Sean Murray is the President and Chief Editor of deBanked and the founder of the Broker Fair Conference. Connect with me on LinkedIn or follow me on twitter. You can view all future deBanked events here.

Articles by Sean Murray

Marketplace Lending Investors Ponder Loan Defaults, Issues in Harvey’s Path

September 1, 2017On the LendAcademy Forum, a Lending Club investor posted that he had been selling notes belonging to Houston borrowers in anticipation of payment issues stemming from Hurricane Harvey. Other users chimed in with assessments of their own personal exposure, including one who noticed that affected zip codes made up a little under 4% of his outstanding principal. By now, secondary note buyers probably have their radar up to heed caution with these.

Elsewhere in the industry, MCA firm Strategic Funding and lender Breakout Capital both announced that they were suspending debits to businesses they’ve funded in the Hurricane’s path.

A message for our customers located in flood-affected areas of Texas pic.twitter.com/4nc8bjWzg5

— Strategic Funding (@SFSCapital) August 28, 2017

The OCC is also advocating that banks suspend payments in those areas from ATM fees to loans. They should consider “restructuring borrowers’ debt obligations, when appropriate, by altering or adjusting payment terms. Payment extensions should reflect individual borrower situations and generally should not exceed 90 days,” according to a statement.

Letter From The Editor – July/August 2017

August 30, 2017Happy end-of-summer. It’s been a remarkable year so far.

In this issue, we talked to small business owners about what works and what doesn’t. Several of them advocated for more personal attention and to shift away from old fashioned marketing tactics like cold calling. If you’re a salesperson, you’ll want to read what your clients told us.

On the bank side, the companies disrupting banking are… other banks, ones that have embraced digital technology and partnerships with online lenders. They’re tech companies with bank charters, or at least that’s how they appear. And it’s working for them quite well. To become a better bank, these banks are taking an entirely different approach than their predecessors.

We’ve got a lot more of course and I want to thank everyone that has supported deBanked all these years, whether as a paying advertiser or as a regular reader. One of the most rewarding things for myself personally has been to see copies of this magazine appear in the lobbies of funding companies all over the country as reading material for visitors. That has given us incredible reach, but I think we can reach even farther. Stay tuned for plans we have in 2018. As the industry turns a page, I hope that you’ll continue turning ours.

–Sean Murray

The deBanked Golf Outing 2017 Was a Success

August 28, 2017 Thanks to everyone that attended deBanked’s first ever industry golf outing at Marine Park Golf Course in Brooklyn, NY. And thank you to all the sponsors who helped make it a success!

Thanks to everyone that attended deBanked’s first ever industry golf outing at Marine Park Golf Course in Brooklyn, NY. And thank you to all the sponsors who helped make it a success!

A PHOTO ALBUM IS NOW LIVE

- SOS Capital

- Elevate Funding

- Hudson Cook, LLP

- Yellowstone Capital

- Signature Printing & Consulting

- Grassi & Co

- Central Diligence Group

- Sure Funding Solutions

- Unique Funding Solutions

- Imperial Advance

Official photos from the event should be available soon. In the meantime, follow us on Instagram to see them when they come out.

P.S. The inaugural conference for MCA and business loan brokers is COMING SOON. Visit http://brokerfair.org to receive updates on Broker Fair 2018.

CFPB Sanctioned By Federal Judge After Engaging in Funny Business During Discovery

August 26, 2017 When the CFPB was asked to support their claims in a brutal lawsuit they had brought against several payment processors, they balked and stonewalled. Eventually, the judge had enough.

When the CFPB was asked to support their claims in a brutal lawsuit they had brought against several payment processors, they balked and stonewalled. Eventually, the judge had enough.

On Friday, US District Judge Richard W. Story granted sanctions against the Consumer Financial Protection Bureau (CFPB) for misconduct in discovery and dismissed their case against several payment processors entirely. The CFPB had accused defendants Global Payments, Pathfinder, Frontline and EMS of providing substantial assistance to deceptive conduct carried out by debt collectors.

During discovery, the CFPB attempted to block their own representatives from being deposed in any capacity. The Court disagreed and ordered the depositions to proceed. Rather than comply, the CFPB asked for a protective order to block questioning on topics relevant to their claims. The court mostly denied it, ordering that the defendants were entitled to question the CFPB about the factual underpinnings of its allegations against them.

