Small Business

The Inefficient Merchant Lending Market Theory

March 5, 2013There are 4 major factors used to determine approvals in the merchant lending market:

• FICO Score / Credit Report history of owners

• Monthly Gross Revenue

• Time in Business

• Average Daily Bank Balance

Only 1 of these factors considers the applicant’s reputation, and that’s credit reports. Credit reports reveal past payment history with other creditors. They show lawsuits, unpaid taxes, and bankruptcies. Knowing whether an applicant pays on time or not is valuable to lenders but it fails to reveal an even more important metric, the business’s ability to generate future profits. If you’re shaking your head and saying “credit reports aren’t for that purpose,” I would respond by asking which of the 4 factors then is?

The amount of money deposited in someone’s bank account in the past reveals how much they took in, but it doesn’t indicate what will happen in the future. Similarly, a substantial daily ending bank balance may show responsibility to maintain a cash cushion, but it says nothing about how likely customers are to buy from that business in the future.

Could time in business then tell us? Is it safe to assume that a business that has been operational for a year, two years, or five years will be there for many more years to come? The local auto mechanic that’s been around for 5 years may only have lasted because no one else has gotten around to opening up a rival auto shop. Would it be safe to give the most hated mechanic in town a three year loan when their success is simply the result of being the only auto mechanic in the community? There may be somewhat of a correlation between time in business and customer satisfaction but it is by no means strong enough to predict future success.

In effect, the major metrics used to judge small businesses for financing today take no consideration of the number one thing that matters to a business for survival, customers. Without customers, the amount deposited historically means nothing. Without customers, a 700 FICO score cannot produce sales, profits, or money to repay a loan. Without customers, a 50 year old restaurant can’t continue to stay open just because it’s been there for 50 years. And without customers you better hope that $1 million in sales last year made you really rich, since without customers, you’re going to need to start a new business… preferably one WITH customers.

This doesn’t mean that these 4 factors are irrelevant, they’re not. But I believe these factors combined are but a tiny sliver of data to predict how well a business will do in the future and at the same time repay a loan. Relying on weak indicators forces lenders to charge higher rates since they must compensate for the risk of unknowns. It also decreases the length of time that lenders can trust their borrowers to hold their money for.

It is no surprise then that loan terms in the merchant lending industry only range from 3 to 12 months. None of the lenders are able to predict how their borrowers are going to do far into the future, so they bank on the odds that sales and deposits in the next few months will mimic sales and deposits in the last few months. That’s also the reason why there are a lot of test/starter/trial funding rounds that are short to witness how a merchant “does” before funding additional capital on a longer term. Underwriters are flying blind. They have to see how you do because they have no data to suggest what will happen.

The big firms do have SOME data by now, but they’re broad statistics that say a certain industry in a certain region is likely to perform X with a Y margin of error. Or FICO scores below 600 are likely to have a Z rate of default. Yet this data also ignores a business’s reputation and relationship with its customers. It applies a blanket assumption of performance over the period of 3 to 12 months. These statistics are highly important to a lender because they can use them to predict defaults and delinquencies as a whole and enable them to set rates that will cover all of it and then some.

The big firms do have SOME data by now, but they’re broad statistics that say a certain industry in a certain region is likely to perform X with a Y margin of error. Or FICO scores below 600 are likely to have a Z rate of default. Yet this data also ignores a business’s reputation and relationship with its customers. It applies a blanket assumption of performance over the period of 3 to 12 months. These statistics are highly important to a lender because they can use them to predict defaults and delinquencies as a whole and enable them to set rates that will cover all of it and then some.

The owner of an ISO once asked me, “Wouldn’t it be great if we got to the point where we were funding every business in America?” My answer was “No.” If 10, 20, or 30% of those businesses failed to repay or eventually went out of business (and they would if you funded everyone) and the lender STILL made money, then the ones in good standing had to of gotten charged way too much. It would also mean that there had to be a portion of performing loans that were actually distressing the borrower, causing the capital they obtained to work against them, rather than for them. The goal shouldn’t be to fund EVERYONE, but rather to fund the few that could truly benefit.

A great example of doing it wrong is Wonga, a UK based lender that accepted a 41% rate of bad debt in 2011 while still managing to reap £62.4 million in profit. If Wonga had a few hundred bucks, a few thousand bucks, or heck only a million, they’d probably be very careful about who they approved and why they approved them. But venture capital changes the game and not always in a positive way. Putting a few hundred million dollars in the hands of Wonga has caused them to become incredibly inefficient.

Why should they only fund 5,000 people through a highly comprehensive underwriting process when they can fund 30,000 people with a one-size fits all rate, ask no questions, and accept that they will burn a lot of their customers along the way? This is the question they must have asked themselves years ago. (You can read the founder’s interview HERE)

At some point when they were developing their business model they had to admit that they really didn’t care what the outcome would be for their borrowers, so long as the business made money. And so they created an algorithm that would statistically predict the rate of default based on weak indicators like demographics, how they answered a few questions, and credit score and the resulting delinquencies were just necessary casualties to make the system work. In essence, Wonga knows they will devastate a portion of their customers and accepts this. They’re like a restaurant that only sells sugar frosted donut cheese ice cream to obese people and accepts that 41% of their revenues will be lost due to their customers dying. Can a lender truly be helping a community or economy where it intentionally hurts a percentage of borrowers because it’s still profitable at the end of the day? Do their contests, soccer sponsorships, and positive messaging on social media make up for their disruption to the economy?

