Sean Murray is the President and Chief Editor of deBanked and the founder of the Broker Fair Conference. Connect with me on LinkedIn or follow me on twitter. You can view all future deBanked events here.

Articles by Sean Murray

Welcome to Broker Fair

May 13, 2018Update: Thanks to everyone who attended, participated, and sponsored!

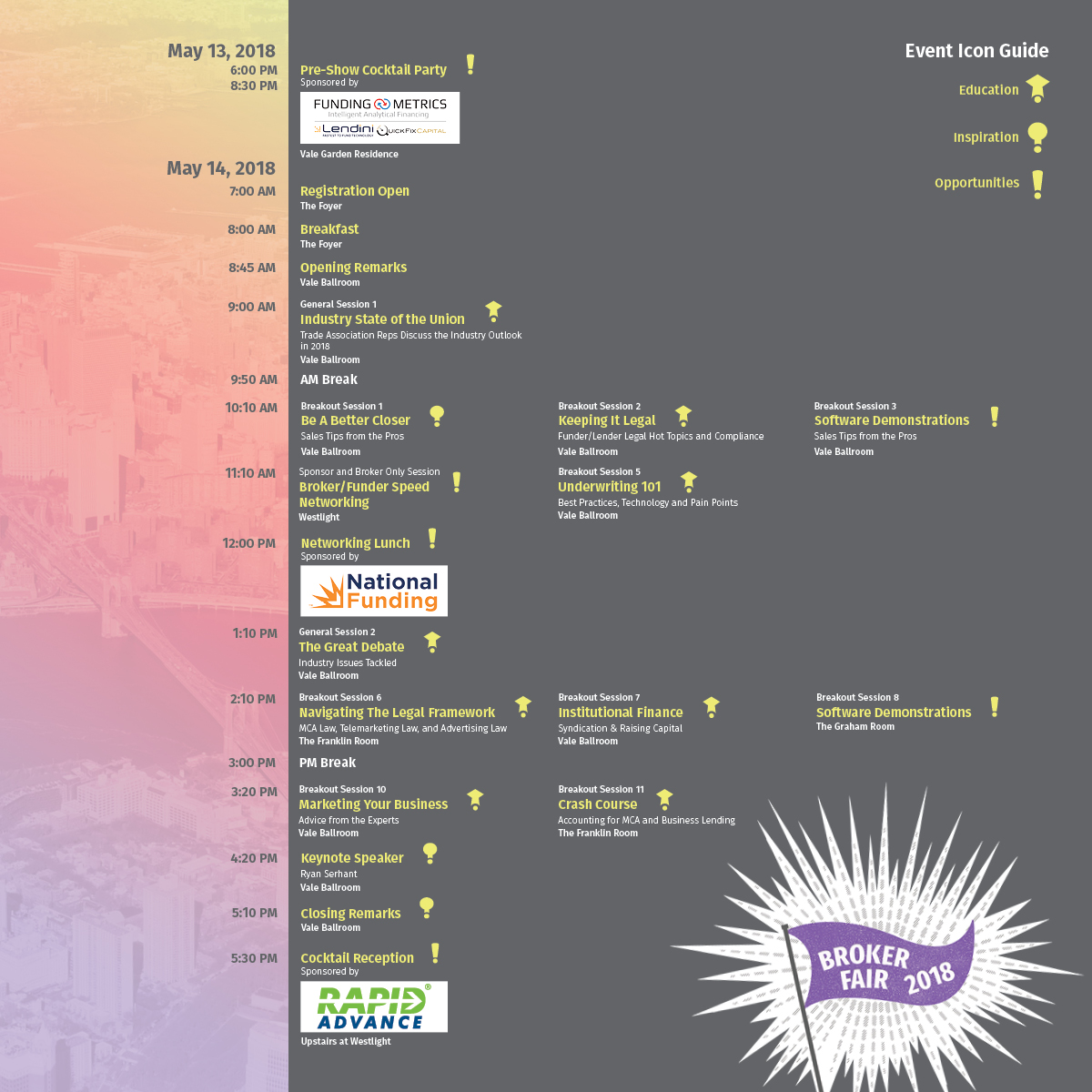

Registration on Monday starts at 7am where you will be able to pick up your badge. The continental breakfast will be available at 8am and the opening remarks begin at 8:45am.