Apparently determined to undermine the process further, the CFPB produced a witness for a deposition who relied almost entirely on “memory aids,” which in one case was a 200+ page document that the witness merely read aloud verbatim when asked questions.

In a Court conference call conducted in April, defendants complained that the CFPB’s “memory aids” were merely lengthy prepared scripts.

And this was not really a memory aid. This was a script. The witness simply read answers. He did not sort of use it as a refresher of his memory. And frequently the witness would not answer the question asked. But you would ask the witness for the factual basis for something, especially outside Global’s knowledge, and he would read, in one instance for an hour, about things that had nothing to do with Global’s knowledge.

The tactics continued throughout, according to the defendants.

[…] I could be wrong on this Your Honor, but it’s quite possible that in the seven hours yesterday there was no human touch; everything was read. And when anything was asked that would be, well, what facts do you have to support that, it was either met with objection, work product, don’t answer; or the witness would just read lengthy narratives, often that were nonresponsive, that sometimes went as long as 45 minutes and often an hour.

Incredulous that the CFPB refused to answer questions at all costs, the judge ordered sanctions against the CFPB and dismissed the case on the basis that they had failed to produce a knowledgeable witness, made improper objections during depositions, and willfully violated the Court’s repeated instructions.

“In light of the CFPB’s pattern of conduct in this case, the Court is not optimistic that reopening the depositions would be fruitful,” the judge said.

The case is Consumer Financial Protection Bureau v. Universal Debt Solutions, LLC, et al. in the Northern District of Georgia, Atlanta Division, Action 1:115-CV-859-RWS.

Journalist Barred From Being a Director of a UK Firm

August 21, 2017 George Popescu, owner of Lending Times, and the winner of the 2017 LendIt Awards for best journalist coverage, has been banned from acting as a company director in the UK for 12 years, according to the government’s Insolvency Service. The ban stems from his tenure as a director of a company called Boston Prime.

George Popescu, owner of Lending Times, and the winner of the 2017 LendIt Awards for best journalist coverage, has been banned from acting as a company director in the UK for 12 years, according to the government’s Insolvency Service. The ban stems from his tenure as a director of a company called Boston Prime.

George Alex Popescu (“Mr Popescu”) breached his fiduciary duties to act in the best interest of Boston Prime Limited (“Boston Prime”) and/or failed to ensure that both Boston Prime, as the regulated firm, and him individually, as the approved person, complied with the Financial Conduct Authority (“the FCA”) rules and guidance.

$6.2 million was transferred out of the company to a company named FXDD. Boston Prime’s receiver is presently suing FXDD seeking the return of the funds to the company. Proceedings are ongoing. Mr. Popescu is not under investigation and there are no legal proceedings at this time against Mr. Popescu.

Meanwhile in the US, Popescu has raised millions of dollars for his latest company, Lampix, by conducting an initial coin offering for Pix tokens. Lampix reports having raised 52921.88 ETH to-date, currently valued at more than $17 million.

A month ago, the SEC issued a warning about these kinds of offerings.

“Recently promoters have been selling virtual coins or tokens in ICOs. Purchasers may use fiat currency (e.g., U.S. dollars) or virtual currencies to buy these virtual coins or tokens. Promoters may tell purchasers that the capital raised from the sales will be used to fund development of a digital platform, software, or other projects and that the virtual tokens or coins may be used to access the platform, use the software, or otherwise participate in the project. Some promoters and initial sellers may lead buyers of the virtual coins or tokens to expect a return on their investment or to participate in a share of the returns provided by the project. After they are issued, the virtual coins or tokens may be resold to others in a secondary market on virtual currency exchanges or other platforms.

Depending on the facts and circumstances of each individual [Initial Coin Offering] ICO, the virtual coins or tokens that are offered or sold may be securities. If they are securities, the offer and sale of these virtual coins or tokens in an ICO are subject to the federal securities laws.”

Lampix is not licensed to sell securities and they claim their tokens are not securities.

