Fintech

CAFE’s Fall 2024 Accelerator Cohort a Success

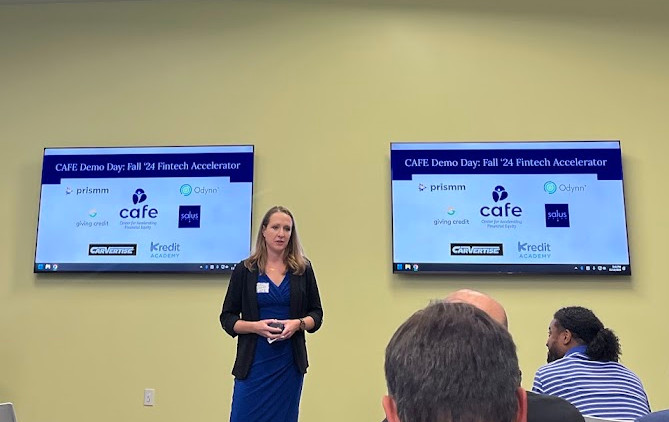

November 25, 2024 deBanked attended and sponsored the final demo day of CAFE’s Fall 2024 Accelerator Cohort. CAFE, as previously profiled, is the non-profit Center for Advancing Financial Equity. The six members of the Cohort were Carvertise, GivingCredit, Kredit Academy, Odynn, Salus, and Prismm.

deBanked attended and sponsored the final demo day of CAFE’s Fall 2024 Accelerator Cohort. CAFE, as previously profiled, is the non-profit Center for Advancing Financial Equity. The six members of the Cohort were Carvertise, GivingCredit, Kredit Academy, Odynn, Salus, and Prismm.

As previously stated, the bi-annual accelerator aims to identify, support and grow extraordinary financial accelerated technologies and innovations. Hundreds of companies apply but only six get selected for each cohort.

The demo day took place inside the Fintech Innovation Hub, situated on University of Delaware’s STAR campus. It was a major success.

To learn more about CAFE, visit: https://ftcafe.org/

Meet the CAFE That Can Accelerate Your Fintech Startup

October 14, 2024 Newer fintechs on a mission to advance financial health and wellness for low-to-moderate income individuals and underserved populations may not have to weather the startup journey alone. Inside the Fintech Innovation Hub, situated on University of Delaware’s STAR campus, is the non-profit Center for Advancing Financial Equity (CAFE). Supported by numerous partnerships including the Small Business Administration, Discover, the Small Business Development Center (SBDC), the American Bankers Association, and more, one of its signature initiatives is its bi-annual fintech accelerator, which aims to identify, support and grow extraordinary financial accelerated technologies and innovations. Hundreds of companies apply but only six get selected for each cohort of the accelerator. One of those selected this past Spring, Parlay, offers a powerful tool to improve small business loan applications. Another, Stratyfy, offers interpretable AI solutions that enable financial institutions to make more accurate, efficient, and fair financial decisions in credit risk, fraud, and compliance.

Newer fintechs on a mission to advance financial health and wellness for low-to-moderate income individuals and underserved populations may not have to weather the startup journey alone. Inside the Fintech Innovation Hub, situated on University of Delaware’s STAR campus, is the non-profit Center for Advancing Financial Equity (CAFE). Supported by numerous partnerships including the Small Business Administration, Discover, the Small Business Development Center (SBDC), the American Bankers Association, and more, one of its signature initiatives is its bi-annual fintech accelerator, which aims to identify, support and grow extraordinary financial accelerated technologies and innovations. Hundreds of companies apply but only six get selected for each cohort of the accelerator. One of those selected this past Spring, Parlay, offers a powerful tool to improve small business loan applications. Another, Stratyfy, offers interpretable AI solutions that enable financial institutions to make more accurate, efficient, and fair financial decisions in credit risk, fraud, and compliance.

Being accepted into CAFE requires a startup to already be up and operating.

“[These companies are] in market, the products are built already,” said Kristen Castell, Managing Director of CAFE. “They do have some customers, some of them are enterprise customers like banks, a full time team, and many of them have raised money already.”

Castell tells deBanked that the companies applying to the accelerator still need a lot of help in terms of making industry connections, scaling distribution, and developing the right partnerships. It’s an eight-week program, some of which takes place on location at the Fintech Innovation Hub in Delaware. The rest is virtual. Applicants and those selected can be from anywhere in the US. The founders, all connected by some level of common interest, are bound to form a bond throughout the unique experience. Last week for example, the members of the Fall cohort went on a field trip to the Wilmington, Delaware headquarters of Best Egg (F/K/A Marlette), an online lender, and got to learn about their path from being a startup in 2014 to the fintech stalwart they are today.