Registration on Monday starts at 7am where you will be able to pick up your badge. The continental breakfast will be available at 8am and the opening remarks begin at 8:45am.

The lunch, sponsored by National Funding, begins at 12. There will be a kosher option available.

Later at the end of the day, the cocktail reception at Westlight, which is upstairs on the 22nd floor, will begin at 5:30pm. Westlight offers amazing outdoor views of the Manhattan skyline. That event is sponsored by RapidAdvance and all you need to enter is your Broker Fair badge.

The agenda will also be available on the backside of your badge.

Thank you also to our Gold Sponsors: National Business Capital, CFG Merchant Solutions, BFS Capital, and CanaCap

California Commercial Financing Disclosures Bill Still a Work in Progress

May 8, 2018 SB-1235, a bill that would require APR disclosures on all types of commercial financing products transacted in California (including some types of factoring, leasing, and merchant cash advance), survived the Judiciary Committee hearing on Tuesday. The bill was previously debated by the Senate Committee on Banking and Financial Institutions, where key provisions like a uniform APR disclosure came under fire.

SB-1235, a bill that would require APR disclosures on all types of commercial financing products transacted in California (including some types of factoring, leasing, and merchant cash advance), survived the Judiciary Committee hearing on Tuesday. The bill was previously debated by the Senate Committee on Banking and Financial Institutions, where key provisions like a uniform APR disclosure came under fire.

Since then, Senator Steve Glazer, the bill’s author, is now proposing an alternative Annualized Cost of Capital metric rather than an Annual Percentage Rate in an attempt to compromise with the opposition that says the metric will not work for non-lending products.

On Tuesday, two trade association representatives continued to press their case for a collaborative solution that would work best for all parties, especially small businesses.

Scott Riehl, VP, State Government Relations at the Equipment Leasing and Finance Association (ELFA) said that his association, whose members include Caterpillar and Hewlett Packard, was not on board with the bill as currently drafted. No one in the financial community has ever even heard of the term Annualized Cost of Capital, Riehl said.

Katherine Fisher, Partner at Hudson Cook, LLP, who was there on behalf of the Commercial Finance Coalition, testified that it would not be possible to calculate an annualized rate when the timeframe of products like factoring and merchant cash advances were indeterminate.

Judiciary Committee Chairwoman Hanna-Beth Jackson wrapped up the lively debate by saying that ultimately California “wants a robust small business community” after several of her committee members voiced concerns that the bill in its current form could potentially deter commercial finance companies from providing capital in their state.

The hearing concluded with only 3 aye votes, putting the bill “on call,” wherein no decision was formally reached.

Update: Before the close of the day, the committee secured a 4th aye vote, pushing the bill forward.

Online Lender Turns to Bachelorette Star to Promote Loans

April 26, 2018Will you accept this rose…err..loan?

Joelle “JoJo” Fletcher has come a long way since her 2016 season on The Bachelorette where she found love with Jordan Rodgers, the younger brother of Green Bay Packers quarterback Aaron Rodgers. The couple is still together and JoJo is now a spokesperson for Marcus, the online consumer lending arm of Goldman Sachs. In the TV advertisement, which you can click to watch below, she explains why Marcus is the way to go if you need financing for home improvement.

ABC seems to produce the best TV celebrities for online lenders. Three judges on Shark Tank, which is also an ABC show, have all been spokespeople for online lenders.

Barbara Corcoran – OnDeck

Lori Greiner – Kabbage

Kevin O’Leary – IOU Financial

While JoJo herself is no shark, The Bachelorette/Bachelor franchise is the number one reality program — among adults 18-49 living in homes with $100,000+ annual income, a demographic that Marcus is undoubtedly targeting.

Full disclosure: I watched the two seasons that JoJo was on in their entirety.

