cryptocurrency

Forget the Metaverse, I Bought Real Land

February 20, 2024 In 1958, developers purchased 82,000 acres of barren land that was situated a hundred miles north of Los Angeles with a plan to build a sprawling metropolis for 400,000 future residents. As it instantly became the third largest city in California by land area, they chose an appropriately symbolic name, California City. It was a flop from the start. Although powerful marketing led to the sale of 50,000 lots by the early 1970s, the city only had a population of 1,300 people by 1969. That was bad enough that the Federal Trade Commission intervened in 1972 and forced a settlement that allowed thousands of landowners to get refunds. California City held on, however, and it’s now home to nearly 15,000 residents. It even has its own airport. But still, what it has become is still remarkably short of the original vision.

In 1958, developers purchased 82,000 acres of barren land that was situated a hundred miles north of Los Angeles with a plan to build a sprawling metropolis for 400,000 future residents. As it instantly became the third largest city in California by land area, they chose an appropriately symbolic name, California City. It was a flop from the start. Although powerful marketing led to the sale of 50,000 lots by the early 1970s, the city only had a population of 1,300 people by 1969. That was bad enough that the Federal Trade Commission intervened in 1972 and forced a settlement that allowed thousands of landowners to get refunds. California City held on, however, and it’s now home to nearly 15,000 residents. It even has its own airport. But still, what it has become is still remarkably short of the original vision.

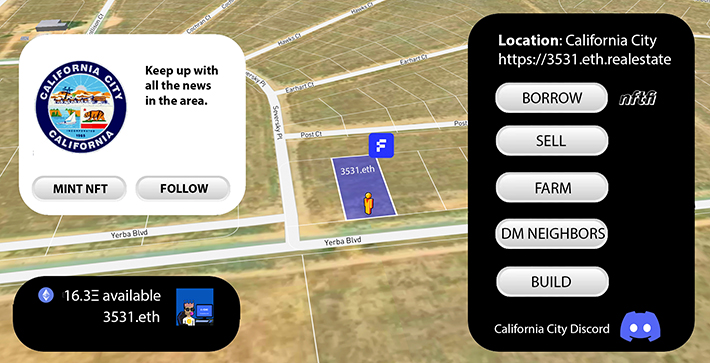

All of this history was something I breezed through right before I impulsively clicked a button on my screen asking me to confirm my purchase for a lot there. One click. That’s apparently all it took to become the newest member of a potential future neighborhood in California City, one that might not ever come to fruition. But how I found it in the first place is the real story. It appears that in the modern era this sleepy desert outpost has become a bit of an experimental laboratory for something relatively new in the real estate world, converting properties into NFTs.

Here’s how it’s done. A landowner places their property into an individual trust and ownership of that trust is governed by whomever owns the corresponding NFT on Ethereum. In effect, the owner of the trust would be defined by their ugly hex address, like this one for example: 0x64233eAa064ef0d54ff1A963933D0D2d46ab5829. It’s actually quite basic and it’s all made possible by a “proptech” company called Fabrica.

Here’s how it’s done. A landowner places their property into an individual trust and ownership of that trust is governed by whomever owns the corresponding NFT on Ethereum. In effect, the owner of the trust would be defined by their ugly hex address, like this one for example: 0x64233eAa064ef0d54ff1A963933D0D2d46ab5829. It’s actually quite basic and it’s all made possible by a “proptech” company called Fabrica.

Founded in 2018 and backed by investors like Mark Cuban and Zain Jaffer, properties tokenized by Fabrica “can be traded instantly, used as collateral and are compatible with all NFT platforms,” the company states. “The product automates sales transactions, facilitating title transfer, payments and regulatory compliance.” Fabrica facilitates the on-ramping of your land into an NFT and even provides its own marketplace for buyers and sellers. That’s where I got mine. Interested parties can read up on a property’s on-chain history and even check the title. There’s also a cool little Google Earth-like animation that flies the user to their specific plot of land. The experience feels a lot like buying a plot of virtual land in a video game or the metaverse except this land is real. That means that sleek little NFT in your digital wallet comes with real responsibilities like property taxes, which Fabrica works to keep the owner informed about. It also means any and all liabilities of property ownership. The upside is that you can go and visit it in real life and even develop it. You can’t do that in a video game.

