MPR Authored

Let’s Play ‘Solve That UCC Filing!’

August 23, 2011

Underwriters have shared with us that it is more challenging than ever to determine if a merchant has an existing MCA balance already. Integrity Payment Systems, a merchant processor in Chicago, recently stated that they have signed on nearly 100 split funding partners. This is astounding given that we only list 24 officially recognized funding firms in our database. Sounds like we could use an update.

The challenge is not so much that WE don’t know who is funding merchants, but rather MCA firms don’t know. We’ll be the first ones to tell you that a retrieval percentage used to be black and white on a merchant statement. If not, you couldn’t miss that big fat UCC-1 lien by a known MCA firm. Those were the easy days when you saw “Secured Party: Fast Capital” and you could phone them up to verify a balance or find out what the scoop was.

Nowadays, there are lockbox programs, ACH debit programs (both variable and fixed payments), and a whole slew of creative structures to make MCA financing possible. The North American Merchant Advance Association(NAMAA) has an exclusive live network of funding activity. That means any NAMAA member can login to make sure that another member doesn’t already have an outstanding balance with the merchant they are about to fund. This database is an invaluable tool to the industry’s success and yet it has one major flaw, there are ONLY 12 members!

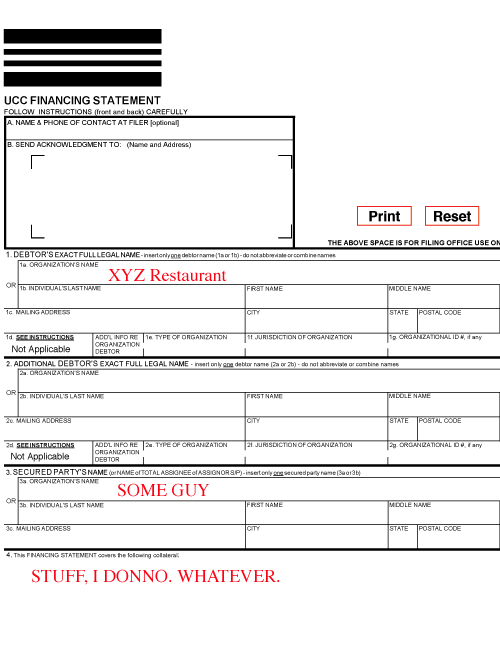

So let’s run through a scenario:

——

Mr. MCA Underwriter is analyzing an application and supporting documents. There is nothing being deducted from the 6 months worth of merchant statements. The bank statements look clean. The credit is good. Everything is pointing towards an approval until they do a UCC search. There are a few terminated UCC’s from over 5 years ago by Bank of America, back when bank lending actually existed. There is nothing since then, except for one by a so called ‘ABC LLC’. There is an address for ABC LLC but there is no contact information for them and a web search reveals nothing about their location or what it is. The UCC language is generic and indicates that it is a lien on the debtors property. Mr. MCA Underwriter has seen plenty like it before but asks the merchant about it anyway. The merchant indicates ABC LLC leased them all their equipment including a new oven and freezer. Everything adds up, the deal is approved, and subsequently funded.

Five days later Mr. MCA Underwiter gets a call from an upset individual with accusations that the merchant’s processing receivables already belong to someone else, an ABC LLC. The individual is a reseller of MCAs normally but has funded 5 clients with his own money(a trend becoming more popular. Read here). He funds those deals under a nondescript company, ABC LLC so that nobody will figure out what it is and solicit his client. Mr. MCA Underwriter explains there was no evidence of repayment of a MCA. It turns out the merchant defaulted 7 months prior and hence the 6 months worth of documentation were clean.

—-

For the past few years, it has been very common for resellers to search UCC databases by secured party, thus revealing ALL of the clients that particular secured party or MCA provider has funded in that state. Those clients are then solicited with the appeal of better rates on a MCA and incentives to get bought out. For some MCA providers, this has had a disastrous effect on retention.

ABC LLC successfully protected themselves on that front because no one was able to identify them as a MCA provider. Thus there was little chance their clients would be revealed. However, the strategy backfired when it became unclear that the merchant’s future credit card receivables had been sold.

ABC LLC’s strategy is becoming extremely common. Many MCA providers are resorting to using code names as the secured party to throw UCC hunters off the trail. We list a lot of those code names HERE. Combine that with the fact that hundreds of people are now funding their own accounts and we have a big mess of no UCCs, confusing UCCs, and incorrectly filed UCCs(some funders are filing them in the state they operate in instead of the state the merchant operates in).

