Articles by deBanked Staff

CFPB’s Funding Cut Almost in Half

July 3, 2025The current Administration’s “Big Beautiful Bill” that passed Thursday includes a paragraph that modifies the CFPB’s annual funding budget. In 2010, The Consumer Financial Protection Act, which created the CFPB, stipulated that that no more than twelve percent of the annual total operating expenses of the Federal Reserve System shall be transferred to the agency. The new law has amended that down to 6.5%.

For perspective, the CFPB received $729.4M from the Fed in FY 2024 but could have drawn up to $785.4M. Had the new cap already been in place, the agency would’ve only been entitled to take up to $425M.

All eyes had been on the CFPB in the small business finance industry where massive regulations relating to how such companies collect data were supposed to have gone into effect this month. The agency ultimately suspended compliance with the rules by one year and said it intends to rewrite those rules in the interim. The agency is required by the fifteen year-old statute to implement some form of data collection on small business lending.

deBanked Celebrates 15 Year Anniversary

July 1, 2025deBanked celebrates its 15th anniversary this month. Launched in 2010 as a blog under the name Merchant Processing Resource, its original focus was on payments and merchant cash advances.The site went through several iterations and began transitioning to the name deBanked in the Fall of 2014.

A look at the MCA content portal in 2010:

If you’re interested in some of the pre-2020 headline history, you can review this old 2019 post we made here.

Thanks for reading and cheers to another 15 years??????

ACH, Wire, and Soon Stablecoin Transfers?

June 30, 2025“Many of the users out there today are not aware of stablecoins, or not interested in stablecoins, and they should not be,” said Jose Fernandez da Ponte, PayPal’s SVP of blockchain, crypto and digital currencies to CNBC. “It should just be a way in which you move value, and in many cases, is going to be an infrastructure layer.”

Stablecoins, blockchain-based units typically pegged to the US Dollar, are taking off. According to Visa, for example, $3.7 trillion worth of stablecoins were transacted in the last 30 days alone. Since there’s no speculation angle to be gained from holding them, the value of using stablecoins versus other methods of payments is primarily speed and cost. As an infrastructure layer, traditional lenders may want to keep an eye on developments there. For example, where ACHs may become too costly or impossible to utilize efficiently, USD-> Stablecoins-> USD could become a viable mechanism to sweep funds from a traditional bank account to a third party. Borrowers may not ever even need to know or be aware that blockchain rails are being used to transmit payments. Lenders too need not be burdened by crypto and instead merely leave the conversion of one to the other and back to a payment service.

This is not the domain of edgy upstart fintechs any longer either. According to American Banker, “The progress of the GENIUS Act has spurred banks to forge stablecoin strategies, with Citigroup, Bank of America and dozens of others considering launching their own stablecoin, joining a stablecoin consortium or both.” Additionally, stablecoin issuer Circle just applied for a national bank charter.

🚨34% of ETH transactions now involve stablecoins, driving network activity near all-time highs pic.twitter.com/iTWBCHZT6b

— matthew sigel, recovering CFA (@matthew_sigel) June 30, 2025

While much of the early blockchain utopian ideals speculated that commerce may be transacted with bitcoin, using the rails to transact in dollars may be a much more near-term and universally accepted method.

The Story of a Debt Relief Scammer

June 26, 2025Listen to this podcast that tells the story of how a scammer purporting to offer debt relief crushed small businesses and haunted an entire financial services industry in the process. Names are changed but it’s based on true events.

Debt Resolution Exec and Factoring SVP Discuss the MCA “Problem”

June 25, 2025Adam Duso of Second Wind Consultants and Curtis Powell of nFusion Capital joined a call with Michael Toglia of ABL Advisor to discuss the problem of dealing with merchant cash advances.

If you were curious to hear a perspective from their points of view, you can watch the interview here.

In related news, nFusion Capital’s COO/CFO Amity Mercado was announced as a new board member of the International Factoring Association (IFA) this week.

Texas Governor Signs Sales-Based Financing ACH Prohibition Into Law

June 21, 2025 Texas Governor Greg Abbott has signed HB 700 which prohibits a sales-based financing provider from automatically debiting any merchant in the state unless they are in a perfected 1st position. And not just a 1st position MCA, a 1st position above anything else at all. It doesn’t matter if the funder doing the debiting is located out of state, only that the merchant be located in Texas.

Texas Governor Greg Abbott has signed HB 700 which prohibits a sales-based financing provider from automatically debiting any merchant in the state unless they are in a perfected 1st position. And not just a 1st position MCA, a 1st position above anything else at all. It doesn’t matter if the funder doing the debiting is located out of state, only that the merchant be located in Texas.

The law broadly encompasses purchase transactions (MCAs) or loans where the payments ebb and flow with sales activity (revenue-based finance loans). Companies with a special bank relationship are exempt from the law. The exemption applies to: “a bank, out-of-state bank, bank holding company, credit union, federal credit union, out-of-state credit union, or any subsidiary or affiliate of those financial institutions.”

The specific language detailing the prohibition is:

CERTAIN AUTOMATIC DEBITS PROHIBITED.

A provider or commercial sales-based financing broker may not establish a mechanism for automatically debiting a recipient’s deposit account unless the provider or broker holds a validly perfected security interest in the recipient’s account under Chapter 9, Business & Commerce Code, with a first priority against the claims of all other persons.

The full law goes even further than the ACH ban, the extent of which can be viewed here. The law goes into effect on September 1, 2025.

P2P Lending / Former ‘LendAcademy Forum’ Has Moved Again

June 19, 2025deBanked has migrated the old LendAcademy p2p lending forum it acquired in 2021 to DailyFunder. Due to software compatibility issues, it was frequently offline on deBanked’s servers. It has now been moved to DailyFunder whose software was able to integrate the content somewhat successfully.

