Industry News

CAN Capital Brings On Edward Dietz as Chief Compliance Officer & General Counsel

February 5, 2020 CAN Capital is continuing its executive hiring spree into 2020 with the news that it has brought on Edward Dietz as its latest Chief Compliance Officer and General Counsel. After providing legal expertise to Marlin Business Services Corporation for nine years and working as an associate for two law firms in Wisconsin and Pennsylvania previous to this, Dietz will oversee CAN’s compliance with all federal and state lending, banking, and securities laws.

CAN Capital is continuing its executive hiring spree into 2020 with the news that it has brought on Edward Dietz as its latest Chief Compliance Officer and General Counsel. After providing legal expertise to Marlin Business Services Corporation for nine years and working as an associate for two law firms in Wisconsin and Pennsylvania previous to this, Dietz will oversee CAN’s compliance with all federal and state lending, banking, and securities laws.

“Having worked with Ed and knowing his skill set and the many intangibles that he brings to CAN, I feel fortunate that he’s leading our legal and compliance efforts,” noted CEO Edward Siciliano in a statement. “Ed’s just what we needed as we position CAN for growth and to lead a new era of small business lending.”

Having graduated from the University of Michigan Law School in 2004, Dietz has nearly two decades of legal experience.

Speaking on the news, Dietz said that he “could not be more excited to join a company and a team that believes so deeply that its people and its culture are the keys to harnessing the company’s growth potential.”

Kabbage Introduces Customized Short Term Loans

February 4, 2020 Today Kabbage, the Atlanta-based fintech company that has been funding businesses since 2009, announced its latest product: customized short-term loans that are a result of the combination of Kabbage Payments and Kabbage Funding.

Today Kabbage, the Atlanta-based fintech company that has been funding businesses since 2009, announced its latest product: customized short-term loans that are a result of the combination of Kabbage Payments and Kabbage Funding.

The loans, which run for the length of 3-45 days, are best suited to those businesses who need funding to cover issues in cash flow caused by the unpredictability of revenue, says Kabbage’s Head of Income Products Abraham Williams. “Rent and payroll are on set days every month, but getting paid is variable. We’ve done loans for 6, 12, and 18 months, and we’ve seen that people pay those off sooner, so we saw a need to have a short-term loan to fill gaps in cash flow.”

The terms of such loans will be decided upon by making use of the aggregate data that Kabbage has access to. With its customers providing a number of data points, such as their Amazon account, banking details, payment processes, and social media accounts, Kabbage is in “a really unique position because of the way that we make decisions on loans for small businesses,” notes Williams. “We can really see a very complete picture of a business, which can be different than how other people are essentially underwriting and assessing risk for loans.”

Two options are available for repayment: a traditional balloon payment to be paid at the end of the 45-day period, or a percentage of each sale made using Kabbage Payments going towards repayment. The latter of these provides more flexibility, with merchants being able to choose the percentage of each sale that is to go toward Kabbage and, as well as this, the fee attached to the Kabbage Payments option is smaller.

With the fee’s amount and terms being dictated by aggregated data, Kabbage is describing them as “dynamic,” providing individualized offers. Fees begin at 0.1% with the minimum amount to be borrowed being $500 and the maximum set at 10% of a merchant’s available line of credit for the short-term.

Liberis Secures $42 Million in Funding, Plans American Expansion

February 3, 2020 Liberis, the London-based small business finance provider, secured £32 million ($42 million) in capital late last month following a round of equity fundraising. The firm, which has funded businesses through cash advances since 2007, has now raised a total of over £150 million ($197 million) via debt and equity.

Liberis, the London-based small business finance provider, secured £32 million ($42 million) in capital late last month following a round of equity fundraising. The firm, which has funded businesses through cash advances since 2007, has now raised a total of over £150 million ($197 million) via debt and equity.

Having already entered Nordic markets, Liberis looks to use this funding to further expand into Europe as well as make their mark in America. Speaking to deBanked, Liberis CEO Rob Straathof explained that the company would be working with its North American partner, Worldpay, to spread itself across all 50 states. Beyond Worldpay, Liberis is planning to create more partnerships with merchant acquirers, those payment platforms which serve merchants, or “SME champions,” as Straathof calls them.

Liberis will not be using brokers to provide cash advances to business owners in the States, the reason being that the company prefers to work with its affiliated partners. “We purely rely on our partners and integrating with our partners,” explained Straathof. “In the UK we still do brokers, but that’s kind of a legacy. It works very well for us and we have a great relationship with brokers. It’s a good channel for us, but we have no intention at this point to launch that in the US.”

The company will also use the funding to increase its staff by 30% in 2020, hiring around 50 people to bolster its 165-person workforce across their four offices in London, Dublin, Stockholm, and Denver.

The Scoop Behind Sprout Funding’s Acquisition of Jet Capital

January 25, 2020 News from North Texas this month as Dallas-based Sprout Funding announced its acquisition of Jet Capital. The move comes as Sprout seeks to expand its technical operations.

News from North Texas this month as Dallas-based Sprout Funding announced its acquisition of Jet Capital. The move comes as Sprout seeks to expand its technical operations.

“Sprout built a reputation as a group that funds a lot of its own internal deals, and Jet had spent a lot of time, energy, and money on their tech platforms,” Sprout’s CEO and Founder Brad Woy told deBanked. “So while we were really good on the sales and marketing side, they seemed to be a little bit more advanced in their tech and reporting, and we brought those two things together.”

Almost all of Jet’s employees will be joining Sprout, with the exception of one person who chose to go their separate way following the merger.

Jet’s COO Allan Thompson spoke kindly of the purchase, saying in a statement that “There is a great cultural alignment in addition to the obvious benefits of combining our technology, processes and people. The result will provide increased capabilities for Sprout and opportunity for all of our customers and partners.”

The financial terms of the acquisition were not disclosed.

Quarterspot is Shifting Its Business Focus

January 22, 2020Last week, several industry insiders reported receiving an email from NY-based company Quarterspot that said their agreement had been terminated.

The contents stated that the company is “shifting its business focus and will no longer be originating loans, but will continue to service currently outstanding loans.”

deBanked has confirmed that to be true. More information may be reported as it becomes available.

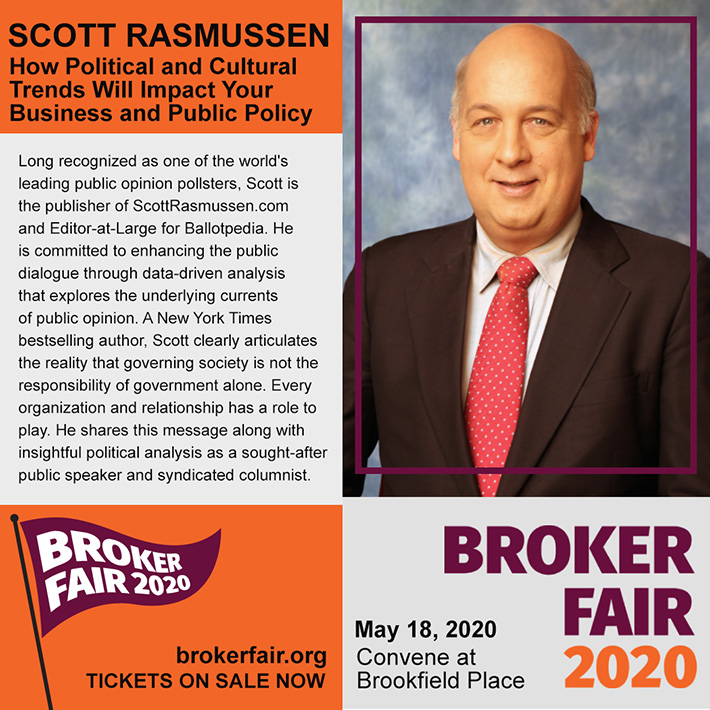

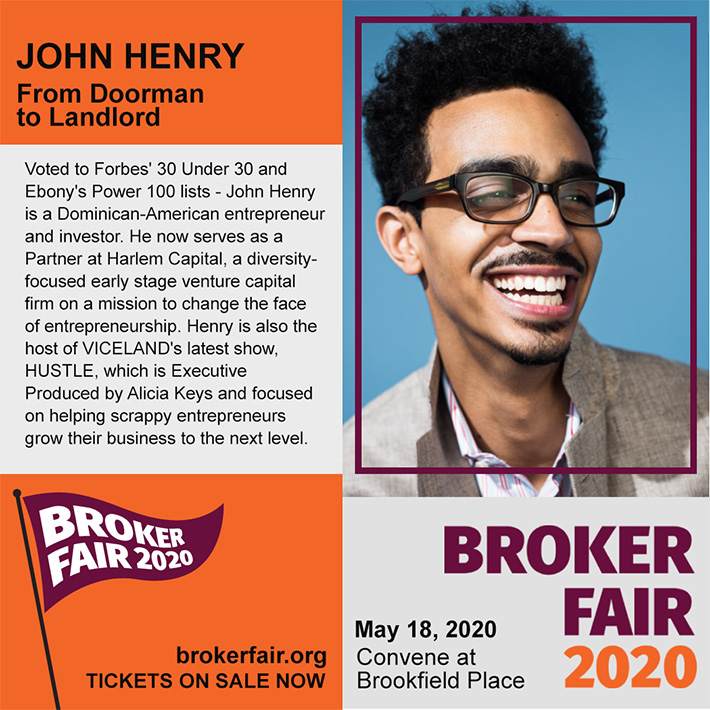

Broker Fair 2020 Announces Two Special Keynote Speakers

January 17, 2020Two special guests will speak at Broker Fair 2020 on May 18th in New York City. Scott Rasmussen and John Henry will complement a roster of leading professionals from the commercial finance industry. Broker Fair 2020 will be deBanked’s largest ever event.

TICKETS ARE ON SALE NOW AND EARLY BIRD PRICING IS STILL AVAILABLE!

Nav Co-founders Step Down From C-Level Positions

January 14, 2020 Levi King, a co-founder of Nav Inc., resigned as the company’s CEO on Tuesday. In a two-part explanation on LinkedIn, King wrote. “To be clear, I’m not burned out on Nav. I’m not aspiring to do something elsewhere, and I’m not leaving the company. I’m still dedicated and passionate about helping Nav succeed. And, I will – just in a different capacity moving forward.”

Levi King, a co-founder of Nav Inc., resigned as the company’s CEO on Tuesday. In a two-part explanation on LinkedIn, King wrote. “To be clear, I’m not burned out on Nav. I’m not aspiring to do something elsewhere, and I’m not leaving the company. I’m still dedicated and passionate about helping Nav succeed. And, I will – just in a different capacity moving forward.”

King will do that by serving as the executive chairman of the board of directors. President & COO Greg Ott will take over as CEO.

On LinkedIn, King further wrote that the company needs “a more qualified leader” to take Nav to the next level after he and co-founder Caton Hanson have successfully grown the company to the right point.

Hanson, who served as the company’s Chief Legal & Compliance Officer, also stepped down and updated his job role with Nav to that of being “Of Counsel” on a part-time basis. Unlike King’s message on LinkedIn, Hanson’s reads as a farewell.

“Thank you for believing in me and our dream,” he wrote. “Thank you for your part in helping Nav achieve what some have called ‘impossible’. I am grateful to know you, have had the opportunity to work alongside you and to call you friends (and for many of you — co-owners). I look forward to Nav’s next chapter – and mine.”

Greg Ott, the new leader of the company, is said in a Nav press announcement to have served as a strategic and organizational leader in both startups and Fortune 1000 corporations. Prior to joining Nav, Ott served as Vice President of Marketing for Intuit QuickBooks.

“Nav’s founders created a company that is truly unique in its ability to revolutionize how small business owners navigate and access capital to grow their business,” Ott commented. “I look forward to building upon Nav’s successes and furthering the company’s vision of aligning financing qualifications, predicting needs, and facilitating transactions between data providers, lenders, partners and small businesses.”

Hudson Cook Partner Appointed to CFPB Taskforce on Federal Consumer Financial Law

January 14, 2020Jean Noonan, a Partner at Hudson Cook, LLP, has been announced as one of the new members of the Consumer Financial Protection Bureau Taskforce on Federal Consumer Financial Law.

Seeking to produce research and legal analysis of US consumer financial laws, over the next year the taskforce will focus on “harmonizing, modernizing, and updating the federal consumer financial laws – and their impending regulations – and identifying gaps in knowledge that should be addressed through research, ways to improve consumer understanding of markets and products, and potential conflicts or inconsistencies in existing regulations and guidance,” according to a CFPB statement.

Noonan has served as General Counsel at the Farm Credit Administration and Former Associate Director of the bureau of Consumer Protection Credit Practice at the Federal Trade Commission. The Hudson Cook Partner has also focused her legal practice on fair lending, private and consumer protection matters, as well as consumer financial services.

“It is a true honor to participate in this historic undertaking by the Bureau,” Noonan said in a Hudson Cook statement. “I look forward to collaborating with the other members of the Taskforce who share my deep interest and experience in the field to help the Bureau to enhance and fortify our consumer financial laws and regulations.”