ACH Advances

How to Value a Merchant Cash Advance Company (or Alternative Lender)

February 9, 2014If you’re at all interested in the future of the merchant cash advance industry, you need to read Wall Street Evaluates Merchant Cash Advance in the first issue of DailyFunder. It offers a fresh perspective through the eyes of financiers outside the industry looking in.

Names include:

- Jason Gurandiano, Managing Director in Deutsche Bank’s Financial Technology Group

- David Cox, Managing Director at Evercore Partners

- Thomas McGovern, Vice President at Cypress Associates

- Steven Mandis, adjunct professor at Columbia Business School.

The article is relatively broad but it communicates some very important points:

1. Some players in the space exist as lifestyle businesses. They’re not scalable, their success is largely attributed to what the owner does for it, and company’s long term vision is to basically make sure the owner takes home a nice paycheck.

2. Some of the big players in the space are on similar growth trajectories. Nothing differentiates each of them from the pack, and none of them really have an advantage over the other.

3. EBITDA is a bad valuation measure and growth is a good one.

3. EBITDA is a bad valuation measure and growth is a good one.

On point #1, a lifestyle business is no good to a professional investor in this space. Aside from the success usually being owner-dependent, one question an investor is certain to ask a prospect is, “If I gave you $100 million today, what would you do with it?” There are many wrong answers to that question. If you said solicit more ISOs, buy more leads, or hire more sales people, they’re going to wonder why you haven’t done those things already.

On the same token, those answers would communicate that you’re going to do the exact same thing you’re already doing. It’s a mistake to think that scaling in such a manner will keep the original margins intact. It also does nothing to protect the company against change or enable it to grow exponentially.

On point #2, it’s great to be big, established, and growing at a moderate pace, but what good is that to an investor looking to double, triple, or quadruple their money? And who’s to say that a moderate growth strategy will continue as it has in the past?

Many many many (did I say many yet?) people have come into this space with visions of grandeur, to be bigger than CAN Capital in less than 24 months. What do their plans usually consist of? Pay higher than average commissions and fund deals they shouldn’t be funding. To date, none of those companies are bigger than CAN Capital and some of them are out of business. A growth plan can’t consist of funding deals you don’t want to and paying commissions you can’t afford. That’s called a suicide mission and it’s very effective.

Some big funding companies may appear sustainable on the outside but they’re woefully fragile on the inside. Jason Gurandiano said it best with this quote, “The general knock on merchant cash advance has been that they are an ISO-centric model.” I’m not discounting the value of ISOs in this business. To some extent they rule the roost, and that’s the problem in the eyes of investors. Many merchant cash advance companies rely on a handful of symbiotic relationships. The ISO relies on the funding company for commissions and the funding company relies on the ISO for deals. But what happens if:

- The ISO is enticed with higher commissions or better service with somebody else

- The ISO’s deal flow slumps

- The ISO goes out of business

- The ISO uses unscrupulous sales practices when selling the funding company’s product

- The ISO uses their relationship as leverage on the funding company to make bad decisions

- The funding company needs to reduce commissions but the ISO can’t sustain it

An ISO-dependent merchant cash advance company doesn’t have much control over growth. Believe me, I’ve been on those phone calls where the ISO is asked to send more business. But what happens if they have no more to send? Or what if they would just rather do most of their business elsewhere?

Again, there is absolutely nothing wrong with a purely ISO-centric model in general, but it is much less attractive to investors looking to do a deal in this industry and that’s the theme of this post.

Point #3 is unique because it addresses the how to value a company once you’ve found one worth investing in. Earnings Before Interest Taxes Depreciation and Amortization (EBITDA) is not a viable valuation formula here as it doesn’t make sense to measure the worth of a company dependent on expensive debt by stripping away the cost of that debt.

