Debunking Jameson Lopp’s Rebuttal on the ‘Jack Dorsey is Satoshi Nakamoto’ Theory

December 1, 2025Back in February 2025, prominent Bitcoiner Jameson Lopp attempted to debunk the theory that Jack Dorsey was Satoshi Nakamoto. Unfortunately, almost all the information he relied on for his arguments were either wrong or required leaps of the imagination. While I addressed this immediately after he posted them here and here, they’re being republished here:

Lopp: “During the time period of 2009 & 2010, Jack Dorsey was not only Chairman of the Board of Twitter, but also the CEO of the fledgling startup Square. It’s quite clear that he was an extremely busy person not only overseeing multiple companies, but traveling around the world meeting important people, doing press interviews, speaking at conferences, promoting philanthropic causes, and more. His activities do not fit the profile of someone who had the time and mental bandwidth to also be building a completely new financial system from scratch while maintaining perfect anonymity.”

Counter:

Twitter: Jack was fired from Twitter in mid-October 2008. He was made “silent” Chairman with no active role in the company and did not return in an active capacity at Twitter until March 28, 2011. So there is no conflict with his role at Twitter as he did not have an official job function there during the time period in question.

Satoshi Nakamoto published the White Paper on October 31, 2008 and sent his last farewell email in April 2011. This reinforces the plausibility that Jack is Satoshi since Satoshi appears right after Jack leaves Twitter and exits right as Jack returns to Twitter. Also, Jack published a reference to the name Satoshi in March 2011, showing that it had been the first tweet ever made by his best friend & love interest (Crystal Taylor) on the beta version of Twitter.

Square: Was Jack too busy launching Square? The company was founded February 11, 2009 and didn’t launch until December 2009. Coincidentally, Satoshi complained about being too busy with work during the same time period.

June 14, 2009 – Satoshi Nakamoto: “Thanks, I’ve been really busy lately.”

July 21, 2009 – Satoshi Nakamoto: “I’m not going to be much help right now either, pretty busy with work, and need a break from it after 18 months development.”

May 16, 2010 – Satoshi Nakamoto: “I’ve also been busy with other things for the last month and a half. I just now downloaded my e-mail since the beginning of April. I mostly have things sorted and should be back to Bitcoin shortly.”

July 8, 2010 – Satoshi Nakamoto: “I’m losing my mind there are so many things that need to be done.”

August 27, 2010 – Satoshi Nakamoto: “Sorry, I’ve been so busy lately I’ve been skimming messages and I still can’t keep up.”

April 23, 2011 – Satoshi Nakamoto: “I’ve moved on to other things. It’s in good hands with Gavin and everyone.”

So if Lopp’s argument is that Jack would’ve been really busy with launching Square then Satoshi complaining about being really busy during the same time period actually reinforces the plausibility of it being Jack.

Lopp: “Jack Dorsey worked with the US Federal Government to visit several countries (Iraq, Mexico, Russia) on behalf of the US tech industry. Does anyone truly believe that Satoshi Nakamoto, who was extremely wary of gaining attention from governments, would be working directly with them?”

Counter: A lot of people truly believe Satoshi worked with the government or was the government. The characterization that Satoshi was “extremely wary of gaining attention from governments” is not based on anything, unless he was referring to the incident in which Satoshi advised people not to donate Bitcoins to WikiLeaks. That incident ironically makes it more plausible that Satoshi was Jack Dorsey because Twitter received a secret court order regarding WikiLeaks (December 14, 2010) a day apart from Satoshi’s last activity on the Bitcoin forum (December 13, 2010). Square was also courting a relationship with Visa, which had made it a policy to restrict funds to WikiLeaks. The Square / Visa partnership was announced on April 27, 2011, four days after Satoshi’s last farewell email.

Lopp: “The first version of the Bitcoin software was Windows only, meaning that Satoshi developed it on Windows. I’m sure Jack used Windows at some point in his life, but he has been a die-hard Apple fan ever since the original iPhone came out. You can find many posts where he refers to various Apple devices he uses. I personally recall speaking with him several years ago and learning that he doesn’t even use laptops or desktops, but sticks to iPhones and iPads. It appears that may have even been true back in 2010. While reading through his 6,200 tweets I saw many referencing Apple products but none regarding Microsoft or Windows.”

Counter: Windows had a 95% share of the entire desktop OS market in 2009. No serious developer that was planning to appeal to mainstream desktop users would’ve developed for anything other than Windows even if they were a “die-hard Apple fan.” Regardless, Jack used Windows, MacOS, FreeBSD, OpenBSD, Blackberry OS, and several flavors of Linux including Gentoo.

Lopp: “I think the best we can do is to show that the person was out and about doing things while Satoshi was known to be sitting at a keyboard.”

Counter: Lopp assumed that posting comments to the internet in 2009 and 2010 required one to be “sitting at a keyboard” despite Jack being a prolific Blackberry user (since at least the year 2000) and later an iPhone user.

