Archive for 2017

Funding Circle is Closing its Forum

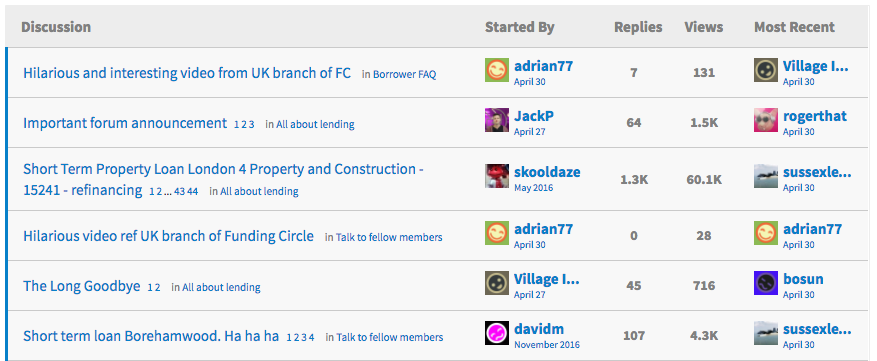

May 1, 2017 One notable remaining aspect of Funding Circle’s peer-to-peer roots has been its own online forum. If you haven’t been part of that community, you’re too late, since it’s shutting down on Tuesday.

One notable remaining aspect of Funding Circle’s peer-to-peer roots has been its own online forum. If you haven’t been part of that community, you’re too late, since it’s shutting down on Tuesday.

According to a forum admin, “there has been a developing trend towards a small number of investors asking questions about a narrow range of technical topics – most of which are better dealt with through our Investor Support team. Therefore we have taken the decision to close the forum at 6pm [UK time] on Tuesday 2nd May. We hope you will all continue sharing your views on Funding Circle over on the P2P Independent Forum, which we will continue to monitor.”

One forum user jokingly theorized that the move was really about silencing investors who use the forum to complain about delinquent borrowers, going so far as to create a humorously custom-captioned movie clip.

According to P2P Finance News, a Funding Circle spokesperson said, “The closure has nothing to do with the performance of Funding Circle property development loans over the last three years which continue to outperform expectations. Investors have earned an average of seven per cent since launch and more than £22m in interest on property loans alone.”

Update 5/2: The Funding Circle Forum has officially been taken down. The URL now just redirects to a general FAQ page

Alternative Lending Is Dead

April 30, 2017At LendIt, Kabbage co-founder & CEO Rob Frohwein, blew the roof off the house with his presentation. Titled, “Alternative lending is dead, long live data,” he explained what he believes the industry should really be about.

On why the term alternative lending doesn’t make sense:

Think about Uber, when they talk about their business. Their tagline is ‘when you don’t feel like taking a taxi.’ They don’t call it alternative transportation at its best

On how most companies have been answering the wrong question:

The question answered by most online lenders is, ‘can you fill the void left by banks?’ I will tell you right now that the question that should’ve been answered by folks going into online lending would be ‘why aren’t banks filling this void?’ When you ask a different question, you get a different answer.

I’m not trying to prove that small businesses need capital. That is blatantly obvious. I’m trying to prove that there is a better way to do it.

Most online lenders tried to disrupt banks by proving they could grow fast and they could acquire capital, but there is only one problem with that approach. You don’t disrupt banks by focusing on the advantage that banks have over you. Banks have customers and money. That is mostly what they have. They have customers and money. So why disrupt the space with the two items that they actually have? The question that should’ve been asked and answered is, ‘why aren’t banks filling this void?’

The answer to that is, because they can’t profitably, for our industry, they can’t profitably serve small business customers. When you ask that question and you figure out the reason, you start building your business a little bit different

On why an online application doesn’t make you a technology company:

Most online lenders thought that by calling themselves a technology company, that they were one, but that wasn’t the case. The biggest piece of technology that most of them promote, is an online application. That’s it. If you think about it, it’s an online application. Everything else is manual. There is nothing, nothing special about an online application.

And outside the US, we’ve already launched in Australia, Spain, the UK, Canada and Mexico. And we’re going to be announcing two other territories in the next several weeks. And by the way, we have no employees in those markets, because we’re able to operate everything remotely because we’re a technology company.

If your business is scaling really fast, and your opex (operating expense) is doing anything but going down, you’re not operating a technology company. Everyone else is flat or up on opex, but we can continue to go down. If you’re running a technology company, you don’t have to lay people off at the slightest hint of trouble and do you know why? Because you don’t have too many employees. Your business scales. Right?

