Brendan Garrett was a Reporter at deBanked. Articles by Brendan Garrett

“You’re Not an Entrepreneur Until…”: How IOU Financial Worked its Way Out of ’08

July 9, 2019“It makes you feel old, but I don’t feel that old,” is how Robert Gloer, President and COO of IOU Financial, describes what it’s like to have been in finance since the early nineties. With his career predating social media and the explosion of tech in the workplace that has marked the previous two decades, Gloer could be presumed to be behind the times with regards to digital resources, but the practices of IOU indicate otherwise.

Born from a chance meeting between Gloer and his business partner, Philippe Marleau, at Finovate in 2008, the two men combined their businesses to form IOU, Marleau bringing the tech support and Gloer providing the operations team. Beginning this venture together just before the economic collapse of ’08, the early days of IOU were rough, and it took them a year of operating before even making their first loan.

Saying that “you’re not a true entrepreneur until you’ve put payroll on your equity line,” Gloer now laughs about those first few years. And what’s not to laugh at? With offices in Atlanta and their headquarters in Montreal, IOU is operating in two markets with a staff of 50 employees and has funded $700 million since its founding, averaging just over $15 million a month via small business loans. And they’ve even gone public, claiming a place on the Canadian stock exchange – sans a flashy IPO announcement party.

Those initial years of graft seem to have paid off, and Gloer assures me that throughout their time operating, he and Marleau, the CEO and director of IOU, have stuck to those initial visions and core values they set out to practice upon founding the company: to provide secure loans to good quality debtors with the aid of technology.

In fact, it is the last aspect of this goal that Gloer is keen emphasize. The incorporation of technology in their lending process is the reason why the COO believes IOU competes at such a high level in the industry for a company of its size. Their B.E.S.T. system is an example of this, as it offers direct access to the small business loans world for every player in the ecosystem. Banks, business, suppliers, credit card and payment processors, and more can sign up to B.E.S.T. and shop around to see which party they’d like to deal with.

Built with the ethos of quality over quantity, IOU charges a relatively low entry fee for B.E.S.T., as Gloer asserts that he’d “rather make $1 from one million people, than $1 million from one person.”

Built with the ethos of quality over quantity, IOU charges a relatively low entry fee for B.E.S.T., as Gloer asserts that he’d “rather make $1 from one million people, than $1 million from one person.”

Comparing his company’s adoption of technology to the infamous story of how Blockbuster CEO John Antioco turned down an offer to buy Netflix in 2000, Gloer claims that the key to long-term success is a company culture that both looks to the future to see incoming trends and incorporates a willingness to change and adapt new developments within the field.

And it is just that which IOU is doing in Canada. Explaining that the alternative finance scene there is still in its “infancy,” Gloer is anticipating what’s to come as an opportunity to implement the lessons learnt in the American market before the mistakes that yielded them are made. Listing COJs specifically as an example of something so muddled that he’d like avoid them north of the border, Gloer believes Canada offers a chance to build an industry cleanly, without as many of the growing pains he’s contended with throughout his decades-long career.

And with business going well, as well as IOU’s recent entry into a $50 million credit facility with Credit Suisse, it looks like Gloer’s, as well as his company’s, time in alternative financing is set to continue.

Robert Gloer is also speaking on a risk management panel at deBanked CONNECT Toronto on July 25th alongside Merchant Growth CEO and President David Gens.

Peer-to-Peer Lending’s Global Struggle

July 8, 2019New rules were introduced to peer-to-peer lending in Britain this month with the introduction of Policy Statement 19/14 by the government. The document heralds in a number of new processes that will be required to be enacted by peer-to-peer lending platforms in the UK by early December this year, if they are to continue operating unmolested.

Among these rules is the expectation for stricter transparency and honesty between platforms and potential investors, specifically with regard to the practice of using borrowers’, investors’, and even the business’s own money to pay for defaulted loans. As well as this there is the introduction of appropriateness tests to ensure that those who are candidates to become investors understand the various risks of the industry they are prospecting.