Wonga’s mission is to grab market share, a strategy to make holy their blanket performance statistics and the rate that has to be charged to make money. Every single individual in the country becomes a candidate for their loans even though the lender will never know anything about the individual borrowers, their long term prospects, or what they can afford. The math says it doesn’t matter because an acceptable amount of the loans will perform and applicants can either accept the high rate or get nothing.

How I portray Wonga is not what I think of the merchant lending market in the US but rather I believe they’re a good example of the trap that merchant lenders COULD fall into if they come into too much money. When I first began to hear lenders fresh off a capital raise saying they wanted to fund the sh*t out of small business and would do anything in their power to fund as many deals as possible, I fear they could end up disrupting communities more than they could help them.

You know that thing called the Internet?

You know that thing called the Internet?

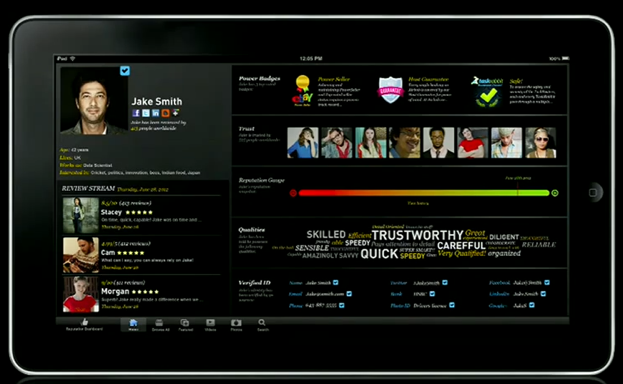

So I’ve talked a lot about what lenders don’t know but nothing about what they can learn. There is an unbelievable amount of free data available on the web that can collectively be used as a strong indicator of future business performance. You know those all important customers I spoke about earlier? The ones that make a business a business? Well lucky for us, they seem to go online and offer feedback about their experiences. Yelp, Zagat, and Facebook come to mind.

How is a business REALLY doing? Reviews will tell you a lot so long as there are enough of them, and not just the star meter, but the actual written reviews. I assure you that it will help a lender if they see that the last 10 reviews say that the owner is a no good lying crook that stopped paying his employees and punched a customer just the other night. A business’s whole reputation can’t be assessed from paperwork and credit scores, but it can be by hearing from people in the local community. That community is online.

That brings me to another point here. If a small business isn’t online, then no faith should be put in that small business in 2013. I don’t know why there are still so many small businesses out there that don’t use e-mail, don’t have a website, and don’t participate on social networks. Unless their shtick is that they are an Amish style operation striving for authenticity, then not being online should be an indicator that they do not care much about their long-term success. I would go so far as to say that any business that does not have at least a website, business fan page on Facebook, twitter account, or a reasonable substitute should be automatically declined for financing. Yeah, I said it!

In 2013, ignoring the Internet is like opening a store with no sign, boarding up the windows, and surrounding the front door with barbed wire. Sure, the locals might know you’re there and be smart enough to come in the back door, and maybe they’re enough to keep your business stable but no one else will find you and the ones that do, will see that you have no interest in being something more. You don’t have to be on every social network but if you’re not on any, you’re doing something wrong. Ideally, you should be somewhat active with your customers online too. This doesn’t mean sending each person that dined at a restaurant a Thank-You e-mail, but it does mean addressing complaints if there are any, posting announcements so customers can see them, and taking steps to improve your reputation.

There are many, many trust and reputation signals online. At the most recent TED Conference, Rachel Botsman talked about collaborative consumption, trust, and reputation. She believes that trust is the most vital currency in our economy, not the money in your bank account, but trust. I highly recommend you watch it below. You should definitely take notice of what may eventually become a reality, an individual’s reputation scorecard, a report that aggregates reviews from everyone you’ve ever had an exchange with, and one that has the ability to evaluate the transactions which have the most meaning. My stellar e-bay seller record going back to 1999 might be on there (72 rave reviews baby!) but they won’t be as important if you’re looking to determine how credible I am as a business lending analyst. Still, in the grand scheme of reputation, they could have their place if someone wanted to gauge how trustworthy I am to deliver on something I agreed to.

Release the darn data

You want to know who is holding out on making the merchant lending industry and American economy a better place? The North American Merchant Advance Association (NAMAA) is. NAMAA possesses a database of every merchant that has defaulted or gone delinquent with a funding member in the last 4 years. There’s thousands of names in it. Not a member of NAMAA? You won’t get to know if a merchant has tried some funny stuff with another funder or gone out of business while having an advance.

But you want to know who this private bank of data hurts most? It hurts every business and wholesaler these merchants work with in the future. A month after a retail store fraudulently skips out on a $100,000 advance, that same retailer could apply for 60 day terms with a supplier and sign a 5 year lease for a new business location. Don’t that supplier and landlord deserve to know that their “awesome” new client has a reputation for committing theft and fraud as recent as 30 days ago? I think it’s our duty to let them know. NAMAA is withholding information that could prevent a lot of unreputable people from doing further harm in local economies. Make this data public and we’ll allow suppliers, landlords, and other lenders to make more informed decisions.

But you want to know who this private bank of data hurts most? It hurts every business and wholesaler these merchants work with in the future. A month after a retail store fraudulently skips out on a $100,000 advance, that same retailer could apply for 60 day terms with a supplier and sign a 5 year lease for a new business location. Don’t that supplier and landlord deserve to know that their “awesome” new client has a reputation for committing theft and fraud as recent as 30 days ago? I think it’s our duty to let them know. NAMAA is withholding information that could prevent a lot of unreputable people from doing further harm in local economies. Make this data public and we’ll allow suppliers, landlords, and other lenders to make more informed decisions.