Point #3 is unique because it addresses the how to value a company once you’ve found one worth investing in. Earnings Before Interest Taxes Depreciation and Amortization (EBITDA) is not a viable valuation formula here as it doesn’t make sense to measure the worth of a company dependent on expensive debt by stripping away the cost of that debt.

According to Aswath Damodaran, debt to a financial service company should be treated like a raw material. In his 2009 paper, Valuing Financial Services Firms, he states, “debt is to a bank what steel is to a manufacturing company, something to be molded into other products which can then be sold at a higher price and yield a profit.” It is a perfect analogy for a merchant cash advance company.

Damodaran’s analysis covers a range of situations but I find an Asset Based Valuation intriguing. It states, “How would you value the loan portfolio of a bank? One approach would be to estimate the price at which the loan portfolio can be sold to another financial service firm,” There isn’t a lot of precedent for that in this industry unfortunately. Damodaran continues though with, “but the better approach is to value it based upon the expected cash flows.” For certain, one would have to take into account the renewal rate, renewal commissions, the average recovery timeframe, and the default rate.

If you bought $100 million in RTR today, how much would you get back 1 year from now or 2 years from now? This number is going to differ from company to company.

An Asset Based Valuation might be in order for a funding company that is winding down and shedding its existing portfolio, but it’s not appropriate for one with growth. One should assume that they’re buying a growing business when investing in a merchant cash advance company, not a packaged portfolio.

One question an investor might ask is, “what am I buying?” The average merchant cash advance company can be perceived as nothing more than a vehicle to maximize the spread between revenue and borrowing costs. They’re not really businesses in the traditional sense, more like arbitrageurs. They buy leads and/or they pay commissions, there are some fixed costs, but there’s not a whole lot more to it. There are virtually no barriers to entry and anybody can replicate the model. So you invest in the people who are doing it currently and their system (assuming it’s working so far). The value of that might only be equivalent to 1x – 4x annual profit. Why pay more when competition can drag margins down, regulations could disrupt the space in the future, or the investor could just as easily start their own company with the funds they have instead?

With that said, the average merchant cash advance company is more attractive to a lender than an equity investor. Additionally, they can also offer a nice monetary return by allowing people to participate in the funding of individual deals. Both are indeed what many investors choose to do, either lend money to these companies or syndicate. Why buy the cow when you can get the milk for free?

Merchant Cash Advance companies that make the headlines with big equity investments are not average. They create value, rather than just engage in arbitrage. They’re building something, changing something, disrupting something. They don’t profit off spreads in the market, they create the market and dominate it. Today this typically happens through technology, and not just any technology, but technology that leads to substantial future earnings. There’s a difference between spending a million dollars on a platform to make things more efficient and spending a million dollars on a platform that causes earnings to increase by 1,000%. Too many companies view technological investments in the former sense, a cost that eats into the spread instead of one that can blow the roof off of it.

Investors are looking for companies that plan to soar from Point A to Z, not ones that are moseying along from A to B.

RapidAdvance was said to have gotten an Enterprise Valuation in excess of $100 million when being acquired by Rockbridge Growth Equity. For the most part that number reflects Total Debt + Total Equity – Cash. When you buy a company, you’re buying their debts as well. 90% of their enterprise value could potentially have been the value of their outstanding debts. Of course I doubt it was, but it should put their eye opening valuation into perspective.

