Business Lending

Capify Consolidates Four Companies Including AmeriMerchant Under One Umbrella

July 21, 2015 What do US-based AmeriMerchant, UK-based United Kapital, Australia-based AUSvance, and Canada-based True North Capital all have in common? They’re now all under the Capify Umbrella. According to a press release issued earlier today,”Capify will now operate under one unified name to serve as a global conglomerate provider of alternative finance solutions, including business loans and additional working capital products, to small and medium-sized businesses. Capiota, United Kapital’s business loan product provider, will also be included in the global rebrand as a part of Capify’s UK office.”

What do US-based AmeriMerchant, UK-based United Kapital, Australia-based AUSvance, and Canada-based True North Capital all have in common? They’re now all under the Capify Umbrella. According to a press release issued earlier today,”Capify will now operate under one unified name to serve as a global conglomerate provider of alternative finance solutions, including business loans and additional working capital products, to small and medium-sized businesses. Capiota, United Kapital’s business loan product provider, will also be included in the global rebrand as a part of Capify’s UK office.”

The consolidation of an Australia-based funding company is notable since that country’s commercial financing landscape is the subject of an upcoming magazine feature story of deBanked’s July/August issue due to be distributed in a couple weeks. In that story, AUSvance’s John de Bree said of American interest over there, “I’m very surprised, the American market’s 15 times the size of ours.”

But as our readers will learn when the story is published, that market is just beginning to heat up.

David Goldin, the founder and CEO of AmeriMerchant will continue to be the consolidated company’s CEO and President. For those not familiar with his background, the release states:

Goldin created this business enterprise with no outside capital or funding and grew the company to more than 200 employees combined globally in all four offices. He entered the alternative lending space in 2002, after previously selling his startup company to Winstar Communications, a multi-billion dollar publicly-traded company at the time of the sale. Goldin has overcome many business obstacles including winning a ground-breaking patent lawsuit that threatened to end the U.S. alternative finance industry in its infancy stages. Via its proprietary underwriting technology platform, the company has demonstrated low default rates especially during the 2007-2009 global recession, a challenging time that resulted in the collapse of many alternative funding companies.

You can check out the full press release here.