I’ve heard the argument that privacy can be a big selling point to borrowers. They don’t necessarily want outsiders to know that they borrowed money or to suffer the shame if they don’t pay it back. I can understand the benefits of privacy from a competitive standpoint for a borrower but it defies all logic and reason for a lender to keep a default under tight wraps. Public record of a default discourages borrowers from defaulting in the first place and is helpful to everyone that may interact with that borrower in some way in the future. How many merchants would reconsider signing on the dotted line for $50,000 if they knew a default meant the lender would personally message all of their fans on Facebook to tell them about it? Is this wrong? Is this any of the customers business? What if their customers were paying for services 12 weeks in advance? Would their customers have the same confidence that their service would be rendered knowing this new information? It is likely that some customers would view a default as a sign that the business cannot deliver on their promises and reconsider using them. By not letting them know, you are putting them all at risk of paying for services they might not get.

Even though everyone hates me, I project 300% growth!

Show an underwriter a chart of sales projections for the next two years and they’ll have no idea if it’s just wishful thinking. All the demographic research in the world won’t convince the bank that people will trust your product. Show an underwriter that 50, 100, or a thousand people are saying positive things about their experience with you online, and they might believe you’re on to something. Time in business, cash flow, profitability, and positive credit history show what someone did and what they have, but reputation and trust reveal what someone’s success in the future will be like.

It’s not just what they say about you

Your reputation goes beyond just what people are saying about you. At some point, you’ll talk back and what you say can clue lenders into who you are and what you are doing. I’ve caught a few business announcements on Facebook that went something like “To our loyal customers, we are making a last ditch effort to get a merchant cash advance to pay off our landlord by Friday and keep the business open. If it does not happen, then we want to thank you all for your support over the years as we will close for good.” Yeah, it’s interesting to see things like this after you just had a 15 minute conversation with that same person that claimed the funds would be used for a marketing campaign.

With hundreds of millions of dollars burning a hole in their pocket, a lender may be tempted to take the Wonga approach. I guarantee Wonga would say I wasted my time by examining a business owner’s social interactions. They’d say there were statistics and data that show they should fund that business anyway because the FICO score and sales volume are within their parameters, that defaults were acceptable and built into the numbers, and that funding as many businesses as fast as you can above a certain interest rate, is better than funding fewer businesses with more appropriate terms.

This is the premise of my inefficient merchant lending hypothesis for lenders that get real sloppy when they have too much money. Would you rather be a lender that charges more, funds more, and knows less about your borrowers or would you rather charge less, fund more intelligently, and know more about who you’re funding? The first road accepts that you will outright devastate a percentage of your customers, disrupt local economies, and leave a bad taste in the mouth of a handful of people. It might be profitable, but could you really claim to be a helper of small business?

When you fund EVERYONE, businesses with bad reputations can knock out competitors with good reputations, the cost of debt can harm more than it helps, or lenders can get skinned alive by defaults they never saw coming. We need to be aware that there are consequences to backing a business with a bad reputation because it can allow them to squeeze out the guys that would’ve actually had the most positive impact on a community. The counter argument may be the theory by the philosopher Adam Smith, a gentleman famous for promoting economic principles such that the pursuit of self-interest promotes the good of society. By this standard, if it’s good for the lender, then ultimately it must be good for the economy. However, allowing yourself to devastate a percentage of your customers isn’t good for the lender’s reputation even if it’s profitable. In a sense, pursuing immediate profit doesn’t mean pursuing ones self-interest. It may be months or years before enough unsatisfied borrowers begin to affect your reputation as a whole. Eventually, public opinion will sway. It’s happening to Wonga right now. If a lender’s business practices today could force them out of business in 5 years, then they are not pursuing their self-interest.

When you fund EVERYONE, businesses with bad reputations can knock out competitors with good reputations, the cost of debt can harm more than it helps, or lenders can get skinned alive by defaults they never saw coming. We need to be aware that there are consequences to backing a business with a bad reputation because it can allow them to squeeze out the guys that would’ve actually had the most positive impact on a community. The counter argument may be the theory by the philosopher Adam Smith, a gentleman famous for promoting economic principles such that the pursuit of self-interest promotes the good of society. By this standard, if it’s good for the lender, then ultimately it must be good for the economy. However, allowing yourself to devastate a percentage of your customers isn’t good for the lender’s reputation even if it’s profitable. In a sense, pursuing immediate profit doesn’t mean pursuing ones self-interest. It may be months or years before enough unsatisfied borrowers begin to affect your reputation as a whole. Eventually, public opinion will sway. It’s happening to Wonga right now. If a lender’s business practices today could force them out of business in 5 years, then they are not pursuing their self-interest.

Real predictions, not just hoping tomorrow’s financial standing will be the same as it was yesterday

I look forward to the day when a merchant lender announces a 3, 5, or 7 year program. Their underwriting analysis would have to be incredibly well thought out, but that’s not a bad thing. Borrowers shouldn’t be forced to choose between an 8 month loan and a 9 month loan because so few lenders are willing to make real long-term projections. A business might make good use of short term financing to pay for an aggressive marketing campaign, but the likelihood that they could “open a 2nd store” and pay back all of the money with interest in 4 months isn’t very good.

My advice to the merchant lenders that are flexing their hundred million dollar muscles right now? Don’t carpet bomb the entire country with loans and hope that a one-size fits all rate and term will have a positive impact on the economy. It won’t. Writing off a portion of your customers today as collateral damage will hurt your reputation in the long run. Some businesses shouldn’t be getting funded even if they have money in the bank and a history of revenue. Others can’t sustain such short term repayments. These things should matter not just in the context of how much it will impact profits, but how much it will impact communities.