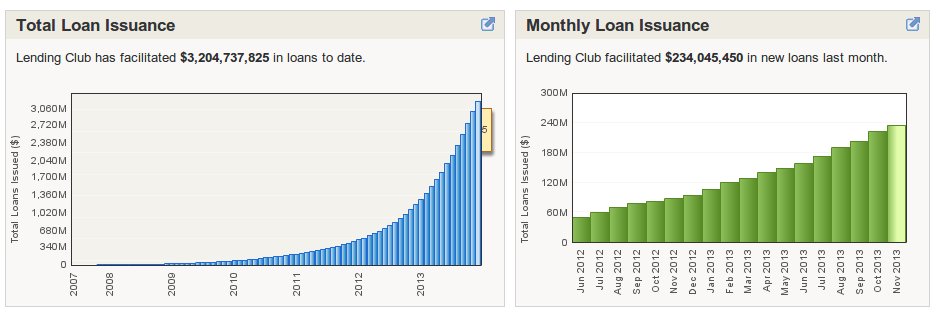

Contrast the RapidAdvance deal with the most recent valuation of Lending Club at $2.3 billion. Lending Club earns substantially lower returns per deal but they have an engine for growth that is virtually unmatched. In the month of August 2012, they booked $70 million in loans. In January of 2014, they booked $258 million. That’s 3.7x the monthly volume they were doing less than 18 months ago. That’s what an investor calls an opportunity.

How do you value a merchant cash advance company? There’s no easy way to do it and it largely depends on whether or not they’re an arbitrage shop chugging along or one creating substantial value.

There’s plenty of free milk out there. Why would someone pay top dollar for your cow?

– Merchant Processing Resource

Meet the New UCCs

January 27, 2014 For all the small businesses that have gotten funded over the last few years, it’s been said that merchant cash advance companies and their lending counterparts have only filed UCCs against 50,000 unique merchants (not saying that’s correct). It’s an impossibly small number but those that have been in the industry a long time know that deals get recycled again and again. Some merchants have been using this product for a decade now. They jump from funder to funder or they stay with one for a long stretch until one doesn’t want to do business with the other anymore. I’ve seen merchants with a UCC history so long and so chronologically perfect that it’s like reading the book of Genesis. AdvanceMe begat funder B who funded the merchant for 365 days and begat funder C who begat funder D who put the merchant on a starter and begat a 2nd location with funder E, who begat 3 more funders each offering the merchant a 6 month program, Amen. And now they’re applying again still in 2014. Don’t get me wrong, it’s great that businesses have been able to put outside capital to use again and again, but it couldn’t hurt to have some fresh faces.

For all the small businesses that have gotten funded over the last few years, it’s been said that merchant cash advance companies and their lending counterparts have only filed UCCs against 50,000 unique merchants (not saying that’s correct). It’s an impossibly small number but those that have been in the industry a long time know that deals get recycled again and again. Some merchants have been using this product for a decade now. They jump from funder to funder or they stay with one for a long stretch until one doesn’t want to do business with the other anymore. I’ve seen merchants with a UCC history so long and so chronologically perfect that it’s like reading the book of Genesis. AdvanceMe begat funder B who funded the merchant for 365 days and begat funder C who begat funder D who put the merchant on a starter and begat a 2nd location with funder E, who begat 3 more funders each offering the merchant a 6 month program, Amen. And now they’re applying again still in 2014. Don’t get me wrong, it’s great that businesses have been able to put outside capital to use again and again, but it couldn’t hurt to have some fresh faces.

The market is saturated, the old school UCC market anyway. Businesses that have used a cash advance historically can potentially get up to 1,000 calls a year by UCC poachers trying to convince them to switch, stack, or do something else. It makes a lot of companies not want to file a UCC, and many don’t or they mask their filing name because of it.

Other companies in the greater alternative lending space would say, “A UCC? Why would we file that?” In the case of purchasing future revenues, it makes sense to put a public claim on assets purchased. Future revenues are an indeed an asset. But to an unsecured creditor, there are no claims to assets. So when I spotted Lending Club in the wild funding a business, I couldn’t help but check to see if they filed a UCC-1. They didn’t and they don’t. Unsecured business credit cards don’t file them either. I don’t think any unsecured creditor can.

With no UCC-1 on record, is merchant cash advance’s newest competitor invisible? Not quite. Each loan serviced on Lending Club’s platform is registered as a security with the SEC. Each deal has a prospectus and investors rather than “syndicates” can choose to participate in the loan based on limited information provided about the borrower. These loans only range up to $35,000.

