Articles by Adam Zaki

Adam is a Reporter from Long Island and graduate of Brooklyn College.

Funders Planning Mounted Response to Debt Settlement Schemers

December 30, 2021 Debt settlement companies are still using their tricky tactics, according to Efraim Kandinov of Fundfi Merchant Funding. He says a large group of funders are currently strategizing a mounted response to activity he believes is illicit.

Debt settlement companies are still using their tricky tactics, according to Efraim Kandinov of Fundfi Merchant Funding. He says a large group of funders are currently strategizing a mounted response to activity he believes is illicit.

Fundfi’s lawyers have already begun to send out Cease and Desists to the companies that have been telling his clients to breach their contracts and stop paying. He says it has become such an issue, that merchants in other parts of the country have begun ignoring his calls because of his New York area code, which they now associate with this kind of scam.

“[The merchant] said,‘I’m having all these New York numbers specifically, call me and plead with me ‘why are you doing this to yourself? Stop paying. Don’t pay these guys, pay me a fee and I’ll take care of it.’”

”This merchant was smart enough to say, ‘hey, this sounds like a scam’ and gave me the rundown.”

According to Kandinov, his company is one of the many that merchants are being told not to pay, while there are other funders who the debt settlers instruct to keep paying.

“They’re specifically targeting certain funders,” said Kandinov. “Whether they’ve been sued before by other ones, or have agreements, I have no idea. However I’m starting to realize, they’re specially targeting certain companies.”

Nuula, Still in the Business Lending Game, Lays Groundwork for Larger Ecosystem

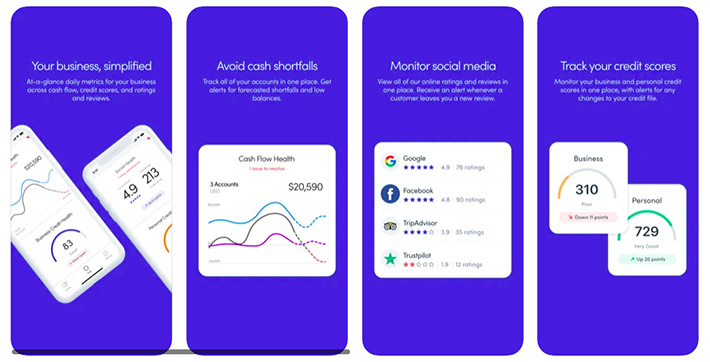

December 29, 2021 Nuula, formerly known as BFS Capital, has 5,000 merchants on a waitlist to access a line of credit after just four months of its application process being made available.

Nuula, formerly known as BFS Capital, has 5,000 merchants on a waitlist to access a line of credit after just four months of its application process being made available.

But there’s more.

“Nuula is built to not only deliver our own financial products, but it’s developed to help us provision and deploy third party financial products that come from our ecosystem,” said Mark Ruddock, Nuula’s CEO. “So what we’re trying to do here is not really be a broker, but we will carefully curate products.”

“That could be larger, longer loans from one partner, it could be insurance from another partner, it could be entrepreneur wealth management from a third partner,” he continued.

“So we bring those partners onto the platform, and then we expose their functionality within the app, in a way that’s consistent with all the other tools in the app. So yes, there is room for third party lenders.”

Ruddock spoke about how as of now, Nuula’s infrastructure only offers opportunities to those interested in directly funding businesses. The company profits via revenue sharing when businesses are provided with capital from a third party funder on the platform.

Despite not being available yet, he hinted at possibly incorporating broker-esque products as the app’s financial product suite grows.

“Today, we don’t see a near term role for brokers on the app, because we’re not really trying to create a marketplace of a multitude of products, we’re really trying to curate things very, very carefully,” said Ruddock. “However that’s not to say say that we will not over time provide the ability for the more digital brokers or intermediaries to play a role as we seek to broaden the portfolio of tools that we offer.”

“I would say no to brokers in the sense that we really don’t have a compelling offer for them at the moment, but yes to other financial services providers.”

Ruddock described how Nuula is serving a niche customer base, a tech-centric merchant who is looking for an easy-to-use mobile software that can manage their businesses’ X’s and O’s. Not only is this type of merchant underserved and beginning to substantiate in numbers according to Ruddock, but they are extremely eager for access to capital.