Mr. MCA Underwriter is facing a lack of clues and it would not be surprising if the industry starts to see a resurgence in advance stacking. If anyone would like to anonymously share UCC code names that we do not have included in our records, please e-mail them to merchantprocessingresource@gmail.com

As the industry evolves, so will the issues. In our opinion, MCA providers should be plainly clear on the arrangement they have with their clients. No judge is going to listen to a story about code names, misleading UCC language, or why you don’t file at all. A UCC-1 is intended to be a public notice and is meant to be found. Small businesses will benefit by the expansion of the MCA industry but poor use of UCCs will inhibit the rate of growth.

And that’s our 2 cents…

-The Merchant Cash Advance Resource

https://debanked.com/merchantcashadvanceresource.htm

Merchant Processing Resource Upgrades

August 23, 2011

SITE NEWS

The contributors of the Merchant Processing and Merchant Cash Advance Resource community would like to thank our visitors for stopping by and all your feedback. In fact, we now have so many daily visits that our web hosting bandwidth was maxing out. This has forced us to upgrade the site (That means pay $$$) to ensure the success and growth of our free resources and articles.

Some of our visitors are reporting technical difficulties or malfunctioning widgets throughout the site. We apologize and have plans to fix them at some point. Keep in mind, we are credit card processing and advance funding professionals so we are doing our best with learning web programming in our free time!

Our domain now supports private e-mail. You may contact us with questions, concerns input, articles, at webmaster@merchantprocessingresource.com

For those that didn’t know, our community includes the following:

- The Ability to submit your own articles – Submit Here

- A community discussion forum on merchant processing – Forum here

- A community discussion forum on merchant cash advance – Forum here

Thank you!

-The Resource

Evidence Merchant Cash Advance is Going Mainstream

August 23, 2011

Need evidence that the Merchant Cash Advance industry has gone mainstream? One of our site’s editors shared this story:

I’ve been working in the Merchant Cash Advance business since 2004. It’s been quite a journey and we’ve really made a difference to small businesses facing capital shortfalls. The growth has been phenomenal and there have been dramatic shifts both in underwriting standards and the characteristics of our clientele.

While I could sit here and write a book about my experience, it’s the phone call I received last week from an old buddy of mine, Bob, that’s worth sharing. Bob is a Venture Capitalist(VC) out in California. He’s a self proclaimed expert of the hospitality industry and has heard a thousand young entrepreneurs pitch him a thousand different ways.

He’s always kept a distance from the Merchant Cash Advance industry and yet is always eager to hear about our tales of success, the achievements of our clients, and our ability to evolve to meet their needs. Last week Bob learned something and gave me a call.

He was sitting in a boardroom in Denver, Colorado. A group of entrepreneurs that made it big with a hotel in Florida, wanted to double their luck and open another hotel there and several in Wisconsin. These were well capitalized individuals and were pitching them for a cool $2 Million.

Bob’s firm seeks equity, so when the hotel group flatly stated that they did not intend to give up any shares, some were ready to declare the meeting over.

The powerpoint presentation flashed to the next slide and the entrepreneurs’ financial proposal was outlined in detail: “In return for $2 Million, you will be purchasing $2,400,000 of our future credit card sales. We will allow you to withhold 15% of each card transaction up until the purchased amount is paid in full.” The withholding percentage would also apply to the location that’s already established.

None of the deciding members of the VC firm like loans too much. There’s something about one payment per month that seems to not work anymore. Too many young businesses see monthly payments as an opportunity to leverage heavily. Having to make one monthly payment to the VCs enables the business to spend money on 20 other projects, all of which carry their own singular monthly payments. Then at month end, the cash gets spread too thin, and suddenly not all of these monthly payments can be met. Sure there are restrictions and terms that are supposed to prevent the business from doing this while the loan is outstanding, but there’s not much anyone can do about it if these terms get violated anyway. By the time the lenders find out, the return on investment is nullified by the cost of fixing it and that’s just if the problem can still be remedied at all. Sometimes all the money is just gone and the lenders have no idea until the day the monthly payment is due.

A purchase of the hotel’s future credit card sales would not classify this proposal as a loan, nor would it rely on a hope that the hotel’s books were properly managed and a payment made on time. While the VCs considered the unique level of security in getting repaid, Bob had a Eureka moment and took a timeout from the meeting to call me.

