Good Internet Connection: A Recap of Broker Fair Virtual’s Debut

June 17, 2020 Last week’s Broker Fair Virtual was the first of its kind for the industry. The day-long event offered talks and networking, just like the in-person event, albeit without the catering service and open bar. Offering a digital space that included a virtual auditorium, networking lounge, expo hall, and individual company booths, the event attempted to recreate the experience of connecting and mingling with the rest of the industry, as much as was possible.

Last week’s Broker Fair Virtual was the first of its kind for the industry. The day-long event offered talks and networking, just like the in-person event, albeit without the catering service and open bar. Offering a digital space that included a virtual auditorium, networking lounge, expo hall, and individual company booths, the event attempted to recreate the experience of connecting and mingling with the rest of the industry, as much as was possible.

Kicking off with a Matrix-inspired introduction to the virtual space led by alternative finance’s version of Neo’s mentor, Mur-pheus (Murray as Morpheus), the show then went in numerous directions, with panels and talks covering a variety of topics and sectors.

Funding Metrics’ David Frascella took to the virtual stage to talk about how his company and the industry at large have been getting through the pandemic; what’s to come for America was up for discussion with Scott Rasmussen, the veteran pollster, who elaborated on how business could be effected by the upcoming presidential election; the future of combining people with data was debated by figures from Become, Elevate Funding, and Ocrolus; Canada’s lending situation and prospects were talked through in Covid and Canadian Credit;The new normal was discussed by NYC’s Fintech Women; and John Henry, an entrepreneur and star of VICELAND’s ‘Hustle,’ spoke of his experience running businesses and what made his story a success.

As well as this selection of talks, another standout was the cannabis panel. Led by a number of industry veterans, which broke down the difference in funding marijuana-based companies compared to other deals, and what could be down the road for the industry as more states consider legalization.

National Funding’s CRO, Justin Thompson, held an extended Q&A session, fielding queries about how National has been faring through these times and what its approaches are as the economy begins to open back up.

How long-term is long-term for the coronavirus’s impact? Are SBA deals the way to go? Does the industry need to go further with its adaption to this new normal? All these questions were asked and answered in The Great Debate, a panel made up of industry figures from various backgrounds.

And brokers’ futures were considered by Lendio’s Brock Blake, United Capital Source’s Jared Weitz, National Business Capital & Service’s James Webster, and The Watson Group’s Gerald Watson. Here, the idea of a recovery, how each struggled through March and April, and PPP were all debated by the panelists, with perspectives of what’s to come leaning both ways.

There’ll be an evolution of new industries and how we do business,” Gerald Watson noted in his closing words, “just look at this conference for example.”

There was no lobby to find brokers and funders hashing out deals in relative privacy away from the expo hall, instead this was replaced by private messages exchanged. Rather than line up for some chicken wings, people chowed down to whatever was in their home on that day. And instead of gathering around a bar and finishing the day after the final talk, attendees cracked something at their desk and chatted it up in the networking lounge, recalling previous events and what was once taken for granted: the ability to connect effortlessly.

The coronavirus continues to physically keep people apart, but for one day last week the industry was able to come together and network, make deals, and gain insight; albeit in a different way, internet connections providing.

If You Do MCA, You’re Not a Lender (Part Two)

June 16, 2020 A three-year-old deBanked blog post turned out to be a bit prophetic.

A three-year-old deBanked blog post turned out to be a bit prophetic.

Titled If You Don’t Make Loans, You’re Not a Lender (And definitely not a ‘direct lender’) and posted on January 19, 2017, I hypothesized that the misuse of financial language on the phone or in an e-mail, particularly if one conflated merchant cash advances with lending, could one day result in a subpoena for a deposition to explain it.

In the People of the State of New York, by Office of the New York State Attorney General v. Richmond Capital Group LLC et al, that very scenario played out. Several people were subpoenaed last year and were required to give testimony to lawyers for the New York State Attorney General to explain why internal company communications allegedly referred to MCAs as loans or why a purported MCA company website made use of lending terminology.

The answers, which are public record, were not great. At least two individuals answered that line of questioning by pleading the fifth to potentially avoid self-incrimination.

While there are a lot of colorful details to consider in this case, the AG’s lawsuit dives into the various ways in which the defendants allegedly conflated financial products, including that a defendant company allegedly advertised itself as a “lender” when it actually was not.

While the allegations in the AG’s complaint are probably somewhat unique, there are claims and arguments within them that may be worth further legal review and analysis. Contact an industry-knowledgeable attorney if you have questions.

Broker Fair Has Completed A Historic Milestone

June 12, 2020Broker Fair reached a milestone yesterday by successfully completing the industry’s first-ever virtual conference. The experimental concept was a response to this year’s restrictions and precautions on large gatherings.

