Archive for 2017

House Committee on Financial Services to Air ‘The State of Bank Lending in America’ at 2PM EST

March 28, 2017Update: The House has blocked streaming of this procession from any place other than Youtube

The Subcommittee on Financial Institutions and Consumer Credit will hold a hearing entitled “The State of Bank Lending in America” at 2PM EST on Tuesday. According to a memo, “the hearing will examine recent trends in lending and how the current regulatory climate impacts the availability of credit for consumers and small businesses.” The premise is that community financial institutions have been lending less since the passage of Dodd-Frank and that this may be constraining consumer and small business access to credit.

Speaking on the panel before the Committee is:

- Mr. Scott Heitkamp, President and Chief Executive Officer, ValueBank Texas, on behalf of the Independent Community Bankers of America

- Ms. Holly Wade, Director, Research and Policy Analysis, National Federation of Independent Businesses

- Mr. David Motley, President, Colonial Companies, on behalf of the Mortgage Bankers Association

- Mr. Michael Calhoun, President, Center for Responsible Lending

We will attempt to live stream it on deBanked’s homepage when it airs.

Amazon Sure is Making a Lot of Small Business Loans

March 26, 2017 Amazon had $661 million in seller receivables at the end of 2016, according to their earnings report, nearly double from the year before. These receivables are from loans made to small businesses (primarily to purchase inventory) who are sellers on their platform.

Amazon had $661 million in seller receivables at the end of 2016, according to their earnings report, nearly double from the year before. These receivables are from loans made to small businesses (primarily to purchase inventory) who are sellers on their platform.

Apparently the lending business is going well for them too, since they claim the allowance for loan losses is so small that it’s not even material enough to report. And similar to Square Capital, Amazon incurs virtually no cost to acquire these borrowers.

One year ago, company CEO Jeff Bezos said in a letter to shareholders that “there are over 70,000 entrepreneurs with sales of more than $100,000 a year selling on Amazon.” By then the company had already lent more than $1.5 billion to small businesses across the US, UK and Japan.

“We wanted to bring the same shopping experience that you have on amazon, which is the one-click shopping experience, to the lending program,” a spokesperson says in a 2014 video about the program. “Instead of going to a bank, having interviews, audited financial statements, a 3 week process and then only a small fraction of people getting approved, our process is literally 3 fields and 3 clicks.”

If Kabbage Wanted to Buy, Would OnDeck Sell?

March 24, 2017 A single line in a Reuters story was enough to cause OnDeck’s stock to jump by as much as 11% on Thursday. Industry blogs and news outlets had reacted pretty quickly to word of an unnamed source claiming that OnDeck is a potential acquisition target if Kabbage raises a new equity round. OnDeck closed for the day up only 6.5%.

A single line in a Reuters story was enough to cause OnDeck’s stock to jump by as much as 11% on Thursday. Industry blogs and news outlets had reacted pretty quickly to word of an unnamed source claiming that OnDeck is a potential acquisition target if Kabbage raises a new equity round. OnDeck closed for the day up only 6.5%.

BloombergGadfly columnist Gillian Tan, wrote that a deal was not very likely because of how much investors are already down since the IPO. “Assuming Kabbage were to propose a traditional takeover at a standard premium, it probably would be swiftly rejected by On Deck’s earliest investors, who still own a combined stake of more than 45 percent, according to data compiled by Bloomberg,” she wrote. “With the stock trading at less than a quarter of its 2014 initial public offering price, it would take a generous premium to get them interested.”

OnDeck also lent nearly twice as much as Kabbage last year and obviously still has faith in leadership considering that their pre-IPO CEO is still in charge. There’s little to suggest at this time that OnDeck would be willing to throw in the towel and sell out to a smaller, younger competitor and book a big loss for shareholders who have been with them since the beginning.

The day before the rumor started, OnDeck actually announced that it had increased its asset-backed revolving credit facility with Deutsche Bank by approximately $52 million to a total of up to approximately $214 million.

Citing Unnamed Sources, Reuters Reports Kabbage Possibly Looking to Acquire OnDeck

March 23, 2017 Reuters is reporting that Kabbage is in talks to raise equity capital to potentially use for acquisitions and that OnDeck is one of several targets under consideration. As Reuters attributed the OnDeck portion to just one of their multiple unnamed sources, it’s entirely speculative at this point.

