Kevin Travers was a Reporter at deBanked.

Articles by Kevin Travers

Escape From Manhattan? Not So Fast Miami

March 16, 2021 As the pandemic raged, word on the street was that fintechs were mulling a Manhattan exodus. Expensive midtown offices didn’t look great compared to Miami beaches.

As the pandemic raged, word on the street was that fintechs were mulling a Manhattan exodus. Expensive midtown offices didn’t look great compared to Miami beaches.

But according to research by Bloomberg, there were no crowds of fleeing New Yorkers like it may have seemed. Only 2,246 people filed a permanent address change from Manhattan to Miami-Dade County, and 1,741 went to Palm Beach County.

3,987 NYC-area residents packed up shop and flew south for the Covid winter, never to return- But that’s only ~5.6% of the total 70,000 people that moved from NY state last year, according to Unicast, a real estate location analytics firm.

“The main problem with moving to Florida is that you have to live in Florida,” Jason Mudrick, a hedge fund manager, told Bloomberg.

In 2019, the US Census Bureau estimated a net 38,512 Greater New York State residents moved to the Sunshine State, suggesting that what was experienced in 2020 may have been nothing more than the routine annual migration. 2020’s Census data is not yet available so it’s difficult to say.

“We’re going to keep going with New York City if that’s all right with you,” Jerry Seinfeld wrote in an August 2020 NY Times Op-ed, “and it will sure as hell be back.”

MSU Spartans Presented by Rocket Mortgage

March 15, 2021 March Madness began with Mortgage madness, in line with 2021. College Basketball fans came to a boil last week when the Michigan Spartans briefly rebranded to a longer name, MSU Spartans Presented by Rocket Mortgage.

March Madness began with Mortgage madness, in line with 2021. College Basketball fans came to a boil last week when the Michigan Spartans briefly rebranded to a longer name, MSU Spartans Presented by Rocket Mortgage.

Fans immediately took to Twitter to complain, as competitors imagined if their beloved teams were also suddenly named after fintech companies. Shortly after, Michigan released a statement claiming they would not be changing their name:

STATEMENT FROM MSU ATHLETICS (MARCH 12):

Michigan State is not renaming its men’s basketball team. While this is a new extension of the partnership for Rocket Mortgage with Men’s Basketball, this is not a first-of-its-kind sponsorship for the Spartans or a new concept in professional or collegiate team partnerships.

Though as some users and news media pointed out, the suffix will still be attached to the team name everywhere at its home games: the rollback is semantics, Rocket Mortgage will still be included in the name, and the logo will appear across the stadium.

“Michigan State University is very important to our company. It is the alma mater of our Founder and Chairman Dan Gilbert, me, and many team members throughout our organization,” Rocket CEO Jay Farner said. “We are honored to contribute to the university that has prepared so many of us for success.”

Strapped for cash, the Detroit Free Press reported the Michigan athletic department is projected to lose $75 million due to the COVID-19 pandemic.

Yahoo Sports writer Jack Baer said that when sports teams take on a corporate name, like the New York Red Bulls, “the business in question actually owns the team rather than giving them millions of dollars to slap their name onto a scoreboard and promotions. In that respect, the MSU Spartans Presented by Rocket Mortgage would be something akin to a little league team getting some help from a local business.”

Rocket Co-founder, Dan Gilbert, has previously donated at least $15 Million to Michigan’s athletics program, overhauling the Breslin Center stadium. Now his Rocket Companies logo will appear everywhere throughout the building.

Some fans still poked fun after the school walked back its original announcement.

Bummer. I was looking forward to taking my family to United Wholesale Mortgage Breslin Center to see the MSU Spartans presented by Rocket Mortgage play on the Auto Owners Insurance Tom Izzo court for a game day experience presented by Farm Bureau Insurance.

— Ryan Peterson (@RyanPD_Peterson) March 12, 2021

Can’t Wait to Become a Bank? Buy One

March 15, 2021 Major fintech companies can’t wait to become chartered banks, and some don’t have the patience to wait for the paperwork to go through.

Major fintech companies can’t wait to become chartered banks, and some don’t have the patience to wait for the paperwork to go through.

Last week, SoFi bought California-based Golden Pacific Bank (GPB) for $22.3 million to speed up its mission to become a nationally chartered bank. SoFi paid for the cash purchase and will apply to take ownership of the bank’s OCC charter- swapping out their pending application to become a bank outright.

“By pursuing a national bank charter, we will be able to help even more people get their money right,” CEO Anthony Noto said. “We are thrilled to have found a partner in Golden Pacific Bank to both accelerate our pursuit to establish a national bank subsidiary, as well as begin to expand our offerings in SoFi’s financial products.”

SoFi, once an anti-bank fintech was preliminarily approved by the OCC for a charter earlier this year.

A year ago Varo started the buy/apply banking trend after receiving approval for an FDIC Bank Charter. LendingClub, a former Peer-to-Peer lender, soon after joined the club by picking up Radius Bank. Square just two weeks ago became a bank, announcing it received an industrial banking license.

Other lesser-known fintechs have been moving toward chartered banking as well. In February, Brex, an online banking fintech, began the process of opening a Utah Based industrial bank as well. Jiko, a small online banking and payments firm, bought Mid-Central National Bank in Minnesota.

There are other up-and-coming fintech banks, like Chime and even blockchain banking contenders, like Figure Technologies. Figure is a home equity lender that is currently applying for a banking charter without the normal FDIC-insured deposits but instead deposits over $250,000 that would act as uninsured high yield loans.

If Sofi’s plan works, the firm aims to contribute $750 million toward digital lending while maintaining GPB’s community banks’ business and branches. The deal should be completed before the end of 2021, and GPB will operate as a division of SoFi Bank.

Fintech Law Goes into Effect in Mexico

March 9, 2021 It will be a big year for fintech in Mexico, with at least 93 fintech firms in the process of obtaining a Financial Technology Institution (FTI) license.

It will be a big year for fintech in Mexico, with at least 93 fintech firms in the process of obtaining a Financial Technology Institution (FTI) license.

Lawyer Rene Arce Lozano, an advisor with the international Hogan Lovells law firm, wrote about the new “fintech law”; the first of its kind in Latin America. Many firms will see an authorization in the coming year from the National Banking and Securities Commission.

“Over the last few years,” Lozano wrote, “the fintech ecosystem in Mexico has evolved to become one of the most developed in Latin America.”

Mexico, home to 441 startups- the largest fintech hub in central America- passed the law in 2018 that went into effect this past year 2020, nurturing the creation of dozens of Mexican neo banks and electronic payments firms.

The new law sets regulations for payments and open banking and has stirred up excitement for fintech enterprise in the country as a whole. But according to Financial specialist Stefan Staschen, the law isn’t the cure-all.

“The law covers only two types of fintech companies,” Stashen wrote. “It does not provide regulatory guidance for other services, such as fintechs offering balance sheet lending, big tech companies launching financial services, investment services other than crowdfunding, or central bank digital currencies.”

The new law may be a great start, but it is the first step to broader regulatory approval to the diverse financial tech world. Staschen works at the CGAP– an international advocacy group based in Washington that aims to extend financial inclusion throughout the world.

Mortgage Brokers: pick a side

March 5, 2021 United Wholesale Mortgage (UWM) and Rocket Mortgage are still going at it, this week heating up to a new boiling point.

United Wholesale Mortgage (UWM) and Rocket Mortgage are still going at it, this week heating up to a new boiling point.

UWM announced on Facebook Live Thursday that it would not partner with brokers who work with Rocket Mortgage or Fairway Independent Mortgage Corp. CEO Mat Ishbia gave brokers until March 15th to sign a loyalty document to pledge their allegiance to the UWM team.

“If you work with them, can’t work with UWM anymore, effective immediately,” Ishbia said. “I can’t stop you, but I’m not going to help you, help the people that are hurting the broker channel, and that’s what’s going on right now.”

After competing Superbowl ads, it looked like the competitors were peacefully building broker networks, but now brokers have to pick a side. Rocket Pro TPO VP Austin Niemiec told the Housing Wire that UWM is attempting to manipulate the broker market.

“What UWM is attempting to do is really manipulate the market and have brokers swear allegiance to one company and literally give them financial penalties if they don’t listen to them,” Niemic said. “That harms their ability to compete, and it harms the consumer. Make no mistake about it, this was a move to benefit one company and one company alone, UWM.”

The feud comes after the stock price of Rocket Companies, Rocket Mortgage’s parent company, spiked in price. Founder Dan Gilbert briefly placed number 16 in Bloomberg’s Billionaire Index.

Square: Banking, Bitcoin, Now Streaming Beats?

March 4, 2021 Square bought a majority stake in Tidal, a music streaming service owned by Jay-Z, for $247 million.

Square bought a majority stake in Tidal, a music streaming service owned by Jay-Z, for $247 million.

Jay-Z will be joining the Square board and Tidal artists will keep their ownership in the firm. Jack Dorsey announced the move on Twitter, seeming to assuage worries from the first post.

“Why would a music streaming company and a financial services company join forces,” Dorsey wrote. “We believe there’s a compelling one between music and the economy. Making the economy work for artists is similar to what Square has done for sellers.”

Square is acquiring a majority ownership stake in TIDAL through a new joint venture, with the original artists becoming the second largest group of shareholders, and JAY-Z joining the Square board. Why would a music streaming company and a financial services company join forces?!

— jack (@jack) March 4, 2021

Dorsey and Jay have been friends for years and were spotted hanging out with Beyonce on a yacht in the Hamptons this summer. Dorsey and Jay-Z last month went in on a multimillion Bitcoin trust fund to support Bitcoin development in India and Africa.

Beyoncé, JAY-Z, Rumi, Blue Ivy w/ Twitter CEO Jack Dorsey in the Hamptons — Aug. 24th. pic.twitter.com/bNEz0Nch2y

— BEYONCÉ LEGION (@Bey_Legion) August 25, 2020

Jay-Z bought Tidal in 2015 for $56 million, but despite working with top music artists like Coldplay and Kanye West, the service has struggled to compete with Apple and Spotify. After a year of closed venues, Billboard reported that last year Tidal had a cash problem and was missing payments to rights holders. Tidal got a cash injection from the sale, while Square spent less than 1% of the firm’s value to bring Jay-Z’s leadership and network of music industry heavy-hitters into the fold.

Jay-Z bought Tidal in 2015 for $56 million, but despite working with top music artists like Coldplay and Kanye West, the service has struggled to compete with Apple and Spotify. After a year of closed venues, Billboard reported that last year Tidal had a cash problem and was missing payments to rights holders. Tidal got a cash injection from the sale, while Square spent less than 1% of the firm’s value to bring Jay-Z’s leadership and network of music industry heavy-hitters into the fold.

“I said from the beginning that Tidal was about more than just streaming music, and six years later, it has remained a platform that supports artists at every point in their careers,” said Jay-Z in a press statement. “Artists deserve better tools to assist them in their creative journey. Jack and I have had many discussions about Tidal’s endless possibilities that have made me even more inspired about its future. This shared vision makes me even more excited to join the Square board. This partnership will be a game-changer for many. I look forward to all this new chapter has to offer!”

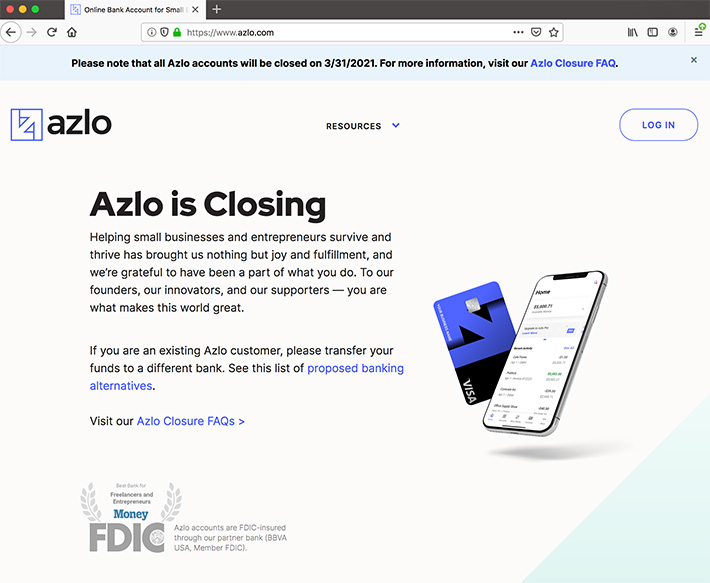

Online NeoBank Azlo Closing at End of Month

March 3, 2021 Azlo, an online business banking platform, announced it will be closing all accounts by March 31, 2021. The decision came down from the majority stakeholder BBVA, support staff dedicated to helping customers transfer out of the platform said.

Azlo, an online business banking platform, announced it will be closing all accounts by March 31, 2021. The decision came down from the majority stakeholder BBVA, support staff dedicated to helping customers transfer out of the platform said.

“Unfortunately, it is true that our parent bank, BBVA USA, has made the decision to close Azlo and all Azlo accounts will be closed by March 31, 2021,” Alex from Azlo support said. “Please know that we regret this; helping small businesses and entrepreneurs survive and thrive has brought us nothing but joy and fulfillment, and we wish we could continue.”

Azlo has a “Business banking alternatives” blog post, featuring options like Quickbooks Cash.

Azlo provided services under BBVA USA, which was acquired in November by PNC Financial Services.

CFPB, SEC Chair Appointments Begin Senate Hearing

March 2, 2021CFPB Chair Nominee Rohit Chopra (“Chopra like Oprah” he explained) and SEC Chair nominee Gary Gensler faced questions from Senators in the first confirmation hearings on Tuesday.

The pair were fielded questions over a video call. The confirmation hearings are mostly ceremonial; with a partisan house and senate, it is unlikely either appointment will be blocked.

Senators used their time to make question-statements featuring popular political talking points. Topics ranged from student loan finance reform, Bitcoin and crypto regulation, environmental reform through business regulation, and retail stock trading protections.

The appointees answered in the uniform tone of life-long public servicemen that have mastered the art of not directly answering questions. Each demonstrates their respective regulator points of view through action. By Reading each appointee’s resume, it becomes clear why they were chosen for Biden’s regulatory offices.

Chopra became a secretary at the CFPB when the organization was minted in 2008, and he focused on regulating student loans. The CFPB under Chopra will likely focus on extending CFPB regulatory controls over lending, payday lending, student debt, and possibly even fintech lending.

Gensler was the Commodity Futures Trading Commission’s chair, and he helped scale up securities regulation following the housing crisis, his work creating the Dodd-Frank act. The SEC will likely ramp up regulatory action over crypto-currency and address concerns with retail investing and public security sales.

“Technologies change, and markets change, but we should always evaluate new approaches to markets,” Gensler said in response to questions about stock trading and gamification.

Steve Daines, a Republican from Montana, asked Chopra his opinion whether the CFPB should be led by a multiple-member commission to avoid politicization over the leadership. Chopra said it wasn’t up to him.

“It’s the job of Congress to decide the agency structure. In my view, regardless if it’s a single director, there needs to be accountability, responsiveness,” Chopra said. “Where I sit at the FTC, this agency has missed some of the worst engagements when it comes to big tech privacy, while the CFTC under Gary did take action and was transparent.”

When the Trump administration attempted to appoint a new CFPB director, the Obama chair claimed it was illegal for the president to seat a new chair. In June last year, the Supreme Court said that was unconstitutional, and like most other executive offices, the president has the power to appoint leaders.

Chopra did say that regulating student loan debt was something under the purview of the CFPB. He was asked if CFPB had the authority to address the $1.7 trillion in student loan debt.

“Yes, my understanding is that the existing law and regulations, those financial services are covered.” He said.

Senator John Kennedy, a Louisianan democrat who tuned republican after 2007, asked Gary Gensler about the great recession and his time creating regulation at the US Treasury in the aftermath.

“Why didn’t anybody go to jail?” Kennedy said.

“Well, I wonder the answer to that question too; I was pursuing civil cases. It is largely up to the Department of Justice,” Gensler tried to answer. “These cases are hard to try and hard to find intent.”

Bill Hagarty, a Republican from Tennessee, asked Gensler about using business regulatory offices for social reforms, using the local proverb “You don’t shoot where the rabbit was.”