Although I’ve counted six properties in California City that are immediately identifiable as NFTs, it’s hardly the only place in the United States where this is being done. Properties available for sale as NFTs as of this writing include locations across Colorado, Arizona, New Mexico, San Bernardino-CA, and even Orange, New York. Some are very remote and speculative, while others are a part of normal civilization and priced accordingly. Buyer beware of course given the serious nature of these assets.

Perhaps one of the biggest obstacles to understanding how this is all possible is the widespread misconception of what NFTs are. Most of the American population lives under the mistaken impression that NFTs are cartoon art pictures like Bored Apes or CryptoPunks that were all the rage in 2021 and to some extent are still popular in niche circles, but almost anything can be tokenized. More recently, for example, domain names are being converted into NFTs to facilitate faster sales and quicker payouts. The same is true now here with land. Not only can land ownership change hands in the blink of an eye by transferring the NFT but one can also easily tap into the value by pledging it on a peer-to-peer NFT loan marketplace like NFTfi. Fabrica officially announced a partnership with NFTfi this past December, for example. The possibilities are endless

For the perpetual skeptics of all things blockchain that are convinced real business will only ever be done in the real world, a visualization of an NFT on a crypto wallet app might not be all that convincing, especially if the icon for it is situated right next to one of those expensive monkey pictures that kids wouldn’t shut up about years ago. The proof then is in the adventure. With a drive of less than two hours from Downtown Los Angeles, there’s a little plot of land on a quiet street known as Yerba Boulevard. It’s covered in weeds and reddish soil. Empty plains make up most of the backdrop but the suburbs are very slowly creeping their way there. In fact, I’ve since learned who my neighbor is across the street. It’s a 26,000 square foot cannabis facility that was just built in 2022. I bet the owners would be into NFTs (😂). Since that facility is up for sale, numerous 3D surrounding views exist of my plot. Turns out I can even walk to the airport. It’s not much but it’s home to me and all I could afford for the purpose of this story and learning what it was all about. Maybe those 400,000 planned residents will eventually want my land and it’ll make me a millionaire. Ah the allure of California City.

Murray Loses Election for ENS Foundation Directorship

May 21, 2023 deBanked president Sean Murray was one of two nominees earlier this month for an open director position of the ENS Foundation. ENS stands for the Ethereum Name Service, a protocol that allows users to substitute human readable usernames for long hexadecimal strings commonly associated with crypto addresses.

deBanked president Sean Murray was one of two nominees earlier this month for an open director position of the ENS Foundation. ENS stands for the Ethereum Name Service, a protocol that allows users to substitute human readable usernames for long hexadecimal strings commonly associated with crypto addresses.

Instead of one’s address looking like this: 0x64233eAa064ef0d54ff1A963933D0D2d46ab5829, it could be debanked.eth or debanked.com or sean.debanked.com or some other domain name owned by the user.

Murray has been an advocate for ENS names as a form of web-based identity. He was one of the first 500 people in the world to use a .com address as an ENS name and the first in the world to turn a .com address into an NFT on mainnet using the official ENS Namewrapper contract. debanked.com, for example, is not only a website address, but also a crypto address and an NFT. Murray has been studying crypto since 2014 and deployed his first deBanked smart contract to ethereum in 2021.

Murray lost the election in a blowout but has expressed that his candidacy led to some positive changes in the ENS ecosystem. The ENS Foundation represents the technology’s official DAO. Murray’s competition was more qualified than he was for the role. The victor, Alex Van de Sande, helped launch ethereum, launched the first Ethereum wallet and Web3 Browser, and was a co-founder of ENS.

“I anticipate there eventually being some crossover between the traditional financial system and blockchain technology,” Murray said. “A username system would be an integral part of that. I’m not into speculating on coins or anything of that nature.”