“It’s a fundamental change in the way underwriting has been done, away from kind of a rearward looking model, towards a real-time forward looking model, and that’s what we believe is going to be required to unlock capital to this new generation of businesses.”

“[Nuula] reimagines underwriting in a way that says ‘don’t just look at the last six months of bank statements’,” Ruddock said. “[We] look on not only of the day of lending, but the lifetime of your relationship, and how those businesses are recovering, growing, and thriving.”

He spoke about how with real-time data being accessible through Nuula, businesses that are building their creditworthiness can have a mobile reference point for the data that they need to see their real-time financial state, while simultaneously giving lenders a live picture of the businesses’ books.

“So even if a business is not strong enough for credit today, it might be in three months, and we can go watch your progression through this period and unlock the capital when the time is right, and then if that business grows out of the pandemic and recovers and is stronger, we’re going to be able to a broader and richer portfolio of credit.”

Although their target customer seems to be a digitally native merchant, Ruddock says that Nuula’s onboarding process is designed to be simple enough for a merchant who may not be as familiar with fintech.

“I’m a fifty-plus year-old CEO of a fintech company, and I would say I’m as digitally savvy as a twenty year-old, so it isn’t really about age anymore,” said Ruddock. “It’s by the way which [merchants] have embraced technology.”

“What we’ve done with Nuula is we’ve tried to make this product intuitive and simple for a first time app user and we’ve tried to help these folks get access to the data that now is sitting in a multitude of systems. While we believe people who have grown up in an app-centric world are going to be amongst the first adopters, we’re trying to make this product accessible for the fifty year-old restaurant owner too.”

Nuula plans on expanding their data harnessing tools with other fintechs early next year. “Over the next two weeks, we will actually unlock the ability for [merchant] sales data from Shopify or Square,” said Ruddock.

Brokers who Utilize Fintech are Here to Stay

December 23, 2021

“I don’t think the industry would really be the same if we didn’t have brokers anymore.”

Dave Stewart, who was recently promoted to Sales and Partnerships Manager at Idea Financial, spoke to deBanked about the role brokers will play in the future of business financing. With so many different kinds of innovation being offered in the financial world through technology, Stewart shared his thoughts on how brokers, funders, and merchants can get the most out of a technology-infused lending environment.

“We think about the whole fintech thing, everything getting technology based, and that there’s a missed opportunity for the human touch,” said Stewart, when asked how technology will influence the way merchants apply for capital. “There’s a lot of clients out there that can go online and fill out an application, but they don’t understand the in’s and out’s.”

“When [the merchant] doesn’t understand how everything actually works, they usually fall back and seek a broker at some point in time.”

Stewart highlighted how from the lender’s perspective, the value of brokers is in being the face to the experience of purchasing a financial product. He described it as someone who can guide the merchant to the right type of financing and then through that specific funding approval process.

“I think there is value in the experience,” said Stewart. “I don’t go to a restaurant to cook my own meal. I go to a restaurant because the service is going to be great, the food is going to be great, and hopefully I have a great experience, and I think that’s a great example of what the broker does.”

Despite believing that the broker’s role in financing is invincible to fintech’s innovation in lending, Stewart didn’t dismiss the value of understanding and leveraging different types of technology in order to be competitive.

“There’s an art to being a good broker,” said Stewart. “There are a lot of people who are not tech savvy and are just monster brokers or monster sales people, but they definitely need or rely on somebody else to explain the technical aspects.”

EIDL Applicants Still Waiting for Funds as Deadline Approaches

December 16, 2021 There is a major pileup of applicants waiting to hear back from the SBA regarding EIDL applications, according to Iron Capital Equities, a fintech firm who owns websites that help businesses through the EIDL application process. According to a press release by the company, many applicants who have not yet received funding seem to believe they’ve been ghosted by the SBA.

There is a major pileup of applicants waiting to hear back from the SBA regarding EIDL applications, according to Iron Capital Equities, a fintech firm who owns websites that help businesses through the EIDL application process. According to a press release by the company, many applicants who have not yet received funding seem to believe they’ve been ghosted by the SBA.

The EIDL deadline to file an application is December 31.

“90% (9 out of 10) of our 400 client applicants are still in limbo, with no update regarding the status of the funds,” states co-founder Matthew Elling. “The short-term economic outlook from small businesses is dim, so these funds are highly sought after.”

