Sean Murray is the President and Chief Editor of deBanked and the founder of the Broker Fair Conference. Connect with me on LinkedIn or follow me on twitter. You can view all future deBanked events here.

Articles by Sean Murray

Ready Capital Was The Biggest PPP Lender By Volume in Round 1 of PPP Funding

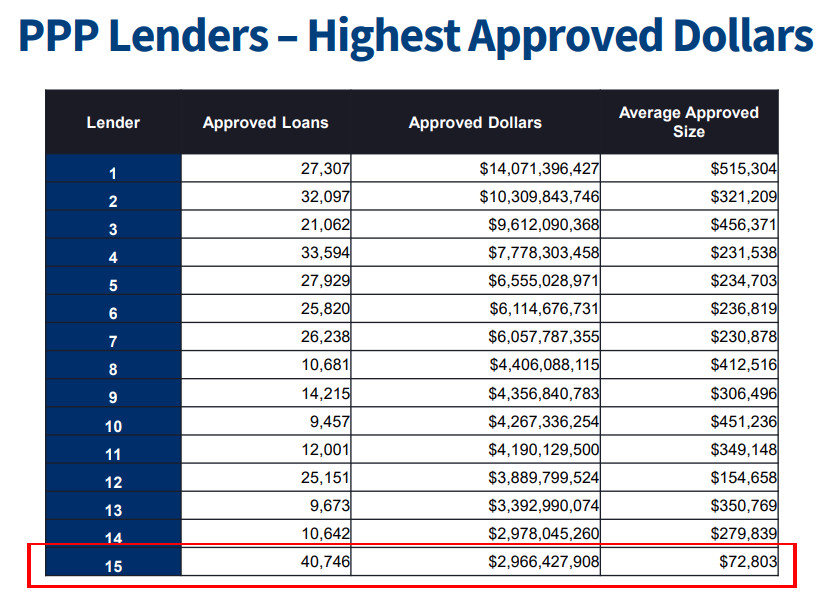

April 22, 2020 Ready Capital, a multi-strategy real estate finance company and one of the largest non-bank SBA lenders in the country, was the top PPP lender by loan volume in the country. Company CEO Thomas Capasse appeared on Fox Business yesterday and announced key statistics that aligned with data published by the SBA. By dollars, Ready Capital was the 15th largest PPP lender.

Ready Capital, a multi-strategy real estate finance company and one of the largest non-bank SBA lenders in the country, was the top PPP lender by loan volume in the country. Company CEO Thomas Capasse appeared on Fox Business yesterday and announced key statistics that aligned with data published by the SBA. By dollars, Ready Capital was the 15th largest PPP lender.

“As a leading non-bank, SBA lender, there’s 14 of us, we’re number two in terms of originations last year,” Capasse said on Fox Business, “we focused broadly, we don’t have deposit relationships, so we open our doors broadly to in particular the smaller mom and pop, the local deli, the pizzeria, the nail salon, so just in terms of the numbers, round one of the PPP, we approved 40,000 loans which is number one in the US, it was about $3 billion in total approvals. And our average balance was only $73,000 versus $230,000 for the average in round one.”

Among Ready Capital’s channels for acquiring PPP loan applications is Lendio, who reported consistent figures (a rough average of $80,000 per PPP loan facilitated), and high volume. Lendio has said on social media that they have been working with several partners, Ready Capital among them.

Ready Capital’s Capasse reasoned that their speed could probably be attributed to an affiliated fintech lender. “We are maybe more efficient than some of the banks because we have an affiliated fintech lender which is able to create online portals and processes to work in a more efficient manner and that enabled us to not only process these loans more efficiently but also to provide broad access to the program, to the smaller business owners.”

The company acquired Knight Capital, a small business finance provider, late last year.

Small Business Group Advocates For Community Anchor Loan Program (CAP) In Wake Of PPP Wind Down and Possible Refresh

April 17, 2020 At last tally, more than 800,000 small business PPP applications have gone unfunded since the program reached its limit, many of which are genuine mom-and-pop shops that employ less than 25 people.