No, FedNow Payments are Not a Digital Currency

April 9, 2023 The Federal Reserve is launching a new instant payments service called FedNow in July 2023. However, there is apparently a common misconception that FedNow is a form of digital currency or a step towards eliminating cash. On April 7, the Fed felt it had to release a statement to say that a central bank digital currency (CBDC) was not currently in process.

The Federal Reserve is launching a new instant payments service called FedNow in July 2023. However, there is apparently a common misconception that FedNow is a form of digital currency or a step towards eliminating cash. On April 7, the Fed felt it had to release a statement to say that a central bank digital currency (CBDC) was not currently in process.

“[FedNow] is like other Federal Reserve payments services, such as Fedwire and FedACH,” the Fed wrote. “FedNow will be available to depository institutions, such as banks and credit unions, in the United States and will enable individuals and businesses to send instant payments through their depository institution accounts. Instant payments allow individuals and businesses to send and receive payments within seconds at any time of the day, on any day of the year, so that the receiver of a payment can use the funds almost instantly.”

FedNow could offer a compelling usecase in the alternative lending industry but that will remain to be seen. In the meantime, as far as CBDCs go, the Fed says that it would need support from Congress and the executive branch “ideally in the form of a specific authorizing law” to consider issuing one. CBDCs have been a popular subject as of late given the total control they could give a governmental authority over its money. Among the potential capabilities would be the power to technologically deactivate or cancel anyone’s money if the government felt it was it being used for some unlawful purpose.

White House Feels the Pressure of Cryptocurrencies

March 22, 2023 Houston, we have a problem. That’s the takeaway about cryptocurrencies from the White House’s most recent Economic Report, a historically dry book produced annually to comply with the Employment Act of 1946. The President’s 2023 report, however, is markedly different from 2022 or any previous year in that it laboriously bewails the persistence and pervasiveness of cryptocurrencies. For example, the report uses the word crypto 255 times in its 2023 report compared to zero times the year before.

Houston, we have a problem. That’s the takeaway about cryptocurrencies from the White House’s most recent Economic Report, a historically dry book produced annually to comply with the Employment Act of 1946. The President’s 2023 report, however, is markedly different from 2022 or any previous year in that it laboriously bewails the persistence and pervasiveness of cryptocurrencies. For example, the report uses the word crypto 255 times in its 2023 report compared to zero times the year before.

The report labels crypto assets as “speculative investment vehicles” that “generally do not perform all the functions of money as effectively as sovereign money” that can also be “harmful to consumers and investors.” Despite this, the United States government is finally being forced to contend with the reality that cryptocurrencies continue to enjoy a collective $1 trillion+ market cap despite all the scams, collapses, price declines, and rug pulls. Bitcoin and Ethereum combined are $775 billion at the time of this writing, something that the White House has apparently given little thought to in previous years. In 2022 neither earned any mention at all.

| Annual Report Year | Mention of crypto | Bitcoin | Blockchain | Digital Asset |

| 2023 | 255 | 75 | 61 | 45 |

| 2022 | 0 | 0 | 0 | 0 |

Finally trying to play catchup, the White House leveraged its criticisms of crypto to pitch its own centralized competitors in the works, the FedNow Instant Payment System and a Central Bank Digital Currency (CBDC). The challenge with FedNow is that it can’t be implemented by force of the government alone.

“FedNow requires commitment and active engagement by the private sector to make it interoperable, which means connecting and communicating with other payment services,” the report states. “While noting that interoperability can take different forms, the Federal Reserve has maintained that it alone cannot fully establish the interoperability of FedNow; achieving this will require active partnership and collaboration with the financial industry.”

“Certain innovations, such as FedNow and a potential U.S. CBDC, could help bring the U.S. financial infrastructure into the digital era in a clear and simple way, without the risks or irrational exuberance brought by crypto assets,” it concludes. “Hence, continued investments in the Nation’s financial infrastructure have the potential to offer significant benefits to consumers and businesses, but regulators must apply the lessons that civilization has learned, and thus rely on economic principles, in regulating crypto assets.”