Incorporating factors like trust and reputation don’t have to slow the application process down. There are technologies to help aggregate, sort, and make sense of these signals online. Automation and speed are good but the day that lenders stop caring about who they’re funding and why they’re funding them is the day that lending becomes inefficient. When it becomes purely a numbers game, we’ll be in bubble territory. Can you think of any other industries where lenders stopped considering whether or not the loans were good for their borrowers and played the numbers? I’m sure you can 😉

Incorporating factors like trust and reputation don’t have to slow the application process down. There are technologies to help aggregate, sort, and make sense of these signals online. Automation and speed are good but the day that lenders stop caring about who they’re funding and why they’re funding them is the day that lending becomes inefficient. When it becomes purely a numbers game, we’ll be in bubble territory. Can you think of any other industries where lenders stopped considering whether or not the loans were good for their borrowers and played the numbers? I’m sure you can 😉

Lend efficiently, be a good citizen, and don’t be afraid to place a value on what customers are saying about your applicants.

– Merchant Processing Resource

https://debanked.com

MPR.mobi on iPhone, iPad, and Android

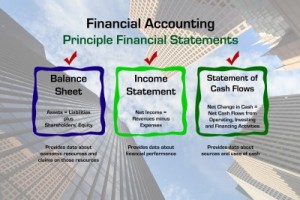

The Financial Statement Problem

February 26, 2013The Banks Know When You Don’t Keep Track

In the land of underwriting, sometimes Assets do not equal Liabilities + Equity. This only happens of course when a Balance sheet is prepared so poorly that it doesn’t even do the fundamental thing, balance… and I’ve seen plenty of these in my career.

I’ve hung around enough small business owners to know that 99% of their time is spent running the business, not maintaining a general ledger. I get that operational duties bring in the cash and pay the bills, and that the books are something that spawn into existence on April 15th just to satisfy the tax man. I know that feeling, but that routine hurts in the long run especially when it comes time to apply for financing.

I’ve hung around enough small business owners to know that 99% of their time is spent running the business, not maintaining a general ledger. I get that operational duties bring in the cash and pay the bills, and that the books are something that spawn into existence on April 15th just to satisfy the tax man. I know that feeling, but that routine hurts in the long run especially when it comes time to apply for financing.

So what is a small business to expect when submitting financial documents for a loan approval?

5 out of 5 bank executives interviewed by Nerdwallet.com complained that too many small business owners don’t keep financial records, rarely update them, or only worry about them during tax season. Their advice? Hire a full-time financial professional. For a small business, this might mean being forced to sacrifice a chef, mechanic, or manager. The trade-off might not be worth it.

The merchant lending industry is a lot more forgiving when it comes to submitting documents. Deals under $100,000 may not require any financial statements at all. Yes, there are options out there specifically for the man or woman that chose a chef over an accountant, but that doesn’t mean they’re encouraging poor record keeping ways, nor does it mean they are blind to bad business practices.

Unfortunately, over the course of many years, advertising that basically anyone can get approved with no financial statements and less than stellar credit history has caused people to let their guard down. The attitude is often, “the lenders don’t seem to care, so why should I take this seriously?” This mindset couldn’t be more detrimental to your approval chances. The CEO of New Resource Bank in his interview with Nerdwallet said, “A lender will judge you based on how you fill out your documents.” The same applies in merchant lending. In my experience, I’d estimate that about 20%-30% of small business owners submitted documentation with at least half the pages missing. I’d receive only the odd numbered pages or I’d get the bank statements for the strong months but none for the bad months even if they were the most recent. Strangest of all were the applicants that sent in only the first page of each statement as if showing the deposit figures for the month were somehow supposed to be comprehensive enough to analyze cash flow. The more disorganized the paperwork, the less credibility the applicant had in the mind of those judging them.

Unfortunately, over the course of many years, advertising that basically anyone can get approved with no financial statements and less than stellar credit history has caused people to let their guard down. The attitude is often, “the lenders don’t seem to care, so why should I take this seriously?” This mindset couldn’t be more detrimental to your approval chances. The CEO of New Resource Bank in his interview with Nerdwallet said, “A lender will judge you based on how you fill out your documents.” The same applies in merchant lending. In my experience, I’d estimate that about 20%-30% of small business owners submitted documentation with at least half the pages missing. I’d receive only the odd numbered pages or I’d get the bank statements for the strong months but none for the bad months even if they were the most recent. Strangest of all were the applicants that sent in only the first page of each statement as if showing the deposit figures for the month were somehow supposed to be comprehensive enough to analyze cash flow. The more disorganized the paperwork, the less credibility the applicant had in the mind of those judging them.

Believe me when I say that there is no lender in the world that is going to be confident in approving a pile of crap, no matter how easy they advertise the approval process is.

My advice? If you can’t make time to organize your books regularly or hire a financial professional, at least build it in to your plans to do it in the future. Bank financing may be out of the question in the interim, but that doesn’t mean you are out of options. Merchant lenders, like the ones listed in our directory can help you. Just make sure you take the the application process seriously. Approving loans without financial statements may make these lenders more open to risk, but they know a bad deal when they see one. Be honest, open, and submit well prepared documentation. That’s the best way to maximize your chances.

Your Life or Your Bank Statements

February 20, 2013“Um, I don’t feel comfortable sending them to you because they’re private.” One of the most interesting things I experienced as a broker and underwriter is the amount of times I heard merchants tell me their bank statements were too private to send in. I understand it’s not exactly the same thing as telling someone your phone number, but if you’re applying for a loan or intend to sell your future receivables, this doesn’t really cross the line as being too personal.

