Business Lending

B2B Finance Expo 2025 Recap

November 12, 2025B2B Finance Expo 2025 was a tremendous success! This conference featured a larger number of attendees, exhibitors, and speakers from across the spectrum of commercial finance and small business lending than the previous inaugural year.

B2B FINANCE EXPO 2025 PHOTOS HERE

VIDEO INTERVIEWS FROM THE RED CARPET HERE

If you want a copy of your interview video file, email events@debanked.com.

To learn more about the Small Business Finance Association, contact Stephen Denis or visit: https://sbfassociation.org

A special shout out to the Diamond and Platinum Sponsors: Rapid Finance, Kapitus, Bitty, and Ocrolus.

Also a shout out to Nexi (WiFi Sponsor), AMA Recovery Group (Breakfast Sponsor), Shoreham Bank (Lanyard Sponsor), and Vox Funding (Key Card Sponsor).

NerdWallet: Organic Search Result Leads for SMB Financing Still Down, LLM-Generated Leads Converting Better

November 7, 2025This quarter, NerdWallet repeated that its SMB financing deal flow continues to lag significantly below last year’s levels because of changes in organic search. Similarly, the company reiterated that the conversion rate of leads coming from LLMs has looked very promising. During the Q3 earnings call, analysts finally asked if LLM traffic meant ChatGPT.

“I’d say the primary driver to think about is actually AI overviews within Google Search,” said NerdWallet CEO Tim Chen. “So because search is becoming more useful, people are searching a lot more. And so we are seeing traffic come through from AI overviews. ChatGPT and Gemini are also driving an increase there. So those are kind of the 2 major drivers in terms of the LLM traffic. When people come through that way, they’re really high intent typically, they’re really held in on finding something in a marketplace, for example. So I think that’s what’s driving some of the higher transaction rates there.”

Though, LLM conversions are promising, they are currently not enough to replace the organic search conversions they were previously generating. CFO John Lee said they expect a continued degradation in SMB in Q4.

Square Loans: Also Repeat Originations Performance Quarter over Quarter

November 7, 2025Square Loans put up $1.7B in originations in Q3 2025. That’s “up” from $1.68B in the prior quarter. In context this is not an unusual lull in growth as Square Loans originations from Q2 to Q3 in 2024 actually dipped by 4%.

Square also put in the footnotes of its earnings that it actually recast its quarterly origination figures going back to Q3 2024 because they had introduced a new short term loan product that was not previously reported in included figures.

Square Loans is the largest online small business lender that deBanked tracks volume for.

Square Loans is a subsidiary of Block so its commercial lending program rarely warrants discussion on its earnings calls since the focus is on payments, Square, and Cash App.

The editor of deBanked has previously theorized that Block CEO Jack Dorsey is the pseudonymous creator of Bitcoin but that has not been proven. Block reported $1.96B in Bitcoin revenue in Q3 but the margins on this are extremely slim as it represents Block acquiring Bitcoin on the open market and selling it to buyers on Cash App.

Shopify Capital: Repeat Originations Performance Quarter over Quarter

November 4, 2025 Shopify Capital originated ~$1B in business loans and merchant cash advances in Q3, the same as the previous quarter. The total for the first nine months of 2025 now sits at ~$2.8B, which means they will surpass 2024’s total of $3B. deBanked has been tracking originations of more than a dozen of the largest online small business lenders since 2014.

Shopify Capital originated ~$1B in business loans and merchant cash advances in Q3, the same as the previous quarter. The total for the first nine months of 2025 now sits at ~$2.8B, which means they will surpass 2024’s total of $3B. deBanked has been tracking originations of more than a dozen of the largest online small business lenders since 2014.

Shopify Capital is not limited to the US and in Q3 it added Ireland and Spain to the list of countries it funds in.

Technically speaking, “Certain loans and merchant cash advances are facilitated by the Company and originated by a bank partner, from whom the Company then purchases the loans and merchant cash advances obtaining all rights, title and interest or discount,” the company explains in its SEC documents.