Elling insisted that he is in constant contact with his customers, and says his company is doing everything they can to service these clients who are playing the waiting game.

“Even though we are a financial technology company, we still ‘talk’ with our customers,” Elling continued. “We understand their struggles in a post COVID economic environment, we have provided them with advice on the SBA assistance like EIDL and the two PPP rounds for payroll and business expense assistance during and after the government-imposed lockdowns.”

EIDL loans were a beacon of hope for many businesses struggling to survive in the pandemic. This type of government funding isn’t a grant, and needs to be paid back by the merchant at a term of 30 years at 3.75% annual interest.

How a Former Banker is Servicing Clients that Turned Down Alternative Funding Offers

December 15, 2021 What do brokers do with the clients that don’t want to pay the costs of an alternative product, but are still too underqualified for traditional financing?

What do brokers do with the clients that don’t want to pay the costs of an alternative product, but are still too underqualified for traditional financing?

Juan Caban, CEO and Co-Founder of Financial Lynx, has leveraged his interpersonal relationships as a former banker with his passion for networking and his discovery of a niche type of client into a business that is now spread across 44 states. Lenders aren’t the only ones turning down deals, the applicants do too, he says.

Caban built a referral business by talking to people, being an active member of the industry, and taking advantage of pandemic-induced halts in business to research the best ways to serve a section of business owners that prior to Financial Lynx, were either using less attractive products or never taking on financing at all.

“I’m a big networker,” said Caban. “I always go out, I meet a lot of people, I always get referrals from a lot of different areas.” He spoke about how as a decade-long banker with major banks, he knew right off the bat in his career that traditional financing was excluding financially-sound merchants who weren’t meeting overzealous bank qualifications.

“I would meet people who want to do business with me and I would present it to my bank, but it was always a challenge,” Caban said. “You want to help out a client, but you’re limited to the credit appetite of the bank that you are working for. After getting frustrated and declining a lot of clients, I wanted to seek out how I can help these clients out.”

After leaving the traditional finance world in 2019, Caban began work at an alternative lender, where the doors to a variety of new options opened up for him.

Caban still felt limited in his abilities to get deals done because of the confines funders mandate through their qualifications, and left to start his own company within seven months. After seeing a market in financing for merchants who fall between the high risk and traditional financing qualification threshold, he began talking to people across the financial community about what products exist for these types of clients.

“I used my banker network, I probably know about 200 bankers here in New York, and I started asking them, ‘hey, do you have a program in your bank that can help this type of client?’” Seeing that merchants with good credit and no desire to pay a 40% cost of capital were being pushed aside throughout the industry, Caban decided to pursue a business out of servicing this type of merchant.

“What I found was that there are some banks out there that as long as [the merchant] has a 700 FICO score, has been in business at least two years, and are considered to be in a preferred industry, some banks are willing to lend in some cases 20% of annual sales, up to $250,000, with just an application and one year of tax returns.”

The lending services being provided through Financial Lynx based on these qualifications are bank lines of credit that revolve and renew annually.

Caban described the qualifications for this type of financing as a look into the business owner themselves, and not as much into the business. “[These banks] focus on you as an individual and if you have personal credit.”

The concept took off.

“I started working exclusively with one MCA broker shop, they were calling hundreds of businesses a day,” said Caban. “They were trying to sell [merchants] cash advances obviously because it is a very lucrative commission business, but anything that was non-cash advance, or didn’t fit the cash advance space, or merchants who wouldn’t accept the expensive cash advances, they would refer that client to me.”

The twist is that the banks don’t pay him a commission so he has to charge a fee to the merchant once the financing is completed.

“At the end of the day I feel good because I am providing the client with something that they couldn’t find on their own,” Caban said. “So I am helping the client, and almost 100% of my clients are satisfied with what they have, because they’re getting cheap financing, 5% instead of 30% money, so even with my 10% consulting fee to connect the client, it’s still 50% cheaper than what they would’ve gotten in any type of cash advance.”

The biggest hesitancy Caban sees from alternative finance companies in terms of working with his niche product and client is the patience required in dealing with bigger banks. “Everything is quick in MCA, [brokers] get approved today, get funded today, and get paid tomorrow. I say look, I can provide the client what you’re looking for, but it is a three week process.”