Let’s be honest here, there’s plenty of folks who get defensive over this simply because they’re overdrawn and they don’t want the lender to see it. I’ve heard every trick in the book, “the last 2 months statements are lost and my bank refuses to send me copies”, “I switched bank accounts yesterday and my old bank won’t send me my previous statements now”, or “I’ll send them over as soon as I have 100% final approval on the loan.” These excuses won’t work and they set off red flags with underwriters. Besides, if you lie about something during the application process and then proceed to sign a guarantee on the loan agreement that you’ve disclosed EVERYTHING, then you’ve already placed yourself in breach of contract or worse, you’ve committed fraud.

Let’s be honest here, there’s plenty of folks who get defensive over this simply because they’re overdrawn and they don’t want the lender to see it. I’ve heard every trick in the book, “the last 2 months statements are lost and my bank refuses to send me copies”, “I switched bank accounts yesterday and my old bank won’t send me my previous statements now”, or “I’ll send them over as soon as I have 100% final approval on the loan.” These excuses won’t work and they set off red flags with underwriters. Besides, if you lie about something during the application process and then proceed to sign a guarantee on the loan agreement that you’ve disclosed EVERYTHING, then you’ve already placed yourself in breach of contract or worse, you’ve committed fraud.

But on the flip side, just as many applicants are worried that submitting their bank statements could lead to identity theft. Maybe there is a slight chance it does, but probably only if you’re sending them to someone that already has all of your other identifying information like your social security number. That’s the “interesting” part I spoke of earlier because few people flinch when filling out their social security number on the application. Don’t get me wrong, I’m not trying to induce worry in businesses that want money. What am I trying to say is that waiting until late in the application process to do research on the lender or broker is too late. You need to be 100% confident in the recipient of your personal information before you even fill out the preliminary application on the first day.

When it comes to identify theft, Your social security number, name, address, and date of birth is really all it takes for you to be fully compromised. The rebuttal on the bank statements is always “But I don’t want someone to know my bank account number because then they might try to take money out of it.” Really? Have you ever written a check to someone? Have you ever signed up for direct deposit? Have you ever seen a waste basket full of bank receipts next to an ATM machine? I hate to say it but your bank account information is already public and you probably give it out to people on a daily or weekly basis. Routing numbers are shouted from the rooftops and you can see that for yourself at routingnumbers.org. If someone is going to try to debit money out of your account, your bank statements aren’t really necessary. It’s sad, but it’s true. Financial institutions review and audit businesses that debit their customers, but sometimes bad guys slip through the cracks. Generally if an unauthorized debit does happen, you are not liable for the loss. According to FTC.gov:

When it comes to identify theft, Your social security number, name, address, and date of birth is really all it takes for you to be fully compromised. The rebuttal on the bank statements is always “But I don’t want someone to know my bank account number because then they might try to take money out of it.” Really? Have you ever written a check to someone? Have you ever signed up for direct deposit? Have you ever seen a waste basket full of bank receipts next to an ATM machine? I hate to say it but your bank account information is already public and you probably give it out to people on a daily or weekly basis. Routing numbers are shouted from the rooftops and you can see that for yourself at routingnumbers.org. If someone is going to try to debit money out of your account, your bank statements aren’t really necessary. It’s sad, but it’s true. Financial institutions review and audit businesses that debit their customers, but sometimes bad guys slip through the cracks. Generally if an unauthorized debit does happen, you are not liable for the loss. According to FTC.gov:

Since December 31, 1995, a seller or telemarketer is required by law to obtain your verifiable authorization to obtain payment from your bank account. That means whoever takes your bank account information over the phone must have your express permission to debit your account, and must use one of three ways to get it. The person must tell you that money will be taken from your bank account. If you authorize payment of money from your bank account, they must then get your written authorization, tape record your authorization, or send you a written confirmation before debiting your bank account. If they tape record your authorization, they must disclose, and you must receive, the following information:

The date of the demand draft;

The amount of the draft(s);

The payor’s (who will receive your money) name;

The number of draft payments (if more than one);

A telephone number that you can call during normal business hours; and

The date that you are giving your oral authorization.If a seller or telemarketer uses written confirmation to verify your authorization, they must give you all the information required for a tape recorded authorization and tell you in the confirmation notice the refund procedure you can use to dispute the accuracy of the confirmation and receive a refund.

In the event these rules are violated and a debit happens anyway, the FTC advises this:

If telemarketers cause money to be taken from your bank account without your knowledge or authorization, they have violated the law. If you receive a written confirmation notice that does not accurately represent your understanding of the sale, follow the refund procedures that should have been provided and request a refund of your money. If you do not receive a refund, it’s against the law. If you believe you have been a victim of fraud, contact your bank immediately. Tell the bank that you did not okay the debit and that you want to prevent further debiting. You also should contact your state Attorney General. Depending on the timing and the circumstances, you may be able to get your money back.

It’s important that you know these rules, but it’s twice as important to do a background check on the financial service company before you send them ANYTHING. Your social security number is your crown jewel. Be smart about who you send it to. And as for your mysteriously missing January bank statement? There’s a pretty good chance your story about where it went or why it’s never coming back isn’t going to work. Good luck and safe funding!

– Merchant Processing Resource

https://debanked.com

MPR.mobi on iPhone, iPad, and Android

Where’s the Reserve?