Lopp says that Jack can’t be Satoshi because on November 6, 2009 Jack tweeted “Late lunch with @fredwilson” and 5 minutes after that, Satoshi committed code to the Bitcoin SourceForge repository. I’m not sure what this is supposed to imply. Is it not possible that Jack was going to have a late lunch with Fred Wilson but committed code before heading out to do that? Lopp makes the assumption that Jack has to be sitting at the table with Wilson when the tweet is sent for this supposed conflict to be true. Lopp forcing whatever narrow meaning he wanted to tweets to fit his narrative and making the additional assumption that Jack could not post from a smart phone to the internet under the Satoshi name are the basis for his entire rebuttal. Not very good.

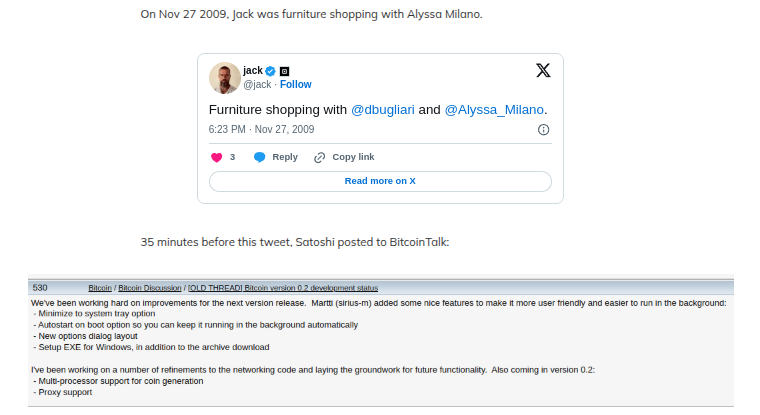

Lopp says that Jack can’t be Satoshi because on November 27, 2009 Jack tweeted that he was furniture shopping with Alyssa Milano and that 35 minutes prior to that Satoshi posted to the forum. Not sure what this is supposed to imply. Satoshi can’t post to a forum and then go shopping? Have people never posted to a forum and then gone somewhere afterwards? Would it not be possible for Satoshi to post to a forum from a phone even if it means he did it while shopping? Ironically, I’ve posted previously about the possibility of Alyssa Milano specifically being in on the Satoshi secret. Not very good.

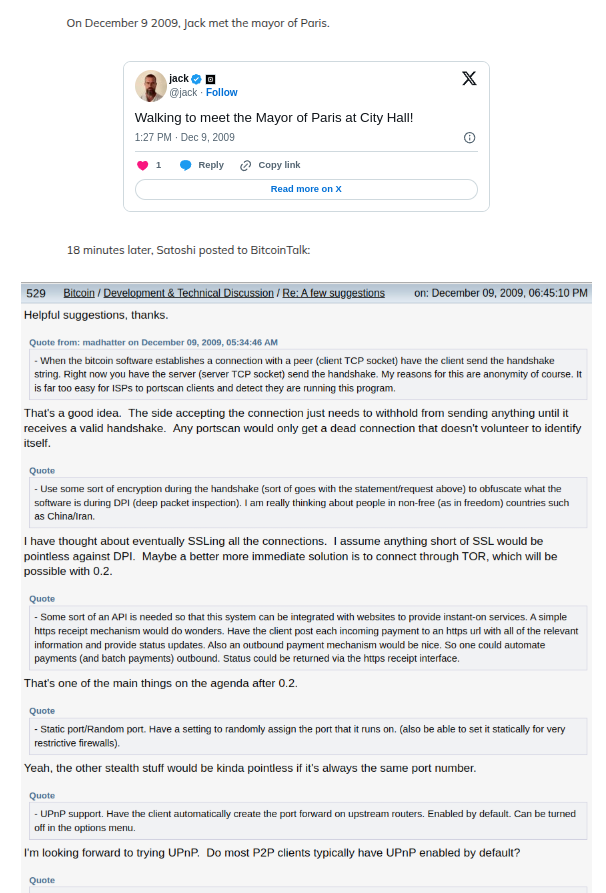

Lopp says that Jack can’t be Satoshi because on December 9, 2009, Jack tweeted that he was walking to meet the Mayor of Paris at City Hall (in Paris) and then 18 minutes later Satoshi posted to the forum. Lopp presumes that Jack was not capable of posting to an online forum while waiting at City Hall to begin the meeting. When did the meeting start? How long did he wait? People post online while they sit and wait for meetings. I have personally sat in government buildings and waited for meetings with officials and passed the time by posting to forums. Why is this considered to be impossible? Answering emails and posts is and was a commonplace thing to pass the time. Not very good.

Lopp says that Jack can’t be Satoshi because he attended a long company meeting on February 26 that ended at 10pm and Satoshi made posts on the forum at 6:17pm and 6:48pm. Okay? He couldn’t have posted before the long meeting? Pretty weak. Not very good.