Reuters is reporting that Kabbage is in talks to raise equity capital to potentially use for acquisitions and that OnDeck is one of several targets under consideration. As Reuters attributed the OnDeck portion to just one of their multiple unnamed sources, it’s entirely speculative at this point.

From a theoretical perspective, would such a thing make sense?

Kabbage has momentum on their side right now. Their recent half billion dollar securitization that was finalized earlier this month was oversubscribed. Although they only originated about half the loan volume of OnDeck last year, Kabbage’s last private market valuation ($1 billion in Oct 2015) is nearly 3x as large as OnDeck’s current market cap.

Valuations in the industry have changed a lot over the last 18 months but there’s no doubt that Kabbage has become a unique competitor. At LendIt, company CEO Rob Frohwein revealed a bit of their secret sauce when he said that their customers borrow from them on average 20-25 times over the course of 4 years, whereas their competitors make only 2.2 loans to their customers on average.

There is a general view in this industry that acquiring a competitor adds little value other than more marketshare. Kabbage, however, may potentially believe that (1) OnDeck is too undervalued to pass up (2) That OnDeck could generate better margins using Kabbage’s strategy (3) That OnDeck’s partner relationships would add additional value (4) That the company cultures are compatible enough to make an acquisition work (5) that the combined entity would allow them to better align their political and regulatory agendas.

We mustn’t forget however that a single unnamed source is pretty weak to go off of. One possible reason that someone would want to report that OnDeck is an acquisition target is to cause a temporary spike in their stock price. (and I certainly do not have any position in the stock)

For now, it’s fun to think about such an acquisition scenario and we’ll report more, if and when we hear anything.

OnDeck CEO Noah Breslow Talked Tech Worker Shortage in Canada on BloombergTV

March 22, 2017On BloobergTV Canada, OnDeck CEO Noah Breslow explained what he thought the country could do to boost innovation. The discussion stemmed from Canada’s decision to set aside C$800 million over the next four years to carry out that objective.

Breslow said that since Canada has excellent schools, those graduates can be nurtured into forming businesses and creating business investment opportunities. He also said that vocational training towards today’s new working-style job would be beneficial as well, whether it’s jobs for people who can design the latest algorithm or people who can build systems and data centers or can rack servers together.

When asked if perhaps government intervention was not the answer to achieve this, Breslow said that there are two ends of that spectrum, and where he believed intervention could be helpful was in the formation and talent development and formation incubation stage of companies. For later-stage companies, it was probably not appropriate, he said.

Breslow also expressed his belief that a permissive immigration policy is important and that there should be less friction to bring in skilled workers to Canada.

You can watch the full video below to hear the rest:

In This Online Lender’s Earnings Report, Profits, MCAs and Term Loans

March 22, 2017Limited details were offered when Enova, a publicly traded company, acquired The Business Backer (TBB) in June 2015. For one, the Cincinnati Business Courier had the exclusive, which one might not describe as the typical go-to source for online finance news. But TBB was not typical. Based in Blue Ash, Ohio as opposed to New York City or San Francisco, the company had originally focused on offering merchant cash advances before eventually expanding their suite of solutions to include other products.

According to Enova’s earnings report, TBB had been purchased for $26.4 million with an estimated contingent $5.7 million of that being based on future earn-out opportunities. There was a caveat though. If future operating results exceeded expectations, that contingent amount could increase over time, but not beyond where the total consideration paid for the company exceeded $71 million. As of 2016’s year-end, that contingent amount had increased by $3.3 million.

Enova’s report makes several mentions of their merchant cash advance business or as they call them, receivable purchase agreements (RPAs). For the most part, they obscure the financial metrics of this aspect by lumping it in with installment loans. These installment loans are described as “multi-payment unsecured consumer installment loan products in 17 states in the United States and in the United Kingdom and Brazil” with repayment periods of two to sixty months, so yeah, they’re pretty different.

Their RPA customers, however, “average approximately $1.5 million in annual sales and 10 years of operating history while those who obtain an open line of credit account average approximately $450 thousand in annual sales and 7 years of operating history,” the report says. These lines of credit are primarily offered through a business lending subsidiary called Headway Capital.

While companies like Lending Club and OnDeck grab all the headlines, Enova describes itself as a “leading technology and analytics company focused on providing online financial services.” And in 2016, they extended nearly $2.1 billion in credit to borrowers and had a net income of $34.6 million.