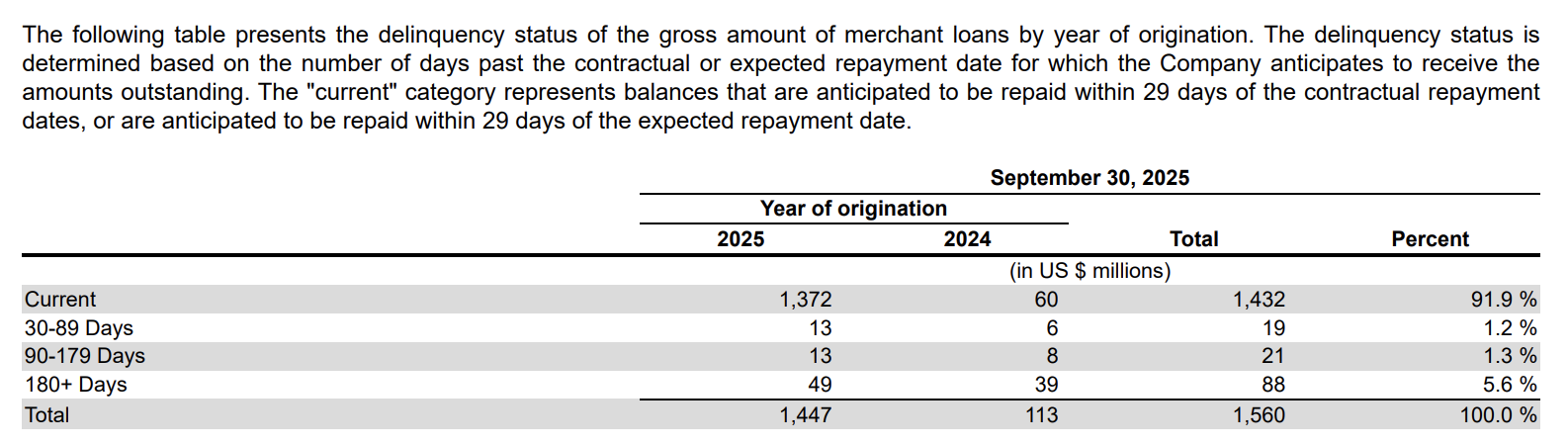

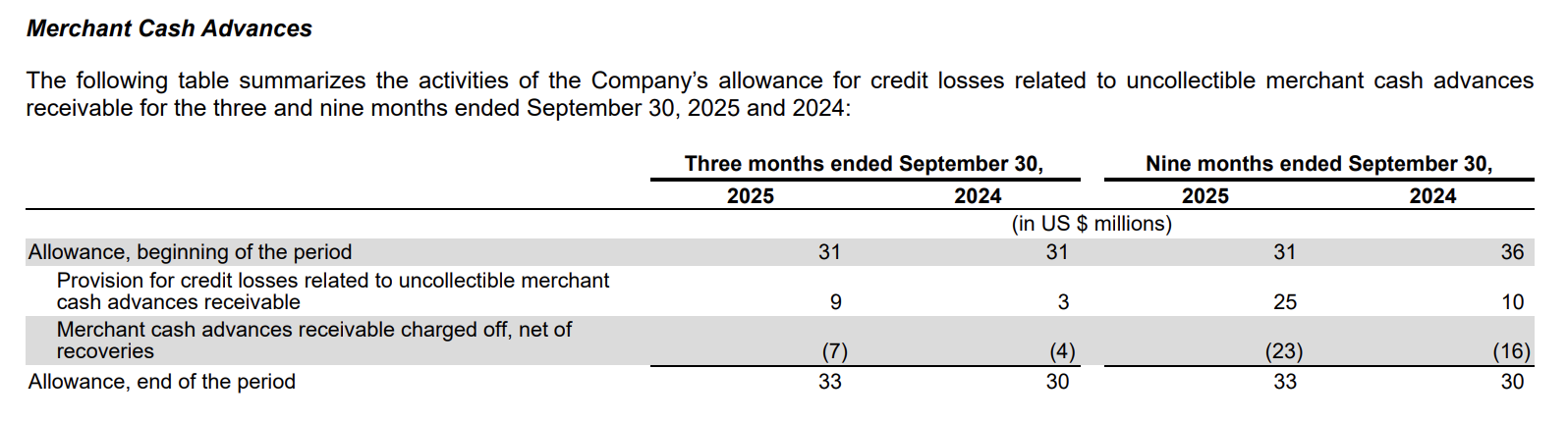

A snapshot of payment status from their Q3 report:

Enova: $1.4B in Small Business Loans in Q3 2025

October 30, 2025Enova continued to set a new internal quarterly record for small business loan originations with $1.4 billion in Q3.

“Since our acquisition of OnDeck five years ago, we’ve not only maintained our strong profit margins, we’ve done so while cutting our consolidated net charge-off rate in half,” said Enova CFO Steven Cunningham during the recent earnings call. Cunningham is scheduled to replace David Fisher in the CEO role this coming January.

Meanwhile, all the major indicators they review continue to show that small businesses are doing well.