Such tests aren’t new to the alternative finance industry, as they have been previously employed for both crowd bonds and equity crowdfunding. But that doesn’t mean that they will comfortably slide into use among peer-to-peer lending processes. The question about when they will be asked to complete the test during the application, be it at the beginning, upon completion of the first form, or after receiving confirmation of a loan, remains unanswered; there are concerns that lending platforms will take a ‘tick all boxes’ approach and pose unsatisfactory questions; and the fear that only larger firms will be able to afford the costs to install these compliance checks, thus edging out smaller peer-to-peer lending companies from the market, is common.

The publication of the document comes after years of success for peer-to-peer lending within the British market. With the previous 12 months showcasing £6.7 billion in peer-to-peer loans being taken out, more than any other European country, the market initially appears to be doing well, but stories about firms collapsing or exiting from the industry indicate otherwise. For example, Lendy, one of the first and largest peer-to-peer platforms in the UK collapsed and left 20,000 investors uncertain about the £160 million that was outstanding in loans; while BondMason withdrew completely from the market, pivoting into alternative property investment services.

The publication of the document comes after years of success for peer-to-peer lending within the British market. With the previous 12 months showcasing £6.7 billion in peer-to-peer loans being taken out, more than any other European country, the market initially appears to be doing well, but stories about firms collapsing or exiting from the industry indicate otherwise. For example, Lendy, one of the first and largest peer-to-peer platforms in the UK collapsed and left 20,000 investors uncertain about the £160 million that was outstanding in loans; while BondMason withdrew completely from the market, pivoting into alternative property investment services.

Looking forward, it appears as if lending platforms in the UK may become less reliant on retail investors and seek out more institutional investors who better understand the risks of peer-to-peer lending.

Peer-to-peer lending has gone through it own iterations in the US, with two platforms still thought of as peer-to-peer (but perhaps are no longer!) recently squaring off with the SEC. Last year, two former executives of Lending Club agreed to settle charges with the SEC for improperly adjusting returns of a related fund and this past April, Prosper Funding LLC agreed to pay a $3 million penalty for miscalculating and materially overstating annualized net returns to retail and other investors.

It could be worse.

China is currently watching its own peer-to-peer lending market collapse, despite the industry previously having drawn 50 million investors. With estimates claiming that half of the market was wiped out in 2018, and forecasts saying that 70% of those that survived will be gone by year end, China is on track to lose 85% of its peer-to-peer platforms within 24 months. This follows a number of cases of executives of Chinese peer-to-peer lending firms embezzling money and fleeing, leading to stories like the 31-year-old woman who hung herself when faced with the reality of losing $40,000 after a shareholder of PPMiao, a state-backed peer-to-peer platform, ran off when the firm went bust, reneging on any accountability.

“It’s amazing how quickly it’s unraveling,” said Zennon Kapron, the managing director of Shanghai-based consulting firm Kapronasia, about the peer-to-peer industry. And while Kapron was speaking about the Chinese market, governments worldwide have shifted from nurturing peer-to-peer lenders to policing them and diligently trying to rein them in.

Making it Work: CanaCap and the Case for Canada

July 5, 2019 What leads an alternative financer to establish their own business in Canada? For Evan Marmott and his partner Adam Benaroch, it was the level of opportunity that the country offered in comparison to United States, where the alternative funding industry had become bloated and saturated with funders and brokers alike by 2017, when the pair established CanaCap.

What leads an alternative financer to establish their own business in Canada? For Evan Marmott and his partner Adam Benaroch, it was the level of opportunity that the country offered in comparison to United States, where the alternative funding industry had become bloated and saturated with funders and brokers alike by 2017, when the pair established CanaCap.