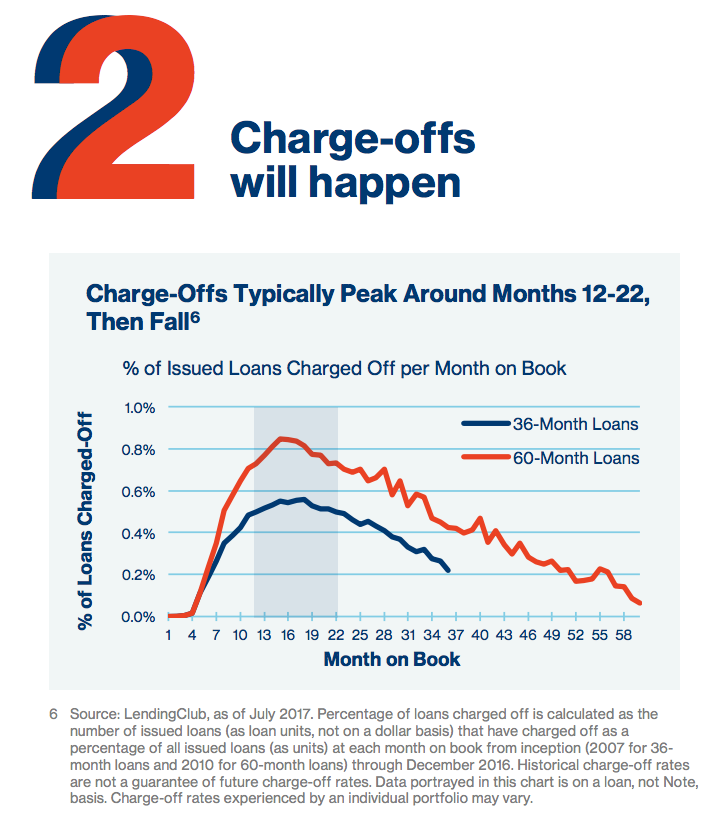

Lending Club: Charge-offs will happen

August 16, 2017 A short guide that Lending Club circulated to retail investors yesterday offers them five key pieces of advice.

A short guide that Lending Club circulated to retail investors yesterday offers them five key pieces of advice.

1. Focus on net returns

2. Charge-offs will happen

3. Diversification is key

4. Monthly payments include principal and interest

5. Reinvestment is critical for consistent returns

Lending Club has gradually drawn more attention to the effect of prepayments on loans and this guide is no different.

“Prepayments impact returns because they reduce the amount of principal earning interest from Notes. A Note is considered prepaid when the dollar amount received is greater than the amount due for any given month,” they say. “It is inevitable that certain loans will charge-off or prepay and result in a loss of investment capital.”

Not mentioned however is that investors are charged a 1% fee on all outstanding principal if a borrower pays off their entire loan early despite it being no fault of the investor. And investors are less likely to monitor the impact of these fees if they keep reinvesting their cash which of course Lending Club advises investors to do.

The guide is still helpful in setting expectations for retail investors who ignored or did not understand all the fine print when they signed up. Quoted below about charge-offs:

“It’s inevitable that some borrowers will get behind on their loan payments. Some of these borrowers will get back on track and others will stop repaying their loans. After it’s clear that a borrower won’t make any more payments a loan is considered ‘charged-off.’ All investors in consumer credit experience some charge-offs, so it’s important to understand them and consider how they might impact your investment strategy.”

Overall, the guide is a nice way of keeping retail investors engaged. As someone who invested on the platform for a few years, one of the biggest disappointments I found was that the platform did not feel like a “club” at all. There was no sense of peer community and there was almost no communication whatsoever from Lending Club about anything other than requests to deposit more money.

But lately, peer funding has been dropping off the platform after reaching an all time high back in the first quarter of 2016. In Q2 of this year, only 13% of loans were funded by peers. 44% of loans were funded by banks. Maybe they’re not entirely ready to see individuals disappear completely or maybe they just want those that remain to keep the faith as returns slide. Hopefully, they continue to supply interesting and helpful materials in the future.

Is The End Near For This Debt Settlement Firm?

August 11, 2017 Corporate Bailout, a New Jersey based firm that purports to help businesses lower the monthly payments on their debts, is back in the news. This time it’s for allegedly running a sex-fueled office with stripper parties, sex dolls, and sexual harassment, according to the New York Post who published video footage of the debauchery. Warning: the New York Post link is not safe for work.

