How An Online Lending Hedge Fund Manager Became “Unwound”

In 2017, Ethan Senturia, the founder of a defunct online lending company, published a tell-all book about his startup’s rise and fall. He called it Unwound. It’s the fall that stood out. Senturia’s poorly modeled business had been heavily financed by an up-and-coming online lending hedge fund manager named Brendan Ross.

In 2017, Ethan Senturia, the founder of a defunct online lending company, published a tell-all book about his startup’s rise and fall. He called it Unwound. It’s the fall that stood out. Senturia’s poorly modeled business had been heavily financed by an up-and-coming online lending hedge fund manager named Brendan Ross.

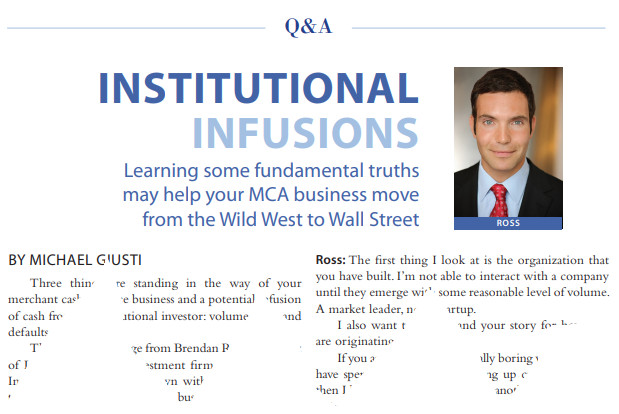

I first encountered Ross in 2014 on the alternative finance conference circuit. Ross’s major theory was that small businesses overpay for credit and that the padded cost served as a hedge against defaults and economic downturns.

“The asset class works even when the collection process doesn’t,” Ross said during a Short Term Business Lending panel at a conference in May 2014. “The model works with no legal recovery.”

As an editor, I helped secure a lengthy interview with Ross that Fall. In it, he placed a special emphasis on building “trust.” It’s a word he used seventeen times over the course of the recorded conversation. “Everything is about trust and eliminating the need for it whenever possible,” he proclaimed.

As an editor, I helped secure a lengthy interview with Ross that Fall. In it, he placed a special emphasis on building “trust.” It’s a word he used seventeen times over the course of the recorded conversation. “Everything is about trust and eliminating the need for it whenever possible,” he proclaimed.

Ross stressed that his fund invested in the underlying loans of online lenders, not in the online lenders themselves. “I need to be the owner of the loan. I need it sold to me in a way that is completely clean.”

Ross would eventually connect with Senturia at Dealstruck, an online small business lender whose philosophy seemed to contradict Ross’s mantra of small businesses overpaying for credit. Dealstruck, it would turn out, had a tendency to have them underpay…

Senturia told the New York Times that year that Dealstruck’s mission was “not about disintermediating the banks but the very high-yield lenders.”

It’s a concept that failed pretty miserably. Senturia recalled in his book that “We had taken to the time-honored Silicon Valley tradition of not making money. Fintech lenders had made a bad habit of covering out-of-pocket costs, waiving fees, and reducing prices to uphold the perception that borrowers loved owing money to us, but hated owing money to our predecessors.”

As the loans underperformed, Senturia became aware that the hedge fund backing them, Ross’s Direct Lending Investments, might also be doomed. Senturia recalled an exchange with Ross in 2016 in which Ross allegedly said of their mutually assured destruction, “I am like, literally staring over the edge. My life is over.”

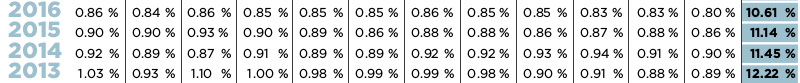

One would expect that in light of that conversation being made public through a book, that investors would question Ross’s report that his fund delivered a double digit annual return (10.61%) the same year his life was over.

Some actually did question it. deBanked received tidbits of information in the ensuing years, always seemingly off the record, that something was not right at Ross’s fund. There was little to go off other than the unlikelihood of his consistently stable stellar returns. Ross had been an especially popular investment manager with the peer-to-peer lending crowd and a regular face and speaker at fintech events. CNBC also had him on their network several times as a featured expert.

All told, Ross managed to amass nearly $1 billion worth of capital under management before his demise.

In 2019, Ross suddenly resigned. His fund, Direct Lending Investments, LLC, was then charged by the SEC with running a “multi-year fraud that resulted in approximately $11 million in over-charges of management and performance fees to its private funds, as well as the inflation of the private funds’ returns.”

Yesterday, the FBI arrested Ross at his residence outside Los Angeles. A grand jury indicted him “with 10 counts of wire fraud based on a scheme he executed between late 2013 and early 2019 to defraud investors…” An announcement made by the US Attorney’s Office in Central California revealed that the charges had been under seal for approximately two weeks prior.

Yesterday, the FBI arrested Ross at his residence outside Los Angeles. A grand jury indicted him “with 10 counts of wire fraud based on a scheme he executed between late 2013 and early 2019 to defraud investors…” An announcement made by the US Attorney’s Office in Central California revealed that the charges had been under seal for approximately two weeks prior.

The SEC simultaneously filed civil charges against him.

No reference is made to Dealstruck in any of it. The Dealstruck brand was later sold to another company that has no connection to Ross or Senturia where it is still in use to this day. Instead, the SEC and US Attorney focus on Ross’s actions allegedly undertaken with another online lender named Quarterspot. Quartersport stopped originating loans in January of this year.

Ross allegedly directed the online lender to make “rebate” payments on more than 1,000 delinquent loans to create the impression that they were current. Quarterspot has not been accused of any civil or criminal wrongdoing.

The SEC included in its complaint that Ross expressed concern about the scale of loan delinquencies.

“…more loans are going late each month than I can afford and still have normal returns, so that the can we are kicking down the road is growing in size,” he wrote in an email. It was dated February 8, 2015.

It’s a sentiment that seems to disprove his early premise that “the asset class works even when the collection process doesn’t.”

Ross is innocent until proven guilty, but an excerpt of an interview with him in 2014 is now somewhat ironic.

“I [understand] that people end up sometimes in the [industry] who have had colorful careers in the securities space. It doesn’t make it impossible for me to work with them,” he said. “But if they had been in the big house for white collar crime, then that is probably a non-starter.”

Last modified: August 12, 2020Sean Murray is the President and Chief Editor of deBanked and the founder of the Broker Fair Conference. Connect with me on LinkedIn or follow me on twitter. You can view all future deBanked events here.