And One of the Largest Small Business Funders is… Pipe?

December 22, 2021 It’s not a loan, Pipe says. Instead businesses can sell their future recurring revenue to investors on a trading platform for cash upfront today. Led by CEO Harry Hurst, the former founder of a rental car delivery service, Pipe has provided an astounding $1.2B worth of capital to businesses this year, putting them on pace to become one of the largest small business finance companies nationwide.

It’s not a loan, Pipe says. Instead businesses can sell their future recurring revenue to investors on a trading platform for cash upfront today. Led by CEO Harry Hurst, the former founder of a rental car delivery service, Pipe has provided an astounding $1.2B worth of capital to businesses this year, putting them on pace to become one of the largest small business finance companies nationwide.

The company claims to have made recurring revenue into an asset class while making Miami their home base, much to the joy of the city’s tech-friendly mayor.

I am so grateful for everyone participating and joining forces to make Miami a global hub for innovation.

This is just one of many! @harryhurst @m_cieplinski @pipe

Read more: https://t.co/OtxrRad0yq

— Mayor Francis Suarez (@FrancisSuarez) December 22, 2020

Pipe considers itself to be the “Nasdaq for revenue” and calls its employees “plumbers” instead of sales agents, underwriters, and engineers.

People wonder how big @pipe is.

In our first full year of trading we’ve provided access to over $1.2B in financing to companies of all shapes and sizes, from bootstrappers to public co’s – all on their terms.

Proud of our team of 76 plumbers is an understatement.

Bring on ‘22!

— Harry Hurst (@harryhurst) December 21, 2021

Pipe has already raised $300 million of equity financing in the last year from investors including Shopify, Slack, Okta, HubSpot, Next47, Marc Benioff’s TIME Ventures, Alexis Ohanian’s Seven Seven Six, Chamath Palihapitiya, MaC Ventures, Fin VC, Greenspring Associates, Counterpoint Global (Morgan Stanley) and more at a valuation of over $2 billion.

“Pipe is levelling the playing field for companies in the capital markets,” said Chamath Palihapitiya, Founder & CEO, Social Capital, to finledger. “By taking the underlying contracts that generate recurring revenue streams and making them tradable for the first time, Pipe has unlocked a multi-trillion dollar asset class, revenue.”

Broker Fair is HERE

December 5, 2021 Monday kicks off Broker Fair 2021 at Convene at Brookfield Place in lower Manhattan. The venue can be found on the 2nd floor of 225 Liberty Street. You must have a ticket and proof of vaccination to enter. The event is sold out.

Monday kicks off Broker Fair 2021 at Convene at Brookfield Place in lower Manhattan. The venue can be found on the 2nd floor of 225 Liberty Street. You must have a ticket and proof of vaccination to enter. The event is sold out.

deBanked TV will be streaming live from inside the venue where host Johny Fernandez will be talking to attendees throughout the day. You can tune in to watch live on debanked.tv starting in the morning on December 6th.

If you see the below entrance on the 2nd floor of the building on December 6th, you’re at the right place:

Broker Fair Ticket Registration To Shut Off Any Day Now

November 28, 2021 Broker Fair 2021 ticket registration will shut off days before the December 6th event. The broker-centric conference is now officially counting down to its kickoff at Convene in New York City.

Broker Fair 2021 ticket registration will shut off days before the December 6th event. The broker-centric conference is now officially counting down to its kickoff at Convene in New York City.

“This pretty much happens every time we put on a show,” said Broker Fair founder Sean Murray. “Even though this event is post-covid, we’re looking at the number of registrations so far and are very pleasantly surprised.”

Hundreds of small business finance brokers are registered to attend Broker Fair. The annual event first launched in 2018.

“I don’t know what day we’re going to disable registration yet, but based on the pace I’d say there’s no way we make it until Friday,” Murray said.