Manual Underwriting Still Dominates in Tech-based Lending Environment

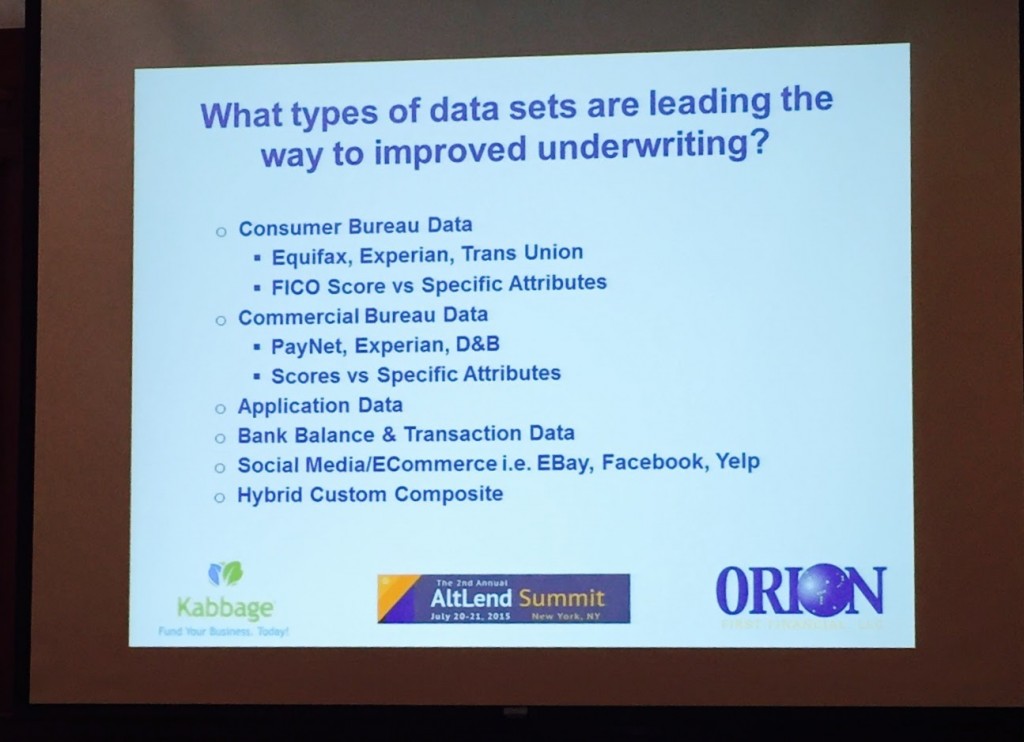

July 21, 2015For all the talk that technology is changing the way people lend and borrow, the commercial side appears stubbornly reluctant to relinquish control to algorithms. At the AltLend conference in NYC, business lenders and merchant cash advance companies alike were mostly united on the idea that somebody needs to be double checking the computers.

“I like eyes on a deal,” said Orion First Financial CEO David Schaefer. He discussed why an entirely manual underwriting process had weaknesses however through an experiment he conducted years ago when he sent the same deal to six underwriters. “Three said yes and three said no,” he explained.

“I like eyes on a deal,” said Orion First Financial CEO David Schaefer. He discussed why an entirely manual underwriting process had weaknesses however through an experiment he conducted years ago when he sent the same deal to six underwriters. “Three said yes and three said no,” he explained.

Like most of the others that spoke on the topic, Schaefer was in favor of a scoring model and he believes an automated underwriting system creates consistency when assessing risk. He was steadfast in his assertion though that humans had to be the last line of defense in fraud detection.

“We’ve got guarantors that have nothing to do with the business,” he said, offering an example of an applicant that was more than 80-years old, yet was passing themselves off as a hands-on construction worker.

“I’m still a big believer in the review and subjectivity,” he concluded.

Funding Circle’s Rana Mookherje expressed similar views. “[Humans] pick up things that an algorithm really can’t do,” he told the crowd.

“We have an experienced underwriter sitting there and calling every borrower that we give money to,” he added.

Mookherje said that their borrower profile differs from those that tend to use merchant cash advances. For instance, their average client has been in business for 10 years, does $2.2 million in annual revenue, and has 700 FICO. They also offer 1-5 year loans, where as merchant cash advance transactions tend to be satisfied in under twelve months.

Mookherje said that their borrower profile differs from those that tend to use merchant cash advances. For instance, their average client has been in business for 10 years, does $2.2 million in annual revenue, and has 700 FICO. They also offer 1-5 year loans, where as merchant cash advance transactions tend to be satisfied in under twelve months.

“If you need money in an hour, we’re not the right place for you,” Mookherje stated.

Funding Circle’s reliance on manual reviews may have to do with the loan terms being extended so long. Even Schaefer had said earlier, “I think it’s a lot easier to determine the behavior of a loan that’s less than twelve months as opposed to one that’s sixty months.”

But do other companies feel differently? Kabbage’s Alan Reeves said that 95% of their customers are 100% automated since there are merchants who get stuck trying to connect their bank account in the online application process.

When Kabbage was asked over a year ago how much of a role computers should play in the underwriting of a deal, COO Kathryn Petralia responded, “Huge.” She also went on to say then that, “it is not going to be like the “Matrix” where machines are making all the decisions. You won’t see an underwriting world without humans.”

It’s ironic however that while Alan Reeves was introduced at the conference as the Head of Risk Analytics, both the printed agenda and his LinkedIn profile cite his title as being the Head of Manual Underwriting. It’s a telling title for a company that is often heralded as the pinnacle of automation and computational decisioning.

But why can’t lenders simply give in entirely to the machines? Mookherje said at one point that, “those that live and die by their underwriting are going to be the ones that survive.” And if that’s the case, then relinquishing control to the computers perhaps risks the chance of death if things don’t work properly.

But humans, with all their natural flaws and imperfections pose the same risk. “Banks want to know that underwriting is consistent, that for any given customer, that you would underwrite them the same,” said Sam Graziano, CEO of Fundation. “And it’s not just having written policies and procedures,” he added. “But having programs in place to ensure these policies are upheld.”

The widespread dependence on humans to tie up loose ends in assessing risk may seem both practical and prudent, but to some traditional bankers, that system carries nightmarish implications.

Jim Salters, CEO of The Business Backer for example shared an experience his company went through years ago when trying to partner with a bank. Salters placed a high value on the manual review process, explaining that it was basically a strength of their core competency. The problem however, was that the bank said that would totally freak out their regulators.