Since each loan is registered with the SEC, all of that information is public. But there’s one catch, Lending Club’s borrowers are anonymous. As an existing investor on Lending Club’s platform, I can only see the borrower’s credit score range, location, and other basics. It’s like browsing leads on iBank and deciding which ones you want to buy but instead of paying to get their personal information so you can contact them and collect docs to underwrite, you have to fund them right then and there based on what you see. You never ever get to find out who they are or see their docs.

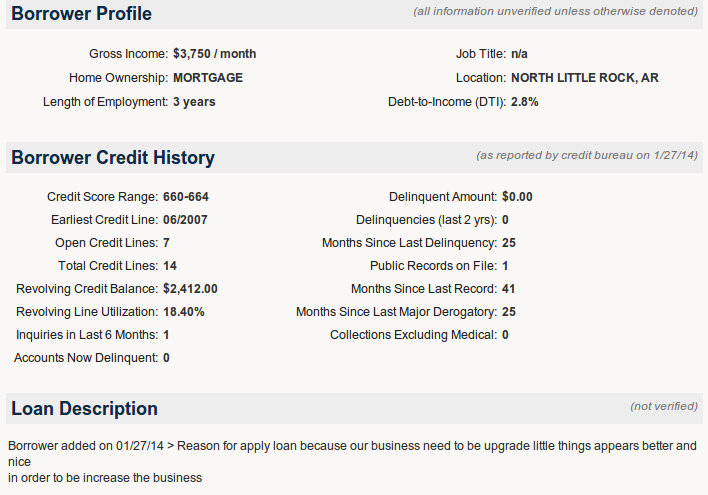

Here’s a screenshot of a real live business loan listing that any of their registered investors can participate in:

28 people are already participating in this loan. I think the smallest you can contribute is $25. Each loan gets filed with the SEC, which anyone can look up using Edgar.

But what you and I can see on the site seems to be all you can see in the SEC filings as well. Business location, credit, loan terms, and date filed, but nothing that identifies them personally. Unless of course you are smarter than I am and find a way.

Lending Club has made $3.5 billion in consumer loans in just a few short years. I have no doubt that they will be a billion dollar player in the business loan market as well. It sure would be nice to find out more about who they’re funding,especially since their cap is $35,000. There’s a good chance they’ll be underserving their clients’ capital needs.

The guys who figured out reverse UCC searching in MCA early made a fortune. Could reverse SEC filings be the next gold rush?

Lending Club Business Loans are Here

January 19, 2014 As mentioned in a thread on DailyFunder, I have personally seen evidence that Lending Club is already doing business loans. The loan was issued this month in the amount of $35,000 and disbursed to a business, not an individual.

As mentioned in a thread on DailyFunder, I have personally seen evidence that Lending Club is already doing business loans. The loan was issued this month in the amount of $35,000 and disbursed to a business, not an individual.

I have been very outspoken about my belief that peer-to-peer lenders will compete directly against merchant cash advance companies and their short term lending counterparts. I am now absolutely positive that will be the case as the first merchant I saw to receive a Lending Club business loan was a former user of merchant cash advances.

One has to ask themselves if Lending Club will be targeting UCCs, particularly those of their new closest competitors in the space, OnDeck Capital and NewLogic. I was not able to determine the terms of the Lending Club loan but it is still my expectation that it will be a 3-5 year deal with automated monthly payments. Compare that against the industry’s dominant short term lenders that do 1 year deals with automated daily payments.

You can argue that there will be very little overlap in the merchants these companies target but I have seen overlap right out of the gate.

I expect we’ll all see a lot more of this.

Industry Fun Leads to Charity Funds

January 15, 20142013’s alternative business financing fantasy football competition came to a close near the end of the regular NFL season. There were some tough matchups and upsets, but two Florida based companies pulled through to win it all. The league raised a total of $9,000 from its participants and as per the rules, must be donated in equal halves to non-profit organizations selected by the two winners.