Lopp says that Jack can’t be Satoshi because on May 20, 2010, Jack tweeted that he was in a car with his brother to go out to dinner with his family and 10 minutes later Satoshi posted to the forum. Was it Jack driving or his brother? Because if it’s his brother, then Jack can post from his phone to the forum while they’re driving. But if it’s Jack driving, then how is he also tweeting? Hmmmm…. Or did they get to the restaurant already and they are waiting and Jack is posting to the forum from the restaurant. I’m still lost on why Jack couldn’t post to a forum from his phone. Why are these things conflicts again? I myself was posting to forums from my phone in 2010. Not very good.

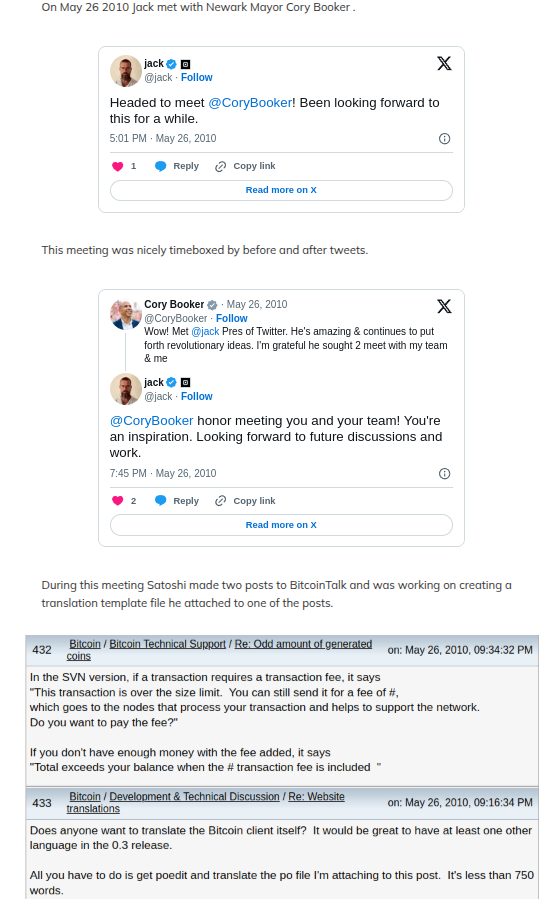

Lopp says that Jack can’t be Satoshi because on May 26, 2010 he tweeted that he was headed to meet Senator Cory Booker at 5:01pm and Satoshi posted to the forum at 5:16pm (with a file attached) and again at 5:34pm. Booker tweets at 7:32pm that he had just met Jack and Jack tweeted at 7:45pm that he had just met Booker. It seems like they actually met late then, perhaps around 7pm. Not sure why it’s considered impossible for Jack to say that he’s headed to a meeting and subsequently post to a forum (with an attachment) before actually being in the meeting itself, which doesn’t appear to have taken place for a while. Maybe Jack left later than he said he was leaving or maybe Jack got there and ended up waiting around for a very long time before the meeting and played on his phone and posted to the forum as people do when they’re bored. Not very good.

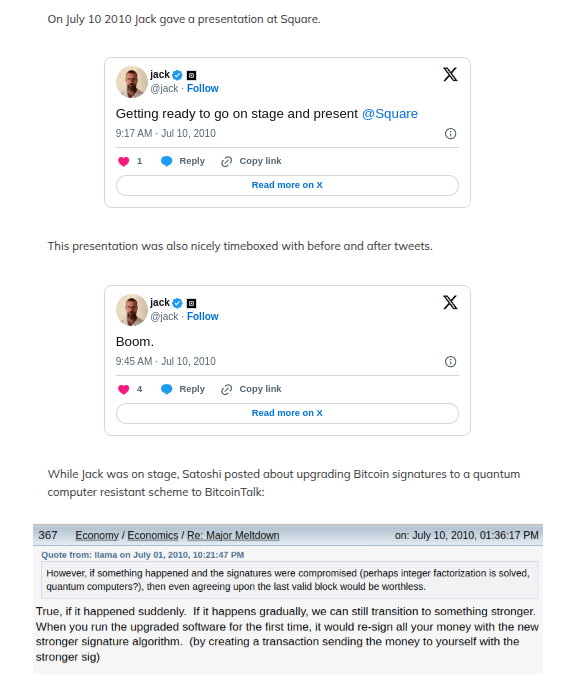

Lopp says that Jack can’t be Satoshi because on Saturday, July 10, 2010, Jack tweeted at 6:17am local time that he was getting ready to go on stage and present Square, followed by Satoshi posting four sentences to the forum at 6:36am local time, followed by Jack tweeting “Boom.” at 6:45am. (The screenshots says 9:17 and 9:45 respectively because they show my timezone) Lopp presumes that “getting ready” means that the presentation, which he believes to be at Square’s headquarters, was starting within minutes or seconds of that first tweet and that the subsequent tweet of “Boom” meant it was over. Satoshi posting in between these times therefore makes it impossible to be Jack.