The recurring message from the event’s panelists was that banks not only want, but may actually require a firm credit model to make decisions. They need to be able to explain to regulators why some loans got approved and others got declined in a perfectly uniform and consistent manner.

Schaefer and Reeves were aligned on the importance of consistency in underwriting. You basically can’t have a system where you arrive at three yeses and three nos on the same loan Schaefer explained.

Schaefer and Reeves were aligned on the importance of consistency in underwriting. You basically can’t have a system where you arrive at three yeses and three nos on the same loan Schaefer explained.

But building an automated system and telling the humans to take a hike isn’t an easy process. There’s a high upfront cost associated with development and it can take years to generate statistically relevant conclusions. And a multivariate decline issued by an algorithm can potentially worsen the customer experience, especially if the customer asks for the specific reason they were declined. Reeves said it can be difficult to explain to the customer that their FICO score was too low relative to their sales volume but that their FICO score on its own was good enough.

And yet once an automated underwriting system is developed, the cost of underwriting should drop significantly according to panelists. With that comes a decision consistency that the company can rely on and a system that bankers can get comfortable with.

But despite it all, Credit Junction CEO Michael Finklestein bluntly stated, “We’re never going to approve a $2 million loan with an algorithm.”

The unifying concept that everyone seemed to agree on was that although credit models were undeniably important, human review would remain a complementary part of the process for the foreseeable future at least in the commercial finance space.

“At the end of the day, it all comes down to underwriting,” said Mookherjee.

Less Regulated, Non-bank Lenders? Never Heard of ‘Em

July 20, 2015 Recently, two journalists for the Wall Street Journal sat down with Senator Chris Dodd and former Congressman Barney Frank to ask their thoughts about the Dodd Frank Act five years later.

Recently, two journalists for the Wall Street Journal sat down with Senator Chris Dodd and former Congressman Barney Frank to ask their thoughts about the Dodd Frank Act five years later.

The WSJ asked Frank specifically, “Do you have concerns that Dodd-Frank rules are driving more activity into the shadow banking system (less-regulated, nonbank lenders), sowing the seeds for a future crisis?”

The response…

Frank: “What activity? The law gives the regulators the power to regulate. When people tell you that activity has been moved to the shadow banking system, ask them what activity because I don’t know exactly what they’re talking about.”

One has to wonder what the awareness level was then when the Dodd Frank lawmakers drafted up Section 1071 to expand the Equal Credit Opportunity Act.

Meanwhile, Frank told me personally last year in a walking one-on-one in NYC that he supported transparency in business loan transactions, such that the borrower should be easily able to identify the terms. The premise behind consumer loan protections was that consumers were less sophisticated, he said. He also that he was not in favor of a federal cap on business loan interest rates.

Federal Government Wants Your Thoughts About Online Lending

July 19, 2015 Whether you’re a funder, lender, broker, or platform, the U.S. Treasury Department deserves to hear your input.

Whether you’re a funder, lender, broker, or platform, the U.S. Treasury Department deserves to hear your input.

Only July 16th, the Treasury announced that it was seeking public comment on various business models and products offered by online marketplace lenders to small businesses and consumers. One stated purpose of this is to study “how the financial regulatory framework should evolve to support the safe growth of the industry.”

The comment period is only open for six weeks.

Over the last year, many funders and brokers have voiced their opinions on best practices, ethics, and standards. Some want regulation to curb what they believe to be immoral behavior and others just want clarity where the laws are obscure, illogical, or even in conflict with themselves.

In at least one recent case, a merchant cash advance company CEO wrote about the complexity of dealing with an endless amount of state laws. In Lift the Fog, Give us Regulation, Merchant Cash and Capital CEO Stephen Sheinbaum wrote, “It is also better, at least for the financial services industry, if the central government is the one to craft the regulation instead of getting one rule from each of the 50 state governments.”

Meanwhile the Consumer Financial Protection Bureau (CFPB) will eventually start to enforce the amendments to the Equal Credit Opportunity Act, which technically already became the law under Section 1071 of the Dodd Frank Act. As part of that, underwriters of business loans and merchant cash advance alike may no longer be allowed to meet applicants, speak with them on the phone, examine their driver’s licenses, review their social media profiles, or even ask what their business model is or how they market themselves.

One has to look at any opportunity afforded by a government agency to share input before future regulations are implemented then as a duty. It might not matter, but you should do it anyway, just like voting.