At last tally, more than 800,000 small business PPP applications have gone unfunded since the program reached its limit, many of which are genuine mom-and-pop shops that employ less than 25 people.

Congress is considering another round of additional PPP funding but Americans may be worrying that such funds will once again go into the hands of some of America’s largest chains. (44.5% of the $349B PPP funds went toward loans over $1 million)

Outspoken successful businessman Mark Cuban has proposed a solution, a lottery system next time around to improve the chances that smaller businesses get their share of the pie. While the public debates the merits of such an approach, one organization (the SBFA) is calling for something much more direct, a targeted fix via a Community Anchor Loan Program (CAP) that would appropriate $10 billion for businesses that were PPP-eligible for loans under $75,000 but did not receive funds.

Deployment of this capital under CAP can and should be administered by non-bank alternative lenders with proven success with this particular small business market, they say.

The proposal also calls for 25% of the funds to specifically be allocated for minority, women, and veteran-owned and agricultural businesses.

In a letter the SBFA submitted to Congress earlier this week, the organization said:

“Women and minority-owned businesses are historically smaller and employ fewer people and, in some communities, are under-banked without the established relationships required to secure a PPP loan. Small farms and agricultural businesses are important to communities and often have trouble qualifying for traditional financing.”

The Small Business Finance Association is a non-profit advocacy organization whose mission “is to take a leadership role in ensuring that small businesses have access to the capital they need to grow and thrive.”

That’s All Folks? – The PPP Money Is Already Gone

April 15, 2020

Update 4/16/20: The SBA has put up an official statement on its website that says “The SBA is currently unable to accept new applications for the Paycheck Protection Program based on available appropriations funding. Similarly, we are unable to enroll new PPP lenders at this time.”

A number of fintech companies have just joined the Paycheck Protection Program, but they’re a tad late to the PPParty. On Twitter, Senator Marco Rubio, one of the co-sponsors of the CARES ACT that developed this program, confirmed the rumors that the well had run dry. “Sadly it appears #PPP will grind to a halt tonight as the limit on $ allocated to guarantee #PPPloans about to be hit.”

Sadly it appears #PPP will grind to a halt tonight as the limit on $ allocated to guarantee #PPPloans about to be hit.

Now 700000 small business applications are in limbo & no new loans will be made until the game of chicken in Congress ends & additional $ approved.

Inexcusable

— Marco Rubio (@marcorubio) April 15, 2020

Here’s the math

Congress approved $349 billion to guarantee #PPP

At 2pm today had over $300 billion in approved #PPPloans

Need $10 billion to cover fees & processing

When we reach $339 billion limit PPP will stop until they end with the ridiculous games & approve more funds

— Marco Rubio (@marcorubio) April 15, 2020

The SBA has often made reference to total funds “approved” when calculating its numbers rather than loaned out, so if you’re a business that has already been approved, then presumably funds have already been allocated for your business and you will still receive them. But if your application is pending, well it’s possible that funding may require additional congressional authorization. That however, as noted by Rubio’s remarks, will require some political compromise.

Update: 4/16 8 AM: Senator Rubio said on Fox Business that the PPP program was now frozen after having reached its limit and has stopped.

We’ll update this as more information becomes available.

Should I Apply to Become a PPP Lender?

April 10, 2020 One question being posed in the small business finance community is whether or not you should apply to become a PPP lender. Unless you are a very large well-capitalized company with a deep legal and compliance bench, you probably shouldn’t.

One question being posed in the small business finance community is whether or not you should apply to become a PPP lender. Unless you are a very large well-capitalized company with a deep legal and compliance bench, you probably shouldn’t.

Here’s why:

- You must supply the capital. While a federal mechanism is being put in place to offload the PPP loans you fund, you need the balance sheet to fund the loans in the first place. Also, consider that community banks have historically expressed frustration with the guaranty process and that’s when times and loan volumes were operating at normal levels. You must be prepared for hiccups to take place that delay or even possibly prevent offloading of some or all of these loans.