“Insights from internal and external sources reflect solid underlying trends for small businesses,” said Fisher. “In conjunction with Ocrolus, we released the eighth iteration of our small business cash flow trend report earlier this week. This offers key insights into the state of small businesses and highlights ongoing trends observed over the past year. Small business confidence is high, as tariffs remain manageable and the economy, and in particular consumer spending, remained strong.”

OppFi: ‘Bitty is a Great Partner’

October 29, 2025Bitty generated $1.4 million in equity income for OppFi in Q3. OppFi, publicly traded, owns a 35% stake in Bitty.

“Bitty is a great partner that we have enjoyed working with and learning from in the SMB space,” said OppFi CEO Todd Schwartz during the company’s Q3 earnings call. “The company shares OppFi’s business principles and corporate values and consistently uses technology to enhance operations and the customer experience. Bitty has identified significant additional growth opportunities and continues to capitalize on the ongoing supply-demand imbalance in the small business revenue-based finance space.”

Overall, OppFi said it had delivered another strong quarter that had outperformed expectations. It raised earnings guidance for the third time this year.

‘Like Family’: How Critical Financing Became One of the Fastest Growing ISOs

October 17, 2025When Farmingdale, Long Island-based Critical Financing (CFI) showed up as the 2,671st fastest growing company on the Inc. 5000 list this year, it was a testament to the company’s many years of hard work. Founded in 2017 by its CEO Brandon Garcia, CFI connects small businesses with a variety of unsecured working capital products.

“[Getting that recognition] was great,” said Garcia. “And I think it’s also a testament to the group that we have. It excites the people that work here too. This is a very stressful job, it’s not easy.”

In CFI’s day-to-day, the sales team finds itself competing against multiple companies on almost every deal that comes across their desks. Small businesses regularly put the pressure on them to get the best rate, the fastest funding, or a combination of both. They say this only increases their drive.

“It has definitely helped us in a way,” Garcia said of it. “I mean who doesn’t want a deal that doesn’t have competition, you can kind of take your time with it, right? But I think when there’s urgency, our guys perform better.”

In the very beginning it was just Garcia himself who had worked in the industry since 2012. He was soon after joined by a former colleague, Robert Menzel, and the two set off to really build up a company. That’s easier said than done, especially in a business where trust is paramount. So they looked within their own circle of friends and family to create a solid foundation.

“I felt it was best that we take care of our own,” Garcia said. “Let’s take care of people that we know that are looking for a new opportunity, and we train them the way that we want them to be trained. We want to give that experience and push it over to them.”

Among those they’ve brought on board to their current headcount of sixteen has been Garcia’s own mother, who works as the company’s head processor. And while they are still actively looking to bring on more people, Garcia said that the number of employees isn’t the ultimate metric of success, but rather the abilities of the ones you do have and the relationships they have with everyone else is the key. On this point, CFI is on pace to surpass $100 million in funding this year. It’s because of their continuous progress and results that they finally got the confidence to apply into the Inc. 5000 and were successful in making it.

“To be able to put that Inc. 5000 sticker in your signature, on the website, it just has a different swag to it,” said Garcia’s partner Menzel, “where it just carries a lot of weight, and even the merchants see that.”

When asked if the end goal was to become a lender themselves, both Menzel and Garcia say they’re happy with what they already do now, which is connect the merchants to the most appropriate source.

“While many competitors chase the close, we lead with transparency and real strategy,” Garcia said. “We act as consultants first. Even if a client doesn’t move forward with us, we want them to walk away smarter and more prepared than when they came in.”

“When you are a lender, you don’t really have that close relationship with other lenders because you’re your own lender,” Menzel said. “You’re not talking to them about deals, how to get deals done, ‘what are they doing? What did they change this month compared to what they’ve been doing, what’s working, what’s not.’ I think having those relationships with the lenders and the lenders’ reps, it’s huge and it makes the job fun, because they’re really all great people that we deal with.”

That closeness is what it’s all about for them.

“We are a group of people who genuinely care about each other,” Garcia said. “We’ve celebrated marriages and welcomed new babies. We hang out on weekends, show up for one another, and create a work environment that doesn’t feel transactional.”

The outcome of that are months where the company is exceeding $10 million a month in funding, and they’re now even more fired up after the Inc. 5000 placement.

“You don’t need this massive shop to be successful in this industry,” Garcia reiterated. “It’s really that simple. You just need the right people. You need to be loyal and just really be truthful with everyone. And good things happen. That’s a big thing for us.”