Corporate Bailout, a New Jersey based firm that purports to help businesses lower the monthly payments on their debts, is back in the news. This time it’s for allegedly running a sex-fueled office with stripper parties, sex dolls, and sexual harassment, according to the New York Post who published video footage of the debauchery. Warning: the New York Post link is not safe for work.

deBanked has written about Corporate Bailout previously, in one case recently where the company is alleged to be robo-dialing out of control. Corporate Bailout never responded to the lawsuit and the court entered a default against the company this past Monday, according to the docket.

Back in April, deBanked also received the recording of a call purportedly between a representative of Corporate Bailout and a small business owner. We had the lengthy dialogue transcribed and it appears below with the names between the parties changed.

Of note, the alleged Corporate Bailout representative in the call makes several references to a partner law firm named Protection Legal Group. There are several lawsuits pending against Protection Legal Group, one of which alleges the firm didn’t have a lawyer licensed to practice in the state they claimed to offer defense in. In that situation, a merchant had to hire another lawyer to sue his lawyer at Protection Legal Group.

| Person Answering Phone: | Hello. |

| Robo Agent: | Hello. How are you today? |

| Person Answering Phone: | I’m good. |

| Robo Agent: | Great! Can I speak to the business owner please? |

| Person Answering Phone: | Who is this please? |

| Robo Agent: | This is Alex from Corporate Bailout. Are they available? |

| Person Answering Phone: | Yeah. One second please. One second. |

| Robo Agent: | Thanks. |

| John: | Hello. |

| Robo Agent: | Can I speak to the business owner please? |

| John: | Speaking. |

| Robo Agent: | This is Alex from Corporate Bailout. I know your time is valuable. So, let me get straight to the point. We help small business owners eliminate their unsecured debts. If your business has taken a merchant cash loan or advance, a high interest credit card debt, accounts payable debt, or any other unsecured business debt, you are now able to settle your outstanding balances for just a fraction of what you owe. I just need to ask two qualifying questions. Okay? |

| John: | Sure. |

| Robo Agent: | What type of entity is your business registered as? LLC, Corp, etc.? Hello? |

| John: | LLC. |

| Robo Agent: | Do you have at least $25,000 in unsecured debt? |

| John: | Yes. |

| Robo Agent: | Great! It looks like you may qualify. Hold on one second while I get a specialist on the phone who can explain further. |

| [Phone Ringing] | |

| Derrick: | Hello. Hi. |

| Robo Agent: | Hi, I have someone here that is interested in moving forward. I will let you take it from here. |

| Derrick: | Thank you for that. My name is Derrick by the way. Who am I speaking with? |

| John: | John. |

| Derrick: | John, it’s a pleasure, John. So, John, go ahead and tell me a little bit. What kind of unsecured debt are you experiencing? Is this with cash advances? |

| John: | Yes. |

| Derrick: | All righty. And that’s our cup of tea. So, I wanna give you an example— |

| John: | What exactly— |

| Derrick: | …of exactly how this would work for you. |

| John: | Okay. Perfect. Yeah. |

| Derrick: | All right. Tell me how many advances do you have. Do you have one or a couple out there? |

| John: | I have 3. |

| Derrick: | 3. Okay. And what do you owe approximately in combined balances? |

| John: | About $85,000. |

| Derrick: | Okay. And lastly, what are they charging you daily? |

| John: | Total of about $2,000. |

| Derrick: | At this day? |

| John: | Yeah. |

| Derrick: | Okay. Obviously, they’re overextending you for sure. Now, you open these advances yourself? Is this your business, John? |

| John: | Yes. |

| Derrick: | Okay. What is it that you do? I just wanna get a better grasp of what’s going on. |

| John: | We’re a trucking company. |

| Derrick: | Oh okay. Yeah. Yeah. I work with a lot of trucking clients. All right. So, here’s the deal. I mean, at 85,000, knowing that these are cash advances, we’re able to reduce that down to about 63,000. Saving you well over 21,000 just on principal. |