“It’s the pay as you go aspect of it that I like. The pace at which we get paid purely depends on the sales volume of the business. Sales up, we get paid more. Sales Down, we get paid less. Good for them, Good for us. If our credit card processing partner is withholding 15 percent of the sales before they’re deposited into our client’s bank, the hotel guys won’t face liquidity issues to meet our payments because we’re already getting paid. They can spend what’s deposited and we don’t have to get nervous on the 29th of the month.” and on and on Bob went, to which I replied, “Yes buddy, some of us have figured this out years ago.”

While $400,000 was a little bit below their desired return on investment, the VC firm put the entrepreneurial hopefuls up in a hotel for a weekend while they convened. There was an intense debate on the subject of equity vs. the purchase of future sales. One triumphal argument was that since hotels conduct transactions on a daily business, they would be collecting back on their investment every business day. That would allow the VC firm to reinvest those funds immediately.

Without completely spilling the beans on a negotiation that included non-disclosure agreements, a compromise was reached. The entrepreneurs left with a deal where they retained 100% of their equity and a structure where payments are made only at the pace that they are able to generate sales. It may have cost them more than what bank loans were going for in 2005, but like Bob and the other VCs made bluntly clear to them “What’s a bank loan? I don’t know any banks that are actually in the business of lending anymore.”

Bob could tell you that he’s been in the Venture Capital business since 1994 and it has been quite a journey. VCs have really made a difference to entrepreneurs with capital shortfalls. The growth was phenomenal until things started to change. The sale of future credit card sales from business to investor is a true mutually benefitting transaction.This structure is not only gaining popularity, but also solidifying a permanent footing in the financial transaction world altogether.

Don’t be surprised if John Doe business owner shows up at a local Bank of America branch in 2014 asking for a loan and this happens: “A loan, What’s that?” replies the financial officer. “Based on your merchant processing history, we’d like to purchase $30,000 of your future credit card sales.”….

-The Merchant Cash Advance Resource

https://debanked.com/merchantcashadvanceresource.htm

North American Merchant Advance Association

August 23, 2011

We’ve spoken about the North American Merchant Advance Association (NAMAA) quite a few times before: The Current Members of NAMAA 11/17/10 and Let’s Play ‘Solve Solve That UCC Filing!’12/28/10. Today the Green Sheet announced some recent developments with the organization, including new members and a planned release of data.

According to NAMAA President and AmeriMerchant CEO, David Goldin, “In the coming months, we will be publishing data that will be the first and only source of industry-wide merchant cash advance provider metrics.” We highly anticipate whatever it is they aim to share and will certainly be reporting on it.

NAMAA is key the to growth, education, and self-regulation for the Merchant Cash Advance Industry. Learn more about them here.

– The Merchant Cash Advance Resource

https://debanked.com/merchantcashadvanceresource.htm

————–

Update 1/12 Are you a new Merchant Cash Advance provider looking to join this association? Download the NAMAA APPLICATION here. The cost appears to be $3,000 a month.

60% of Merchants are Unaware of The Costs They Would Incur for a Data Breach

August 23, 2011Posted on January 12, 2011 at 8:34 PM

The process is so routine, that you may not give it any thought. Customer enters your store, purchases an item using a credit card, and the funds are deposited in your bank account a day or two later. Your terminal for swiping cards never gives you any problems and your customer service representative is a pretty nice guy. And then one day you have a data breach…….

A data breach, regardless of how it happened, is your liability. According to the 2009 U.S. Cost of a Data Breach Study by the Ponemon Institute, the average cost for merchants coping with a data breach in 2009 was $6.7 million. $6.7 Million!

That National Retail Federation(NRF) and First Data have just published a study that indicates 60% of merchants are unaware of the costs they would incur for a data breach and 64% believe their businesses are not vulnerable to credit/debit card data theft. The numbers are alarming and it sheds light on a problem that merchant processing salespeople face these days. Many business owners have been told at one point or another that their credit card machine is old, non-compliant, or requires an upgrade. This can come off sounding like a cheap sales pitch, especially after being informed that the upgrade involves some kind of fee.