This presentation was taking place at the Sun Valley Conference in Idaho, an invite-only event for major tech moguls. Jack was even at the Sun Valley on Ice show that evening. There is no evidence I have seen to suggest that “Boom” meant he had finished giving his presentation but Lopp needs us to believe that in order to create a conflict in the timeline to support his argument. Not very good.

Lopp points to the fact that Satoshi posted to the forum precisely during the short window that Jack was meeting with the President of Chile in Santiago on July 14, 2010. Satoshi posted at 9:10pm UTC time on the forum which would have been 5:10pm in Santiago.

Jack:

(1) says at 3:36pm that he’s on the way to meet him and that they will spend an hour together

(2) suggests that their meeting was already over by 5:03pm.

At 4:10pm a tweet goes out from the President’s account about their meeting. It does not confirm they are actually together yet even if it implies they are.

Satoshi posts to the forum at 4:25pm.

Jack signals the meeting is over with a tweet at 5:03. Satoshi posts at 5:10pm local time. While narrowly outside the perceived window, it is outside of it, and we don’t know when the meeting actually ended. It could have been over at 4:45, for example. A tweet at 5:03 doesn’t mean it ended at exactly 5:03.

It is well documented that Jack and the President met but it is not known for precisely how long. It could have been 10 minutes as these are how these things go, particularly with important figures like a head of state. Lopp takes the hour at face value and combines it with his belief that Satoshi did not have access to a cell phone in order to make his debunking work. Besides, couldn’t Jack have typed up his forum post prior to the meeting and then finally posted it after the meeting? Not good enough

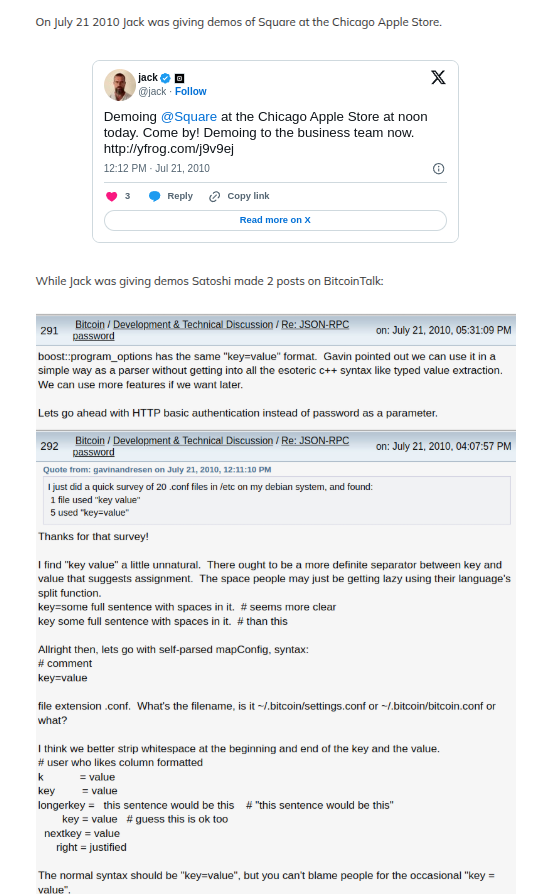

On July 21, 2010, Lopp says that Jack can’t be Satoshi because Jack was at an Apple Store in Chicago where his company was hosting a demo of Square starting at 12 noon all while the forum shows that Satoshi posted at 11:07am and 12:31pm local time that same day. I’m not sure why Satoshi being in a computer store would imply it would be impossible to post a message from a computer or from a phone. The more substantive post of the two that Lopp relied upon was the one that was made an hour before the demo. For this to be a conflict, it would require Jack to literally be doing a Square demo himself during the exact minute of 12:31 when Satoshi posted. Not very good.

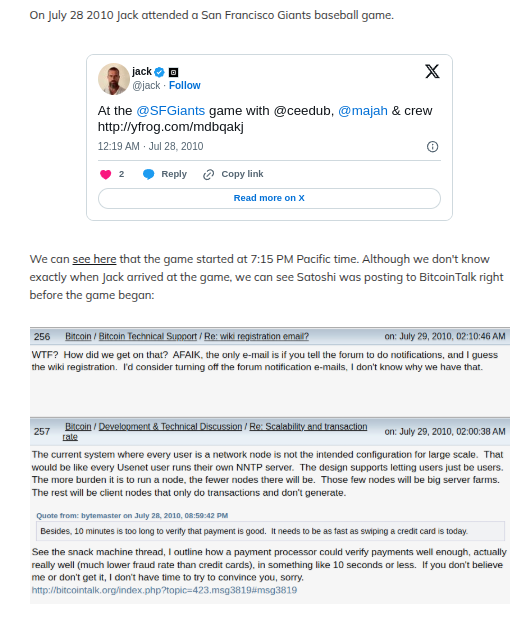

Lopp says that Jack can’t be Satoshi because on July 28, 2010, Jack was attending a baseball game while Satoshi was posting on the 28th. Unfortunately Lopp got the dates wrong. Jack was at the baseball game on the 27th, not the 28th, as evidenced by the 9:19pm PT tweet on July 27, 2010 that he uses as his evidence.