“This time, we have some opportunities to meet the American Bankers Association in Washington, DC,” Castell said. “We also meet the regulators at CFPB in Washington, DC. There’s some other conference opportunities like another accelerator called RevTech Labs that has an investor conference in Charlotte. So there’s an opportunity to pitch there to investors.”

The learning curve for any company coming through the accelerator is dramatically shortened by the access and guidance they get, whether that be from other fintechs, from bankers, from regulators, or the largest fintech trade association, the American Fintech Council.

At the end of it all there’s a demo day in person at the Fintech Innovation Hub in Delaware, where they present to investors, bankers, academics, industry and community leaders, non-profit organizations and entrepreneurs alike to show what they’re made of.

Castell, a former banker herself that previously worked for JPMorgan and BlackRock, also experienced a taste of being a fintech entrepreneur when she became interested in impact investing. It’s a scene she loves. When the plan for CAFE was in development, the opportunity to be involved with financial inclusion, technology, and startups all in one was something she really wanted to take on.

“It’s really been an incredible opportunity to build the organization, to build the program, to work with all these partners, to bring all these stakeholders that I had mentioned earlier in and we’re not done,” she said. “We’re just getting started.”

The six members of the Fall cohort are Carvertise, GivingCredit, Kredit Academy, Odynn, Salus, and Prismm. Sponsors include the American Bankers Association (ABA), Siegfried Advisory, Delaware Prosperity Partnership (DPP), Wolf & Co, Delaware Tech Park, deBanked, and Discover Financial Services.

deBanked is expected to attend the demo day in November.

Photos From B2B Finance Expo and More

September 30, 2024

Photos from B2B Finance Expo can be FOUND HERE. The order of them arranges at random. We’re still adding a few to the gallery. If you want a higher res version of a photo or to inquire if there are any of you that may not be here, email events@debanked.com. Video interviews from the red carpet or from the trade show floor will start being added over the next couple days and should take up to 2 weeks to get them all up. There is a ton of video content!

Congratulations to Cesar Valero (pictured at right), Business Development Exec of Spartan Capital on his victory at the event’s official poker tournament! Story on this to follow! Second place went to Erica Bell, Business Development Exec at Tax Guard. The final table of the match was HIGH PRESSURE so if you want to know how they got so good at the game, make sure to give them a buzz.

Congratulations to Cesar Valero (pictured at right), Business Development Exec of Spartan Capital on his victory at the event’s official poker tournament! Story on this to follow! Second place went to Erica Bell, Business Development Exec at Tax Guard. The final table of the match was HIGH PRESSURE so if you want to know how they got so good at the game, make sure to give them a buzz.B2B Finance Expo was a two-day event in Las Vegas that brought folks together from across the fintech and commercial finance industries.

Special thanks goes out to Greg Smith and Steve McLaughlin of FT Partners for their incredible insights on Day 1. Proceeds from the event will benefit the Small Business Finance Association (SBFA). A thank you to all the sponsors and attendees.

Applicant Didn’t Complete their Business Loan Application? They Might’ve Gotten Stuck

September 26, 2024 “Early discovery showed us in the market that over 85% of [small business] loan application packets were straight up abandoned,” said Jay Long, COO and co-founder of Parlay.

“Early discovery showed us in the market that over 85% of [small business] loan application packets were straight up abandoned,” said Jay Long, COO and co-founder of Parlay.

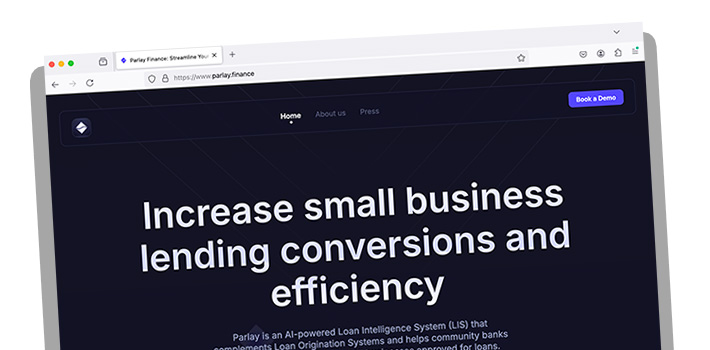

In an era where fintechs have sought to increase the speed and accuracy of the underwriting process, Parlay, an AI-native SaaS company, noticed that one major lingering challenge for small business lenders starts well before today’s tech stacks even come into play. For example, an applicant might not be sure what they’re supposed to be submitting to the lender in the first place and thus the process may never even make it to the fintech underwriting stage. This bottleneck comes at a cost for both a lender who fails to move a loan application forward and for a borrower who gets stuck and isn’t able to get what they wanted.