Financial Advantage Group selected the Spring of Tampa Bay, a noble choice since their mission is to prevent domestic violence, protect victims and promote change in lives, families and communities. DailyFunder, the trustee of the competition reached out to the organization late last month and made the donation in a low-key manner as per their request. They did express their gratitude to Scott Williams of Financial Advantage Group on their facebook page however:

Business Financial Services selected Wounded Warrior Project. They wrote their own post about the organization and why they are proud to support that cause on their website here: http://www.businessfinancialservices.com/blog/fantasy-football-for-charity/

Wounded Warrior Project accepted their donation with some pizazz, holding a giant check for a photo-op at the organization’s Jacksonville, FL office.

—-

I personally would like to thank Heather Francis of Merchant Cash Group for being a great competition co-host this year as well all of the participants that contributed funds to make these donations possible:

- Merchant Cash Group

- Benchmark Merchant Solutions

- Yellowstone Capital

- Raharney Capital

- Strategic Funding Source

- Sure Payment Solutions

- Pearl Capital

- United Capital Source

- NVMS

- Entrust Merchant Solutions

- Financial Advantage Group

- Snap Advances

- Business Financial Services

- Integrity Payment Systems

- DailyFunder

- Capital Stack

I’m already looking forward to next season!

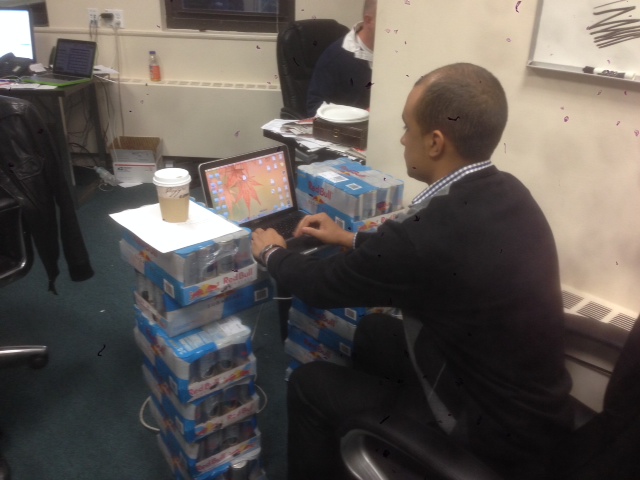

2014 Starts off With a Case of Red bull

January 10, 2014 Woah, slow down there fellas. Let us digest one thing at a time. We’re not even 2 weeks into the new year and already we’ve learned that:

Woah, slow down there fellas. Let us digest one thing at a time. We’re not even 2 weeks into the new year and already we’ve learned that:

CAN Capital raised another $33 Million (but that they didn’t need it?)

Merchant Cash Advance was the the feature story on the front page of the Wall Street Journal. Seriously…

Bloggers are learning about this industry for the first time. They’re having a bit of trouble getting it right.

PayPal, which just recently kicked off its own merchant cash advance program (or as they call it, their Working Capital Program) has already issued 4,000 advances.

Regulators are freaking out over the use of social media information in loan approvals.

DailyFunder will begin mailing out the first alternative business lending magazine a week from today. It’s free so sign up!

Forget Fancy Algorithms, Give the Merchants a Psych Exam

January 1, 2014Select an answer to each of the following questions:

1. When faced with financial hardship during the course of my loan, I would do the following:

(a) Do nothing and hope my luck changes.

(b) Call the bank and block all debits from the lender and wait for the lender to call me about it.

(c) Change my phone number, hide, and avoid making anymore loan payments at all costs.

(d) Call the lender to inform them of my hardship.

(e) Sell my business and let the lender sort it out with the new owner.

2. The IRS sends you a letter that says they believe you understated your income last year and owe back taxes. As a result I would do the following:

(a) Ignore the letter until it becomes a more pressing issue.