We hope that the hundreds of attendees found the event fun, educational, and productive! The in-person show is still happening at Convene at Brookfield Place in Lower Manhattan on March 22, 2021.

Yesterday’s show included live sessions, a networking chat, and a virtual exhibit hall. Attendees will have formal access to the recorded sessions very soon (There were a lot of them).

The Funders Are Coming Back

June 10, 2020 Nearly three months on from the beginning of the United States’ lockdown, the alternative finance industry is starting to feel a recovery. As states look to ease lockdowns, businesses seek to start back up, and offices are reopening, an element of normalcy, if it can be called that, appears to be returning. deBanked reached out to a number of businesses in the industry to find out how they were plotting their recovery, as well as what they thought of the future for the space and the American economy.

Nearly three months on from the beginning of the United States’ lockdown, the alternative finance industry is starting to feel a recovery. As states look to ease lockdowns, businesses seek to start back up, and offices are reopening, an element of normalcy, if it can be called that, appears to be returning. deBanked reached out to a number of businesses in the industry to find out how they were plotting their recovery, as well as what they thought of the future for the space and the American economy.

One such company was Everest Business Funding. After experiencing a strong start to 2020 in January and February, covid-19 and the economic shutdown that accompanied it came as a shock to Everest, CEO Scott Crocket explained.

“It’s difficult to imagine an exogenous event outside of our control that could more squarely impact an industry like this,” Crockett stated. “I mean, after all, we provide capital to small and medium-sized businesses all across the United States, all 50 states, every type of small business you can imagine. And we’re cruising along, we had a record 2019, we’re off to a great start with January, February, even the beginning of March … and we really saw it come on in the third week of March, the week that started with Monday the 16th. It started as a kind of a trickle in, but by the end of the week it was more of a tidal wave in terms of the number of small businesses in our portfolio that were calling in looking for some type of relief as a result of what was happening.”

Crockett said that they paused all new funding the following week, out of concern for the company’s ability to generate business while there was a national economic shutdown in place. Since then however, Everest has been slowly getting back to what it was, with employees now returning to the office in waves and discussions being had over when exactly to start funding again, be it late June or early July.

Another firm that halted its funding operations was the New York-based PIRS Capital. Similarly, it was mid-March when the pressure was first felt, and PIRS didn’t return to funding until May 15th. PIRS COO Andrew Mallinger chalked this up to the company’s lack of reliance on automated underwriting processes, saying that although “the industry was leaning towards automatic funding and all these models and 20-second approvals, we weren’t fully invested in that yet. So it was good to see that the old-school approach is back and working again, interfacing with these brokers and really understanding their deals and what they’re bringing to the table.”

Mallinger is also confident going into the rest of 2020. Saying that while the company is maintaining a cautiously optimistic outlook, PIRS is working off the assumption that there will eventually be growth this year and that it is set to continue working from home for however long that may be, on the basis that New York may be one of the last states to return to offices.

Also looking forward is Velocity Group USA’s Trace Feinstein, who believes there will tough times ahead for many in the industry, but who also holds that there are opportunities for those who can make it through.

“Anyone who can weather this storm is going to come out 10 times better than they did going in.” The Chief Syndication Officer said in a call. “It’s an adjustment for our economy, it’s an adjustment for our country, and I think it’s an adjustment for our industry on top of that. So there’s a lot of different changes and things are going to be happening, but I think it’s going to be very good for the ones who make it out of it.”

Feinstein, who said that most of Velocity’s workers are back in its offices, noted that it approached underwriting during the pandemic with thoroughness. Daily underwriting meetings entailed going through each state, looking at what was happening there with infection rates, and discussing how various industries could be affected.

Reporting that applications following the lockdown were actually cleaner than before, with average credit scores going up to be between 650 and 750, Feinstein explained that he pushed underwriters to rely on common sense rather than overthinking their decisions and to treat these deals like they would any MCA application.

And while many funders have struggled through the lockdown period, another part of the industry, collection agencies, have been doing well after an initially tough stretch.

Shawn Smith of Minneapolis’ Dedicated Commercial Recovery has claimed to have grown the company’s portfolio by 100% in 60 days despite a particularly trying period in mid-April. Explaining that the company was two weeks away from having to bring in strict measures to keep things going, Dedicated began getting calls again just in time, with its clients mostly phoning in about MCA deals.

Looking ahead, Smith is anticipating a busy summer and fall as businesses, funders, and the courts come back, but he is worried about a second wave and the alternative finance industry not putting in the precautions needed to stave off the economic impacts this next time around.