February 15, 2013 5 years ago it was merchant account sales. These days it’s all about the average daily ending balance in the business bank account. As the alternative business lending industry evolved, so too did the criteria to qualify, and nothing is more important now than historical cash flow. I spent a lot of time underwriting MCAs and one thing I noticed is that having a significant cash reserve is the exception, not the rule. Many small business owners I’ve encountered rely on overdraft protection just to pay their bills instead of using it as a backup cushion for the extremely rare circumstance that a check clears at the wrong time. The applicants with $1,000, $5,000 or $10,000 in daily reserves are treated very favorably in underwriting because heck, they can probably afford to take on debt. And then there’s the business owners with $20,000, $30,000 or $50,000 stashed away in the business account, a curious rarity that can actually throw up red flags.

5 years ago it was merchant account sales. These days it’s all about the average daily ending balance in the business bank account. As the alternative business lending industry evolved, so too did the criteria to qualify, and nothing is more important now than historical cash flow. I spent a lot of time underwriting MCAs and one thing I noticed is that having a significant cash reserve is the exception, not the rule. Many small business owners I’ve encountered rely on overdraft protection just to pay their bills instead of using it as a backup cushion for the extremely rare circumstance that a check clears at the wrong time. The applicants with $1,000, $5,000 or $10,000 in daily reserves are treated very favorably in underwriting because heck, they can probably afford to take on debt. And then there’s the business owners with $20,000, $30,000 or $50,000 stashed away in the business account, a curious rarity that can actually throw up red flags.

“Why is this merchant applying for capital when they’ve got $30,000 sitting in the account right now? Something doesn’t add up here,” an underwriter might say. But the only thing that doesn’t add up is the fact that so many businesses are running on fumes. We’ve got a few small business owners writing about matters from their perspective on The Frontline, and we took great interest in something written by Chef Angela Bell. As a restaurant owner, she believes it is important to keep a cash reserve equal to a minimum of 3 months expenses. Depending on the size of the restaurant and seasonality, that reserve may need to be able to cover an entire year. This includes rent and salaries!

It seems in practice, this rule is constantly violated. Maybe holding on to extra cash hurts the competitive edge, maybe a cash reserve existed but was consumed during an emergency, or maybe the business just isn’t doing that great. There are a lot of possibilities to explain the disappearance of cash reserves, and I’m not faulting the businesses for being in this situation, but rather pointing out that in my experience, money seems to go out as fast as it comes in.

This isn’t a 2013 problem or a financial crisis problem. It’s a small business problem and one that has been around for decades. It’s why the purchase of future credit cards spawned into existence. The original Merchant Cash Advance (MCA) program wasn’t created to help people with poor credit, it was designed to help the businesses that had no cash reserves. If a business has $2,000 in deposits every day but also $2,000 in withdrawals, there’s a good chance a debt payment will bounce. Even with 750 credit, no bank would ever take the risk on a business like that, and that’s where MCA came in. Assuming the business’s plans were sound, an MCA funder would withhold a percentage of merchant account sales before they were even transferred to the business’s bank account. That eliminated the risk of bounced checks for the funder and put the burden of operating on tight cash flow on the small business. Funders then reduced the strain by withholding less in times of weak sales and more in times of strong sales. The percentage system was the bridge to ensure the relationship was not predatory.

I’ve heard the frustrated replies from a business owner that was declined for weak or negative balances. They often sound something like this “Well, if I had cash I wouldn’t be needing a loan from you now would I?!” I feel for these people, I really do, but their approach to debt is misguided. Debt is not something you take on when you are out of money so you can continue business as usual. Debt is for growth or to be used as a temporary cash flow measure. Banks approve applicants that don’t need money because those that NEED IT are more likely to default.

I’ve heard the frustrated replies from a business owner that was declined for weak or negative balances. They often sound something like this “Well, if I had cash I wouldn’t be needing a loan from you now would I?!” I feel for these people, I really do, but their approach to debt is misguided. Debt is not something you take on when you are out of money so you can continue business as usual. Debt is for growth or to be used as a temporary cash flow measure. Banks approve applicants that don’t need money because those that NEED IT are more likely to default.

MCA was the good faith option for small business owners that cried foul over the banks that wouldn’t lend to them. How could there be NOBODY willing to take a chance on them? And so MCA funding companies came along and did what the masses demanded, but at a cost to compensate them for the significant risk.

Today, there is high demand for merchant loans, loans that are evaluated based on a daily average bank balance and monthly revenue. Many people will get less than they want and others should consider traditional MCA instead. Those few that are at the breaking point and believe a loan will allow them to pay past due bills and keep them afloat are better off not applying at all. And for the rest that are contemplating using the $50,000 cash reserve they built up to expand should seriously consider financing instead to protect their cushion as best they can.

Tomorrow, the health inspector could close your doors, vandals could destroy your valuable assets, or the town could perform massively disruptive construction right outside the front steps that cripples sales for months. If you’re running on fumes, you’ll run out of gas. Always keep the cash reserve tank full and nobody will be able to stop you.

– Merchant Processing Resource

https://debanked.com

MPR.mobi on iPhone, iPad, and Android

Letters from the Frontline

February 12, 2013 I’ve worked in the alternative business lending industry for quite a while and I’ve noticed something off about many of the marketing campaigns. Some lenders have gotten so caught up in the funding that they’re losing sight of what it’s like to run a small business. Admit it, we’re all a little rusty even if we were once small business owners ourselves.

I’ve worked in the alternative business lending industry for quite a while and I’ve noticed something off about many of the marketing campaigns. Some lenders have gotten so caught up in the funding that they’re losing sight of what it’s like to run a small business. Admit it, we’re all a little rusty even if we were once small business owners ourselves.

I started working as a deli clerk when I was 15 years old and continued to do it part time until my senior year of college when I began waiting tables at a restaurant instead. I could definitely tell you a few things about the daily grind and the epic drama that happens in the back of the house on a Friday night, but it’s been a while since I lived it.