Holding over 30 years of experience in alternative finance between them, Marmott and Benaroch founded CanaCap with the intention of capitalizing off interested Canadian merchants that were much more receptive to the message of brokers and funders. Not being bombarded by constant emails and advertisements for quick loans, Marmott says, leads Canadian business owners to be more open-minded to discussing alternative funding with brokers, resulting in both a better understanding of the conditions of the financing as well as more time on the phone to make deals. And on top of this, the lack of a dominant player within the alternative funding world of Canada leads to a divided market share, allowing small and large firms alike to succeed.

Accompanying this advantage of time and space within the market is the quality of merchants found in Canada. Claiming that Canadian merchants generally perform better than American business owners when repaying debts, Marmott explains that funders operating north of the border can expect to have a “cleaner” portfolio.

And lastly, the level of product knowledge amongst potential customers appeared to be just right to Marmott and Benaroch. With the former noting how CanaCap is unique in its willingness to offer second positions to Canadian businesses, Marmott highlights how his company benefits from larger financers, such as OnDeck, who many of their customers would go to first, learn about the funding process, be denied funds, and then be picked up by CanaCap after further researching the industry.

With offices in both Montreal and New York, the latter of these being for CapCall, the American counterpart to CanaCap, Marmott is well-attuned to the differences between the two markets. And while he concedes that the downside of brokering in the Great White North is the 30% that is clipped from commissions due to currency exchange, he affirms that the savings from reduced marketing costs, providing better return on investment rates, offset this loss.

Altogether, the CEO makes a convincing case for why one should consider alternative financing in Canada. Taking the tack that the country provides a fresh slate of sorts to financers, where merchants have yet to be inundated with offers, promotions, and horror stories about the industry, Marmott and Benaroch have enjoyed success with their model of approving over 90% of their applicants and streamlining the application process as to increase turnaround times.

With plans to stay put for the foreseeable future, Marmott says that he’s “looking forward to funding small businesses” as his company continues to service the entire country and the alternative finance industry in Canada develops. A plan that doesn’t sound too bad, especially with signs pointing towards increased growth and further interest from merchants.

Forgiving the Unforgivable: Democrats Propose Wide Range of Solutions for Student Debt

July 1, 2019 To forgive or not to forgive? That is the question as Democratic presidential candidate hopefuls line up to state whether or not they are still repaying their student loans (and if this repayment reaches six figures) and what their intentions for the student loan crisis are, leading to the $1.6 trillion debt becoming one of the central issues of this race.

To forgive or not to forgive? That is the question as Democratic presidential candidate hopefuls line up to state whether or not they are still repaying their student loans (and if this repayment reaches six figures) and what their intentions for the student loan crisis are, leading to the $1.6 trillion debt becoming one of the central issues of this race.

With calls coming forward from all corners of the Democratic Party, voters are seeing a wide range of options for how to tackle what has been hailed as the potential cause of the next financial crash, the only thing is, not everyone is clear about how they intend to pay for it.

Last week Bernie Sanders surprised many with his calls to forgive all student debt. Prior to this, Elizabeth Warren announced that she planned to cancel debt “for more than 95%” of those burdened with loan debt. And while these candidates have led the charge of progressive arguments for how to deal with the debt crisis, the popularity of their proposed policies has baited other Democrats to follow suit.

Joe Biden, who remains the frontrunner despite criticisms of his performance in the first debate, has said that he wants to forgive teachers’ student loans. South Bend Mayor Pete Buttigieg wants to solve the problem by offering free college to those coming from lower-income and middle-class backgrounds, saying in the debate that he does not “believe it makes sense to ask working-class families to subsidize even the children of billionaires.” Robert O’Rourke has suggested cancelling the debt of those who work in fields or areas where there is a low supply of labor. Kamala Harris has called for debtless tuition and lower interest rates on existing loans. And Eric Swalwell, the Californian congressman, has proposed forgiving debt in exchange for engaging in work-study programs and community service while at college.