Lopp misread the dates.

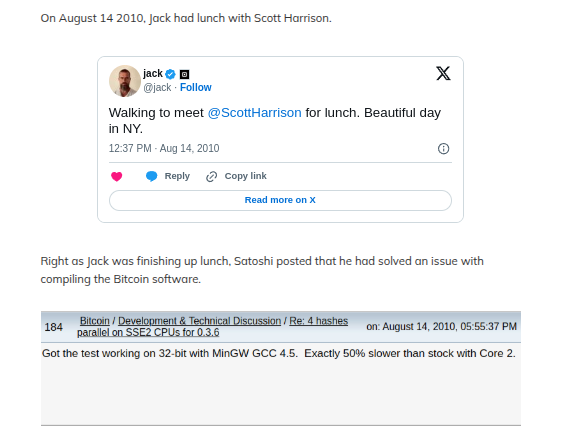

Lopp says that Jack can’t be Satoshi because he tweeted on August 14, 2010 that he was walking to meet with Scott Harrison for lunch and that an hour and 18 minutes later Satoshi posted two sentences on the forum that he had solved an issue with compiling the Bitcoin software. Ok? Which means what? Which means we have to presume that Satoshi had been busy doing this work exactly during the lunch time window and then rushed to post about it immediately to the forum? Satoshi couldn’t have solved it earlier and then posted it on the forum later when he got around to it like right after a lunch meeting? Not very good.

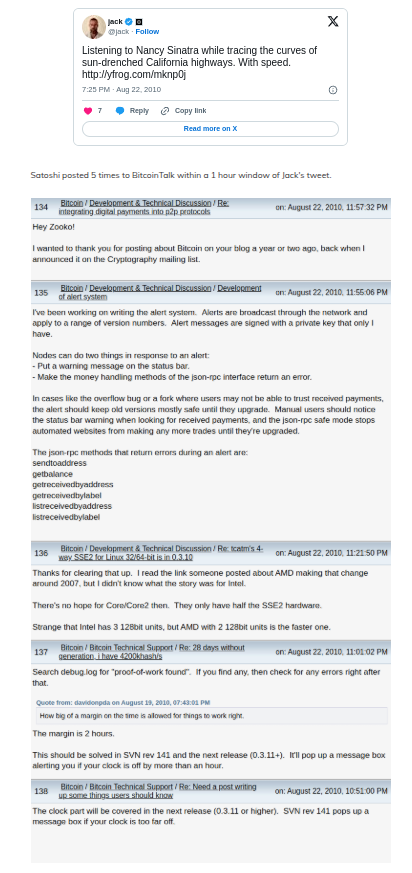

Lopp says that Jack can’t be Satoshi because he tweeted on August 22, 2010 at 4:25pm that he was listening to music while on the highway when Satoshi posted to the forum at 3:51pm, 4:01pm, 4:21pm, 4:55pm, and 4:57pm local time. I like this one to Lopp’s credit because there’s a link in Jack’s tweet to a purported photo of Jack behind the wheel looking out through the windshield. And so the argument here is that Jack can’t be posting to the forum because Jack is too busy driving! But we only know this because Jack is tweeting! And with a photo too? So if Jack is really driving, he is still apparently capable of taking a photo while driving and tweeting while driving, which hurts the case that he couldn’t also be capable of posting to the forum. Or there’s the possibility that someone else was actually driving and he was busy posting to the forum from his phone. Or… that Jack actually made that tweet about being on the highway hours or days after it actually happened. Or it never happened at all and it was online content for engagement or a dream of something nice. But if we give this one the benefit of the doubt and say Jack was really driving at that time, we can’t ignore that the evidence of him driving is a result of him playing on his phone while doing it. These “conflicts” are not very good at debunking Jack as Satoshi because they require leaps of the imagination

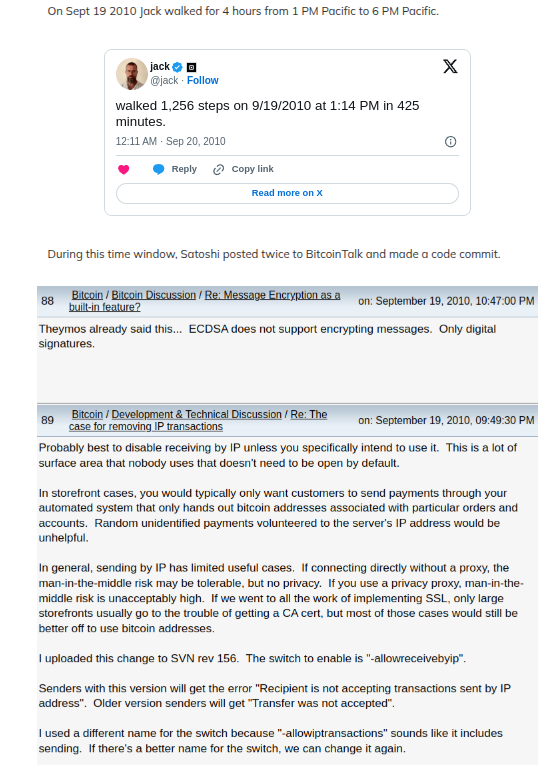

Lopp says that Jack can’t be Satoshi because he tweeted on September 19, 2010 that he walked 1,256 steps in the span of 425 minutes and that Satoshi posted to the forum twice during this time period and made a code commit. I did the math and it seems 1,256 steps is only 0.6 miles and 425 minutes is over 7 hours. This seems to actually support the theory of someone sitting around all day and builds on the case that Jack is Satoshi to make the code commit. Not very good and even supports Jack as Satoshi