- You only earn a 5% processing fee on loans under $350,000. For larger loans, it’s a smaller percentage. You can’t even charge the applicant any fees at all so your compensation is entirely dependent on the SBA to pay you. Consider that your underwriting costs may offset some or all of that fee, leaving very little room for profit.

- You must have 2019 audited financial statements available for inspection by the SBA.

And you must have either of the following:

1.

- You must already have been applying Bank Secrecy Act-level compliance prior to this crisis.

- You must have been originating at least $50 million in business loans or other commercial financial receivables per year for each of the last 3 years consistently.

OR

2.

- You must already be a service provider to a bank.

- You must already have a contract to support the bank’s lending activities.

It’s a tough bar to meet for a small and mid-sized small business financing provider, but the program isn’t really set up to become a major profit center for lending companies, it’s supposed to be a support center for SMBs to keep workers employed. Initially, many banks were hesitant to get involved because PPP participation was going to generate LOSSES for them. It still might.

So what’s the incentive to be a non-bank PPP lender? It’s a moral pursuit on the front-end rather than a financially-driven one. On the back-end, it’s a tool for lead generation, public relations, and elevating goodwill value. If such lenders are able to execute successfully, it could further develop trust for fintech with legislators, regulators, and the general public. On the other hand, however, if they perform poorly, it could reflect negatively on fintech as a whole.

So if you find yourself on the PPP lending bench, you’re not missing out financially. You can still become an agent/broker should an approved SBA lender accept you. Such a role presents limited upside financial potential, so if it’s riches you seek, the PPP doesn’t provide them.

Lastly, becoming a PPP lender certainly won’t save a dying lending company. Making loans at 1% interest to distressed and closed businesses isn’t going to somehow save a company with an already damaged loan portfolio. It’s just going to put it out of business faster.

Should you apply to become a PPP lender? That’s up to you. Good luck!

Sorry, You’re Not Eligible For PPP Money

April 8, 2020 The rush to submit your PPP application may be for naught if you own an ineligible business. The SBA prohibits loan guarantees to “businesses primarily engaged in lending, investments, or to an otherwise eligible business engaged in financing or factoring.” If there’s any confusion as to what that includes, the SBA lists 7 specific ineligible business types under this definition in the statutory code. They include:

The rush to submit your PPP application may be for naught if you own an ineligible business. The SBA prohibits loan guarantees to “businesses primarily engaged in lending, investments, or to an otherwise eligible business engaged in financing or factoring.” If there’s any confusion as to what that includes, the SBA lists 7 specific ineligible business types under this definition in the statutory code. They include:

- Banks

- Life Insurance Companies (but not independent agents);

- Finance Companies

- Factoring Companies

- Investment Companies

- Bail Bond Companies

- Other businesses whose stock in trade is money

The PPP’s interim final rule refers to this statute as a rule for ineligibility as it applies to the PPP.

The statute does list a handful of businesses engaged in lending that may traditionally qualify for an exception. They are as follows:

- A pawn shop that provides financing is eligible if more than 50% of its revenue for the previous year was from the sale of merchandise rather than from interest on loans.

- A business that provides financing in the regular course of its business (such as a business that finances credit sales) is eligible, provided less than 50% of its revenue is from financing its sales.

- A mortgage servicing company that disburses loans and sells them within 14 calendar days of loan closing is eligible. Mortgage companies primarily engaged in the business of servicing loans are eligible. Mortgage companies that make loans and hold them in their portfolio are not eligible.

- A check cashing business is eligible if it receives more than 50% of its revenue from the service of cashing checks.

- A business engaged in providing the services of a financial advisor on a fee basis is eligible provided they do not use loan proceeds to invest in their own

deBanked is not a law firm. Consult a CPA or an attorney to provide better guidance on your company’s eligibility.