“The ones that say, ‘hey we want to do what’s best for the client,’ they buy into it, they send us referrals on a constant basis,” Caban continued. “The ones that say ‘it’s taking too long, they’re not into it’ and I tell them ‘you’re going to lose that client eventually.’ As opposed to losing them, make some money out of it before you leave them.”

Trying to convince the legitimacy of his product seems to be part of the daily ritual for Caban. “Having a bank line of credit is considered a unicorn in the industry. Everyone says that they have it, but it’s not really a line of credit. We’re actually providing true lines of credit. It’s truly a revolving line of credit.”

“It’s always a thing where it’s like, are you for real?”

MCA-Centric Fintech Looks to Continue Expanding into US Market

December 14, 2021

“I had an ISO once ask me if our software was for real. He was like, ‘Can it really do all that?’”

SysArc, an Indian fintech company that has branched into the US market via Texas, attended Broker Fair last week in order to pitch their product to the industry’s head honchos. The company offers software specifically catered to each component of the MCA process. With software program names like FUNDperfect and ISOperfect, deBanked was all ears.

“FUNDperfect, is a highly configurable solution with an exceptional capacity to adapt and is function-based on diverse organizational needs,” said Pria Chandrakumar, Vice President of Customer Engagement at SysArc, and winner of 2021 Fintech Woman of the Year in India. “We have a merchant portal where merchants can submit an application online, upload documents and even authorize bank verification so bank statements can be automatically pulled.”

When asked about the company’s thought process on creating an MCA-focused software, it appears as if SysArc came upon a niche after casting a net into the greater finance world. “[We’ve] always had a strong presence in the US servicing banks, credit unions, FHLBs, and MCAs,” said Chandrakumar. “We are experts in lending and cater to all forms of lending right from real estate, mortgages, personal loans, [and] small business loans.“

The biggest difficulty it seems for fintechs across the space, including SysArc, is trying to explain how tech can be useful to an industry that has been dominated by sales tactics and practices that go back generations. Chandrakumar spoke on some of reasons that make brokers and funders who operate in old-school sales mentalities hesitant to adopt fintech.

“Common misconceptions [among MCA] are affordability, complexity of software, loss of commission and mostly ignorance of what technology is capable of,” said Chandrakumar. “Brokers and funders must understand that the fintech industry has come a long way and has solved most of their operational problems.”

“The software also plays a huge role in reducing the risk since first level scoring and underwriting is done by the system, avoiding any human errors,” Chandrakumar continued.

FUNDperfect seems to be flexible in nature, so much so that it is broken down into smaller modules if needed, allowing ISOs and funders to pick the modules they need.

“ISOs can get just the brokering piece of the software called ISOperfect,” said Chandrakumar. “This takes the application through the point of selecting an offer and passing it on to the funder.”

After talking about plans of further expansion into the American market, Chandrakumar reiterated SysArc’s value in their gameplan of how to sell it here in the states. “We will use technology to make MCA financing quicker, while at the same time reducing the risks associated with funding by sharing data on merchant, ISO, and funder performances; so companies can make informed business decisions.”

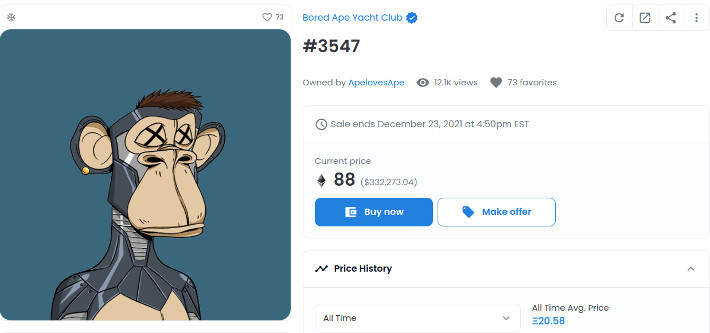

NFT Owner’s Typo Costs $297K

December 13, 2021It seems the only thing blockchain technology can’t promise is a solution to human error.

The owner of an NFT Bored Ape Yacht Club #3547 got their decimals mixed up on Saturday when they sold the token for 0.75 eth, or 1% of its market value, by mistake. In an attempt to sell the token for 75 eth, or $300,000, the NFT was sold in error to an automated buyer in a call option-like purchase for $3,066, according to CNET.