Heed their words. Payment Card Industry Data Security Standard(PCI DSS) compliance is mandatory and you can be hit with fines for a violation. Business owners are required to perform a Self-Assessment Questionnaire(SAQ) once a year. If you’ve never performed one or aren’t familiar with it, you can pick up instructions and questionnaires on the PCI DSS website. (https://www.pcisecuritystandards.org/merchants/self_assessment_form.php)

Protect your customers. Preach it, don’t breach it.

-deBanked

https://debanked.com

Merchant Cash Advance Providers Cope with New Business Failure Rate

August 23, 2011

“Why can’t I get a better deal? I’ve been in business for 9 months already!”

Is this you?: Your doors open, you bring in customers, and revenue is pouring in. It seems like your business plan was right on the mark and there’s no doubt things will continue as is or get better. For cash flow or expansion purposes, you seek out a loan or line of credit.

Your bank shuts you down and not because they weren’t impressed with your business, but because they require a minimum of 3 years in business. So what to do now?…

While banks can only sustain a certain amount of risk, a Merchant Cash Advance(MCA) provider can fill the gap by purchasing the future credit/debit card processing transactions of a business. It’s a solid capital source for an old company and a perfect fit for a new one. But even they have a risk threshold.

YIKES! 25% 1st year failure rate, 50% 1st year failure rate, only 1 in 3 survive, 9 out of 10 are gone in first two years! Despite the wide inconsistencies, it’s enough to rattle the underwriters of MCA providers across the country. As a result, the majority of Merchant Cash Advance(MCA) providers require a full year of operation before being eligible to apply. Some buck the trend and there’s a reason for it.

Statistics claiming a failure rate of 50-90% for small businesses seem to be largely overexaggerated. Unfortunately, these figures have caught on as fact and are quoted, requoted, reported, distorted, and multiplied. It’s discouraging and yet millions of people start a business every year. Here are some verifiable and credible stats:

U.S. Department of Labor: 24% of all businesses started in 1992 had failed by 1996

Amy E. Knaup, Bureau of Labor Statistics: 34% of businesses fail within the first 2 years, 56% fail within first 4 years

Score.org (Official partner of Small Business Administration): Reported in Nevada that 50% of all new businesses fail within 2 years

The data reflects the survival rate of businesses started in the 2nd quarter of 1998. Leisure and hospitality is the category most suited for a MCA and 20% of them failed within the first year.

Business Owners: There is no such thing as a low interest business loan, as we presented in a previous article. Some MCA providers are purchasing about $14,000 worth of credit card receivables for a price of $10,000 today. That’s a cost of $4,000. Think about it this way: If someone gave you $1, could you turn it into $2? If someone gave you $10,000 could you turn it into $20,000? If you believe in your business, then you will create repeat customers.

For example:

A $10,000 investment in advertising immediately brings in $12,000 of sales. At first glance, the $4,000 cost on $10,000 from a MCA does not seem worth it. However, the repeat business comes into play. If only half of them come back a second time, then your return becomes $18,000 ($12,000 in sales the first time, and $6,000 the second time).The return on your investment grows for as long as any one of those customers continues to do business with you in the future. $50,000 in sales over the course of a year can be the result of an initial $10,000 advertising campaign. Is it worth it now? absolutely!

Strangely, some business owners still balk because the cost is higher than their expectations. As Americans we have a tendency to believe that anything above 10% is too high. We could be poised to make 500% of our investment and still don’t want to pay 40% for the funds to make it happen.

It’s a pyschological thing. As business owners, we want a 5% interest rate but don’t consider the fact that interest rates that low only exist with taxpayer guarantees. We want a loan from the bank but don’t consider that our collateral (house, car, furniture, future paychecks, spouses belongings) will be reposessed in the case of default. And we want the bank to approve us even though all data indicates that out of the 100 businesses exactly like ours, 20 of them will fail in the first year.

Let us remind you that most MCAs are uncollateralized, are only repaid at the pace that revenue is generated, are not taxpayer subsidized, and available despite the high failure rate for new businesses. In the spirit of a fair deal, it doesn’t get more fair than this. Entrepreneurs are fortunate to have access to capital but if you can’t envision turning $1 into $2, maybe starting a business wasn’t such a good idea…

– The Merchant Cash Advance Resource

Merchant Cash Advance Application Process – A Guide For Business Owners

August 23, 2011

We are happy to provide business owners with useful information. Since the site can be a bit difficult to navigate, we have compiled a 7 page printable PDF packet that summarizes what to expect when applying for a Merchant Cash Advance.