But don’t you own a small business now? Yes, I do. I’ve been a part of two successful Merchant Cash Advance start-ups and I went off on my own full-time near the end of 2011. These days I have vendors, invoices, customers, contractors, accountants, and lawyers to deal with. I have monthly financials to reconcile, servers to monitor, and office rent to pay. But let’s be honest, my experience doesn’t really translate if I’m on the phone with a merchant that just had a waitress quit, a 12-top walk out on the bill, and an oven break, all while a health inspector is doing an unannounced review. Yeah, something about THAT is a little different than my day-to-day routine.

Sometimes we need to take a step back and stop trying to find the algorithm that best calculates FICO scores and monthly cash flow figures and start analyzing small businesses for what they really are. That led us to an interesting idea; Why not have actual merchants spell it out for us? What better way for us to connect with the retailers and service people of the U.S. than to have a two way dialogue right here on MPR?

Starting today, we’re announcing our experimental Small Business Corner, aka The Frontline. A small group of actual retail store owners or managers are going to contribute regularly with stories, tips, and advice about what it’s like for them. I think it will be insightful for us, as well as for the other small business owners that visit our site.

As the alternative business lending industry gets more saturated, shouting from the rooftops that you have “cash available with fast approvals!” isn’t a way to connect with the actual businesses that may benefit from a cash infusion. I’m guessing we’ll learn what does. These contributors are free to write what they want, so there’s no telling what’s in store. We hope you enjoy it.

Visit the Frontline

– Merchant Processing Resource

https://debanked.com

MPR.mobi on iPhone, iPad, and Android

Competitive Advantage: Keeping What’s Yours

February 6, 2013 The most effective competitive advantages are the ones you’re able to keep. And one of the most important of your competitive advantages can be your team. When a close partner, associate, consultant, or key employee leaves your organization there can be a really good chance of losing more than the individual qualities, skills, or experience that made that particular person such an asset. In fact, they just might take off ready, willing, and able to share with your competition what it is that makes your company, products, and/or services unique.

The most effective competitive advantages are the ones you’re able to keep. And one of the most important of your competitive advantages can be your team. When a close partner, associate, consultant, or key employee leaves your organization there can be a really good chance of losing more than the individual qualities, skills, or experience that made that particular person such an asset. In fact, they just might take off ready, willing, and able to share with your competition what it is that makes your company, products, and/or services unique.

It’s clear that making sure the only thing an employee leaves with when they empty their desk is a few free office supplies is certainly in the best interests of your small business. This is definitely a case where an ounce of prevention is worth a pound of cure. There are three common means small business owners can put into place to help protect themselves:

- An NDA, or Non-Disclosure Agreement

- A Non-Compete Agreement

- A Non-Solicitation Agreement

Each one of these legal documents shares the goal of protecting the competitive advantages of your small business, but they are different from each other. For instance, a Non-Disclosure Agreement is commonly used when bringing in a consultant. A Non-Compete Agreement is commonly used when a major goal is to prohibit a former employee from working for a competitor within a specific geographical area for a specific period of time. A Non-Solicitation Agreement keeps a former partner or employee from leaving one business and then soliciting other employees to come and work for them.

I’m Just a Small Business – Is this REALLY Something I Need to Concern Myself With?

Certainly not all small business owners need to be concerned about NDA’s, Non-Competes, or Non-Solicitation agreements. However, although you might think of yourself as “just another small business” your business may actually require some of the protections these documents offer. It can be helpful to conduct a “confidentiality audit” to help you determine whether or not to make an appointment with an attorney. For example, here are a few things that warrant protection:

- Trade secrets such as inventions, formulas, or scientific discoveries

- Specialized methods or processes

- Specific Data

- Client and/or Customer Information

Again, you may not think of your business as needing protection. However, it is common for small businesses to fit into categories that may indeed fall prey to damage inflicted by former employees absconding with sensitive and/or valuable information.

Most small businesses are going to have employees who come into regular, consistent contact with clients and customers. What may not be obvious is that, in the course of that contact, those employees develop valuable relationships with those clients. Should such an employee leave your small business, unless you are protected, there is nothing keeping that employee from taking those customers and/or clients (and their business) with them. Your customer base should be protected as it is essentially your most valuable asset.

Advances in technology have also created situations where small business owners will want to protect themselves. Certainly if your small business conducts research and/or develops products it only makes sense to legally protect proprietary and intellectual property. For example, you will want to be sure that you retain the rights to new designs (including the right to obtain a patent) created by an employee. However, proprietary and intellectual property may not be limited to “new” products. For instance, your small business may develop an innovative application for existing technology.

If you are still on the fence regarding whether or not you should contact an expert for advice as to whether or not you might need a Non-Compete, Non-Solicitation, and/or Non-Disclosure Agreement take a moment to answer a couple simple questions:

- Do my partners, associates, consultants, or employees have on-going contact and/or access to sensitive client information and lists that would be of benefit to a competitor?

- Do my partners, associates, consultants, or employees have access to anything that is best kept “secret” from my competitors or that would place my business at risk if the information was made public? (We’re not talking about illegal activity, more along the lines of a “secret recipe” or special way of doing things.)

If you answered yes (or even “maybe”) to one or both of these questions it is better to be “safe than sorry” and make an appointment to receive expert advice from an attorney or other subject matter expert.

– Merchant Processing Resource

https://debanked.com

MPR.mobi on iPhone, iPad, and Android

Social Media for Small Business: Food for Thought

January 29, 2013Here’s an interesting trend: blog posts on the subject of the “decline” of social media. Within 90 seconds you can locate three such articles on Forbes.com:

- 3 Reasons You Should Quit Social Media In 2013

- Facebook, Twitter? Can The Decline of Social Media Come Fast Enough?