After the purchase, the buyer dumped ten times the amount paid for the NFT into gas fees to process the transaction instantaneously, a move that prevented any chance of the error being remedied.

“How’d it happen? A lapse of concentration I guess,” the seller of Bored Ape #3547 told CNET. “I list a lot of items every day and just wasn’t paying attention properly. I instantly saw the error as my finger clicked the mouse but a bot sent a transaction with over 8 eth [$34,000] of gas fees so it was instantly sniped before I could click cancel, and just like that, $250k was gone.”

Members of the NFT legal community spoke to deBanked about how this type of stuff is all too common and unfortunate, but just comes with the territory of an unregulated financial space.

“It’s a pretty typical problem here in the Wild West,” said Jacob Martin, an attorney specializing in NFTs and author of the NFT Tax Guide. “It’s user error, not platform error. It sucks, but it is what it is.”

The Bored Ape NFT collection is one of the most sought after collections on the blockchain, with entry level tokens being worth about $200,000. While this error may have been able to be fixed in the world of traditional finance, the unforgiving nature of the blockchain world allows errors like this to be cashed in on by opportunistic purchasers.

Back in August, another Bored Ape was accidentally sold for $26,000. When the seller offered the purchaser almost double that to return the NFT, the new purchaser flipped the token to another user for $150,000.

In November, Cryptopunk #7557 which at the time was worth $19 million, was accidentally listed for $19,000. It immediately sold without remedy for the error.

When asked if regulation would help remedy errors like this in the future, some NFT legal gurus were weary about turning to government for solutions to user-committed blockchain errors.

“I don’t think it’s about regulation, it’s about education,” Shekinah Apedo, an attorney who serves as a Compliance SARs Analyst for Bittrex and NFT legal consultant to numerous companies, told deBanked. “The point of decentralization is that there’s no middleman or institution to run to when an error occurs, like one may do with a typo during a bank transaction. Education is necessary and warnings involving risk should be made known.”

“Cigarettes are legal but they are required to have warning labels,” Apedo continued. “Perhaps, regulation involving warning labels or advertising the risks of being your own bank as an NFT and crypto trader or investor would be good for the mainstream public.”

SMB Lending Fraud Being Combatted with Fintech, AI

December 9, 2021 After almost a month in service, Linear Financial Technologies has seen success with its machine learning fraud detection program, Linear Defense. The technology is used to help prevent fraud in all stages of small business lending.

After almost a month in service, Linear Financial Technologies has seen success with its machine learning fraud detection program, Linear Defense. The technology is used to help prevent fraud in all stages of small business lending.

“Since launching Linear Defense last month, market feedback has been very positive,” said Sandip Nayak, Chief Strategy & AI Officer at Linear Financial Technologies, exclusively to deBanked. “We are actively deploying the solution with our first fintech client and have a second major client, [our] first bank client, preparing to deploy Defense in early 2022.”

According to Nayak, Linear Defense is leading the way in fraud prevention since its release. “We have engaged with a number of banks to test Linear Defense on their customer channels, and the solution has shown it can outperform existing fraud programs in accurately and efficiently detecting fraud.”

Linear Defense gains its predictive power through unsupervised machine learning. The software can be taught to detect fraud in multiple types of financial products and applications, using any combination of first party, third party and alternative data to determine its detection algorithms, according to the company.

”Fraud costs the global economy trillions annually, in terms of actual fraud and lost business opportunities from ‘false-positives.’ Now more than ever, financial institutions and other companies delivering financial services products are concerned with the increasing sophistication of fraudsters and are searching for more effective tools to keep up,” said Linear CEO Sam Graziano.

The company claims they have created a simple, lightweight solution that clients consume through an API, seamlessly integrating into their current origination, customer onboarding, or other operating systems.

“Linear Defense is a one-of-a-kind, AI-based fraud platform that surpasses existing market solutions when it comes to detecting financial crimes and fraudulent activity. Using true alternative data and deep learning algorithms, the platform has the unique ability to auto-calibrate to a client’s specific channels and customer population,” said Nayak.

“The solution’s superior predictive power enables clients to reduce the manual touch points required to onboard new customers,” said Nayak. [It’s] creating a better experience for consumers and SMBs, and a more secure process that protects our clients against bad actors.”