| John: | How do I do that? |

| Derrick: | That’s very simple. I mean, what we do is we appoint you a power of attorney that represents the association. And what they’ll do is that by power of attorney they’ll contact your creditors in a form of hardship for you. Okay? And that’s the key word there because by law— And it doesn’t matter if it’s a cash advance or a Capital One Visa. Whoever that creditor is, whatever obligations you have to that creditor comes to an immediate halt. That means no more interest accruement. That means that whatever number I’m telling you by the time you hire us let’s say by today, that’s the number. Yeah. |

| John: | One second. Why does it come to a sudden halt if I have a contract with them? Like can’t they sue me for this? I mean, I signed a contract with them and everything. How is it legal to go and say that I can’t pay them? I’m not understanding you. |

| Derrick: | Well, #1, these are cash advances, which is highly unregulated. Everyone knows if you look into it. Okay? Everyone knows— |

| John: | I did. |

| [Crosstalk] | |

| Derrick: | Okay. Yeah. There you go. Well, they’re tiptoeing the line of legalities here by pressing [0:04:55][Inaudible] laws. That’s why we’re able to snatch them and nip them in the butt. Okay? When you are charging on a daily basis an overextended amount way past 25% APR, this is abuse. This comes to abuse now and we have to come at them in a form of hardship. By law, that’s what happens and everything comes to a halt right then and there. Now, they have to settle. Now, here’s the thing. I know you’re saying can they sue you. You know, they can. They can. Probability is very low. |

| John: | Why would I take the risk of getting sued? I mean, I’m just trying to understand. Is what you guys doing also legal? I mean, no offense, it sounds a little— |

| Derrick: | Oh yeah. |

| John: | This sounds a little less legal. What you’re doing sounds a little more illegal than what they’re doing because I really have a contract with them that I signed and I notarized. I mean, that is like legal documents. |

| Derrick: | Yeah. We give you a legal contract. It needs to be notarized and all that too. Okay? But here’s the thing. It is legal here. You’re working with the law firm. Okay? The law firm will then take that responsibility and make sure that they do reduce your debt size. Okay? It’s a cash advance. It’s a slam dunk every time. Who do you work with by the way? |

| John: | [0:06:15][Inaudible] I’ll give it to you in a couple minutes. Where did you get my information from? ‘Cause I usually get calls from them. Like this is the first call I’m getting from this type of company. Where did you guys get my information from? |

| Derrick: | So, we essentially look through UCC filings and UCC filings are only liens that are basic entry companies that normally take out cash advances. Normally. |

| John: | Right. |

| Derrick: | 9 times out of 10 when I see a UCC file that looks like yours and, you know, I’m usually right it’s a cash advance, so yeah. |

| John: | Which business were you referring to though? |

| Derrick: | I don’t know. I don’t know. Your phone call got transferred to me. So, we have several ways of finding new clients and one of them is that we have a database. People make outbound calls. I’m the one on the receiving end. I work with my clients one-on-one to get them enrolled, have them feel good about the program, and then I pass them along to the law firm. That’s my role here. So essentially, it happens like this, John. Right? Let’s say hypothetically today you’re like “You know what? This makes sense. I am in a hardship. I need to get out of this crap. All right, what do I need to do today?” I get you on board today just hypothetically. By Thursday because today is Tuesday— We need at least 48 hours. By Thursday, the law firm contacts you and they say, “You know, John, we reviewed everything. You know, you’re good to go. Let’s now help you stop making those payments so that way your bank no longer honors the ACHs you’re making daily. So essentially, by Thursday, we’ll put a stop, a complete halt to your payments. And then we can culminate maybe a week to 2 weeks before there’s any expense. And by the way, it will be a fraction of that cost. We’re talking at least 50% less in those payments. That’s how overextended they have you on. We don’t have to have that start for at least 2 weeks from today or whenever— |

| John: | So, in essence, I will still have to pay them. Just in a longer period of time you’re saying? |

| Derrick: | Right. Yeah. Well, we can work that out, but the whole point of this program is not to stress anybody. And that’s where the idea of a scam needs to be thrown out of the window. Okay? |

| John: | So, they’re scamming me you’re saying? |

| Derrick: | Yeah. I would say so. You don’t feel like you’re being highway robbed right now paying 2,000 a day? And I can give you even better numbers if I look at— you know, if I take a peek at the contract just to see the real numbers ‘cause on average they’re charging anywhere from 30 to 60 percent on a borrowed amount. That’s an average. I know you’re in that category. |