What IOU Financial Revealed in its Earnings Statement

April 29, 20172016 was a weird year for online lenders and IOU Financial, who lends to small businesses, fared no differently. Loan origination volume for the year was $107.5 million, down 26.5% from 2015. Revenues were up due to the company retaining more of their loans on balance sheet but losses were up as well.

Here are the most interesting statistics we found:

- 93% of their loan volume came from brokers

- 15% of merchants in their portfolio were classified as specialty trade contractors and home building renovation

- 14% of merchants in their portfolio are based in Florida (more than New York and New Jersey combined)

- Their borrowers have been in business for an average of 11.4 years

- Their average loan size is $69,695

- Their average loan term is 12 months

- They sold $60.8 million of loan receivables in 2016, down from $137.3 million in 2015

- The company has loaned $415 million to small businesses since inception

- The company had 53 full-time employees at year-end

IOU Financial is the only lender that deBanked is tracking whose stock is down year-to-date. At close on Friday, company shares were down more than 28% for the year.

Elevate Readies Rise for Growth

April 28, 2017 Alternative lender Elevate has hired Tony Leopold for the newly created role of general manager of Rise, the company’s flagship product that is 100 percent online. The addition places Rise in the spotlight ahead of Elevate’s maiden earnings report as a publicly traded company, which is being unveiled in May. Leopold had ambitious plans for Rise, which bodes well for the company’s balance sheet.

Alternative lender Elevate has hired Tony Leopold for the newly created role of general manager of Rise, the company’s flagship product that is 100 percent online. The addition places Rise in the spotlight ahead of Elevate’s maiden earnings report as a publicly traded company, which is being unveiled in May. Leopold had ambitious plans for Rise, which bodes well for the company’s balance sheet.

Before Leopold came on board Jason Harvison, Elevate’s COO, oversaw all of Elevate’s products.

“As Rise has grown and become more complex it starts to become difficult for one person to manage all the moving pieces. It made sense to have a general manager come in and oversee the different parts of the puzzle for Rise,” Leopold told deBanked.

Leopold’s move to Elevate from United Rentals represents his foray into the world of fintech. Prior to that he also had a stint with Bain & Company, experiences from which he fully intends to pull as he steer’s Rise into its next chapter.

“I see a lot of parallels in the way we raise capital and make decisions about how to allocate that capital. The fintech side feels very familiar to me as United Rentals was very capital intensive. My experience at United Rentals will be very useful with Rise in moving it from where it is today to a higher level in the future. It is a playbook that I know very well.”

In his new role, Leopold, who officially came on board in March, oversees decisions that touch Rise and its customers on issues ranging from where he wants interest rates to progress, to value creation for the customer and the company, to customer acquisition. He also leads the charge on the states in which Rise is available and the product strategy in each of those states, which at the moment stands at 15.

And while expansion is on the horizon, Leopold’s near-term focus is on the states in which the product is already offered. “My main priority is making sure we increase share in states that we are already in through customer acquisition and more importantly customer retention. Over time we will add additional states to extend our reach as it makes sense.”

Leopold kept his cards close to his vest on the details, though he pointed to Elevate’s deep bench of talent to increase customer loyalty. “That’s our secret sauce. We have a world class risk analytics team that identifies customers that are a good fit for our product. This gives the customer access to credit that they didn’t have before.”

Rising Up

Elevate in 2015 grew its revenue nearly 60 percent to $434 million, while gross profit in that year came in at $125 million. Shares have climbed 27 percent (as of April 28) since the carefully timed IPO.

“I have responsibility for the P&L results for the Rise product, the flagship product for Elevate. Rise is critical to the overall performance of the company,” said Leopold. “Growth is something that is a priority, and historically this company has not had a problem achieving that. Growth for the sake of growth doesn’t create shareholder value. But as we continue to grow we will do so profitably and responsibly from a credit perspective.”

While Rise is by no means a payday product, its target customer possesses subprime credit. As a result, the interest rates attached to Rise product loans range from 36 percent on the low end to 299 percent. Rates improve to the lower end of that range as customers prove their credit worthiness.