“Anyone can lend out a lot of money or put out a lot of money on the street, but your ability to get it back is going to be very important, and you want the fire extinguisher in place before the house is on fire … what you’re seeing in the MCA industry is because it’s just not as aged as the equipment leasing and banking industries … the MCA companies just didn’t have 20-30 year veterans in collections and legal … we’re so concerned with how to write more deals and get more money out there, and not about how to get it back and not about having strong enough underwriting standards and things like that. So when it got stress tested, the pain came back real quick.”

Likewise, Kearns Brinen & Monaghan’s Mark LeFevre claimed that after having a rocky road during the earlier stages of the pandemic and switching to a “plan B” for the year, the collections company is optimistic about going forward. Having weathered what may be the worst stretch without having had to furlough or lay-off anyone, KBM now has brought most of its workers back after a reworking of the office space. A pre-return fumigation, sneeze guards, and temperature-taking upon re-entry to the office building have all been employed after KBM’s employees asked to return to the workplace.

“The industry is changing literally day to day,” explained the President and CEO. “Some of the laws that are passed by the House and by the Senate are changing quicker than I’ve ever seen. I’ve just never seen it before. But I think it’s for the better and we’re starting to see the comeback of the economy, the stock market, employment. The unemployment numbers are really good and, in my opinion, [the numbers will] continue to go down from what we’re seeing in our industry.”

Impact Of COVID-19 on The Merchant Cash Advance Market

June 8, 2020deBanked recently caught up with Gunes Kulaligil, author of Merchant Cash Advance Valuation Dynamics.

Gunes Kulaligil (gkulaligil@methodicalmgmt.com) is a co-founder of Methodical Management, a New York based firm providing valuations, transaction advisory and due diligence services to lenders and investors active in the specialty finance sector. www.methodicalmgmt.com

Gunes Kulaligil (gkulaligil@methodicalmgmt.com) is a co-founder of Methodical Management, a New York based firm providing valuations, transaction advisory and due diligence services to lenders and investors active in the specialty finance sector. www.methodicalmgmt.com

deBanked: The economic effects of the coronavirus are myriad and widespread. What are some of the specific challenges that the merchant cash advance market is currently experiencing? And what new obstacles can the industry expect further down the line as a result of the pandemic?

Gunes Kulaligil: The pandemic has redefined what “off the charts” means for unemployment claims and other leading economic indicators, but the full impact of job losses and halted economic activity has yet to be observed in the credit performance of many specialty finance assets. MCAs are unique in the sense that payments are daily or weekly and tied directly to revenues. As such, we were able to observe the preliminary impact of the lockdown on MCA cashflows earlier than for most other types of non-bank specialty finance loans.

When incomes and revenues are disrupted, consumers and businesses alike will often prioritize which debt to service first. They may be unwilling to pay certain accounts, even if able to do so, in order to preserve cash for prolonged uncertainty. However, this is not the case for MCAs as payments are remitted automatically; therefore, the cashflows are aligned with and reflect true business performance free of the impact of payment prioritization. As early as the second half of March, we observed payments from merchants drop approximately 20% to 30% depending on the type of industry. In addition, payment pace continued to decline into April and May, albeit at a slower pace, as modifications and servicing efforts picked up. Funders have a vested interest in merchants being able to stay in business and to build their revenues back up. Thus, any modification effort — whether that is a deferral, reduced percentage of sales remitted, or lower payback amounts — that incentivizes the merchant and provides some flexibility goes a long way.

At the same time, funders’ portfolios look worse as performing MCAs pay down and a lack of new origination results mechanically in the remainder of their portfolios having more tail risk – a lack of new origination would be a drag on performance even without the pandemic. For these portfolios, it is crucial to monitor portfolio performance at a granular level to identify businesses that will successfully navigate reopening and increase their revenues; so that servicing resources can be directed where they are most needed and will be most effective. Funders that have invested in technology and maintain connectivity with merchants via CRM tools and with established servicing / resolution teams and processes will have a competitive edge in doing so.

Poor performance caused by the pandemic has also led warehouse facilities to breach covenants or take-out partners to pause purchases unless platforms pledge additional skin in the game or pay higher interest rates to go forward with covenant modifications or resume purchases. They may also increase monitoring requirements and the level of oversight they apply.

deBanked: Conversely, is the pandemic creating any opportunities for funders and brokers as the situation develops?

Gunes Kulaligil: Indeed. While the near-term outlook is grim, a lot of relief and stimulus is working its way through the economy. The U.S. Government is intent on providing support as states are starting to re-open as quickly and as safely as possible. In retrospect, nobody had a pandemic playbook and programs like PPP were designed, deployed and funded on the fly with collaboration from both banks and non-bank lenders during volatile markets.