| [Crosstalk] | |

| John: | I understand, but I didn’t know about it that’s why I’m saying if I knew about all this, I can’t deny in court if they sue me. They do have a legal document against me. I mean, it is an issue. |

| Derrick: | Right. Well, here’s the good thing. I mean, people are in such a worse shape than you, John, that they’ll hire any company who’s gonna promise them that they’ll be able to negotiate, but the greater thing why this is such a more wise decision for you is that you’re not hiring a middle man. As a matter of fact, I can show you, okay, any agreements that we have. We provide litigation defense services on top of the settlement. So, if ever anything should happen, which being at 85,000 likely not, but if ever anything should happen, you have attorneys there that will show up in court for you, that will battle, that will counter lawsuit if we have to, whatever, drag out the process, whatever it takes. Whatever it takes. But at the end of the day if they wanted to sue you, you know how long a sue takes place or takes to convert? |

| [0:09:59] | |

| John: | I know, but— |

| Derrick: | It takes a long time. |

| John: | At the end of the day, I would still be found guilty that I did sign the contract. What defense could I possibly have for that? I’m just trying to understand what the legality is. |

| Derrick: | The defense is #1 it’s a hardship. If you look into that, hardships create a big deal in the law system. So, that’s #1. Number 2 is that this is technically not even a debt that you have. Check in on technicalities. They only purchase future receivables at expect it let’s say 2,000 a day. |

| John: | Yeah. And they also have a judgment against me though. |

| Derrick: | That is all scare tactics. That’s all. Confession of judgments you’re talking about, right? |

| John: | Yeah. Yeah. |

| Derrick: | Confession of judgment that you signed. Yeah. Yeah. Almost everybody signs a confession of judgment now. They just started implementing that the last 3 years. |

| John: | They can’t do anything with that? |

| Derrick: | Not when you have a power of attorney reaching out to them for settlement against the hardship cost. They can’t do that. |

| John: | Oh. |

| Derrick: | And if they use that– |

| John: | And also like with this document, they can like freeze accounts and they can freeze assets and stuff like that. But if you guys trick them and they can’t do that– |

| Derrick: | Yes. They won’t be able to. But if we need to take any preventative actions, your law firm, your adviser there will tell you to possibly change. |

| John: | So, you guys have a lawyer? You are the lawyer then? |

| Derrick: | I’m not the lawyer. I’m not the lawyer. I don’t do the negotiation. I told you my role here is just to get you on board so I can pass you to the law firm. That’s it. That’s my role. Give you the information– |

| John: | what’s your charge? |

| Derrick: | Okay. Good question, John. So, let me look at this number here again. I wanna give you something real. So let’s say it’s 85, right? 85,000 you owe. That gets reduced down to $63,340. That 63,000 is going to cover absolutely everything. That covers paying back your cash advances. That will cover for our services and fees all inclusive. Okay? The only reason why we’re able to do that, John, is because we are a nationwide law firm that does negotiations for cash advances specifically. That’s what Protection Legal Group does. And so, are you familiar with a class action lawsuit? Are you familiar with that? |

| John: | Yeah. |

| Derrick: | Okay. So, we approach settlements in that same format. Class action settlement is what we call it. So, essentially you’re one drop in the ocean. Right? And that’s why I wanted to ask you who you work with so I can give you references. But guaranteed we have, you know, up in the hundreds of clients in those cash advances that we have already control such a large portion of their funds. So, because we’re going to– Who do you have? do you have Swift? [inaudible] |

| John: | I’m not gonna reveal that information yet until I look into your company a little more only because it’s my first time hearing about this. I will look into this. I wanna speak with my lawyer about it and everything. But you were telling me it would be lowered to 63,000. That’s fine. |

| Derrick: | Yeah. That’s at most. |

| John: | What’s your fee? |

| Derrick: | Our fees are inclusive, John. I can’t tell you what it is until we submit everything, until we submit all the hard copies into the law firm |

| John: | What’s the percentage range? I mean, there’s gotta be some sort of number that I can go by. |

| Derrick: | Yeah. Yeah. I can give you a percentage. So, let’s say we reduce it down to 70 cents on the dollar, right? 42 cents of the dollar will go to your creditors. Okay? |