Meet at the 2018 Financial Services Conference

April 22, 2018I will be attending the 2018 Financial Services conference by CounselorLibrary and Hudson Cook, LLP on Monday, April 23rd in Baltimore, MD. deBanked is a sponsor of the event. If you would like to meet, please email me at sean@debanked.com.

April 23rd is a Special One-Day Program with Merchant Cash Advance and Small Business Lending Breakout Sessions.

deBanked is a partner with CounselorLibrary in the Merchant Cash Advance Basics online course, the only certification course available for MCA.

A partner from Hudson Cook, LLP, Katherine Fisher, also recently testified on behalf of the Commercial Finance Coalition at a state Senate hearing in California on commercial loan disclosures. You can read her transcript here.

What Got Said in The California Senate Hearing About Commercial Loan Disclosures

April 19, 2018

California State Senator Steve Glazer was the reason that representatives from small business finance trade associations were in Sacramento on Wednesday. Glazer’s bill, SB 1235, calls for mandatory APR disclosures on loan and non-loan products alike, even if the transaction is business-to-business and even if the transaction assesses no interest charges and even when no such APR can be calculated or exists.

That proposal caught the attention of several interested groups, including those whose members offer short term small business loans, factoring, and merchant cash advances. Among those who testified in front of the Senate Committee on Banking and Financial Institutions on Wednesday was Joseph Looney, COO & General Counsel of RapidAdvance, who spoke on behalf of the Small Business Finance Association, and Katherine Fisher, Partner at Hudson Cook, LLP, who spoke on behalf of the Commercial Finance Coalition. Each of them were there representing separate constituents with their own individual views.

Transcripts of their testimonies are below:

“Chairman Bradford, Vice Chair Vidak, and Members of this committee. I am Joseph Looney and I am the General Counsel for a commercial finance company named RapidAdvance. We are a California Finance Lender licensee and have provided more than $200,000,000 in capital to thousands of businesses in California. Today I am providing testimony on behalf of the Small Business Finance Association or SBFA, which is the leading association for companies that provide funding to Main Street businesses. The SBFA is in opposition to Senate Bill 1235 as currently drafted. While there are various issues with the Bill, the overarching concern we have is that it treats small businesses like consumers. States and the federal government have generally refused to treat small businesses the same as consumers when it comes to financing disclosures for two reasons. First, there is a significant concern that imposing consumer disclosures and regulation on small businesses would reduce the flow of capital and negatively impact the economy. Second, small business owners are sophisticated and do not need the same protections provided to consumers. Business owners hire and fire employees, handle taxes and payroll, negotiate with customers and vendors, arrange financing, handle litigation and execute on business strategies every day. Also, businesses look at money differently than consumers. A business gets capital and uses it to make more money or solve a problem in their business. In this scenario, the most important item to the business owner is how fast can they get the money and what are the conditions for getting it. The APR disclosure included in the Bill is problematic as it will create confusion. The CFPB has recently concluded the APR is confusing, does not provide as much value as thought and is extremely complicated for creditors to calculate. In fact, the CFPB is making the APR less important by moving it to the end of some disclosures and completely removing it in some cases. The APR is so complicated to calculate there are numerous pages in the Code of Federal Regulations devoted to explaining the calculation. Additionally, there are pages of guidance on how to handle various consumer products and payment types and what assumptions should be made for various products as well as shielding creditors from liability for minor calculation errors. This Bill does not address any of these issues. It simply takes an APR disclosure requirement for fixed monthly payment consumer finance transactions and concludes it should apply to materially different commercial products. While we do not support the Bill as it imposes consumer disclosures such as the APR on small business transactions, we are supportive of the idea of providing businesses with cost disclosures. Thank you.” |

