can buy notes, whereas Lending Club terminated theirs completely.

Prosper generated $100 million in revenue in 2020 and had 353 full-time employees at year-end.

Prosper is not publicly traded but is required to file regular financial statements with the SEC because it sells notes to retail investors.

LendingClub Talks Earnings Post Radius-Bank Acquisition

March 11, 2021 “It’s really hard to imagine a better time to be launching a digital bank,” said LendingClub CEO Scott Sanborn on the company’s Q4 earnings call. “First up, we’ll be building on Radius’ multi-award winning online and mobile deposit offering to make it very easy for our customers to manage their lending, spending and savings in a holistic fashion.”

“It’s really hard to imagine a better time to be launching a digital bank,” said LendingClub CEO Scott Sanborn on the company’s Q4 earnings call. “First up, we’ll be building on Radius’ multi-award winning online and mobile deposit offering to make it very easy for our customers to manage their lending, spending and savings in a holistic fashion.”

The company reported a Q4 net loss of $26.7M on $75.9M in revenue and originated $912M in loans. Their status of being a bank, however, is only just beginning. CFO Tom Casey explained the following:

In addition to lowering our funding cost of deposits, our new marketplace bank will capture significant financial benefits from being a bank and having a marketplace. [….]For every $100 million of loans we originate, we generate about $4 million through an origination and servicing fee when we sell the loans in the marketplace. The vast majority of this fee-based revenue is realized immediately and without requiring a significant amount of capital. However, it is highly dependent on origination volume.

[…]

We can now bolster this revenue stream with bank revenue generated by loans held for investment on our balance sheet. As you can see on the left side of the page, every $100 million of loans we hold on the balance sheet should generate additional marginal profitability of approximately $12 million. And when you compare that to the $4 million in the marketplace, that’s 3 times more. And this recurring revenue is not dependent on originations in any given quarter.

LendingClub experienced unique success during the pandemic, stating that loan performance exceeded their expectations.

“Coming out of the pandemic,” Sanborn said, “the strength of our underwriting has now also been cycle-tested. Losses on loans issued pre-COVID are in line with our pre-pandemic expectations, and loans issued since the pandemic are some of our best-performing loans in recent years.”