That Fintech Business Loan Performance Should Help You: How Hansa is Giving Both Borrowers and Lenders a Powerful Tool

October 15, 2025“Business owners want to be reported on,” said Henry Magun, founder and CEO of Hansa. “When we do a lot of surveys around this and when we survey small business owners en masse, would they rather borrow from a provider that does report to the business credit bureaus or does not, 85% of business owners say that they would rather borrow from a provider that does report to the business credit bureaus.”

It’s a familiar story: small business borrows from a fintech lender, repays it perfectly, and later on down the road applies for financing elsewhere believing that their previous payment history will support an approval or more favorable terms, only to find out there’s no public record of it at all.

“We hear that all too often,” said Magun. “It’s a very common experience, and that is one of the reasons why we are extremely focused on not only building the back-end pipes to do the furnishment to the bureaus for the lenders and make that process effortless, but also creating a front-end product that makes it a transparent process for the SMBs.”

Hansa, headquartered in New York City, enables lenders to report payment history to the credit bureaus and access existing reports on their customers. The key here is that it’s business credit reporting, not personal. Although most people are familiar with Dun & Bradstreet, Experian and Equifax also have business bureaus specifically for business credit. There’s also consortium-based organizations such as the Small Business Finance Exchange, for example, that take in commercial credit data.

While term loans and cards for SMBs, two rapidly growing products in the fintech space, are their main focus, the Hansa platform can make reporting possible for just about anything.

“We realize that there is such a diversity of product-type in the SMB financing space,” Magun said. “Is it a term loan? Is it a card? Is it an MCA product? You know, are there daily payments, weekly payments, monthly payments? All across the board, we do it all.”

The benefits of reporting business credit are obvious. Lenders can claim that good performance will legitimately build business credit, borrowers benefit from actually building business credit, and lenders can rely on this highly relevant data to drive more informed decisions.

“It’s really about getting the fintech ecosystem towards the future in which companies are focused on supporting financial wellness, and we really view credit furnishment in the SMB space as core to that, ultimately being able to reliably build credit is extremely important for financial mobility, economic mobility because it enables people to [graduate] to bank products and things like that, and being able to take your history with you in order to progress. That’s really important for economic mobility.”

On the flipside, for lenders that have spent years fine-tuning algorithms to predict payment performance outside of traditional credit reports, one area that continues to remain cloaked in obscurity is payment performance with other fintech lenders. Alternative methods, at least within the fintech community, are commonly used to make a best-guess effort, such as employing automated tools to scan an applicant’s bank account deposits with a known list of lender names and then matching them to corresponding bank debits to predict the performance and status of those accounts. But even if one can assess with a high degree of confidence about how those credit lines are performing, it’s not exactly an official affirmation from the lender, and the transaction history might not go far back enough. Besides, these risk assessment methods are entirely personalized to the lender, and don’t necessarily give the business an asset (a universally recognized credit report), that it can furnish elsewhere and benefit from. A business could use a credit report for a trade line or a bank loan or in some other transaction where it could hold weight for them, for example.

On the flipside, for lenders that have spent years fine-tuning algorithms to predict payment performance outside of traditional credit reports, one area that continues to remain cloaked in obscurity is payment performance with other fintech lenders. Alternative methods, at least within the fintech community, are commonly used to make a best-guess effort, such as employing automated tools to scan an applicant’s bank account deposits with a known list of lender names and then matching them to corresponding bank debits to predict the performance and status of those accounts. But even if one can assess with a high degree of confidence about how those credit lines are performing, it’s not exactly an official affirmation from the lender, and the transaction history might not go far back enough. Besides, these risk assessment methods are entirely personalized to the lender, and don’t necessarily give the business an asset (a universally recognized credit report), that it can furnish elsewhere and benefit from. A business could use a credit report for a trade line or a bank loan or in some other transaction where it could hold weight for them, for example.

“It really is a ‘rising tide raises all ships’ scenario in the sense that in a more mature ecosystem where there’s higher ubiquity of reporting, everyone benefits,” Magun said. “It helps all the funders and creditors on their underwriting processes, and it helps the business owners, the applicants, because it increases the portability of your credit history.”

The usefulness speaks for itself. Hansa, for example, has increased the number of reports that they’re furnishing data on by more than 400x since the beginning of this year. And the lenders can show off to their borrowers what they’re reporting and where it’s being reported to in any manner they wish.

“We’ve started to see really great traction amongst these various players, and we’re really excited to be working with them and it works,” said Magun.

Already they are seeing improved payment rates and increased engagement rates between the borrowers and lenders.

“It’s really powerful,” Magun said, “and SMBs really do care about being able to build their credit.”