“A lot of small businesses when you request a bunch of stuff in an email or you just say ‘give me these things,’ they may not have the financial background, that financial education to know how to answer those questions,” said Alexandra McLeod, CEO and co-founder of Parlay. “And so what we’ve done is we’ve built a series of really intuitive, user-friendly, plain-English workflows that are easy and rapid to get through but also systematic.”

Parlay’s Loan Intelligence System (LIS) was drawn from interviews with hundreds of small businesses and also by observing how they did with existing workflows.

“We’re asking them yes-no questions, and based on how they answer, then the questions arrange themselves in a specific way,” said McLeod. “But also, we have tool tips in the platform, so if somebody doesn’t know what a term is or if they need help building something—like a debt schedule is something they have to provide, and people don’t know how to generate those, then we have these builders in the workflows to help them with that.”

At present, Parlay is focused on SBA 7(a) loans with their most common customer being a community bank or credit union. The company’s focus on the intake process has also enabled their technology to do even more, and that is to nurture applicants that are not eligible for approval to eventually become eligible through personalized actionable recommendations.

According to Parlay, their LIS easily integrates with existing Loan Origination Systems and it improves profitability without increasing overall business risk.

For McLeod, who has a prior background with financial inclusion initiatives and startups, she’s seen firsthand that there are financial institutions eager to provide capital to the underserved but that the economics to do it with legacy systems at scale have just made it too cost prohibitive. “The other side of the problem is the small business needs more hand holding,” said McLeod, “and the lender can’t provide it. And so this is a perfect application of technology where you can offer a scalable alternative where you can handhold the small business, you can provide a lot more insight to the lender as to the needs of those small businesses and you can generate that outcome of more booked loans because more people can actually get through the process.”

Notably, Parlay is a recent graduate of the Center for Accelerating Financial Equity (CAFE) Fintech Accelerator Program, which supports fintechs advancing health & wellness of underserved populations. CAFE is headquartered in the Fintech Innovation Hub building on University of Delaware’s STAR Campus, a building deBanked covered in 2022.

NorthOne is Building Finance Departments For Small Businesses

October 20, 2022 NorthOne recently received $67 million in Series B funding from investors including former NFL star Drew Brees, Battery Ventures, Don Griffith, Ferst Capital Partners, FinTLV, Operator Stack, Redpoint Ventures, Tencent, Tom Williams, and Next Play Capital.

NorthOne recently received $67 million in Series B funding from investors including former NFL star Drew Brees, Battery Ventures, Don Griffith, Ferst Capital Partners, FinTLV, Operator Stack, Redpoint Ventures, Tencent, Tom Williams, and Next Play Capital.

Founded in 2016 by CEO Eytan Bensoussan and COO Justin Adler, NorthOne was designed for small business owners to build a finance department without the complexity of a bank. Coming from an entrepreneurial background, Bensoussan noticed that being a great owner does not make one a great financial manager. With the idea of building good banking and accounting for businesses and combined with Adler’s professional career in the tech space, NorthOne was born.

“We want to build finance departments out of every small business in America, bring the sophistication of what so many of the biggest companies around us enjoy but bring it to the small businesses that could never dream of being able to build a finance department for their small business,” said Bensoussan. “I think that’s the gap that we’re closing.”

Through NorthOne, customers not only get access to a bank account but also technology that organizes and manages other business functions. Business owners can pay invoices, do payroll, and send ACHs or wires in seconds, for example, all while integrating with their existing accounting, e-commerce, and POS software.

Conducting all this from a desk or mobile device without having to go to a bank is a service directed at small businesses with fewer than 10 employees, that are family owned, and are managed locally in the community.

“…here we are talking to a lot of these business owners explaining that there’s so much more that a bank account could offer if it was designed to be more than just a store of money,” said Bensoussan. “I think that’s this eye-opening moment when we talk to them, and we get a lot of folks saying I never even thought that it could go that far. And it’s an exciting moment for us as well.”

Onyx IQ Customers Can Now Use Actum Processing

October 18, 2022 Onyx IQ recently announced a new partnership with Actum Processing. Customers of Onyx IQ, a loan & MCA management company founded in 2017, will now be able to process their ACH payments using Actum.

Onyx IQ recently announced a new partnership with Actum Processing. Customers of Onyx IQ, a loan & MCA management company founded in 2017, will now be able to process their ACH payments using Actum.