Below are the questions, the Treasury wants you to answer (or Click to view on Treasury.gov):

1. There are many different models for online marketplace lending including platform lenders (also referred to as “peer-to-peer”), balance sheet lenders, and bank-affiliated lenders. In what ways should policymakers be thinking about market segmentation; and in what ways do different models raise different policy or regulatory concerns?

2. What role are electronic data sources playing in enabling marketplace lending? For instance, how do they affect traditionally manual processes or evaluation of identity, fraud, and credit risk for lenders? Are there new opportunities or risks arising from these data-based processes relative to those used in traditional lending?

3. How are online marketplace lenders designing their business models and products for different borrower segments, such as:

• Small business and consumer borrowers;

• Subprime borrowers;

• Borrowers who are “unscoreable” or have no or thin files;

Depending on borrower needs (e.g., new small businesses, mature small businesses, consumers seeking to consolidate existing debt, consumers seeking to take out new credit) and other segmentations?

4. Is marketplace lending expanding access to credit to historically underserved market segments?

5. Describe the customer acquisition process for online marketplace lenders. What kinds of marketing channels are used to reach new customers? What kinds of partnerships do online marketplace lenders have with traditional financial institutions, community development financial institutions (CDFIs), or other types of businesses to reach new customers?

6. How are borrowers assessed for their creditworthiness and repayment ability? How accurate are these models in predicting credit risk? How does the assessment of small 10 business borrowers differ from consumer borrowers? Does the borrower’s stated use of proceeds affect underwriting for the loan?

7. Describe whether and how marketplace lending relies on services or relationships provided by traditional lending institutions or insured depository institutions. What steps have been taken toward regulatory compliance with the new lending model by the various industry participants throughout the lending process? What issues are raised with online marketplace lending across state lines?

8. Describe how marketplace lenders manage operational practices such as loan servicing, fraud detection, credit reporting, and collections. How are these practices handled differently than by traditional lending institutions? What, if anything, do marketplace lenders outsource to third party service providers? Are there provisions for back-up services?

9. What roles, if any, can the federal government play to facilitate positive innovation in lending, such as making it easier for borrowers to share their own government-held data with lenders? What are the competitive advantages and, if any, disadvantages for nonbanks and banks to participate in and grow in this market segment? How can policymakers address any disadvantages for each? How might changes in the credit environment affect online marketplace lenders?

10. Under the different models of marketplace lending, to what extent, if any, should platform or “peer-to-peer” lenders be required to have “skin in the game” for the loans they originate or underwrite in order to align interests with investors who have acquired debt of the marketplace lenders through the platforms? Under the different models, is there pooling of loans that raise issues of alignment with investors in the lenders’ debt obligations? How would the concept of risk retention apply in a non securitization context for the different entities in the distribution chain, including those in which there is no pooling of loans? Should this concept of “risk retention” be the same for other types of syndicated or participated loans?

11. Marketplace lending potentially offers significant benefits and value to borrowers, but what harms might online marketplace lending also present to consumers and small businesses? What privacy considerations, cybersecurity threats, consumer protection concerns, and other related risks might arise out of online marketplace lending? Do existing statutory and regulatory regimes adequately address these issues in the context of online marketplace lending?

12. What factors do investors consider when: (i) investing in notes funding loans being made through online marketplace lenders, (ii) doing business with particular entities, or (iii) determining the characteristics of the notes investors are willing to purchase? What are the operational arrangements? What are the various methods through which investors may finance online platform assets, including purchase of securities, and what are the advantages and disadvantages of using them? Who are the end investors? How prevalent is the use of financial leverage for investors? How is leverage typically obtained and deployed?

13. What is the current availability of secondary liquidity for loan assets originated in this manner? What are the advantages and disadvantages of an active secondary market? Describe the efforts to develop such a market, including any hurdles (regulatory or otherwise). Is this market likely to grow and what advantages and disadvantages might a larger securitization market, including derivatives and benchmarks, present?

14. What are other key trends and issues that policymakers should be monitoring as this market continues to develop?

The Treasury asks that you include your name, company name, address, job title, email address, and phone #. You can submit your responses on http://www.regulations.gov/. Just click on the tab that says “Are you new to the site?”

You can also submit by mail:

To: Laura Temel,

Attention: Marketplace Lending RFI,

U.S. Department of the Treasury, 1500

Pennsylvania Avenue NW., Room 1325

Washington, DC 20220

If you have questions, email marketplace_lending@treasury.gov or call 202-622-1083.