Joe Biden, who remains the frontrunner despite criticisms of his performance in the first debate, has said that he wants to forgive teachers’ student loans. South Bend Mayor Pete Buttigieg wants to solve the problem by offering free college to those coming from lower-income and middle-class backgrounds, saying in the debate that he does not “believe it makes sense to ask working-class families to subsidize even the children of billionaires.” Robert O’Rourke has suggested cancelling the debt of those who work in fields or areas where there is a low supply of labor. Kamala Harris has called for debtless tuition and lower interest rates on existing loans. And Eric Swalwell, the Californian congressman, has proposed forgiving debt in exchange for engaging in work-study programs and community service while at college.

The means by which each of these proposals will be paid for has varied from candidate to candidate, with some offering detailed plans, and others, verbal assurances. Both Warren and Sanders have published how they will raise funds for their strategies, with the former stating that she will impose a 2% tax on Americans with $50 million or more in wealth, and the latter proposing a tax on Wall Street speculators that he claims will raise $2.4 trillion over a ten-year period. Meanwhile, other candidates have yet to clarify how their solutions will be financed; and these announcements are being made just as the Congressional Budget Office’s most recent evaluation of the 2017 Republican-backed tax cut has estimated the net cost of the cuts to come to $1.9 trillion – $3 trillion more than the total sum of student debt.

The conversation generated from these announcements has spilled out beyond debates and candidate interviews, as non-political figures such as Mark Cuban, Jamie Dimon, and Gary Vaynerchuk have each contributed their two cents. The last of these has explained that he sees the next generation of Americans as the ones who will “walk away” from colleges as they are known now; Dimon has gone on record in his annual letter to JPMorgan Chase shareholders to call the crisis a “disgrace” that is “hurting America”; and Cuban has partnered with ChangEd, a program that seeks to assist students in paying off their debts, as part of an event to help high school and college students learn more about their future finances.

Interactions like these, between popular figures and the hot topic that student debt has become, are increasing in frequency, and as the Democratic primaries run on it is likely this trend will continue. However, it is too early to say which side of Dems will win, pro-forgiveness or a lighter, less dramatic form of relief for students.

With reports indicating the extent to which student loans affect the 45 million indebted Americans who took them out, it appears that this will be one of the major issues to shape the primary and presidential races. Stories of graduates sacrificing opportunities to marry, have children, buy a home, and even continue careers in the fields they studied beg the question of what exactly the benefit of college is. The next year will demonstrate whether Democrats are able to drum up an answer.

2M7 Financial Solutions and the State of Alternative Funding in Canada

July 1, 2019 “What’s a cash advance?”

“What’s a cash advance?”

This is how Avi Bernstein, CEO of 2M7 Financial Solutions, recalled a typical conversation in 2008, when his company was founded in the Canadian market. According to him, customer knowledge of alternative financing methods was dismal, partly due to a handful of homogenous banks dominating the scene as well as a void of funders in the country.

Flash forward to 2019 and 2M7 is operating within a Canadian market that is much more trusting and knowledgeable of merchant cash advances, although it is not yet at the levels witnessed in the U.S.

“Low hanging fruit,” is how Bernstein describes the industry now, as small and medium-sized businesses are flocking to 2M7 and its contemporaries, which offer higher approval ratings and faster confirmation of funding than their more traditional counterparts. In fact, according to a 2018 study conducted by Smarter Loans, 24% of those Canadians surveyed stated that they sought their first loan with an alternative lender that year. As well as this, only 29% reported that they pursued funding from more established, traditional financial institutions and 85% of those that received financing confirmed their satisfaction.

Figures like these help to explain why the Canadian market has seen a rise in interest from foreign businesses in the previous five years. Greenbox Capital, First Down Funding, and Funding Circle are examples of those companies who have successfully implanted themselves within the market, a feat that Bernstein claims isn’t easy.

“It’s a different business,” he notes when comparing the market to that of the U.S. Listing the dissimilarities in market maturity levels, sales tactics, processing channels, and collection styles, as well as the currency exchange rate that’s to be considered, Bernstein says that he’s found those American funders who come to Canada unprepared never stay long enough to become a fixture of the industry.