Sen. Rubio: PPP Application For Fintech Lenders Expected This Week

April 6, 2020Update: 4/8/20 The PPP Application for Fintech Lenders is Here

Senator Marco Rubio tweeted on Saturday that he expects the US Treasury Department to release a separate PPP application for non-bank lenders early this week. The Treasury and SBA have previously issued guidance on the minimum criteria a fintech lender would have to meet to be eligible, leading to confusion when the official application released a day later omitted any mention of fintech lending.

Senator Marco Rubio tweeted on Saturday that he expects the US Treasury Department to release a separate PPP application for non-bank lenders early this week. The Treasury and SBA have previously issued guidance on the minimum criteria a fintech lender would have to meet to be eligible, leading to confusion when the official application released a day later omitted any mention of fintech lending.

The rollout has not been perfect. One challenge facing fintech lenders is the supply of capital as the loans must be issued from their own balance sheet and held on their books for at least 7 weeks until they can be purchased by the federal government. Rubio said that we will need a defined purchase mechanism for such a transfer to take place to assist not only fintech lenders but also community banks.

The good news is multiple FinTechs including @PayPal & other online lenders are ready,able & willing to process #PPPloans for them & anyone else.But they need @USTreasury to release application for nonbank lenders to become certified.

I expect that very early next week. 5/13

— Marco Rubio (@marcorubio) April 4, 2020

StreetShares Posts Another Loss

April 2, 2020Sales and Marketing Expenses declined dramatically for StreetShares for the six-month period ending December 31, 2019, according to the company’s latest SEC filing, but the company’s payroll expense still wildly exceeded revenue, putting them yet again into deep net loss territory.

StreetShares recorded total operating revenues of $2.43M, payroll expenses of $3.49M, and a net loss of $5.18M for the period.

The company’s accumulating losses over time has translated into a stockholder deficit of $35.2M. This reporting period is pre-COVID-19 but the company disclosed that future financial results may be adversely affected by the virus.

The company also borrowed $3M in the form of a convertible promissory note issued to an investor.

Only 16.81% of loans on the StreetShares platform were funded by institutional investors for the period. Retail investors, the largest segment by far, funded 70.63%.

How to Become a PPP Approved Lender With the SBA

March 31, 2020Update 4/8/20: The PPP Lender Application for Non-banks/fintech Companies is HERE

Update 4/3/20: The PPP Lender Application for Banks is HERE

The Treasury Department has set an April 3rd expected start time for lenders to begin accepting Payroll Protection Program loan applications. But who exactly can make the loans? Are fintech lenders in or out?

According to the Treasury, the following are already approved:

- All existing SBA-certified lenders

- All federally insured depository institutions, federally insured credit unions, and Farm Credit System institutions

BUT! A broad set of additional lenders can begin making loans as soon as they are approved and enrolled in the program. This “broad set,” that presumably includes fintech lenders, can apply by emailing an application to DelegatedAuthority@sba.gov.

While the loans are 100% backed by the full faith and credit of the United States. Lenders will be compensated in accordance with the following structure, a percentage of the financing outstanding balance at the time of final disbursement:

- Loans $350,000 and under: 5.00%

- Loans greater than $350,000 to $2 million: 3.00%

- Loans greater than $2 million: 1.00%

Lenders may not collect any fees from the applicant.

Who can be an agent/broker?

- An attorney;

- An accountant;

- A consultant;

- Someone who prepares an applicant’s application for financial assistance and is employed and compensated by the applicant;

- Someone who assists a lender with originating, disbursing, servicing, liquidating, or litigating SBA loans;

- A loan broker; or

- Any other individual or entity representing an applicant by conducting business with the SBA

Agent fees will be paid out of lender fees. The lender will pay the agent. Agents may not collect any fees from the applicant. The fee structure is below:

- Loans $350,000 and under: 1.00%

- Loans greater than $350,000 to $2 million: 0.50%

- Loans greater than $2 million: 0.25%

For more info, check here: https://home.treasury.gov/policy-issues/top-priorities/cares-act/assistance-for-small-businesses