“There are 170 million subprime Americans, customers that often times do not have access to traditional sources of credit such as banks and credit cards. The credit they do have access to in some states can be predatory. While we charge interest rates that are higher than credit-card companies for new customers, we take losses at a higher rate as well. To provide credit and take on higher risk you have to have a higher interest rate. Otherwise we wouldn’t be able to provide credit to customers who need it,” said Leopold.

When Leopold joined United Rentals in 2010, the company had revenue of $2.2 billion and an adjusted EBITDA margin of 31%. When he left, the previous fiscal year United Rentals had $5.8 billion in revenue with adjusted EBITDA margins of 48%.

Elevate reports its first-quarter results on May 8.

Nulook Capital Bankruptcy Envelops PSC

April 27, 2017Nulook Capital was not the only casualty of its April 4th Chapter 11 bankruptcy filing. On Wednesday, April 26th, a federal judge in a separate action issued an order aimed at one of Nulook’s alleged creditors, PSC. PSC is also a Long Island-based company engaged in the merchant cash advance business.

In the order, the Honorable Arthur D. Spatt appointed a receiver for International Professional Services Inc. dba PSC and PSC Financial, granting him exclusive dominion and control over all of their assets, books, records and business affairs.

PSC was originally listed as a creditor in the Nulook bankruptcy with $400,000 owed. Another creditor however, GWG MCA Capital, Inc., argued that PSC had interfered with its first position lien and taken possession of its collateral. Alas, in the suit that GWG brought, the court found the full extent of their arguments compelling enough to appoint a receiver over PSC.

Rough Year? Market Tells Different Story for Alternative Lenders So Far

April 25, 2017 A decent day for OnDeck’s stock on Tuesday was enough to place the company’s share price in positive territory year-to-date, where just about every other public online lender finds themselves as well. According to the new deBanked Tracker, Square is up more than 33% on the year and Yirendai up 19%. Even Lending Club, whose stock is still miles below their IPO price is still up more than 12% in 2017.

A decent day for OnDeck’s stock on Tuesday was enough to place the company’s share price in positive territory year-to-date, where just about every other public online lender finds themselves as well. According to the new deBanked Tracker, Square is up more than 33% on the year and Yirendai up 19%. Even Lending Club, whose stock is still miles below their IPO price is still up more than 12% in 2017.

Meanwhile, Elevate just only went public earlier this month, singlehandedly putting an end to the drought of fintech IPOs. They’re already up 33% from their $6.50 IPO price.

On the publicly traded fund side, Ranger Direct Lending’s YTD struggles stem mainly from their exposure to Argon Credit who is going through bankruptcy. Ranger invested in the Princeton Alternative Income fund who had invested in Argon.

While the deBanked Tracker shows Canadian-listed IOU Financial as significantly underperforming their lending peers, very little volume of the stock trades on a daily basis. A major shareholder of the company however, FinTech Ventures LLLP, shed more than half their holdings of the company last week. As that amounted to nearly 10% of all of IOU’s outstanding shares, the company had to file a document announcing the move.

As an aside, the S&P 500 was up 6.69% YTD by market close on Tuesday and Bitcoin, which doesn’t get as much attention anymore, is up nearly 22% over the same time period.

—

The deBanked Tracker is still in beta and for now is automatically updated once per day after markets close in the US.

Words Matter in Contracts (And everywhere else)

April 25, 2017 The Counselor Library conference powered by law firm Hudson Cook LLP was a big hit in Baltimore this week. While focused on consumer lending, they held a special one-day program on merchant cash advance and small business lending. The topics and discussions were off-limits to press reporting but what was largely visible on the exhibition floor was the Merchant Cash Advance Basics training course.

The Counselor Library conference powered by law firm Hudson Cook LLP was a big hit in Baltimore this week. While focused on consumer lending, they held a special one-day program on merchant cash advance and small business lending. The topics and discussions were off-limits to press reporting but what was largely visible on the exhibition floor was the Merchant Cash Advance Basics training course.

Recent merchant cash advance case law suggests that it is of critical importance for sales reps and underwriters to be knowledgeable of their own products. To be specific, the words you use to communicate with merchants over emails, on the phone and in your contracts should always be consistent and in compliance with applicable laws. What you write on forums and the promises you make in your ads should also pass legal muster.

Even if you consider yourself to be an industry veteran, the Merchant Cash Advance Basics course should refresh your memory on fundamental industry practices. If you are a newcomer, consider Merchant Cash Advance Basics an absolute necessity.

Hudson Cook, LLP has established itself as a leader in the MCA legal arena and we were proud to participate in their event.