“It’s a different business,” he notes when comparing the market to that of the U.S. Listing the dissimilarities in market maturity levels, sales tactics, processing channels, and collection styles, as well as the currency exchange rate that’s to be considered, Bernstein says that he’s found those American funders who come to Canada unprepared never stay long enough to become a fixture of the industry.

Warning against half measures, Bernstein explains that “You’ve gotta put boots on the ground” if you want to succeed in Canada. Giving the impression that unless you’re willing to learn the rules applied in the market, hire people, and house them in an office north of the American border, Bernstein is keen to highlight what’s required of foreign companies looking with interest at Canada.

But it’s a risk-reward situation. The market is opening up as more funders enter it, and with the arrival of larger companies, such as OnDeck Capital, more resources are being devoted to raising awareness of alternative financing amongst Canadians.

Meanwhile, homogenous firms like 2M7 are continuing to grow in this developing market. Receiving an average of 200-300 applications for funds per month, 2M7 is capitalizing off opportunities by proving themselves to be open to a wider range of applications. Bernstein asserts that “we try to fund everything,” and that they keep an “open mind to every opportunity” that lands on their desk. Perhaps this is a mindset not shared by more conservative of funders in the industry, but, as Bernstein says, “we’re here, we’re funding, and we’re ready to rock n’ roll.”

You can meet Avi Bernstein and 2M7 at deBanked CONNECT Toronto on July 25th.

“You Can’t Stay Static”: Paul Teitelman and the Building of an SEO Firm

June 30, 2019

How does someone become an SEO expert? How does someone found a successful SEO consultancy firm? For Paul Teitelman, his road to SEO mastery and independence started by admitting he knew nothing about the industry.

How does someone become an SEO expert? How does someone found a successful SEO consultancy firm? For Paul Teitelman, his road to SEO mastery and independence started by admitting he knew nothing about the industry.

Beginning in the late noughties, following his graduation in Marketing Management from Dalhousie University, Teitelman went to an Interactive Advertising Bureau job fair, pitched himself to his soon-to-be boss, and replied, “No! But I’m your man. I’ll learn it all,” when asked if he knew anything about SEO.

Thus began his tenure at Search Engine People, one of Canada’s first Search Engine Marketing companies. Here he entered as a Link Ninja and learned the trade by implementing SEO campaigns for both Fortune 100 and 500 companies as well as for local businesses. From this, he advanced to a managerial position, in which he led teams of SEO specialists who were responsible for ensuring clients would appear at the top of Google search pages. And then, in 2011, Teitelman left Search Engine People to make his own way, becoming the CEO and founder of his self-titled, Toronto-based SEO consultancy firm.

How did the move to independence pan out? Well, as of June 2019 he has hired his 25th employee, his team is kept busy servicing the needs of clients, and he experiments with pioneering SEO strategies and theories within his own blog network. Claiming that his firm offers “the best of both worlds” as a result of him having worked on both ends of the SEO spectrum, Teitelman explains that clients benefit from his offering of the transparency, promptness, and directness that are inherent with small firms; and that he reaps the reward of an agency price tag, a perk that comes with producing consistently successful SEO work.

When asked about how others could follow in his footsteps, he said, regardless of the industry, whether you’re an SEO expert or broker, that “you can’t stay static.” Emphasizing the necessity of having foresight when you leave your old job, Teitelman notes that entrepreneurs need to stay ahead of the curve of trends, be that an update to Google’s search result algorithm or a niche opening in the alternative finance market. As well as this, Teitelman highlighted the importance of being secure in that knowledge that when you leave to make it independently you will have a list of clients to take with you, who’ll keep you from leaving yourself high and dry.