Merchant Loses Whole EIDL After Attempting to Earn High Yield On It

July 25, 2022 It’s a tale of Covid EIDL relief gone wrong. A small business owner in Colorado Springs, CO is begging for his funds back after taking the entire lump sum of his EIDL funds ($525,000) and depositing them with a high-yield non-FDIC insured cryptocurrency tech company. The tech company, Celsius, declared bankruptcy less than two months later, yanking the merchant’s EIDL funds with it. Celsius was not a bank, the arrangement not a true deposit account, and the funds not FDIC-insured.

It’s a tale of Covid EIDL relief gone wrong. A small business owner in Colorado Springs, CO is begging for his funds back after taking the entire lump sum of his EIDL funds ($525,000) and depositing them with a high-yield non-FDIC insured cryptocurrency tech company. The tech company, Celsius, declared bankruptcy less than two months later, yanking the merchant’s EIDL funds with it. Celsius was not a bank, the arrangement not a true deposit account, and the funds not FDIC-insured.

In a letter submitted by the merchant to the bankruptcy court, he says that he deposited the funds there to “earn an APY to help pay back the 3.9% on the loan…” He further added that he believed his account to be safe because of the site’s Terms of Use.

“The funds in my Celsius Custodial account are not mine, they are the US Governments and I my entire business is secured and backed by these funds,” he wrote. “If they are not returned, my business would go bankrupt, my 15 employees would be let go, and 14 years of my life’s work lost and at the age of 49 years old, I would have to start over with nothing.”

Prior to the bankruptcy, Alex Mashinsky, Celsius’ CEO, oft touted the phrase: “banks are not your friend.”

New Owner of Loan.eth Says its Worth Millions

June 8, 2022 Less than two months after spotlighting a new domain name market linked to the Ethereum blockchain, the name loan.eth was sold on a secondary market for the equivalent of $45,000. It’s not a website domain like one would expect with a .com or a .net, but rather a crypto wallet address shortener that can double as a screen name and authentication service on web 3.0. That’s just the tip of the iceberg of the utility that a .eth domain can offer.

Less than two months after spotlighting a new domain name market linked to the Ethereum blockchain, the name loan.eth was sold on a secondary market for the equivalent of $45,000. It’s not a website domain like one would expect with a .com or a .net, but rather a crypto wallet address shortener that can double as a screen name and authentication service on web 3.0. That’s just the tip of the iceberg of the utility that a .eth domain can offer.

Although most people may not be familiar with .eth domain names, the new owner of loan.eth, who goes by @BloomCapital_ on twitter, is so confident that such names will be adopted in the future, that he believes the value of this one will be many times what he paid for it.

“Just so it has to be said, Loan.eth won’t be sold for less than $10M,” Bloom wrote. Bloom said he considers loan to be the top .eth name that he has.

Senior Business Lending Exec of Square Has Moved to Coinbase

May 16, 2022 Ronak Daya, who spearheaded several of Square Capital’s lending divisions, including “head of product for business lending” and “head of product for external lending and partnerships,” announced on twitter that he had moved on from the company. He had been involved in SMB lending for 7 straight years. His new role? Head of Financing Products at Coinbase.

Ronak Daya, who spearheaded several of Square Capital’s lending divisions, including “head of product for business lending” and “head of product for external lending and partnerships,” announced on twitter that he had moved on from the company. He had been involved in SMB lending for 7 straight years. His new role? Head of Financing Products at Coinbase.

If you thought Coinbase was just about buying Bitcoin, you’re wrong. Daya announced that he’ll be leading a team “to build lending and financing products both for consumers and institutional clients.”

“As I explored what came after Square, my primary focus was on challenging myself to go in a fundamentally new domain/area, and build for a new customer,” Daya wrote. “The priority was learning. Learning by building in domains that I am passionate about, but know little about.”

Convinced that the world is moving towards becoming a crypto-native economy, Daya added that he wants to “play a part in using trust, ease and education to onboard the next billion customers to a new financial system.”

Currently, Coinbase already offers a lending product, loans up to $1 million at 8% APR with monthly payments and no credit check. Though Bitcoin is used as collateral, payments are made by monthly ACH debit or through a linked USD wallet.