Lopp: “I find the aggregate of all the evidence to provide so much doubt that a reasonable person would conclude that it’s far more likely that Satoshi was someone else.”

Counter: Try again.

Jack Dorsey Enters His Final Words on the Satoshi Nakamoto Identity Question

November 23, 2025During Block’s November 19, 2025 company Investor Day presentations, Block Head (CEO) Jack Dorsey was asked by Jeff Cantwell, a Senior Equity Analyst at Seaport Research Partners, if he was actually Satoshi Nakamoto, the pseudonymous creator of Bitcoin. The question was likely prompted by the internet theory circulating that he was but it could also have been borne out of Block’s strong Bitcoin focus.

Dorsey responded with his final answer on the matter as quoted though this exchange below:

Jeff Cantwell: “Jack, this is probably the most important question you’ll ever get asked from the sell side, are you Satoshi Nakamoto?”

Jack Dorsey: “On the Satoshi question, the most beautiful thing about Bitcoin is that question does not matter at all anymore. It’s an open protocol taken over by a community that wants to see an alternative to an option. And if it was important to Satoshi, there’s a simple way they can prove who they are. So we’ll wait for that day.”

Full day transcript including this exchange

Coindesk Podcast Explores Sean Murray’s Jack Dorsey Theory on Satoshi Nakamoto

November 20, 2025A new one-hour long video podcast published by Coindesk explores Sean Murray’s theory that Jack Dorsey is Satoshi Nakamoto, the creator of Bitcoin.

Murray’s last major tweet linking the clues together, long after originally theorizing it in February 2024, can be read here:

THE NEWEST WHY JACK DORSEY IS SATOSHI NAKAMOTO

C++ for Bitcoin source code

Now confirmed Jack coded in C++ as far back as mid-90sC in the White Paper

Now confirmed Jack coded in C as far back as mid-90s.Satoshi pseudonym

"Satoshi" was the first tweet Jack's best friend…— Seán Murray (@financeguy74) August 2, 2025

One prominent Bitcoin developer that attempted to debunk the theory apparently did not consider a world in which Dorsey could post to the internet from a smart phone. Murray debunked his two attempts to debunk it here and here.

The podcasters did not contact Murray when making it.

Square Activates Paying With Dollars Over Bitcoin Lightning Networks Rails

November 16, 2025Square is rolling out Bitcoin acceptance in every state across the US except New York and with that the prospect of skipping merchant processing fees if their customers pay with Bitcoin. Square is taking direct aim at the card payment networks and their bank partners, eliminating chargeback risk, and bypassing their fees. The twist is that customers need not even have Bitcoin and the merchants need not know much about Bitcoin. Instead, Cash App customers that have a cash balance in their accounts can simply pay a Square merchant with dollars using Bitcoin’s Lightning Network rails.

Customers that do in fact have Bitcoin can also pay a Square merchant using Cash App or any other Lightning Network compatible wallet such as Coinbase and also spare the merchant from a transaction fee. Block, Square’s parent company, is hoping that Bitcoin payments take off.

“It’s time,” tweeted Block CEO Jack Dorsey, “the independent and free currency is here.”

Block is going all-in on Bitcoin since Dorsey, a long-time advocate, financier, and evangelist for Bitcoin, is trying to shift the narrative of Bitcoin’s use-case in the public sphere back to everyday money and away from its current status as a Wall Street investment or digital gold. (The editor of deBanked has long claimed that Jack Dorsey is probably Satoshi Nakamoto, Bitcoin’s pseudonymous founder). Block has even replaced its existing peer-to-peer Cash App network with the Bitcoin Lightning Network. That means Cash App users accustomed to using a $cashtag can now send/receive payments outside the Cash App network.

Square will also be enabling stablecoin payments via the Solana blockchain starting in early 2026 and will explore integrations with other blockchains but will remain Bitcoin-centric and dominant.

it’s time.

the independent and free currency is here. https://t.co/tWDksqldWY

— jack (@jack) November 10, 2025

Square did their part, now let’s do ours. For bitcoin to become everyday money, merchants need to accept it. But first, they’ll need a reason to. We've put together the resources to help anyone make the case that only bitcoin can defeat credit card fees: https://t.co/fYkCARD5MD pic.twitter.com/1QO9KVyEuj

— Spiral (@spiralbtc) November 12, 2025

This means:

– For @CashApp customer: no taxable event, no decrease in bitcoin stack

– For @Square merchants: no fees, no chargebacks

– For the world: no middleman, just pure open networkFeels like the future.

— Miles 🌞 (@milessuter) November 12, 2025

POV: you pay for your coffee with bitcoin ☕ pic.twitter.com/4DCq7fxeSf

— Square (@Square) November 12, 2025

somewhat poetic we happened to launch dollars on lightning today and also the last penny ever minted was today

something in there

— OBJ (@owenbjennings) November 13, 2025

Is Jack Dorsey Satoshi Nakamoto? I Say Yes

September 20, 2025I’m the originator of the theory that Jack Dorsey is Satoshi Nakamoto, the creator of Bitcoin, which I first considered in February 2024. After extensive research, the theory has now been firmed up with incredible circumstantial evidence. I was the first person to discover that Dorsey was registered on the cypherpunk mailing list under two different email addresses, the first to recover Dorsey’s personal webpage dedicated to cryptography in 1997 (and his home page here), and basically connect all the dots that I compiled in my tweet below:

THE NEWEST WHY JACK DORSEY IS SATOSHI NAKAMOTO

C++ for Bitcoin source code

Now confirmed Jack coded in C++ as far back as mid-90sC in the White Paper

Now confirmed Jack coded in C as far back as mid-90s.Satoshi pseudonym

"Satoshi" was the first tweet Jack's best friend…— Seán Murray (@financeguy74) August 2, 2025

Jack Dorsey is Satoshi Nakamoto?

February 25, 2025If you’ve seen the analysis that connects Jack Dorsey to Satoshi Nakamoto floating around the web, that was researched by yours truly. I first proposed the possibility on February 24, 2024 and have since discovered a lot of compelling evidence to really support it. Here is a link to the recent tweet that went viral on the matter and a mirror of that tweet with source links. This is hardly all that I have. I did tag Dorsey so that he could see it but he did not reply to it or directly weigh in.

I have been following Dorsey’s company Square for deBanked since 2011.

In early 2024, a legal trial commenced on the matter of Satoshi Nakamoto’s identity (Crypto Open Patent Alliance v Craig Steven Wright) for which Dorsey played a key role to prove that an individual named Craig Wright was NOT Satoshi. Wright had been claiming such for some time.

As part of the trial, a large trove of new emails and testimony surrounding Bitcoin’s founding were disclosed, including many emails written by Satoshi himself (Emails with Martti Malmi / Emails with Nicholas Bohm). Before the judge made a ruling on the outcome, Dorsey made interesting remarks in Block’s Q1 2024 earnings announcement on May 2, 2024. He mentioned Satoshi the person as the basis for the company’s crypto strategy. While skeptics have chalked this up to simple fandom or ideology, it was wholly unnecessary to reference Satoshi the person and potentially risky if he doesn’t know Satoshi’s true identity. Coinbase, for example, lists “the identification of Satoshi Nakamoto, the pseudonymous person or persons who developed Bitcoin, or the transfer of Satoshi’s Bitcoins” as a risk factor to revenue. Block makes no such disclosure despite nearly half of the company’s revenue being derived from Bitcoin sales.

From Dorsey’s Block shareholder letter on May 2, 2024:

These statements could have been made without referencing Satoshi by name, especially in an era where longtime Bitcoin advocates have sought to minimize the influence of Satoshi the individual today. However, these statements would be very fitting if the CEO was speaking about himself.

Block has also self-published a book titled My First Bitcoin and the Legend of Satoshi Nakamoto which glorifies Satoshi and concludes by stating that “Satoshi’s vision is having an impact all around the world.” Hard copy print versions of the book were also made and distributed. deBanked obtained a copy.

That viral post again with source links can be found here. I am not an investor in bitcoin or Block. My experience with Bitcoin over the past 10+ years is as a payments mechanism, namely as peer-to-peer cash.

My email is sean@debanked.com

El Salvador Partners with DeFi Lending Platform for Bitcoin-Backed SMB Loans

January 21, 2022

El Salvador continues to be an unprecedented experiment of mainstream crypto use. The small Latin American country that shifted its national currency to Bitcoin alongside the US dollar in June is now partnering with Acumen, a DeFi lending platform, to power Bitcoin-backed loans.

“Basically what we are doing is an alliance with the government,” said Andrea Maria Gomez, a Project Manager for Acumen. “[The government] is not backing anything. They are just giving us the channels for which we will reach the small and medium enterprises.”

CONAMYPE, an acronym in Spanish that represents the national commission for medium and small enterprises, already offers business financing. Rates for this are generally high, and just like in the US, the qualifications to get financing are extensive. With Bitcoin-backed loans, it seems that the funding process will be the thing that affects El Salvadoran merchants the most.

“We work through a stable doc so investors put their crypto in there, we convert it into a stable coin, and what we eventually loan out to the end user is dollars,” said Gomez. “So we don’t give Bitcoin or Solana or anything like that, we give them dollars.”