Non-bank lenders’ success in being able to reach truly small businesses, as well as the speed and efficiency in deploying the funds, has not gone unnoticed. The PPP experience also highlighted stark differences between the types of clients that large commercial banks serve versus those served by non-bank lenders. As deBanked reported, banks focused on larger clients whereas non-bank and fintech lenders assisted much smaller businesses in comparison. Origination fees on PPP loans were not insignificant either. SBA pays PPP lenders a 1% to 5% origination fee depending on the funded amount. For example, Ready Capital reported a gross revenue of $100 million on $2.1 billion funded. Notably, Ready Capital’s average PPP loan size was approximately $70,000 compared to an average of more than $500,000 for JP Morgan Chase for approximately $15 billion the bank funded in round one of PPP.

Small business activity is not only a leading indicator of distress but also at the center of any significant economic recovery. Small businesses account for 45% of GDP with 88% of these businesses employing fewer than 20 people. There is no meaningful recovery without small businesses getting back on their feet. As businesses re-emerge, their financing needs will vary widely in timing, amount, frequency, term, etc. depending on industry and many other factors. Continued involvement from the federal government whether in the form of deploying more low-interest rate loans, forgivable loans or loans with some sort of guarantee is likely. Lenders who can continue to serve their clients either by extending a suite of bespoke private credit or by facilitating the deployment and servicing of government funds will succeed.

Broker Fair 2020 Virtual Video Q&A

June 6, 2020Broker Fair 2020 Virtual is this week! Still have questions? I answered some of Johny Fernandez’s questions in this video interview below:

Most Brokers Plan to Minimize Use of a Central Office Post-COVID, Survey Suggests

May 26, 2020 A survey conducted by Overland Park, KS-based Strategic Capital revealed that only 36.8% of respondents plan to completely return to the office full-time after cities fully open back up. The vast majority of respondents were small business finance brokers.

A survey conducted by Overland Park, KS-based Strategic Capital revealed that only 36.8% of respondents plan to completely return to the office full-time after cities fully open back up. The vast majority of respondents were small business finance brokers.

44.7% selected that they would minimize office space or only use office space to house core team members while 18.4% planned to terminate their office lease altogether and adopt a work from home model permanently.

Broker Fair, Not a Webinar… A Virtual Reality Conference

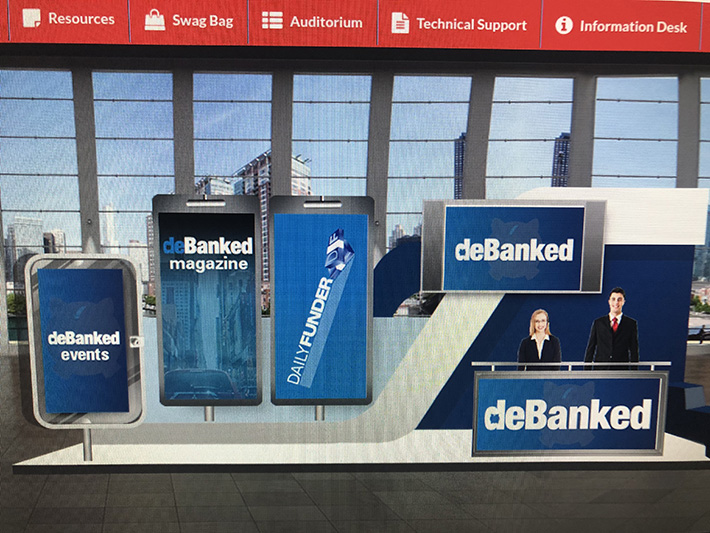

May 21, 2020 Coming June 11th, Broker Fair in Virtual Reality. Much different from a webinar, Broker Fair Virtual will actually be a virtual world with a lobby, exhibit hall, networking lounge, and auditorium. Attendees will be able to interact with each other as well as visit and interact with sponsors at their virtual booths.

Coming June 11th, Broker Fair in Virtual Reality. Much different from a webinar, Broker Fair Virtual will actually be a virtual world with a lobby, exhibit hall, networking lounge, and auditorium. Attendees will be able to interact with each other as well as visit and interact with sponsors at their virtual booths.

There will be live video sessions too of course (see the agenda here), but if you’re there for the networking, get ready for a totally unique experience!

Broker Fair 2020 Virtual isn’t replacing the In-person event. That’s been rescheduled to 3/22/21 at the same location, Convene at Brookfield Place in New York City. All attendees registered for the in-person event are able to attend this virtual event on June 11th for free. If you never registered for that, you can still buy tickets that grant access to both at: https://brokerfair.org/register/

See you at Broker Fair!