OnDeck (ONDK) Curiously Flips the Script

July 17, 2015

“The company is now reportedly losing tens of millions of dollars through defaults on its loans,” reads a release put out just hours ago by Robbins Arroyo LLP about OnDeck. Their announcement is a little late because OnDeck just announced a Q2 profit on July 15th.

After nearly eight straight years of losses, OnDeck issued a press release announcing that their Q2 earnings call on August 3rd would reveal GAAP net income of somewhere between $4 million and $5 million.

It’s a stark difference from the guidance issued in their Q1 earnings report which put projected Adjusted EBITDA for Q2 at between a loss of $3 million and a loss of $4 million. Projected GAAP losses were much worse.

2015 was supposed to be another year of carefully planned red ink for the business lender as they continued their unrelenting strategy of growth. So where did this profit come from? And were some of their business decisions in Q2 influenced by unhappy shareholders?

Unlike Lending Club who had some company insiders file notices with the SEC to announce they had sold stock, OnDeck did not experience a rush to the selling exits when the lockup period expired. No insider sales were reported.

I published my theories about the stock’s drop back on June 29th.

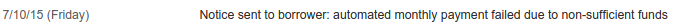

And now suddenly we have a profit, but the source of the cash is clearly identified in the release. OnDeck sold off a lot of their loans to institutional investors and booked the revenue.

“In the second quarter, 19% of the loans sold through Marketplace were loans originated prior to the second quarter that were previously designated as loans held for investment,” the release stated. That sale also allowed them to reduce their loan loss reserves, it said.

The downside is that the perceived risk of the loans themselves at least for now in the public’s mind has not changed. OnDeck is simply transferring the risk to someone else but they can only do that in the future so long as there are buyers. Therefore they need to consider creating an asset that they and their shareholders would be comfortable holding on to and plan for the economic doomsday where there are no buyers, which will inevitably come.

Compass Point analysts Michael Tarkan and Andrew Eskelsen were not impressed by the pre-announcement. In a note to clients, they wrote, “On the surface, results were stronger than expected due to significantly higher gain on sale revenue and lower expenses. However, if we exclude the one-time gains, core revenues came in well below our expectations, suggesting a meaningful deceleration in loan origination growth and/or another decline in yields.”

Notably, OnDeck’s sudden reliance on the OnDeck Marketplace to achieve profit coincides with a U.S. Treasury Department request for public comments on online marketplace lenders.

“Treasury seeks responses that will allow policymakers to study the various business models and products offered by online marketplace lenders, the potential for online marketplace lending to expand access to credit to historically underserved borrowers, and how the financial regulatory framework should evolve to support the safe growth of this industry.”

OnDeck experienced a surge in its stock price the morning following the Q2 forecast. It has since come down a little and closed at $13.45 on July 16th.

—

Note: I have never bought or sold OnDeck stock.

Do Bank Statements Matter in Lending? Business Lenders and Consumer Lenders Disagree

July 16, 2015Bank statements. Those in consumer lending argue they’re all but irrelevant because FICO and credit reports do the job of predicting risk just fine, but over in today’s small business lending environment, there’s an entirely different sentiment; Reveal your recent banking history or be declined.

After having bought nearly $60,000 worth of consumer notes on Lending Club and Prosper combined, there’s something I’ve seen a lot of, bounced ACHs.

Lending Club doesn’t reveal borrower bank data to their investors. Sure, anyone can see the credit report, the income level, zip code, and job title, but the borrower could have negative $10,000 in the bank and be living off overdraft protection on day 1 and an investor would never know it.

Lending Club doesn’t reveal borrower bank data to their investors. Sure, anyone can see the credit report, the income level, zip code, and job title, but the borrower could have negative $10,000 in the bank and be living off overdraft protection on day 1 and an investor would never know it.

For all the fanfare surrounding online marketplace consumer lending, access to borrower banking history is oddly absent.

“Welcome to consumer lending, where the rules are different because the game is too,” replied a user to my comment on a peer-to-peer lending forum.

Veteran consumer lenders assumed I was a lost newbie who knew nothing about lending. “I have a feeling if you ask to crawl someone’s bank account, they’ll just go elsewhere,” one user said. “Seems that’d only work on subprime borrowers who have limited bargaining power.”