When asked about how others could follow in his footsteps, he said, regardless of the industry, whether you’re an SEO expert or broker, that “you can’t stay static.” Emphasizing the necessity of having foresight when you leave your old job, Teitelman notes that entrepreneurs need to stay ahead of the curve of trends, be that an update to Google’s search result algorithm or a niche opening in the alternative finance market. As well as this, Teitelman highlighted the importance of being secure in that knowledge that when you leave to make it independently you will have a list of clients to take with you, who’ll keep you from leaving yourself high and dry.

And much like how the merchant cash advance scene in Canada has seen an increase in both interest and product knowledge amongst customers over recent years, as has SEO. Subject to myth-making and conjecture as a result of its technical lingo and specialized nature, SEO has long been the victim of misunderstanding according to Teitelman, who says those who are curious about the service “shouldn’t believe everything they read on the internet.”

Going on to say that “the more education customers get, the more exciting the industry becomes,” it’s clear that Teitelman is looking forward to the future of SEO. Time will tell if his offer back in 2008 will be matched by interested industries, curious about the possibilities that SEO promises and willing to “learn it all.”

Paul Teitelman is also speaking on a sales and marketing strategies panel at deBanked CONNECT Toronto on July 25th alongside Smarter Loans President Vlad Sherbatov and SharpShooter Funding Managing Partner Paul Pitcher.

“Do It Better Than How You Learned It”: How Paul Pitcher Came To Be In Canada

June 27, 2019 Few kids who dream of running their own international business actually grow up to live that fantasy. Even fewer end up working alongside their childhood heroes. Paul Pitcher is doing both, and he’s loving every minute of it.

Few kids who dream of running their own international business actually grow up to live that fantasy. Even fewer end up working alongside their childhood heroes. Paul Pitcher is doing both, and he’s loving every minute of it.

Growing up in Annapolis, Maryland, the Managing Partner at First Down Funding and SharpShooter Funding studied at Severn School and immersed himself in sport. Under the eye of his father, Pitcher began playing basketball and baseball at the age of 4. Golf came later, and it followed him into his young adult life as he played at a collegiate level while enrolled at the University of Tampa, where he studied International Marketing and Finance. And upon graduation, Pitcher landed a job in Washington D.C., working in sales for the Washington Wizards and Capitals.

Sports accompanied him in each phase of his life, so it comes as no surprise that it is entwined with his current business ventures.

After leaving the Regional Sales Manager position he held with the Wizards and Capitals, Pitcher became a broker, eventually establishing First Down in 2012 – seeing it as a solution to a problem many business owners across the country face: acquiring capital. Offering funds via merchant cash advances, First Down provides financial aid to small and medium-sized businesses.

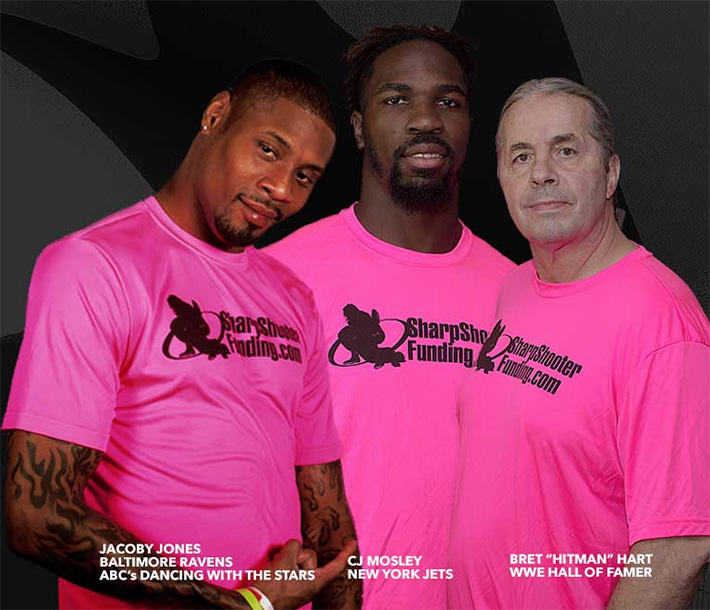

And after enjoying success in the United States, lightning struck on June 6th, 2015. Out of the blue, over 25 Canadian business owners applied for funding from First Down. Chalking it up to ads First Down had placed across social media, Pitcher decided to dive into the new, northern market, but only after consulting with the only Canadian he knew, WWE Hall of Famer Bret ‘Hitman’ Hart.