“The lending space happens to be one of our most productive niches, being that funders and brokers need a means to collect payments and fund deals,” said Vincent Lipari, President of Actum, “the ACH network is that vehicle and Actum takes pride in delivering reliable services for our clients.”

Onyx IQ, described as a “digital lending platform that enables you to fully automate every aspect of your business” and led by smb finance veteran Jay Keller, launched its software this past July.

“It’s a workflow solution with all the appropriate integrations and all of the reporting that the MCA and alternative lending spaces might need,” said Elizabeth Schuerman, VP of Sales at Onyx IQ.

The arrangement between the two companies is not mutually exclusive. Onyx IQ customers can use other processors if they so choose and Actum does ACH processing in many spaces outside of lending including the shipping space, fantasy sports, gaming, and more, but the collaboration is significant for another reason; Both individuals, Lipari of Actum and Keller of Onyx IQ, have known each other for roughly 11 years and ironically had never done any business together. When the opportunity presented itself, their non-business relationship grew into this newfound partnership.

“Integrations like the one we have with Onyx IQ help Actum attract more quality lenders, which is good for growth in transactions and revenues,” Lipari said.

Overall, the deal “allows net new customers to start funding in as little as 2-4 weeks, processing ACH payments and paying commissions on the rails that already exist between the two platforms,” an official statement says.

Rapid Finance Has Evolved Into a Three-Piece Business

October 12, 2022 Historically, Rapid Finance has been a lender, but over the last few years the company has expanded into other areas including portfolio servicing and technology. It’s a three-piece business, one that now includes a new wholly owned subsidiary, Thrive.

Historically, Rapid Finance has been a lender, but over the last few years the company has expanded into other areas including portfolio servicing and technology. It’s a three-piece business, one that now includes a new wholly owned subsidiary, Thrive.

Thrive is described as an end-to-end digital lending platform that can be used by banks, credit unions, or other organizations to offer small business loans faster and easier to their customers.

Kunal Sehgal, co-founder and CEO at Thrive, said that Thrive’s technology can handle everything “from the application intake, to actual data collation and aggregation, to underwriting to decisioning, to origination to closing, and then servicing as well.”

The product gives Rapid a unique tool in its arsenal, given the company’s background. Will Tumulty, CEO at Rapid Finance, explained that Thrive’s technology will be greatly enhanced by Rapid’s own experience in the lending business.

“If you want to do a partnership with Rapid [through Thrive], you’re not just signing up for software,” Tumulty told deBanked. “You can get software, you can get potentially balance sheet access, you get expertise in servicing and credit management that Rapid has developed over more than 15 years in small business lending. And we think that’s a big difference for companies that are looking for a partner to help them get into the small business lending space.”

The acquisition was announced on October 3rd at American Banker’s Small Business Banking conference and is part of Rapid’s recent corporate rebrand and restructuring, which includes a new logo and website.

Lavu Adds MCA Product Through Partnership With Parafin

October 7, 2022 It’s not just DoorDash that Parafin has partnered up with to provide MCA funding. Last week, the restaurant software company Lavu launched Lavu Capital to help restaurants owners access capital.

It’s not just DoorDash that Parafin has partnered up with to provide MCA funding. Last week, the restaurant software company Lavu launched Lavu Capital to help restaurants owners access capital.

“We are a restaurant software company that focuses on small and medium restaurants,” said Saleem S. Khatri, CEO of Lavu. “Think of your favorite restaurants that have one or two locations that are really really popular, that are ingrained in the community. We do everything from point of sale to online ordering, payment processing, and anything a restaurant would need to start and grow their business.”

Khatri said that one thing they noticed is that these restaurants have a fundamentally hard time getting loans and that led them to connect with Parafin. Parafin’s product is an advance on future sales, not a loan, and their offerings have been simply integrated into Lavu’s technology. Parafin automatically generates an offer for restaurant owners that they can see in their Lavu dashboard.

“…it’s just really beautifully designed,” said Khatri. “It basically says, ‘Hey, you have an offer to borrow up to $5,000. Do you want it yes or no?’ And you just click ‘yes’ and you’re good to go, the money deposits straight into your bank account, and then you have a repayment schedule. And it just pulls it directly from your bank account according to that repayment schedule.”

Khatri says they haven’t really begun to market the product yet and they’ve just started off with a limited base of customers but that the plan is to roll it out to all their customers around the US. They’d even do it with their customers outside of the US if they could, but the tech is not set up to do that just yet.

“This is going to be a feature and an offering that really really benefits our customers because it gets to the heart of what they need, which is they’re in constant need of liquidity, they’re in constant need of kind of tools to run their business better,” Khatri said. “And it just really fits our portfolio of products that we offer to these customers. So the reception has been awesome.”