“I’m assuming you may be new to lending,” he continued. “Making a loan based on deposit balances is rarely a good idea.”

My initial question to them was that without bank statements, how could they ascertain if a borrower’s finances were actually in order at least at the time the loan was issued? It’s really easy to access someone’s banking history for the last 90 days by using common tools like Yodlee or Microbilt, I argued.

Some people sympathized with my logic but others believed requesting bank data would be suicide in today’s competitive environment. And still more wondered if there might be consumer protection laws that prevented lenders from seeing a loan applicant’s banking records (which sounded ridiculous).

A Credit Card Issuer’s Take

Those questions led me to interview an underwriting manager at one of the nation’s largest credit card issuers who would only speak on the condition of total anonymity, including the bank’s name. There, he oversees a department of people that manually assess credit card applicants. There is no algorithmic approval process. In his department, humans underwrite each application, conduct phone interviews with the prospective borrowers, and request additional documents if they feel it’s warranted.

Requesting bank statements is a regular part of the job, explained the manager. “We require proof of income for any line over 25k,” he added. “It’s the main thing we ask for along with proof of address.”

Requesting these documents keeps them compliant with the Bank Secrecy Act, he explained, but the bank statements in particular are their first choice in verifying somebody’s income, even more than pay stubs. And their underwriters aren’t oblivious zombies, he noted. If an applicant has no money in the bank, they’ll decline it.

Requesting these documents keeps them compliant with the Bank Secrecy Act, he explained, but the bank statements in particular are their first choice in verifying somebody’s income, even more than pay stubs. And their underwriters aren’t oblivious zombies, he noted. If an applicant has no money in the bank, they’ll decline it.

“The Adverse Action reason [for that] would be ‘sufficiently obligated’,” he stated. “That’s when their bank account shows they can not take on any additional financial obligations.”

The manager shared however that he believed there is a very strong correlation between what’s on the credit report and what to expect in the bank statements. Generally speaking, good credit will show a healthy banking situation, he explained. They’re rarely taken by surprise. Overall, the credit reports and phone interviews are enough for them to feel comfortable and the bank statements are really just there to check off a compliance box.

Meanwhile, those that speculated requesting bank data would be a death knell competitively might want to talk to Kabbage’s sister company, Karrot. Karrot already crawls bank accounts as part of their consumer loan application program and competes with Lending Club, Prosper, and Avant. Considering Kabbage has funded more than half a billion dollars worth of business loans using this very methodology, it’s safe to say that applicants aren’t flocking to competitors in droves over the perceived injustice or inconvenience of filling out three additional fields on a web application to share their transaction history.

Bounced Payments

Kabbage CEO Rob Frohwein offered these comments last year about their underwriting, “A critical aspect of consumer lending is determining the appropriate amount of a payment to collect so that an account doesn’t become overdrawn. Our intelligence accurately predicts how much of a payment to request via ACH so consumers avoid the cost and headache associated with non-sufficient funds.”

I thought about those statements when I noticed that thirty-six of my Lending Club notes carried a Grace Period status the other day. These are borrowers whose payments just recently bounced. Some are only three or four months into a five-year loan. Worse, there are those that are saying they have no money whatsoever to make a payment. How can this be when they just practically got approved?

To the consumer crowd it’s business as usual. “If you got their bank account, you still wouldn’t be able to predict who will default. You can’t predict defaults on any individual borrower,” argued one veteran on a forum.

But it’s not all about the lender’s tolerance for risk. ACH rejects can have consequences that affect a lender’s ability to debit accounts in the future.

“Ultimately, regulatory thresholds set by NACHA will continue to become more and more critical of returns,” said Moe Abusaad of ACH Processing Co, an ACH processor based in Plano, TX. “I think it’s safe to say that there is a positive correlation in considering statements as a component of the underwriting process to the rate of returns incurred,” he added.

And while it’s true that bank data can’t make predictions perfectly on its own, nobody in small business lending or merchant cash advance would consider an approval without it.

Bank Statements or Bust

“There is no substitute for banking information when reviewing a client for approval,” said Andrew Hernandez, a co-founder of Central Diligence Group, a risk management firm that allows business lenders and merchant cash advance companies to outsource their underwriting.