It includes:

- A sample application of what will be asked

- A list of what documentation is needed and why

- A breakdown on the established methods of repayment

- Contingent requirements that funding providers may have

- Glossary of Terms

The PDF packet can be downloaded here: The Merchant Cash Advance Application Process – A Guide for Business Owners

-The Merchant Cash Advance Resource

Who is Really Getting a Merchant Cash Advance?

August 23, 2011

You’ve seen ads like it before: “Get up to $250,000 for your small business today!”

For the local corner deli, that kind of cash may seem too good to pass up. There’s just one catch, many Merchant Cash Advance(MCA) providers cap funding approvals at somewhere in the range of 125% of a business’s monthly credit card processing volume. That means a deli processing $10,000 would be eligible for up to $12,500. ‘Mom and pop’ shops are often left wondering if anyone could ever really get $250,000 or if that figure is just a deceptive marketing gimmick.

/>

/>

The Merchant Cash Advance Resource would like business owners to know that $250,000 is not only possible, but deals of this size and larger are made often. The typical recipients are retail chains and restaurant franchises, but any business generating enough volume in credit/debit card sales is eligible. If there was any doubt about the popularity or legitimacy of the MCA financial product, take a look at some franchise names that have used it:

- Burger King

- Domino’s Pizza

- Hooters

- Subway

- Dunkin Donuts

- Taco Bell

- Denny’s

- Wendy’s

- Meineke Car Care

- Maaco

- Aamco Transmissions

- Curves Fitness

This data was confirmed by researching UCC filings on AdvanceMe, Strategic Funding Source, Merchant Cash and Capital, First Funds, and Business Financial Services.

Every funding provider is not created equal. Some of the oldest players such as AdvanceMe, Merchant Cash and Capital, and Strategic Funding Source are capitalized well enough to do deals up to $1,000,000. Other firms specifically seek out larger businesses such as Bankcard Funding in Long Island, New York. According to a representative there, their average funded deal is $100,000. Others have a comfort range of $5,000 to $75,000 but will bring in outside investors if they need to go beyond that.

Merchant Cash Advance is not just for smaller businesses, nor is it a last resort source of capital. It is an established alternative to bank lending that offers incredibly flexible repayment terms. Despite the benefits, a MCA still has a reputation for being expensive. While we don’t dispute that, we do recognize the need for it. Unlike SBA loans which can carry default guarantees up to 90%, MCA’s are completely backed by private investors. There are no billions of dollars to fall back on, government backed guarantees, or bailouts when things turn ugly.

Over the past few years, some MCA firms simply weren’t able to generate enough profit and closed as a result. In the case of Global Swift Funding(GSF), a MCA provider that dissolved back in 2009, the return on investment simply did not prepare them for the loss they would realize from a very important client.

http://www2.ocregister.com/articles/gantes-money-million-2399154-bankruptcy-restaurants

John Gantes, formerly one of the richest Men in Orange County, California owned 110 restaurants throughout the western part of the U.S. As the economy turned sour, he reportedly started loading up on Merchant Cash Advance funding for each location. In the end GSF cried foul, but they could not sustain operations further.

There is risk on both sides of the equation. A MCA is not for businesses on the fritz, but rather is a tool to acquire inventory, new locations, upgrade equipment, get through a slow season, and grow. While much hype surrounds the minimal paperwork requirements for MCA, businesses seeking in excess of $100,000 should expect a more intensive underwriting process.

“Have detailed financial statements handy and expect some scrutiny of the Balance Sheet,” was advice offered by one underwriter. “We’re going to want to make sure you are using these funds for the right reasons.”

And yet the MCA industry stands by their mantra of making capital accessible to all. With funding amounts reportedly as low as $1,000, and more than 21,000 individual advances made in 2010 alone, there is really no better time for a small business owner to apply.

The funds are there but it’s important to set your own expectations of how much you can access. The corner deli should be able to put $12,500 to good use. Our experience shows that positive sales activity will probably make the funding provider more comfortable to extend a larger amount to you down the road. I think we’d all like to get $250,000 today but in the absence of government backed guarantees, a tumultuous economy, and jittery investors, you’ll need to get your foot in the door first and work your way up.

-The Merchant Cash Advance Resource

http://www.merchantcashadvanceresource.com

Images Copyright (c) of 123RF Stock Photos