“Chairman Bradford and committee members: Thank you for the opportunity to present testimony today regarding SB-1235. My name is Kate Fisher and I am here today on behalf of the Commercial Finance Coalition, a group of responsible finance companies that provide capital to small and medium-sized businesses through innovative methods. Small businesses face a gap in credit availability. Commercial Finance Coalition member companies are trying to close this gap and help spur entrepreneurship so more Americans and Californians can own and operate their own businesses. I also am a lawyer who works with providers of commercial financing on complying with state and federal law. The Commercial Finance Coalition supports California’s efforts to make business financing more transparent. Businesses benefit from having different types of financing available, and being able to comparison shop. SB 1235 would require commercial finance providers to disclose the cost of capital by providing the following helpful disclosures: The Total Amount of Funds Provided These three disclosures will help a California business owner understand and compare the cost of financing across different products. However, the Commercial Finance Coalition opposes requiring an APR disclosure. It’s important to note that SB 1235 aims at providing comparable disclosures across very different financing types. Commercial Finance Coalition members mostly engage in “accounts receivable purchase transactions.” These transactions are also known as merchant cash advance or factoring, and involve a business selling its receivables at a discount. For example, if a business’s sales go down, the business can pay less. If a business’s sales go up, the business can pay more. And if a business is burned down in a fire, the business can pay nothing until it can reopen its doors. SB 1235 would require disclosure of an Annual Percentage Rate (or APR). There are two problems with requiring an APR disclosure or even an “Estimated APR”: First – SB 1235 fails to address the complexity of calculating APR for different types of commercial finance transactions. This creates a significant litigation risk and minefield for finance providers making a good faith effort to disclose APR, and may stifle small business financing in California. Second – Requiring an Estimated APR disclosure creates an unfair disadvantage for offers of “accounts receivable purchase transactions” – or factoring. Again, these transactions are purchases, and do not need to be “paid back” unless the business has sufficient sales. Also, this disclosure could confuse a business owner who is looking for alternatives to lending. I’m very optimistic that California can lead the way in providing businesses with disclosures that are helpful – and not confusing. |

In response, Senator Glazer deferred to the experts who testified but he was not willing to make a key concession in the moment. At Glazer’s prodding, the bill made it out of committee with enough votes, and with the goal of continuing to fine tune the details particularly with respect to APR.

More information surrounding the bill and it’s progress will be made available soon.

Full video of the hearing below:

Crypto Hype Man Ian Balina Hacked

April 16, 2018Cryptocurrency and ICO hype man Ian Balina has been hacked, according to a statement he published on social media. Balina’s self-reported fortune totaled $3.2 million just days earlier.

“I’m not worried about the money,” Balina tweeted. “I learned my lesson. I only care about catching the hacker.”

Balina is famous in the crypto world for his investment analysis and opinion on ICOs, in part because he managed to turn the $36,000 he had in cryptocurrency in May 2017 to $5.3 million by early January 2018. That rise was catalogued through his daily Instagram posts. The recent bear market cut into his profits significantly but his activity on social media had not let up. As of yesterday, he was still a millionaire.

Now his worth is uncertain.

Balina was previously mentioned on deBanked for having interviewed George Popescu about his ICO for Lampix. The value of Lampix, which Balina said he did not invest in, is down 77% from its ICO price.

The March/April 2018 Edition Has Shipped

April 13, 2018

The March/April 2018 edition of deBanked Magazine has shipped! The print version is distributed before all of the content is republished online so if you want to be one of the first to read our exclusive stories, make sure you’re subscribed. It’s FREE.

This issue, which will also be distributed at Broker Fair on May 14th, offers tips for more successful marketing, an in-depth discussion about merchants that are behaving badly, and a story that examines the impact of last year’s major hurricanes on the industry. There’s more of course, which is why it’s great to be a free subscriber.

On another note, Broker Fair is now just a month away. I can’t wait to see you there!

LendItFintech In Photos and Sound Bites

April 10, 2018

when speaking about the increase in mortality rate for people who have faced major financial distress

when interviewed by Jo Ann Barefoot

When asked by Bloomberg Technology reporter Emily Chang if Goldman Sachs would be considered a competitor

when interviewed by Lendio’s Brock Blake

When asked who will win the race for marketshare

When asked if it’s harder to underwrite loans above $50,000

talks business at the company booth

Below: Ocrolus account executive John Lowenthal stands in front of the company booth