(b) Consult with my accountant/lawyer.

(c) I didn’t file a tax return last year.

(d) Pretend I never got it.

(e) Pay whatever is owed.

—-

Congratulations! based on the answers you chose you have been approved!

—-

According to the New York Times, Banks in 16 countries are using psychometric tests to gauge the creditworthiness of applicants in lieu of credit reports. That’s because the criteria used to score credit in the U.S. is not always available abroad, particularly in developing nations.

According to the New York Times, Banks in 16 countries are using psychometric tests to gauge the creditworthiness of applicants in lieu of credit reports. That’s because the criteria used to score credit in the U.S. is not always available abroad, particularly in developing nations.

There isn’t necessarily a right or wrong answer to each test question. Instead an algorithm measures the loan repayment performance statistics of each answer and learns to approve or decline based on those selections by applicants in the future. Interesting isn’t it? The questions wouldn’t be easy to manipulate either since they are currently psychological. Applicants are asked for example how strongly they believe in or disbelieve in fate.

Would such an idea have legs for alternative business lending in the U.S.? I think there’s something to it. I can say from experience that in my former lifetime as an underwriter, our team would rarely read from a script during a merchant interview. Instead we would engage applicants in a conversation about their business to gauge their attitude and determine the level of commitment to their work. You’d be surprised what this approach would reveal.

In this context, business owners would share that they had no idea whether or not they were losing money, that they planned on closing the business if the advance didn’t turn things around, that they didn’t care about previous loans that they defaulted on, that they weren’t even the person running the business day to day but rather the name on all the paperwork because they had good credit, or that they were using the money to fund a vacation to the carribean because the business was failing and they wanted to get away. We did make sure to steer the conversation towards the requirements on our checklist, but the final decision on borderline deals was often decided on this call.

Some funders use this interview call just to confirm information on the application, but it should no doubt play a role in a deal approval. That’s just my opinion. Once the deal is funded though, it will all come down to fate, hard work, or coincidence. I guess it all depends on how strongly the merchant agreed or disagreed with each of those on the exam.

Underwrite at your own risk.

Amazon Quietly Funding Small Businesses

December 30, 2013 Ever since Amazon announced their exclusive business loan program last year, they’ve been quietly booking deals. I say quietly because no one really talked about it much ever since. Though the loan program is available only to qualified Amazon.com merchants, it’s very similar to how Kabbage started off with eBay. Amazon’s Business Loan program has all the bells and whistles of merchant cash advance financing and their clients tend to have huge daily sales volumes.

Ever since Amazon announced their exclusive business loan program last year, they’ve been quietly booking deals. I say quietly because no one really talked about it much ever since. Though the loan program is available only to qualified Amazon.com merchants, it’s very similar to how Kabbage started off with eBay. Amazon’s Business Loan program has all the bells and whistles of merchant cash advance financing and their clients tend to have huge daily sales volumes.

So are they really doing deals? You betcha they are. Secured Party Name: Amazon Capital Services. I wonder if any of their merchants would do a fixed ACH deal.

Enjoy.

Peer-to-Peer Lending Will Meet MCA Financing

December 29, 2013 In 2014 the peer-to-peer lending industry will collide with merchant cash advance and the rest of alternative business lending. Get familiar with these names: Lending Club, Funding Circle, and Prosper. They are brothers and sisters in the business of non-bank financing. They’re also seasoned, tested, and much like the merchant cash advance industry, experiencing phenomenal growth.

In 2014 the peer-to-peer lending industry will collide with merchant cash advance and the rest of alternative business lending. Get familiar with these names: Lending Club, Funding Circle, and Prosper. They are brothers and sisters in the business of non-bank financing. They’re also seasoned, tested, and much like the merchant cash advance industry, experiencing phenomenal growth.