“For [merchants], it’s easier,” Gomez continued. “You are not depending on the volatility of a coin, you just have dollars.”

Just like in the US, funders borrow money at high rates from banks, resulting in the cost of financing being pushed down to the final borrower. In a government that has Bitcoin as an official currency, Acumen can lend Bitcoin backed dollars at a lower rate than what’s already being offered in the marketplace.

“What we are doing, this is like an initial run, is we are going to contribute one fund to CONAMYPE for them to be able to [lend] at a lower rate,” said Gomez. “We can provide at a lower rate because in crypto, the capital is loaned at a lower rate.”

When asked about the lack of digitally-native people in El Salvador, Gomez stressed that the application process doesn’t require a crypto-enthused business owner. “Business owners don’t need to understand the tech or go to a wallet to ask for the loan. It’s a regular loan to them. The difference is, the source of the funds is coming from this protocol.”

The El Salvadoran government is confident that these loans will open up access to capital to small businesses who would have no alternative source for funding. Mónica Taher, Technological & Economic International Affairs Director at Government of El Salvador, shared her thoughts with deBanked about the vision for this plan down the line.

“The Bitcoin small loans for Salvadoran businesses will re-energize the economy by allowing the unbanked to have the opportunity to have access to digital money and create a credit history,” said Taher.

This Just In: Crypto Transactions Aren’t Tax Free

January 20, 2022 Patrick White, CEO, Bitwave

Patrick White, CEO, Bitwave“I don’t always believe people that say they are surprised about having to pay taxes on crypto. There’s a field on your tax form to say where you’ve made money doing illegal things. If you sell drugs, there’s a place to report how much money you’ve spent selling drugs. The IRS doesn’t care. Everything is taxed in this country.”

There is no such thing as too many crypto transactions when it comes to accounting purposes according to Patrick White, CEO of Bitwave. Bitwave operates the software that does the accounting for major blockchain companies and retailers who have taken crypto as payment.

White says that the high volume of crypto transactions aren’t coming from individuals sending digital assets back and forth, but rather from the companies that host the infrastructure of these transactions.

“It’s not just trading, trading is fun and we all love the rat race that is trading, but where it’s a lot more interesting is how some of our customers who are in the NFT space are seeing millions of revenue transactions a month.”

These sites like OpenSea, a client of Bitwave, are seeing sky high amounts of these types of transactions. When asked about the cost of accounting for an individual doing ten-thousand trades a month, White laughed.

“Ten-thousand trades a month is nothing,” he said.

White spoke of an instance which is seemingly a common occurrence in the crypto world. “We had a customer who when we were running their [transactions], I couldn’t figure out [an issue] with one of their months. I went to go look at the data, and they had turned on a Binance bot and without even realizing it, they didn’t know this, they accidentally had 200,000 trades in a month. The volume is incredible.”

White spoke of an instance which is seemingly a common occurrence in the crypto world. “We had a customer who when we were running their [transactions], I couldn’t figure out [an issue] with one of their months. I went to go look at the data, and they had turned on a Binance bot and without even realizing it, they didn’t know this, they accidentally had 200,000 trades in a month. The volume is incredible.”

When asked about how digital assets have impacted the accounting world, White stressed that the amount of transactions have resulted in companies appearing larger than they are from a transactional-perspective. According to him, some of his clients are doing as many transactions as some of the largest companies in the world.

“[One client] is a one-year old company that is doing the volume of a sixty year-old retail business, it’s unheard of.”

When asked further about the difference of cost in accounting digital assets versus dollars, White explained that it isn’t much different than how larger companies have maintained their books for some time.

“No matter what, if you are a high frequency trader and you’re making hundreds of millions of trades a year, you will need software to deal with that,” said White. “I wouldn’t say that [the amount of transactions] are increasing costs across the board, it is a cost that you would already be expected to [have].”

When asked about the apparent vacuum of crypto-native accountants, White seemed to cast blame on the approach of the information. When hiring, he says he finds more value in people with engineering experience over accounting experience, and blockchain experience over anything else.

“[Other accountants] are trying to apply finance 1.0 things to this crypto world,” said White. “We look for good engineers. A good engineer can figure anything out, a bad engineer with accounting experience can’t. We’re looking for blockchain experience, as blockchain [technology] is more difficult than accounting in many ways.”

While most businesses will file extensions this time around and finish their taxes in October, White believes that blockchain accounting will become more widespread as new firms leverage the infancy of the space and settle into their niches.

“Cottage industries will come up in order to enable the IRS,” said White. “I don’t expect the IRS to build this technology or this understanding in-house. There will be people and businesses that will do it for them.”

With the IRS’ decisions about taxing crypto having the potential to change at any notice, White stressed the necessity for malleability when developing this kind of accounting technology in such an unpredictable space.

“We’ve designed Bitwave from the very beginning to be able to rapidly adjust to the new laws that are coming out,” he said. “Even back then, it was very obvious that we couldn’t build this tech in such a way that it is inflexible.”