“Money moves fast through these businesses and every business is unique, so a lot more variables come into play than just having to account for the timely monthly payments of credit cards, cars, and mortgages as you find in the consumer world,” he added. “A FICO score along with other information presented in a credit report provide a detailed, historical snapshot of a client’s creditworthiness in consumer lending, and while these are great complementary tools for us to use in our underwriting process, I believe that banking data paints us a picture of its own which is absolutely essential in assessing the risk of a B2B transaction in our space.”

Those underwriting business loan deals have reported seeing applicants with open personal loans from Lending Club, which shows that the exact same borrowers are being underwritten in two different ways.

But Julio Izaguirre, another co-founder of Central Diligence Group added that, “banking transactions are essential in gauging the cash flow of the business by looking at recent and up-to-date bank volume, but it is even more important with businesses that lack historical data and cannot provide financials or other documentation to show and prove their track record.”

Translation: A lack of credit history and formal financial statements can be overcome thanks to in-depth analysis of bank account data.

“When our underwriters look at a bank statement you can get a better understanding of the business cash flow, operational cost and how the owner manages his business,” said Heather Francis, CEO of Gainesville, FL-based Elevate Funding. “The credit score is like a person’s blood pressure reading,” she continued. “It indicates there may be an issue but until lab work is pulled and analyzed you don’t know what that issue is. The bank statement is that lab work and it can tell you more about the issues behind the scenes than a credit score can.”

Greg DeMinco, a Managing Partner of Americas Business Capital based in Cherry Hill, NJ would probably agree. “FICO isn’t everything,” he shared. “Bank statements can tell a great story especially if there is upward momentum month after month, and more importantly a high ratio of deposits to requests for the advance.”

Meanwhile, the manager of the credit card issuer was surprised to hear about the high value placed on bank statements in business lending. I offered him the example of an applicant with good credit that was consistently negative in the bank because of a reliance on overdraft protection as a way to make sure all the bills were being paid. “That’s the craziest thing I ever heard,” he commented.

But over in the peer-to-peer lending forum it didn’t sound so crazy at all. “Plenty of Americans are ‘broke’, in the sense that they have negative net worth, yet they’ll continue servicing their debts for… a long time… no matter what it takes,” shared one user.

The argument seems to come full circle, that business lending and consumer lending are just different.

But to Isaac Stern, the CEO of New York-based Yellowstone Capital, the bank statements are not just about financial health. “We are literally underwriting against fraud,” said Stern, who said his office regularly receives applications with doctored statements. “Logging in [to the banks] and verifying those statements are probably the most important part of the process,” he noted.

His logic goes that a consumer that is paid a salary has a predictable stream of income and so that information along with a credit report might be enough for a consumer lender, but business revenue is less predictable and can vary practically day-to-day.

“You can’t just look at a FICO score and say, ‘this is a good a business’,” Stern explained. “The story is in the bank statements.”