On the company’s Q4 earnings call in February, Company CEO David Fisher said, “There currently seems to be a bit of a shakeout occurring in the non-bank small business lending and financing industry. A number of our competitors have either ceased funding or completely shut down over the past several months. From the intelligence we were able to gather, this is largely due to credit issues and their portfolios. As we mentioned last quarter, we have taken a more methodical approach than some to growth for our small business products. And we’re now seeing the benefits of that approach. Recent advantages of our small business book are performing well and the unit economics continue to improve especially as acquisition costs have dropped following the shakeout I just mentioned.”

Enova’s small business financing portfolio only constituted 12% of their loan portfolio at the end of last year. And at $13.70 a share, the company’s current market cap is larger than OnDeck’s.

Prosper Lost A Whopping $119 Million in 2016

March 20, 2017 Prosper might be the online lender for the who’s who of Wall Street these days, but the company still lost $119 million in 2016. To add perspective, Prosper only had $136 million in revenue for the year, meaning that for every dollar it earned it spent almost two. The loss was also more than 4x greater than the loss in 2015 even though the company earned significantly less revenue in 2016.

Prosper might be the online lender for the who’s who of Wall Street these days, but the company still lost $119 million in 2016. To add perspective, Prosper only had $136 million in revenue for the year, meaning that for every dollar it earned it spent almost two. The loss was also more than 4x greater than the loss in 2015 even though the company earned significantly less revenue in 2016.

| Year | Revenue | Profit (Loss) |

| 2012 | $7.6M | ($16.0M) |

| 2013 | $18.3M | ($27.0M) |

| 2014 | $81.3M | ($2.6M) |

| 2015 | $204.2M | ($26.0M) |

| 2016 | $136.0M | ($118.7M) |

General and Administrative was the largest line item expense at $102.7M, which consisted mainly of employee compensation. The second largest expense was Sales and Marketing at $70.1M.

The company originated more than $2.2 billion in loans for the year, down from $3.7 billion last year.

“The decrease in originations we experienced during the year ended December 31, 2016 were primarily driven by a number of our largest investors pausing or significantly reducing their purchases of Borrower Loans beginning in the second quarter of the year,” their earnings report said. “We believe these investors have paused or reduced their investment activity because of an increase in their cost of capital; negative actions and publicity at competitors; and our limited use of investor rebates, which have become more prevalent in the industry.”

To try and correct course, Prosper offered to sell up to 35% of their company to a consortium of Wall Street’s elite who have the right to buy up to $5 billion of their loans over the next 2 years.

WebBank Releases Earnings, Market Valuation

March 20, 2017 WebBank, a Salt Lake City-based bank commonly used by online lenders such as Avant, CAN Capital and Prosper to make loans nationwide, reported year-end figures last week through an SEC filing. The company is 91.2% owned by Steel Partners Holdings L.P (NYSE:SPLP). The bank reported net income of $29.2 million for 2016.

WebBank, a Salt Lake City-based bank commonly used by online lenders such as Avant, CAN Capital and Prosper to make loans nationwide, reported year-end figures last week through an SEC filing. The company is 91.2% owned by Steel Partners Holdings L.P (NYSE:SPLP). The bank reported net income of $29.2 million for 2016.

“Despite significant declines in a number of WebBank’s key programs, caused by capital market disruptions, WebBank successfully added new partners, new products and began holding more assets to maturity in 2016,” the report read.

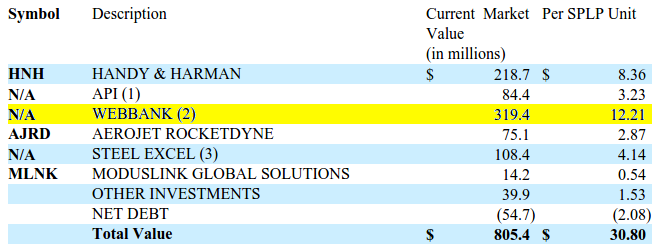

Although Steel Partners also owns businesses in energy, defense, logistics, food products and more, WebBank is its most valuable segment with a market valuation of $319.4 million. That number, according to the release, is 12x the company’s after-tax net income.

Steel Partners got in on WebBank early, making their initial investment in the bank more than 20 years ago in 1996.

“WebBank offers revolving and closed-end credit to consumers and small businesses nationwide, partnering with nonbank finance companies, financial technology platforms, retailers and manufacturers to offer access to WebBank’s products,” the report says.”Revenue is largely derived from these loans, which provide fee and interest income.”