- Why I Dumped My Smartphone – 2 Months Into Building My Personal Innovation Lifestyle

OK, so three articles can’t be considered a “trend” – but they definitely provide some food for thought.

Should You Quit Social Media in 2013?

The very notion that people are suggesting there might be value in at least “taking a break” from social media should get our attention. Take the three reasons J. Maureen Henderson gives in her article for doing so:

- It harms your self-esteem

- Your blood pressure will thank you

- Online is no substitute for offline

Henderson is speaking to personal self-esteem and gives the example that there are those of us who might feel better about ourselves if we weren’t constantly exposed to technology that forced us to compare ourselves to and compete with over-achieving peers. Yes, it can be personally humbling to discover the jerk you sat next to in biology graduated from Harvard when you barely made it out of State. Small business owners overdosing on social media just might have a similar problem trying to duplicate the social media activities of large competitors whose marketing budget is a big as their small businesses’ net worth – which can be very discouraging and demotivating.

Personal social media activity definitely can get pretty ugly. Name calling, ostracizing, bullying and just generally disrespectful communications can certainly cause your blood pressure to rise. Small business owners can have a similar reaction to preserving and protecting their online brand reputation. While it’s great to be able to communicate directly with customers and clients, the flip side is small business owners don’t have total control over the conversation any longer. Even if you’re monitoring your own platforms (for example comments on your business Facebook page), there’s always the opportunity that you could be missing some “flaming” commentary about your business online somewhere out there on the Internet.

Henderson notes a study stating that one-quarter of those surveyed feel they haven’t fully experienced real-life events due to activities necessary to place those real events on virtual social media platforms. She also points out that most people looking for a job do so online even though 70% of jobs are never posted online and are instead filled via in-person networking. Here is a lesson small business owners might want to take to heart – the impact, effectiveness, and value of getting in front of your customers and clients “in-person.” Real customer experiences are as important as virtual customer experiences.

Are People Dumping Their Smartphones?

We could give you a ton of statistics, but the short answer is a definite NO. As a matter-of-fact, the trend now is major increases in consumers using mobile devices to stay connected online. Some people may be becoming less enamored with “traditional” social media – but we’re definitely going to see an increase (at least for the foreseeable future) in the use of these devices according to a wide variety of studies by reliable resources such as Mashable.

The point is small business owners need to be aware that social media is constantly evolving (and most likely always will be evolving.) And that fact is both a blessing and a curse for small business owners. Certainly having new ways to effectively engage consumers along the “pathway to purchase” is a valuable opportunity. The threat can be not only keeping up with new technologies, but also the ways those technologies impact consumer behavior.

Even “expert advice” can be both confusing and in conflict. For example, here are two predictions in an article you can find at business2community.com:

Joey Sargent, Principal, BrandSprout Advisors: In 2013, we’ll see more social maturity in both B2C and B2B applications. Business will get “social smarts” and more fully integrate social media into their day-to-day operations across the organization. This means less social for social’s sake, and more focus on social media as a legitimate business tool to facilitate communication, engagement and loyalty.

Jayme Pretzloff, Online Marketing Director for Wixon Jewelers: Going into 2013 social media will impact sales more than any other metric because of the continued integration as a marketing platform and the acceptance of users to be marketed to. In 2011, almost 70% of users said that no social media platform influenced their buying decision and in 2012, that was cut in half to 35%. In 2013, this number will be decreased significantly again because these sites have become an integral way to gain access to information on companies, promotions and products.

Bill Corbett, Jr., President of Corbett Public Relations: The hype proliferated by “marketing” people about the tremendous business generating benefits of social media for small business will wind down.

Beverly Solomon, Creative Director at musee-solomon: People are over saturated with social media. They will gradually remove themselves from all but a few networks, blogs, etc. So many ads come in everyday that they have lost their impact. Most people just delete them before reading them. Social media will function more to alert friends of rip-offs than to encourage sales. Only the most clever sales campaigns will have any impact. More and more advertisers will be leaving social media and returning to snail mail, print and other traditional ads. Social media will continue to be a dating hook up, gossip fest and avenue for “gurus” to sell seminars. But real businesses will use social media less and less.

Who’s Right?

With such conflicting advice from subject matter experts – how is a small business owner to know who to listen to? Fortunately this question is easy to answer: Listen to your customers and clients because they – and only they – know how they prefer to be contacted as well as what the content of those communications must be in order to be of value and meaningful to them. This means small business owners need to find out where their target market “hangs out.” Are they already online and using social media? If so, how and where? If not, why not and what other ways would they like to hear from you?

The one constant advantage of social media is the ability to communicate with your market. But it is certainly not the only channel. As for our position on the matter? We’re making social media a bigger priority. We’ve just gotten more involved on Google+, a social network that just passed twitter and youtube to be the 2nd most used platform in the world.

It might be time for the everyday small business owner to take a peek at the big G, especially if they feel like Facebook isn’t delivering.

Guest Authored

– Merchant Processing Resource

https://debanked.com

MPR.mobi on iPhone, iPad, and Android

The World is Going Mobile

January 28, 2013We noticed a lot of people sharing and retweeting a link today to a web campaign by Google to create mobile friendly sites. Coincidentally, we’ve been working on “mobile-izing” Merchant Processing Resource for the past couple weeks. We used Google’s GoMo tool to see how we’re doing so far:

2 Seconds and easy to use! Now it’s your turn to GoMo.

Get to our site easily on your phone by typing in MPR.mobi.