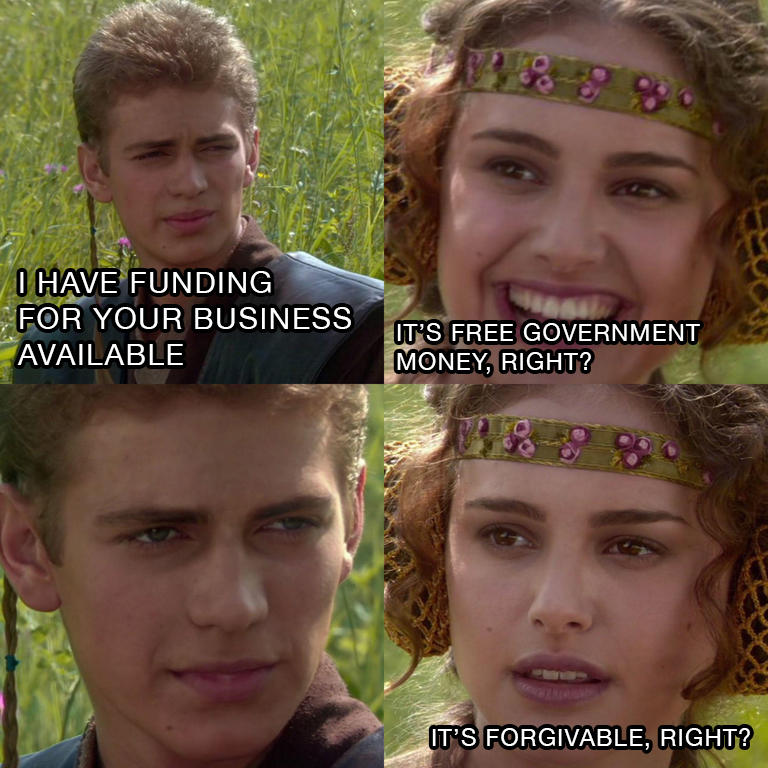

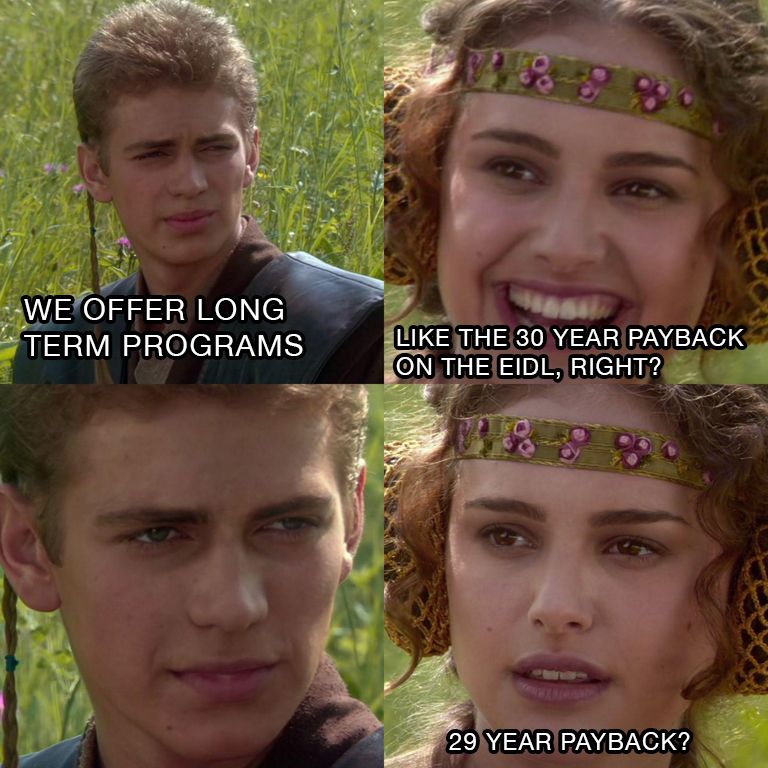

deBanked Thanksgiving Memes 2021

November 24, 2021Happy Thanksgiving. Every year since 2012, we have published original industry memes on Thanksgiving! Here’s our latest batch!

Not Just For Salespeople: Becoming a Certified Small Business Finance Professional

November 23, 2021 Its aim is to become an industry standard. The newly launched Certified Small Business Finance Professional (CSBFP) program will first become available at Broker Fair in New York City on December 6th.