| John: | And the 28? |

| Derrick: | And 28 cents gets [0:13:58][Inaudible] up between the law firm and your attorney. It’s like 4 cents in a dollar to the attorney, 24 cents to the law firm. So, that’s how it works. Normally, that’s what they look to negotiate. |

| John: | So, you’ll get the 24, they get the 4? |

| Derrick: | That’s if they agree to that term. Yeah. The whole point is for your attorney to figure that out with the lender. At the end of the day– |

| John: | Isn’t that 24% on the dollar also? |

| Derrick: | No. No. On the 70 cents on the dollar that we reduce it. So, you have 85,000. Reduce it to 70 cents on the dollar let’s say. In that 70 cents, 42 goes to them. The remainder of the 28 is split. Right? 4 cents to your attorney, 24 to the law firm. So that’s the numerology of how it gets distributed. |

| John: | That’s 40% |

| Derrick: | Right. That’s how it gets– What is? |

| John: | The 28 cents on the 70 cents is 40%. |

| Derrick: | 40%? |

| John: | Yeah. |

| Derrick: | No. No. It’s smaller than that. |

| John: | Do the math. |

| Derrick: | If it were 40%– |

| John: | Do the math. You said 28. Do 28 divided by 70. |

| Derrick: | 28 divided by 70, 0.4. Yeah. 40%. So, what are we getting off here? |

| John: | So basically, you’re charging me 40% and they’re charging me the same 40%. So what’s the difference? I’m just trying to understand why– |

| Derrick: | No. Yeah. We’re making 40– Hold on. We’re making 40% of that 70%. They’re making 60% out of that 70 cents. I mean, if you wanna get in detail, that’s what it works down to. At the end of the day, the whole program cost for you is only 63,000. So, you make the decision whether you pay 63,000 or 85,000. |

| John: | And run the risk of getting sued. |

| Derrick: | No one touches–. No. You have a law firm that will fight and give you the litigation defense. |

| John: | Right. That’s not a–I understand that. I understand they’ll give it to me. But I also run the risk of losing. And if I lose, I would have to pay all their legal fees and that extra money that I know, you know, what trying to get out of. So, here’s what I’m gonna do. I’m gonna have to look into this a little more ’cause I’m not just gonna give all my information in a second. Can you send me some– |

| Derrick: | Yeah, that’s fine. |

| John: | …information so I can look it over? |

| Derrick: | What’s your best email, John? |

| John: | It’s [address redacted] |

| Derrick: | @gmail.com. Do you happen to be in front of a computer now? |

| John: | I do. Yeah. |

| Derrick: | All right. I just wanna make sure that you at least get it. I’m putting in the subject heading, ATTENTION John. This should be easy to find. So, you know, you can loo at– |

| John: | I just wanna make sure what it’s about. what is this for? What’s it called? |

| Derrick: | Debt relief I can put in there. Is that okay? |

| John: | Yeah. That’s fine. |

| Derrick: | I’ll put debt relief as well. Yeah. |

| John: | And this is from Mason & Hanger? |

| Derrick: | Mason & Hanger? |

| John: | Yeah. That’s where you’re calling from? |

| Derrick: | What’s that? No. No. Protection Legal Group is the name of the law firm. Protection Legal Group. |

| John: | Oh, it’s not Mason & Hanger? |

| Derrick: | No. I don’t know where you got that name. |

| John: | From the caller ID |

| Derrick: | Really? Mason & Hanger? I don’t know. That’s strange. You know, when I make calls out of the office, sometimes it comes out like– |

| John: | Are you gonna have your contact number over there or no? |

| Derrick: | Yeah, it’s in the email. Tell me if you have it now ’cause it says that it’s sent |

| John: | [Name redacted]? |

| Derrick: | [Name redacted]. Yup. that’s me. All right. So, there’s a summary of what we went over and then those things in bold would be what we need in order— if you wanna proceed forward, but the very first thing you’ll see in bold is the current cash advance agreement signed or unsigned. Very important. That’s what’s gonna help us approve you or not and see if we can fit you in the program. We have to look over the verbiage in there. You see one document attached. Right? |