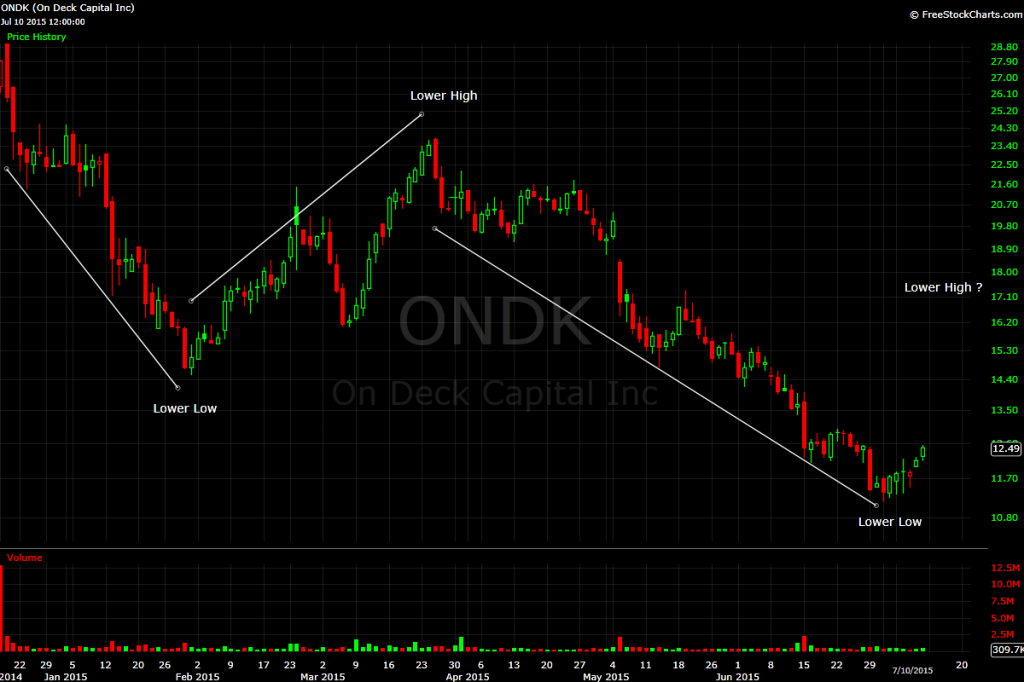

An OnDeck (ONDK) Technical Analysis

July 12, 2015For some of us working in the merchant cash advance industry, we saw the IPO of OnDeck (ONDK) as a major stepping stone in getting recognized by main street and receiving overall exposure. Unfortunately it has not been the best representative of us in the stock market. I started monitoring ONDK on the first day it started to trade and after 7 months, it clearly hasn’t looked positive.

I am a student in technical analysis. In layman’s terms, it is the study of price action of a traded financial instrument to make an informed investment decision. The following is my view.

The first thing that pops out when viewing the chart is that the single biggest day of volume (number of shares traded) was the IPO day. The stock has yet to trade in that kind of volume since then.

The other obvious thing that pops out is that the stock has been in downtrend, a series of lower lows and lower highs. As the old Wall Street adage says, “The trend is your friend.” Trying to call a bottom in this stock has been useless as it seems like those that have, are catching a falling knife.

Moving averages are used to determine whether the stock is trending or not. With very few trading days the longer term averages are not able to be rendered. In May the stock met resistance at the 20/50 EMA crossover. Coincidentally this was also the beginning of the latest down leg. It is also worth noting that the stock has not closed above the 20 day EMA since it was breached. There was one failed attempt that resulted in the continuation of the down trend in the middle of May. The stock is currently at the 20 EMA and is testing this level again. A close above this could be an indication of a possible change in trend.

The bottom of the chart has the RSI. This is a measurement of Overbought and Oversold conditions, which is telling us that the stock has been oversold for a couple of months. It recently started moving upward from the oversold condition.

The MACD is another technical indicator used. It measures the momentum of the stock. I like to think of momentum as the thrust/force of the move in a stock. This indicator points two things to me. As the stock has been going lower there hasn’t been a lower low in the indicator. It actually seems there is a slight uptrend in the indicator, which tells me as the stock has gone lower, there hasn’t been the same force/thrust to the move. This is a classic example of divergence, meaning the stock is doing one thing while the momentum indicator is doing another.

The information above points to two possibilities. The first is that the stock is currently taking a breather from its downtrend. This is normal in a stock cycle; after all, stocks do not go up or down in straight lines. The other is that the stock could be in the beginning stages of stabilizing. Stabilizing does not mean that the stock will begin a new uptrend. It means the stock could be range bound for a couple of months.

OnDeck Q2 Earnings Announcement

July 6, 2015Update: The news reports that said OnDeck was reporting earnings today on July 6th were false

An OnDeck representative said they have not yet scheduled a date.

OnDeck (ONDK) was reportedly going to release 2015’s Q2 earnings after the market closed on Monday, July 6th (That information was confirmed as false.) Analysts predict the company will show a loss of 7 cents a share.

OnDeck (ONDK) was reportedly going to release 2015’s Q2 earnings after the market closed on Monday, July 6th (That information was confirmed as false.) Analysts predict the company will show a loss of 7 cents a share.

The company has faced a fierce sell-off in recent weeks, moving the stock to all time lows and down more than 50% from its high. The trend began after the Q1 report in which company executives argued that a decrease in the interest rates charged to their customers was not a response to competitive pressure.

Bloomberg’s Zeke Faux ran the following headline anyway:

Since then, the stock has struggled to recover. I posted a summary of why that might be on June 29th, in a short piece tiled, What Happened to OnDeck.

Barron’s was particularly tough on them, labeling them a subprime lender in dot-com clothing. For now, the key to an OnDeck rebounds seems to be about shedding that toxic label and convincing investors that despite a crowded field, they are the clear standout choice.

An increase in the default rate this quarter however would probably evoke a further negative response.