Google Culls Online Lenders – Pay or Else?

Can you become one of the biggest or most successful online lenders without Google? A search layout update may be inadvertently culling the herd.

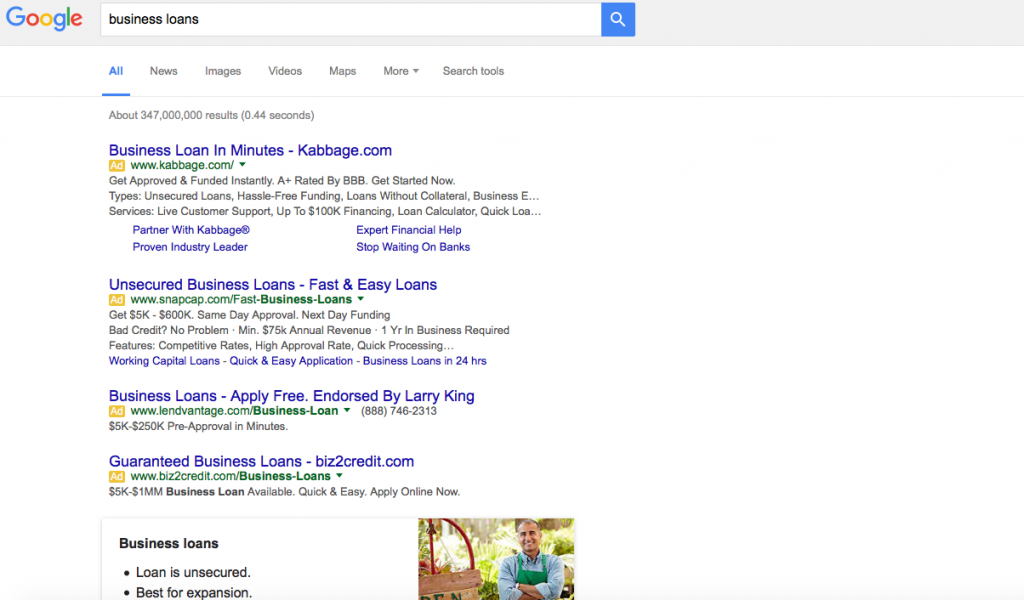

In late February, Google eliminated ads from the right side of the page while adding another layer to the top and bottom. When factoring in features like site links, the effects on organic search has been devastating. Non-paid links are now entirely below the fold for many commercial keywords, which means users may limit their selections entirely to ads. Here’s an example of a full screen browser window on a Macbook Air when searching for Business Loans:

Brad Geddes, a Google Adwords marketing author, expert and consultant, has said the Click-through rate (CTR) on this new 4th ad placement is skyrocketing. “Depending on the keyword, position 4 is going to have a 400%-1000% CTR increase,” he said on Webmaster world. And while side links and bottom links were never a huge factor anyway (less than 15% of click-throughs), Geddes believes a consequence of this change is that fewer ad slots means higher cost bids to rank on the 1st page. “Companies with thin margins are going to have a lot of words fall to page 2,” he wrote.

In summary: Fewer ad placements, higher costs per click, decreased likelihood of organic click-throughs.

And the online lending industry is already feeling the burn. Several funders and ISOs on the commercial side have told deBanked in confidence that the online lead gen battle has been lost or that they have been temporarily sidelined by the increase in costs. At least one funder is refocusing their efforts entirely on the ISO channel after a horrible experience with Pay-Per-Click.

And it’s not just the costs, it’s the quality of leads, they say. The searchers clicking their expensive ads and running up their bills sometimes literally meet none of the qualifications their ads stipulate. Yet many searchers click anyway, rendering the ads’ carefully scripted messages moot. One study might explain why that is. In it, users spent around .764 seconds considering the first paid search result and a total of only 4.5 seconds scanning the first five results. That’s not a whole lot of time to read each ad, digest them and consider whether or not there’s an appropriate fit.

And it’s not just the costs, it’s the quality of leads, they say. The searchers clicking their expensive ads and running up their bills sometimes literally meet none of the qualifications their ads stipulate. Yet many searchers click anyway, rendering the ads’ carefully scripted messages moot. One study might explain why that is. In it, users spent around .764 seconds considering the first paid search result and a total of only 4.5 seconds scanning the first five results. That’s not a whole lot of time to read each ad, digest them and consider whether or not there’s an appropriate fit.

On one industry forum, ISOs have reported that the cost of acquiring a merchant cash advance or business loan deal from Pay-Per-Click is ranging from $700 to $1,200. “PPC for premium keywords as high as $40 at times. Ugly. Real ugly,” one user wrote. Another user wrote, “It’s not just Adwords that is saturated. The whole market is saturated. Lenders and the onslaught of new brokers are making it tough. Lenders with programs like Funding Circle and Kabbage, and with all the advertising money in the world to burn and get direct traffic.” And still another believes that online ads are simply inviting the lowest hanging fruit. “Internet leads have the highest level of fraud,” said one sales manager.

Notably, many of the top 8 funders are only competing for a limited number of competitive keywords or may not even be running Adwords at all. PayPal and Square for example, focus only on their existing payment processing customers despite being “online lenders.”

It’s too early to tell what effects Google’s ad changes will have on the online lending industry, though a couple of companies who were paying just enough to extract clicks from side ads have indicated the change is for the worse and they have suspended their campaigns.

The natural alternative to paid search, organic search, is seldom discussed anymore as a realistic strategy these days, in part because the rankings might be rigged anyway.

One irony that’s pervasive in the online lending industry is that borrowers are being targeted offline where it’s potentially more affordable. In a discussion thread that garnered 76 posts last fall, ISOs and funders suggested that direct mail, referrals, UCCs, cold calling, radio and even going out and shaking hands, were pegged as “what’s next” for marketing. Pay-Per-Click was only mentioned once and only in the context of it being something that had long ago been made too expensive for small and mid-size companies.

The cost of making these things work might be why so many funders are hoping that brokers can figure it out. “We decided that the best way to grow is to build relationships to avoid the overhead, compliance, training and manpower that a sales team would require,” said Nulook Capital’s Jordan Feinstein in an interview with deBanked last month.

With Google becoming even more competitive now though, perhaps United Capital Source’s Jared Weitz summed it up best. “Marketing is getting more expensive and only the ones who can afford to pay can play,” Weitz said.

Last modified: March 15, 2016Sean Murray is the President and Chief Editor of deBanked and the founder of the Broker Fair Conference. Connect with me on LinkedIn or follow me on twitter. You can view all future deBanked events here.