SmartBiz Loans Expands Its Footprint With a NorCal Bank

April 25, 2017Technology-based lending platform SmartBiz Loans, which is dedicated to facilitating SBA loans, has expanded its bank roster. SmartBiz announced today a new partnership with Sacramento-based Five Star Bank, bringing the tally of the number of banks on the startup’s platform to five and thrusting marketplace lending into the spotlight once again.

Five Star already delivers SBA loans to customers but through the SmartBiz platform will slash both the time and costs in the underwriting process while reaching new small business customers in the process.

Evan Singer, CEO of SmartBiz Loans, told deBanked that the mindset of the executive team at the Silicon Valley startup has always been to bring banks back into the fold and to incentivize them to fill a void in the market left by the financial crisis by originating smaller loans, in particular SBA loans.

“What we’ve seen in the market is that good businesses cannot get access to low-priced capital if they want to borrow $250,000. So sure, if they want to borrow $5 million they can get access. That’s why we came up with the idea to bring the banks back through fintech,” he said.

Five Star Bank, a privately held bank with $850 million in total assets, is pleased to be among those ranks. James Beckwith, president and CEO of Five Star Bank, was introduced to the SmartBiz technology about a year ago after which time the bank execs began the due diligence process.

“I was intrigued,” Beckwith told deBanked. “We felt the need to somehow play in the space. But we also knew it wasn’t practical for us to develop our own platform. So this was really right in our sweet spot of how we like to partner with people.”

As a result of the partnership Five Star Bank, which makes loans from its own balance sheet, is reaching small business clients the bank did not have access to before.

“Our market presence didn’t allow us to touch a lot of these businesses before, whether from Los Angeles, or Arizona, or San Jose. It’s really people we were unable to touch now being touched through the SmartBiz partnership,” said Beckwith, adding that the small businesses span industry verticals.

“At this point we’re looking at deals in the Western United States and we hope to expand that. The small businesses are really all types – construction companies, PR firms, consulting firms, — there’s no concentration in terms of industry type,” he noted.

The bank’s target customer is seeking a loan for $350,000 or less and the average loan size is $250,000 to $270,000. Terms of an SBA loan on this platform are comprised of a rate of Prime plus 2.75 over a 10-year period.

“The term is much longer and the rate is much lower than traditional loans. Small businesses can save thousands of dollars per month by getting an SBA loan through the SmartBiz and Five Star partnership,” said Singer. In fact, Five Star bank spends about one-tenth of the time on a file or customer originating from SmartBiz than it would on a customer coming from the traditional retail side of their business.

Industry Shakeout

Much of the fallout in the marketplace lending market segment has been tied to the stigma of subprime lending. Beckwith is quick to point out, however, that the underwriting standards for the loans on this platform, which are agreed upon by both Five Star and SmartBiz, are high.

“If you look at some of the average FICO scores we are doing, they are actually good deals. They’re SBA, they’re not subprime deals. I would not characterize them as subprime deals at all,” Beckwith said.

Meanwhile the marketplace lending segment has undoubtedly become more crowded in recent years, attracting the likes of lenders and non-lenders alike, evidenced by the participation of Amazon and Square Capital in this space, for instance.

According to Singer some industry shakeout can be expected in the near term. He expects over the next couple of years that those marketplace lenders and other alternative lenders unable to meet customer demands will either experience a wave of consolidation or they simply won’t be around any longer.

“We are already starting to see a number of our loan proceeds being used to refinance expensive shorter-term debt where they save thousands per month. Businesses are getting smarter with available options and folks that are able to best meet and deliver with small businesses on their minds first are going to come out on top,” said Singer.

SBA 7(a) Cap

As a technology platform dedicated to SBA loans, the issue of the program’s annual allotted cap is something that gets revisited on an ongoing basis. Nonetheless even when the SBA program has come close to suspension, Congress has stepped in to keep it afloat.

“The great thing about SBA is that it has support from both sides of the aisle in D.C. We’ll see what happens this year,” said Singer.

James agrees. “Every year that this becomes an issue the cap has been increased. I feel comfortable that what has happened in the past will happen again in the future because these programs are very viable. The small business space has very strong economic development activity.”

If they’re right this bodes well not only for the Smart Biz and Five Star partnership but also the new banks that the tech-based lender has in its pipeline.

“We are adding banks into the marketplace. And we’re selective about who we add,” Singer said.