The LendAcademy forum, launched in 2011, was the most popular p2p lending forum in the US. An unfortunate incident, however, caused the data to be permanently lost in 2021. When that happened, deBanked used proprietary forensic techniques to restore as much of it as possible in a takeover deal it inked with the former operators.

DailyFunder, launched in 2012, is the oldest and most popular small business finance forum in the US. Any issues relating to it going further should be referred to DailyFunder at webmaster@dailyfunder.com.

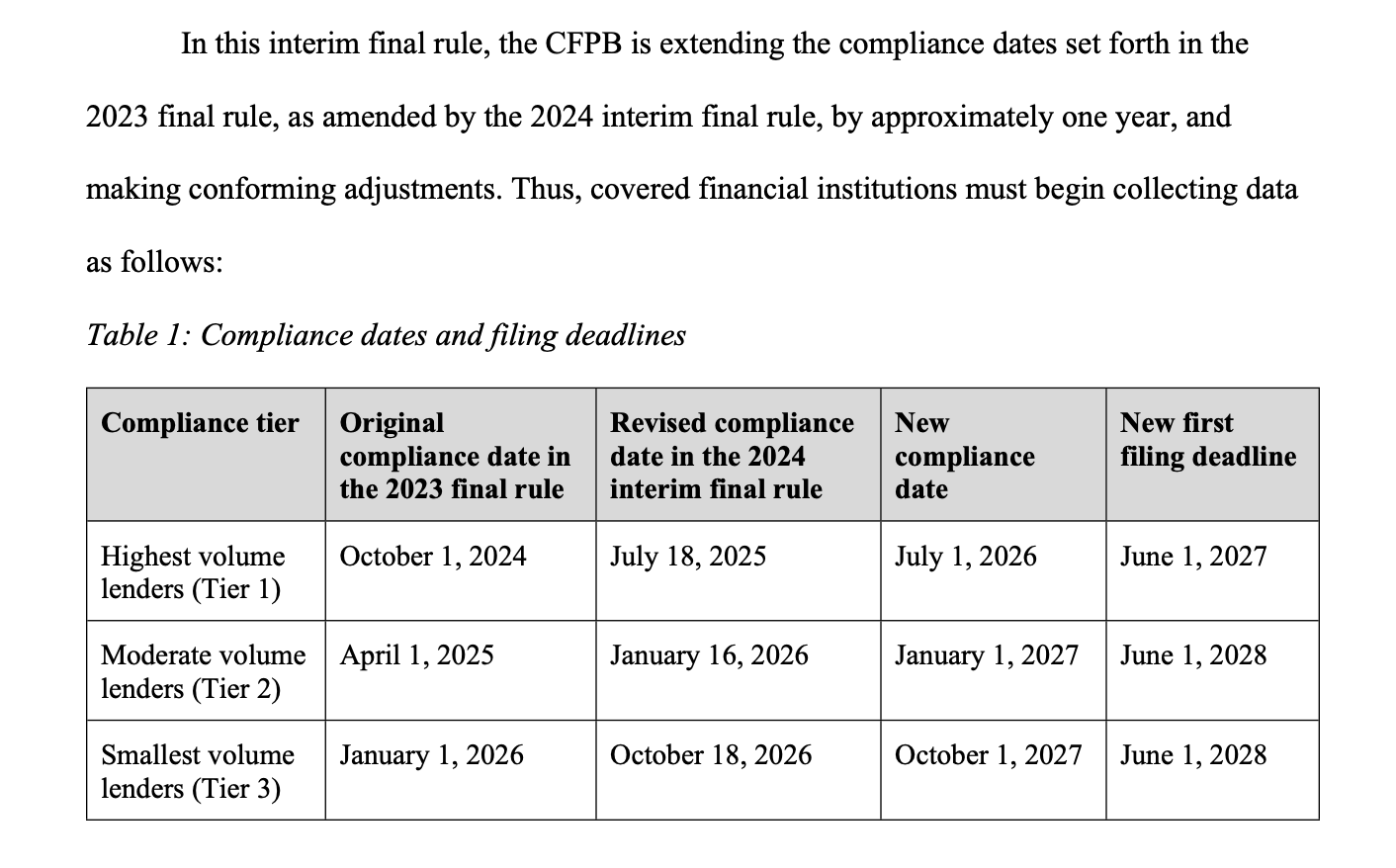

CFPB Small Business Lending Rule Compliance Delayed a Year

June 17, 2025 The CFPB has officially hit the pause button on complying with the small business lending data collection rules. They were supposed to go into effect next month. The Agency, however, announced in April that it planned to rewrite all of the rules and would not enforce them in the interim. Alas, covered parties wondered if they were still required to comply regardless of the whims on enforcement. Consequently, a new deadline for compliance was set for July 1, 2026. That assumes the new rules are ready by then or that there are no further delays.

The CFPB has officially hit the pause button on complying with the small business lending data collection rules. They were supposed to go into effect next month. The Agency, however, announced in April that it planned to rewrite all of the rules and would not enforce them in the interim. Alas, covered parties wondered if they were still required to comply regardless of the whims on enforcement. Consequently, a new deadline for compliance was set for July 1, 2026. That assumes the new rules are ready by then or that there are no further delays.

The rules have technically been delayed by fifteen years already since the law requiring such rules to be implemented was passed in 2010 (Dodd-Frank). Other priorities, politics, debates over the legislation’s scope, and endless litigation relating to it pushed back rule-making and compliance to where it is now. During Trump’s first term, there was even disagreement as to what the CFPB should even be called. deBanked has been covering the law for more than 10 years.

The law had previously been deemed applicable to both loans and merchant cash advances. The rules had been codified in 888 pages of guidelines.