| John: | Right. Right. |

| Derrick: | Do you see what’s in bold? Yeah, I have a few things in bold there that we require from you. Okay? The hardship letter is one of them that’s attached in there. But before all of that, we wanna take a look at a copy of the agreements you have with the 3 cash advances. It could be signed or unsigned. Your personal information is not gonna do us any good. We wanna see if we can approve you first. Okay? That’s all. It’s just by procedure. And then what we find in there, which only takes about 20 to 30 minutes to approve you, I can tell you, “Hey, John, you know, here are the real numbers, what we found based on your contract. Here’s what we can offer and here are your options.” And then we can come into an agreement together. The whole point of this is to get you off from paying— You’re paying 10 grand a week, man, you know. To get you off of 10 grand. Maybe down to 5,000. Whatever that number is that’s more comfortable for you and obviously is realistic for the law firm. Okay? |

| John: | You are basically just the broker for the law firm? |

| Derrick: | I’m their spokesman, you know. I’m their marketing arm. Not a broker or anything. If I were a broker, I’d have countless sources of different law firms that does this. |

| John: | I assume you have one law firm that you work with? |

| Derrick: | I only represent them. |

| John: | Who do you work with? |

| Derrick: | What was that? |

| John: | Who is the law firm that you work with? |

| Derrick: | Protection Legal Group. Protection Legal Group. You can put that down. |

| John: | Can you email me that information? I wanna make sure. It is in the email? |

| Derrick: | Yeah. It’s in the email. Yeah. Yeah. It’s all in there. |

| John: | Okay. Protection Legal Group |

| Call trails out into goodbyes… |

In the follow up email that came up from a corporatebailout.com address, Derrick said, “We have teamed up with nationwide law firm, Protection Legal Group, who will negotiate with lenders on your behalf. By enrolling in our program, we would reduce the total advance balances down to 70 cents on the dollar! But more importantly, we turn your daily payment into a ONCE a week payment, and reduce that amount by up to 50%!”

Company Founded By LendIt’s Co-founders Has Acquired LendingRobot

August 10, 2017 NSR Invest has acquired LendingRobot to become the largest robo-advisor in the alternative lending space, according to an announcement made by both companies.

NSR Invest has acquired LendingRobot to become the largest robo-advisor in the alternative lending space, according to an announcement made by both companies.

Of note is that three of NSR Invest’s co-founders, Peter Renton, Bo Brustkern, and Jason Jones, are also co-founders of the LendIt Conference.

The acquisition is a reminder that the conference founders are also significant players in the alternative lending space itself. According to the announcement, the new combined parent company, Lend Core, LLC, serves over 8,000 clients and manages over $150 million in assets.

For those not familiar with LendingRobot, deBanked started reporting on the company more than two years ago as a tool for investors to automate their investment picks on marketplace lending platforms like Lending Club and Prosper. I eventually became an individual paying customer of the service, using it to automate the purchase of nearly $30,000 worth of tiny $25 and $50 notes that fit within the parameters I had set. LendingRobot’s classic service can also automate investments on the Funding Circle platform, though I have never signed up with Funding Circle or invested in their loans.

When I last met with Emmanuel Marot, LendingRobot’s CEO, in person, he was launching a new hedge fund dubbed the LendingRobot Series that would be managed with robo-advisor technology. The hedge fund was included in NSR Invest’s acquisition.

NSR Invest CEO and LendIt co-founder Bo Brustkern will lead the combined entity as CEO. In a prepared statement he said, “We have long respected the work of the LendingRobot team and recognize that our companies are pursuing a common goal. That is, to provide a unifying investment solution for the millions of investors worldwide who seek the attractive, uncorrelated, diversified returns that alternative lending can provide. With this combination of our firms, we are bringing enhanced capabilities to our combined client bases today, and big plans for the future. A shining example of the kind of innovation that we will emphasize is the Lending Robot Series Fund, which provides customization, liquidity and diversification to investors through a novel, elegant, low-cost fund structure.”

Meanwhile, Marot will continue on only as a special advisor to the company. In a prepared statement, he said, “NSR and LendingRobot have taken different tracts to provide similar services. Now is the perfect time to combine our complementary strengths. The combination of LendingRobot’s advanced technology and NSR’s extensive knowledge of this industry puts us in the best position to provide superior investment advice in the alternative lending space for both individual and institutional investors.”