Its aim is to become an industry standard. The newly launched Certified Small Business Finance Professional (CSBFP) program will first become available at Broker Fair in New York City on December 6th.

But what’s the difference between this one and others? Steve Denis, Executive Director of the Small Business Finance Association (SBFA), says that his organization’s backing of the CSBFP makes all the difference.

“We’re the largest trade group in the space without question,” Denis said, adding that the group has about 30 members, several of which are among the largest in the country.

“It’s going to be a signal that you’re doing things the right way and want to go out of your way to show that you are doing things the right way,” Denis said.

The certification will require applicants to complete a course centered on understanding products, laws governing the industry, and compliance. The certification exam will focus on testing applicants’ ability to understand key concepts and best practices.

This course is designed to be taken in person. While it will be available at Broker Fair, Denis said that they plan to partner with other events as well.

“We’re going to focus on as many in-person training sessions as possible,” he said.

“We’re going to focus on as many in-person training sessions as possible,” he said.

And it’s not just salespeople they’re targeting. Underwriters, collectors, support staff, and more are not only all welcome to obtain their certification, but are also encouraged.

“It’s open to anyone in the industry,” Denis said. “The more the better. […] It will send a very strong message that there is a diverse group of people that want to take a certification and take it very seriously.”

In the official announcement, it was stated that it would be more than just a stamp and that certified professionals would also be provided with “a way to connect, learn and grow beyond the initial education process.”

Denis compared the CSBFP standard to CFPs (Certified Financial Planners) in the financial advisor space.

Attendees of Broker Fair 2021 can take the course at the event at no extra charge.

New York’s Fourth Judicial Department Affirms Its Settled Law That MCA Agreements Are Not Usurious

November 16, 2021 New York’s Appellate Division for the Fourth Judicial Department in the Supreme Court of New York issued a landmark decision for the merchant cash advance industry on November 12th.

New York’s Appellate Division for the Fourth Judicial Department in the Supreme Court of New York issued a landmark decision for the merchant cash advance industry on November 12th.

By affirming the original decision issued in Kennard Law P.C. DBA Kennard Law and Alfonso Kennard v High Speed Capital LLC (Index No: 805626/2020), the Appellate Division agreed that among other things that it is settled law in New York that the underlying purchase and sale of future receivables agreement at issue in the case is not a usurious loan.

On June 10, 2020, plaintiffs filed their lawsuit against the defendant, asking the Court to vacate a confession of judgment on the basis that the defendant’s underlying contract dated back on August 24, 2017 was really an unenforceable criminally usurious loan.

The defendant moved to dismiss and the judge granted the motion, holding that:

1. Plaintiffs’ claim of usury is barred by the one-year statute of limitations applicable to usury based claims.

2. Plaintiffs have failed to plead a cognizable cause of action upon which to seek relief.

3. Plaintiffs have no recoverable damages.

4. Plaintiffs’ claims are barred by documentary evidence and settled law in New York holding that the parties’ underlying agreement was not a usurious loan.

Plaintiffs appealed, hoping that the Fourth Department would be persuaded by their arguments that the agreement was usurious. It wasn’t. Instead the Appellate Division unmistakably and unanimously affirmed the original judgment.

The decision demonstrates that there is consensus across judicial departments. Kennard in the Fourth Department (Western New York) is similar to Champion Auto Sales, LLC et al. v Pearl Beta Funding, LLC in the First Department (Manhattan and the Bronx) circa 2018.

Coincidentally, the attorney representing the losing parties, Amos Weinberg, is the same in both landmark cases.

The attorney representing High Speed Capital was Christopher Murray of Stein Adler Dabah & Zelkowitz, LLP.

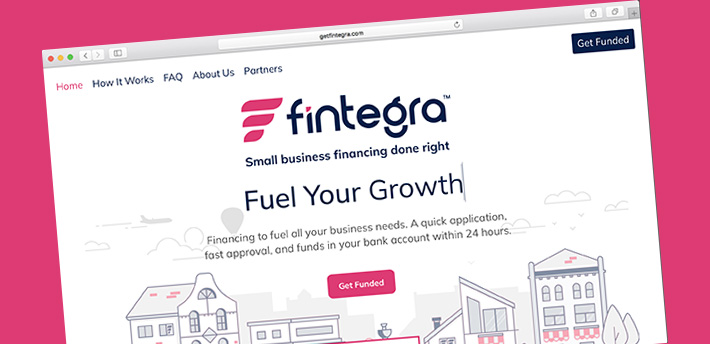

Yes Lender Becomes Fintegra, Brings on Former Federal Reserve Vice Chair

November 15, 2021 Yes Lender is now Fintegra. Along with the name change, the company is bringing on Roger Ferguson, former Vice Chair of the Federal Reserve (1997-2006) in an advisory role. Ferguson is also an investor in Fintegra.

Yes Lender is now Fintegra. Along with the name change, the company is bringing on Roger Ferguson, former Vice Chair of the Federal Reserve (1997-2006) in an advisory role. Ferguson is also an investor in Fintegra.

“Our new name combines ‘fintech’ with ‘integrity’” said Glenn Forman, CEO at Fintegra. [The name] serves as a daily reminder to our customers and colleagues of our mission and values, which we take very seriously.”

The company’s goal is seemingly to write a lot of deals, and get them funded as fast as possible through a fintech application process. According to a press release, the online application can get merchants their funds within 24 hours of their application being submitted.

When touching upon Fintegra’s goals with the rebranding, Forman spoke on a good work environment along with customer-centric business decisions. “We’re committed to putting capital in the hands of entrepreneurs so they can grow their businesses and improve the lives of their customers, suppliers and employees, and we’ll continue to do so in a highly ethical and empathetic way.”

When speaking about the partnership with Ferguson, Forman believes this unprecedented addition will bring equally unprecedented opportunities to this company.

“We’re incredibly fortunate to be able to tap Roger’s wisdom and experience to accelerate Fintegra’s growth. His track record of success and impeccable ethics are perfectly aligned with our brand.”

Forman and Ferguson are looking to rekindle an old working relationship to help Fintegra take off. “While it’s been a few years since we worked together at McKinsey & Company, it feels great to be joining forces again to take Fintegra to new heights.”

Wing Lake Capital Announces New Capstone Fund

November 12, 2021 After acquiring Franklin Capital in October of last year, Wing Lake Capital CEO Shaya Baum spoke to deBanked about a new fund the company is unveiling, the Capstone Fund.

After acquiring Franklin Capital in October of last year, Wing Lake Capital CEO Shaya Baum spoke to deBanked about a new fund the company is unveiling, the Capstone Fund.

A mix of debt and equity has put $50 million into the Capstone Fund, all from investors of the Franklin Fund. According to Baum, the Franklin Fund still has about $100 million in it.

“Wing Lake Capital has two funds now,” said Baum. “There’s the Franklin Fund and the Capstone Fund. The Franklin Fund was launched as a bridge for companies that are stuck in the cash advance merry-go-round. Companies are stacking cash advances until they are using Peter to pay Paul, and then there are no more Peters.”

Comparing the Franklin Fund to the Capstone Fund, Baum described it as a “graduate fund” that will enable companies with too many advances to move beyond them and that it would serve as a stepping stone between the Franklin Fund and traditional SBA or bank financing.

Additionally, the Capstone Fund is also a place where companies who have extenuating reasons why they’re denied credit, but aren’t in distressed business situations, can get access to capital.

Baum’s business model is sometimes at odds with the advance providers his companies try to draw customers away from, with Baum going so far as to say that some of these providers “hate” him. Despite this, he says that some quietly work with him.

“These companies say one thing publicly and privately do another,” said Baum. “These companies that come to us for help are companies that can no longer pay their cash advance debt.”

As part of his company’s program, the advance provider can recover some of its money, he asserted.

“We’re getting 800 deals a week from cash advance companies saying ‘hey, can you help us get out of these?’”

Regardless of the tension with competitors, Baum believes the new fund will ultimately benefit the merchants.

“The Capstone Fund is really focused on growth capital as opposed to restructuring distressed assets. Okay, we’ve restructured your business, you don’t have to pay that cost of capital, you have to focus only on growth. You have opportunities to grow, room for success, now let’s scale the business.”