Having met the wrestler in 1993, Pitcher gambled on Hart remembering the 10-years-old kid in the Looney Toons t-shirt that he took a photo with two decades ago. And it paid off. Following discussions of what First Down did and how it met the needs of the Canadian market, Hart partnered with the company and now serves as commissioner to SharpShooter, the Canadian arm of First Down.

With the backing of a hero from his youth behind him, Pitcher expanded beyond the borders of the US, and with this came further support from sports stars. Recent years have seen CJ Mosley of the New York Jets, Jacoby Jones of the Baltimore Ravens, and the Shogun Welterweight Champion Micah Terill partnering with Pitcher.

With the backing of a hero from his youth behind him, Pitcher expanded beyond the borders of the US, and with this came further support from sports stars. Recent years have seen CJ Mosley of the New York Jets, Jacoby Jones of the Baltimore Ravens, and the Shogun Welterweight Champion Micah Terill partnering with Pitcher.

Noting that the spirit and culture of sport has definitely bled into First Down and SharpShooter from both his own personal life as well as the lives of those athletes that are partnered to it, Pitcher affirms that healthy competition is integral to both sport and business.

Believing that it’s just as important to win as it is to develop the environment you are in, Pitcher is in the funding market for the long-run. And it is exactly this that attracts him to Canada. Comparing it to Baltimore in his home state, he sees the Great White North as a region that is less saturated with funding firms like you would find in New York or Chicago, in other words, he sees it as a place of opportunity, where there is room to grow.

Of course, with such opportunity there are growing pains, like the populace’s level of product knowledge as well as the building of trust between business owners and SharpShooter, but Pitcher welcomes it. Emphasizing his love for competition, he calls for more firms like his to enter the market, be they big or small, as according to him, it could only help build upon the culture of non-bank funding that has taken root in Canada.

“Whatever you do, do it better than how you learned it,” are among the final words Pitcher leaves me with, and with the other closing remarks hinting at further expansion beyond Canada, the Managing Partner seems to be living by this maxim. Be it the education he picked up in Tampa, the lessons learnt in sales, or even a chance encounter with a childhood hero, Pitcher appears to be aiming to continually build and expand upon what he has experienced.

Paul Pitcher is also speaking on a sales and marketing strategies panel at deBanked CONNECT Toronto on July 25th alongside Smarter Loans President Vlad Sherbatov and SEO Consultant Paul Teitelman.

Ocrolus Secures $24M in Series B

June 26, 2019 A fresh logo and new company jumpers aren’t the only recent additions to the Ocrolus offices this month, as the business has secured $24 million in Series B funding.

A fresh logo and new company jumpers aren’t the only recent additions to the Ocrolus offices this month, as the business has secured $24 million in Series B funding.

This development marks the $33 million point in investments for the automation platform. Led by Oak HC/FT, and backed by FinTech Collective,

Bullpen Capital, QED Investors, among other investors, the funds will be put to use expanding upon Ocrolus’s software and staffing.

With 40 employees currently working at Ocrolus, Co-founder and CEO Sam Bobley said that the company hoped to double this number over the next 12 months, aiming to have “a little over north of 80 this time next year.” As well as this, plans are underway to expand the capabilities of their product. Built to analyze financial documents, such as bank statements, pay stubs, and IDs, with 99% accuracy, Bobley explained that he plans for Ocrolus to be able to extract data from invoices and mortgage documents as well.

And while work on their software continues, the company is also looking to develop their customer base. With intentions to both deepen their core clientele, which is small business lenders, while also opening up their product to new markets, Ocrolus is set to put this $24 million towards building upon what they have established since opening their doors in 2014.