The old guard of merchant cash advance companies should take notice. After losing significant ground to Kabbage and OnDeck Capital, a new breed of fighter is about to enter the ring. I hear this phrase too often in response to the threat of competition, “there’s enough opportunity out there for everyone.”

But is there? Aside from the ACH repayment boom, one of the biggest drivers of merchant cash advance industry growth has been stacking. Stacking is the process of issuing an additional advance or loan to a merchant without paying off their existing advances or loans. That puts merchants in the position of having 2, 3, 4, or even 5 daily withdrawals to remain in good standing with all of them.

While the legality and risks of stacking have long been debated, the deeper revelation here is that there may not be as much new opportunity as everyone thinks. There has been an ongoing turf war over land that had already been discovered. It’s caused overall annual funding volume to rise significantly, but there’s not much room for 400%, 500% or 1,000% growth.

Funders like Kabbage came in and conquered the online merchant cash advance space without anyone noticing. Some funders have taken 5 years to double output on a monthly basis. Impressive, yes, but Lending Club on the other hand has more than quadrupled monthly funding volume over just the last 18 months. Not only that, but they’re doing more than OnDeck and CAN Capital (formerly Capital Access Network) combined. That’s massive.

Backed by Google and recently valued at $2.3 Billion, Lending Club is expected to go public in the next 12 months. As they seek to extend their dominance from consumer lending to business lending, funders should seriously ask themselves, is there really enough opportunity out there for everyone?

The Achilles Heel for merchant cash advance companies is money. Regardless of how fast they turn it over, there’s no possible way to experience fast triple digit growth without outside capital. Some funders spend a lot of time and energy trying to raise it. Others are content without it and go chugging along at a moderate pace.

Peer-to-peer lenders on the other hand have a unique advantage, unlimited access to cash. That’s because they source all the money from individuals. The money is crowdsourced from an infinite pool of investors and they just book the deals and service them. Combine this model with a sweet infusion from an IPO and alternative business lending will have its very own behemoth.

Peer-to-peer lenders on the other hand have a unique advantage, unlimited access to cash. That’s because they source all the money from individuals. The money is crowdsourced from an infinite pool of investors and they just book the deals and service them. Combine this model with a sweet infusion from an IPO and alternative business lending will have its very own behemoth.

I’m not predicting the doom of merchant cash advance at the hands of Lending Club, but quite the opposite. Lending Club will legitimize non-bank business financing once and for all. Merchants will seek capital and investors will seek lucrative returns. Merchant cash advance companies offer a vastly better ROI than what 3-5 year loans can do with regulated interest rates. The top 10 Prosper investors are only earning 15-19%.

Lending Club will carpet bomb businesses across the nation with marketing and likely end up declining 90% of them. If they do indeed stick to their model of 3-5 year loans, they will undoubtedly leave a trail of interested but unfundable merchants. Alternative lenders and merchant cash advance companies will rush in to fill the void.

At the same time, that capital raising problem could fix itself. As everyone jumps on the peer-to-peer/crowdsourcing bandwagon, investors will be thrilled to learn that merchant cash advance is peer-to-peer based as well. Oh you didn’t know? Many funders already crowdsource capital from “syndicates”. Syndication in merchant cash advance is a simplified form of crowdsourcing. ISOs, investors, and account reps can pool funds collectively into deals just as someone could with Prosper or Lending Club.

I first raised this similarity in December 2010 (three years ago!) and even went so far as to make a mock version of Prosper’s site with MCA terminology plastered on it. Eerie isn’t it?

The difference between a company like Lending Club and say a company like RapidAdvance is whether or not funding is meant to be used as working capital or permanent capital.

The consumer lending model is not applicable when it comes to underwriting businesses. Renaud Laplanche, the CEO of Lending Club acknowledged that when he testified before congress a few weeks ago. But is he really ready to experience it for himself?

We shall see in 2014 when the line blurs once and for all. MCA, say hi to your family, P2P.

—————

Get familiar: