Articles by deBanked Staff

Shopify Capital: Repeat Originations Performance Quarter over Quarter

November 4, 2025 Shopify Capital originated ~$1B in business loans and merchant cash advances in Q3, the same as the previous quarter. The total for the first nine months of 2025 now sits at ~$2.8B, which means they will surpass 2024’s total of $3B. deBanked has been tracking originations of more than a dozen of the largest online small business lenders since 2014.

Shopify Capital originated ~$1B in business loans and merchant cash advances in Q3, the same as the previous quarter. The total for the first nine months of 2025 now sits at ~$2.8B, which means they will surpass 2024’s total of $3B. deBanked has been tracking originations of more than a dozen of the largest online small business lenders since 2014.

Shopify Capital is not limited to the US and in Q3 it added Ireland and Spain to the list of countries it funds in.

Technically speaking, “Certain loans and merchant cash advances are facilitated by the Company and originated by a bank partner, from whom the Company then purchases the loans and merchant cash advances obtaining all rights, title and interest or discount,” the company explains in its SEC documents.

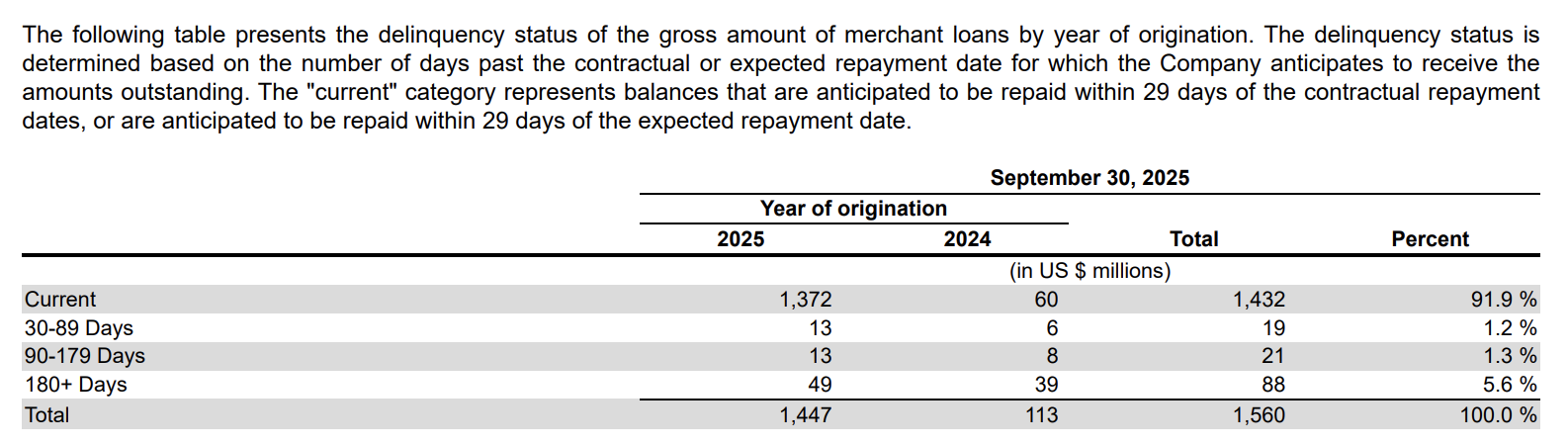

A snapshot of payment status from their Q3 report:

PayPal: Business Loan and Working Capital Originations of $600M in Q3

November 3, 2025PayPal originated approximately $600M in business loans and working capital loans in the third quarter. A financial institution makes the loans to their clients and PayPal purchases the receivables and services the portfolio. Under this basis the company has purchased $1.6B worth of receivables for the first nine months of 2025.

“The allowance for credit losses at September 30, 2025 for our merchant receivable portfolio was $163 million, an increase from $113 million at December 31, 2024,” PayPal stated in its earnings report. “The increase in allowance for credit losses was related to a decline in credit quality of merchant loans outstanding primarily from modifications in acceptable risk parameters in 2024, which included broadened eligibility. In the second quarter of 2025, we updated our expected credit loss model for all portfolios to utilize multiple economic scenarios rather than the single scenario previously utilized. These changes did not have a material impact on our allowance for credit losses in the period.”

deBanked CONNECT MIAMI – Feb 12, 2026

October 31, 2025deBanked CONNECT MIAMI returns to the Fontainebleau on February 12, 2026. After last year’s massive turnout, it is anticipated to be deBanked’s largest event of 2026.

To sponsor, contact: events@debanked.com

For early bird tickets with a huge discount, register now at: https://www.debankedmiami.com

Enova: $1.4B in Small Business Loans in Q3 2025

October 30, 2025Enova continued to set a new internal quarterly record for small business loan originations with $1.4 billion in Q3.

“Since our acquisition of OnDeck five years ago, we’ve not only maintained our strong profit margins, we’ve done so while cutting our consolidated net charge-off rate in half,” said Enova CFO Steven Cunningham during the recent earnings call. Cunningham is scheduled to replace David Fisher in the CEO role this coming January.

Meanwhile, all the major indicators they review continue to show that small businesses are doing well.

“Insights from internal and external sources reflect solid underlying trends for small businesses,” said Fisher. “In conjunction with Ocrolus, we released the eighth iteration of our small business cash flow trend report earlier this week. This offers key insights into the state of small businesses and highlights ongoing trends observed over the past year. Small business confidence is high, as tariffs remain manageable and the economy, and in particular consumer spending, remained strong.”

OppFi: ‘Bitty is a Great Partner’

October 29, 2025Bitty generated $1.4 million in equity income for OppFi in Q3. OppFi, publicly traded, owns a 35% stake in Bitty.

“Bitty is a great partner that we have enjoyed working with and learning from in the SMB space,” said OppFi CEO Todd Schwartz during the company’s Q3 earnings call. “The company shares OppFi’s business principles and corporate values and consistently uses technology to enhance operations and the customer experience. Bitty has identified significant additional growth opportunities and continues to capitalize on the ongoing supply-demand imbalance in the small business revenue-based finance space.”

Overall, OppFi said it had delivered another strong quarter that had outperformed expectations. It raised earnings guidance for the third time this year.

See You in Las Vegas for B2B Finance Expo

October 24, 2025The team is now heading to Las Vegas for B2B Finance Expo. Hopefully you have your ticket already to the two-day conference taking place on Oct 28-29 at the Wynn in collaboration with the SBFA.

Here’s what you need to know:

For Merchants: It’s Not Just Cards vs. Cash Anymore

October 22, 2025 38% of small businesses accept Zelle as a form of payment, according to the latest Small Business Cash Flow Trend Report produced by OnDeck and Ocrolus. 29.2% accept Venmo and 28.6% accept PayPal. Apple Pay / Google Pay and CashApp were right behind them at 22.6% and 16.4% respectively.

38% of small businesses accept Zelle as a form of payment, according to the latest Small Business Cash Flow Trend Report produced by OnDeck and Ocrolus. 29.2% accept Venmo and 28.6% accept PayPal. Apple Pay / Google Pay and CashApp were right behind them at 22.6% and 16.4% respectively.

These figures emphasize the diversity of payment streams that Main Street has now become accustomed to. Long ago it was simply cash vs. card. 40.1%, however, said that they still don’t accept any alternative payment methods at all.

The survey did not ask if businesses accept Bitcoin or crypto but it could in the future. Block, for example, which owns CashApp, recently began rolling out Bitcoin acceptance tech to all of its Square merchants.

While small businesses have historically been cost conscious about which payment method they prefer to accept payments, 31.6% of those surveyed said they passed their credit card processing fees on to their customers.

See Who’s Speaking at B2B Finance Expo

October 10, 2025See who’s speaking at B2B Finance Expo: Speaker page | Agenda Page

Register Here